Publications

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Chapter 2 ─ U.S. Trust Planning and Example Structures for High Net Worth Families

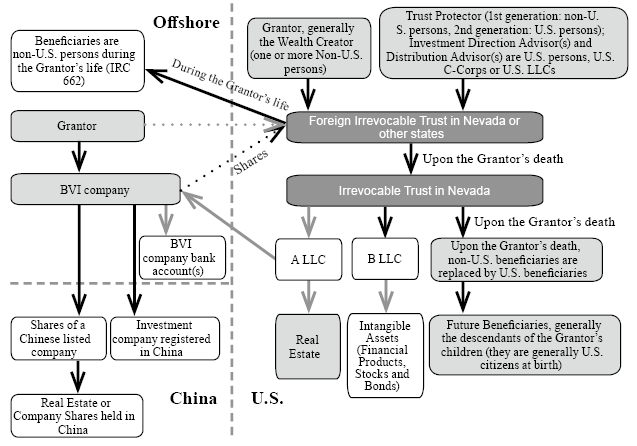

Type 4: A Non-U.S. Person Settles a Foreign Irrevocable Non-Grantor Trust. The beneficiary is a non-U.S. person during the Grantor’s life; however, U.S. beneficiaries can be added after the Grantor’s death.

- Limitations of Structure:

- The Grantor’s gift of assets is irrevocable. As such, the Grantor will not be able to and should not participate in the investment and distribution of the trust’s assets. He or she will not be able to enjoy the income produced by assets gifted to the trust.

- After the assets are gifted to the U.S. Irrevocable Non-Grantor Trust, any income generated after the transfer is subject to U.S. income tax. Income taxes are generally paid by the trust itself, unless income is distributed to the trust’s beneficiaries, in which case the beneficiaries may be liable for income taxes.

- The Grantor should keep in mind that different countries and jurisdictions may impose transfer taxes and / or income taxes on the gift of assets to a U.S. trust. Note: Gift tax residents in Taiwan may be liable for gift taxes if they gift assets to a U.S. Irrevocable Non-Grantor Trust.

- Suitable Situations:

- Non-U.S. person as Grantor (he or she is generally the person who currently possesses assets that will be gifted into the trust) wishes to make a completed gift to the newly settled trust that is irrevocable.

- The Trust Protector will typically be a non-U.S. person or a non-U.S. Corporation.

- The trust’s beneficiaries must be non-U.S. persons during the Grantor’s lifetime if the Grantor wishes that income generated by the trust’s non-U.S. assets not be subject to U.S. income tax during the Grantor’s life. Income can and should be distributed to non-U.S. beneficiaries during the Grantor’s life.

- Assets to be gifted to the trust should be outside of the U.S. prior to the transfer and remain outside of the U.S. after the transfer (and prior to the Grantor’s death) to avoid unwanted tax and legal complications.

- As such, the trust has a non-U.S. person Grantor, non-U.S. person(s) serving as Protector, non-U.S. beneficiaries and non-U.S. assets when the trust is settled.

- Rationale:

- The assets are transferred to the United States trust, and the grantor retains neither ownership nor beneficial interests.

- Assets are sufficiently protected, potentially protecting the grantor from his creditors and / or spouse.

- Avoids the complicated procedures and high costs of probate in the U.S.

- The estate can be split per stirpes, through “division” or “decanting” for future generations.

- For those concerned with privacy, the United States is not a Common Reporting Standards (CRS) participant.

Generally, upon the Grantor’s death, the second generation Trust Protector (U.S. person) will become the Trust Protector and the trust will become a U.S. Irrevocable Non-Grantor Trust (please refer to Appendices, Section D to learn more about the Court and Control Tests and why the trust would become a U.S. trust). The Trust Protector can then replace the trust’s non-U.S. beneficiaries with U.S. beneficiaries if he or she so wishes.

Foreign-sourced income generated by assets held in this trust is not subject to U.S. income tax during the Grantor’s life. This is because the trust is a Foreign Irrevocable Non-Grantor Trust during the Grantor’s life.

When the trust converts from a foreign trust to a U.S. trust, the cost basis of the trust’s holdings can be stepped up to fair market value just before the Grantor’s death (please refer to Appendices, Section C for additional information regarding stepped up basis). After the Grantor’s death, income generated by the trust for U.S. beneficiaries will be subject to U.S. income tax. After the Grantor’s death, the trust’s income and principal can be distributed to U.S. and non-U.S. beneficiaries alike.

After the Grantor’s death, profits earned by the trust are usually distributed to U.S. beneficiaries. This may reduce the overall income tax rate; for additional information, please refer to Appendices, Section B.