專業叢書

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Chapter 5 ─ U.S. Non-Dynasty Trusts

美國非朝代信託

In the U.S., trusts are used for a variety of purposes. In prior chapters, we generally focused on dynasty trusts, trusts which are designed to pass on a family’s wealth for generations, often transferring assets from one generation to the next at minimal expense. In this chapter, we are focused on the different types of non-dynasty trusts. These include living trusts, testamentary trusts, GRATs and IDGTs. When combined with one or more dynasty trusts, non-dynasty trusts allow planners to create additional structures that fit the different needs of different wealth creators.

Generally speaking, “revocable trusts” are trusts in which the grantor is able to revoke the creation of the trust (and usually take back all assets previously gifted to the trust), while “irrevocable trusts” are trusts in which the grantor does not hold that power. A “grantor trust” defines a trust in which the trust’s income is taxed to the grantor rather than to the trust itself or to the trust’s beneficiaries. A “non-grantor trust” defines a trust in which the trust’s income is either taxed to the trust or the trust’s beneficiaries, but not to the grantor. In most grantor trusts, the grantor holds one or more powers, which lead the U.S. IRS to deem the trust’s income taxable to the grantor rather than to the trust itself. As a result, grantor trusts generally have neither a tax identification number (TIN), nor U.S. federal income tax liability.

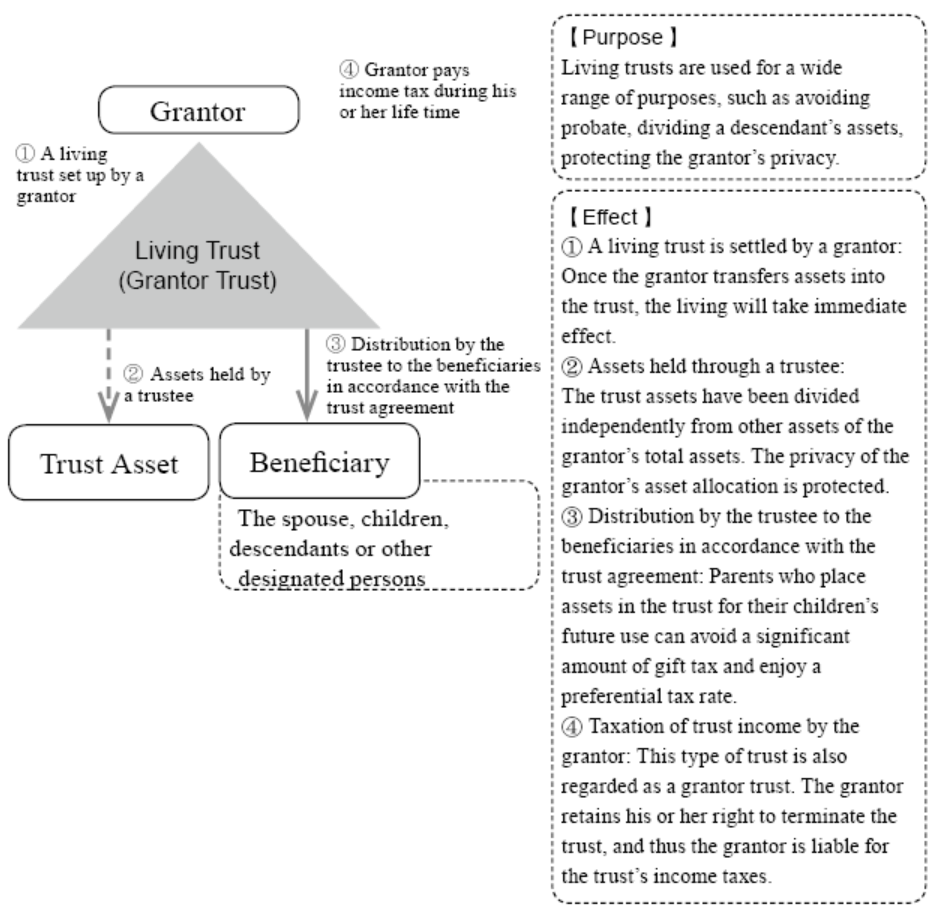

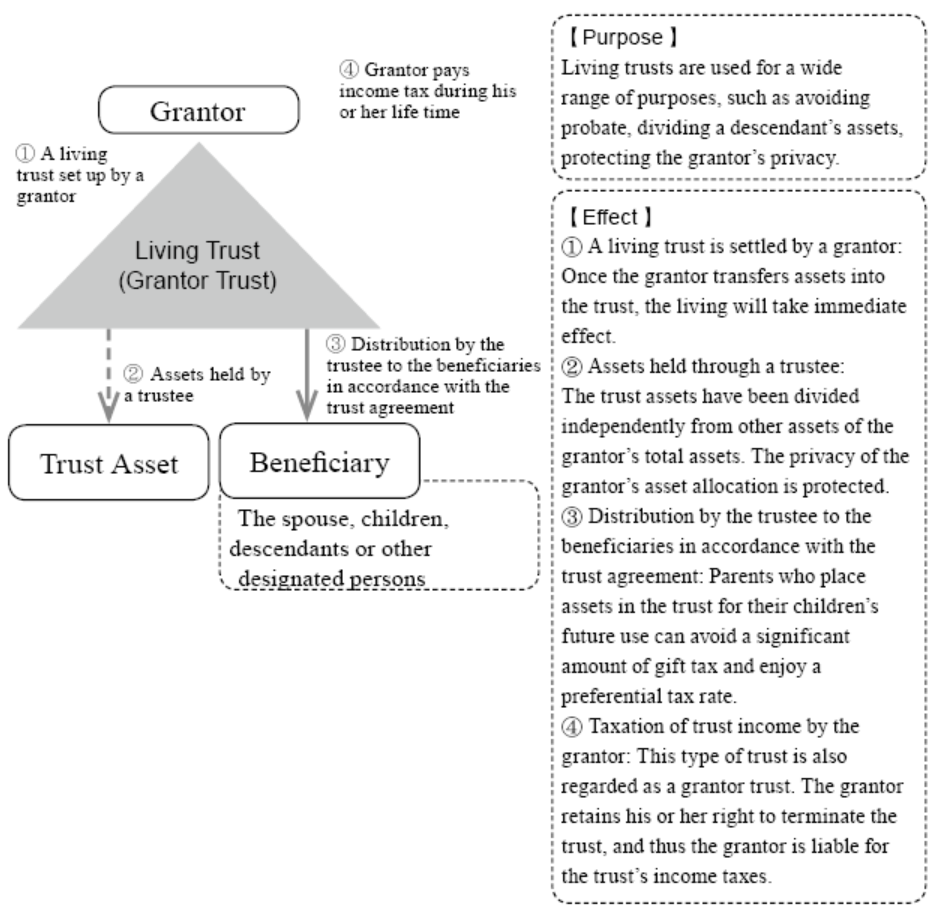

In addition to dynasty trusts, “living trusts” and “testamentary trusts” are quite commonly used in the U.S. among estate planning practitioners. A living trust is drafted and executed during a person’s life time. In most U.S. states, a living trust essentially serves as a will, albeit allowing the decedent’s descendants to skip probate. Typically, a living trust is drafted as a revocable trust in which the grantor, the administrator and the beneficiaries are all the owner of the assets. The rationale behind setting up a living trust is typically to avoid probate. In the U.S., probate is the default process for administering a deceased person’s will (or a deceased person’s estate, if no will exists). This process can take anywhere between 6 months and 24 months for simpler scenarios. In more complicated scenarios, however, it could take 3 - 7 years. In addition to the time cost of probate, the administration of a decedent’s estate often costs anywhere between 4% - 10%, depending on the number of courts and professionals involved. Lastly, probate is a very public legal process, which would reveal all the assets of a person to the public and leave a public record. Unlike a living trust, which bypasses probate, a testamentary trust actually creates a trust immediately after the decedent’s death. The distribution of assets is then controlled by this testamentary trust agreement; however, the assets still have to go through probate before being transferred to the testamentary trust.

This chapter provides an introduction for 6 types of non-dynasty trusts commonly used in the U.S. We recommend taking a brief look at each of the structures set forth to determine which structures may be necessary to achieving certain objectives.

In the U.S., trusts are used for a variety of purposes. In prior chapters, we generally focused on dynasty trusts, trusts which are designed to pass on a family’s wealth for generations, often transferring assets from one generation to the next at minimal expense. In this chapter, we are focused on the different types of non-dynasty trusts. These include living trusts, testamentary trusts, GRATs and IDGTs. When combined with one or more dynasty trusts, non-dynasty trusts allow planners to create additional structures that fit the different needs of different wealth creators.

Generally speaking, “revocable trusts” are trusts in which the grantor is able to revoke the creation of the trust (and usually take back all assets previously gifted to the trust), while “irrevocable trusts” are trusts in which the grantor does not hold that power. A “grantor trust” defines a trust in which the trust’s income is taxed to the grantor rather than to the trust itself or to the trust’s beneficiaries. A “non-grantor trust” defines a trust in which the trust’s income is either taxed to the trust or the trust’s beneficiaries, but not to the grantor. In most grantor trusts, the grantor holds one or more powers, which lead the U.S. IRS to deem the trust’s income taxable to the grantor rather than to the trust itself. As a result, grantor trusts generally have neither a tax identification number (TIN), nor U.S. federal income tax liability.

