Publications

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Chapter 2 ─ U.S. Trust Planning and Example Structures for High Net Worth Families

美國家族信託類型介紹與籌劃

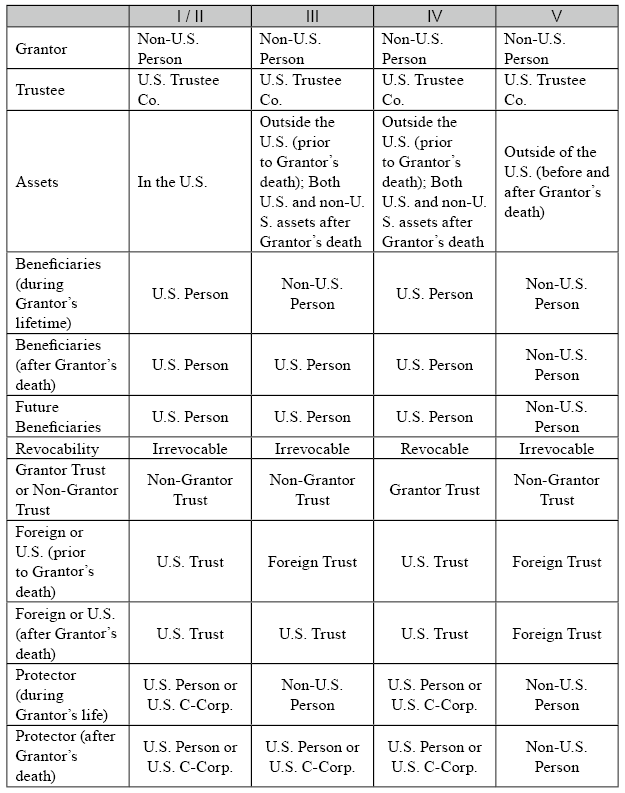

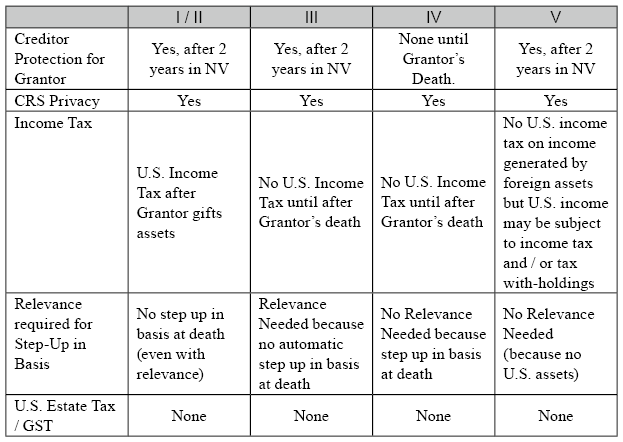

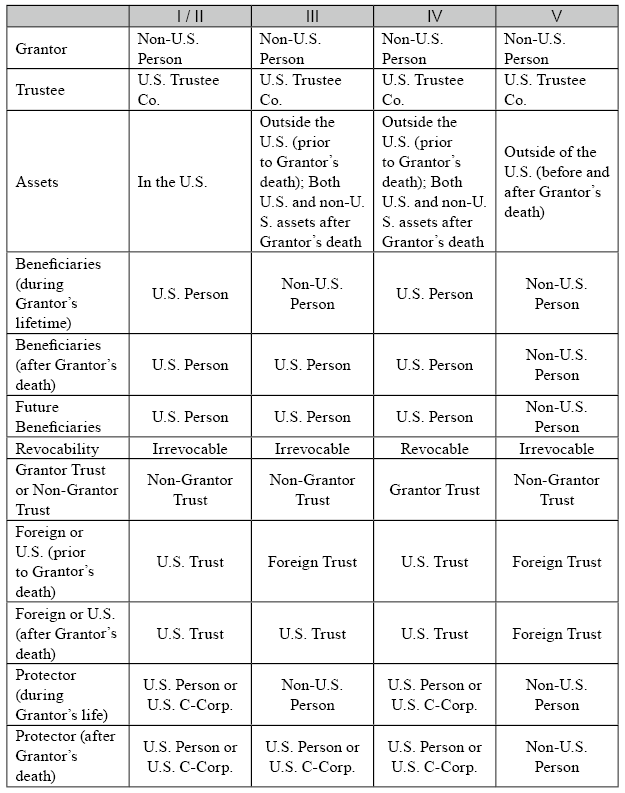

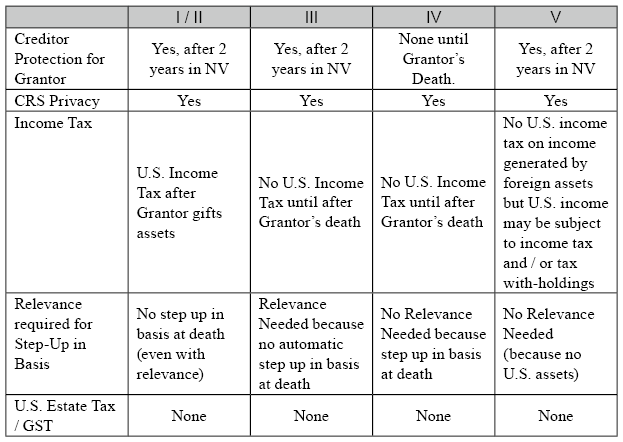

According to our experiences, most Chinese families set up the U.S. trusts in the following five types. The following is a comparison of these five types of trusts and their corresponding conditions based on the purpose, timing, and identity of the beneficiaries, so that readers can choose the right type of trust according to their situations.

Over the past two decades, U.S. trusts have become increasingly important for Wealth Creators, especially for foreigners or immigrants who have generated much of their wealth abroad. Wealth Creators generally find that the following five structures (or a combination of the five structures) suit their business or financial succession goals. In this chapter, we will analyze these five structures and discuss their suitability, rationale and limitations. This book seeks to explore various structures and provide frameworks to help readers make more educated decisions regarding cross-border estate and tax planning strategies, especially for readers with current or future U.S. descendants.

