专业丛书

依文章标籤分类搜寻

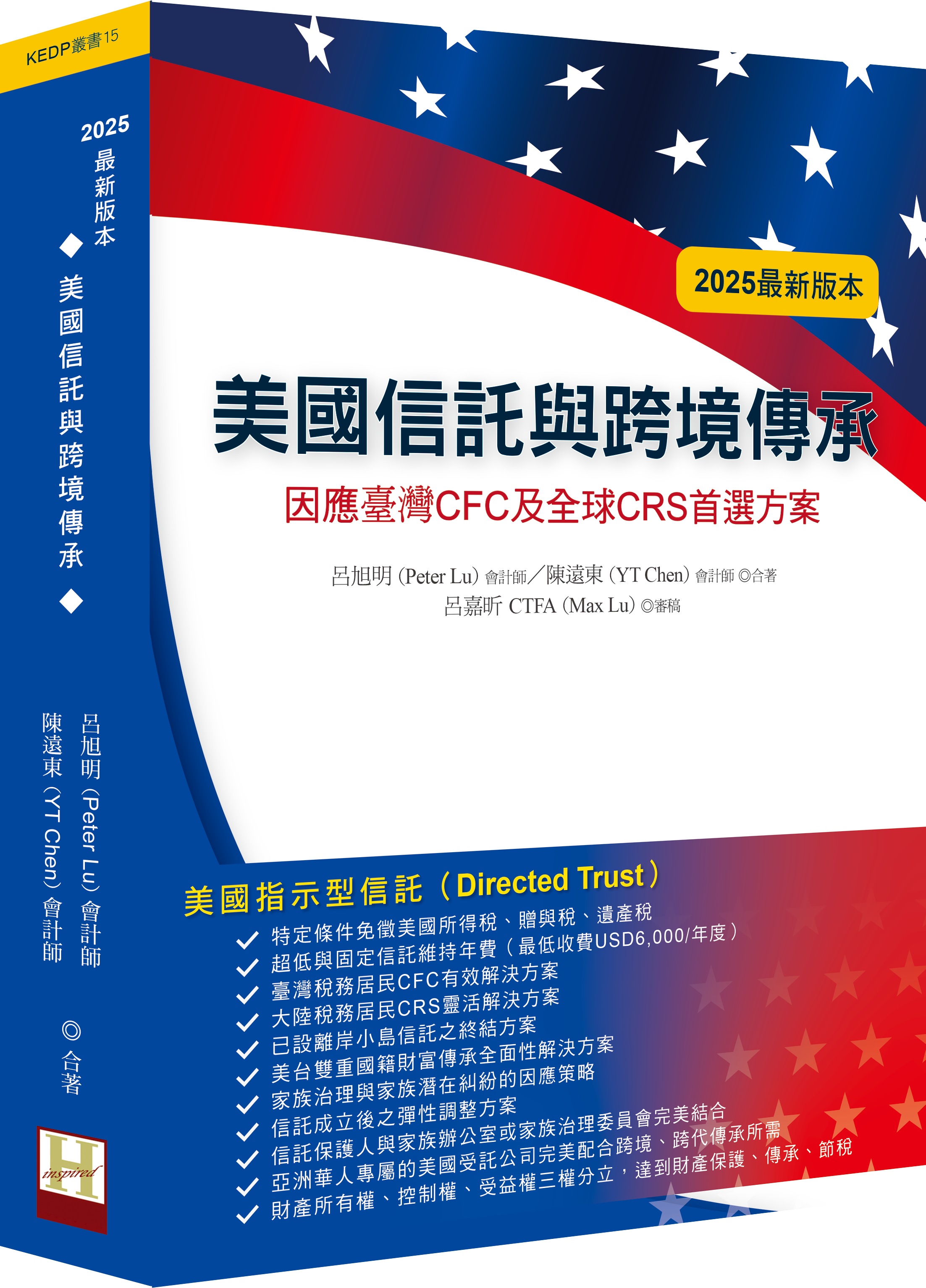

美國信託與跨境傳承

給跨境家族的規劃建議、因應臺灣CFC及全球CRS首選方案— 美國指示型信託(Directed Trust)