In addition to dynasty trusts, “living trusts” and “testamentary trusts” are quite commonly used in the U.S. among estate planning practitioners. A living trust is drafted and executed during a person’s life time. In most U.S. states, a living trust essentially serves as a will, albeit allowing the decedent’s descendants to skip probate. Typically, a living trust is drafted as a revocable trust in which the grantor, the administrator and the beneficiaries are all the owner of the assets. The rationale behind setting up a living trust is typically to avoid probate. In the U.S., probate is the default process for administering a deceased person’s will (or a deceased person’s estate, if no will exists). This process can take anywhere between 6 months and 24 months for simpler scenarios. In more complicated scenarios, however, it could take 3 - 7 years. In addition to the time cost of probate, the administration of a decedent’s estate often costs anywhere between 4% - 10%, depending on the number of courts and professionals involved. Lastly, probate is a very public legal process, which would reveal all the assets of a person to the public and leave a public record. Unlike a living trust, which bypasses probate, a testamentary trust actually creates a trust immediately after the decedent’s death. The distribution of assets is then controlled by this testamentary trust agreement; however, the assets still have to go through probate before being transferred to the testamentary trust.

This chapter provides an introduction for 6 types of non-dynasty trusts commonly used in the U.S. We recommend taking a brief look at each of the structures set forth to determine which structures may be necessary to achieving certain objectives.

I. Overview of a Living Trust

If a trust has a short duration, then it is deemed as a non-dynasty trust. Generally, living trusts are not considered dynasty trusts.

A living trust, also known as “Inter Vivos”, is a trust formed by the grantor during his or her lifetime. The grantor transfers assets (such as a real estate, bank account, company stock, etc.) into the living trust and appoints a trustee through the trust agreement to manage the trust assets for the benefit of the ultimate beneficiaries. The trustee holds legal title to the assets transferred into the trust and transfers the assets to the designated beneficiaries upon the fulfillment of certain conditions set forth in the trust (usually the death of the grantor).

Under a living trust structure, if the grantor chooses to set up a revocable living trust, he or she will still retain control of the trust property during his or her lifetime even after the assets are transferred from his or her individual account to the revocable trust. 1

1 Living Trust. https://www.investopedia.com/terms/l/living-trust.asp.

The main purpose of a living trust is to avoid the time-consuming and costly probate process and to allow the estate to be distributed according to the grantor’s wish. In contrast to the complex legal probate process, a living trust can ensure that the trust assets and estates are executed according to the wishes of the grantor upon his or her death, without having to go through the courts to deal with disputes between heirs. In view of its effect, a living trust can also be considered a legal document to replace a will.

II. Types of Living Trusts

Several types of living trusts are available to an individual seeking to settle a living trust. The most common types of living trust consist of Revocable Living Trusts (RLT) and Irrevocable Living Trusts (ILT). In a revocable living trust, the grantor retains the right to revoke and return the property delivered to the trust to himself at any time. An irrevocable living trust, however, is irrevocable once the trust agreement is signed.

A revocable living trust may be revoked or modified at any time by the grantor. Generally, revocable living trusts are drafted to protect the interests of the grantor, so that the grantor retains the right to control the trust throughout his or her lifetime. Since the grantor retains power over the assets placed in a revocable living trust, the grantor’s creditors are generally able to compel that a grantor pay out of his or her revocable living trust. 2

2 Revocable Trust vs. Irrevocable Trust: What’s the Difference? https://www.investopedia.com/ask/answers/071615/what-difference-between-revocable-trust-and-living-trust.asp.

III. Living Trust Framework

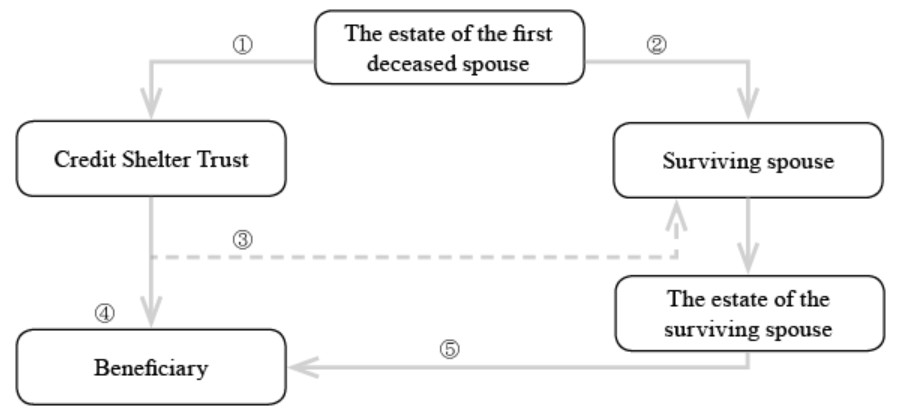

The following chart describes the operation process of a living trust:

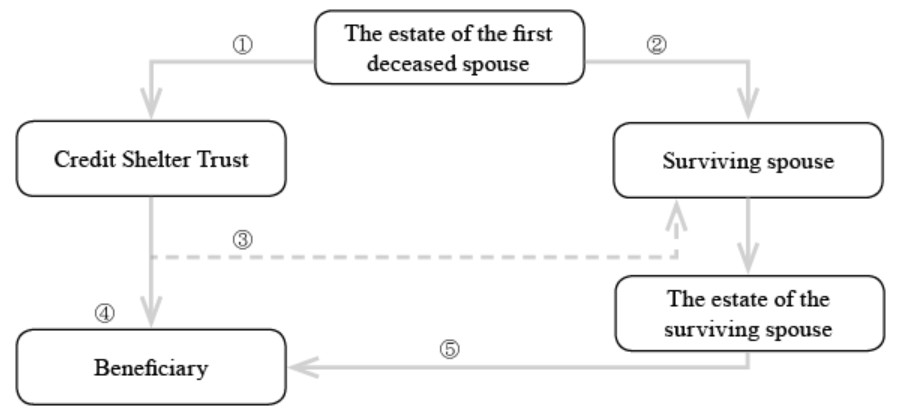

①Upon the death of the first spouse, the grantor should place assets with equivalent value to the unused estate tax exemption amount in a Credit Shelter Trust.

②The remainder of the estate is left to the surviving spouse and is entitled to the unlimited marital deduction exemption between spouses.

③The spouse’s authority over the trust assets may also be restricted.

④Upon the death of the surviving spouse, the Credit Shelter Trust assets are transferred to the beneficiary and not subject to estate tax.

⑤Upon the death of the surviving spouse, only the portion of the trust assets transferred to the beneficiary that exceeds the estate tax exemption is subject to U.S. estate tax.

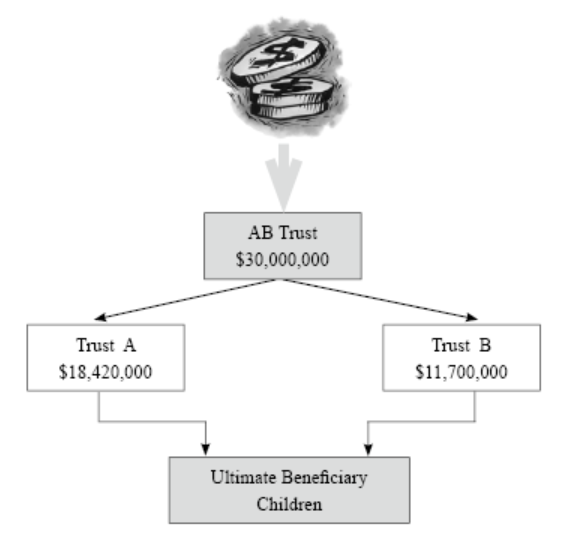

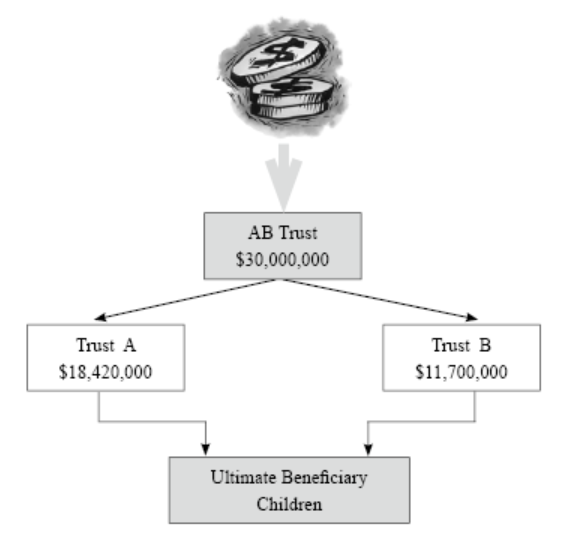

Take AB living trust with a total asset value of US$30 million as an example:3

3 A-B Trust. https://www.investopedia.com/terms/a/a-b-trust.asp.

① An AB Trust is established jointly by a married couple. The couple can enjoy the income from the trust during their lifetime. Once they pass away, their children become the trust’s beneficiaries.

② Upon the death of one of the spouses (e.g., Mr. Wang), the AB Trust is split between Trust A and Trust B.

