專業叢書

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Chapter 5 ─ U.S. Non-Dynasty Trusts

(4) Intentionally Defective Grantor Trust (IDGT)

I. Overview of an IDGT Trust

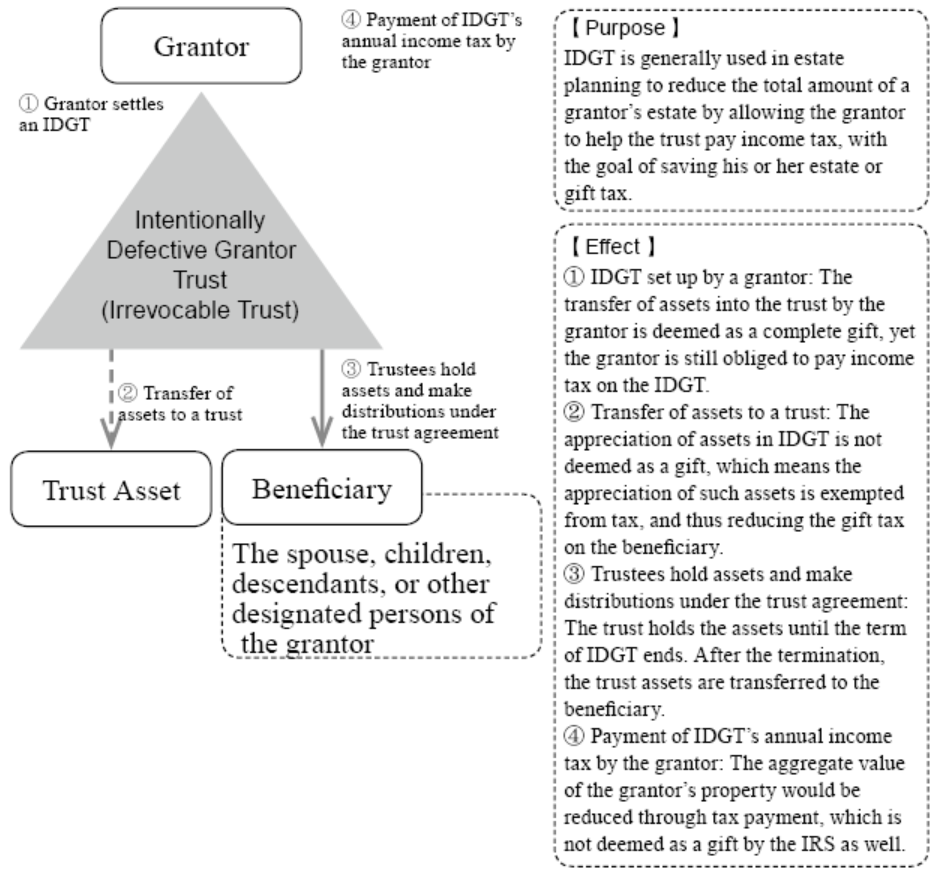

Intentionally Defective Grantor Trusts (IDGTs) are not income tax efficient, instead, they are made for estate and gift tax efficient purpose. IDGTs are subject to gift tax when the grantor transfers cash or assets into the trust and the trust income derived from it will subject to the grantor. Thus, this type of trust is not set for income tax mitigation purposes.

The IDGT allows the grantor to pay for the income tax of the trust, so there is no recognition under income tax law that these assets have been transferred away from the individual. Because the grantor must pay for the income tax of the trust each year, the assets in the trust will be tax-free even if the value of the assets increases from time to time, thereby avoiding gift tax and reducing estate tax on the grantor’s beneficiaries. The beneficiaries of an IDGT are usually the grantor’s children or descendants who receive the appreciated assets while income taxes are still paid wholly by the grantor.

A grantor trust allows a grantor to make investment plans through a trust, such as a Spousal Lifetime Access Trust (SLAT), which is a version of IDGTs in which the grantor’s spouse is usually included as a current beneficiary along with the grantor’s descendants. Although the grantor’s spouse must relinquish the control of the trust, the assets are made available to the beneficiary in a manner that does not incur estate tax and when appropriate, can also be distributed to the beneficiary. SLATs can be valuable to married couples in minimizing future estate tax liability while maintaining a degree of control power. In some cases, the beneficiary’s spouse can act as trustee and oversee the trust’s investments and distributions.14

14 Maximize Next Generation Assets With Intentionally Defective Grantor Trusts. https://www.bnymellonwealth.com/articles/strategy/maximize-next-generation-assets-with-intentionally-defective-grantor-trusts.jsp.

When properly structured, an IDGT can be a very effective estate planning tool, allowing people to reduce their taxable estate while gifting assets to beneficiaries at a fixed value. The grantor of the trust can also reduce their taxable estate by paying income tax on the trust assets, basically gifting additional wealth to the beneficiaries.15

15 Intentionally Defective Grantor Trust (IDGT). https://www.investopedia.com/terms/i/igdt.asp.

II. Establishing an IDGT

(i) Purpose and Operating Method

IDGT is basically made for estate tax purposes. Estate tax will be equal to the value of the grantor’s estate minus the value of assets transferred into the trust. The individual would sell the assets to the trust in exchange for a promissory note for a certain term (e.g., 10 or 15 years). The note will pay enough interest ensuring the value of the note will be at above-market price, but the underlying assets are expected to appreciate faster.

