专业丛书

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 4 Relevant U.S. Tax Forms for U.S. Trusts & Individuals

14. California Form 541

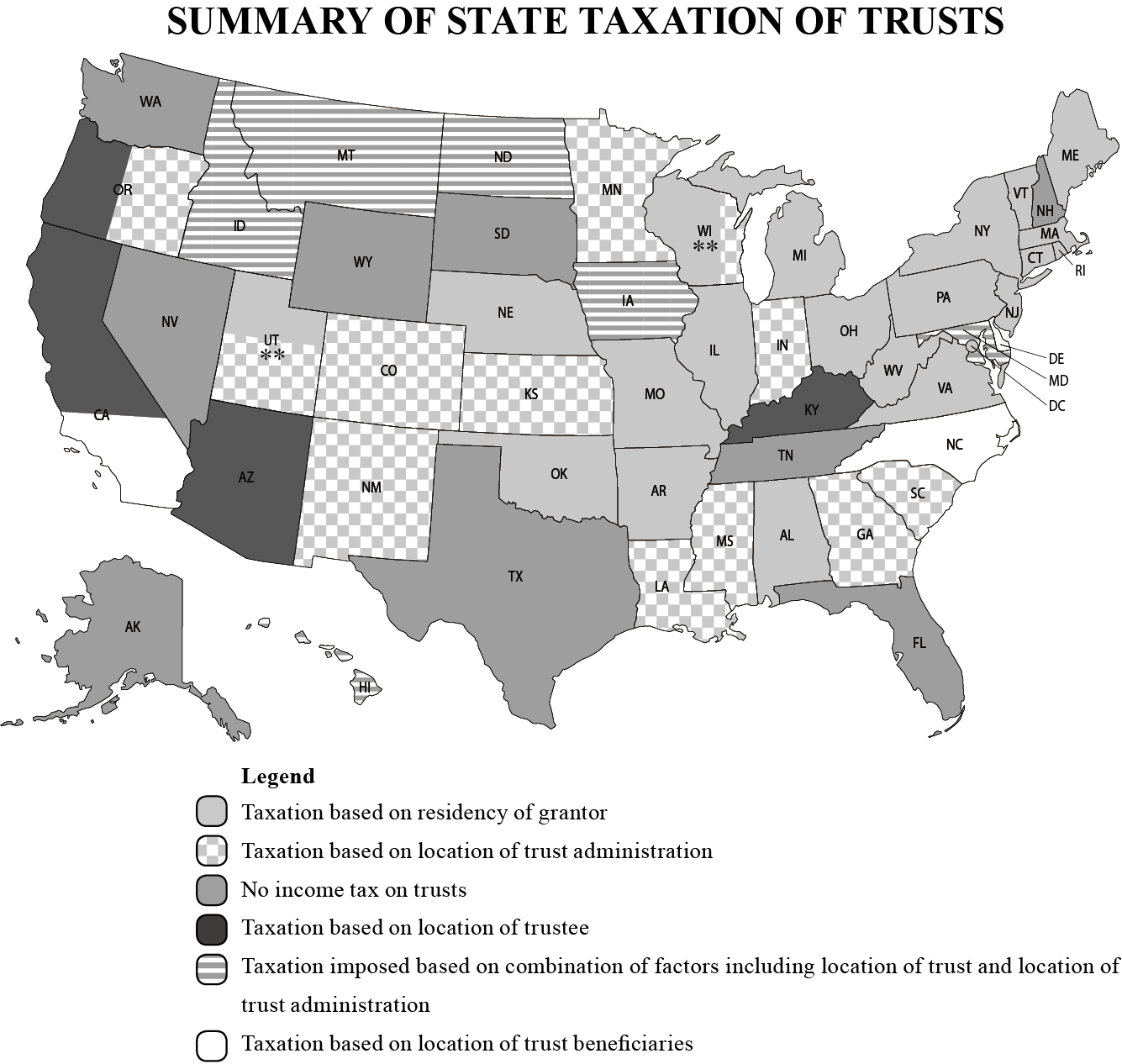

When it comes to taxes, oftentimes clients focus almost exclusively on completing their federal tax obligations; however, state law and state taxation should play a part in the clients’ trust and estate planning as well. In addition to taxing trusts that are administered in California, the Franchise Tax Board of California (FTB) also imposes taxes on trusts that have fiduciaries and beneficiaries based in California. Below you can find a map of the U.S., with how various states impose income taxes on trusts.

If an irrevocable non-grantor trust has one the following characteristics, it will be deemed a California trust (for California income tax purposes):

(1) One or more California trustee(s)

(2) One or more California fiduciaries (including the Trust Protector, Trust Distribution Advisor or Trust Investment Direction Advisor)

(3) One or more California beneficiaries receiving a distribution in that tax year

A California trust is required to file an income tax return in California if the trust: (i) has net income from all sources in excess of $100; or (ii) has gross income from all sources in excess of $10,000, regardless of the amount of net income. Taxes due in connection with a Form 541 along with the form are due on April 15; however, taxpayers are generally allotted a filing extension (without filing an extension) until October 15.

While state taxes often come as an afterthought when it comes to estate planning, Wealth Creators should be mindful when it comes to the jurisdiction(s) of the trusts’ fiduciaries when settling a trust. In addition, special attention should be paid to those with California residency. This is especially the case when a trust makes distributions of income to California tax residents, as doing so may trigger both high California state income taxes and California “throwback” taxes.