美國指示型信託(Directed Trust)無可取代之優勢:

◎特定條件免徵美國所得稅、贈與稅、遺產稅

◎超低與固定信託維持年費(最低收費USD6,000/年度)

◎臺灣稅務居民CFC有效解決方案

◎大陸稅務居民CRS靈活解決方案

◎已設離岸小島信託之終結方案

◎美台雙重國籍財富傳承全面性解決方案

◎家族治理與家族潛在糾紛的因應策略

◎信託成立後之彈性調整方案

◎信託保護人與家族辦公室或家族治理委員會完美結合

◎亞洲華人專屬的美國受託公司完美配合跨境、跨代傳承所需

◎財產所有權、控制權、受益權三權分立,達到財產保護、傳承、節稅

美國指示型信託(Directed Trust)無可取代之優勢:

◎特定條件免徵美國所得稅、贈與稅、遺產稅

◎超低與固定信託維持年費(最低收費USD6,000/年度)

◎臺灣稅務居民CFC有效解決方案

◎大陸稅務居民CRS靈活解決方案

◎已設離岸小島信託之終結方案

◎美台雙重國籍財富傳承全面性解決方案

◎家族治理與家族潛在糾紛的因應策略

◎信託成立後之彈性調整方案

◎信託保護人與家族辦公室或家族治理委員會完美結合

◎亞洲華人專屬的美國受託公司完美配合跨境、跨代傳承所需

◎財產所有權、控制權、受益權三權分立,達到財產保護、傳承、節稅

傳:傳遞,此處為「傳授」之意。承:承接,此處指「繼承」之意。

承,泛指對某學問、技藝、教義等,在師徒間的傳授和繼承的過程。在談到家族傳承,我們須先了解,什麼是家族、什麼是家族財富,如何傳承等概念……

承,泛指對某學問、技藝、教義等,在師徒間的傳授和繼承的過程。在談到家族傳承,我們須先了解,什麼是家族、什麼是家族財富,如何傳承等概念……

傳承的啟動與執行,需要由一代傳富者、二代繼富者與傳承專家建立傳承應有共識,否則難以順利推動。James E. Hughes Jr.在其著作《家族財富》中指出,家族能否成功延續財富,關鍵在於其內部的行為模式。他認為,家族財富的長期維繫與家族成員的行為表現密不可分……

多個世紀以來,信託都用於家族承傳資產,同時爭取長遠資產保值增值;由於信託將法定所有權以及實益所有權分拆,造就多項獨特優勢,例如:在繼承程序方面,藉由信託傳承無需經過遺囑認證(Probate),可避免繁瑣的繼承程序,加快資產分配,並讓資產分配可以按照設立人意思,持續供養有需要的家族成員,彈性靈活……

在美國,信託是一項法律工具,常用於保護和管理財產。具體而言,信託是一種法律結構,透過設立信託並將財產移轉予受託人管理,使第三方受益人得以依照信託協議受益。更精確地說,信託是一種三方委託關係:第一方為設立人(Settlor),其將財產轉移給第二方受託人(Trustee),由其管理並為第三方受益人(Beneficiary)之利益運用該等資產……

謂「美國指示型朝代信託」(Dynasty Trust),是指以財富代代相傳為目的所設立的長期信託架構。只要資產持續留在朝代信託中,便可避免繳納贈與稅、遺產稅以及隔代移轉稅。朝代信託與一般信託最大的不同,在於其「信託存續期限」。透過適當的信託架構設計,朝代信託得以實現永久傳承財富的目標……

對於有財富傳承需求的高淨值華人而言,信託雖稱不上是完美的規劃工具,但在眾多傳承方式中,經過逾千年的發展,已堪稱是最出色的一種;但信託作為財富傳承的工具,在各國、各地區受到不同法律與規則的規範,且依據家族需求的不同,衍生出不同多種類型……

一、可撤銷信託合約公版

二、不可撤銷信託合約公版

三、美國律師法律意見備忘錄

四、家族憲法合約公版

二、不可撤銷信託合約公版

三、美國律師法律意見備忘錄

四、家族憲法合約公版