專業叢書

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Appendices

附錄

Gift Tax

Under U.S. tax law, gift taxes are typically owed by the donor. Generally, a foreign (non-U.S.) donor is not subject to gift tax unless he or she is gifting a U.S. situs asset. U.S. situs assets for gift tax purposes include U.S. or foreign currency within the U.S., real estate in the U.S. and other tangible property within the U.S. (cars, jewelry, antiques, etc.)

Under current U.S. gift tax rules, gifts to the same recipient in the same year that exceeds the annual exclusion for gifts will be reported and paid as gift tax ($159,000 in 2021 if the recipient is a non-U.S. citizen’s spouse, or an unlimited amount if the recipient is a U.S. citizen’s spouse, with a full gift tax exemption). The annual exclusion for gifts is $15,000 in 2021 and $16,000 in 2022. In addition, the annual exclusions is calculated per recipient and there is no limit to the number of recipients.

In addition, the U.S. allows “spouse split gifts,” which means that although the subject of the gift is in the name of either the husband or the wife, the gift can be made using both spouse’s individual annual exclusion for gifts. This means that each spouse is deemed to have given half of the gift, thus the gift tax exemption will be twice the original amount ($30,000). However, in this case, regardless of whether the gift exceeds the exemption amount, Form 709 must be filed, with the owner as the filer along with the spouse’s signature to indicate consent.

In addition, when filing a gift tax return, the following should be noted:

Tax Cuts and Jobs Act of 2017 (TCJA) made significant changes to the estate and gift tax exemption, increasing the lifetime gift tax exemption for an individual from $5.49 million to $11.18 million per person. The TCJA Tax Reform, considering certain tax benefits, will expire in 2025. The U.S. government has made several changes to the estate and gift tax rules since 2000, it is advised that you check with your accountant for confirmation if there are any changes to the exemption amount applicable for that year when making a gift.

Estate Tax

If the decedent was a “U.S. Citizen” or “U.S. Resident,” the same estate tax rules apply regardless of whether the decedent was in the U.S. or abroad at the time of his or her death, meaning the “worldwide assets” left behind at the time of his death are taxable for U.S. estate tax purposes.

In particular, it should be noted that the term “U.S. resident” for estate tax purposes is defined differently from that for income tax purposes. A U.S. tax resident is determined based on domicile under U.S. estate tax law. A foreign person legally residing in the U.S. who intends to settle in the U.S. on a permanent basis is considered a U.S. resident for estate tax purposes and is subject to the same rules as a U.S. citizen (including worldwide estate taxation). However, there are many conditions that must be considered in order be to be qualified for residency.

For non-U.S. estate tax residents, U.S. situs assets for estate tax purposes are still taxed at U.S. estate tax rates. The non-U.S. decedent is not subject to estate tax unless passed away with U.S. situs assets for estate tax purposes under his or her name. U.S. situs assets for estate tax purposes include real estate or tangible property in the U.S., stock in U.S. corporations and mutual funds, certain U.S. bank deposits, debt obligations of a U.S. person or the U.S. government, cash surrender value of a U.S. insurance policy insuring life of another person, etc.

An estate tax filer in the U.S. is called an “executor” of an estate, which is defined as the executor, individual representative, or administrator of a decedent. If the foregoing does not apply, any person with actual or constructive possession of any property of the decedent, is considered an “executor”, and must file an estate tax return on Form 706 and Form 8971 to disclose basic information about the decedent and his or her inherited property.

The IRS gives the following example: Suppose A owns half of a farm or a building or a business and the other half is owned by A’s brother (or sister or friend or someone else). Then A’s estate should include this one-half interest in A’s total estate. However, there are many other factors that come into play, so it is important to consult with a tax or legal professional when filing.

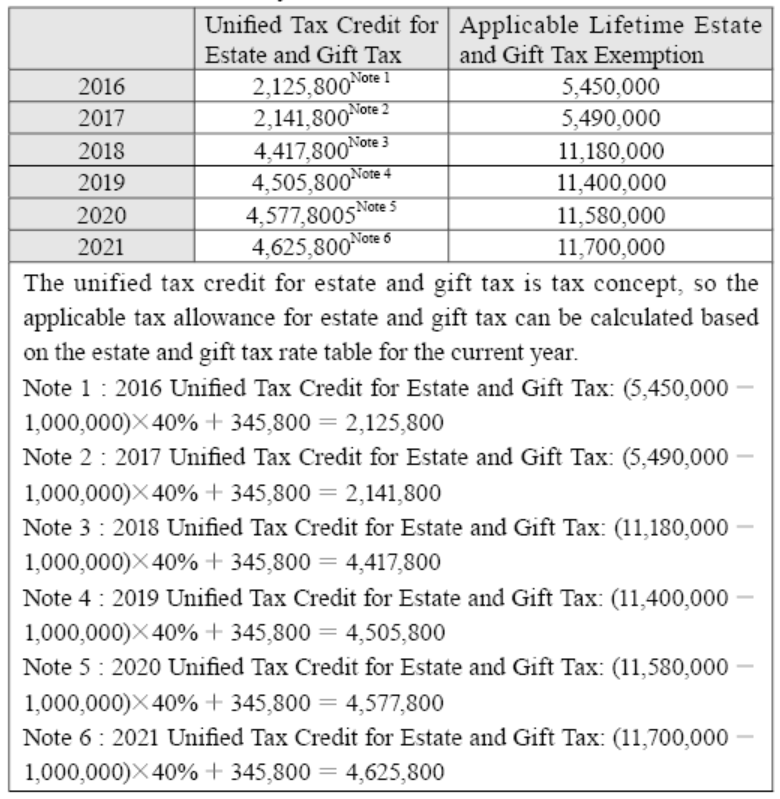

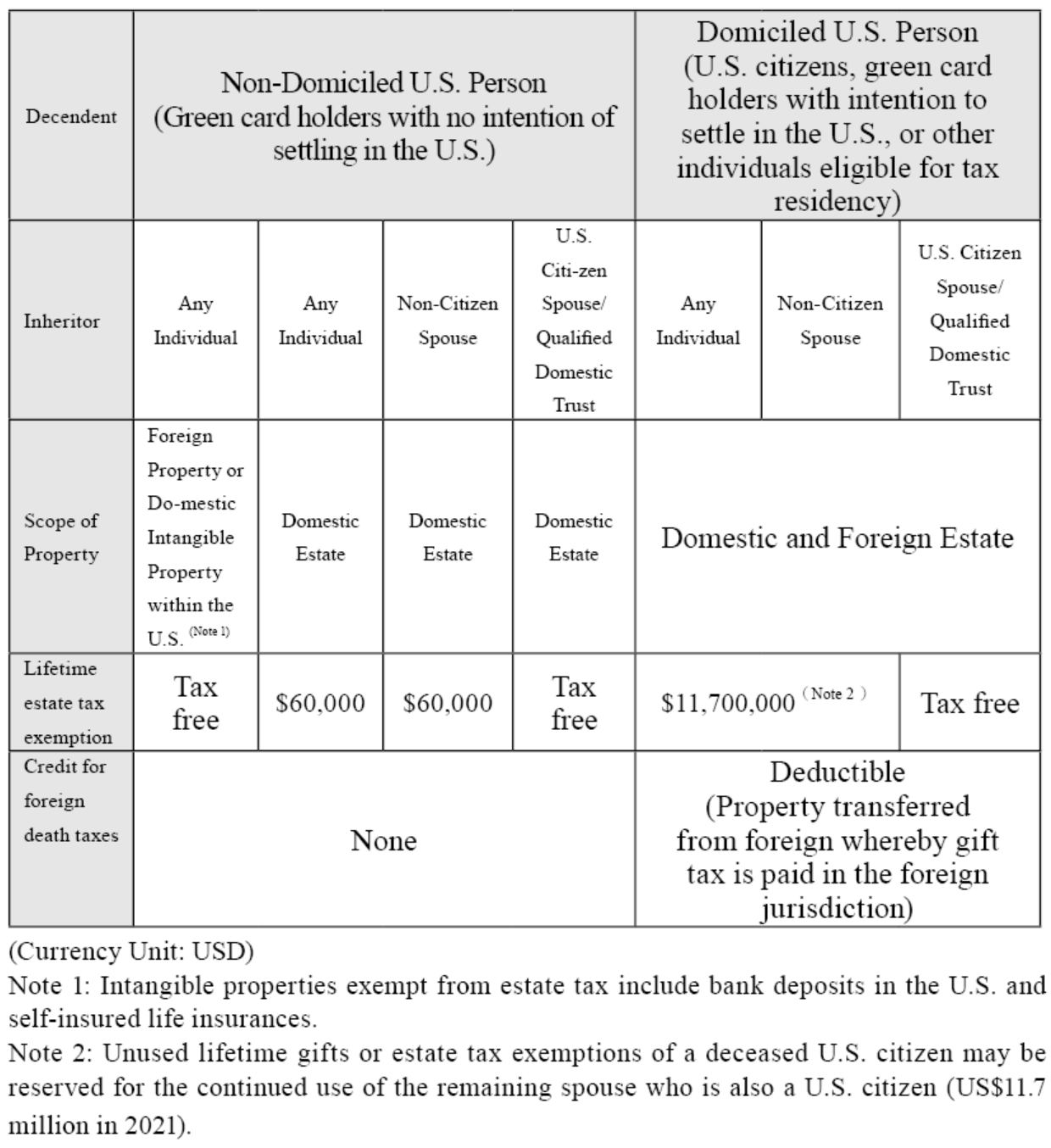

The following table is the lifetime exemptions for estate and gift tax in the U.S. in recent years:

