专业丛书

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 4 Relevant U.S. Tax Forms for U.S. Trusts & Individuals

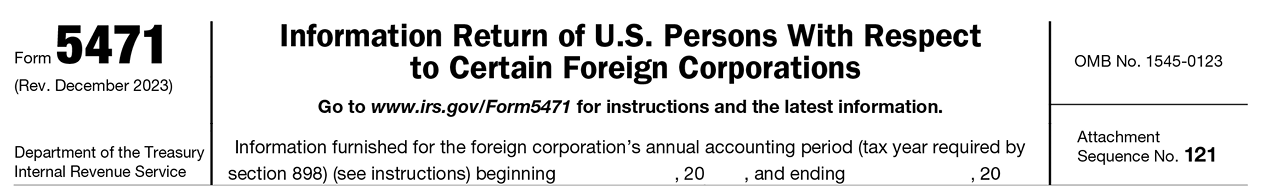

5. Form 5471

Form 5471 is used by certain U.S. persons who are officers, directors, or shareholders in certain foreign corporations. The form and schedules are used to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Generally, if you own or control a foreign company, directly or indirectly, you may be required to file Form 5471 and should consult with your U.S. accountant to determine how to appropriately satisfy your tax and disclosure obligations.

A U.S. shareholder for these purposes is a U.S. person that owns (directly, indirectly, or constructively) 10% or more of the total combined voting power or value of shares of all classes of a foreign corporation’s stock. A CFC is any foreign corporation if more than 50% of the total combined voting power or value of shares of all classes of stock of the corporation is owned by U.S. shareholders on any day during the foreign corporation’s tax year. A U.S. shareholder of a CFC is required to include in gross income on a current basis their pro rata share of certain income earned by the CFC, regardless of whether they receive a distribution. An SFC is a CFC or any foreign corporation whose shares (at least 10%) are held by a U.S. person, unless it is otherwise categorized as a PFIC.

A controlled foreign corporation (CFC) that is not a foreign insurance company generally must satisfy the following requirements:

(1) A foreign company formed in a foreign country that is classified as a foreign corporation for U.S. purposes:

-

- Mandatory per se foreign corporation on the IRS list. See Form 8832 instructions.

- By default if all owners have limited liability

- By election on Form 8832 entity classification election for certain foreign eligible entities

(2) More than 50% of the vote or value is owned by U.S. shareholder who each own at least 10% of the vote or value.

(3) Direct, indirect, and constructive ownership percentages are taken into account under I.R.C. §§ 958(a) and (b) attribution rules to determine if a foreign corporation is a CFC.

Generally, all U.S. persons described in Categories of Filers below must complete the schedules, statements, and/or other information. The word “generally” is used, as there are many rules, interpretations and exceptions that may apply to the Wealth Creator’s specific situation; thus, Wealth Creators and their families should defer to their professional legal and tax advisors.

Category 1: A person who was a U.S. shareholder of an SFC at any time during the SFC’s tax year ending with or within the U.S. shareholder’s tax year and who owned stock on the last day in that year in which the foreign corporation was an SFC.

Category 2: A U.S. person who is an officer or director of a foreign corporation in which a U.S. person has acquired (in one or more transactions): (1) 10% stock ownership (by vote or value) with respect to the foreign corporation, or (2) an additional 10% or more of the outstanding stock (by vote or value) of the foreign corporation.

Category 3: This category includes:

-

- A U.S. person who acquires stock in a foreign corporation that, when added to any stock owned on the date of acquisition, meets the 10% ownership threshold (by vote or value) with respect to the foreign corporation.

- A U.S. person who acquires stock that, without regard to stock already owned on the date of acquisition, meets the 10% ownership threshold (by vote or value) with respect to the foreign corporation.

- A person who is treated as a U.S. shareholder of a captive insurance company under Sec. 953(c) with respect to a foreign corporation.

- A person who becomes a U.S. person while meeting the 10% ownership threshold (by vote or value) with respect to the foreign corporation.

- A U.S. person who disposes of sufficient stock in the foreign corporation to reduce their interest to less than the 10% ownership threshold.

- A U.S person who owns at least 10% of the corporation (by vote or value) when the corporation is reorganized.

Category 4: A U.S. person who had control (i.e., ownership of stock possessing either more than 50% of the total combined voting power or value of shares of all classes of stock) of a foreign corporation during the annual accounting period of the foreign corporation.

Category 5: A U.S. person who was a U.S. shareholder that owned stock in a foreign corporation that was a CFC at any time during the foreign corporation’s tax year ending with or within the U.S. shareholder’s tax year, and who owned that stock on the last day in that year in which the foreign corporation was a CFC.