專業叢書

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Appendices

Section A: Introduction of U.S. Gift Tax, Estate Tax, and U.S. Situs Asset

Gift Tax

Under U.S. tax law, gift taxes are typically owed by the donor. Generally, a foreign (non-U.S.) donor is not subject to gift tax unless he or she is gifting a U.S. situs asset. U.S. situs assets for gift tax purposes include U.S. or foreign currency within the U.S., real estate in the U.S. and other tangible property within the U.S. (cars, jewelry, antiques, etc.)

Under current U.S. gift tax rules, gifts to the same recipient in the same year that exceeds the annual exclusion for gifts will be reported and paid as gift tax ($159,000 in 2021 if the recipient is a non-U.S. citizen’s spouse, or an unlimited amount if the recipient is a U.S. citizen’s spouse, with a full gift tax exemption). The annual exclusion for gifts is $15,000 in 2021 and $16,000 in 2022. In addition, the annual exclusions is calculated per recipient and there is no limit to the number of recipients.

In addition, the U.S. allows “spouse split gifts,” which means that although the subject of the gift is in the name of either the husband or the wife, the gift can be made using both spouse’s individual annual exclusion for gifts. This means that each spouse is deemed to have given half of the gift, thus the gift tax exemption will be twice the original amount ($30,000). However, in this case, regardless of whether the gift exceeds the exemption amount, Form 709 must be filed, with the owner as the filer along with the spouse’s signature to indicate consent.

In addition, when filing a gift tax return, the following should be noted:

Tax Cuts and Jobs Act of 2017 (TCJA) made significant changes to the estate and gift tax exemption, increasing the lifetime gift tax exemption for an individual from $5.49 million to $11.18 million per person. The TCJA Tax Reform, considering certain tax benefits, will expire in 2025. The U.S. government has made several changes to the estate and gift tax rules since 2000, it is advised that you check with your accountant for confirmation if there are any changes to the exemption amount applicable for that year when making a gift.

Estate Tax

If the decedent was a “U.S. Citizen” or “U.S. Resident,” the same estate tax rules apply regardless of whether the decedent was in the U.S. or abroad at the time of his or her death, meaning the “worldwide assets” left behind at the time of his death are taxable for U.S. estate tax purposes.

In particular, it should be noted that the term “U.S. resident” for estate tax purposes is defined differently from that for income tax purposes. A U.S. tax resident is determined based on domicile under U.S. estate tax law. A foreign person legally residing in the U.S. who intends to settle in the U.S. on a permanent basis is considered a U.S. resident for estate tax purposes and is subject to the same rules as a U.S. citizen (including worldwide estate taxation). However, there are many conditions that must be considered in order be to be qualified for residency.

For non-U.S. estate tax residents, U.S. situs assets for estate tax purposes are still taxed at U.S. estate tax rates. The non-U.S. decedent is not subject to estate tax unless passed away with U.S. situs assets for estate tax purposes under his or her name. U.S. situs assets for estate tax purposes include real estate or tangible property in the U.S., stock in U.S. corporations and mutual funds, certain U.S. bank deposits, debt obligations of a U.S. person or the U.S. government, cash surrender value of a U.S. insurance policy insuring life of another person, etc.

An estate tax filer in the U.S. is called an “executor” of an estate, which is defined as the executor, individual representative, or administrator of a decedent. If the foregoing does not apply, any person with actual or constructive possession of any property of the decedent, is considered an “executor”, and must file an estate tax return on Form 706 and Form 8971 to disclose basic information about the decedent and his or her inherited property.

The IRS gives the following example: Suppose A owns half of a farm or a building or a business and the other half is owned by A’s brother (or sister or friend or someone else). Then A’s estate should include this one-half interest in A’s total estate. However, there are many other factors that come into play, so it is important to consult with a tax or legal professional when filing.

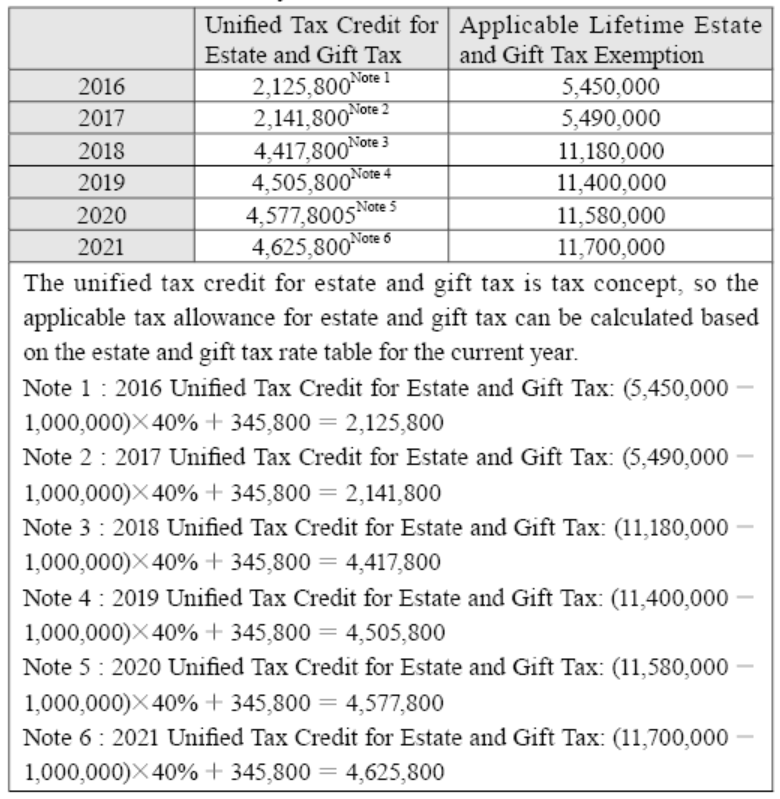

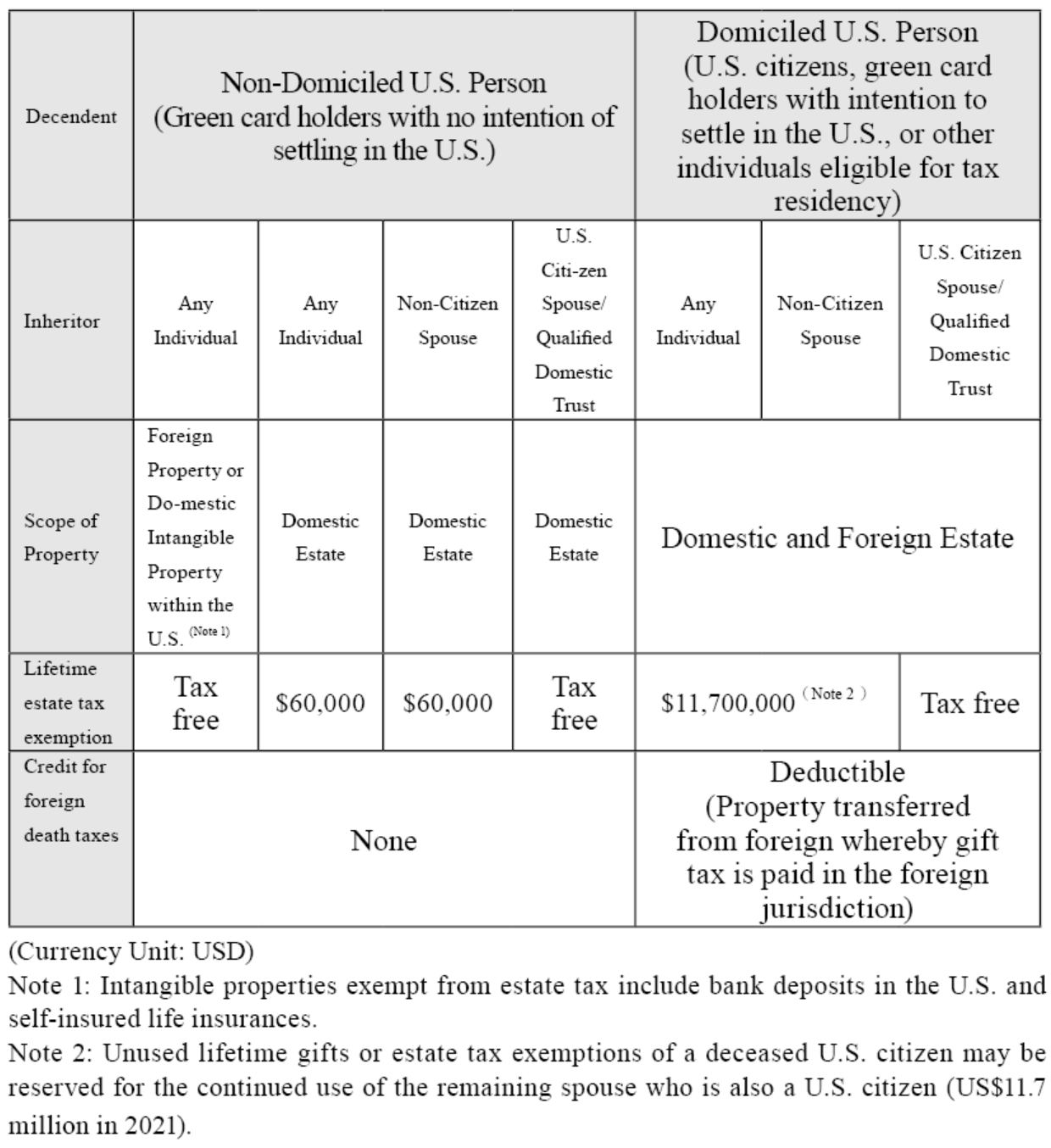

The following table is the lifetime exemptions for estate and gift tax in the U.S. in recent years:

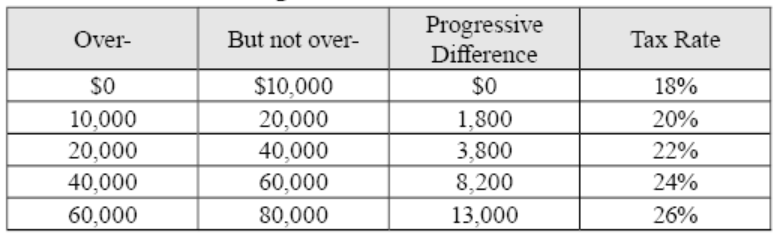

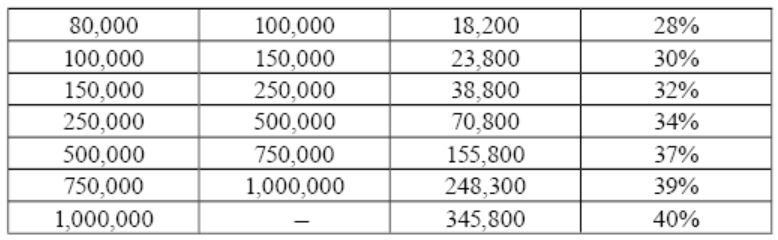

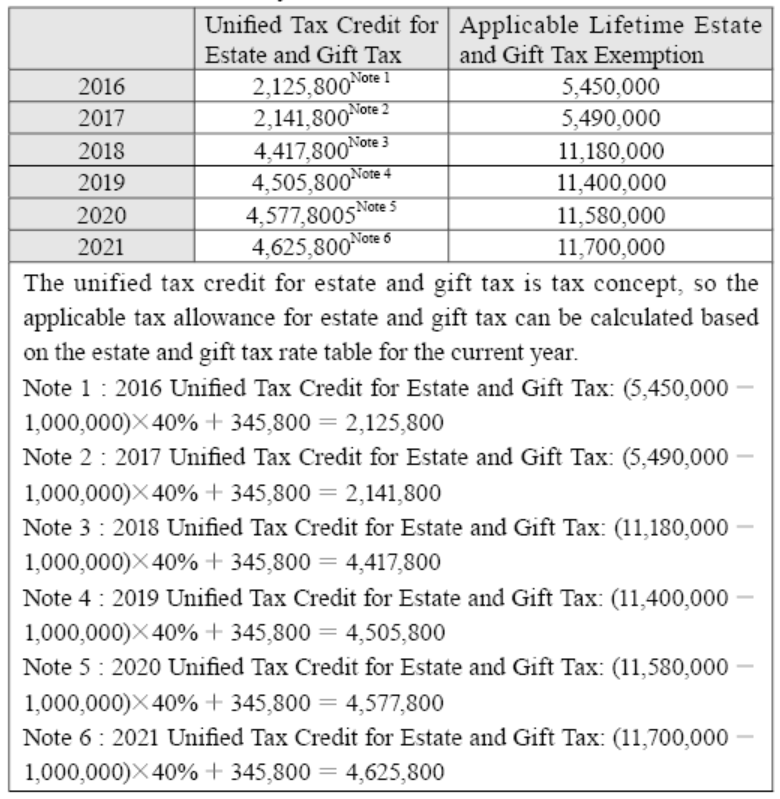

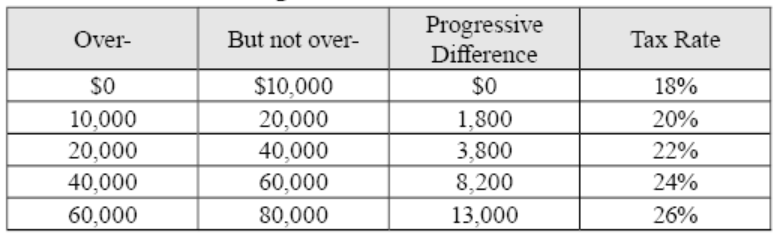