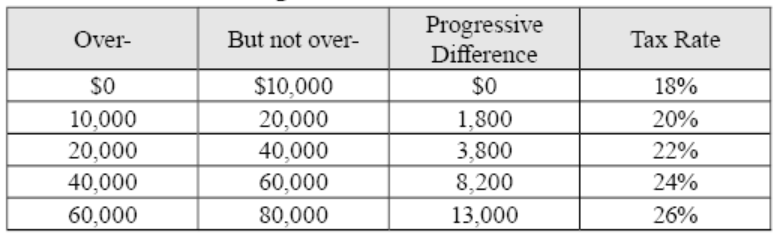

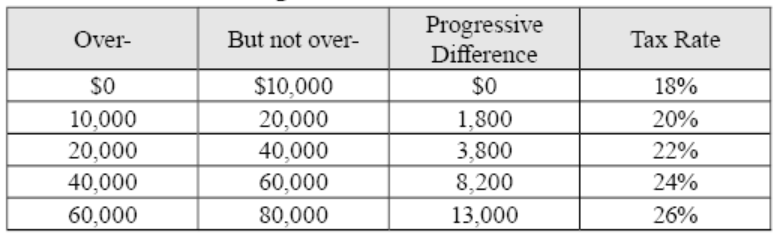

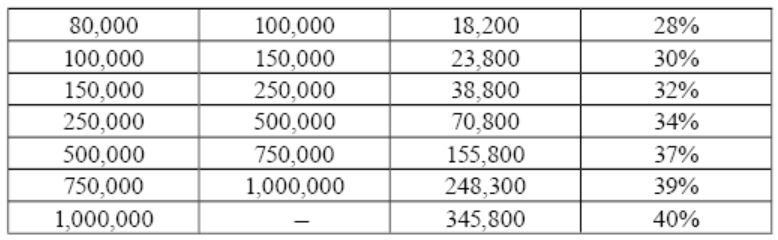

2021 Tax Rate and Progressive Rate of Estate and Gift

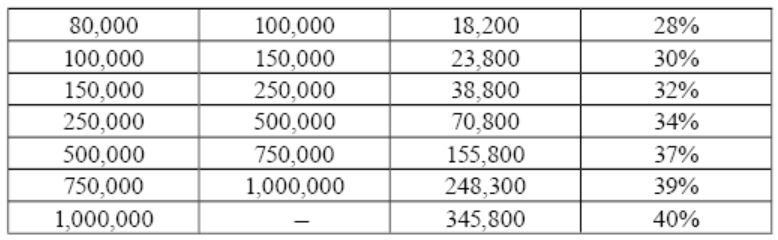

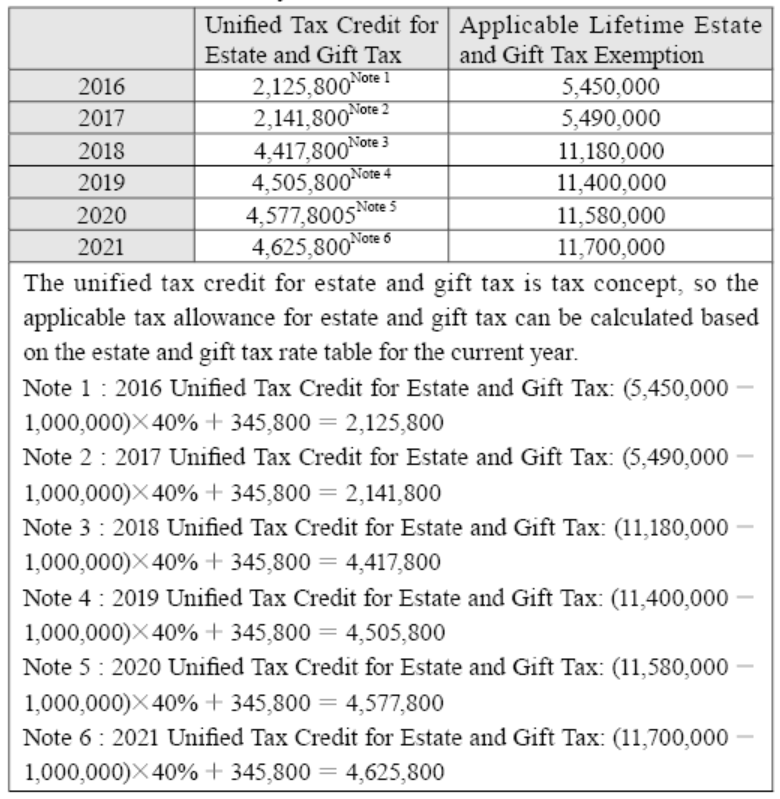

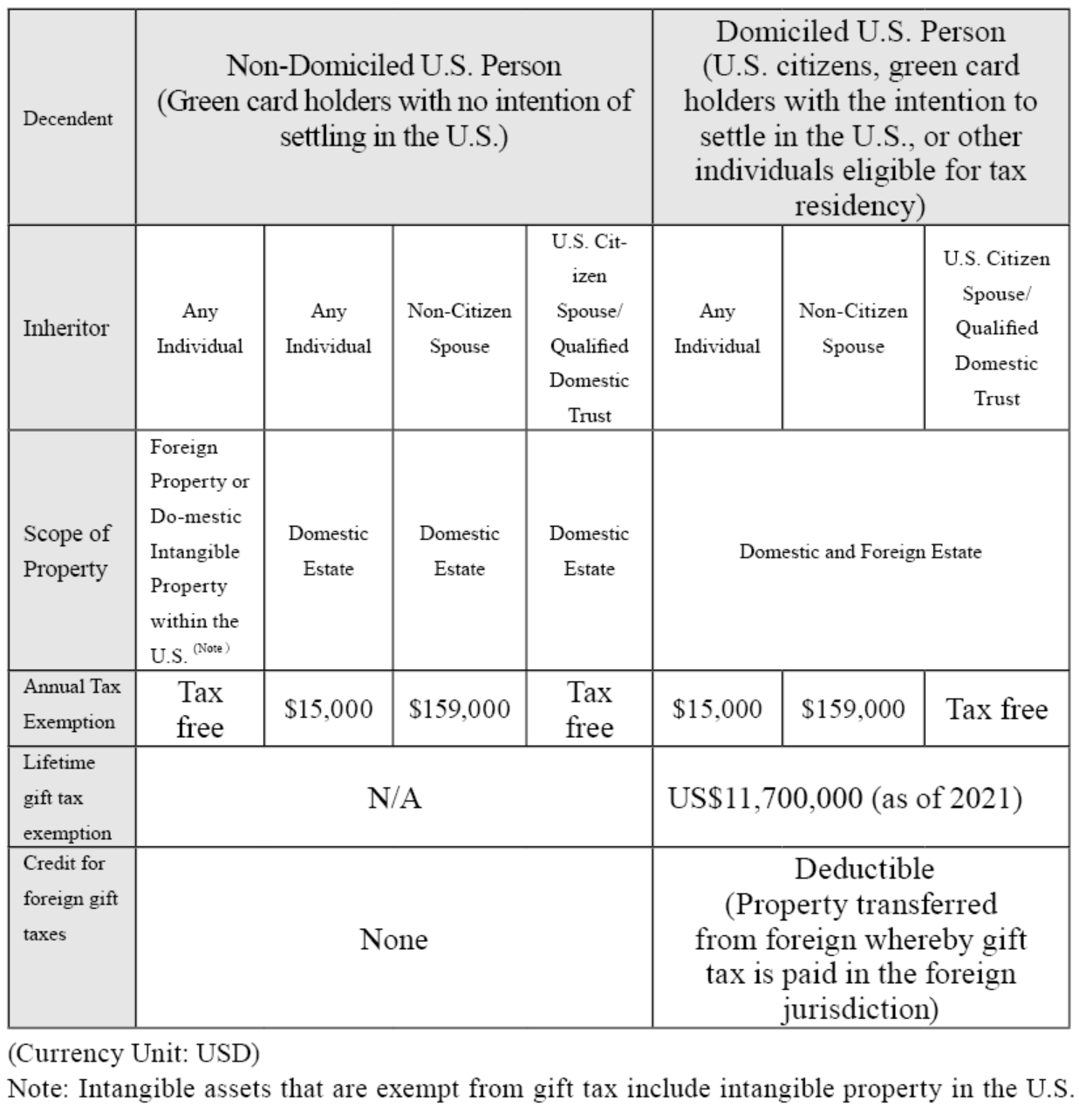

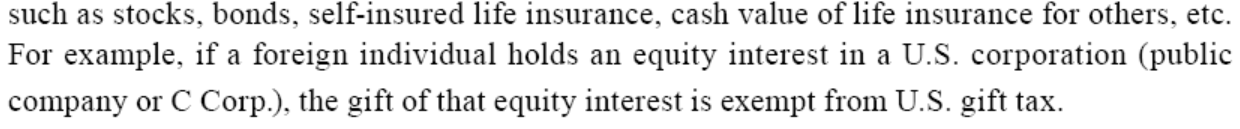

The following table summarizes the differences in inheritance of estates and gifts by U.S. citizens, residents, and nonresident aliens to different assets and individuals (2021 regulations).

2021 Gift Tax — Comparison of Tax Exemptions for Non-Domiciled and Domiciled U.S. Residents

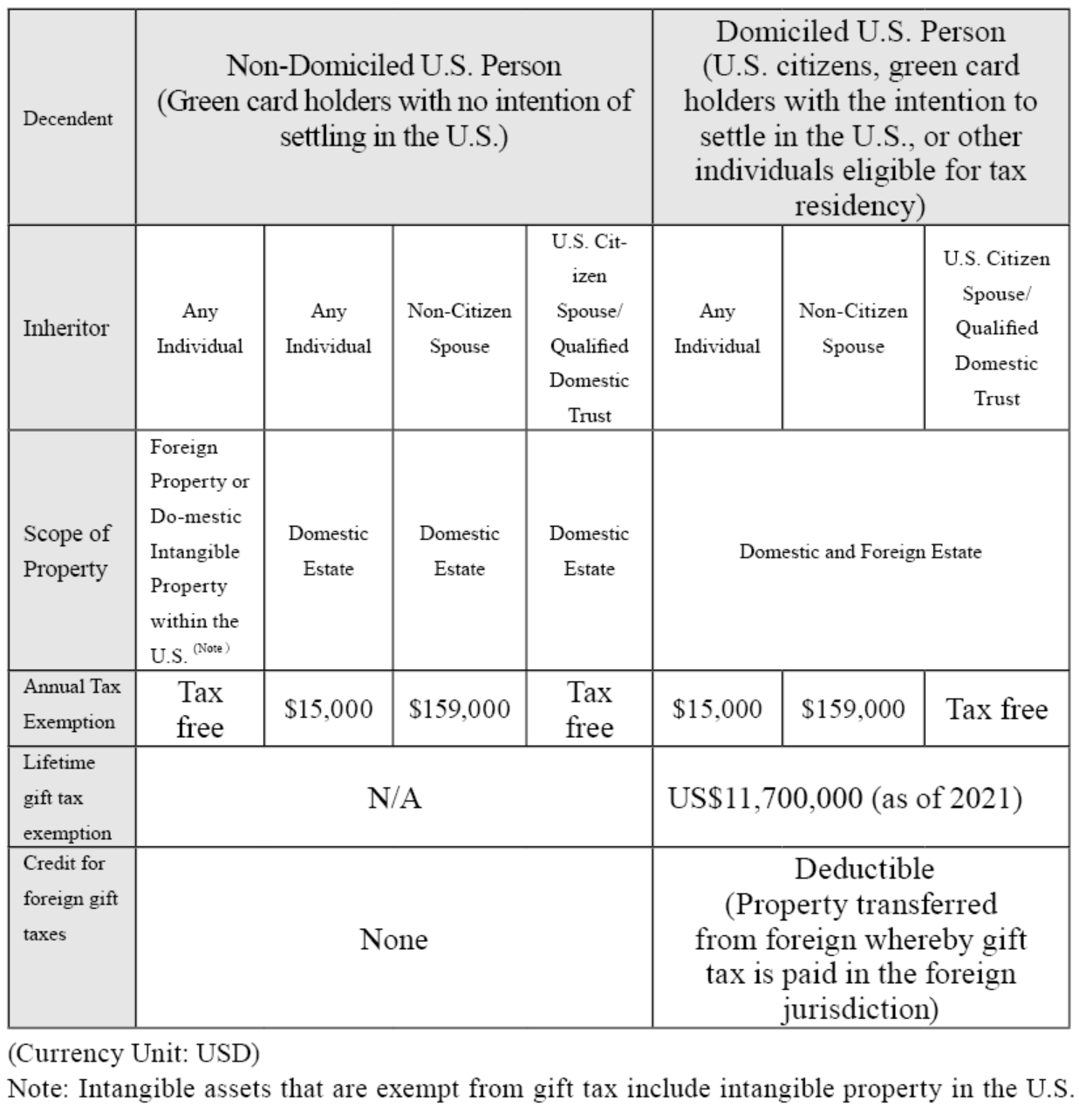

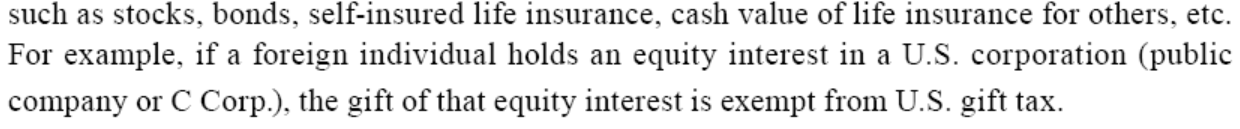

Estate Tax (as of 2021) —— Comparison of Tax Exemptions for Non-Domiciled and Domiciled U.S. Residents

Under U.S. tax law, gift taxes are typically owed by the donor. Generally, a foreign (non-U.S.) donor is not subject to gift tax unless he or she is gifting a U.S. situs asset. U.S. situs assets for gift tax purposes include U.S. or foreign currency within the U.S., real estate in the U.S. and other tangible property within the U.S. (cars, jewelry, antiques, etc.)

