專業叢書

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Appendices

Section B: The reason why a trust should distribute its income to beneficiaries

U.S. irrevocable trusts that exceed the reporting threshold will need to declare a trust tax return and pay income tax. After income tax is paid, the income will become part of the trust’s principal. Taxpayers should distribute the trust income to U.S. beneficiaries to avoid being subject to the highest tax rate for U.S. tax

purposes and file Form 1040 according to the income category and amount shown on Form 1041 (K-1).

The following is a detailed introduction of Form 1041 and K-1:

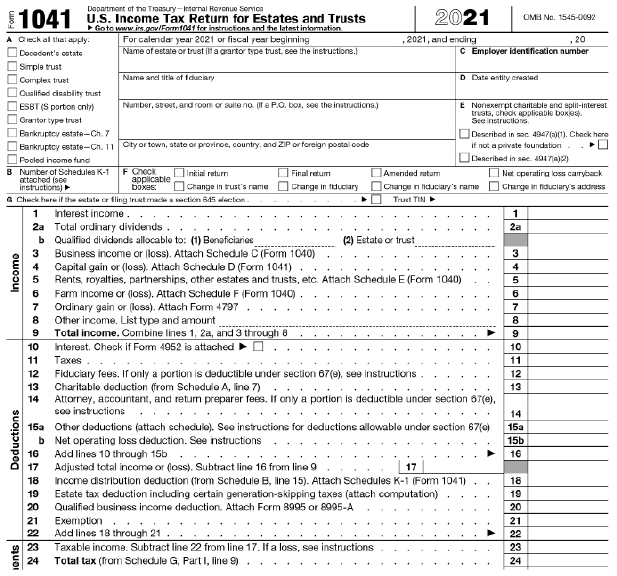

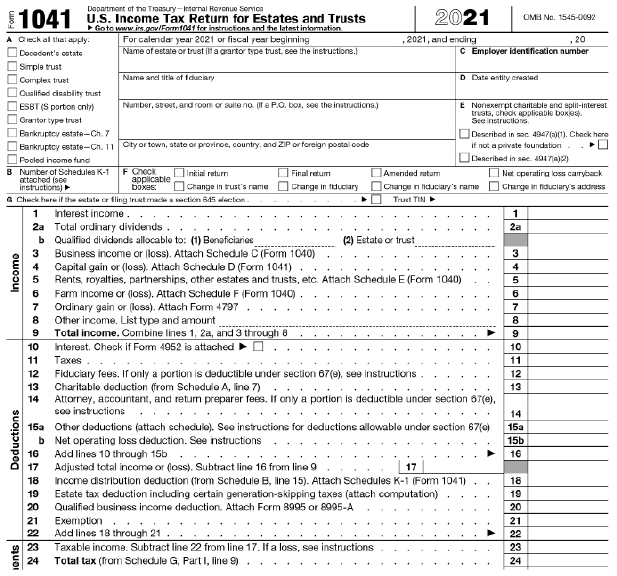

I. Form 1041 (Federal Trust Tax Form)

(i) Filing date: April 15th of each year. Form 7004 may be filed by April 15th and can be extended to September 30th.

(ii) Filing requirements: Form 1041 is required if any of the following conditions are met:

Trust tax is computed by subtracting the required deductions and exemptions (US$100 for Complex Trust only) from the trust’s gross income of the tax year. Fiduciary fees, attorney, accountant and return preparer fees, and other expenses are subject to Section 67(e), and when the following requirements are met, it will result in deduction. The deduction will be limited by the percentage of tax-exempt income.

* Tax exempt income US$30,000

* US$30,000 / US$50,000 = 60%

* US$15,000 × 0.6 = 9,000 (expenses corresponding to the tax-free income are not deductible)