IV. Probate Procedures

(i) Instructions and Steps

Probate is the legal process of transferring ownership of a deceased person’s assets to his or her inheritors through a court. It involves, among other things, proving the validity of a will to the court (a routine procedure), appointing a personal representative with authority to deal with the estate assets previously owned by the deceased person, discern and check the estate, estimate the estate’s value, pay off any debts and taxes of the deceased, and finally distribute the remaining estate according to Will or under state law.4

In California, for example, if an individual’s property is not placed in a trust at the time of death or cannot be transferred through insurance by a designated beneficiary and the gross value of the decedent’s estate exceeds the specified amount (US$16,625 as of January 1, 2020) in accordance with the Probate Code §13100, the decedent’s estate will need to go through the probate process.5&6

Under California law, the following property is not subject to the probate process:7

① life insurance ② retirement plans ③ property transferred to a living trust ④ property held as a joint tenant ⑤ money in an account paid directly to a beneficiary upon death ⑥ half of the community property owned by the spouse.

4 Probate. https://www.investopedia.com/terms/p/probate.asp.

5 Ca. Probate Code § 13100.

6 https://leginfo.legislature.ca.gov/faces/codes_displaySection.xhtml?lawCode=PROB§ionNum=13050.

7 Ca. Probate Code § 13050.

If a trust has a short duration, then it is deemed as a non-dynasty trust. Generally, living trusts are not considered dynasty trusts.

A living trust, also known as “Inter Vivos”, is a trust formed by the grantor during his or her lifetime. The grantor transfers assets (such as a real estate, bank account, company stock, etc.) into the living trust and appoints a trustee through the trust agreement to manage the trust assets for the benefit of the ultimate beneficiaries. The trustee holds legal title to the assets transferred into the trust and transfers the assets to the designated beneficiaries upon the fulfillment of certain conditions set forth in the trust (usually the death of the grantor).

Under a living trust structure, if the grantor chooses to set up a revocable living trust, he or she will still retain control of the trust property during his or her lifetime even after the assets are transferred from his or her individual account to the revocable trust. 1

1 Living Trust. https://www.investopedia.com/terms/l/living-trust.asp.

The main purpose of a living trust is to avoid the time-consuming and costly probate process and to allow the estate to be distributed according to the grantor’s wish. In contrast to the complex legal probate process, a living trust can ensure that the trust assets and estates are executed according to the wishes of the grantor upon his or her death, without having to go through the courts to deal with disputes between heirs. In view of its effect, a living trust can also be considered a legal document to replace a will.

II. Types of Living Trusts

Several types of living trusts are available to an individual seeking to settle a living trust. The most common types of living trust consist of Revocable Living Trusts (RLT) and Irrevocable Living Trusts (ILT). In a revocable living trust, the grantor retains the right to revoke and return the property delivered to the trust to himself at any time. An irrevocable living trust, however, is irrevocable once the trust agreement is signed.

A revocable living trust may be revoked or modified at any time by the grantor. Generally, revocable living trusts are drafted to protect the interests of the grantor, so that the grantor retains the right to control the trust throughout his or her lifetime. Since the grantor retains power over the assets placed in a revocable living trust, the grantor’s creditors are generally able to compel that a grantor pay out of his or her revocable living trust. 2

2 Revocable Trust vs. Irrevocable Trust: What’s the Difference? https://www.investopedia.com/ask/answers/071615/what-difference-between-revocable-trust-and-living-trust.asp.

III. Living Trust Framework

The following chart describes the operation process of a living trust:

①Upon the death of the first spouse, the grantor should place assets with equivalent value to the unused estate tax exemption amount in a Credit Shelter Trust.

②The remainder of the estate is left to the surviving spouse and is entitled to the unlimited marital deduction exemption between spouses.

③The spouse’s authority over the trust assets may also be restricted.

④Upon the death of the surviving spouse, the Credit Shelter Trust assets are transferred to the beneficiary and not subject to estate tax.

⑤Upon the death of the surviving spouse, only the portion of the trust assets transferred to the beneficiary that exceeds the estate tax exemption is subject to U.S. estate tax.

Take AB living trust with a total asset value of US$30 million as an example:3

3 A-B Trust. https://www.investopedia.com/terms/a/a-b-trust.asp.

① An AB Trust is established jointly by a married couple. The couple can enjoy the income from the trust during their lifetime. Once they pass away, their children become the trust’s beneficiaries.

② Upon the death of one of the spouses (e.g., Mr. Wang), the AB Trust is split between Trust A and Trust B.

- To fully utilize Mr. Wang’s lifelong gift tax exemption, Mr. Wang can transfer US$11.7 million into Trust B and use his unlimited Marital Deduction to transfer the remaining assets into Trust A. Therefore, it is not necessary to pay any estate tax when Mr. Wang deceases. Afterwards, if Mrs. Wang passes away, only Trust A’s asset will be accrued to Mrs. Wang’s taxable asset. In addtion, Mrs. Wang's lifetime exemption US$11.7 million is also applicable. In this way, this AB living trust will effectively defers estate tax payment.

- Mrs. Wang is allowed to keep benefitting from profits of Trust B if she meets some requirements, but she would not be considered the owner of Trust B for estate tax purposes. Therefore, once Mrs. Wang passes away, the assets in Trust B acquired by her children would not be viewed as Mrs. Wang’s estate, so that they would not be subject to estate tax.

IV. Probate Procedures

(i) Instructions and Steps

Probate is the legal process of transferring ownership of a deceased person’s assets to his or her inheritors through a court. It involves, among other things, proving the validity of a will to the court (a routine procedure), appointing a personal representative with authority to deal with the estate assets previously owned by the deceased person, discern and check the estate, estimate the estate’s value, pay off any debts and taxes of the deceased, and finally distribute the remaining estate according to Will or under state law.4

In California, for example, if an individual’s property is not placed in a trust at the time of death or cannot be transferred through insurance by a designated beneficiary and the gross value of the decedent’s estate exceeds the specified amount (US$16,625 as of January 1, 2020) in accordance with the Probate Code §13100, the decedent’s estate will need to go through the probate process.5&6

Under California law, the following property is not subject to the probate process:7

① life insurance ② retirement plans ③ property transferred to a living trust ④ property held as a joint tenant ⑤ money in an account paid directly to a beneficiary upon death ⑥ half of the community property owned by the spouse.

4 Probate. https://www.investopedia.com/terms/p/probate.asp.

5 Ca. Probate Code § 13100.

6 https://leginfo.legislature.ca.gov/faces/codes_displaySection.xhtml?lawCode=PROB§ionNum=13050.

7 Ca. Probate Code § 13050.

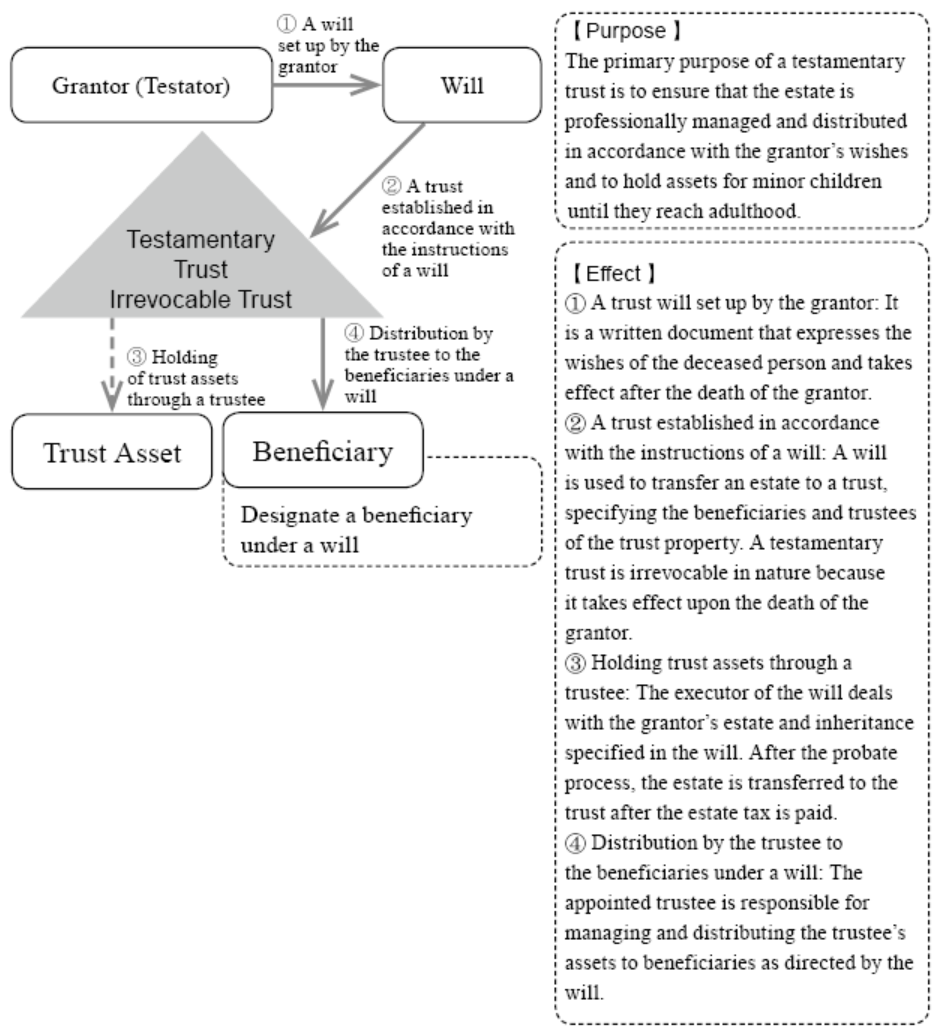

I. Overview of a Testamentary Trust

A testamentary trust usually involves three parties: the “testator” (i.e., the “grantor”), the “trustee” who manages the trust assets, and the “beneficiaries” mentioned in the will. A testamentary trust is a trust created under the direction of a will. The testator creates a will during his or her lifetime, which not only covers the guardianship of minor children, but also specifies the estate to be placed in the trust and how the estate will be distributed. When the will is authorized by the court, the executor will set up a trust in accordance with the instructions of the will and transfer the estate into the trust to make it a trust asset and the trustee will continue to manage the trust assets for the beneficiaries.8

8 Testamentary Trust. https://www.investopedia.com/terms/t/testamentarytrust.asp.

A testamentary trust is established according to the grantor’s will and becomes effective upon his or her death. Therefore, a testamentary trust is irrevocable in nature, and because the grantor is no longer alive, a testamentary trust cannot be revoked or modified after it is created. However, a will can be changed by the grantor any time during his or her lifetime.