Under current U.S. gift tax rules, gifts to the same recipient in the same year that exceeds the annual exclusion for gifts will be reported and paid as gift tax ($159,000 in 2021 if the recipient is a non-U.S. citizen’s spouse, or an unlimited amount if the recipient is a U.S. citizen’s spouse, with a full gift tax exemption). The annual exclusion for gifts is $15,000 in 2021 and $16,000 in 2022. In addition, the annual exclusions is calculated per recipient and there is no limit to the number of recipients.

In addition, the U.S. allows “spouse split gifts,” which means that although the subject of the gift is in the name of either the husband or the wife, the gift can be made using both spouse’s individual annual exclusion for gifts. This means that each spouse is deemed to have given half of the gift, thus the gift tax exemption will be twice the original amount ($30,000). However, in this case, regardless of whether the gift exceeds the exemption amount, Form 709 must be filed, with the owner as the filer along with the spouse’s signature to indicate consent.

In addition, when filing a gift tax return, the following should be noted:

- Gifts with “future interests” must be reported though the value is under US$15,000.

- If both spouses have reportable gifts, they should fill out separate gift tax returns, but are allowed send the documents in the same envelope.

- If the gift is jointly held by a married couple, the gift will automatically be considered gifted half by each spouse, and each spouse will need to file a gift tax return individually.

- If the donor of the gift is a natural person and the gift is made to a trust, estate, partnership or company, the beneficiary, heir, partner or shareholder of the company will be subject to gift tax.

- If the donor does not pay the gift tax, the recipient may also be obligated to report and pay the gift tax under certain circumstances.

- If the donor dies before filing his or her tax obligation, the executor will be obligated to file the donor’s tax.

- If a gift is made to qualified charities, then no reporting is required. If the gift is only a transfer of “partial interest” or if any of the recipients are not qualified charities and is required to report the gift tax, then the portion of the gift made to qualified charities must also be filed.

- If the amount of gift is made for medical or educational purposes, which we commonly refer to as Health, Education, Maintenance, and Support (HEMS), the amount of gift paid to such institutions are not eligible for gift tax.

Tax Cuts and Jobs Act of 2017 (TCJA) made significant changes to the estate and gift tax exemption, increasing the lifetime gift tax exemption for an individual from $5.49 million to $11.18 million per person. The TCJA Tax Reform, considering certain tax benefits, will expire in 2025. The U.S. government has made several changes to the estate and gift tax rules since 2000, it is advised that you check with your accountant for confirmation if there are any changes to the exemption amount applicable for that year when making a gift.

Estate Tax

If the decedent was a “U.S. Citizen” or “U.S. Resident,” the same estate tax rules apply regardless of whether the decedent was in the U.S. or abroad at the time of his or her death, meaning the “worldwide assets” left behind at the time of his death are taxable for U.S. estate tax purposes.

In particular, it should be noted that the term “U.S. resident” for estate tax purposes is defined differently from that for income tax purposes. A U.S. tax resident is determined based on domicile under U.S. estate tax law. A foreign person legally residing in the U.S. who intends to settle in the U.S. on a permanent basis is considered a U.S. resident for estate tax purposes and is subject to the same rules as a U.S. citizen (including worldwide estate taxation). However, there are many conditions that must be considered in order be to be qualified for residency.

For non-U.S. estate tax residents, U.S. situs assets for estate tax purposes are still taxed at U.S. estate tax rates. The non-U.S. decedent is not subject to estate tax unless passed away with U.S. situs assets for estate tax purposes under his or her name. U.S. situs assets for estate tax purposes include real estate or tangible property in the U.S., stock in U.S. corporations and mutual funds, certain U.S. bank deposits, debt obligations of a U.S. person or the U.S. government, cash surrender value of a U.S. insurance policy insuring life of another person, etc.

An estate tax filer in the U.S. is called an “executor” of an estate, which is defined as the executor, individual representative, or administrator of a decedent. If the foregoing does not apply, any person with actual or constructive possession of any property of the decedent, is considered an “executor”, and must file an estate tax return on Form 706 and Form 8971 to disclose basic information about the decedent and his or her inherited property.

Introduction to Tax Reporting Obligations:

1. Filing Form

In the case of a decedent’s death in 2021, when the total estate left to each U.S. citizen and resident, plus taxable gifts and special allowances from prior years exceeds US$11.7 million or when a lifetime exemption is passed to a spouse, the executor must file an estate tax return using Form 706 and disclose basic information about the inheritors and their inherited property using Form 8971.

2. What items are included in the estate of a decedent?

The decedent’s estate includes all assets and interests owned by the decedent at the date of his or her death (refer to Form 706) and may include cash, securities, real estate, insurance, trusts, annuities, business interests and other assets. It is important to keep in mind that the total estate may include assets that are and are not probated.The IRS gives the following example: Suppose A owns half of a farm or a building or a business and the other half is owned by A’s brother (or sister or friend or someone else). Then A’s estate should include this one-half interest in A’s total estate. However, there are many other factors that come into play, so it is important to consult with a tax or legal professional when filing.

3. Which properties are not included in the estate?

In principle, only assets that are owned solely by the decedent’s spouse or other individuals are excluded from the decedent’s estate.

4. What items can be deducted from estate tax?

- Unlimited Marital Deduction: One of the major deductions for married couples is the unlimited marital deduction. The unlimited marital deduction is available for assets inherited by a spouse who is a U.S. citizen and is completely tax-free.

- Charitable Deduction: Assets bequeathed by the decedent to a qualified charity may be deducted from his/her gross estate.

- Mortgage loans and debts held by the heirs.

- Administration expenses related to the estate.

- Losses incurred during the administration of the assets.

The following table is the lifetime exemptions for estate and gift tax in the U.S. in recent years:

2021 Tax Rate and Progressive Rate of Estate and Gift

The following table summarizes the differences in inheritance of estates and gifts by U.S. citizens, residents, and nonresident aliens to different assets and individuals (2021 regulations).

2021 Gift Tax — Comparison of Tax Exemptions for Non-Domiciled and Domiciled U.S. Residents

Estate Tax (as of 2021) —— Comparison of Tax Exemptions for Non-Domiciled and Domiciled U.S. Residents

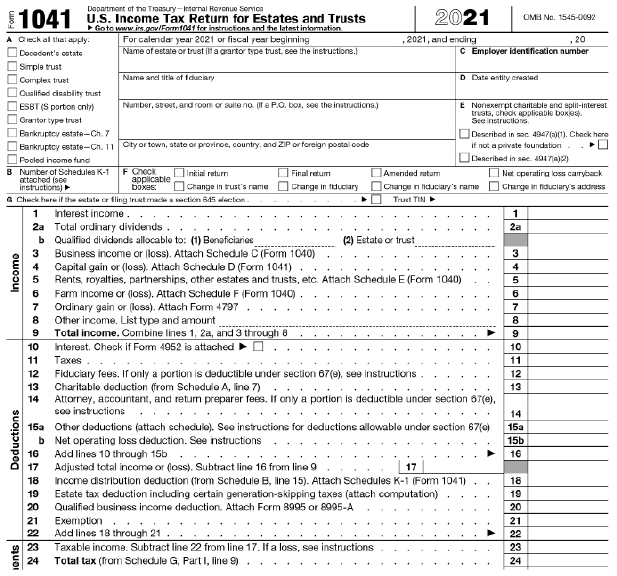

U.S. irrevocable trusts that exceed the reporting threshold will need to declare a trust tax return and pay income tax. After income tax is paid, the income will become part of the trust’s principal. Taxpayers should distribute the trust income to U.S. beneficiaries to avoid being subject to the highest tax rate for U.S. tax

purposes and file Form 1040 according to the income category and amount shown on Form 1041 (K-1).

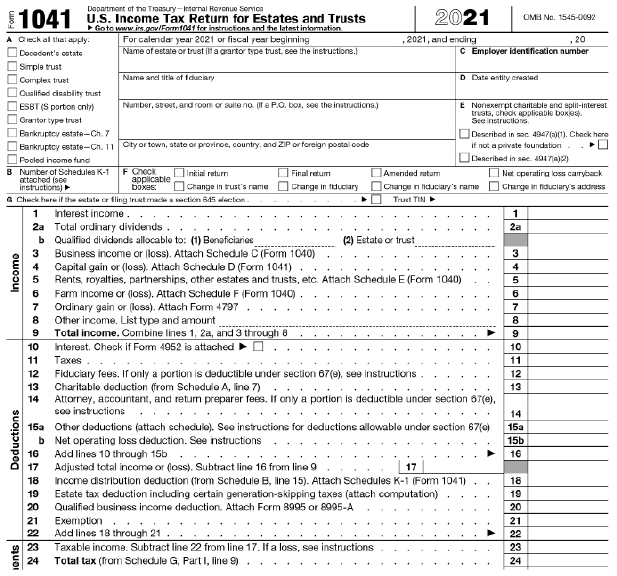

The following is a detailed introduction of Form 1041 and K-1:

I. Form 1041 (Federal Trust Tax Form)

(i) Filing date: April 15th of each year. Form 7004 may be filed by April 15th and can be extended to September 30th.

(ii) Filing requirements: Form 1041 is required if any of the following conditions are met:

Trust tax is computed by subtracting the required deductions and exemptions (US$100 for Complex Trust only) from the trust’s gross income of the tax year. Fiduciary fees, attorney, accountant and return preparer fees, and other expenses are subject to Section 67(e), and when the following requirements are met, it will result in deduction. The deduction will be limited by the percentage of tax-exempt income.

* Tax exempt income US$30,000

* US$30,000 / US$50,000 = 60%

* US$15,000 × 0.6 = 9,000 (expenses corresponding to the tax-free income are not deductible)

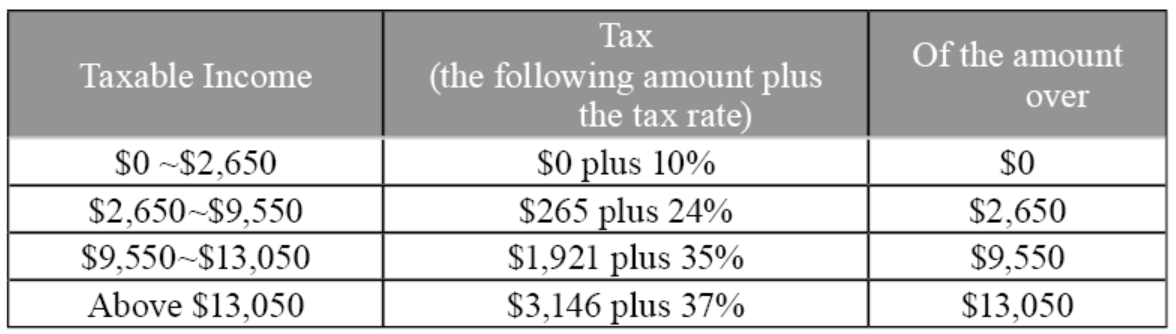

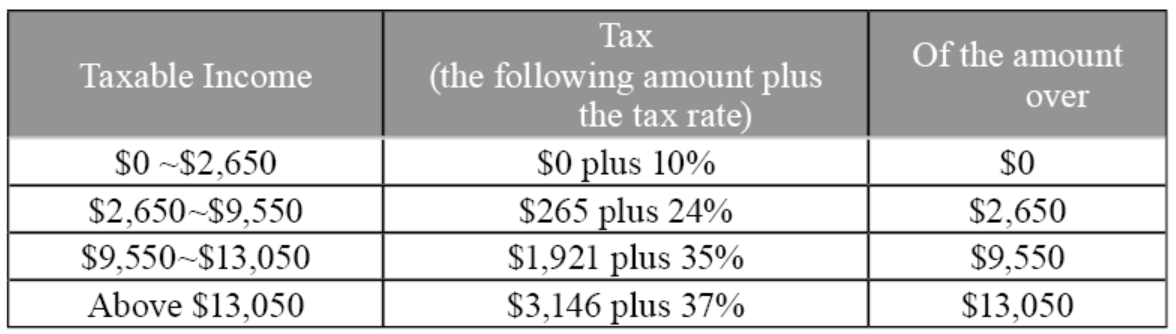

2021 Tax Rate, Form 1041

I. Introduction on Schedules of Form 1041

The following are the commonly used schedules of Form 1041:

