專業叢書

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Chapter 5 ─ U.S. Non-Dynasty Trusts

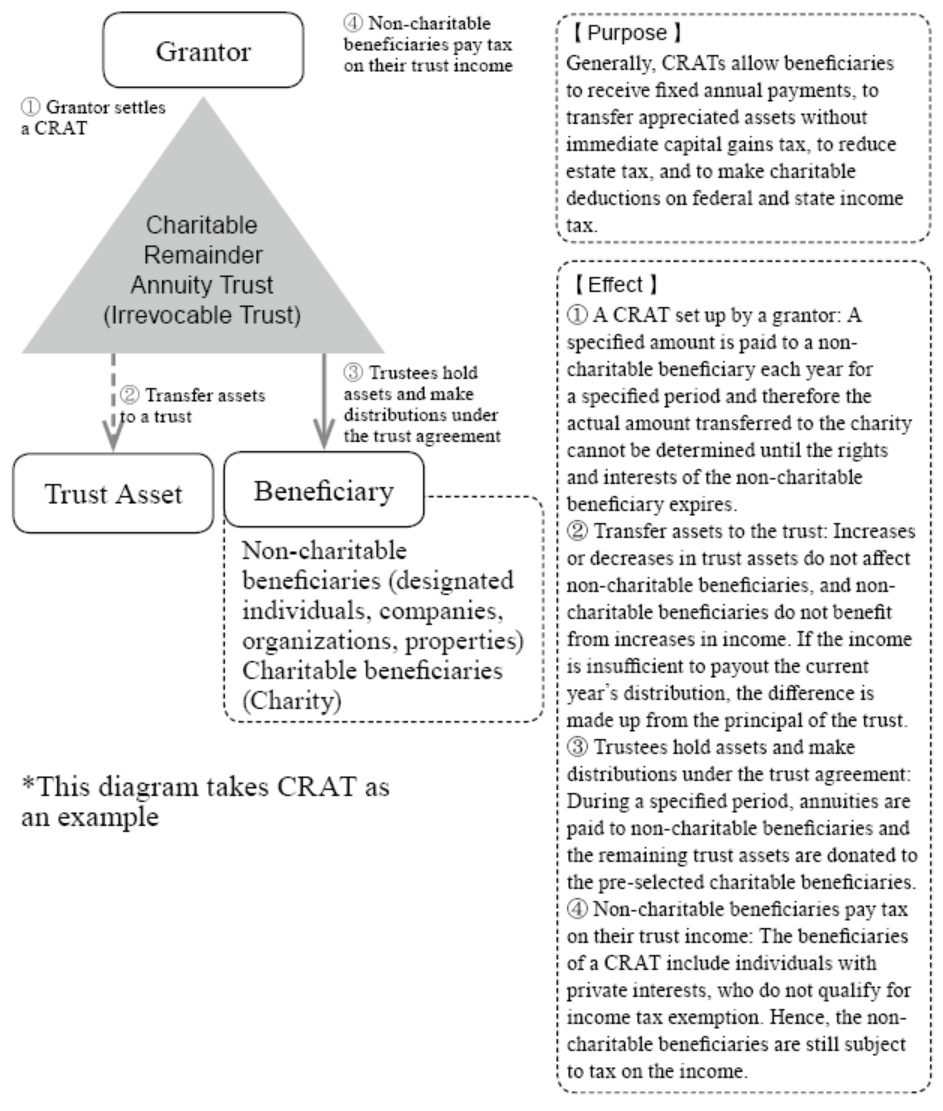

(6) Charitable Trust

I. Overview of a Charitable Trust

A charitable trust is established to achieve the philanthropic goals of a grantor and take the whole or part of the society as a beneficiary of the trust. A charity business refers to a business that has great value or social significance to the society. This includes the relief of poverty, religious groups, victims, the disabled, education, science and technology, culture, art, sports, medical and health affairs, environmental protection, maintenance of ecological balance, etc. The most renowned example of a charitable trust is the Bill and Melinda Gates Foundation Trust, which is currently set to run for 20 years after the death of Bill and Melinda. At the end of the 20-year term, the remaining assets and the interest received will become the property of the charity. Despite their divorce, their desire to engage in philanthropic business and continue to operate their charitable trust does not change.21&22 A charitable trust is a way for a grantor to continue and live out his or her wishes and values through a charitable trust.

21 Bill and Melinda Gates Foundation. https://www.gatesfoundation.org/about/financials/foundation-trust.

22 What the Gates Divorce Means for the Bill and Melinda Gates Foundation. https://www.nytimes.com/2021/05/04/business/bill-melinda-gates-divorce-foundation.html.