When a will becomes effective, the executor will deal with the estate and inheritance of the grantor and transfer the estate to the trust after paying estate tax. A will can contain more than one testamentary trust, and the trustees are appointed to manage the assets in the trust and distribute them to the beneficiaries in accordance with the instructions of the will.

Since the trustee must distribute the trust property according to the will, such as paying for the education of children, making charitable distributions, etc., the creation of a testamentary trust allows the grantor to continue his or her desire to control the distribution of the estate and to achieve the goal of taking care of the beneficiaries (heirs or legatees) and to avoid unnecessary disputes.

II. Purpose of Creating a Testamentary Trust 9

Generally, a testamentary trust is created for young children, relatives with disabilities, or others who may inherit a large sum of money upon the death of the testator until such beneficiary reaches the legal age or is able to take over the estate. The executor of a will may hold the beneficiary’s share of the estate in the trust until he or she reaches a specified age. A termination date can be provided for in the terms of a testamentary trust. Typical dates may be when the beneficiary turns 25 years old, graduates from university, or gets married. The testator may also make distributions for charitable purposes as he or she wishes under a charitable trust.

9 10 Things You Should Know About a Testamentary Trust. https://www.legalzoom.com/articles/10-things-you-should-know-about-a-testamentary-trust.

Testamentary trusts can be designed in a variety of ways, and in some cases the testator wishes to separate control of the assets from the distribution of income. For example, if the testator has four adult children, the trust assets are invested uniformly by professionals and each child is entitled to a 25% distribution of the trust income. In this situation, it may be more appropriate to create four additional sub-trusts, transfer the proportion of the trust benefits to be distributed to each child to the sub-trust, and allow the children to manage their own sub-trusts.

If the above structure is implemented, the will would direct the testator’s remaining estate to be transferred to the trustee of the testamentary trust, who is responsible for the primary investment of the estate. The estate will be placed by the independent controller of the primary trust. The owner of the income and asset of the primary trust will be the trustees of the testamentary trust and the general beneficiaries will be limited only to the testator’s spouse, children, other lineal descendants, and specific charities supported by the testator and the family. Typically, a sub-trust will be created for each child of the testator and the descendants of that child, as well as for the general beneficiaries.

III. The Process of Creating a Testamentary Trust

(i) Prepare Your Will Documents

A will is a legal document that sets out the testator’s final wishes regarding the distribution of assets and the relationship between his or her relatives. The testator may record the guardianship of dependents and the management of their financial interests, and may leave the estate to a specific group or donate it to a charity. A testator makes a will while he or she is alive and executes it at his or her death. An executor is named in a will and is responsible for the administration of the estate.

A will is the primary document used by the probate court to guide and resolve estate issues in the probate process, and the probate court oversees the executor to ensure that the will is executed and the wishes of the will are carried out. Assets that do not have a designated beneficiary are not considered probate assets and are transferred to a beneficiary, such as a life insurance policy. Overall, it is the will and the probate court that will ultimately determine all the assets, including who receives the estate and how much that person should receive. A will can appoint a guardian for surviving family members and make arrangements for any other special circumstances, including taking care of a child or an elderly with special needs.

(ii) Election of Executors

An executor is a company or individual named in a will to handle the estate of the testator, and the executor will handle the estate according to the wishes set out in the will. Before appointing an executor, it is important to understand their duties and obligations so that you can evaluate whether they have the time and ability to handle everything as required.

Most people appoint a family member or friend as an executor due to trust and respect. However, such executors often face problems such as being uncapable to carry out their role as an executor due to grief, lack of professional knowledge to deal with complex and difficult estate issues, difficulties in making consistent decisions when relatives and friends are co-executors, personal responsibility for mistakes in handling the estate, or conflicts of interest arising from being both the executor and the beneficiary.

If the term of the will is simple, appointing a friend or relative as an executor can be an efficient way to deal the affairs of the testator, provided that they have the time and are competent to do so. However, if the estate involves complex distribution of assets, or if the trust established under the will requires long-term professional management, appointing a professional or professional organization as a neutral executor should be a more appropriate option. 10

10 Learn About the Role of an Executor. https://www.thebalance.com/executor-executrix-3505523.

(iii) Probate Proceedings

The probate process, as described in the living trust, is the legal process by which the descendants come to court with a will created during the life of the testator and seek approval from the court. The process takes an average of 16 months, and if there is an estate in another state, it must also be probated in that state, and all of the terms in the will must be made public by the court. In addition to the documents being made to the public, the estate must be first used to pay back loans from creditors before they are distributed to the beneficiaries in accordance with the state law. Moreover, high attorney and court fees are also a consideration for grantors when creating a will. They usually cost more than 4% to 10% of the total estate.

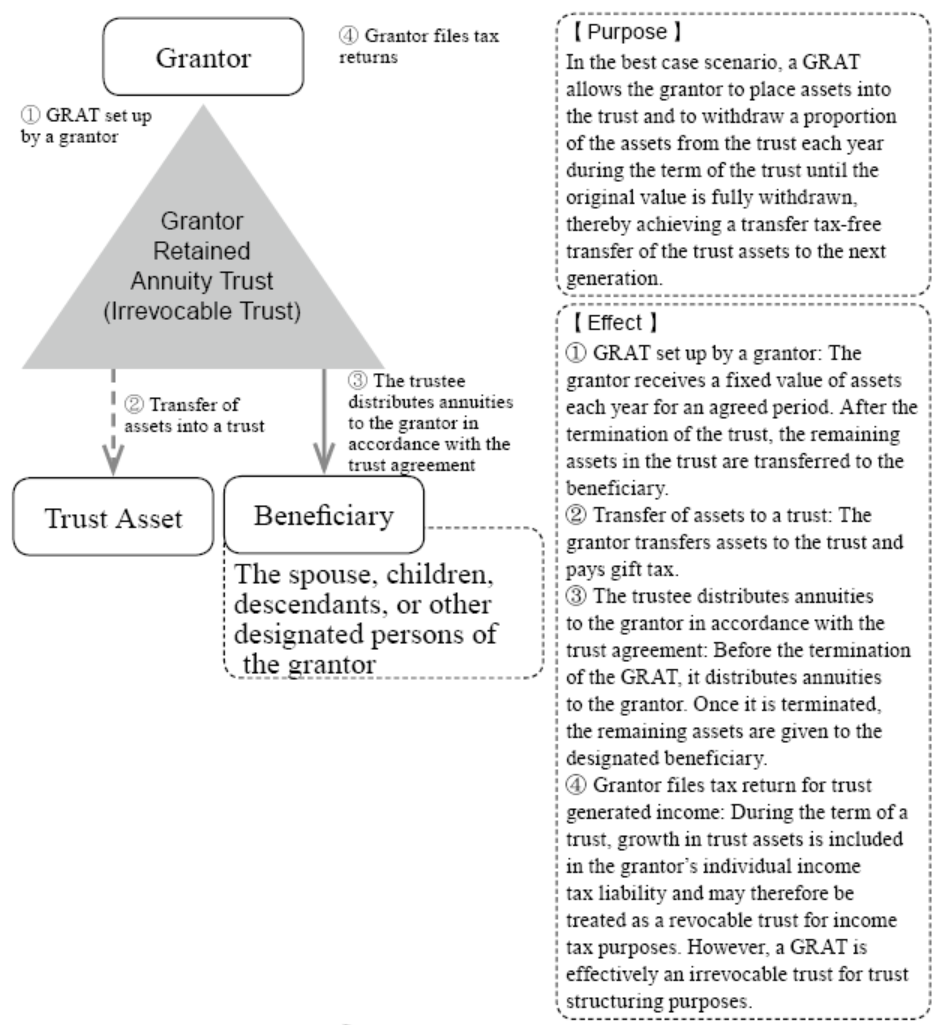

I. Introduction of GRAT

A Grantor Retained Annuity Trust (GRAT) is an irrevocable gift trust, commonly used in estate or unlisted equity planning, that allows the grantor or grantor to pass significant wealth to the next generation with little or no gift tax liability, minimizing the amount of tax on gifts made to family members. A GRAT is an irrevocable trust that is created for a fixed period of time. Once the trust is created, the grantor should transfer his or her assets into the trust and make annuity payments each year. When the trust is terminated, the beneficiary will receive assets free of estate and gift tax.

