专业丛书

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 1 Introduction to Cross-Border Estate Planning

Case Study 4: What happens if an offshore trust does not adequately protect the trust’s assets? What is an illusory trust?

Background:

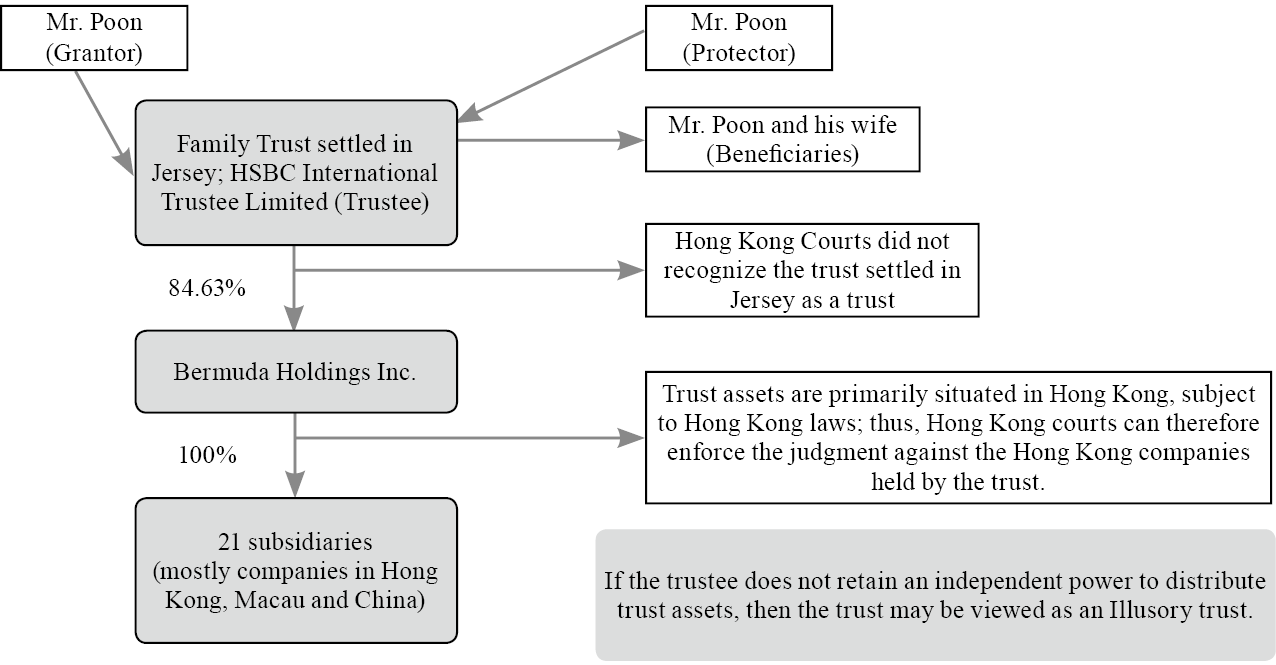

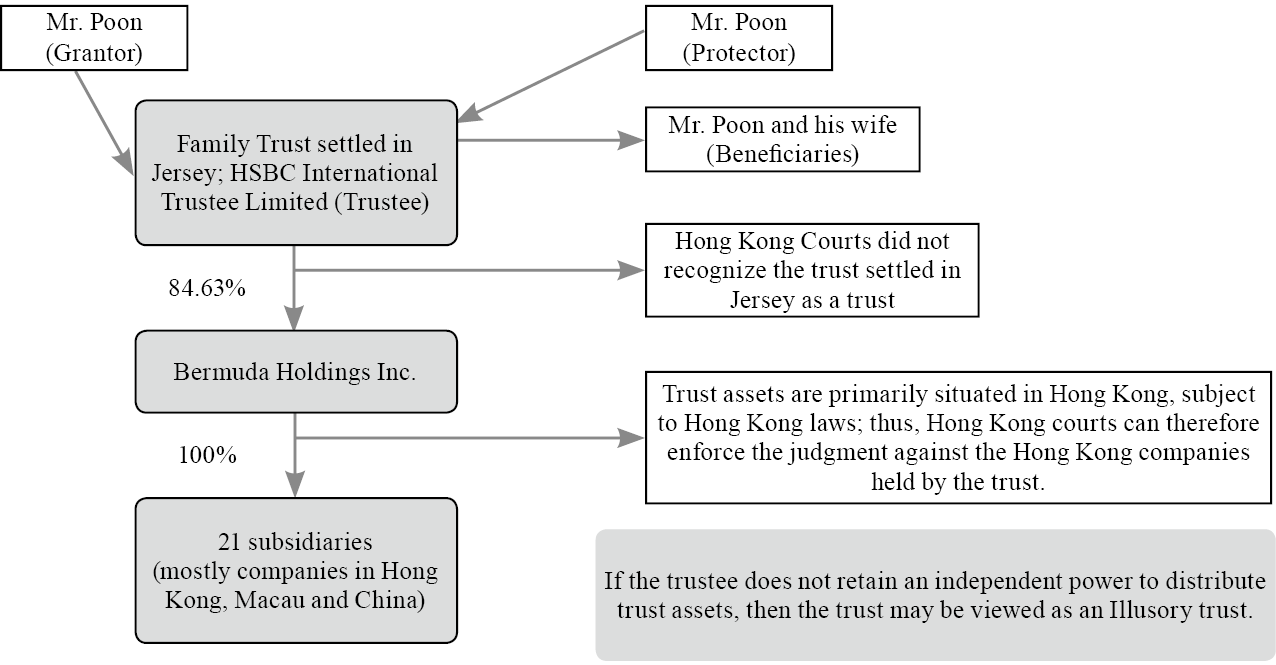

In the past decades, Wealth Creators often used offshore trusts settled in various jurisdictions to protect their assets. Otto Poon, the founder of Analogue Holdings, settled an irrevocable discretionary Jersey Trust in July 1995. He served as the Trust’s Grantor, the Trust Protector, and one of the Trust’s Beneficiaries. HSBC’s Trust Company was appointed as trustee of his trust. After the Trust was established, he gifted 85% of his holdings in Analogue to his trust.

Since Mr. Poon still retained effective control over to the trust assets, the Hong Kong Court of Final Appeal held that the trust assets were includible in his matrimonial assets. The trust thus did not serve its intended purpose.

Reflections on Succession:

At the time of the ruling, the court decision shocked many Wealth Creators, who previously believed that their assets would be thoroughly protected by offshore trusts no matter whether they held substantial control over the trust’s assets or not.