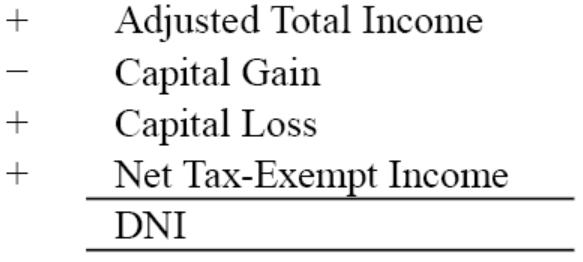

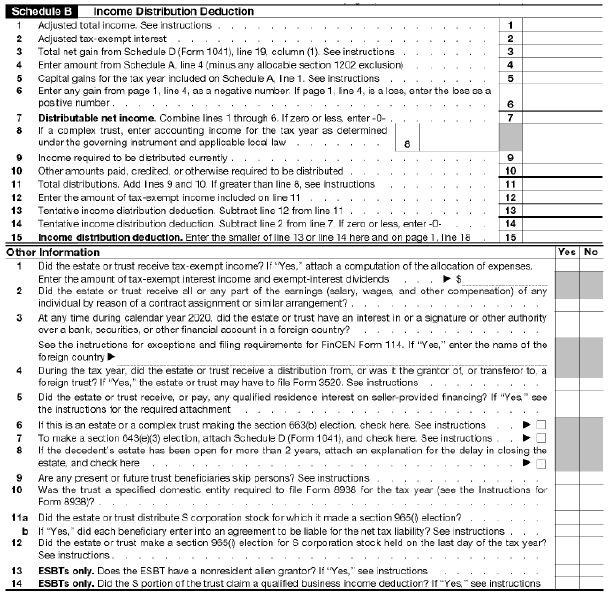

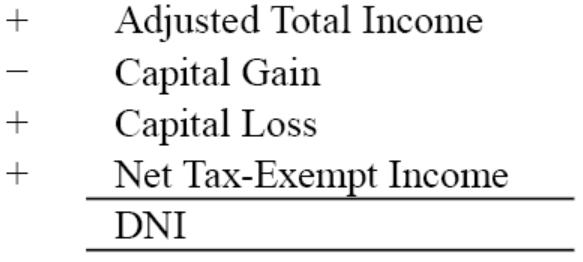

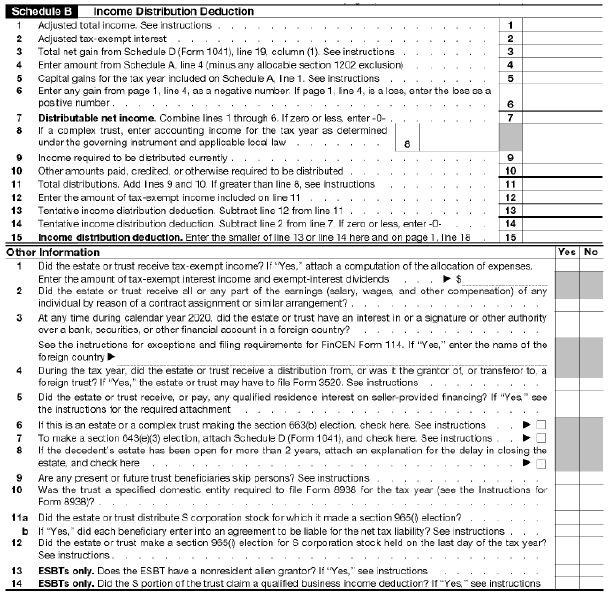

(i) Schedule B - Calculation of Income Distribution Deduction

To prevent double taxation, the amount of distribution to the beneficiaries must be deducted from taxable income up to the maximum amount of Distributable Net Income (DNI) when calculating trust taxable income. Although tax-exempt interest is not included in taxable income, it is included in DNI because it can be distributed to the beneficiaries (however, expenses related to tax-exempt income should be deducted when tax-exempt income is included in DNI). In addition, capital gains are not included in DNI because they are not distributed back to the principal of the trust.

DNI (Distributed New Income) is calculated as follows:

IDD (Income Distribution Deduction) will be treated as an amount of deduction on the trust’s tax return (Form 1041, line 18).

DNI (Distributable Net Income) - Tax-Exempt Income; or

Actual Distribution - Tax-Exempt Income, whichever is smaller.

The following Schedule B and other columns of Form 1041 are provided for reference:

(ii) Schedule D - Capital Gains (Losses)

The amount of capital gain or loss from a Form 1099-B issued by a broker should be

filled in Schedule D. Schedule D of Trust Tax Form 1041 is substantially the same as Schedule D of Individual Tax Form 1040, please see the instructions below:

When the trust has capital gains, the total amount of capital gains (long and short term combined) will be shown in column 4 of Form 1041 Capital Gain (or Loss). The long-term and short-term capital gains or losses will shown on Schedule D, and the transaction information of the current year will be shown on Form 8949.

When there are capital gains and losses at the same time, capital losses can fully offset against capital gains. When capital losses are greater than capital gains, there are two other methods to offset the gains:

①Offset another general income. A negative amount is shown in column 4 of Form 1041 when offsetting a general income, which will directly deduct the general income of the year, up to a maximum of US$3,000 a year.

②Offset capital losses carryover into future years. The capital losses carryover will be deferred to the next following year. If there are capital gains in the following year, the short-term and long-term capital gains will first offset respectively, then the insufficient short-term and long-term capital losses and gains may offset against each other. Lastly, the remaining capital losses will return to Method 1 and continue offset against other income. Capital losses carryover do not have an expiration date and can be used until it is used up.

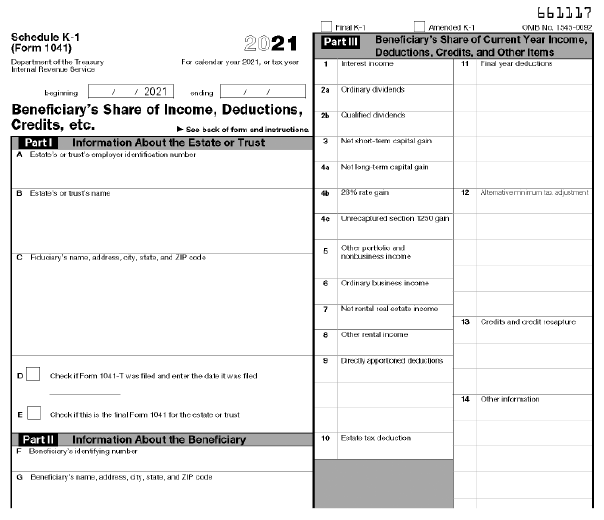

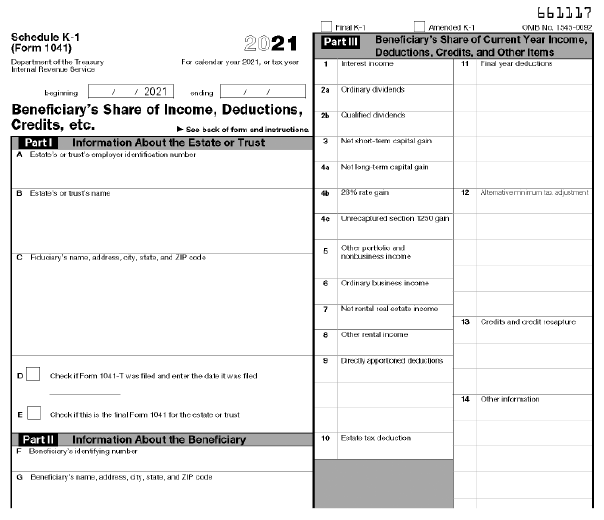

(iii) Schedule K-1

When a U.S. beneficiary receives distribution, the income from K-1(Form 1041) needs to be filled on Form 1040 and to be attached to Schedule E. As shown in the attached chart 2021 K-1:

purposes and file Form 1040 according to the income category and amount shown on Form 1041 (K-1).

The following is a detailed introduction of Form 1041 and K-1:

I. Form 1041 (Federal Trust Tax Form)

(i) Filing date: April 15th of each year. Form 7004 may be filed by April 15th and can be extended to September 30th.

(ii) Filing requirements: Form 1041 is required if any of the following conditions are met:

- Any taxable income for the tax year,

- Gross income of $600 or more (regardless of taxable income), or

- A beneficiary who is a nonresident alien

- Late filing penalty: 5% of the tax due fine per month, up to a maximum of 25%.

- Late payment penalty: 5% of the tax due fine per month , up to a maximum of 25%.

Trust tax is computed by subtracting the required deductions and exemptions (US$100 for Complex Trust only) from the trust’s gross income of the tax year. Fiduciary fees, attorney, accountant and return preparer fees, and other expenses are subject to Section 67(e), and when the following requirements are met, it will result in deduction. The deduction will be limited by the percentage of tax-exempt income.

- Fees paid or incurred in connection with the administration of the trust

- Management fee will only be incurred if the property is held in the trust

- Assuming the actual payment of the attorney’s fee is US$15,000

* Tax exempt income US$30,000

* US$30,000 / US$50,000 = 60%

* US$15,000 × 0.6 = 9,000 (expenses corresponding to the tax-free income are not deductible)

2021 Tax Rate, Form 1041

I. Introduction on Schedules of Form 1041

The following are the commonly used schedules of Form 1041:

(i) Schedule B - Calculation of Income Distribution Deduction

To prevent double taxation, the amount of distribution to the beneficiaries must be deducted from taxable income up to the maximum amount of Distributable Net Income (DNI) when calculating trust taxable income. Although tax-exempt interest is not included in taxable income, it is included in DNI because it can be distributed to the beneficiaries (however, expenses related to tax-exempt income should be deducted when tax-exempt income is included in DNI). In addition, capital gains are not included in DNI because they are not distributed back to the principal of the trust.

DNI (Distributed New Income) is calculated as follows:

IDD (Income Distribution Deduction) will be treated as an amount of deduction on the trust’s tax return (Form 1041, line 18).

DNI (Distributable Net Income) - Tax-Exempt Income; or

Actual Distribution - Tax-Exempt Income, whichever is smaller.

The following Schedule B and other columns of Form 1041 are provided for reference:

(ii) Schedule D - Capital Gains (Losses)

The amount of capital gain or loss from a Form 1099-B issued by a broker should be

filled in Schedule D. Schedule D of Trust Tax Form 1041 is substantially the same as Schedule D of Individual Tax Form 1040, please see the instructions below:

When the trust has capital gains, the total amount of capital gains (long and short term combined) will be shown in column 4 of Form 1041 Capital Gain (or Loss). The long-term and short-term capital gains or losses will shown on Schedule D, and the transaction information of the current year will be shown on Form 8949.

When there are capital gains and losses at the same time, capital losses can fully offset against capital gains. When capital losses are greater than capital gains, there are two other methods to offset the gains:

①Offset another general income. A negative amount is shown in column 4 of Form 1041 when offsetting a general income, which will directly deduct the general income of the year, up to a maximum of US$3,000 a year.