A GRAT is a property management trust that incorporates the advantages of a revocable trust. When a GRAT is created, although beneficiaries receive assets from the trust provided by the grantor, the grantor still retains the right to receive the original value of the assets back from the trust during the term of the GRAT. The annuity payments are derived from the appreciation or income of the trust’s assets. After the termination of the GRAT, the remaining assets are transferred to a beneficiary designated by the grantor. If the grantor dies before the termination of the trust, the assets become part of the grantor’s taxable estate.11

A common way for transferring GRAT assets is for parents to set up a GRAT and list their beneficiary children, then parents can put as much money into the GRAT as they wish. Under the terms of the existing GRAT, the principal plus interest of the GRAT is transferred back to the parents after a pre-determined period of time. Any remaining income earned on the interest is allowed to remain in the trust and can be inherited by the next generation free of estate and gift taxes.12

11 Grantor Retained Annuity Trust (GRAT). https://www.investopedia.com/terms/g/grat.asp.

12 Grantor Retained Annuity Trusts (GRAT). https://www.n-klaw.com/grantor-retained-annuity-trustsgrat/.

II. Advantages of settling a GRAT:

① Avoids the risk of uncertainty with arrangements by locking in a minimum valuation rate at the lowest valuation for assets with high potential for future premium appreciation.

② Contribute a low tax basis in return for a higher value of wealth.

③ Invest with a lower valuation rate in the present for a higher investment return rate in the future.

④ Reducing gift tax before death to avoid substantial appreciation of assets in the future, generating a low cost but high leverage effect.

⑤ A balance among the three rights of a trust through a definite wealth arrangement plan in which to optimize ownership and control rights of assets before death and to maximize the beneficiary rights of the assets after death.

⑥ Integrating financial actuary and legal taxation to achieve a dynamic balance between finance and law, as well as cutting up costs and maximizing income.

⑦ Setting up an irrevocable trust to maximize the extent of separation of business assets and personal assets, effectively isolating and blocking potential disputes and risks to assets and wealth.

⑧ An irrevocable grantor trust allows the grantor to be free from U.S. income tax liability while allowing beneficiaries to enjoy the assets free of estate tax upon the grantor’s death.

⑨ Structuring a clear trust planning schedule and making long-term investments not only avoids gift and estate taxes, but also maximizes the value of assets and minimizes investment risks.

⑩ With the arrangement of multi-principal legal structure, it is fully demonstrated that the trust is not a short-term profit-seeking tool, but rather a tool for wealth substitution, effective tax-saving strategy, and long-term investment and wealth preservation.

III. The Risk of GRAT

There are some disadvantages of establishing a GRAT. When a GRAT is established, the term of the trust is usually set up by the grantor. After the termination of the trust, the remaining assets are transferred to the designated beneficiaries, but if the grantor passes away before the trust terminates, all of the assets in the trust will be returned to the grantor and the assets will be included in the grantor’s taxable estate.

The duration of a trust is one of the most important factors affecting a GRAT’s effectiveness. The longer the trust period of the GRAT, the more effective it is in reducing gift taxes, but the higher chance that the grantor will die before the trust period ends. Therefore, when establishing a trust, the grantor should consider his or her age and health condition to set an appropriate term for the trust.

Also, in a GRAT, the grantor transfers assets into a trust as a complete gift and he or she will receive income based on the original value of the assets from the trust during the term of the trust. (the term of a GRAT is at least two years13). After the termination of the trust, the remaining assets will be distributed (based on any appreciation value and the IRS assumed rate of return) to the grantor’s beneficiaries at the rate of return set by the IRS (IRC §7520). When the 7520 rate goes down, the present value of the same annuity payment will increase so that the amount of the gift decreases. Establishing a GRAT for estate planning is only successful when the growth rate of the transferred property exceeds the 7520 rate. If the GRAT “fails” due to the lack of growth in its investments, the legal and administrative fees spent are non-refundable.

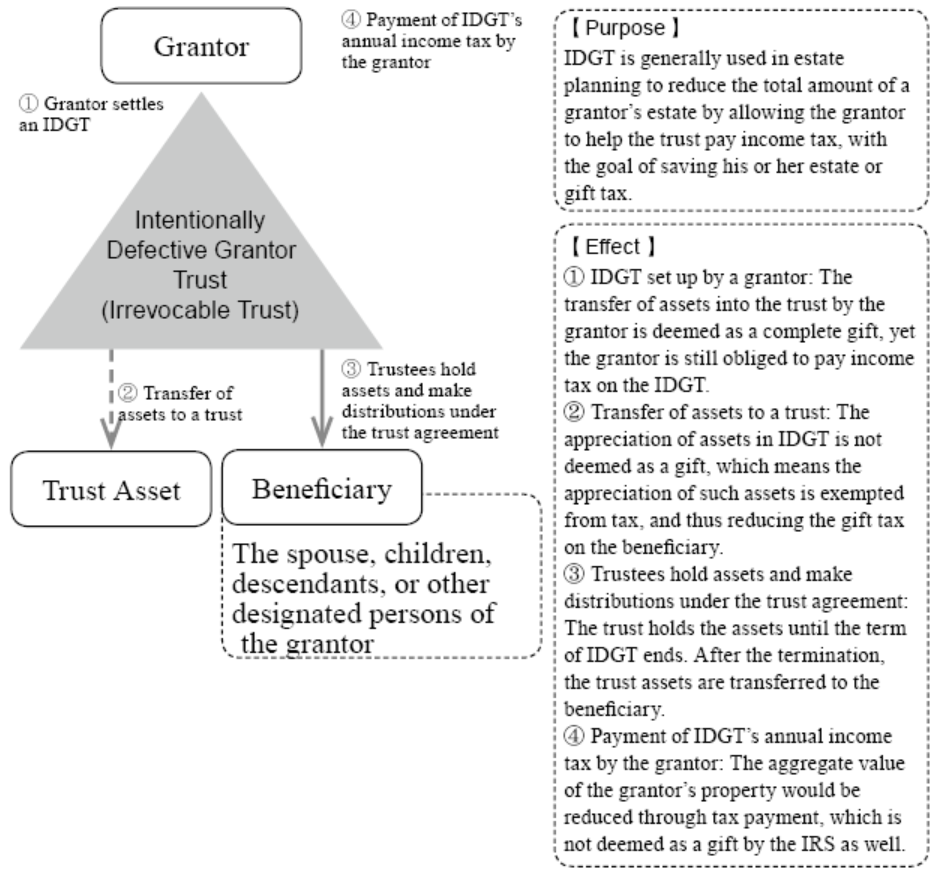

I. Overview of an IDGT Trust

Intentionally Defective Grantor Trusts (IDGTs) are not income tax efficient, instead, they are made for estate and gift tax efficient purpose. IDGTs are subject to gift tax when the grantor transfers cash or assets into the trust and the trust income derived from it will subject to the grantor. Thus, this type of trust is not set for income tax mitigation purposes.

The IDGT allows the grantor to pay for the income tax of the trust, so there is no recognition under income tax law that these assets have been transferred away from the individual. Because the grantor must pay for the income tax of the trust each year, the assets in the trust will be tax-free even if the value of the assets increases from time to time, thereby avoiding gift tax and reducing estate tax on the grantor’s beneficiaries. The beneficiaries of an IDGT are usually the grantor’s children or descendants who receive the appreciated assets while income taxes are still paid wholly by the grantor.

A grantor trust allows a grantor to make investment plans through a trust, such as a Spousal Lifetime Access Trust (SLAT), which is a version of IDGTs in which the grantor’s spouse is usually included as a current beneficiary along with the grantor’s descendants. Although the grantor’s spouse must relinquish the control of the trust, the assets are made available to the beneficiary in a manner that does not incur estate tax and when appropriate, can also be distributed to the beneficiary. SLATs can be valuable to married couples in minimizing future estate tax liability while maintaining a degree of control power. In some cases, the beneficiary’s spouse can act as trustee and oversee the trust’s investments and distributions.14

14 Maximize Next Generation Assets With Intentionally Defective Grantor Trusts. https://www.bnymellonwealth.com/articles/strategy/maximize-next-generation-assets-with-intentionally-defective-grantor-trusts.jsp.

When properly structured, an IDGT can be a very effective estate planning tool, allowing people to reduce their taxable estate while gifting assets to beneficiaries at a fixed value. The grantor of the trust can also reduce their taxable estate by paying income tax on the trust assets, basically gifting additional wealth to the beneficiaries.15

15 Intentionally Defective Grantor Trust (IDGT). https://www.investopedia.com/terms/i/igdt.asp.

II. Establishing an IDGT

(i) Purpose and Operating Method

IDGT is basically made for estate tax purposes. Estate tax will be equal to the value of the grantor’s estate minus the value of assets transferred into the trust. The individual would sell the assets to the trust in exchange for a promissory note for a certain term (e.g., 10 or 15 years). The note will pay enough interest ensuring the value of the note will be at above-market price, but the underlying assets are expected to appreciate faster.