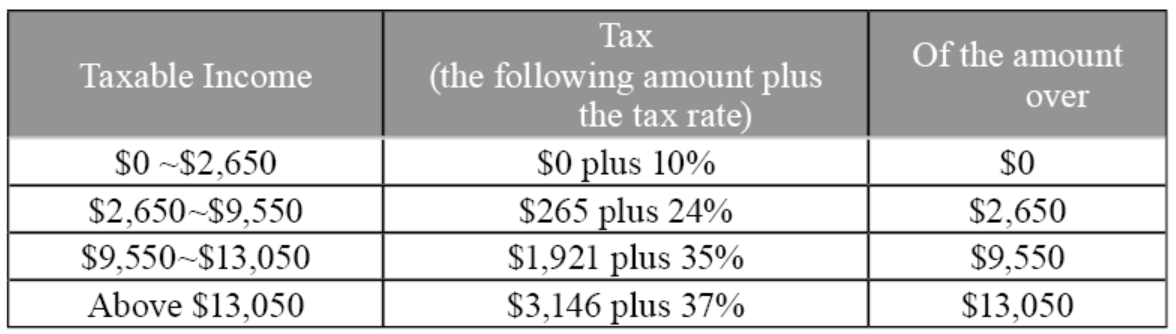

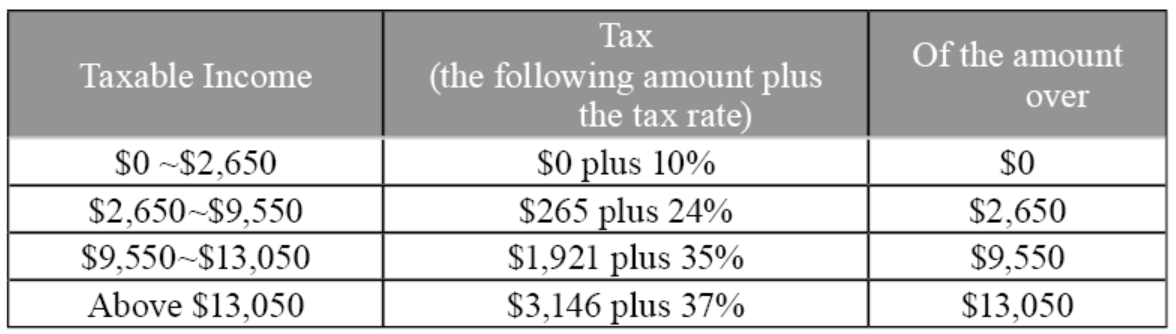

2021 Tax Rate, Form 1041

I. Introduction on Schedules of Form 1041

The following are the commonly used schedules of Form 1041:

