专业丛书

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 4 Relevant U.S. Tax Forms for U.S. Trusts & Individuals

12. FinCEN Beneficial Ownership Filing (Corporate Transparency Act)

The Corporate Transparency Act (“CTA”) enacted by Congress requires that existing and newly formed or registered corporations, limited liability companies, and other business entities operating in the United States report beneficial ownership information in the form of a Beneficial Ownership Information Report (“BOIR”).

(1) The Corporate Transparency Act and FinCEN

The Corporate Transparency Act aims to combat illicit financial activities by requiring entities subject to its regulations to submit BOIR to the Financial Crimes Enforcement Network (“FinCEN”) of the U.S. Department of the Treasury within specified deadlines (detailed below).

(2) Requirements for Beneficial Ownership Information Reports (BOIR)

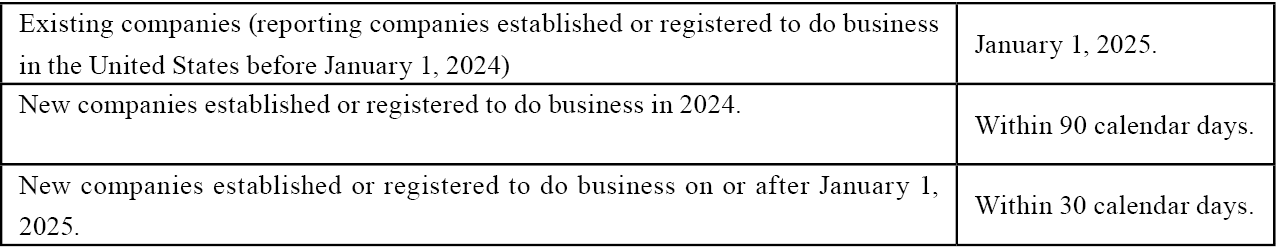

Entities subject to the regulations (“Reporting Companies”) must submit their initial reports by the following deadlines:

The BOIR is not an annual requirement. A reporting company is required to file a BOIR upon formation within a certain allotted timeframe and after there is a change in the company’s beneficial ownership. Generally, reporting companies must provide the following information:

- Name of each beneficial owner (“BO”), as defined by FinCEN.

- Date of birth of each BO.

- Address of each BO.

- Personal identification of each BO (valid passport, driver’s license, or ID).

- Information about the Reporting Company itself, including its name and address.

- Companies established on or after January 1, 2024, must also submit information about the individuals establishing the company (“Company Applicant”).

Potential violations include intentionally failing to submit BOIR, intentionally submitting incorrect BOIR, or intentionally failing to correct or update previously submitted BOIR. Violators may face civil penalties of up to $592 per day for the duration of the violation and criminal penalties of up to $10,000 and up to two years of imprisonment.