专业丛书

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 4 Relevant U.S. Tax Forms for U.S. Trusts & Individuals

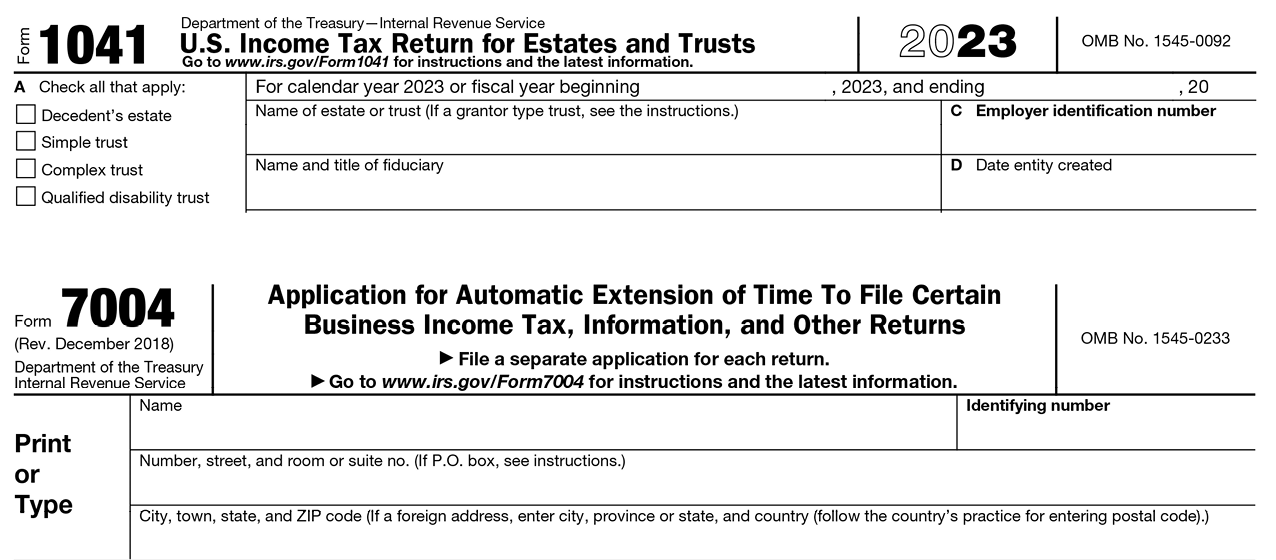

3. Form 1041 (including Form 7004)

Fiduciaries of U.S. trusts and estates which meet the following criteria must file Form 1041 to report income:

(1) Any taxable income for the tax year;

(2) Gross income of $600 or more (regardless of taxable income);

(3) A beneficiary who is a nonresident alien.

The form is due on April 15 of each year. An automatic filing extension to September 30 is generally applicable if Form 7004 is filed by April 15. You must provide Schedule K-1 (Form 1041), on or before the day you are required to file Form 1041, to each beneficiary who receives a distribution of property or an allocation of an item of the estate.

Irrevocable trusts established by non-U.S. persons are generally treated as non-grantor trusts, with certain exceptions. Non-grantor trusts generally pay income tax on any income generated by income not distributed to the trust’s beneficiaries. Income distributed to trust beneficiaries is typically recorded on a Form K-1 and provided to the beneficiaries’ tax preparers. Beneficiaries who receive income generally must include income received from the trust on their Form 1040. Distributions within the first 65 days of the year are generally treated as distributions for the previous calendar year. As such, qualified tax professionals often give clients’ an estimate of income taxes owed at the beginning of the year to give the clients’ a chance to decide if they would like to distribute to the trusts’ beneficiaries.

A trust is a grantor trust if the grantor retains certain powers or ownership benefits. Generally, a revocable trust settled by a non-U.S. person is treated as a foreign grantor trust. In general, a grantor trust is ignored for income tax purposes and all of the income, deductions, etc., are treated as belonging directly to the grantor. This also applies to any portion of a trust that is treated as a grantor trust. If the entire trust is a grantor trust, fill in only the entity information of Form 1041. Don’t show any dollar amounts on the form itself; show dollar amounts only on an attachment to the form. Don’t use Schedule K-1 (Form 1041) as the attachment.

Note: For a detailed explanation of the Form 3520, please refer to the previous section, which discusses the Form 1040. A Form 3520 may be required to be filed with the Form 1041 if a trust receives a gift from a non-U.S. donor (certain exceptions apply).

Late Filing Penalty: The law provides a penalty of 5% of the tax due for each month, or part of a month, for which a return isn’t filed up to a maximum of 25% of the tax due (15% for each month, or part of a month, up to a maximum of 75% if the failure to file is fraudulent). The penalty won’t be imposed if you can show that the failure to file on time was due to reasonable cause. If you receive a notice about penalty and interest after you file this return, send us an explanation and we will determine if you meet reasonable-cause criteria.

Late Payment Penalty: Generally, the penalty for not paying tax when due is 1/2 of 1% of the unpaid amount for each month or part of a month it remains unpaid. The maximum penalty is 25% of the unpaid amount. The penalty applies to any unpaid tax on the return. Any penalty is in addition to interest charges on late payments.