專業叢書

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Chapter 5 ─ U.S. Non-Dynasty Trusts

(2) Testamentary Trust

I. Overview of a Testamentary Trust

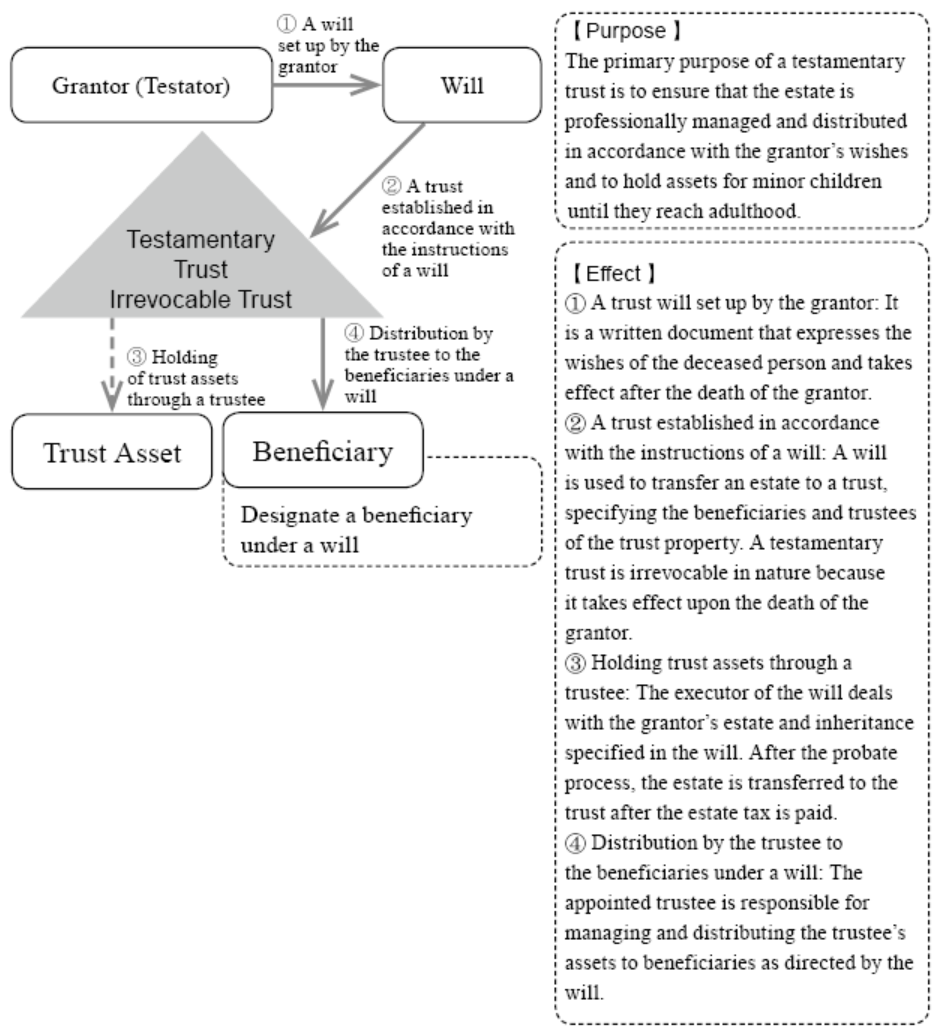

A testamentary trust usually involves three parties: the “testator” (i.e., the “grantor”), the “trustee” who manages the trust assets, and the “beneficiaries” mentioned in the will. A testamentary trust is a trust created under the direction of a will. The testator creates a will during his or her lifetime, which not only covers the guardianship of minor children, but also specifies the estate to be placed in the trust and how the estate will be distributed. When the will is authorized by the court, the executor will set up a trust in accordance with the instructions of the will and transfer the estate into the trust to make it a trust asset and the trustee will continue to manage the trust assets for the beneficiaries.8

8 Testamentary Trust. https://www.investopedia.com/terms/t/testamentarytrust.asp.

A testamentary trust is established according to the grantor’s will and becomes effective upon his or her death. Therefore, a testamentary trust is irrevocable in nature, and because the grantor is no longer alive, a testamentary trust cannot be revoked or modified after it is created. However, a will can be changed by the grantor any time during his or her lifetime.

When a will becomes effective, the executor will deal with the estate and inheritance of the grantor and transfer the estate to the trust after paying estate tax. A will can contain more than one testamentary trust, and the trustees are appointed to manage the assets in the trust and distribute them to the beneficiaries in accordance with the instructions of the will.