②Offset capital losses carryover into future years. The capital losses carryover will be deferred to the next following year. If there are capital gains in the following year, the short-term and long-term capital gains will first offset respectively, then the insufficient short-term and long-term capital losses and gains may offset against each other. Lastly, the remaining capital losses will return to Method 1 and continue offset against other income. Capital losses carryover do not have an expiration date and can be used until it is used up.

(iii) Schedule K-1

When a U.S. beneficiary receives distribution, the income from K-1(Form 1041) needs to be filled on Form 1040 and to be attached to Schedule E. As shown in the attached chart 2021 K-1:

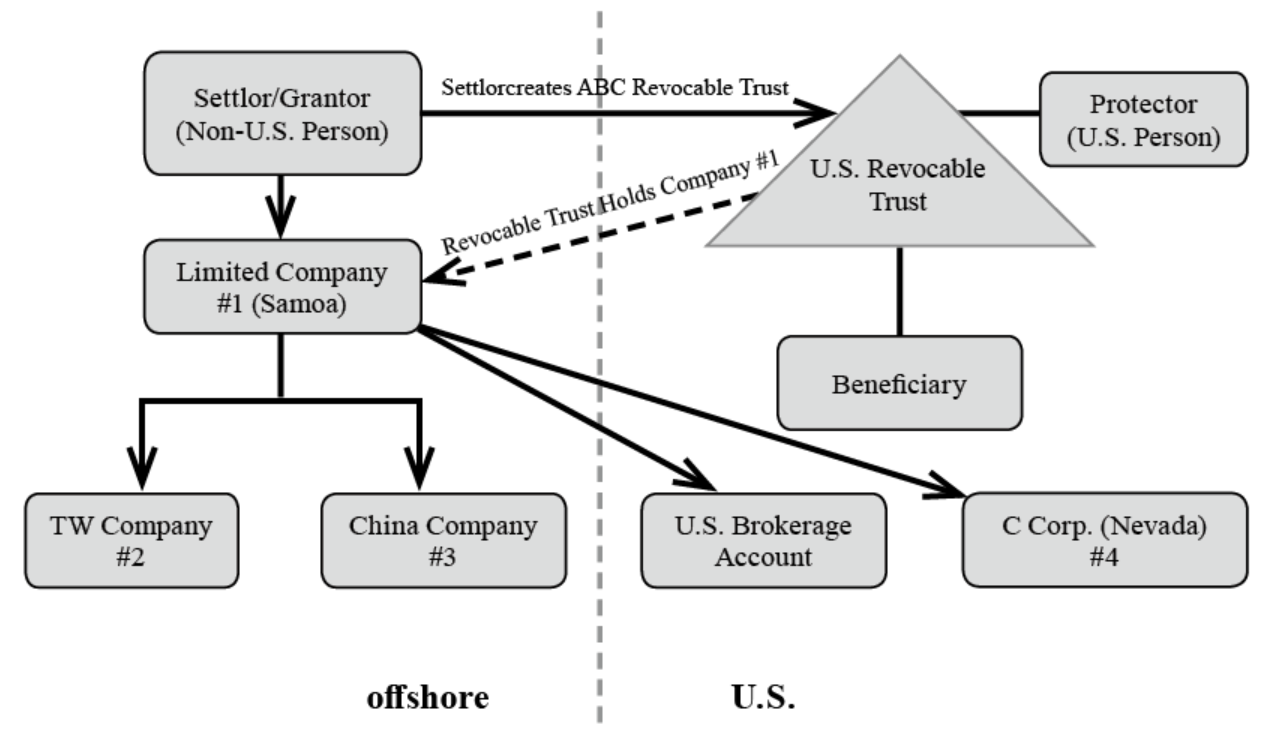

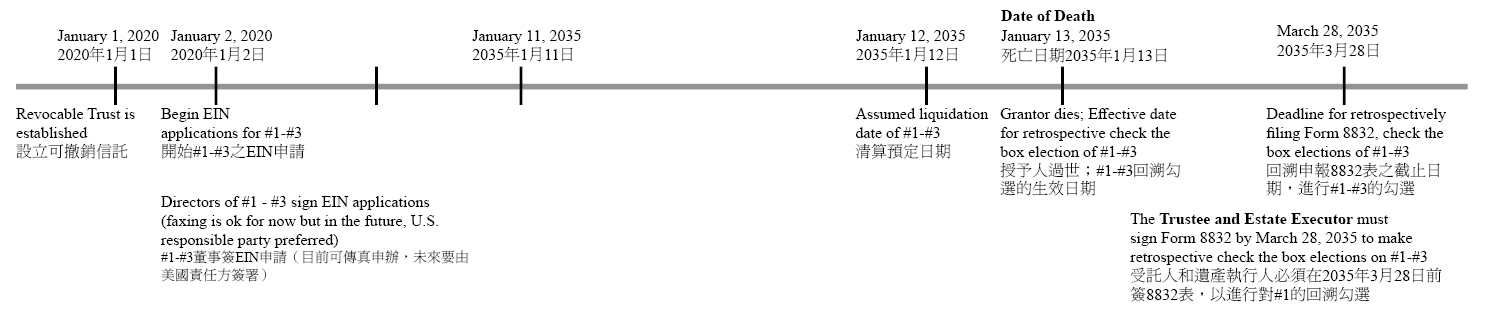

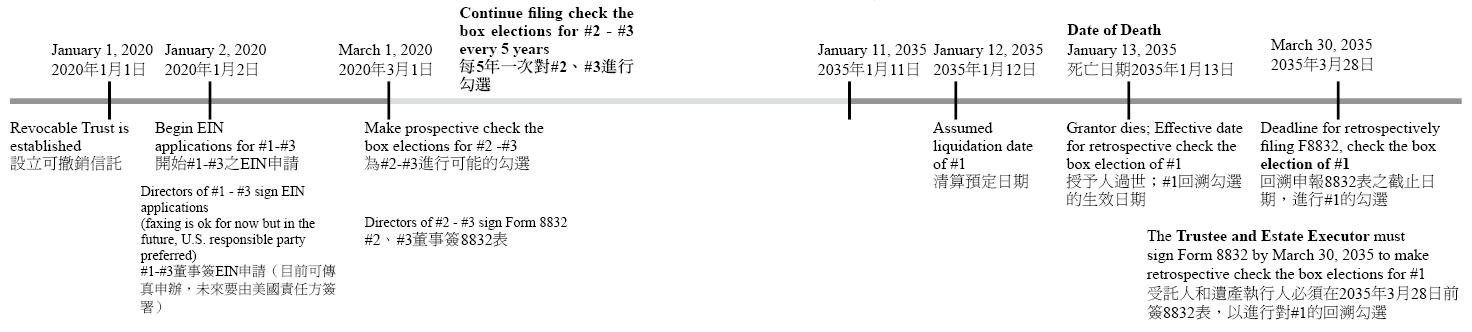

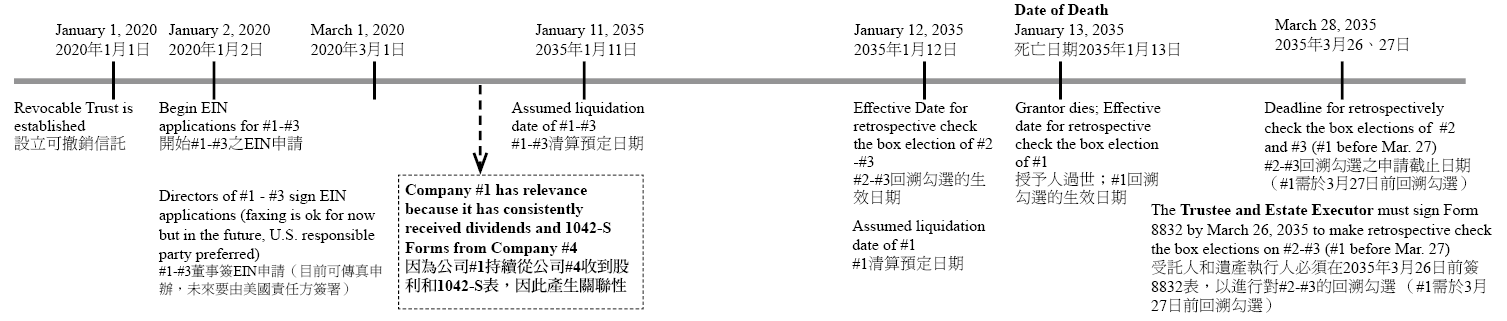

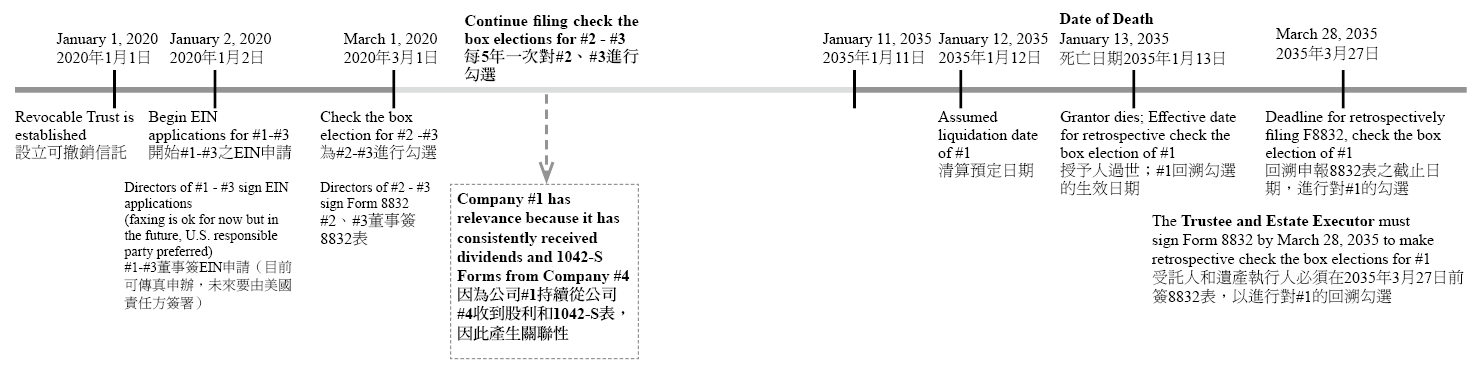

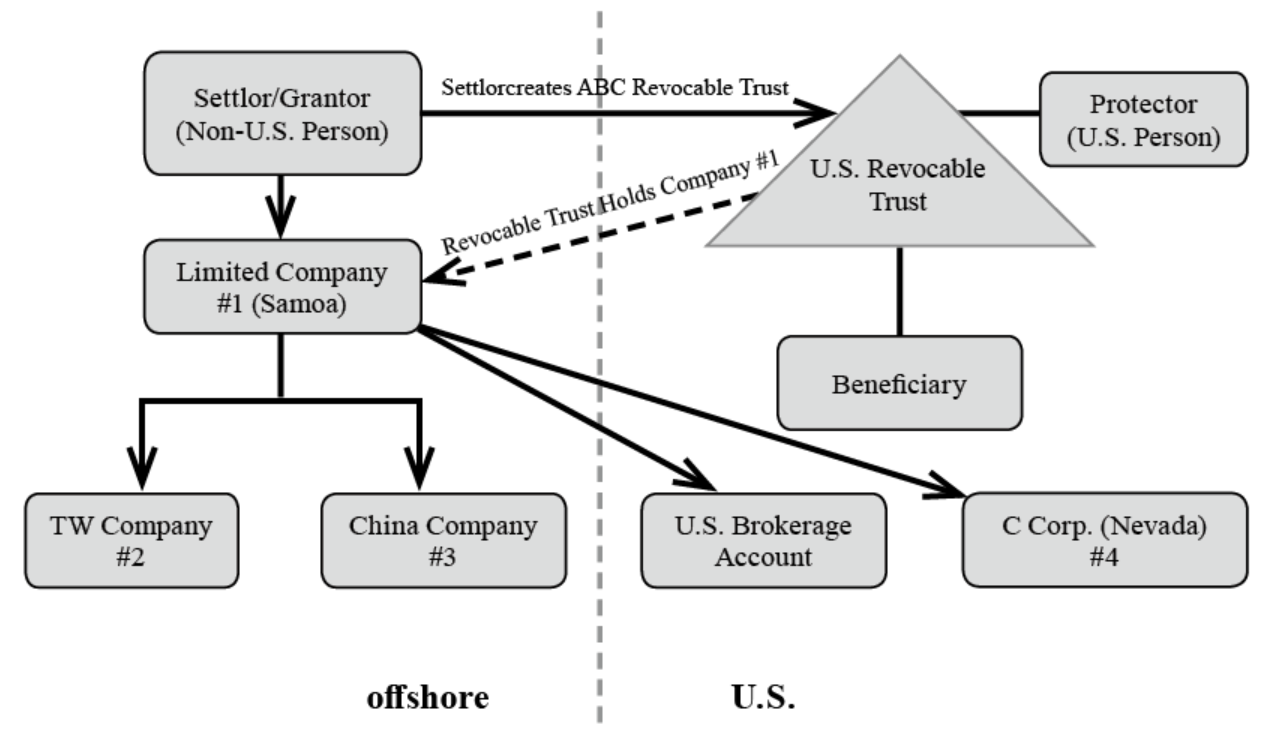

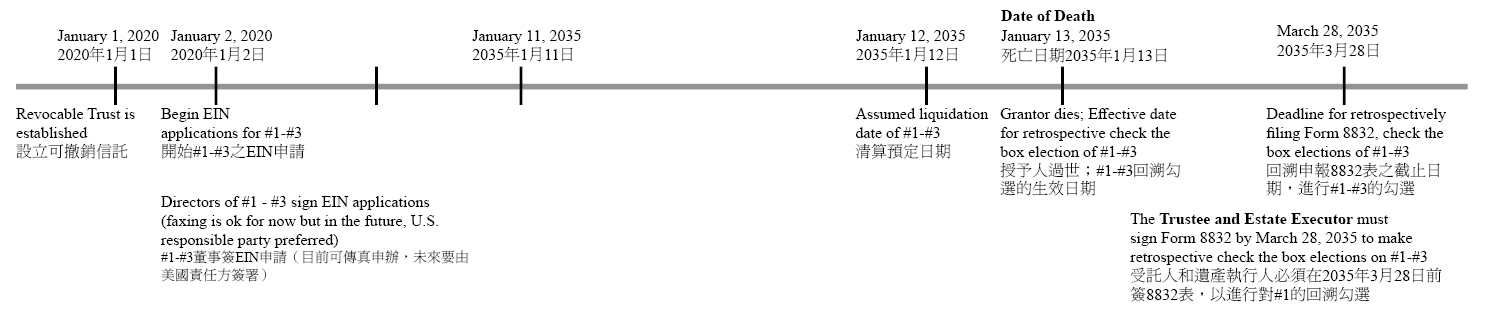

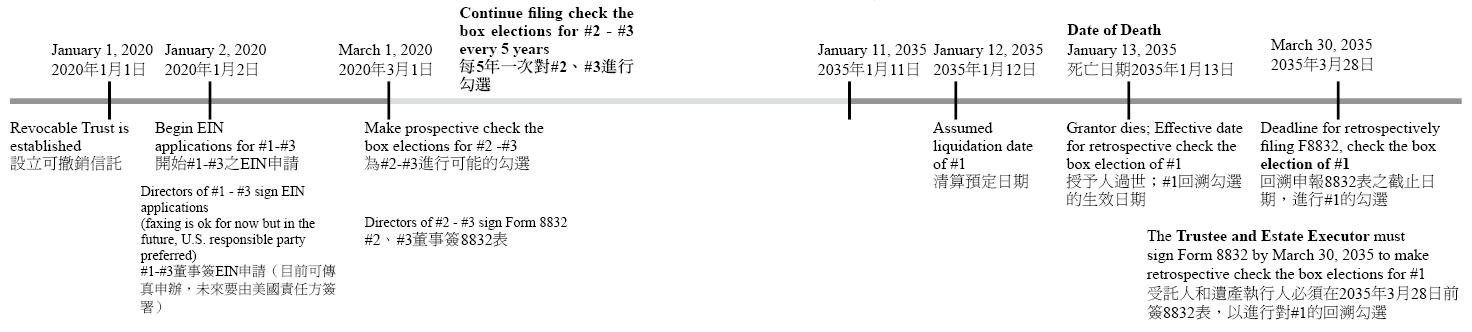

A non-U.S. persons settles a U.S. revocable trust with U.S. beneficiaries and a U.S. trust protector. The trust holds only stock of foreign corporations. When the grantor deceases, the trust is converted from a U.S. grantor trust to a U.S. non-grantor trust.

At this point, a check the box election can be filed to step up in basis of the foreign assets and to minimize CFC and PFIC issues. How should the trust step up the basis in its foreign company holdings?

1. No Change in Tax Law

If there is no change in the provisions stepping up basis at death, then you would rely on the powers by grantor under the trust agreement to ensure an increase in cost basis at death under Section 1014(b)(3).

A foreign eligible entity’s election is relevant for tax purposes on the effective date, so the election is valid for five years. You can avoid having to make renewal elections if the entity acquires an asset or otherwise earns income that preserves its relevance. If you have created reference by receiving dividends from #4 or brokerage account and continue filing check the box elections for #2 and #3 every 5 years, you only have to check the box for #1 and do not have to check the box for #2 and #3, since we previously filed a check the box election for them every five years.

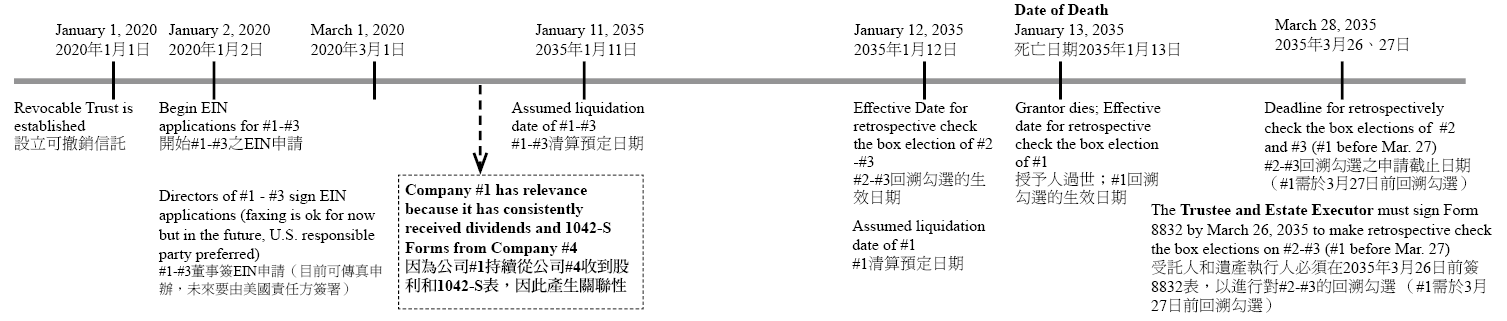

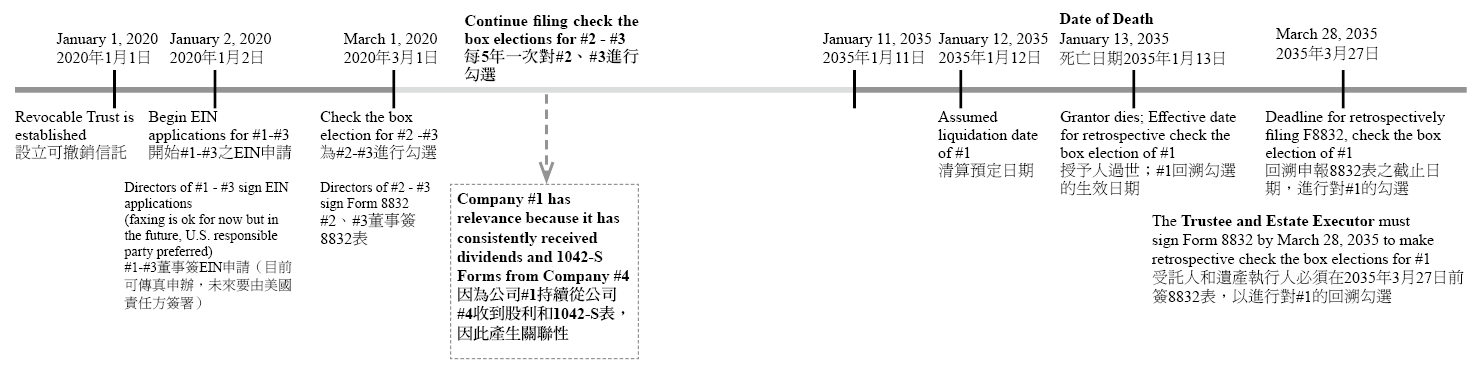

2. Change in Tax Law

If the tax law is changed so as to eliminate the automatic step-up in basis at death, then you would still check the box on #1 effective on the date of death. Ideally, you would check the box on #2 and #3 effective at least a day prior to the date of death so as ensure that they have been fully “liquidated” for tax purposes effective prior to the deemed liquidation of #1. The reason for this is that we want to ensure that when you check the box on #1, the deemed liquidation at the end of the day preceding the date of death will be given full effect, resulting in a deemed sale immediately before grantor’s death that has the result of stepping up the basis of the underlying assets.

You can also create reference by receiving dividends from #4 or brokerage account and continue filing check the box elections for #2 to #3 every 5 years. Then you only have to check the box for #1 after the trust grantor’s death.

At this point, a check the box election can be filed to step up in basis of the foreign assets and to minimize CFC and PFIC issues. How should the trust step up the basis in its foreign company holdings?

1. No Change in Tax Law

If there is no change in the provisions stepping up basis at death, then you would rely on the powers by grantor under the trust agreement to ensure an increase in cost basis at death under Section 1014(b)(3).

A foreign eligible entity’s election is relevant for tax purposes on the effective date, so the election is valid for five years. You can avoid having to make renewal elections if the entity acquires an asset or otherwise earns income that preserves its relevance. If you have created reference by receiving dividends from #4 or brokerage account and continue filing check the box elections for #2 and #3 every 5 years, you only have to check the box for #1 and do not have to check the box for #2 and #3, since we previously filed a check the box election for them every five years.

2. Change in Tax Law

If the tax law is changed so as to eliminate the automatic step-up in basis at death, then you would still check the box on #1 effective on the date of death. Ideally, you would check the box on #2 and #3 effective at least a day prior to the date of death so as ensure that they have been fully “liquidated” for tax purposes effective prior to the deemed liquidation of #1. The reason for this is that we want to ensure that when you check the box on #1, the deemed liquidation at the end of the day preceding the date of death will be given full effect, resulting in a deemed sale immediately before grantor’s death that has the result of stepping up the basis of the underlying assets.

You can also create reference by receiving dividends from #4 or brokerage account and continue filing check the box elections for #2 to #3 every 5 years. Then you only have to check the box for #1 after the trust grantor’s death.

While both U.S. domestic trusts and U.S. foreign trusts can be settled in the U.S., U.S. domestic trusts are generally preferred for Wealth Creators wishing to settle trusts for U.S. beneficiaries.

U.S. Domestic Trust

Under 26 U.S.C.§ 7701(a)(30)(E) and (31)(B), a trust must meet both the “court test” and the “control test” to be considered as a U.S. trust:

(i) A court within the United States is able to exercise primary supervision over the administration of the trust (court test); and

(ii) One or more United States persons have the authority to control all substantial decisions of the trust (control test).1

1 26 U.S.C. § 7701 (a)(30)(E) (“the term ‘United Person’ means any trust if: (i) a court within the United States is able to exercise primary supervision over the administration of the trust; and (ii) one or more United States persons have the authority to control all substantial decisions of the trust.”)

26 CFR § 301.7701-7 (c)(3)(ii).

Court Test

Under 26 CFR § 301.7701-7, the term the United States is used in this section in a geographical sense. Thus, for the purposes of the court test, the United States includes only the States and the District of Columbia. A trust is a U.S. domestic trust if it is administered solely within the U.S., has no provisions directing administration outside the U.S., and has no automatic migration provisions.

Control Test

One or more U.S. persons must have the authority, by vote or otherwise, to make all “substantial decisions” of the trust with no other person having veto power.

According to 26 CFR § 301.7701-7, substantial decisions include, but are not limited to, decisions concerning:

Whether and when to distribute income or corpus;

The amount of any distributions;

The selection of a beneficiary;

In the event of an inadvertent change in any person that has the power to make a substantial decision of the trust that would cause the domestic or foreign residency of the trust to change, the trust is allowed 12 months from the date of the change to make necessary changes either with respect to the persons who control the substantial decisions or with respect to the residence of such persons to avoid a change in the trust’s residency. For the purposes of this section, an inadvertent change means death, incapacity, resignation, change in residency or other change with respect to a person that has a power to make a substantial decision of the trust that would cause a change to the residency of the trust but that was not intended to change the residency of the trust. If the change is made within 12 months, the trust will remain as a U.S. trust. Conversely, if no change is made, the trust will become a foreign trust after the term is expired.2

Foreign Trust

The term “foreign trust” means any trust other than a trust described in 26 U.S.C. §7701(a)(30)(E).3 In other words, a foreign trust does not meet the court test and / or the control test.

2 26 CFR § 301.7701-7 (d)(2)(i).

3 26 U.S.C. § 7701 (a)(31)(B) (Foreign Trust) (“the term ‘foreign trust’ means any trust other than a trust described in subparagraph (E) of paragraph (30).”).

U.S. Domestic Trust

Under 26 U.S.C.§ 7701(a)(30)(E) and (31)(B), a trust must meet both the “court test” and the “control test” to be considered as a U.S. trust:

(i) A court within the United States is able to exercise primary supervision over the administration of the trust (court test); and

(ii) One or more United States persons have the authority to control all substantial decisions of the trust (control test).1

1 26 U.S.C. § 7701 (a)(30)(E) (“the term ‘United Person’ means any trust if: (i) a court within the United States is able to exercise primary supervision over the administration of the trust; and (ii) one or more United States persons have the authority to control all substantial decisions of the trust.”)

26 CFR § 301.7701-7 (c)(3)(ii).

Court Test

Under 26 CFR § 301.7701-7, the term the United States is used in this section in a geographical sense. Thus, for the purposes of the court test, the United States includes only the States and the District of Columbia. A trust is a U.S. domestic trust if it is administered solely within the U.S., has no provisions directing administration outside the U.S., and has no automatic migration provisions.

Control Test

One or more U.S. persons must have the authority, by vote or otherwise, to make all “substantial decisions” of the trust with no other person having veto power.

According to 26 CFR § 301.7701-7, substantial decisions include, but are not limited to, decisions concerning:

Whether and when to distribute income or corpus;

The amount of any distributions;

The selection of a beneficiary;

- Whether a receipt is allocable to income or principal;

- Whether to terminate the trust;

- Whether to compromise, arbitrate, or abandon claims of the trust;

- Whether to sue on behalf of the trust or to defend suits against the trust;

- Whether to remove, add, or replace a trustee;

- Whether to appoint a successor trustee to succeed a trustee who has died, resigned, or otherwise ceased to act as a trustee, even if the power to make such a decision is not accompanied by an unrestricted power to remove a trustee, unless the power to make such a decision is limited such that it cannot be exercised in a manner that would change the trust’s residency from foreign to domestic, or vice versa; and

- Investment decisions; however, if a United States person under section 7701(a)(30) hires an investment advisor for the trust, investment decisions made by the investment advisor will be considered substantial decisions controlled by the United States person if the United States person can terminate the investment advisor’s power to make investment decisions at will.

In the event of an inadvertent change in any person that has the power to make a substantial decision of the trust that would cause the domestic or foreign residency of the trust to change, the trust is allowed 12 months from the date of the change to make necessary changes either with respect to the persons who control the substantial decisions or with respect to the residence of such persons to avoid a change in the trust’s residency. For the purposes of this section, an inadvertent change means death, incapacity, resignation, change in residency or other change with respect to a person that has a power to make a substantial decision of the trust that would cause a change to the residency of the trust but that was not intended to change the residency of the trust. If the change is made within 12 months, the trust will remain as a U.S. trust. Conversely, if no change is made, the trust will become a foreign trust after the term is expired.2

Foreign Trust

The term “foreign trust” means any trust other than a trust described in 26 U.S.C. §7701(a)(30)(E).3 In other words, a foreign trust does not meet the court test and / or the control test.

2 26 CFR § 301.7701-7 (d)(2)(i).

3 26 U.S.C. § 7701 (a)(31)(B) (Foreign Trust) (“the term ‘foreign trust’ means any trust other than a trust described in subparagraph (E) of paragraph (30).”).

Case Study: A non-U.S. person established a foreign non-grantor trust and then becomes a U.S. tax resident.

Mr. Wang, a non-U.S. person, has placed US$100,000 per year to a foreign non-grantor trust since 2000. The beneficiaries of this trust are Mr. Wang’s wife and children, both of whom are U.S. tax residents. In 2024, Mr. Wang becomes a U.S. tax resident and it triggers following questions: Whether the trust is subject to U.S. federal income tax because of status change of Mr. Wang? What portion of the trust assets will be subject to U.S. income tax? What is the treatment of the undistributed net income (UNI) accumulated in a foreign irrevocable trust? Will there be any U.S. transfer tax issues?

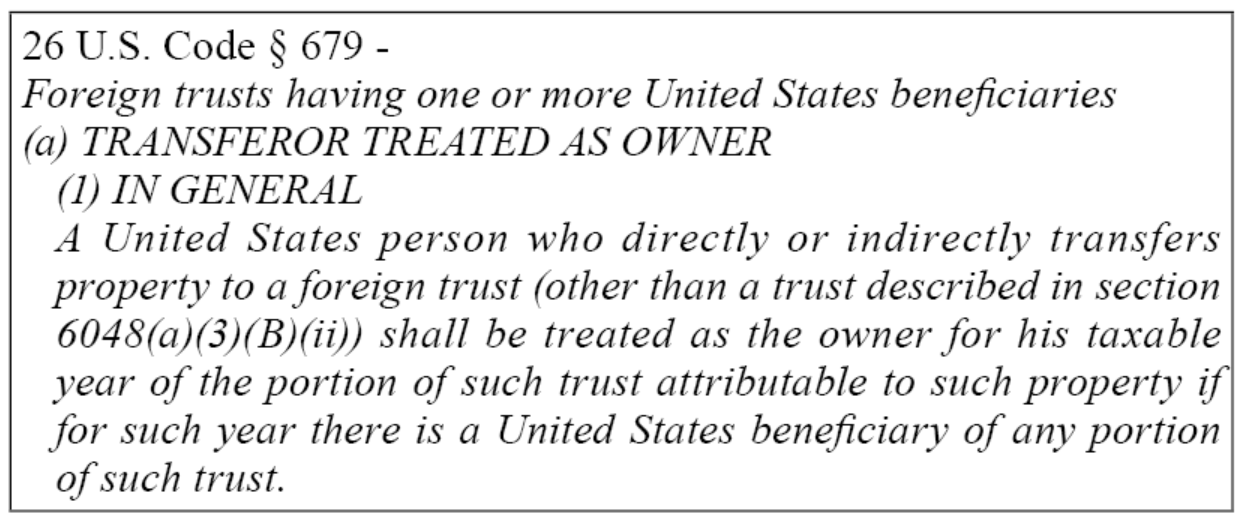

A trust is recognized a grantor trust because the grantor retains certain powers over the trust assets. However, under U.S. Code § 679, if a U.S. grantor transferred assets into a foreign trust and there’s a U.S. beneficiary, no matter what powers the grantor retains over the trust assets, the grantor shall be treated as the owner for his or her taxable year of the portion of the trust and be subject to U.S. federal income tax.

26 U.S. Code § 679(a)(4) Discussion

For U.S. income tax purposes, foreign trusts with U.S. beneficiaries are taxed at a significantly higher rate than domestic trusts with U.S. beneficiaries. Foreign trusts are trusts that fail either the court test, the control test or both the court and control tests.

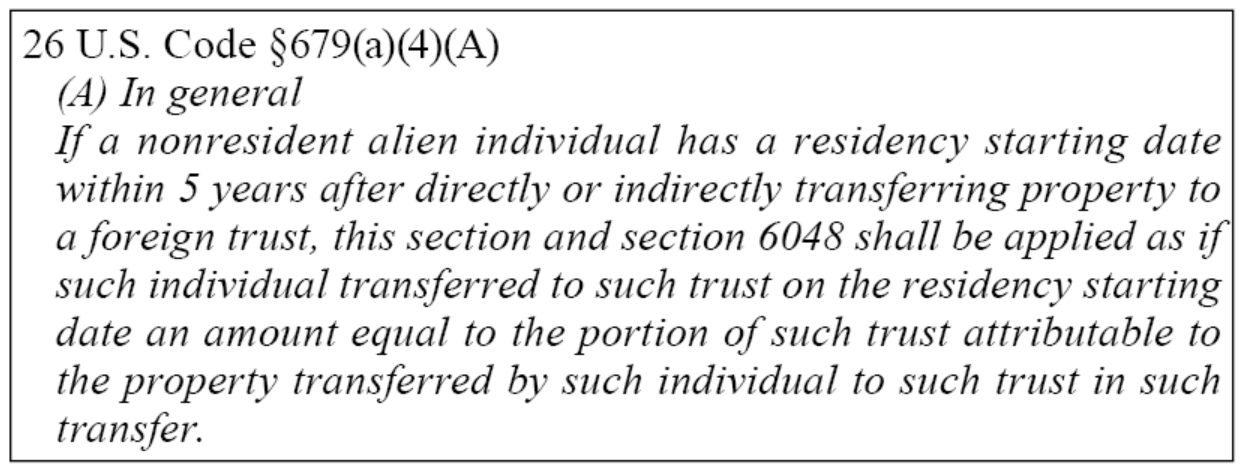

26 U.S. Code §679(a)(4)(A) Excerpt and Case Study

26 U.S. Code §679(a)(4), which was added in 1996, extended §679. Originally, §679 was applied only if the grantor was a U.S. tax resident. After the 1996 Act was enacted, a five-year retroactive period was made to prevent taxpayers from avoiding U.S. income tax through tax planning.

A U.S. person who is deemed to be the owner of a foreign trust will be subject to U.S. income tax each year on the portion of income derived from the portion of the trust’s assets. In Mr. Wang’s case, he shall be treated as the owner of the portion of the trust attributable to property transferred after he becomes a U.S. person in 2024. However, after the §679(a)(4) was added, any income derived from the trust assets which he transferred within five years (i.e., 2019~2023) would attribute to Mr. Wang, which would be subject to U.S. income tax.