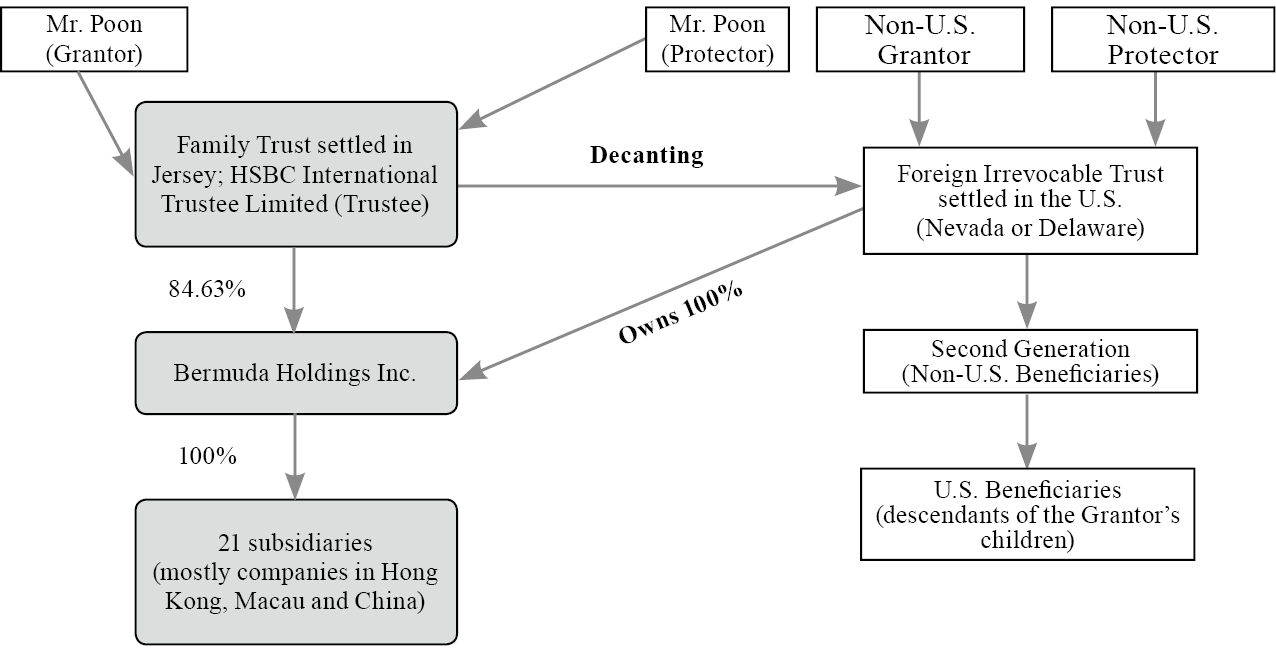

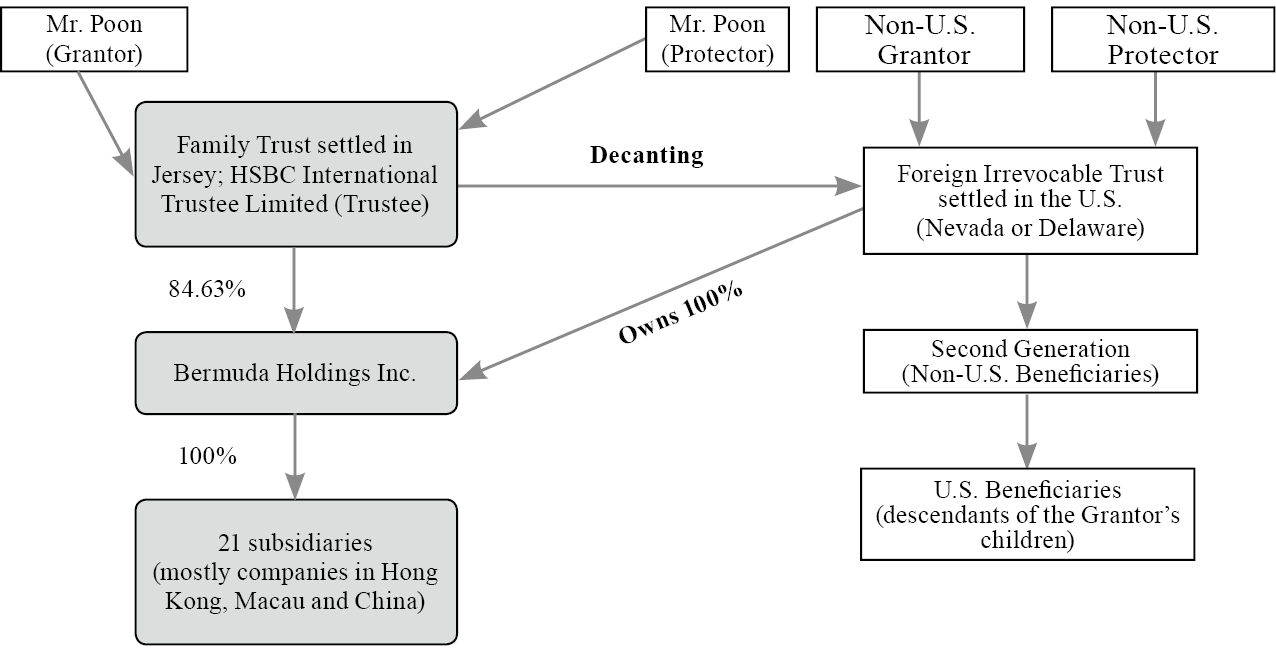

In Structure (2), since the primary purpose of such trusts is to protect the trust’s assets and to pass these assets on to the trust’s beneficiaries, powers are more often clearly delineated, with the grantor retaining minimal to no powers. We advise that families seeking to create these structures find competent legal counsel in all applicable jurisdictions in order to ensure that the assets held in these trusts would be protected and that the trust would be treated as an entity independent from the trust’s grantor, protector, and beneficiaries.

Succession Framework Proposal:

The Offshore Trust (Prior to Restructuring)

Suggested Structure

Succession Framework Analysis:

While offshore trusts have long been a mainstay for wealthy families, balancing the need for control with the asset protection qualities of a trust is important to keep in mind. If the trust’s grantor retains many powers over the trust, courts may view the trust skeptically or, in a worst-case scenario, deny that the trust ever existed. This could potentially cause assets to be seized by creditors. The following steps are crucial for determining whether a trust is able to serve its function and protect assets from potential creditors:

In the past decades, Wealth Creators often used offshore trusts settled in various jurisdictions to protect their assets. Otto Poon, the founder of Analogue Holdings, settled an irrevocable discretionary Jersey Trust in July 1995. He served as the Trust’s Grantor, the Trust Protector, and one of the Trust’s Beneficiaries. HSBC’s Trust Company was appointed as trustee of his trust. After the Trust was established, he gifted 85% of his holdings in Analogue to his trust.

Since Mr. Poon still retained effective control over to the trust assets, the Hong Kong Court of Final Appeal held that the trust assets were includible in his matrimonial assets. The trust thus did not serve its intended purpose.

Reflections on Succession:

At the time of the ruling, the court decision shocked many Wealth Creators, who previously believed that their assets would be thoroughly protected by offshore trusts no matter whether they held substantial control over the trust’s assets or not.

1. There are generally three types of offshore trust structures:

(1)A client’s private bank representative or wealth advisor creates a trust structure to facilitate investment of the client’s assets.

(2)A client retains a professional trust company and establishes a trust for the primary purpose of asset protection or succession planning.

