Publications

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Chapter 2 ─ U.S. Trust Planning and Example Structures for High Net Worth Families

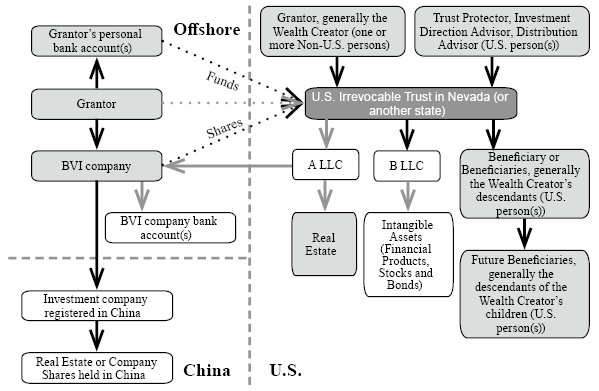

TYPE 1: A Non-U.S. Person Settles a U.S. Irrevocable Non-Grantor Trust

This structure is suitable for Wealth Creators who have created their wealth outside of the U.S. and want to make a permanent and irrevocable gift of assets from a non-U.S. jurisdiction to the United States for the benefit of his or her descendants. Generally, Wealth Creators who plan to transfer $5 million or more in assets should consider creating a U.S. irrevocable dynasty trust.

- Suitable Situations:

- Non-U.S. person as Grantor (he or she is generally the person who currently possesses assets that will be gifted into the trust)

- The Trust Protector will typically be a U.S. person, U.S. C-Corporation or U.S. Limited Liability Company (LLC)

- This structure is typically recommended for Wealth Creators with descendants who are or plan to become U.S. persons. As such, the trust will primarily have U.S. beneficiaries.

- Assets to be gifted to the trust should be outside of the U.S. prior to the transfer to avoid unwanted tax and legal complications.

- Rationale:

- Assets are irrevocably and permanently transferred into the U.S. trust. The Grantor of the trust will retain no control, ownership or beneficial interest in the trust. The Grantor will generally not be liable for paying income or estate taxes in their home country unless there is an applicable tax when assets are gifted into a trust.

- The assets held in a U.S. trust will generally withstand challenges from creditors potentially including an ex-spouse in a marriage dissolution, if there was not fraudulent intent and if the assets are transferred into the trust a sufficient time before any creditors attempt to enforce a claim.

- Assets transferred to this type of U.S. trust will generally not be subject to U.S. estate tax or generation-skipping transfer taxes; however, a legal opinion regarding transfer taxes is typically drafted and presented to a client prior to the Grantor settling the trust.

- By placing the assets in trust, the Grantor’s descendants will not have to go through U.S. probate to receive their inheritance. Probate in the U.S. is generally a long and costly endeavor.

- Assets gifted to the irrevocable trust may be further divided for future generations through a division of the original trust or a decanting of the trust’s assets into separate trusts.

- For those concerned with privacy, the United States is not a Common Reporting Standards (CRS) participant.

- Limitations of Structure:

- The Grantor’s gift of assets is irrevocable. As such, the Grantor will not be able to and should not participate in the investment and distribution of the trust’s assets. He or she will not be able to enjoy the income produced by assets gifted to the trust.

- After the assets are gifted to the U.S. Irrevocable Non-Grantor Trust, any income generated after the transfer is subject to U.S. income tax. Income taxes are generally paid by the trust itself, unless income is distributed to the trust’s beneficiaries, in which case the beneficiaries may be liable for income taxes.

- The Grantor should keep in mind that different countries and jurisdictions may impose transfer taxes and / or income taxes on the gift of assets to a U.S. trust. Note: Gift tax residents in Taiwan may be liable for gift taxes if they gift assets to a U.S. Irrevocable Non-Grantor Trust.