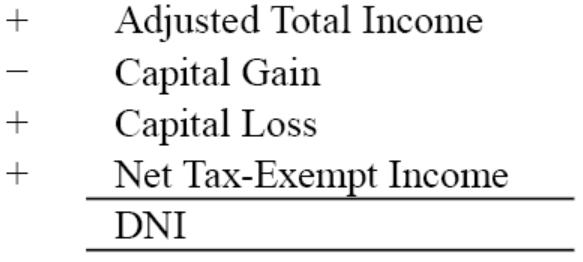

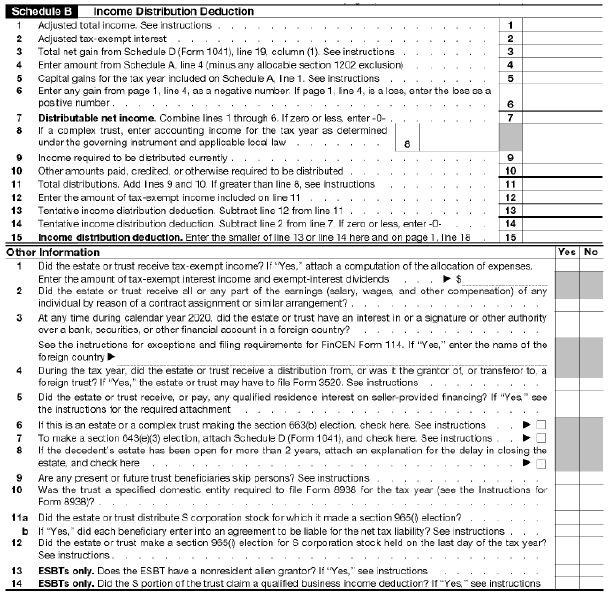

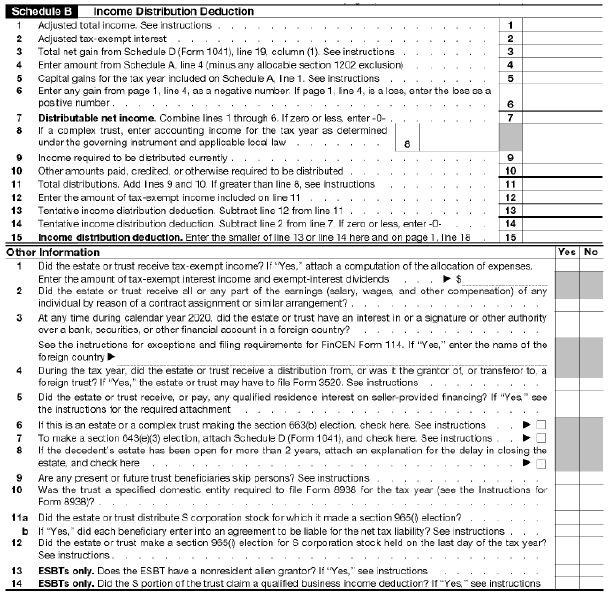

(i) Schedule B - Calculation of Income Distribution Deduction

To prevent double taxation, the amount of distribution to the beneficiaries must be deducted from taxable income up to the maximum amount of Distributable Net Income (DNI) when calculating trust taxable income. Although tax-exempt interest is not included in taxable income, it is included in DNI because it can be distributed to the beneficiaries (however, expenses related to tax-exempt income should be deducted when tax-exempt income is included in DNI). In addition, capital gains are not included in DNI because they are not distributed back to the principal of the trust.

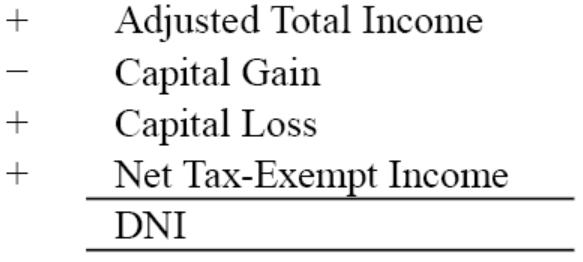

DNI (Distributed New Income) is calculated as follows:

IDD (Income Distribution Deduction) will be treated as an amount of deduction on the trust’s tax return (Form 1041, line 18).

DNI (Distributable Net Income) - Tax-Exempt Income; or

Actual Distribution - Tax-Exempt Income, whichever is smaller.

The following Schedule B and other columns of Form 1041 are provided for reference:

(ii) Schedule D - Capital Gains (Losses)

The amount of capital gain or loss from a Form 1099-B issued by a broker should be

filled in Schedule D. Schedule D of Trust Tax Form 1041 is substantially the same as Schedule D of Individual Tax Form 1040, please see the instructions below:

When the trust has capital gains, the total amount of capital gains (long and short term combined) will be shown in column 4 of Form 1041 Capital Gain (or Loss). The long-term and short-term capital gains or losses will shown on Schedule D, and the transaction information of the current year will be shown on Form 8949.

When there are capital gains and losses at the same time, capital losses can fully offset against capital gains. When capital losses are greater than capital gains, there are two other methods to offset the gains:

①Offset another general income. A negative amount is shown in column 4 of Form 1041 when offsetting a general income, which will directly deduct the general income of the year, up to a maximum of US$3,000 a year.

②Offset capital losses carryover into future years. The capital losses carryover will be deferred to the next following year. If there are capital gains in the following year, the short-term and long-term capital gains will first offset respectively, then the insufficient short-term and long-term capital losses and gains may offset against each other. Lastly, the remaining capital losses will return to Method 1 and continue offset against other income. Capital losses carryover do not have an expiration date and can be used until it is used up.