Over the past two decades, U.S. trusts have become increasingly important for Wealth Creators, especially for foreigners or immigrants who have generated much of their wealth abroad. Wealth Creators generally find that the following five structures (or a combination of the five structures) suit their business or financial succession goals. In this chapter, we will analyze these five structures and discuss their suitability, rationale and limitations. This book seeks to explore various structures and provide frameworks to help readers make more educated decisions regarding cross-border estate and tax planning strategies, especially for readers with current or future U.S. descendants.

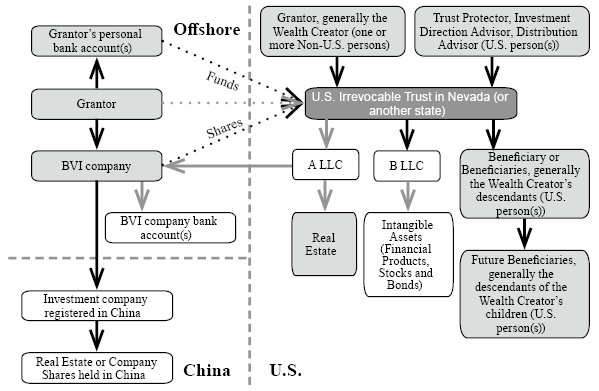

This structure is suitable for Wealth Creators who have created their wealth outside of the U.S. and want to make a permanent and irrevocable gift of assets from a non-U.S. jurisdiction to the United States for the benefit of his or her descendants. Generally, Wealth Creators who plan to transfer $5 million or more in assets should consider creating a U.S. irrevocable dynasty trust.

- Suitable Situations:

- Non-U.S. person as Grantor (he or she is generally the person who currently possesses assets that will be gifted into the trust)

- The Trust Protector will typically be a U.S. person, U.S. C-Corporation or U.S. Limited Liability Company (LLC)

- This structure is typically recommended for Wealth Creators with descendants who are or plan to become U.S. persons. As such, the trust will primarily have U.S. beneficiaries.

- Assets to be gifted to the trust should be outside of the U.S. prior to the transfer to avoid unwanted tax and legal complications.

- Rationale:

- Assets are irrevocably and permanently transferred into the U.S. trust. The Grantor of the trust will retain no control, ownership or beneficial interest in the trust. The Grantor will generally not be liable for paying income or estate taxes in their home country unless there is an applicable tax when assets are gifted into a trust.

- The assets held in a U.S. trust will generally withstand challenges from creditors potentially including an ex-spouse in a marriage dissolution, if there was not fraudulent intent and if the assets are transferred into the trust a sufficient time before any creditors attempt to enforce a claim.

- Assets transferred to this type of U.S. trust will generally not be subject to U.S. estate tax or generation-skipping transfer taxes; however, a legal opinion regarding transfer taxes is typically drafted and presented to a client prior to the Grantor settling the trust.

- By placing the assets in trust, the Grantor’s descendants will not have to go through U.S. probate to receive their inheritance. Probate in the U.S. is generally a long and costly endeavor.

- Assets gifted to the irrevocable trust may be further divided for future generations through a division of the original trust or a decanting of the trust’s assets into separate trusts.

- For those concerned with privacy, the United States is not a Common Reporting Standards (CRS) participant.

- Limitations of Structure:

- The Grantor’s gift of assets is irrevocable. As such, the Grantor will not be able to and should not participate in the investment and distribution of the trust’s assets. He or she will not be able to enjoy the income produced by assets gifted to the trust.

- After the assets are gifted to the U.S. Irrevocable Non-Grantor Trust, any income generated after the transfer is subject to U.S. income tax. Income taxes are generally paid by the trust itself, unless income is distributed to the trust’s beneficiaries, in which case the beneficiaries may be liable for income taxes.

- The Grantor should keep in mind that different countries and jurisdictions may impose transfer taxes and / or income taxes on the gift of assets to a U.S. trust. Note: Gift tax residents in Taiwan may be liable for gift taxes if they gift assets to a U.S. Irrevocable Non-Grantor Trust.

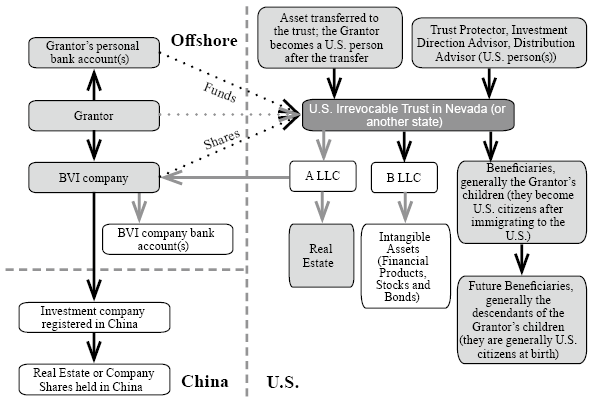

This structure differs from Type 1 as the grantor intends to immigrate and has not resided in the United States prior to immigration. When the grantor settles the trust, he or she is a non-U.S. person. In accordance with IRC §679(a)(4)(A), if the grantor becomes a U.S.-person within five years of settling the trust, the trust will be treated as a grantor trust for U.S. tax purposes. The grantor will then be subject to U.S income tax on any income the trust has earned over the past five years.

To learn more about IRC §679(a)(4)(A), please refer to Appendices, Section E.

- Rationale:

- By placing the assets in trust, the Grantor’s descendants will not have to go through U.S. probate to receive their inheritance. Probate in the U.S. is generally a long and costly endeavor.

- For those concerned with privacy, the United States is not a Common Reporting Standards (CRS) participant.

- The Wealth Creator can rest assured that his or her assets can be passed on to the next generation. Since the trust’s assets are held in trust, the Grantor of the trust is generally able to control how the assets will be managed and distributed after his death.

- The increase in value of assets held by the trust are not subject to U.S. income taxes during the Grantor’s life.

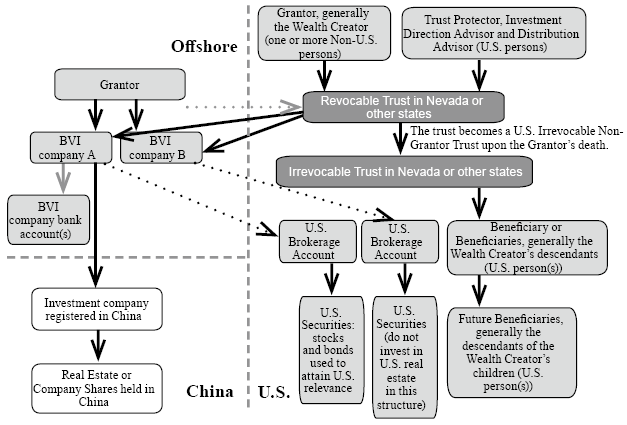

This structure applies when a non-U.S. person Grantor settles a U.S. Revocable Grantor Trust in the U.S. with U.S. beneficiaries. The trust becomes a U.S. Irrevocable Non-Grantor Trust upon the Grantor’s death. Upon the Grantor’s death, the cost basis of assets held by the trust can be stepped up to fair market value through a check the box election (please refer to Appendices, Section C for additional information).

Key Advantages: 1) The income from offshore assets is not subject to U.S. income tax during the Grantor’s life; 2) The basis of assets held by the trust can be stepped up to fair market value immediately prior to the Grantor’s death.

- Suitable Situations and Limitations:

- Grantor wishes to retain control over trust assets during his or her life. The Grantor’s gift to the trust is structured as an incomplete gift for U.S. gift and estate tax purposes.

- Non-U.S. person as Grantor (he or she is generally the person who currently possesses assets that will be gifted into the trust)

- The Trust Protector will typically be a U.S. person, U.S. C-Corporation or U.S. Limited Liability Company (LLC).

- The trust’s beneficiaries must be non-U.S. persons during the Grantor’s lifetime if the Grantor wishes that income generated by the trust’s non-U.S. assets not be subject to U.S. income tax during the Grantor’s life.

- Assets to be gifted to the trust should be outside of the U.S. prior to the transfer and remain outside of the U.S. after the transfer (and prior to the Grantor’s death) to avoid unwanted tax and legal complications. The gifted assets should not produce Effectively Connected Income for U.S. tax purposes (Generally, when a foreign person engages in a trade or business in the United States, all income from sources within the United States connected with the conduct of that trade or business is considered to be Effectively Connected Income (ECI).

- Assets gifted to the trust should not be U.S. situs for estate tax purposes (please refer to Appendices, Section A for additional information regarding U.S. situs for estate and gift tax purposes).

- The trust’s principal and income can be distributed to U.S. persons at any time. This requires a proper filing of Form 3520.

- Precautions:

- Since the Grantor is making an incomplete gift, the Grantor’s creditors (including an ex-spouse in the dissolution of a marriage dissolution) could potentially get access to trust assets.

- After the Grantor’s death, the trust will be subject to U.S. income tax.

- Check the box elections are complicated and require professional assistance. For more information, please refer to Appendices, Section C.

- Limitations of Structure:

- The Grantor’s gift of assets is irrevocable. As such, the Grantor will not be able to and should not participate in the investment and distribution of the trust’s assets. He or she will not be able to enjoy the income produced by assets gifted to the trust.

- After the assets are gifted to the U.S. Irrevocable Non-Grantor Trust, any income generated after the transfer is subject to U.S. income tax. Income taxes are generally paid by the trust itself, unless income is distributed to the trust’s beneficiaries, in which case the beneficiaries may be liable for income taxes.

- The Grantor should keep in mind that different countries and jurisdictions may impose transfer taxes and / or income taxes on the gift of assets to a U.S. trust. Note: Gift tax residents in Taiwan may be liable for gift taxes if they gift assets to a U.S. Irrevocable Non-Grantor Trust.

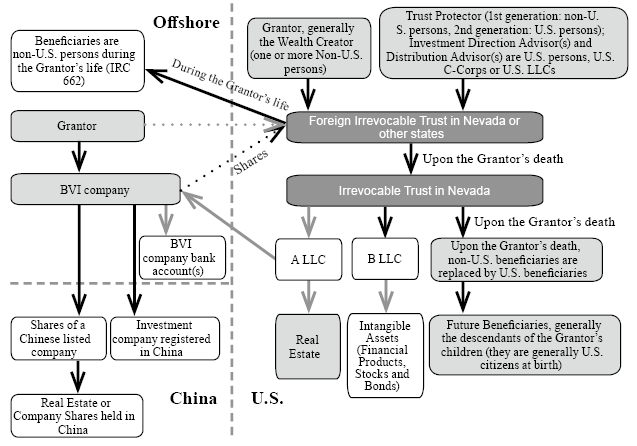

- Suitable Situations:

- Non-U.S. person as Grantor (he or she is generally the person who currently possesses assets that will be gifted into the trust) wishes to make a completed gift to the newly settled trust that is irrevocable.

- The Trust Protector will typically be a non-U.S. person or a non-U.S. Corporation.

- The trust’s beneficiaries must be non-U.S. persons during the Grantor’s lifetime if the Grantor wishes that income generated by the trust’s non-U.S. assets not be subject to U.S. income tax during the Grantor’s life. Income can and should be distributed to non-U.S. beneficiaries during the Grantor’s life.

- Assets to be gifted to the trust should be outside of the U.S. prior to the transfer and remain outside of the U.S. after the transfer (and prior to the Grantor’s death) to avoid unwanted tax and legal complications.

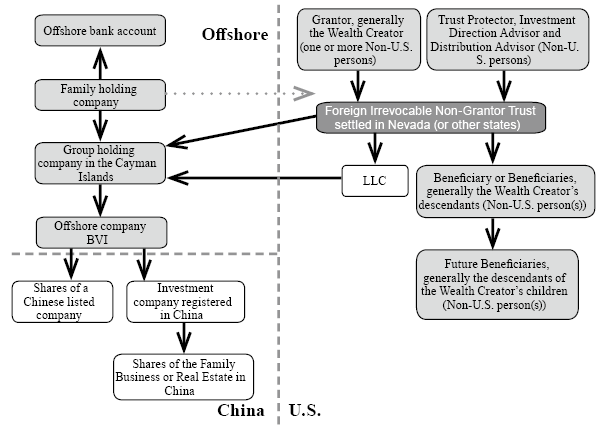

- As such, the trust has a non-U.S. person Grantor, non-U.S. person(s) serving as Protector, non-U.S. beneficiaries and non-U.S. assets when the trust is settled.

- Rationale:

- The assets are transferred to the United States trust, and the grantor retains neither ownership nor beneficial interests.

- Assets are sufficiently protected, potentially protecting the grantor from his creditors and / or spouse.

- Avoids the complicated procedures and high costs of probate in the U.S.

- The estate can be split per stirpes, through “division” or “decanting” for future generations.

- For those concerned with privacy, the United States is not a Common Reporting Standards (CRS) participant.

Generally, upon the Grantor’s death, the second generation Trust Protector (U.S. person) will become the Trust Protector and the trust will become a U.S. Irrevocable Non-Grantor Trust (please refer to Appendices, Section D to learn more about the Court and Control Tests and why the trust would become a U.S. trust). The Trust Protector can then replace the trust’s non-U.S. beneficiaries with U.S. beneficiaries if he or she so wishes.

Foreign-sourced income generated by assets held in this trust is not subject to U.S. income tax during the Grantor’s life. This is because the trust is a Foreign Irrevocable Non-Grantor Trust during the Grantor’s life.

When the trust converts from a foreign trust to a U.S. trust, the cost basis of the trust’s holdings can be stepped up to fair market value just before the Grantor’s death (please refer to Appendices, Section C for additional information regarding stepped up basis). After the Grantor’s death, income generated by the trust for U.S. beneficiaries will be subject to U.S. income tax. After the Grantor’s death, the trust’s income and principal can be distributed to U.S. and non-U.S. beneficiaries alike.

After the Grantor’s death, profits earned by the trust are usually distributed to U.S. beneficiaries. This may reduce the overall income tax rate; for additional information, please refer to Appendices, Section B.

This trust structure includes foreign grantor, beneficiaries, and the trust assets are located outside the U.S. If the non-US protector changes to a U.S. person, the trust will then transfer to a U.S. trust accordingly.

If the dividends received each year are all distributed by the trust, the beneficiary and the trust would not be subject to U.S. income tax under IRC 662 (because the income is foreign-sourced in this case); however, the trust itself still has obligations to report Subpart F Income of its CFC each year, so this structure is not recommended.

- Applicable to:

- Prerequisites:

- Non-U.S. Grantors, non-U.S. Protectors, non-U.S. Beneficiaries.

- The assets which are ready to be transferred to the trust are located outside the U.S. ; upon transfer to the trust, assets are still offshore.

- The grantor shall make a complete gift to set up an irrevocable trust, which means the ownership of the assets will be immediately relinquished and prohibited to return to the grantor.

- The trustee company of the trust is U.S. Trustee Company (e.g in Delaware or Nevada).

- The grantor must be a non-resident alien to the U.S., and the trust is completely unrelated to the grantor once the trust agreement is signed.

- People other than the trust grantor can transfer property into this U.S. irrevocable trust.

- Assets held by the trust should be located outside of the U.S. (BVI company’s equity will be changed to be held directly by the U.S. trustee in the future)

- The protector is appointed by the grantor at trust establishment and must be a non-resident alien to the U.S., but can be changed at any time with the consent of the beneficiaries (the protector can be changed at any time).

- Offshore company’s equity is held by the trust, but the executive director (Director) of the company is appointed by the protector.

- The grantor shall open a bank account and must seek for banks outside the U.S. (ex. HK or Singapore) that could accept U.S. trust acting as a shareholder of the offshore company.

- In the future, all financial operations of the offshore company in offshore banks will be carried out by the executive director of the offshore company.

- Purposes:

- The grantor transfers asset ownership into the U.S while the actual assets remain outside the U.S. By giving up the ownership of the asset, there will be no estate and income tax issues in the located country in the future.

- The assets are sufficiently protected without the right of recourse from the creditor and the divorced spouse.

- Avoid the estate tax that may arise from the inheritance of grantor assets.

- Avoid the complicated procedures and high cost of the estate probate in the U.S.

- The estate is split by future generations per stirpes through “division” or “decanting ”.

- Avoidance of CRS notification issues (U.S. is non-CRS participant)

- Precautions:

- The assets gifted by the grantor cannot be revoked and the grantor has no right to manage or benefit from the principle and the income of the trust.

- U.S. income tax issues will arise under these circumstances in the future.

- Remember to take the grantor’s country of residence into consideration when transferring assets into a trust, since it might raise local gift tax issues. (For example, Taiwan gift tax residents will need to pay gift tax as they transfer foreign assets into U.S. irrevocable trust).