From a wealth management perspective, a charitable trust is a useful and multi-pronged approach to estate planning. The creation of a charitable trust not only leaves assets to the charity and its beneficiaries but also allows the grantor to have control over how and when the trust income is distributed while he or she is alive, while benefiting the grantor, the designated beneficiaries, and the charity. It is important to note that the grantor’s charitable trust structure and the charities selected by the grantor must qualify for the charitable deduction by the IRS. The federal tax deduction requirements are set forth in IRC §501, which lists 29 types of non-profit organizations that are eligible for the federal income tax deduction, as described in IRS Publication No. 557. 23&24

23 Publication 557 (Rev. February 2021), Cat. No. 46573C. https://www.irs.gov/pub/irs-pdf/p557.pdf.

24 What Is a Charitable Trust? https://www.westernsouthern.com/learn/financial-education/what-is-a-charitable-trust.

A charitable trust is an irrevocable trust. Hence, once it is created, it cannot be cancelled or modified. The trustee will manage the trust’s assets after the grantor has transferred control of the assets to the trust. Charitable trusts can be classified into two types, depending on how and when the benefits of the trust are distributed: Charitable Lead Trusts (CLTs) and Charitable Remainder Trusts (CRTs). Both trusts can pay benefits through an “Annuity” and “Unitrust”, but the order of distribution of the remainder are different in both trusts. The following is an introduction to CLT and CRT.

II. Charitable Lead Trust (CLT)

Charitable Lead Trust (“CLT”) first distributes a portion of the trust’s income to a charitable organization so that the grantor receives a tax deduction equal to the amount that can be received from a charitable contribution. After the end of the trust term, the remaining assets of the trust will be returned to the donor or to a designated non-charitable beneficiary. Under the CLT structure, a person with substantial wealth can place assets that are certain to increase in value in the future into the trust first, so that the increase in value will be free of taxation on the grantor’s estate. 25

25 What is a charitable trust and why would I need one? https://www.northwest.bank/personal/plan/invest/leaving-legacy/what-charitable-trust-and-why-would-i-need-one.

CLT donates trust assets to a charity for a specified period. After the trust term ends, the remaining trust funds will be paid to the beneficiary. This not only reduces the beneficiary’s tax liability but also provides the beneficiary with estate and gift tax deductions as well as tax deductions for charitable donations once the remaining trust assets are distributed to the beneficiary. The CLT reduces the beneficiary’s potential tax liability upon inheritance and provides the donor with an ongoing charitable contribution for a specified period without the need for the donor to make monthly manual payments. Unlike the charitable remainder trust described later, in addition to making monthly payments to the charity, a CLT can also make monthly payments to the beneficiary and in some cases, to the donor. It should be noted that the amount must be between 5% and 50% of the trust’s residual assets. 26

26 Charitable Lead Trust. https://www.investopedia.com/terms/c/charitableleadtrust.asp.

III. Charitable Remainder Trust (CRT)

A Charitable Remainder Annuity Trust (CRAT) is a gift transaction in which a donor places assets into a charitable trust that subsequently pays a fixed income in the form of an annuity to a designated beneficiary. The beneficiary receives a fixed income from the CRAT in the form of an annuity calculated as a fixed percentage of the initial value of the trust’s assets, but that percentage must be no less than 5%. The CRAT lasts until the donor’s death, at which time any remaining funds in the trust are donated to a charity pre-chosen by the donor. As the annuity paid by the CRAT is fixed and operates immediately upon the creation of the trust, the assets within the trust structure must also remain highly liquid. 27

27 Charitable Remainder Annuity Trust (CRAT). https://www.investopedia.com/terms/c/charitable-remainder-annuity-trust.asp.

A CRAT is a relatively reassuring design for donors because its beneficiaries receive a guaranteed annual income stream that does not fluctuate regardless of the trust’s investment performance. For example, if the initial value of the trust assets is US$2 million, and the trust pays 5% to the beneficiary each year, the beneficiary will receive a fixed annual annuity of US$100,000, regardless of the investment return on the trust assets or the state of the economy. A CRAT may exist for the life of one or more beneficiaries and may also be subject to a certain number of years in its terms, such as a term not exceeding 20 years.

The main difference between a CRAT and other charitable annuities is that a CRAT is structured as a separate trust. It should be noted that although the trust itself is a tax-exempt entity, income from the trust distributed to beneficiaries is taxable under U.S. tax law and other Treasury regulations. Depending on the individual circumstances of the donor, all or part of the trust’s income may be taxed at “Ordinary Income Rates”, but part of the income may be taxed at lower “Capital Gains Tax Rates” or may even be tax-free for a few years.