(ii) Typically, the establishment of an IDGT includes the following grantor trust terms:

① Power of Substitution: Grantor can reacquire assets from the IDGT and replace them with equivalent assets.16 The grantor may exchange assets in the name of the trust for other properties of equivalent value without the consent of other person with fiduciary duties, which creates a grantor trust for income tax purposes, but does not result in the inclusion of IDGT trust assets in the grantor’s taxable estate.

16 IRC Section 675(4)(c).

Under IRC §2038, in the case of a revocable trust, the revocable trust assets would be included in the grantor’s taxable estate. However, because an IDGT is an irrevocable trust, so the trust assets would not be included in the grantor’s taxable estate.

② Ability to loan from the trust: grantor may retain the authority to loan from an IDGT without adequate interest or secured loans. Similarly, other non-adverse party may have the ability to loan from the trust. 17 If it is possible for the grantor to loan from IDGT’s assets at less than the appropriate interest and secured loan or on terms more favorable than those required for such transactions under typical commercial terms then it is a grantor trust for tax purposes.

③ Right of Disposition. The grantor may retain the power to change or add non-charitable beneficiaries. The right of disposition also allows the grantor to make additional direct distributions to existing beneficiaries named in the trust.

17 IRC Section 675(2).

III. The Duties of a Trustee

A trustee is required to keep complete and adequate records for both tax and non-tax reasons under California and federal laws. First, a trustee is responsible for giving a full account to the beneficiaries, and reporting information about trust assets, liabilities and finances when requested by a beneficiary with a current vested interest. Second, a trustee also responsible for paying required taxes and reporting it to federal, state, and local tax authorities.

As for the records should be maintained mainly fall into three broad categories: ① Legal documents; ② Trustee’s Log; and ③ financial, asset and tax documents. Let us elaborate on each category’s detail.

A trustee should keep all original legal documents and correspondences in record. The record keeping system entails document folders and an index. The original trust document and all its amendments should be preserved. Likewise, any other legal documents pertinent to settling the trust, such as promissory notes, court orders, tax documents, accounting records and correspondences to beneficiaries, attorneys, accountants and others should all be kept.

The foregoing only works to the extent to those which are documented. Hence trustee, or his or her attorney, will not rely simply on the oral communications with beneficiaries but will also be followed up by the written form of the oral communications.

A trustee should keep a chronological trustee log diary from the beginning. Entries should disclose details of the time spent (on a daily basis), discretionary decisions, meetings, travel and out of pocket expenses in furtherance of trustee duties. A detailed log will show the basis for all discretionary trustee decisions: The legal authority relied upon; the professional advice obtained; and the critical information and documents considered in making the judgment. 18

18 Trustee Duties –A Guide for Trustees. https://www.arl-lawyers.co.nz/wp-content/uploads/2015/10/Trustees-Duties-2015.pdf.

If the trustee out of benevolence fails to comply with the terms of the trust and causes damage to the trust, the trustee is free from liability to the extent that the damage would not have occurred even if the trustee had not breached the trust, and to the extent that the damage is not causally related to the breach.

Even if a trust agreement exempts a trustee from liability for breach of agreement, the exclusion is not effective to the extent that the breach of the trust agreement is an abuse of duty of care by the trustee to the grantor. Common trustee defaults are also not excused by the terms of the trust: the trustee’s intentional defaults, the trustee intentionally disregarding the interests of the beneficiaries, or the trustee gaining interest from unlawful practices.

If the beneficiary has not sued the trustee for a long period of time to claim liability for the breach, the beneficiary may not do so again. In the light of objective circumstances, it would be unfair to allow the beneficiary to do so. The beneficiary does not lose the right to request execution of the trust simply because the term of the trust has ended, but if the trustee denies the existence of the trust and the beneficiary is fully aware of it, then the beneficiary may lose the right to request execution of the trust since the term of the trust has already ended. 19

19 G.G. Bogert & G.T. Bogert, The Law of Trusts and Trustees s 229, at 726, 2d ed. (1993).

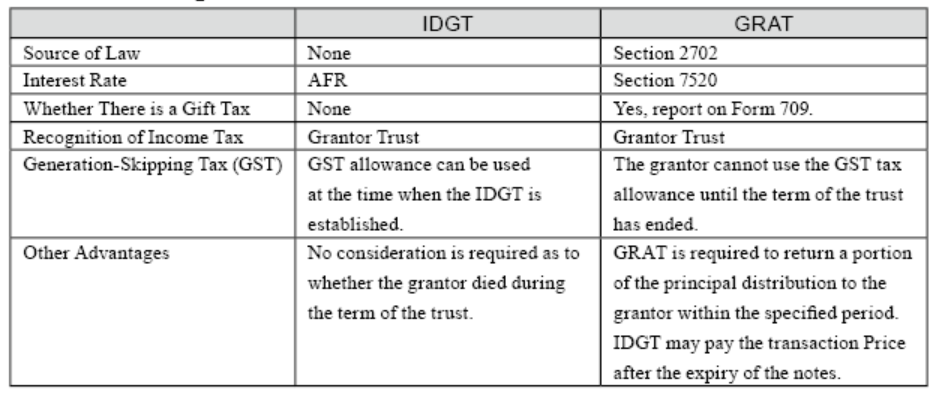

IV. Comparison of GRAT and IDGT

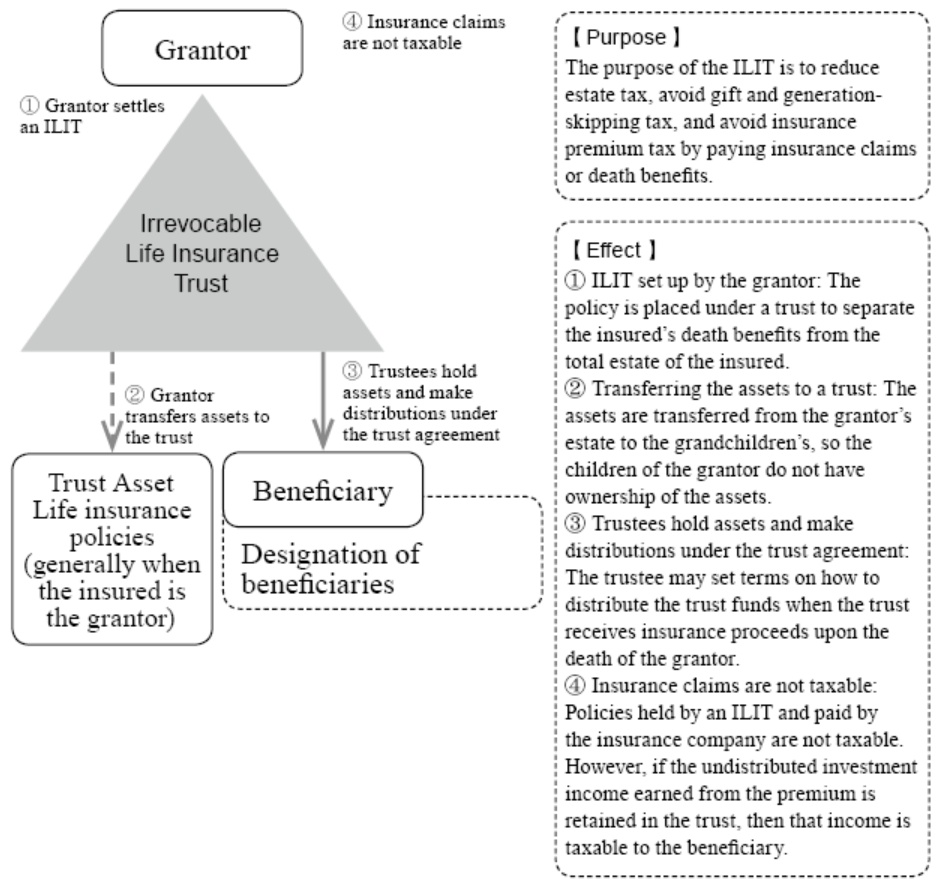

I. Overview of an ILIT

An irrevocable life insurance trust (ILIT) is a trust that cannot be revoked or modified once it has been created. ILITs are designed to use life insurance policies as assets owned by the trust. Once the grantor has contributed property or life insurance death benefits to the trust, they cannot change the terms of the trust or reclaim any of the property they hold.

People purchase life insurances for many reasons because it provides many unique functions that are not found in other financial products. For example, in the early years of the policy, the insured needs to pay only a small sum to lock in a certain level of monetary benefit at death. This amount often grows as time passes.

The grantor must prevent from claiming any direct control or ownership of the ILIT. Therefore, the premium payments must come from a checking account owned by the ILIT and not the grantor. If the grantor transfers life insurance policies into the ILIT and passes away within three years, that transfer is still subject to estate tax. In addition, high value life insurance policies may also be counted when calculating the estate taxes owed. Before creating an ILIT, one should confirm whether the company allows the individual to purchase insurance policies for a related person. After creating the trust, the insurance company must be notified that the ownership of the insurance policy is under the trust. The insurance company can then issue the insurance policy and set the trust as the owner of the policy and send it the policy.

An ILIT is a trust that pays the premiums and holds the policy. It is designed to avoid the need for the insurer to hold the policy personally in order to save estate tax and to allow the beneficiaries to receive insurance claims from the trust after the death of the insured and to pay estate tax on the insurance benefits. Generally, if the trust is an irrevocable trust, the insurer cannot be the trustee. It must appoint a legal adult or an organization to be the trustee. Moreover, the trust must be established three years before the insured’s death and must apply for a “Federal Tax ID” from the IRS.

After the trust is established, a bank account is registered in the trustee’s name. Funds are deposited into the trust account and premiums are paid from the trust account to the insurance company. This isolates the policy from personal property, separating the value of the policy and insurance benefits which helps the insurer to avoid lawsuits and claims.

As an alternative to naming a single beneficiary, an ILIT offers several legal and financial benefits to heirs, including favorable tax treatment, asset protection, and guaranteed benefits that is consistent with the beneficiary’s will. If a grantor transfers an existing life insurance policy to an ILIT, there is a three-year look-back period during which the death benefits can be included in the grantor’s estate. Once the life insurance company makes an offer for a new application, the trust can be properly listed as the owner, thereby replacing the initial application.20

20 When Is It a Good Idea to Use ILIT Trust? https://www.investopedia.com/ask/answers/10/irrevocable-life-insurance-trust.asp。

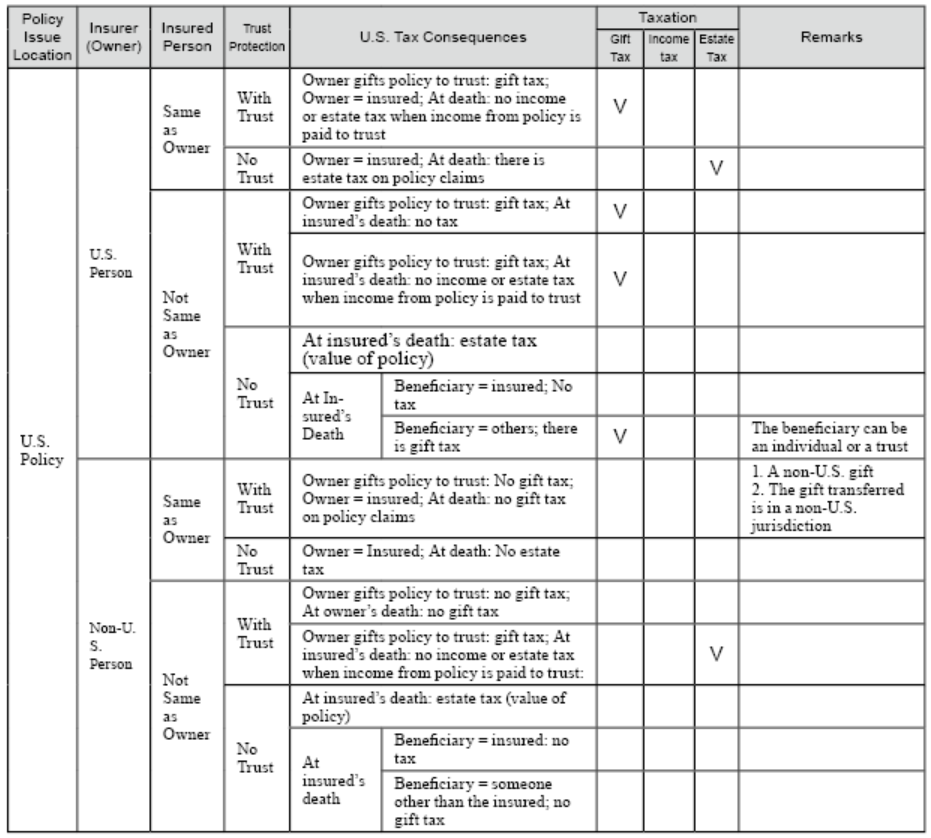

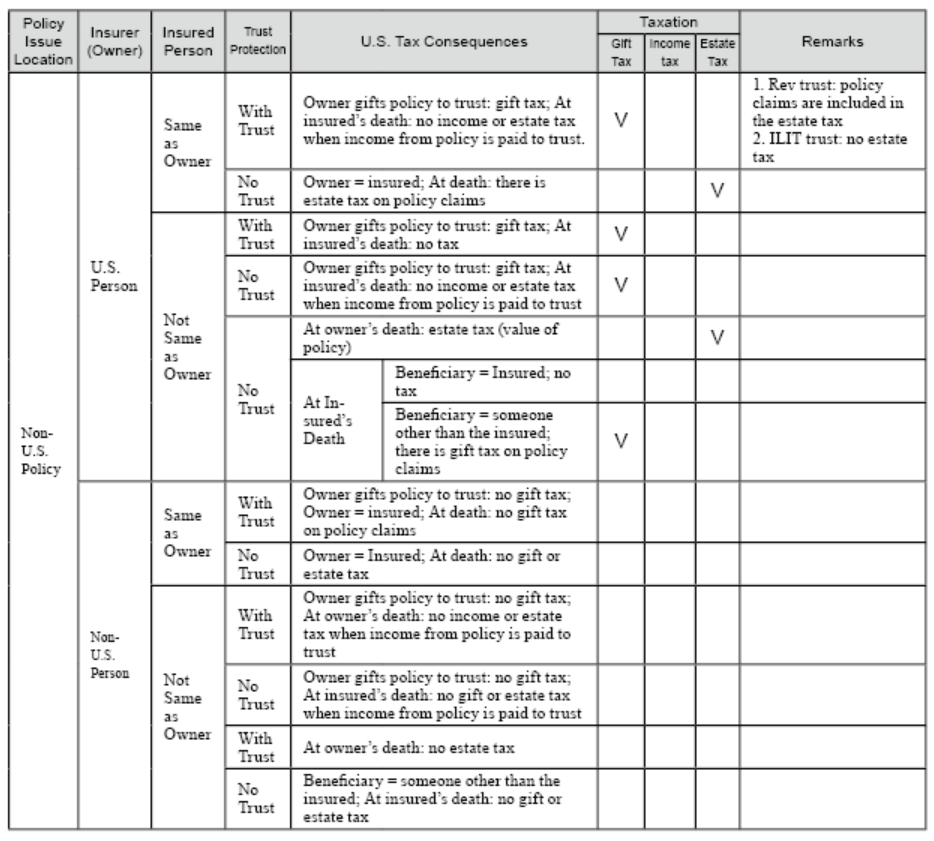

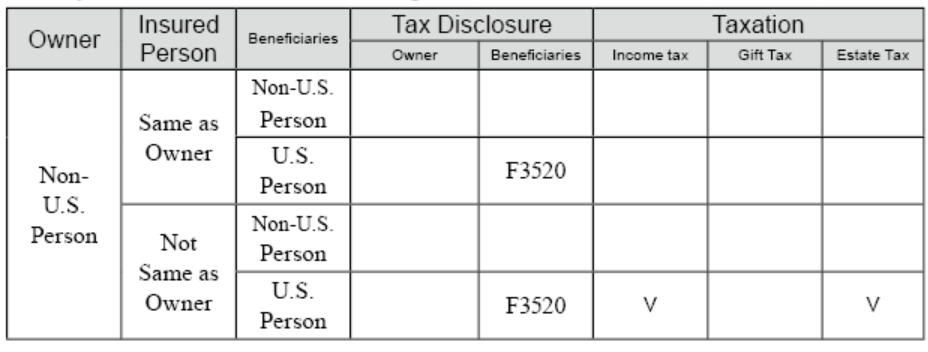

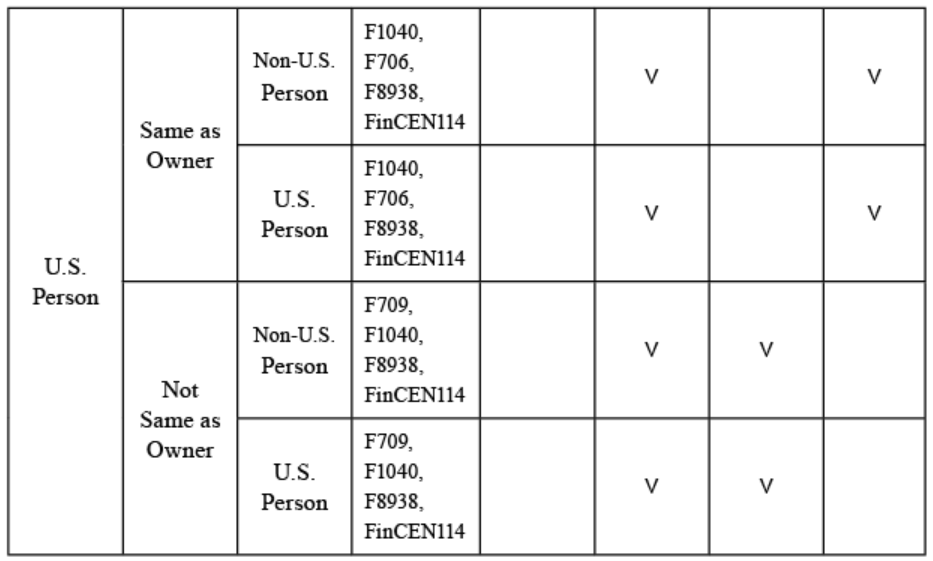

The following is a comparison table illustrating foreign and domestic insurance taxation which lists the nationality of the policyholders (owners) and the insured, as well as the U.S. tax consequences with or without a trust:

Offshore policies (Hong Kong, Singapore, Bermuda and other foreign trusts) that have not set up a family trust or have set up a family trust, face U.S. tax filing issues as follows:

I. Overview of a Charitable Trust

A charitable trust is established to achieve the philanthropic goals of a grantor and take the whole or part of the society as a beneficiary of the trust. A charity business refers to a business that has great value or social significance to the society. This includes the relief of poverty, religious groups, victims, the disabled, education, science and technology, culture, art, sports, medical and health affairs, environmental protection, maintenance of ecological balance, etc. The most renowned example of a charitable trust is the Bill and Melinda Gates Foundation Trust, which is currently set to run for 20 years after the death of Bill and Melinda. At the end of the 20-year term, the remaining assets and the interest received will become the property of the charity. Despite their divorce, their desire to engage in philanthropic business and continue to operate their charitable trust does not change.21&22 A charitable trust is a way for a grantor to continue and live out his or her wishes and values through a charitable trust.

