專業叢書

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Chapter 5 ─ U.S. Non-Dynasty Trusts

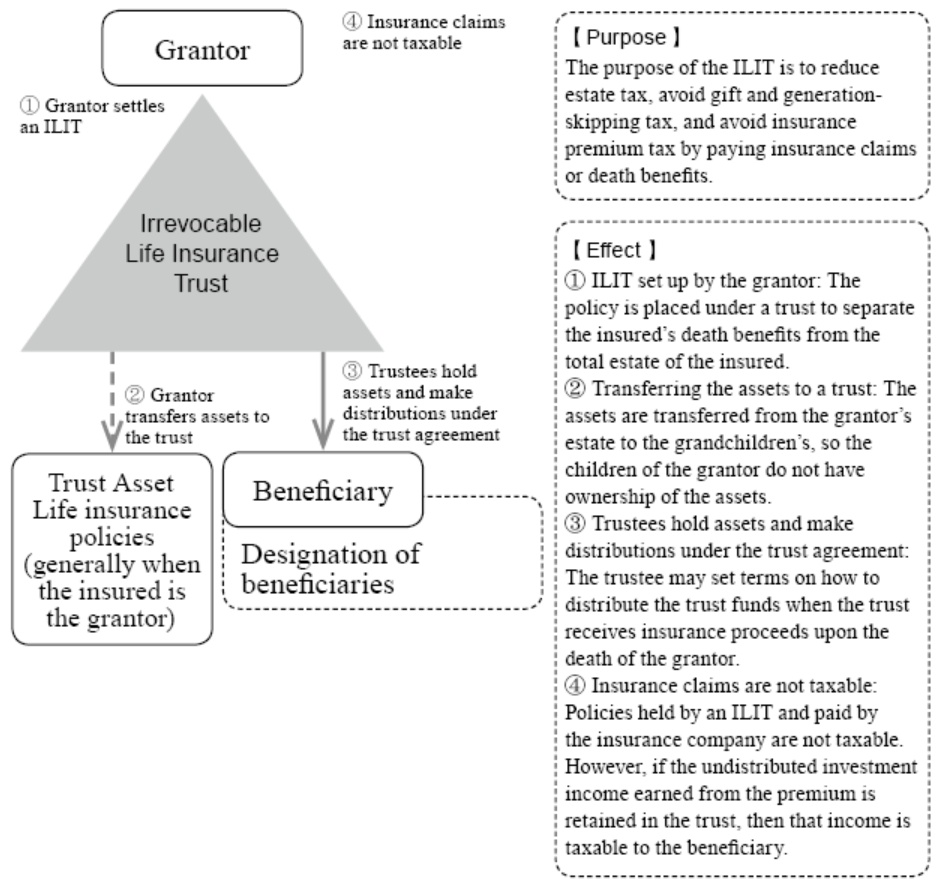

(5) Irrevocable Life Insurance Trust (ILIT)

I. Overview of an ILIT

An irrevocable life insurance trust (ILIT) is a trust that cannot be revoked or modified once it has been created. ILITs are designed to use life insurance policies as assets owned by the trust. Once the grantor has contributed property or life insurance death benefits to the trust, they cannot change the terms of the trust or reclaim any of the property they hold.

People purchase life insurances for many reasons because it provides many unique functions that are not found in other financial products. For example, in the early years of the policy, the insured needs to pay only a small sum to lock in a certain level of monetary benefit at death. This amount often grows as time passes.

The grantor must prevent from claiming any direct control or ownership of the ILIT. Therefore, the premium payments must come from a checking account owned by the ILIT and not the grantor. If the grantor transfers life insurance policies into the ILIT and passes away within three years, that transfer is still subject to estate tax. In addition, high value life insurance policies may also be counted when calculating the estate taxes owed. Before creating an ILIT, one should confirm whether the company allows the individual to purchase insurance policies for a related person. After creating the trust, the insurance company must be notified that the ownership of the insurance policy is under the trust. The insurance company can then issue the insurance policy and set the trust as the owner of the policy and send it the policy.

An ILIT is a trust that pays the premiums and holds the policy. It is designed to avoid the need for the insurer to hold the policy personally in order to save estate tax and to allow the beneficiaries to receive insurance claims from the trust after the death of the insured and to pay estate tax on the insurance benefits. Generally, if the trust is an irrevocable trust, the insurer cannot be the trustee. It must appoint a legal adult or an organization to be the trustee. Moreover, the trust must be established three years before the insured’s death and must apply for a “Federal Tax ID” from the IRS.

