Publications

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Chapter 2 ─ U.S. Trust Planning and Example Structures for High Net Worth Families

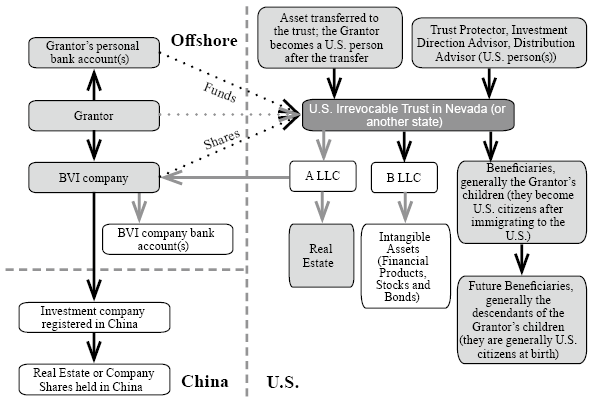

Type 2: A Non-U.S. Grantor Settles a U.S. Irrevocable Non-Grantor Trust Prior to Immigrating

This structure differs from Type 1 as the grantor intends to immigrate and has not resided in the United States prior to immigration. When the grantor settles the trust, he or she is a non-U.S. person. In accordance with IRC §679(a)(4)(A), if the grantor becomes a U.S.-person within five years of settling the trust, the trust will be treated as a grantor trust for U.S. tax purposes. The grantor will then be subject to U.S income tax on any income the trust has earned over the past five years.

To learn more about IRC §679(a)(4)(A), please refer to Appendices, Section E.