Since the trustee must distribute the trust property according to the will, such as paying for the education of children, making charitable distributions, etc., the creation of a testamentary trust allows the grantor to continue his or her desire to control the distribution of the estate and to achieve the goal of taking care of the beneficiaries (heirs or legatees) and to avoid unnecessary disputes.

II. Purpose of Creating a Testamentary Trust 9

Generally, a testamentary trust is created for young children, relatives with disabilities, or others who may inherit a large sum of money upon the death of the testator until such beneficiary reaches the legal age or is able to take over the estate. The executor of a will may hold the beneficiary’s share of the estate in the trust until he or she reaches a specified age. A termination date can be provided for in the terms of a testamentary trust. Typical dates may be when the beneficiary turns 25 years old, graduates from university, or gets married. The testator may also make distributions for charitable purposes as he or she wishes under a charitable trust.

9 10 Things You Should Know About a Testamentary Trust. https://www.legalzoom.com/articles/10-things-you-should-know-about-a-testamentary-trust.

Testamentary trusts can be designed in a variety of ways, and in some cases the testator wishes to separate control of the assets from the distribution of income. For example, if the testator has four adult children, the trust assets are invested uniformly by professionals and each child is entitled to a 25% distribution of the trust income. In this situation, it may be more appropriate to create four additional sub-trusts, transfer the proportion of the trust benefits to be distributed to each child to the sub-trust, and allow the children to manage their own sub-trusts.

If the above structure is implemented, the will would direct the testator’s remaining estate to be transferred to the trustee of the testamentary trust, who is responsible for the primary investment of the estate. The estate will be placed by the independent controller of the primary trust. The owner of the income and asset of the primary trust will be the trustees of the testamentary trust and the general beneficiaries will be limited only to the testator’s spouse, children, other lineal descendants, and specific charities supported by the testator and the family. Typically, a sub-trust will be created for each child of the testator and the descendants of that child, as well as for the general beneficiaries.

III. The Process of Creating a Testamentary Trust

(i) Prepare Your Will Documents

A will is a legal document that sets out the testator’s final wishes regarding the distribution of assets and the relationship between his or her relatives. The testator may record the guardianship of dependents and the management of their financial interests, and may leave the estate to a specific group or donate it to a charity. A testator makes a will while he or she is alive and executes it at his or her death. An executor is named in a will and is responsible for the administration of the estate.

A will is the primary document used by the probate court to guide and resolve estate issues in the probate process, and the probate court oversees the executor to ensure that the will is executed and the wishes of the will are carried out. Assets that do not have a designated beneficiary are not considered probate assets and are transferred to a beneficiary, such as a life insurance policy. Overall, it is the will and the probate court that will ultimately determine all the assets, including who receives the estate and how much that person should receive. A will can appoint a guardian for surviving family members and make arrangements for any other special circumstances, including taking care of a child or an elderly with special needs.

(ii) Election of Executors

An executor is a company or individual named in a will to handle the estate of the testator, and the executor will handle the estate according to the wishes set out in the will. Before appointing an executor, it is important to understand their duties and obligations so that you can evaluate whether they have the time and ability to handle everything as required.

Most people appoint a family member or friend as an executor due to trust and respect. However, such executors often face problems such as being uncapable to carry out their role as an executor due to grief, lack of professional knowledge to deal with complex and difficult estate issues, difficulties in making consistent decisions when relatives and friends are co-executors, personal responsibility for mistakes in handling the estate, or conflicts of interest arising from being both the executor and the beneficiary.

If the term of the will is simple, appointing a friend or relative as an executor can be an efficient way to deal the affairs of the testator, provided that they have the time and are competent to do so. However, if the estate involves complex distribution of assets, or if the trust established under the will requires long-term professional management, appointing a professional or professional organization as a neutral executor should be a more appropriate option. 10

10 Learn About the Role of an Executor. https://www.thebalance.com/executor-executrix-3505523.

(iii) Probate Proceedings

The probate process, as described in the living trust, is the legal process by which the descendants come to court with a will created during the life of the testator and seek approval from the court. The process takes an average of 16 months, and if there is an estate in another state, it must also be probated in that state, and all of the terms in the will must be made public by the court. In addition to the documents being made to the public, the estate must be first used to pay back loans from creditors before they are distributed to the beneficiaries in accordance with the state law. Moreover, high attorney and court fees are also a consideration for grantors when creating a will. They usually cost more than 4% to 10% of the total estate.