專業叢書

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Chapter 5 ─ U.S. Non-Dynasty Trusts

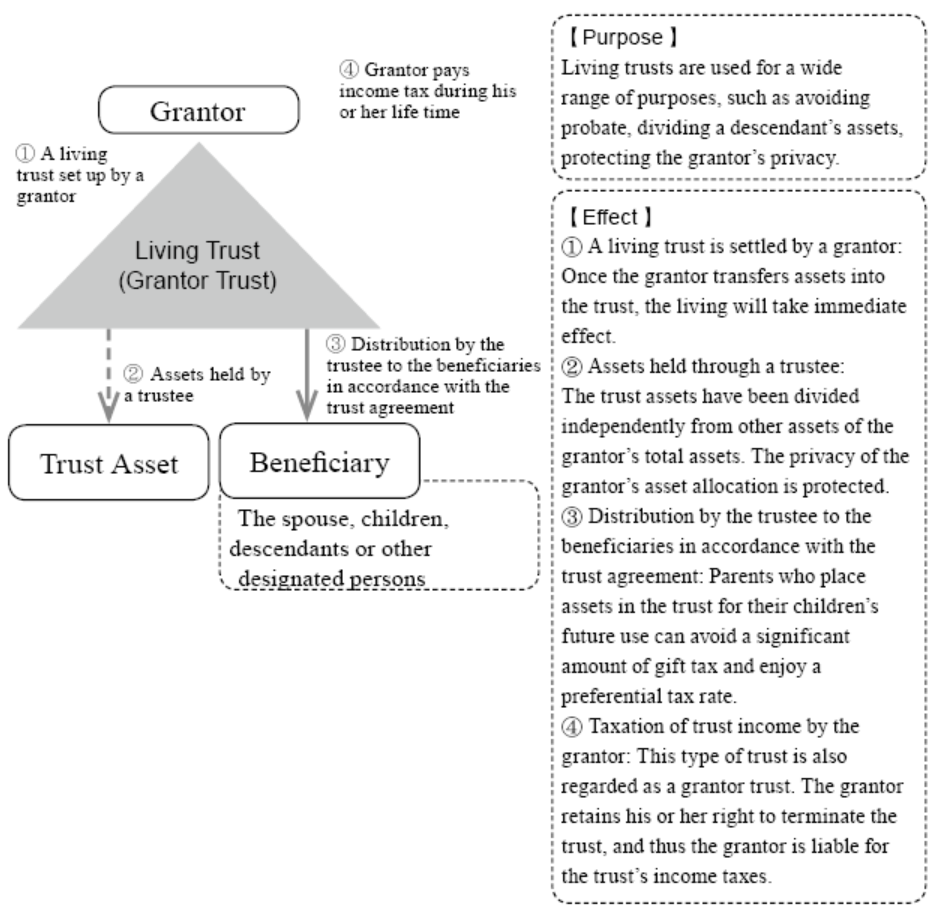

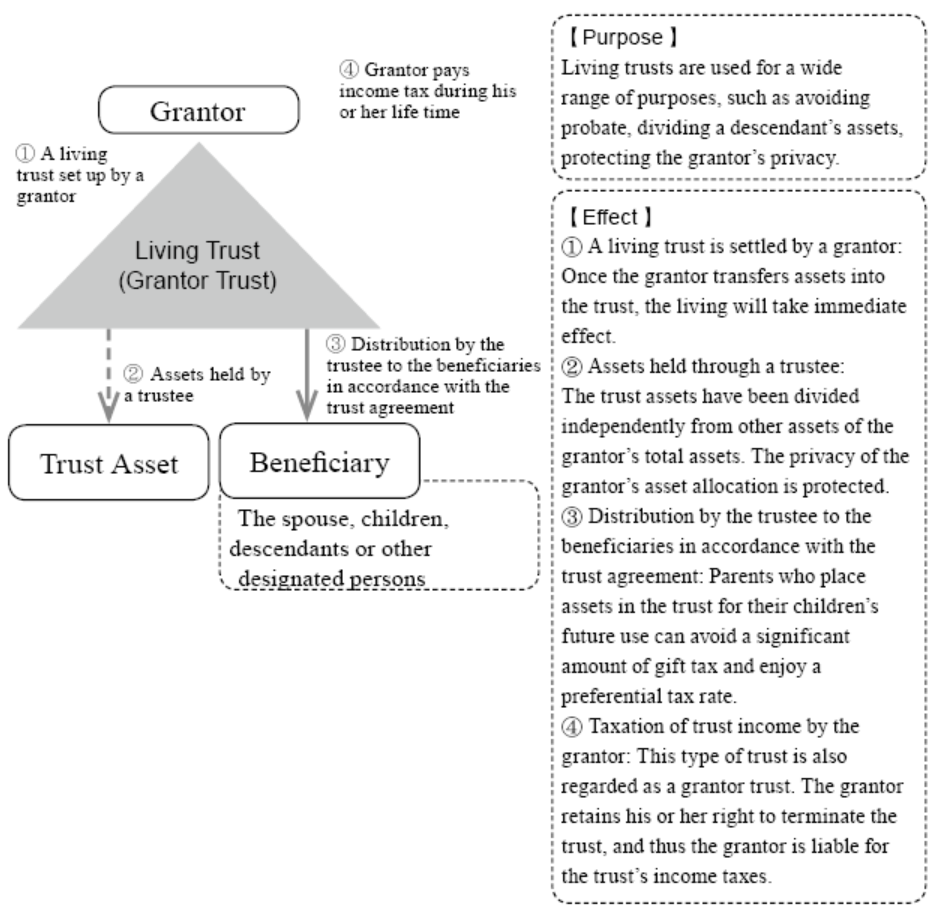

(1) Living Trust

I. Overview of a Living Trust

If a trust has a short duration, then it is deemed as a non-dynasty trust. Generally, living trusts are not considered dynasty trusts.

A living trust, also known as “Inter Vivos”, is a trust formed by the grantor during his or her lifetime. The grantor transfers assets (such as a real estate, bank account, company stock, etc.) into the living trust and appoints a trustee through the trust agreement to manage the trust assets for the benefit of the ultimate beneficiaries. The trustee holds legal title to the assets transferred into the trust and transfers the assets to the designated beneficiaries upon the fulfillment of certain conditions set forth in the trust (usually the death of the grantor).

Under a living trust structure, if the grantor chooses to set up a revocable living trust, he or she will still retain control of the trust property during his or her lifetime even after the assets are transferred from his or her individual account to the revocable trust. 1

1 Living Trust. https://www.investopedia.com/terms/l/living-trust.asp.