After the trust is established, a bank account is registered in the trustee’s name. Funds are deposited into the trust account and premiums are paid from the trust account to the insurance company. This isolates the policy from personal property, separating the value of the policy and insurance benefits which helps the insurer to avoid lawsuits and claims.

As an alternative to naming a single beneficiary, an ILIT offers several legal and financial benefits to heirs, including favorable tax treatment, asset protection, and guaranteed benefits that is consistent with the beneficiary’s will. If a grantor transfers an existing life insurance policy to an ILIT, there is a three-year look-back period during which the death benefits can be included in the grantor’s estate. Once the life insurance company makes an offer for a new application, the trust can be properly listed as the owner, thereby replacing the initial application.20

20 When Is It a Good Idea to Use ILIT Trust? https://www.investopedia.com/ask/answers/10/irrevocable-life-insurance-trust.asp。

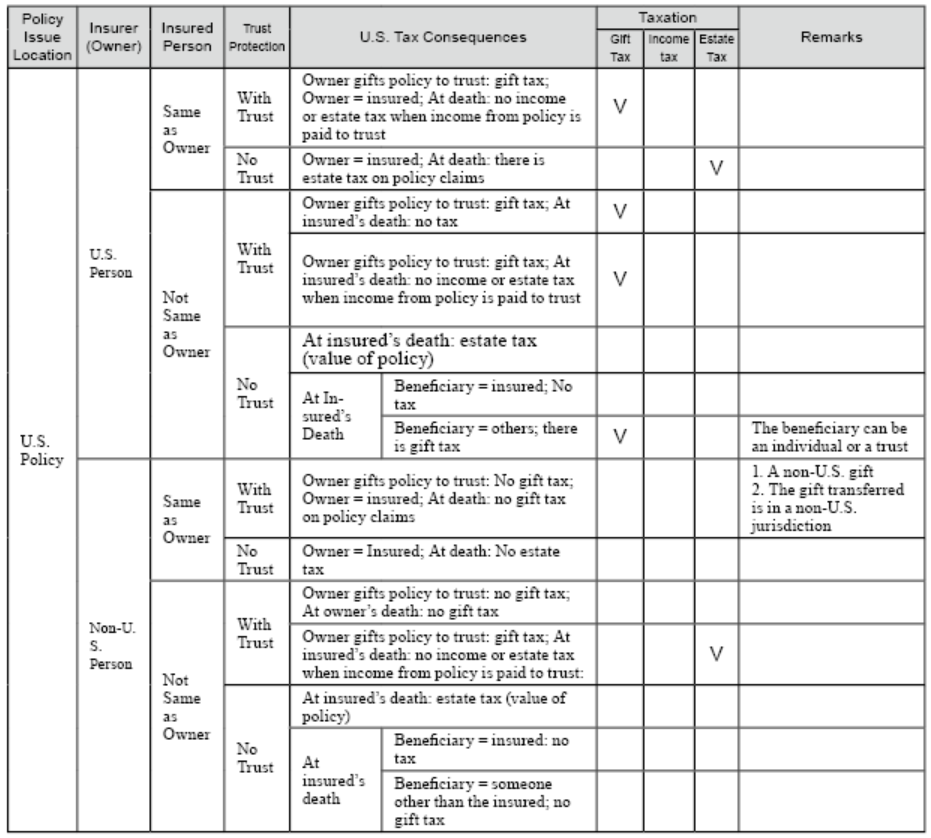

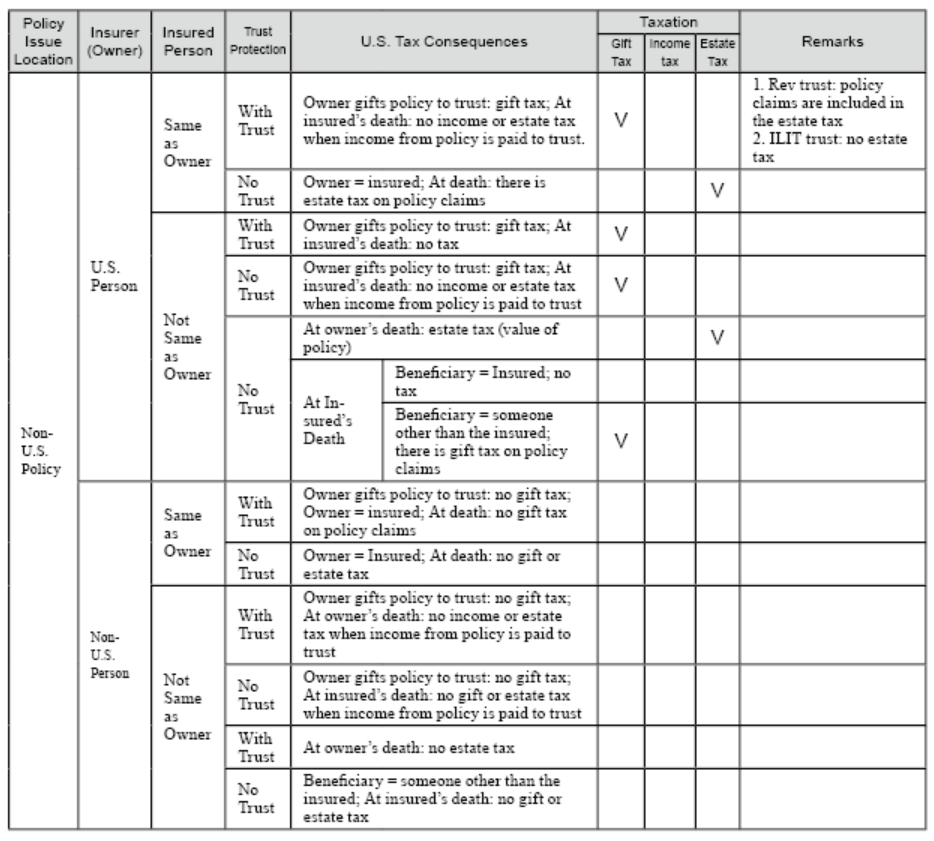

The following is a comparison table illustrating foreign and domestic insurance taxation which lists the nationality of the policyholders (owners) and the insured, as well as the U.S. tax consequences with or without a trust:

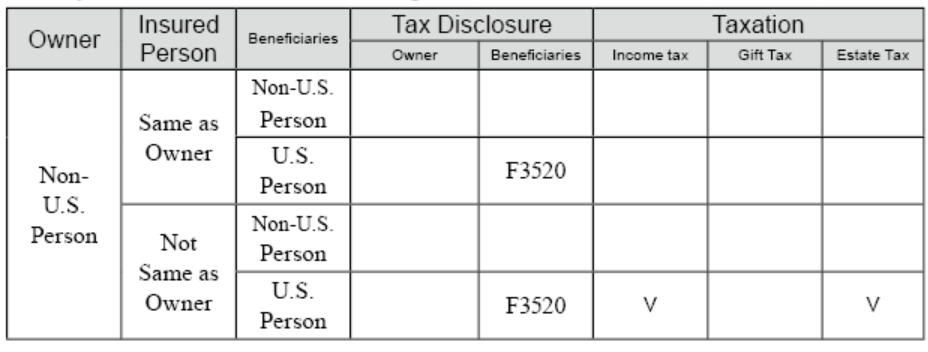

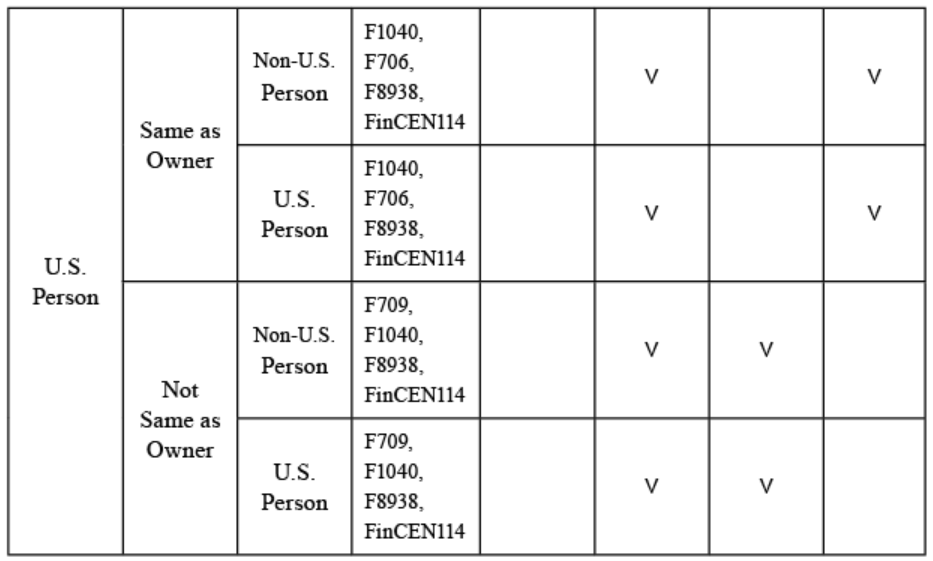

Offshore policies (Hong Kong, Singapore, Bermuda and other foreign trusts) that have not set up a family trust or have set up a family trust, face U.S. tax filing issues as follows: