Publications

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Chapter 2 ─ U.S. Trust Planning and Example Structures for High Net Worth Families

Introduction

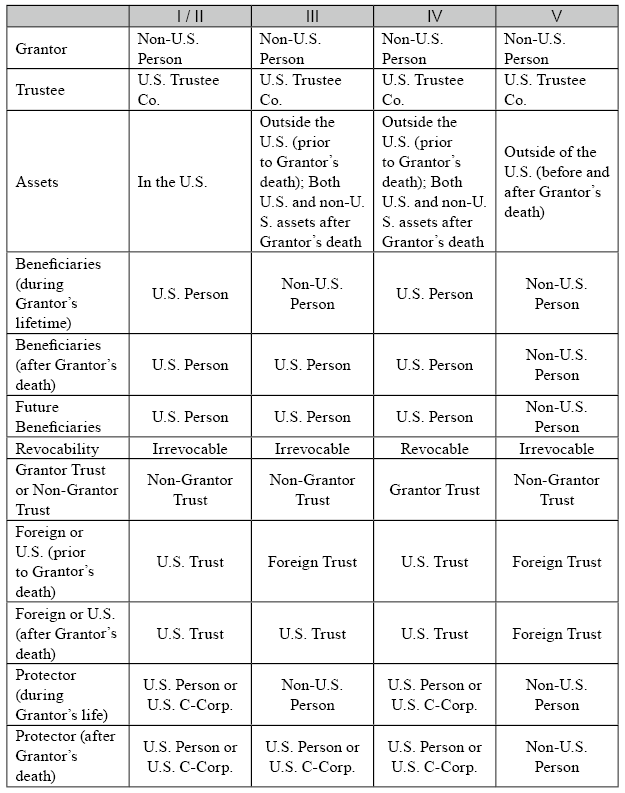

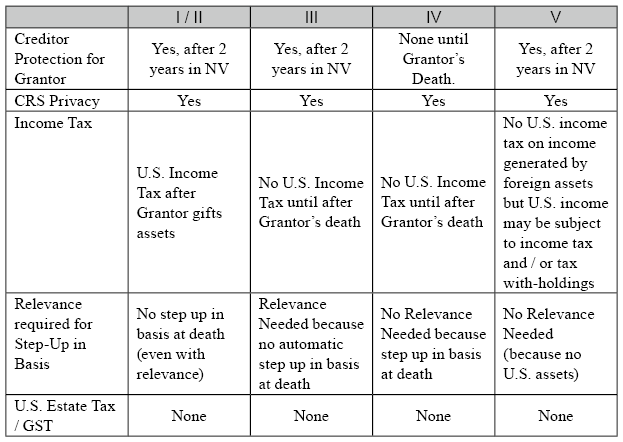

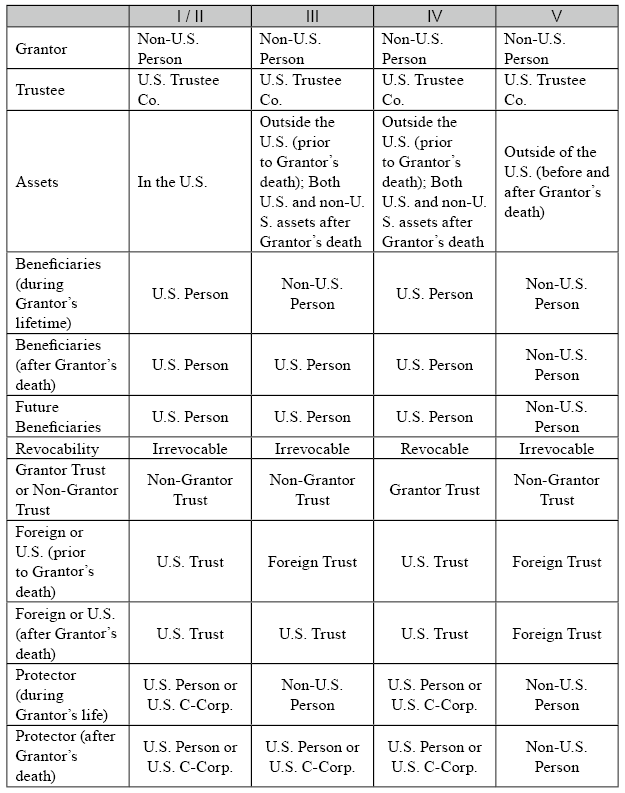

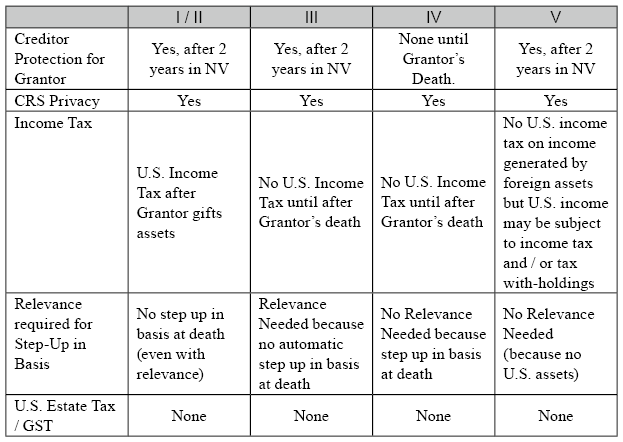

According to our experiences, most Chinese families set up the U.S. trusts in the following five types. The following is a comparison of these five types of trusts and their corresponding conditions based on the purpose, timing, and identity of the beneficiaries, so that readers can choose the right type of trust according to their situations.

Over the past two decades, U.S. trusts have become increasingly important for Wealth Creators, especially for foreigners or immigrants who have generated much of their wealth abroad. Wealth Creators generally find that the following five structures (or a combination of the five structures) suit their business or financial succession goals. In this chapter, we will analyze these five structures and discuss their suitability, rationale and limitations. This book seeks to explore various structures and provide frameworks to help readers make more educated decisions regarding cross-border estate and tax planning strategies, especially for readers with current or future U.S. descendants.

Over the past two decades, U.S. trusts have become increasingly important for Wealth Creators, especially for foreigners or immigrants who have generated much of their wealth abroad. Wealth Creators generally find that the following five structures (or a combination of the five structures) suit their business or financial succession goals. In this chapter, we will analyze these five structures and discuss their suitability, rationale and limitations. This book seeks to explore various structures and provide frameworks to help readers make more educated decisions regarding cross-border estate and tax planning strategies, especially for readers with current or future U.S. descendants.