The main purpose of a living trust is to avoid the time-consuming and costly probate process and to allow the estate to be distributed according to the grantor’s wish. In contrast to the complex legal probate process, a living trust can ensure that the trust assets and estates are executed according to the wishes of the grantor upon his or her death, without having to go through the courts to deal with disputes between heirs. In view of its effect, a living trust can also be considered a legal document to replace a will.

II. Types of Living Trusts

Several types of living trusts are available to an individual seeking to settle a living trust. The most common types of living trust consist of Revocable Living Trusts (RLT) and Irrevocable Living Trusts (ILT). In a revocable living trust, the grantor retains the right to revoke and return the property delivered to the trust to himself at any time. An irrevocable living trust, however, is irrevocable once the trust agreement is signed.

A revocable living trust may be revoked or modified at any time by the grantor. Generally, revocable living trusts are drafted to protect the interests of the grantor, so that the grantor retains the right to control the trust throughout his or her lifetime. Since the grantor retains power over the assets placed in a revocable living trust, the grantor’s creditors are generally able to compel that a grantor pay out of his or her revocable living trust. 2

2 Revocable Trust vs. Irrevocable Trust: What’s the Difference? https://www.investopedia.com/ask/answers/071615/what-difference-between-revocable-trust-and-living-trust.asp.