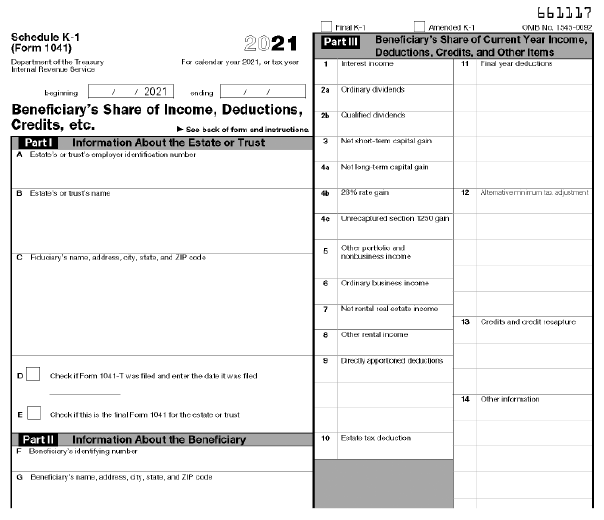

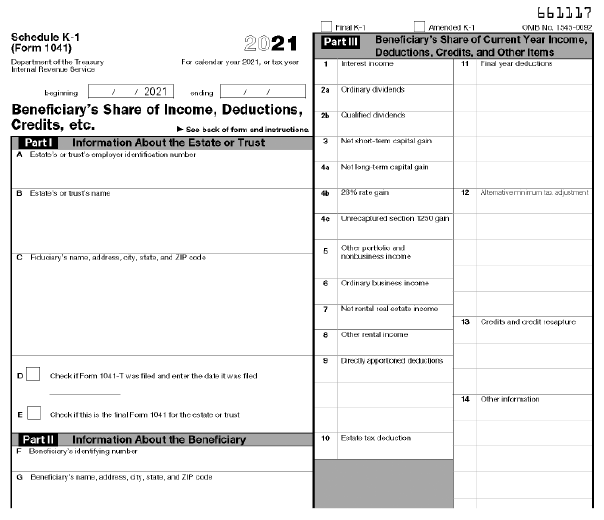

(iii) Schedule K-1

When a U.S. beneficiary receives distribution, the income from K-1(Form 1041) needs to be filled on Form 1040 and to be attached to Schedule E. As shown in the attached chart 2021 K-1:

purposes and file Form 1040 according to the income category and amount shown on Form 1041 (K-1).

The following is a detailed introduction of Form 1041 and K-1:

I. Form 1041 (Federal Trust Tax Form)

(i) Filing date: April 15th of each year. Form 7004 may be filed by April 15th and can be extended to September 30th.

(ii) Filing requirements: Form 1041 is required if any of the following conditions are met:

- Any taxable income for the tax year,

- Gross income of $600 or more (regardless of taxable income), or

- A beneficiary who is a nonresident alien

- Late filing penalty: 5% of the tax due fine per month, up to a maximum of 25%.

- Late payment penalty: 5% of the tax due fine per month , up to a maximum of 25%.

Trust tax is computed by subtracting the required deductions and exemptions (US$100 for Complex Trust only) from the trust’s gross income of the tax year. Fiduciary fees, attorney, accountant and return preparer fees, and other expenses are subject to Section 67(e), and when the following requirements are met, it will result in deduction. The deduction will be limited by the percentage of tax-exempt income.

- Fees paid or incurred in connection with the administration of the trust

- Management fee will only be incurred if the property is held in the trust

- Assuming the actual payment of the attorney’s fee is US$15,000

* Tax exempt income US$30,000

* US$30,000 / US$50,000 = 60%

* US$15,000 × 0.6 = 9,000 (expenses corresponding to the tax-free income are not deductible)

2021 Tax Rate, Form 1041

I. Introduction on Schedules of Form 1041

The following are the commonly used schedules of Form 1041:

(i) Schedule B - Calculation of Income Distribution Deduction

To prevent double taxation, the amount of distribution to the beneficiaries must be deducted from taxable income up to the maximum amount of Distributable Net Income (DNI) when calculating trust taxable income. Although tax-exempt interest is not included in taxable income, it is included in DNI because it can be distributed to the beneficiaries (however, expenses related to tax-exempt income should be deducted when tax-exempt income is included in DNI). In addition, capital gains are not included in DNI because they are not distributed back to the principal of the trust.

DNI (Distributed New Income) is calculated as follows:

IDD (Income Distribution Deduction) will be treated as an amount of deduction on the trust’s tax return (Form 1041, line 18).

DNI (Distributable Net Income) - Tax-Exempt Income; or

Actual Distribution - Tax-Exempt Income, whichever is smaller.

The following Schedule B and other columns of Form 1041 are provided for reference:

(ii) Schedule D - Capital Gains (Losses)

The amount of capital gain or loss from a Form 1099-B issued by a broker should be

filled in Schedule D. Schedule D of Trust Tax Form 1041 is substantially the same as Schedule D of Individual Tax Form 1040, please see the instructions below:

When the trust has capital gains, the total amount of capital gains (long and short term combined) will be shown in column 4 of Form 1041 Capital Gain (or Loss). The long-term and short-term capital gains or losses will shown on Schedule D, and the transaction information of the current year will be shown on Form 8949.

When there are capital gains and losses at the same time, capital losses can fully offset against capital gains. When capital losses are greater than capital gains, there are two other methods to offset the gains:

①Offset another general income. A negative amount is shown in column 4 of Form 1041 when offsetting a general income, which will directly deduct the general income of the year, up to a maximum of US$3,000 a year.

②Offset capital losses carryover into future years. The capital losses carryover will be deferred to the next following year. If there are capital gains in the following year, the short-term and long-term capital gains will first offset respectively, then the insufficient short-term and long-term capital losses and gains may offset against each other. Lastly, the remaining capital losses will return to Method 1 and continue offset against other income. Capital losses carryover do not have an expiration date and can be used until it is used up.

(iii) Schedule K-1

When a U.S. beneficiary receives distribution, the income from K-1(Form 1041) needs to be filled on Form 1040 and to be attached to Schedule E. As shown in the attached chart 2021 K-1: