專業叢書

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Appendices

Section C: The use of check the box elections to step up the basis of the offshore assets held by U.S. revocable trusts

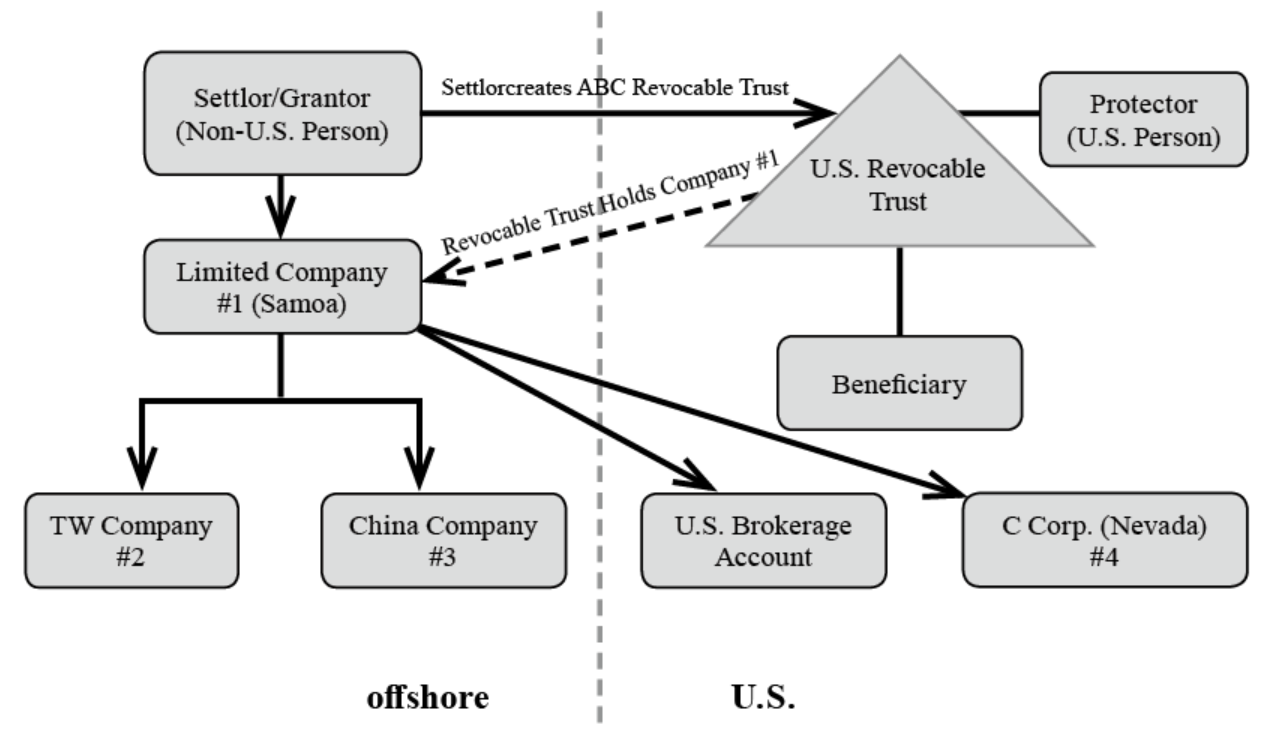

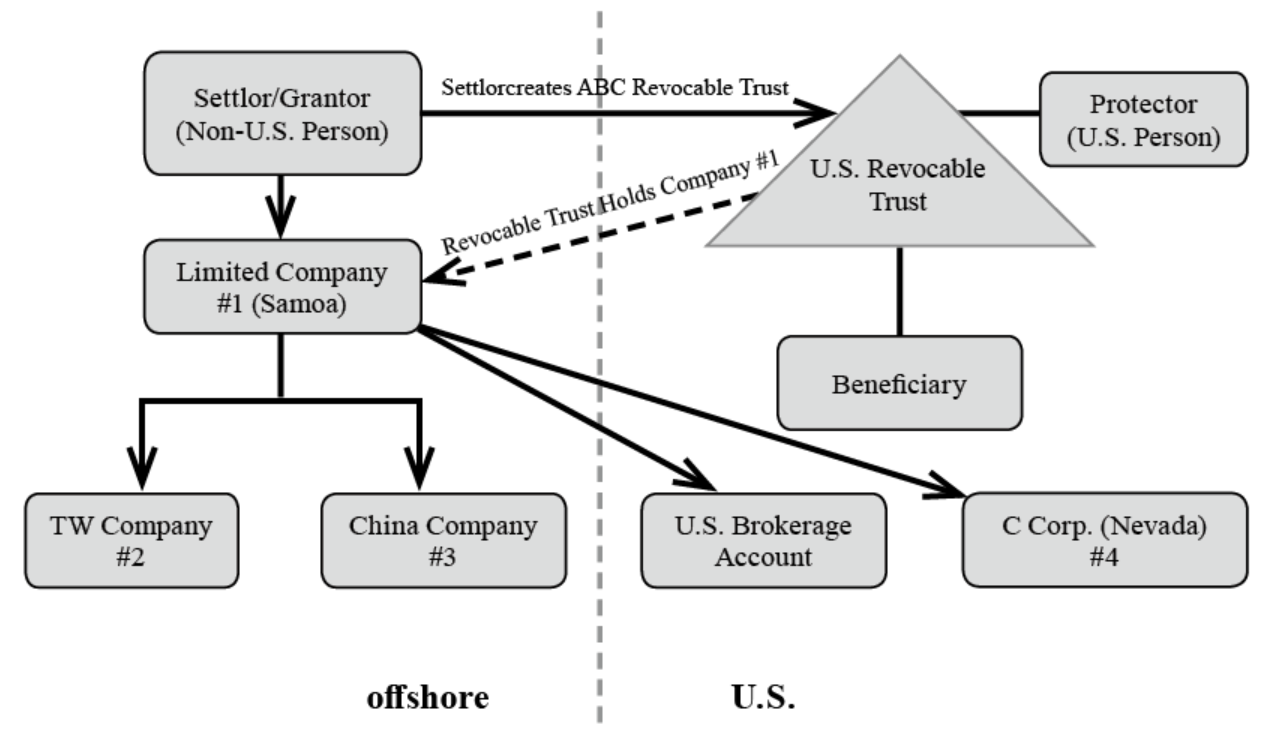

A non-U.S. persons settles a U.S. revocable trust with U.S. beneficiaries and a U.S. trust protector. The trust holds only stock of foreign corporations. When the grantor deceases, the trust is converted from a U.S. grantor trust to a U.S. non-grantor trust.

At this point, a check the box election can be filed to step up in basis of the foreign assets and to minimize CFC and PFIC issues. How should the trust step up the basis in its foreign company holdings?

1. No Change in Tax Law

If there is no change in the provisions stepping up basis at death, then you would rely on the powers by grantor under the trust agreement to ensure an increase in cost basis at death under Section 1014(b)(3).

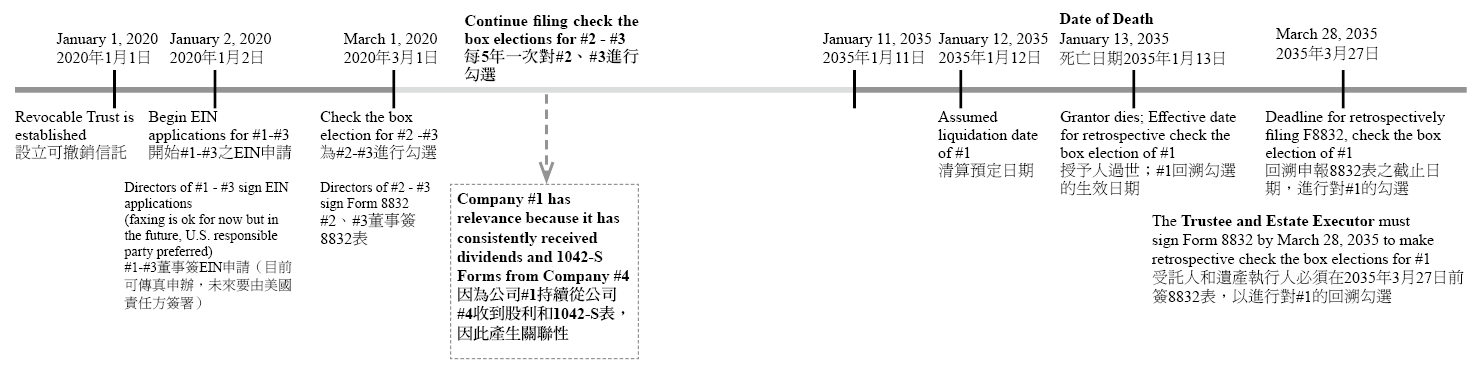

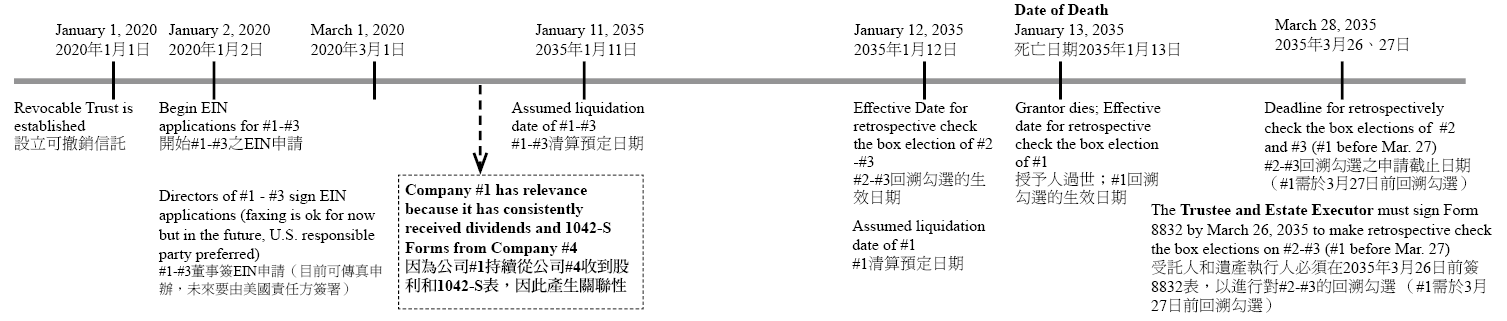

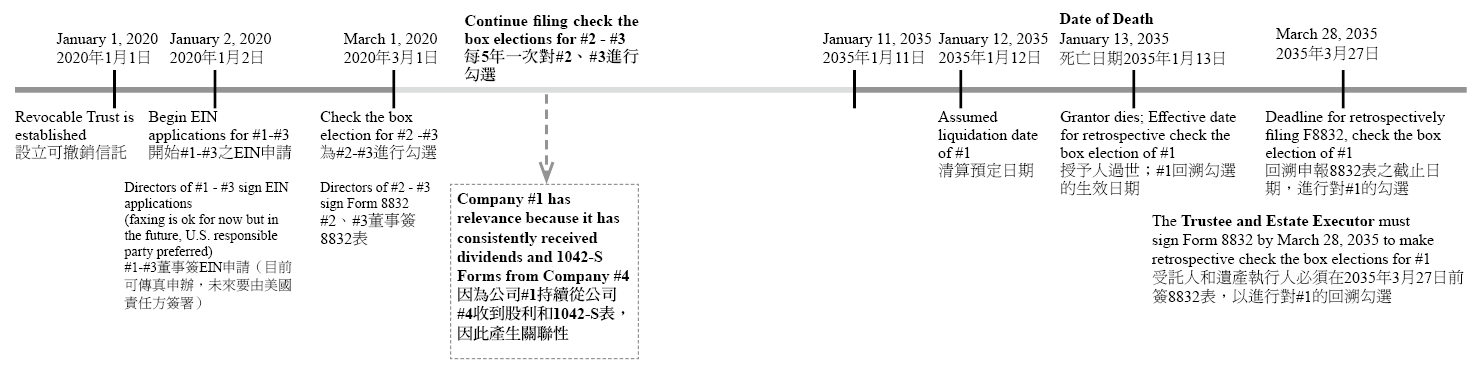

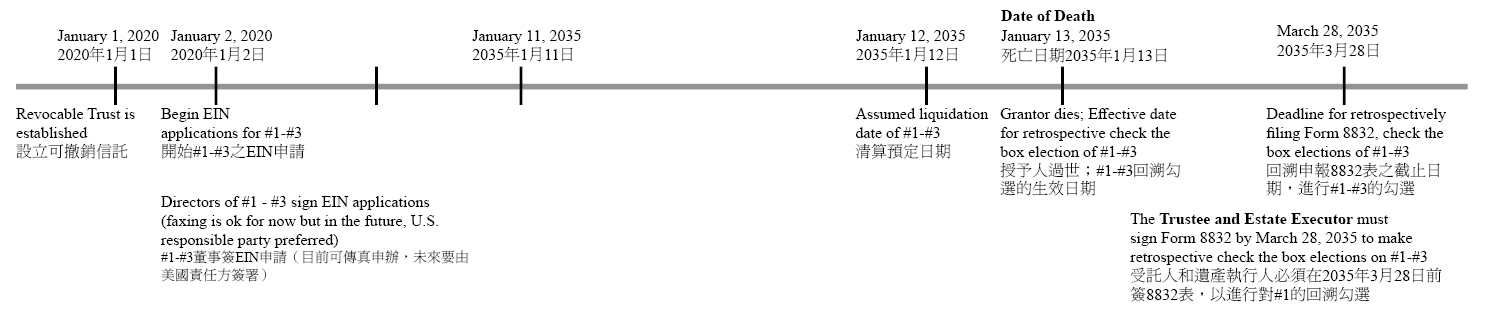

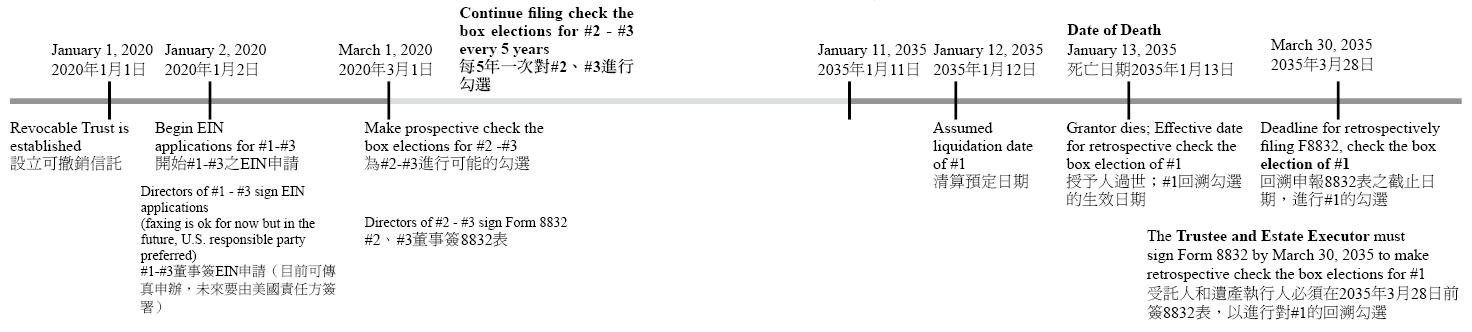

A foreign eligible entity’s election is relevant for tax purposes on the effective date, so the election is valid for five years. You can avoid having to make renewal elections if the entity acquires an asset or otherwise earns income that preserves its relevance. If you have created reference by receiving dividends from #4 or brokerage account and continue filing check the box elections for #2 and #3 every 5 years, you only have to check the box for #1 and do not have to check the box for #2 and #3, since we previously filed a check the box election for them every five years.

2. Change in Tax Law

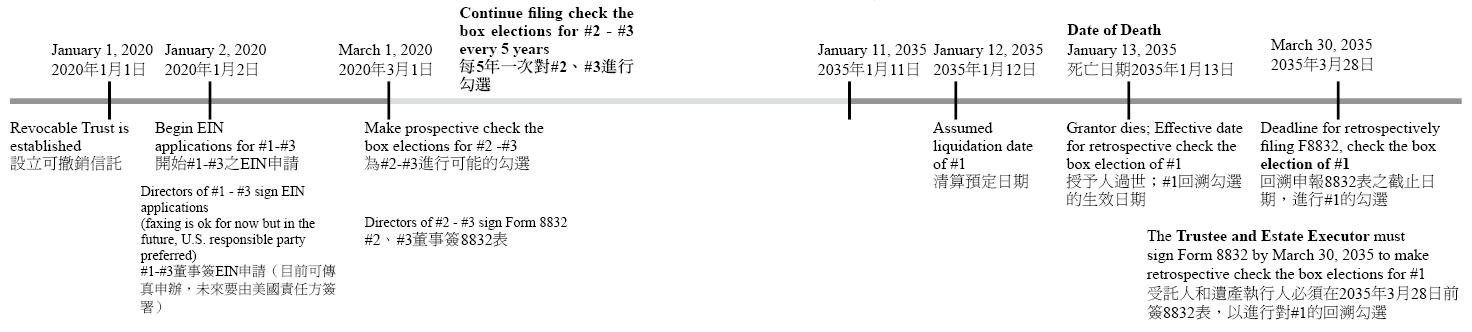

If the tax law is changed so as to eliminate the automatic step-up in basis at death, then you would still check the box on #1 effective on the date of death. Ideally, you would check the box on #2 and #3 effective at least a day prior to the date of death so as ensure that they have been fully “liquidated” for tax purposes effective prior to the deemed liquidation of #1. The reason for this is that we want to ensure that when you check the box on #1, the deemed liquidation at the end of the day preceding the date of death will be given full effect, resulting in a deemed sale immediately before grantor’s death that has the result of stepping up the basis of the underlying assets.

You can also create reference by receiving dividends from #4 or brokerage account and continue filing check the box elections for #2 to #3 every 5 years. Then you only have to check the box for #1 after the trust grantor’s death.

At this point, a check the box election can be filed to step up in basis of the foreign assets and to minimize CFC and PFIC issues. How should the trust step up the basis in its foreign company holdings?

1. No Change in Tax Law

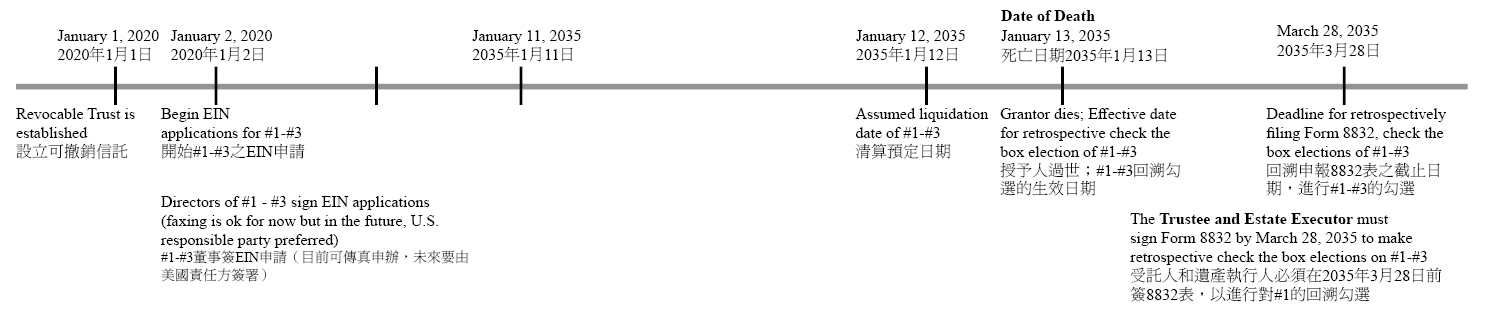

If there is no change in the provisions stepping up basis at death, then you would rely on the powers by grantor under the trust agreement to ensure an increase in cost basis at death under Section 1014(b)(3).

A foreign eligible entity’s election is relevant for tax purposes on the effective date, so the election is valid for five years. You can avoid having to make renewal elections if the entity acquires an asset or otherwise earns income that preserves its relevance. If you have created reference by receiving dividends from #4 or brokerage account and continue filing check the box elections for #2 and #3 every 5 years, you only have to check the box for #1 and do not have to check the box for #2 and #3, since we previously filed a check the box election for them every five years.

2. Change in Tax Law

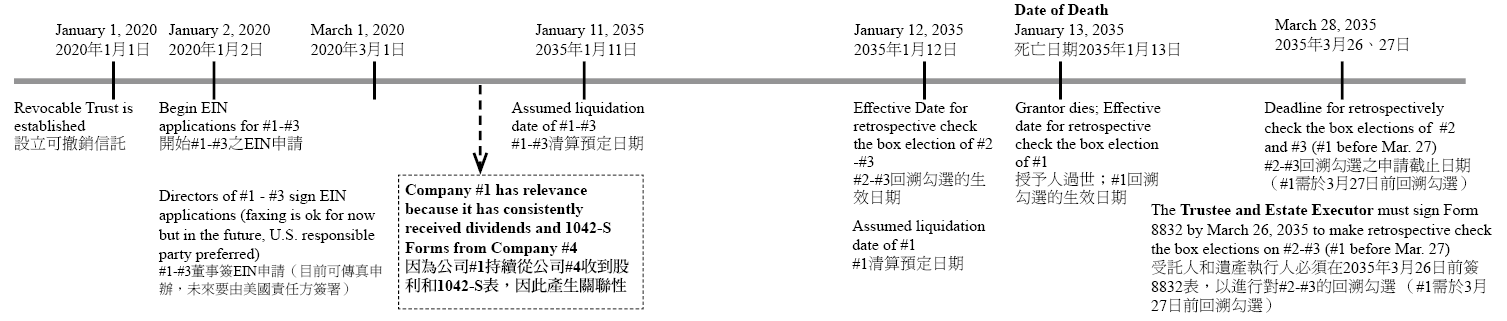

If the tax law is changed so as to eliminate the automatic step-up in basis at death, then you would still check the box on #1 effective on the date of death. Ideally, you would check the box on #2 and #3 effective at least a day prior to the date of death so as ensure that they have been fully “liquidated” for tax purposes effective prior to the deemed liquidation of #1. The reason for this is that we want to ensure that when you check the box on #1, the deemed liquidation at the end of the day preceding the date of death will be given full effect, resulting in a deemed sale immediately before grantor’s death that has the result of stepping up the basis of the underlying assets.

You can also create reference by receiving dividends from #4 or brokerage account and continue filing check the box elections for #2 to #3 every 5 years. Then you only have to check the box for #1 after the trust grantor’s death.