(ii) Typically, the establishment of an IDGT includes the following grantor trust terms:

① Power of Substitution: Grantor can reacquire assets from the IDGT and replace them with equivalent assets.16 The grantor may exchange assets in the name of the trust for other properties of equivalent value without the consent of other person with fiduciary duties, which creates a grantor trust for income tax purposes, but does not result in the inclusion of IDGT trust assets in the grantor’s taxable estate.

16 IRC Section 675(4)(c).

Under IRC §2038, in the case of a revocable trust, the revocable trust assets would be included in the grantor’s taxable estate. However, because an IDGT is an irrevocable trust, so the trust assets would not be included in the grantor’s taxable estate.

② Ability to loan from the trust: grantor may retain the authority to loan from an IDGT without adequate interest or secured loans. Similarly, other non-adverse party may have the ability to loan from the trust. 17 If it is possible for the grantor to loan from IDGT’s assets at less than the appropriate interest and secured loan or on terms more favorable than those required for such transactions under typical commercial terms then it is a grantor trust for tax purposes.

③ Right of Disposition. The grantor may retain the power to change or add non-charitable beneficiaries. The right of disposition also allows the grantor to make additional direct distributions to existing beneficiaries named in the trust.

17 IRC Section 675(2).

III. The Duties of a Trustee

A trustee is required to keep complete and adequate records for both tax and non-tax reasons under California and federal laws. First, a trustee is responsible for giving a full account to the beneficiaries, and reporting information about trust assets, liabilities and finances when requested by a beneficiary with a current vested interest. Second, a trustee also responsible for paying required taxes and reporting it to federal, state, and local tax authorities.

As for the records should be maintained mainly fall into three broad categories: ① Legal documents; ② Trustee’s Log; and ③ financial, asset and tax documents. Let us elaborate on each category’s detail.

A trustee should keep all original legal documents and correspondences in record. The record keeping system entails document folders and an index. The original trust document and all its amendments should be preserved. Likewise, any other legal documents pertinent to settling the trust, such as promissory notes, court orders, tax documents, accounting records and correspondences to beneficiaries, attorneys, accountants and others should all be kept.

The foregoing only works to the extent to those which are documented. Hence trustee, or his or her attorney, will not rely simply on the oral communications with beneficiaries but will also be followed up by the written form of the oral communications.

A trustee should keep a chronological trustee log diary from the beginning. Entries should disclose details of the time spent (on a daily basis), discretionary decisions, meetings, travel and out of pocket expenses in furtherance of trustee duties. A detailed log will show the basis for all discretionary trustee decisions: The legal authority relied upon; the professional advice obtained; and the critical information and documents considered in making the judgment. 18

18 Trustee Duties –A Guide for Trustees. https://www.arl-lawyers.co.nz/wp-content/uploads/2015/10/Trustees-Duties-2015.pdf.

If the trustee out of benevolence fails to comply with the terms of the trust and causes damage to the trust, the trustee is free from liability to the extent that the damage would not have occurred even if the trustee had not breached the trust, and to the extent that the damage is not causally related to the breach.

Even if a trust agreement exempts a trustee from liability for breach of agreement, the exclusion is not effective to the extent that the breach of the trust agreement is an abuse of duty of care by the trustee to the grantor. Common trustee defaults are also not excused by the terms of the trust: the trustee’s intentional defaults, the trustee intentionally disregarding the interests of the beneficiaries, or the trustee gaining interest from unlawful practices.

If the beneficiary has not sued the trustee for a long period of time to claim liability for the breach, the beneficiary may not do so again. In the light of objective circumstances, it would be unfair to allow the beneficiary to do so. The beneficiary does not lose the right to request execution of the trust simply because the term of the trust has ended, but if the trustee denies the existence of the trust and the beneficiary is fully aware of it, then the beneficiary may lose the right to request execution of the trust since the term of the trust has already ended. 19

19 G.G. Bogert & G.T. Bogert, The Law of Trusts and Trustees s 229, at 726, 2d ed. (1993).

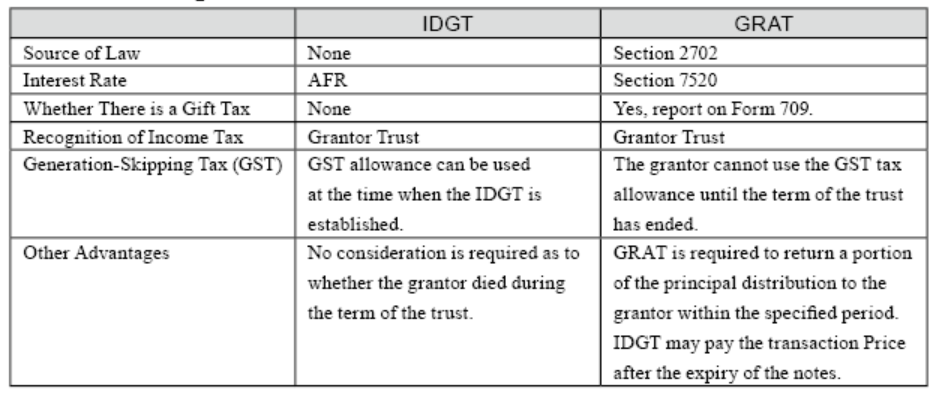

IV. Comparison of GRAT and IDGT