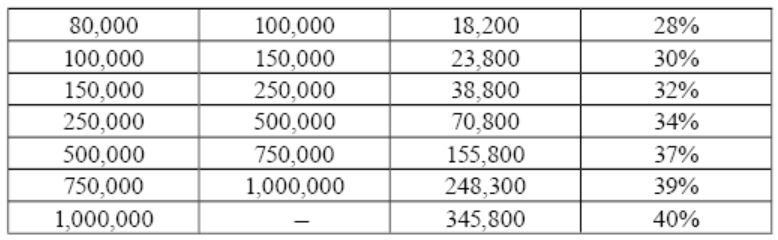

2021 Tax Rate and Progressive Rate of Estate and Gift

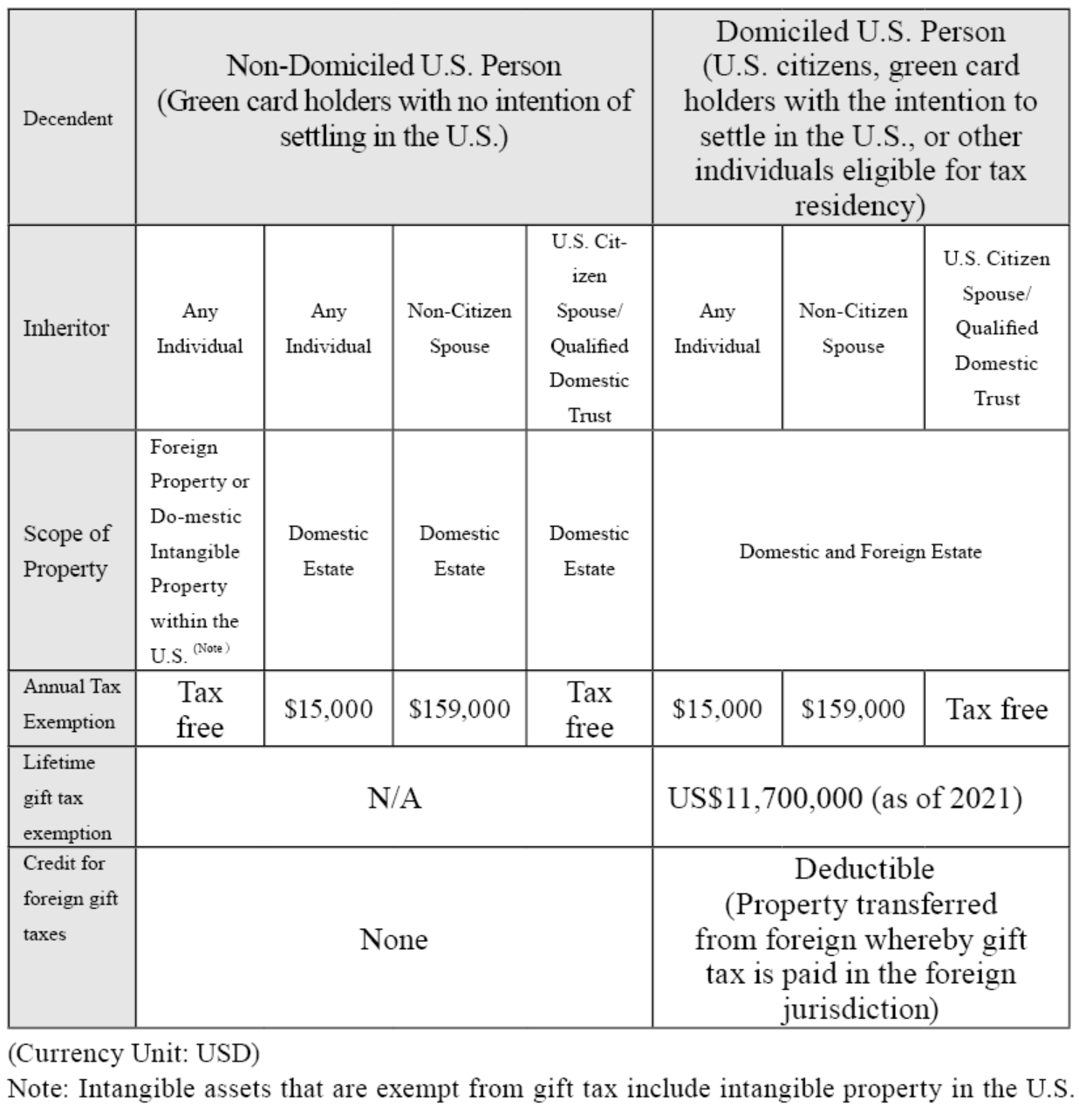

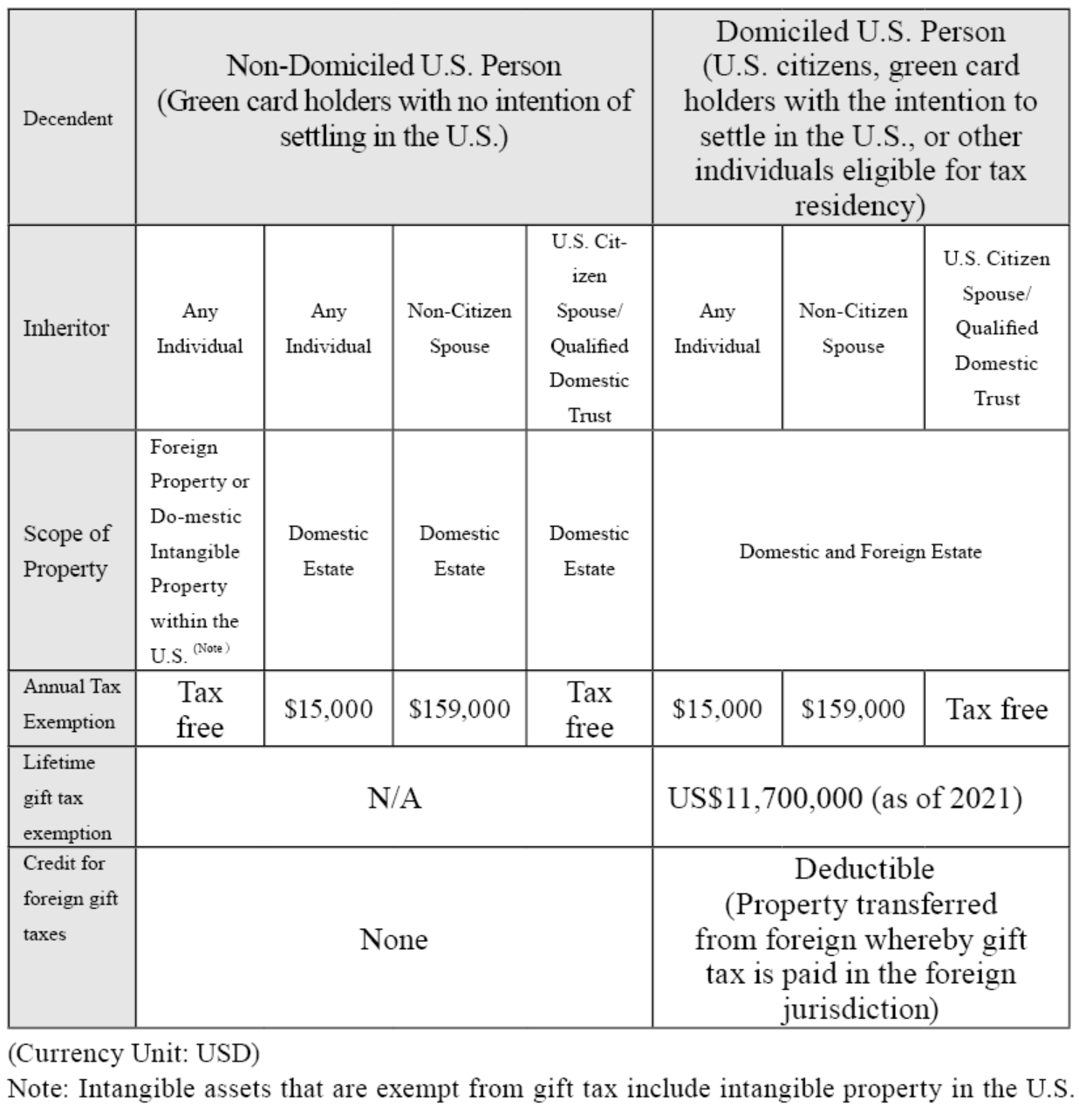

The following table summarizes the differences in inheritance of estates and gifts by U.S. citizens, residents, and nonresident aliens to different assets and individuals (2021 regulations).

2021 Gift Tax — Comparison of Tax Exemptions for Non-Domiciled and Domiciled U.S. Residents

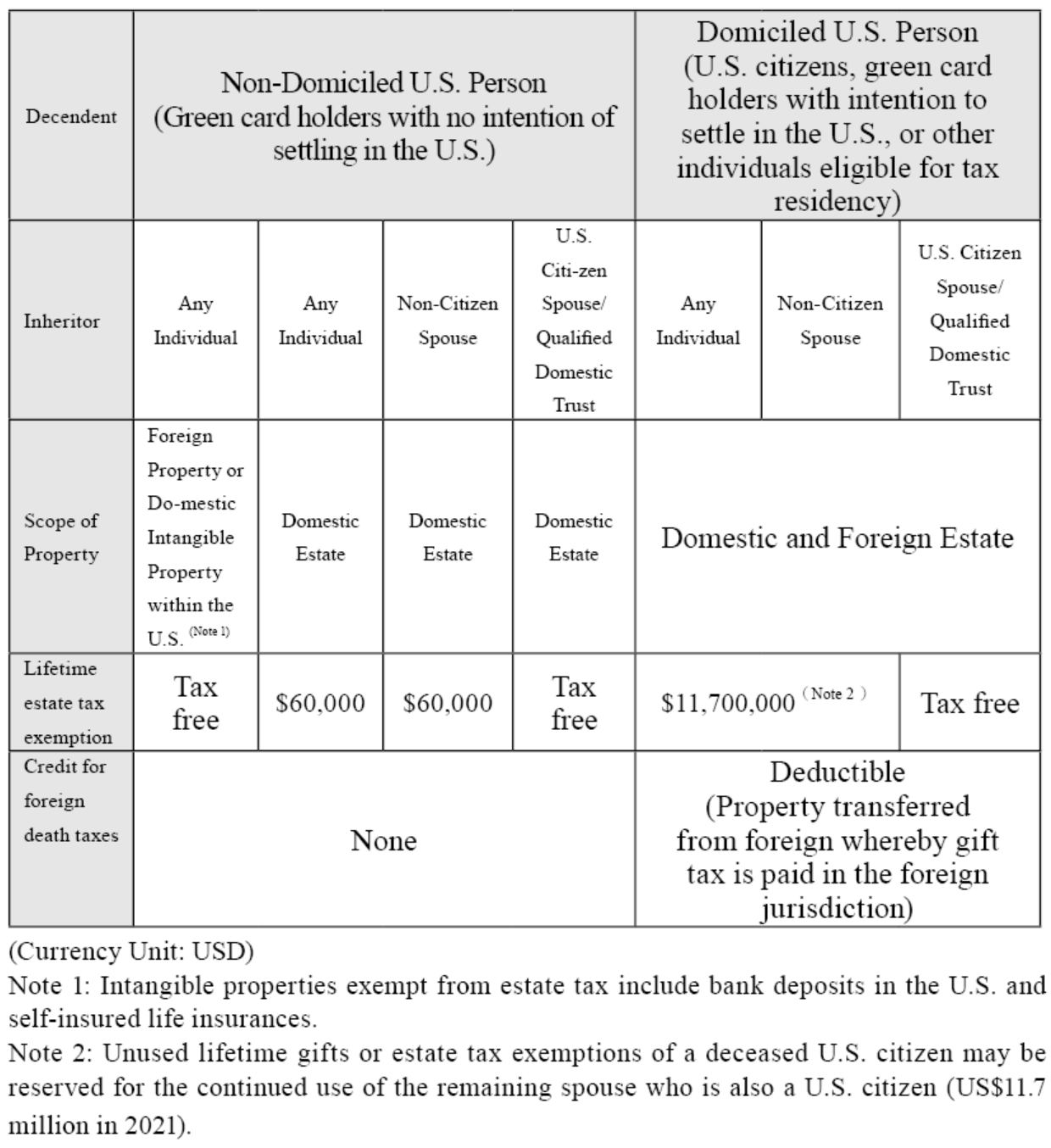

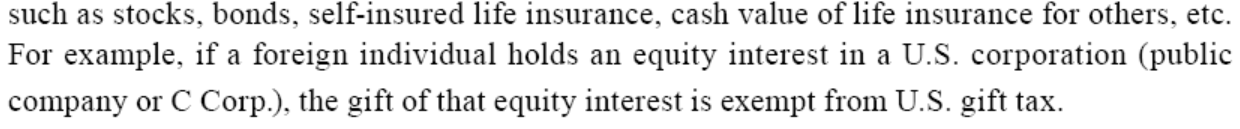

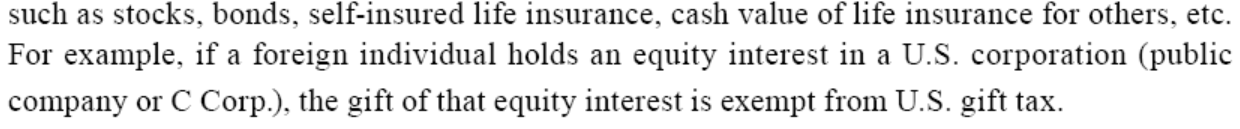

Estate Tax (as of 2021) —— Comparison of Tax Exemptions for Non-Domiciled and Domiciled U.S. Residents

Under U.S. tax law, gift taxes are typically owed by the donor. Generally, a foreign (non-U.S.) donor is not subject to gift tax unless he or she is gifting a U.S. situs asset. U.S. situs assets for gift tax purposes include U.S. or foreign currency within the U.S., real estate in the U.S. and other tangible property within the U.S. (cars, jewelry, antiques, etc.)

Under current U.S. gift tax rules, gifts to the same recipient in the same year that exceeds the annual exclusion for gifts will be reported and paid as gift tax ($159,000 in 2021 if the recipient is a non-U.S. citizen’s spouse, or an unlimited amount if the recipient is a U.S. citizen’s spouse, with a full gift tax exemption). The annual exclusion for gifts is $15,000 in 2021 and $16,000 in 2022. In addition, the annual exclusions is calculated per recipient and there is no limit to the number of recipients.

In addition, the U.S. allows “spouse split gifts,” which means that although the subject of the gift is in the name of either the husband or the wife, the gift can be made using both spouse’s individual annual exclusion for gifts. This means that each spouse is deemed to have given half of the gift, thus the gift tax exemption will be twice the original amount ($30,000). However, in this case, regardless of whether the gift exceeds the exemption amount, Form 709 must be filed, with the owner as the filer along with the spouse’s signature to indicate consent.

In addition, when filing a gift tax return, the following should be noted:

- Gifts with “future interests” must be reported though the value is under US$15,000.

- If both spouses have reportable gifts, they should fill out separate gift tax returns, but are allowed send the documents in the same envelope.

- If the gift is jointly held by a married couple, the gift will automatically be considered gifted half by each spouse, and each spouse will need to file a gift tax return individually.

- If the donor of the gift is a natural person and the gift is made to a trust, estate, partnership or company, the beneficiary, heir, partner or shareholder of the company will be subject to gift tax.

- If the donor does not pay the gift tax, the recipient may also be obligated to report and pay the gift tax under certain circumstances.

- If the donor dies before filing his or her tax obligation, the executor will be obligated to file the donor’s tax.

- If a gift is made to qualified charities, then no reporting is required. If the gift is only a transfer of “partial interest” or if any of the recipients are not qualified charities and is required to report the gift tax, then the portion of the gift made to qualified charities must also be filed.