III. Living Trust Framework

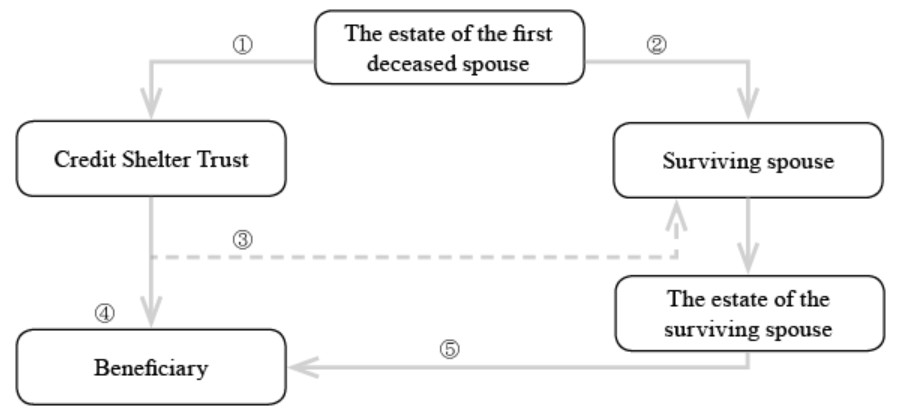

The following chart describes the operation process of a living trust:

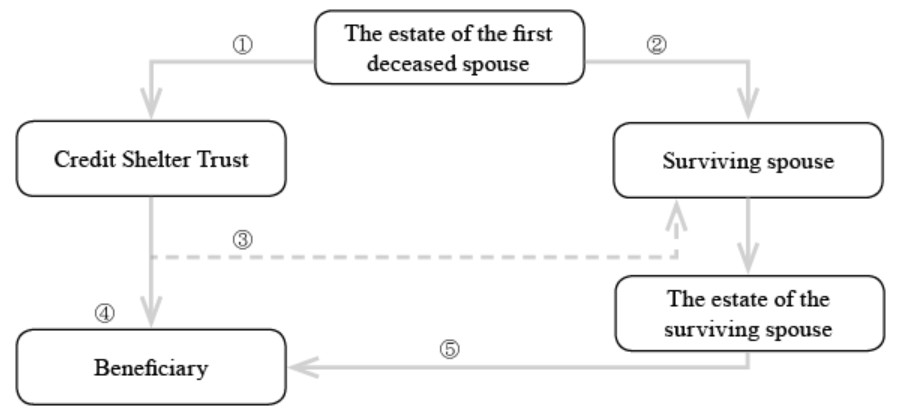

①Upon the death of the first spouse, the grantor should place assets with equivalent value to the unused estate tax exemption amount in a Credit Shelter Trust.

②The remainder of the estate is left to the surviving spouse and is entitled to the unlimited marital deduction exemption between spouses.

③The spouse’s authority over the trust assets may also be restricted.

④Upon the death of the surviving spouse, the Credit Shelter Trust assets are transferred to the beneficiary and not subject to estate tax.

⑤Upon the death of the surviving spouse, only the portion of the trust assets transferred to the beneficiary that exceeds the estate tax exemption is subject to U.S. estate tax.

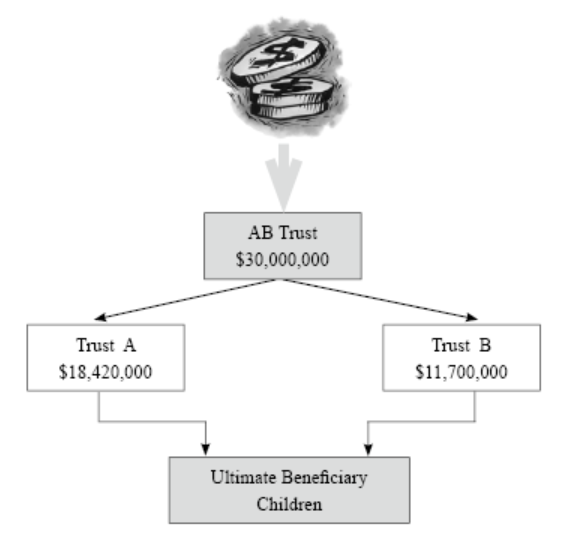

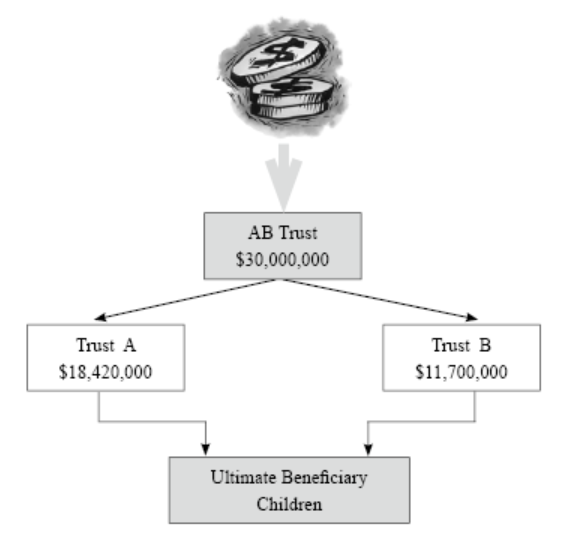

Take AB living trust with a total asset value of US$30 million as an example:3

3 A-B Trust. https://www.investopedia.com/terms/a/a-b-trust.asp.

① An AB Trust is established jointly by a married couple. The couple can enjoy the income from the trust during their lifetime. Once they pass away, their children become the trust’s beneficiaries.

② Upon the death of one of the spouses (e.g., Mr. Wang), the AB Trust is split between Trust A and Trust B.

IV. Probate Procedures

(i) Instructions and Steps

Probate is the legal process of transferring ownership of a deceased person’s assets to his or her inheritors through a court. It involves, among other things, proving the validity of a will to the court (a routine procedure), appointing a personal representative with authority to deal with the estate assets previously owned by the deceased person, discern and check the estate, estimate the estate’s value, pay off any debts and taxes of the deceased, and finally distribute the remaining estate according to Will or under state law.4

In California, for example, if an individual’s property is not placed in a trust at the time of death or cannot be transferred through insurance by a designated beneficiary and the gross value of the decedent’s estate exceeds the specified amount (US$16,625 as of January 1, 2020) in accordance with the Probate Code §13100, the decedent’s estate will need to go through the probate process.5&6

Under California law, the following property is not subject to the probate process:7

① life insurance ② retirement plans ③ property transferred to a living trust ④ property held as a joint tenant ⑤ money in an account paid directly to a beneficiary upon death ⑥ half of the community property owned by the spouse.

4 Probate. https://www.investopedia.com/terms/p/probate.asp.

5 Ca. Probate Code § 13100.

6 https://leginfo.legislature.ca.gov/faces/codes_displaySection.xhtml?lawCode=PROB§ionNum=13050.

7 Ca. Probate Code § 13050.

If a trust has a short duration, then it is deemed as a non-dynasty trust. Generally, living trusts are not considered dynasty trusts.

A living trust, also known as “Inter Vivos”, is a trust formed by the grantor during his or her lifetime. The grantor transfers assets (such as a real estate, bank account, company stock, etc.) into the living trust and appoints a trustee through the trust agreement to manage the trust assets for the benefit of the ultimate beneficiaries. The trustee holds legal title to the assets transferred into the trust and transfers the assets to the designated beneficiaries upon the fulfillment of certain conditions set forth in the trust (usually the death of the grantor).

Under a living trust structure, if the grantor chooses to set up a revocable living trust, he or she will still retain control of the trust property during his or her lifetime even after the assets are transferred from his or her individual account to the revocable trust. 1

1 Living Trust. https://www.investopedia.com/terms/l/living-trust.asp.

The main purpose of a living trust is to avoid the time-consuming and costly probate process and to allow the estate to be distributed according to the grantor’s wish. In contrast to the complex legal probate process, a living trust can ensure that the trust assets and estates are executed according to the wishes of the grantor upon his or her death, without having to go through the courts to deal with disputes between heirs. In view of its effect, a living trust can also be considered a legal document to replace a will.

II. Types of Living Trusts

Several types of living trusts are available to an individual seeking to settle a living trust. The most common types of living trust consist of Revocable Living Trusts (RLT) and Irrevocable Living Trusts (ILT). In a revocable living trust, the grantor retains the right to revoke and return the property delivered to the trust to himself at any time. An irrevocable living trust, however, is irrevocable once the trust agreement is signed.

A revocable living trust may be revoked or modified at any time by the grantor. Generally, revocable living trusts are drafted to protect the interests of the grantor, so that the grantor retains the right to control the trust throughout his or her lifetime. Since the grantor retains power over the assets placed in a revocable living trust, the grantor’s creditors are generally able to compel that a grantor pay out of his or her revocable living trust. 2

2 Revocable Trust vs. Irrevocable Trust: What’s the Difference? https://www.investopedia.com/ask/answers/071615/what-difference-between-revocable-trust-and-living-trust.asp.

III. Living Trust Framework

The following chart describes the operation process of a living trust:

①Upon the death of the first spouse, the grantor should place assets with equivalent value to the unused estate tax exemption amount in a Credit Shelter Trust.

②The remainder of the estate is left to the surviving spouse and is entitled to the unlimited marital deduction exemption between spouses.

③The spouse’s authority over the trust assets may also be restricted.

④Upon the death of the surviving spouse, the Credit Shelter Trust assets are transferred to the beneficiary and not subject to estate tax.

⑤Upon the death of the surviving spouse, only the portion of the trust assets transferred to the beneficiary that exceeds the estate tax exemption is subject to U.S. estate tax.

Take AB living trust with a total asset value of US$30 million as an example:3

3 A-B Trust. https://www.investopedia.com/terms/a/a-b-trust.asp.

① An AB Trust is established jointly by a married couple. The couple can enjoy the income from the trust during their lifetime. Once they pass away, their children become the trust’s beneficiaries.

② Upon the death of one of the spouses (e.g., Mr. Wang), the AB Trust is split between Trust A and Trust B.

- To fully utilize Mr. Wang’s lifelong gift tax exemption, Mr. Wang can transfer US$11.7 million into Trust B and use his unlimited Marital Deduction to transfer the remaining assets into Trust A. Therefore, it is not necessary to pay any estate tax when Mr. Wang deceases. Afterwards, if Mrs. Wang passes away, only Trust A’s asset will be accrued to Mrs. Wang’s taxable asset. In addtion, Mrs. Wang's lifetime exemption US$11.7 million is also applicable. In this way, this AB living trust will effectively defers estate tax payment.

- Mrs. Wang is allowed to keep benefitting from profits of Trust B if she meets some requirements, but she would not be considered the owner of Trust B for estate tax purposes. Therefore, once Mrs. Wang passes away, the assets in Trust B acquired by her children would not be viewed as Mrs. Wang’s estate, so that they would not be subject to estate tax.

IV. Probate Procedures

(i) Instructions and Steps

Probate is the legal process of transferring ownership of a deceased person’s assets to his or her inheritors through a court. It involves, among other things, proving the validity of a will to the court (a routine procedure), appointing a personal representative with authority to deal with the estate assets previously owned by the deceased person, discern and check the estate, estimate the estate’s value, pay off any debts and taxes of the deceased, and finally distribute the remaining estate according to Will or under state law.4

In California, for example, if an individual’s property is not placed in a trust at the time of death or cannot be transferred through insurance by a designated beneficiary and the gross value of the decedent’s estate exceeds the specified amount (US$16,625 as of January 1, 2020) in accordance with the Probate Code §13100, the decedent’s estate will need to go through the probate process.5&6

Under California law, the following property is not subject to the probate process:7

① life insurance ② retirement plans ③ property transferred to a living trust ④ property held as a joint tenant ⑤ money in an account paid directly to a beneficiary upon death ⑥ half of the community property owned by the spouse.

4 Probate. https://www.investopedia.com/terms/p/probate.asp.

5 Ca. Probate Code § 13100.

6 https://leginfo.legislature.ca.gov/faces/codes_displaySection.xhtml?lawCode=PROB§ionNum=13050.

7 Ca. Probate Code § 13050.