專業叢書

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Chapter 5 ─ U.S. Non-Dynasty Trusts

(3) Grantor Retained Annuity Trust (GRAT)

I. Introduction of GRAT

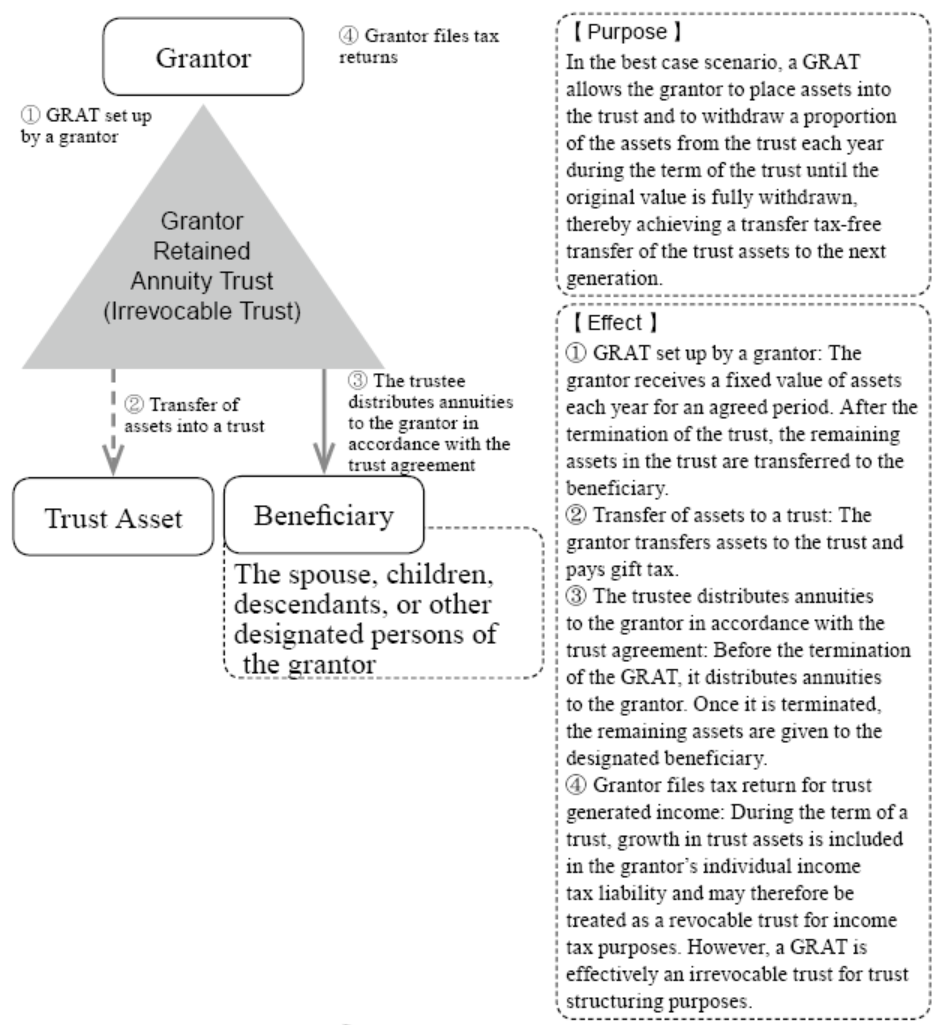

A Grantor Retained Annuity Trust (GRAT) is an irrevocable gift trust, commonly used in estate or unlisted equity planning, that allows the grantor or grantor to pass significant wealth to the next generation with little or no gift tax liability, minimizing the amount of tax on gifts made to family members. A GRAT is an irrevocable trust that is created for a fixed period of time. Once the trust is created, the grantor should transfer his or her assets into the trust and make annuity payments each year. When the trust is terminated, the beneficiary will receive assets free of estate and gift tax.

A GRAT is a property management trust that incorporates the advantages of a revocable trust. When a GRAT is created, although beneficiaries receive assets from the trust provided by the grantor, the grantor still retains the right to receive the original value of the assets back from the trust during the term of the GRAT. The annuity payments are derived from the appreciation or income of the trust’s assets. After the termination of the GRAT, the remaining assets are transferred to a beneficiary designated by the grantor. If the grantor dies before the termination of the trust, the assets become part of the grantor’s taxable estate.11

A common way for transferring GRAT assets is for parents to set up a GRAT and list their beneficiary children, then parents can put as much money into the GRAT as they wish. Under the terms of the existing GRAT, the principal plus interest of the GRAT is transferred back to the parents after a pre-determined period of time. Any remaining income earned on the interest is allowed to remain in the trust and can be inherited by the next generation free of estate and gift taxes.12

11 Grantor Retained Annuity Trust (GRAT). https://www.investopedia.com/terms/g/grat.asp.

12 Grantor Retained Annuity Trusts (GRAT). https://www.n-klaw.com/grantor-retained-annuity-trustsgrat/.

II. Advantages of settling a GRAT:

① Avoids the risk of uncertainty with arrangements by locking in a minimum valuation rate at the lowest valuation for assets with high potential for future premium appreciation.

② Contribute a low tax basis in return for a higher value of wealth.

③ Invest with a lower valuation rate in the present for a higher investment return rate in the future.

④ Reducing gift tax before death to avoid substantial appreciation of assets in the future, generating a low cost but high leverage effect.

⑤ A balance among the three rights of a trust through a definite wealth arrangement plan in which to optimize ownership and control rights of assets before death and to maximize the beneficiary rights of the assets after death.

⑥ Integrating financial actuary and legal taxation to achieve a dynamic balance between finance and law, as well as cutting up costs and maximizing income.

⑦ Setting up an irrevocable trust to maximize the extent of separation of business assets and personal assets, effectively isolating and blocking potential disputes and risks to assets and wealth.

⑧ An irrevocable grantor trust allows the grantor to be free from U.S. income tax liability while allowing beneficiaries to enjoy the assets free of estate tax upon the grantor’s death.

⑨ Structuring a clear trust planning schedule and making long-term investments not only avoids gift and estate taxes, but also maximizes the value of assets and minimizes investment risks.

⑩ With the arrangement of multi-principal legal structure, it is fully demonstrated that the trust is not a short-term profit-seeking tool, but rather a tool for wealth substitution, effective tax-saving strategy, and long-term investment and wealth preservation.

III. The Risk of GRAT

There are some disadvantages of establishing a GRAT. When a GRAT is established, the term of the trust is usually set up by the grantor. After the termination of the trust, the remaining assets are transferred to the designated beneficiaries, but if the grantor passes away before the trust terminates, all of the assets in the trust will be returned to the grantor and the assets will be included in the grantor’s taxable estate.

The duration of a trust is one of the most important factors affecting a GRAT’s effectiveness. The longer the trust period of the GRAT, the more effective it is in reducing gift taxes, but the higher chance that the grantor will die before the trust period ends. Therefore, when establishing a trust, the grantor should consider his or her age and health condition to set an appropriate term for the trust.

Also, in a GRAT, the grantor transfers assets into a trust as a complete gift and he or she will receive income based on the original value of the assets from the trust during the term of the trust. (the term of a GRAT is at least two years13). After the termination of the trust, the remaining assets will be distributed (based on any appreciation value and the IRS assumed rate of return) to the grantor’s beneficiaries at the rate of return set by the IRS (IRC §7520). When the 7520 rate goes down, the present value of the same annuity payment will increase so that the amount of the gift decreases. Establishing a GRAT for estate planning is only successful when the growth rate of the transferred property exceeds the 7520 rate. If the GRAT “fails” due to the lack of growth in its investments, the legal and administrative fees spent are non-refundable.