- If the amount of gift is made for medical or educational purposes, which we commonly refer to as Health, Education, Maintenance, and Support (HEMS), the amount of gift paid to such institutions are not eligible for gift tax.

Tax Cuts and Jobs Act of 2017 (TCJA) made significant changes to the estate and gift tax exemption, increasing the lifetime gift tax exemption for an individual from $5.49 million to $11.18 million per person. The TCJA Tax Reform, considering certain tax benefits, will expire in 2025. The U.S. government has made several changes to the estate and gift tax rules since 2000, it is advised that you check with your accountant for confirmation if there are any changes to the exemption amount applicable for that year when making a gift.

Estate Tax

If the decedent was a “U.S. Citizen” or “U.S. Resident,” the same estate tax rules apply regardless of whether the decedent was in the U.S. or abroad at the time of his or her death, meaning the “worldwide assets” left behind at the time of his death are taxable for U.S. estate tax purposes.

In particular, it should be noted that the term “U.S. resident” for estate tax purposes is defined differently from that for income tax purposes. A U.S. tax resident is determined based on domicile under U.S. estate tax law. A foreign person legally residing in the U.S. who intends to settle in the U.S. on a permanent basis is considered a U.S. resident for estate tax purposes and is subject to the same rules as a U.S. citizen (including worldwide estate taxation). However, there are many conditions that must be considered in order be to be qualified for residency.

For non-U.S. estate tax residents, U.S. situs assets for estate tax purposes are still taxed at U.S. estate tax rates. The non-U.S. decedent is not subject to estate tax unless passed away with U.S. situs assets for estate tax purposes under his or her name. U.S. situs assets for estate tax purposes include real estate or tangible property in the U.S., stock in U.S. corporations and mutual funds, certain U.S. bank deposits, debt obligations of a U.S. person or the U.S. government, cash surrender value of a U.S. insurance policy insuring life of another person, etc.

An estate tax filer in the U.S. is called an “executor” of an estate, which is defined as the executor, individual representative, or administrator of a decedent. If the foregoing does not apply, any person with actual or constructive possession of any property of the decedent, is considered an “executor”, and must file an estate tax return on Form 706 and Form 8971 to disclose basic information about the decedent and his or her inherited property.

Introduction to Tax Reporting Obligations:

1. Filing Form

In the case of a decedent’s death in 2021, when the total estate left to each U.S. citizen and resident, plus taxable gifts and special allowances from prior years exceeds US$11.7 million or when a lifetime exemption is passed to a spouse, the executor must file an estate tax return using Form 706 and disclose basic information about the inheritors and their inherited property using Form 8971.

2. What items are included in the estate of a decedent?

The decedent’s estate includes all assets and interests owned by the decedent at the date of his or her death (refer to Form 706) and may include cash, securities, real estate, insurance, trusts, annuities, business interests and other assets. It is important to keep in mind that the total estate may include assets that are and are not probated.The IRS gives the following example: Suppose A owns half of a farm or a building or a business and the other half is owned by A’s brother (or sister or friend or someone else). Then A’s estate should include this one-half interest in A’s total estate. However, there are many other factors that come into play, so it is important to consult with a tax or legal professional when filing.

3. Which properties are not included in the estate?

In principle, only assets that are owned solely by the decedent’s spouse or other individuals are excluded from the decedent’s estate.

4. What items can be deducted from estate tax?

- Unlimited Marital Deduction: One of the major deductions for married couples is the unlimited marital deduction. The unlimited marital deduction is available for assets inherited by a spouse who is a U.S. citizen and is completely tax-free.

- Charitable Deduction: Assets bequeathed by the decedent to a qualified charity may be deducted from his/her gross estate.

- Mortgage loans and debts held by the heirs.

- Administration expenses related to the estate.

- Losses incurred during the administration of the assets.

The following table is the lifetime exemptions for estate and gift tax in the U.S. in recent years:

2021 Tax Rate and Progressive Rate of Estate and Gift

The following table summarizes the differences in inheritance of estates and gifts by U.S. citizens, residents, and nonresident aliens to different assets and individuals (2021 regulations).

2021 Gift Tax — Comparison of Tax Exemptions for Non-Domiciled and Domiciled U.S. Residents

Estate Tax (as of 2021) —— Comparison of Tax Exemptions for Non-Domiciled and Domiciled U.S. Residents