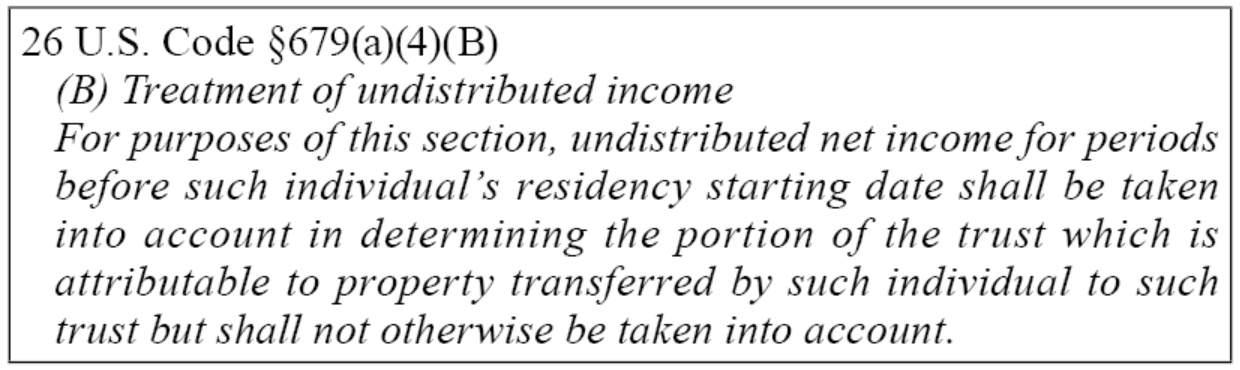

26 U.S. Code §679(a)(4)(B) Excerpt and Case Study

If there’s any UNI generated by the assets which the grantor transferred to the trust within five years before he or she becomes a U.S. person, it is subject to income tax to the grantor.

In this case, Mr. Wang continuously transferred assets to the trust during 2019 to 2023. We assume those assets generate US$10,000 income every year and all the income accumulated in the trust. Therefore, there’s US$50,000 UNI in 2024 when the grantor becomes a US person.

Conclusion:

In this scenario, Mr. Wang becomes a U.S. tax resident in 2024, the portion of the trust that he is deemed as owner is US$550,000 (including US$500,000, he transferred into the trust from 2019 to 2023 and the UNI US$50,000 generated from pervious assets). Mr. Wang must pay income tax for UNI according to §679(a)(4)(B) when he becomes U.S. person. And rest of the assets is subject to income tax in the future.

Decanting is the act of transferring assets from one trust into a different trust and is generally done with irrevocable trusts. Not all states allow trusts to be decanted, but Delaware and Nevada both have decanting statutes. People decant a trust for some reasons: to amend trusteeship, to adapt to changes, to fix drafting errors or to combine trusts or separating trusts. However, transferring assets from the original trust to a new trust may incur tax risks, so people need to be cautious with the details of each step in the decanting process.

Materials required for decanting:

1. New Trust Information

Names, addresses, set-up date and EIN of the new trust

2. New Trustee Information

Name, certificate of incorporation, articles of incorporation, registered address and the business address of the new trustee

3. Information of New Trustee Controlling Persons

List of current directors: list of authorized signatories of new trustees, minutes of the new trustees’ approval of the list of authorized signatories

4. New Trust Deed

Notify the attorney at the location of the new trust to draft the new trust document and contract.

5. Rationale Letter for the original trustee provided by the new trustee, explaining the reasoning behind setting up a new trust and transferring the assets. It is necessary to address that the transfer of the assets is for the best benefits of the beneficiaries and will not cause any negative tax issues.

6. Deed of Appointment and Indemnity signed by the new trustee

7. Legal Validity Opinion provided by a local lawyer in the location where the new trust is set up, validating the new trust under local law and the new trustee’s power to act as a trustee.

8. Written Statement provided by the new trustee to promise that the new trustee will be responsible for reporting the tax liabilities of the original trust in the following year after the assets have transferred to the new trust.

Steps a Decanting Coordinator should follow when decanting:

1. After the new trustee has signed the trust agreement, please confirm the following:

I. Apply for EIN for the trust

The application may take 2-4 weeks, since foreigners do not have Social Security Number and Individual Taxpayer Identification Number, they will need to fill out Form SS-4 and fax it to IRS, which will take a longer time.

II. Set up an LLC and draft its operating agreement

III. Open a bank account for the LLC under the trust

IV. The listed steps should be timed and scheduled since some trustee companies would only allow funds deposited in their escrow accounts for a limited period of time. The bank account of the LLC must be set up first, and then the funds can be transferred to the bank account of the company under the trust.

2. If the original trust is a foreign trust, it is important to note whether the original trust has distributed its annual earnings (DNI); decanting assets that include undistributed earnings (UNI) will be subject to throwback tax.

3. If the trust distribution is to be made in the current year, the distribution must be completed within 65 days after the end of the year.

Preparations:

Before decanting a foreign trust to a U.S. trust, the client should evaluate whether the foreign trust is under tax inefficient and poorly managed (e.g., high maintenance fees and tax liabilities) conditions and should also understand the whole picture of the trust structure, including: the grantor, beneficiaries, trustee company, and the background of the establishment with a decanting coordinator’s assistance.

The following situations require persons involved to further understand:

1. A foreign non-grantor trust is tax disadvantageous when the beneficiary is a U.S. citizen.

2. When the beneficiary of a foreign non-grantor trust is a U.S. person and the trust has accumulated undistributed income, the beneficiary will be subject to throwback tax when the trust receives distributions in that year; and when the foreign non-grantor trust holds foreign financial products such as mutual funds, money market funds, etc., there will be PFIC issues with future distributions of income from those assets.

3. It is possible that the beneficiary was not a U.S. person when the trust was originally established, but later becomes a U.S. person with a green card or U.S. citizenship.

4. At the time the trust is established, the grantor (who is also the primary beneficiary) has U.S. citizenship or green card.

Under what circumstances can decanting be permitted

We will confirm that whether there is a provision for decanting in the trust agreement. If there’s no such provision, we will further determine whether the government and courts in the jurisdiction where the trust law is located have such authority. In many cases, the trustee company initiates the decanting while in some cases, the beneficiary initiates the decanting, but it depends on the case to determine whether there is a negative tax effect.

What are the tax consequences of decanting?

It is important to analyze the tax consequences of decanting because many of the income, gift, estate, and GST tax consequences may result from decanting. Our goal is to minimize the tax burden at the time of decanting.

Eliminating beneficiary (beneficiaries) may trigger gift tax, which is the main tax disadvantage that should be prevented. Another scenario is where beneficiaries are not eliminated, but there is an exchange of beneficial interests, which may also have a negative tax effect in the decanting process.

It is advisable for the attorney to first understand whether the trust has Undistributed Net Income and to adequately justify that decanting will not cause an adverse tax effect, so the original trustee company will feel comfortable accepting the request for decanting.

With thorough evaluation, if it is concluded that “ when there is a U.S. beneficiary, there is a need to decant an offshore trust to a U.S. trust,” then KEDP will explain the necessity of decanting it to a U.S. trust. After obtaining the client’s consent, KEDP will assist in work related to the trust decanting.

Steps of trust decanting:

1. Clarify all the assets the client holds

2. Prepare a new trust agreement drafted by a U.S. attorney and select a new trustee company

3. If the client intends to decant his or her trust, he or she shall authorize KEDP or the attorney to notify the original trustee company.

4. Communicate with the new trustee company about the decanting process

5. The original and new trustee companies should review the new trust agreement

6. The original and new trustee companies should sign a new trust agreement and relative documents with the client.

Materials required for decanting:

1. New Trust Information

Names, addresses, set-up date and EIN of the new trust

2. New Trustee Information

Name, certificate of incorporation, articles of incorporation, registered address and the business address of the new trustee

3. Information of New Trustee Controlling Persons

List of current directors: list of authorized signatories of new trustees, minutes of the new trustees’ approval of the list of authorized signatories

4. New Trust Deed

Notify the attorney at the location of the new trust to draft the new trust document and contract.

5. Rationale Letter for the original trustee provided by the new trustee, explaining the reasoning behind setting up a new trust and transferring the assets. It is necessary to address that the transfer of the assets is for the best benefits of the beneficiaries and will not cause any negative tax issues.

6. Deed of Appointment and Indemnity signed by the new trustee

7. Legal Validity Opinion provided by a local lawyer in the location where the new trust is set up, validating the new trust under local law and the new trustee’s power to act as a trustee.

8. Written Statement provided by the new trustee to promise that the new trustee will be responsible for reporting the tax liabilities of the original trust in the following year after the assets have transferred to the new trust.

Steps a Decanting Coordinator should follow when decanting:

1. After the new trustee has signed the trust agreement, please confirm the following:

I. Apply for EIN for the trust

The application may take 2-4 weeks, since foreigners do not have Social Security Number and Individual Taxpayer Identification Number, they will need to fill out Form SS-4 and fax it to IRS, which will take a longer time.

II. Set up an LLC and draft its operating agreement

III. Open a bank account for the LLC under the trust

IV. The listed steps should be timed and scheduled since some trustee companies would only allow funds deposited in their escrow accounts for a limited period of time. The bank account of the LLC must be set up first, and then the funds can be transferred to the bank account of the company under the trust.

2. If the original trust is a foreign trust, it is important to note whether the original trust has distributed its annual earnings (DNI); decanting assets that include undistributed earnings (UNI) will be subject to throwback tax.

3. If the trust distribution is to be made in the current year, the distribution must be completed within 65 days after the end of the year.

Preparations:

Before decanting a foreign trust to a U.S. trust, the client should evaluate whether the foreign trust is under tax inefficient and poorly managed (e.g., high maintenance fees and tax liabilities) conditions and should also understand the whole picture of the trust structure, including: the grantor, beneficiaries, trustee company, and the background of the establishment with a decanting coordinator’s assistance.

The following situations require persons involved to further understand:

1. A foreign non-grantor trust is tax disadvantageous when the beneficiary is a U.S. citizen.

2. When the beneficiary of a foreign non-grantor trust is a U.S. person and the trust has accumulated undistributed income, the beneficiary will be subject to throwback tax when the trust receives distributions in that year; and when the foreign non-grantor trust holds foreign financial products such as mutual funds, money market funds, etc., there will be PFIC issues with future distributions of income from those assets.

3. It is possible that the beneficiary was not a U.S. person when the trust was originally established, but later becomes a U.S. person with a green card or U.S. citizenship.

4. At the time the trust is established, the grantor (who is also the primary beneficiary) has U.S. citizenship or green card.

Under what circumstances can decanting be permitted

We will confirm that whether there is a provision for decanting in the trust agreement. If there’s no such provision, we will further determine whether the government and courts in the jurisdiction where the trust law is located have such authority. In many cases, the trustee company initiates the decanting while in some cases, the beneficiary initiates the decanting, but it depends on the case to determine whether there is a negative tax effect.

What are the tax consequences of decanting?

It is important to analyze the tax consequences of decanting because many of the income, gift, estate, and GST tax consequences may result from decanting. Our goal is to minimize the tax burden at the time of decanting.

Eliminating beneficiary (beneficiaries) may trigger gift tax, which is the main tax disadvantage that should be prevented. Another scenario is where beneficiaries are not eliminated, but there is an exchange of beneficial interests, which may also have a negative tax effect in the decanting process.

It is advisable for the attorney to first understand whether the trust has Undistributed Net Income and to adequately justify that decanting will not cause an adverse tax effect, so the original trustee company will feel comfortable accepting the request for decanting.

With thorough evaluation, if it is concluded that “ when there is a U.S. beneficiary, there is a need to decant an offshore trust to a U.S. trust,” then KEDP will explain the necessity of decanting it to a U.S. trust. After obtaining the client’s consent, KEDP will assist in work related to the trust decanting.

Steps of trust decanting:

1. Clarify all the assets the client holds

2. Prepare a new trust agreement drafted by a U.S. attorney and select a new trustee company

3. If the client intends to decant his or her trust, he or she shall authorize KEDP or the attorney to notify the original trustee company.

4. Communicate with the new trustee company about the decanting process

5. The original and new trustee companies should review the new trust agreement

6. The original and new trustee companies should sign a new trust agreement and relative documents with the client.