21 Bill and Melinda Gates Foundation. https://www.gatesfoundation.org/about/financials/foundation-trust.

22 What the Gates Divorce Means for the Bill and Melinda Gates Foundation. https://www.nytimes.com/2021/05/04/business/bill-melinda-gates-divorce-foundation.html.

From a wealth management perspective, a charitable trust is a useful and multi-pronged approach to estate planning. The creation of a charitable trust not only leaves assets to the charity and its beneficiaries but also allows the grantor to have control over how and when the trust income is distributed while he or she is alive, while benefiting the grantor, the designated beneficiaries, and the charity. It is important to note that the grantor’s charitable trust structure and the charities selected by the grantor must qualify for the charitable deduction by the IRS. The federal tax deduction requirements are set forth in IRC §501, which lists 29 types of non-profit organizations that are eligible for the federal income tax deduction, as described in IRS Publication No. 557. 23&24

23 Publication 557 (Rev. February 2021), Cat. No. 46573C. https://www.irs.gov/pub/irs-pdf/p557.pdf.

24 What Is a Charitable Trust? https://www.westernsouthern.com/learn/financial-education/what-is-a-charitable-trust.

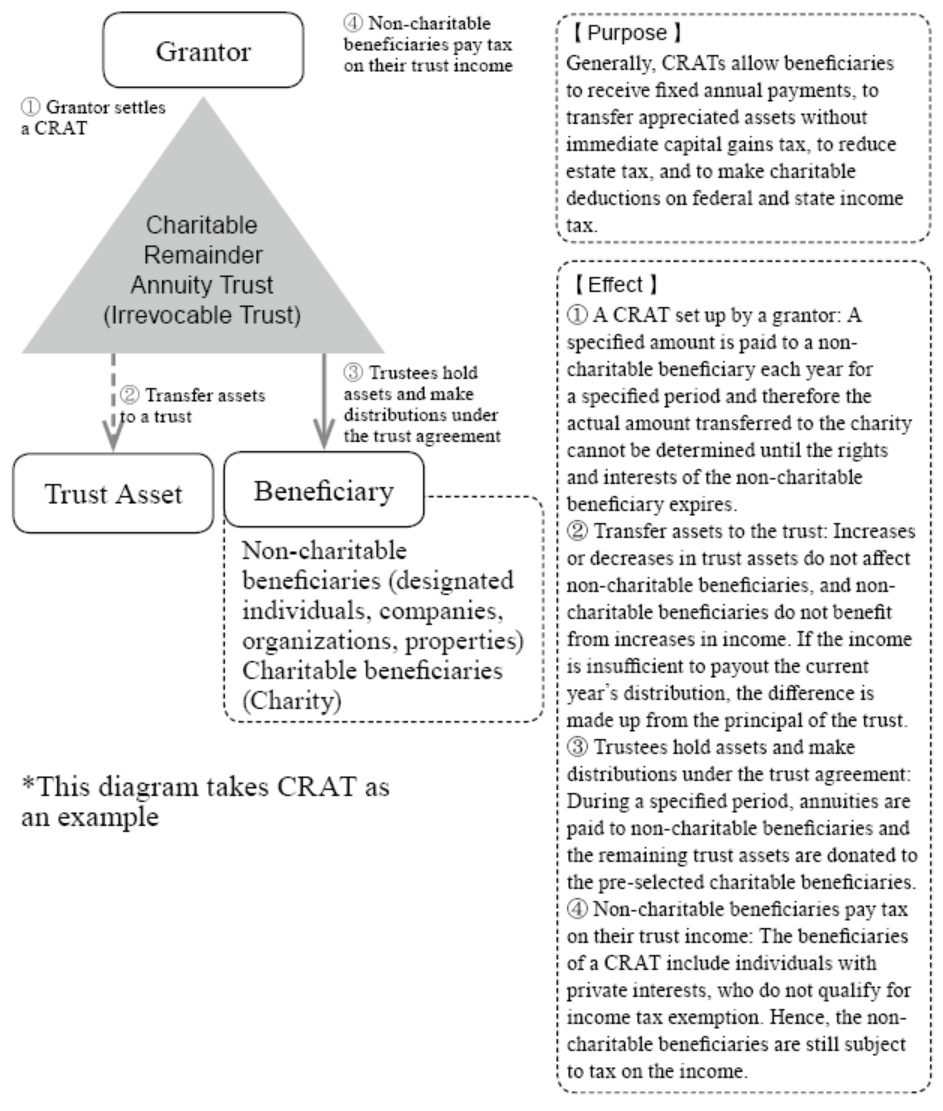

A charitable trust is an irrevocable trust. Hence, once it is created, it cannot be cancelled or modified. The trustee will manage the trust’s assets after the grantor has transferred control of the assets to the trust. Charitable trusts can be classified into two types, depending on how and when the benefits of the trust are distributed: Charitable Lead Trusts (CLTs) and Charitable Remainder Trusts (CRTs). Both trusts can pay benefits through an “Annuity” and “Unitrust”, but the order of distribution of the remainder are different in both trusts. The following is an introduction to CLT and CRT.

II. Charitable Lead Trust (CLT)

Charitable Lead Trust (“CLT”) first distributes a portion of the trust’s income to a charitable organization so that the grantor receives a tax deduction equal to the amount that can be received from a charitable contribution. After the end of the trust term, the remaining assets of the trust will be returned to the donor or to a designated non-charitable beneficiary. Under the CLT structure, a person with substantial wealth can place assets that are certain to increase in value in the future into the trust first, so that the increase in value will be free of taxation on the grantor’s estate. 25

25 What is a charitable trust and why would I need one? https://www.northwest.bank/personal/plan/invest/leaving-legacy/what-charitable-trust-and-why-would-i-need-one.

CLT donates trust assets to a charity for a specified period. After the trust term ends, the remaining trust funds will be paid to the beneficiary. This not only reduces the beneficiary’s tax liability but also provides the beneficiary with estate and gift tax deductions as well as tax deductions for charitable donations once the remaining trust assets are distributed to the beneficiary. The CLT reduces the beneficiary’s potential tax liability upon inheritance and provides the donor with an ongoing charitable contribution for a specified period without the need for the donor to make monthly manual payments. Unlike the charitable remainder trust described later, in addition to making monthly payments to the charity, a CLT can also make monthly payments to the beneficiary and in some cases, to the donor. It should be noted that the amount must be between 5% and 50% of the trust’s residual assets. 26

26 Charitable Lead Trust. https://www.investopedia.com/terms/c/charitableleadtrust.asp.

III. Charitable Remainder Trust (CRT)

A Charitable Remainder Annuity Trust (CRAT) is a gift transaction in which a donor places assets into a charitable trust that subsequently pays a fixed income in the form of an annuity to a designated beneficiary. The beneficiary receives a fixed income from the CRAT in the form of an annuity calculated as a fixed percentage of the initial value of the trust’s assets, but that percentage must be no less than 5%. The CRAT lasts until the donor’s death, at which time any remaining funds in the trust are donated to a charity pre-chosen by the donor. As the annuity paid by the CRAT is fixed and operates immediately upon the creation of the trust, the assets within the trust structure must also remain highly liquid. 27

27 Charitable Remainder Annuity Trust (CRAT). https://www.investopedia.com/terms/c/charitable-remainder-annuity-trust.asp.

A CRAT is a relatively reassuring design for donors because its beneficiaries receive a guaranteed annual income stream that does not fluctuate regardless of the trust’s investment performance. For example, if the initial value of the trust assets is US$2 million, and the trust pays 5% to the beneficiary each year, the beneficiary will receive a fixed annual annuity of US$100,000, regardless of the investment return on the trust assets or the state of the economy. A CRAT may exist for the life of one or more beneficiaries and may also be subject to a certain number of years in its terms, such as a term not exceeding 20 years.

The main difference between a CRAT and other charitable annuities is that a CRAT is structured as a separate trust. It should be noted that although the trust itself is a tax-exempt entity, income from the trust distributed to beneficiaries is taxable under U.S. tax law and other Treasury regulations. Depending on the individual circumstances of the donor, all or part of the trust’s income may be taxed at “Ordinary Income Rates”, but part of the income may be taxed at lower “Capital Gains Tax Rates” or may even be tax-free for a few years.