(3)A client retains attorneys and a trust company for assistance with settling a private trust company (PTC).

When establishing an offshore trust, the Wealth Creator should evaluate the pros and cons of each jurisdiction. Typically, if there is a dispute, complaints would be filed in the jurisdiction that the trust company is situated and not where the trust assets are situated. Wealth Creators that seek to protect their assets through establishing a trust should seek jurisdictions with strong case law as a basis for providing those protections.

In Structure (1), described above, private bankers and wealth managers attempt to recommend trusts that (A) maximize the investment advisor’s control over the trust, (B) minimize the trust’s tax liability and (C) maximize the grantor’s retained powers. As the grantor often retains substantially all powers (including the power to invest the trust assets, the power to distribute the trust assets and the power to determine trust beneficiaries), these types of trusts typically suffer from a lack of independence. Since the trust lacks independence, many competent courts would and have ruled that these trusts never existed and that the grantor has retained his interest in assets “gifted” to the trust, thus opening the trust’s assets up for distribution to the grantor’s creditors. These trusts are often referred to as “Illusory Trusts.”

In Structure (2), since the primary purpose of such trusts is to protect the trust’s assets and to pass these assets on to the trust’s beneficiaries, powers are more often clearly delineated, with the grantor retaining minimal to no powers. We advise that families seeking to create these structures find competent legal counsel in all applicable jurisdictions in order to ensure that the assets held in these trusts would be protected and that the trust would be treated as an entity independent from the trust’s grantor, protector, and beneficiaries.

In Structure (3), Wealth Creators may be persuaded to establish a Private Trust Company (PTC) either in an offshore jurisdiction or even in the U.S. While a PTC can and often do provide certain protections, they often also come with immense and immediate setup and maintenance costs (often exceeding US$200,000 per year). Highly customized and extremely complex, PTCs may not be suitable for most families and certainly can make the process of cross-border wealth transfers an even more daunting task.

2. While many jurisdictions offer grantors flexibility to retain certain powers in a bid to win their business, offshore trusts, generally settled on offshore islands or territories, often provide the maximum amount of flexibility. For many years, this was seen as a boon for professionals (especially attorneys specializing in offshore trusts); however, as clearly illustrated in this case, a high degree of control may lead other jurisdictions to disregard the trust structure in its entirety. The risk of a trust being recognized as an “illusory trust” is increasing, as more and more competent jurisdictions realize that an offshore trust is only a trust in name and not in substance.

Succession Framework Proposal:

The Offshore Trust (Prior to Restructuring)

Suggested Structure

Succession Framework Analysis:

While offshore trusts have long been a mainstay for wealthy families, balancing the need for control with the asset protection qualities of a trust is important to keep in mind. If the trust’s grantor retains many powers over the trust, courts may view the trust skeptically or, in a worst-case scenario, deny that the trust ever existed. This could potentially cause assets to be seized by creditors. The following steps are crucial for determining whether a trust is able to serve its function and protect assets from potential creditors:

1. When reviewing a trust agreement, advisers typically focus on the grantor’s intent. Typically, trusts are settled either to protect the Grantor’s assets or reduce tax-related risks. Another important aspect to consider are the grantor and his or her descendants’ current and future tax residencies. We especially recommend families that are drafting trusts with U.S. beneficiaries seek competent U.S. tax counsel to determine the tax effects of offshore trusts.

2. Trust agreements should be drafted so that grantors do not have powers that would jeopardize the trust’s independence. If the trust agreement provides for a trust protector (generally a fiduciary in charge of the most impactful functions of a trust), the grantor and the trust’s beneficiaries should not also serve as the trust protector. Doing so may reduce the likelihood of the trust being deemed an illusory or ineffective trust.

3. When preparing a structure that includes a trust, advisers should consider potential gift and estate tax consequences for the grantor, the trust protector, the beneficiaries, and the trust itself. Failure to do so may result in adverse tax consequences.

4. For families with any U.S. nexus (one or more U.S. grantor, protector, beneficiary, or asset), we would recommend evaluating the pros and cons of U.S. trusts versus offshore trust structures. For families with existing offshore trust(s), we recommend looking to see whether migrating the trust to the U.S. or decanting the assets to a U.S. trust is possible. While this often requires the assistance of U.S. and non-U.S. counsel, the relative stability of a U.S. legal jurisdiction and its consistent set of protective trust laws is almost always worth the effort.

5. U.S. trusts (including foreign trusts settled in the U.S. for U.S. income tax purposes) are typically drafted or reviewed by attorneys in the state that the trust is settled. Typically, those attorneys also give an opinion regarding the independence of the trust. Tax counsel would also usually a separate opinion regarding potential U.S. tax consequences.