专业丛书

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 4 Relevant U.S. Tax Forms for U.S. Trusts & Individuals

Summary

While the beginning of this book focused primarily on the utilization of U.S.-based dynasty trusts, this chapter focuses primarily on the various tax filing requirements for cross-border families and entities controlled by them. Specifically, this book briefly describes each of the tax forms we find relevant for cross-border families.

The U.S. imposes various obligations on many entities it has varying levels of jurisdiction over. These obligations are generally mandated by laws passed by the U.S. Congress and operationally carried out by U.S. Department of The Treasury (“USDT”). The Internal Revenue Service (“IRS”) is one of the many agencies that report to the USDT.

The descriptions that follow are for purely education purposes and is not meant to be and should not be used as a guide for tax filing purposes. Clients that must complete one or more of the following forms should engage professional CPAs and licensed attorneys for their unique tax filing and estate planning needs.

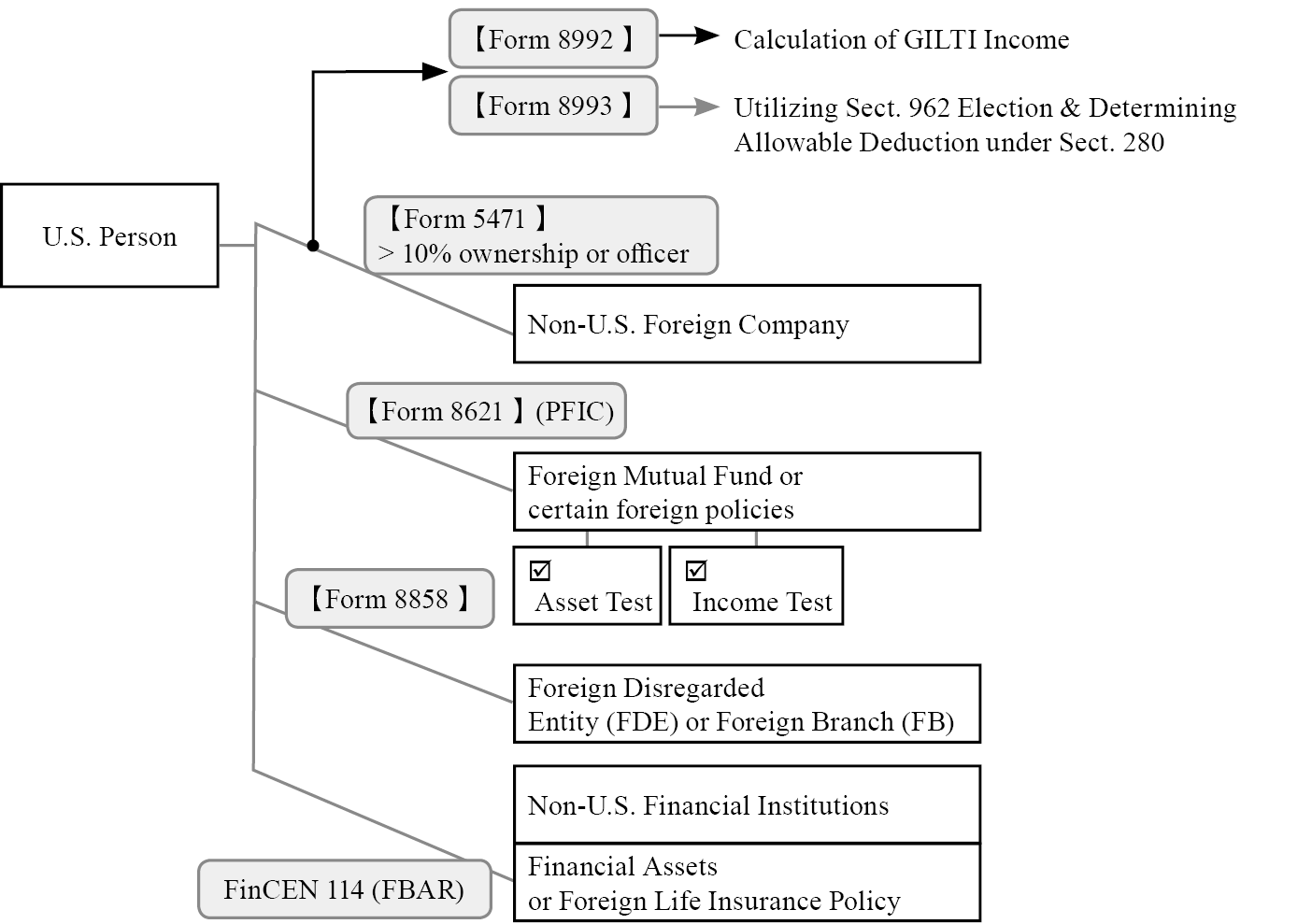

In our experience, cross-border families often must file one or more of the following forms. The following charts illustrate which forms could potentially be relevant for which taxpayers; please note that this is not an exhaustive list of the disclosures required of each individual within but rather an illustration of how and when each form could be used.

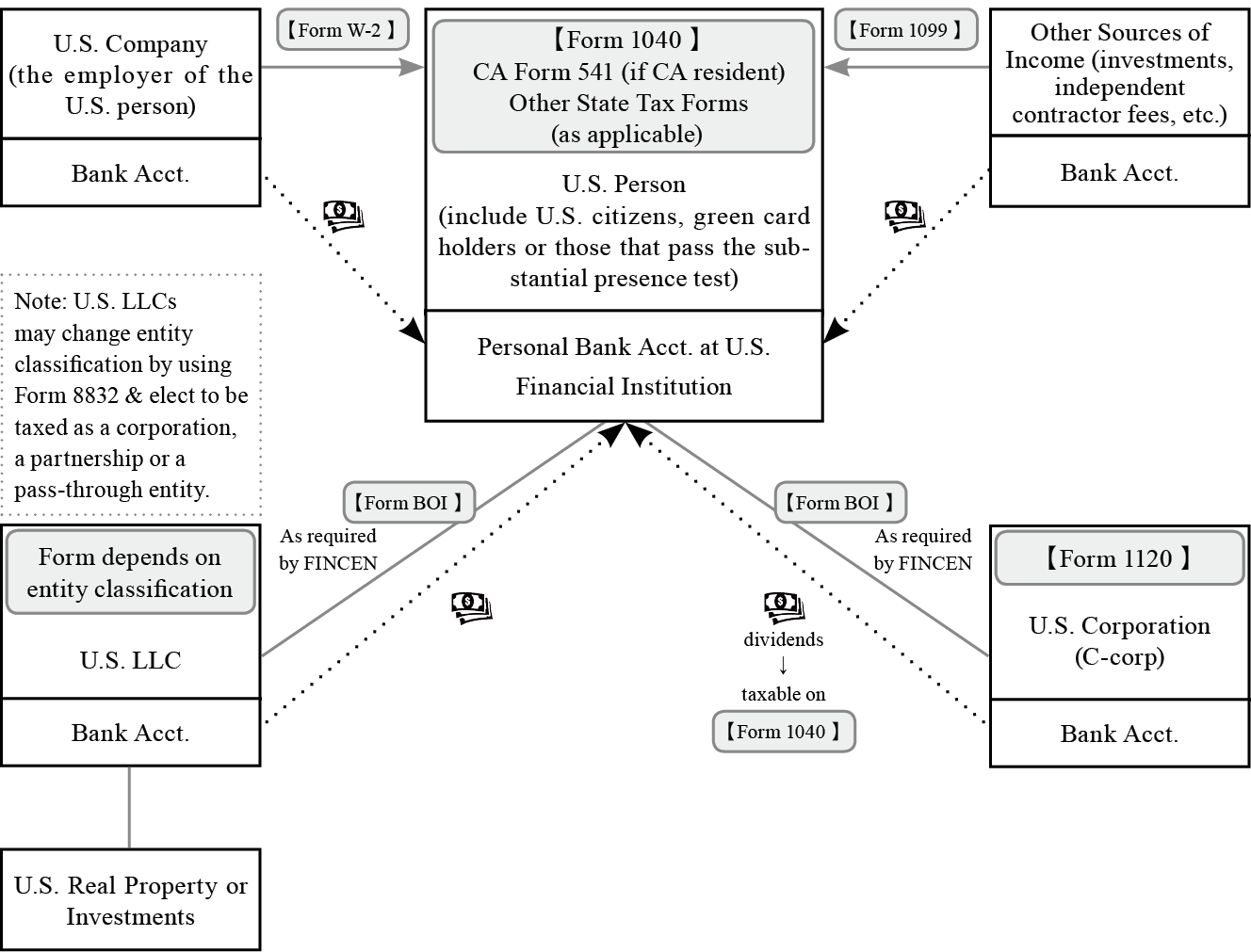

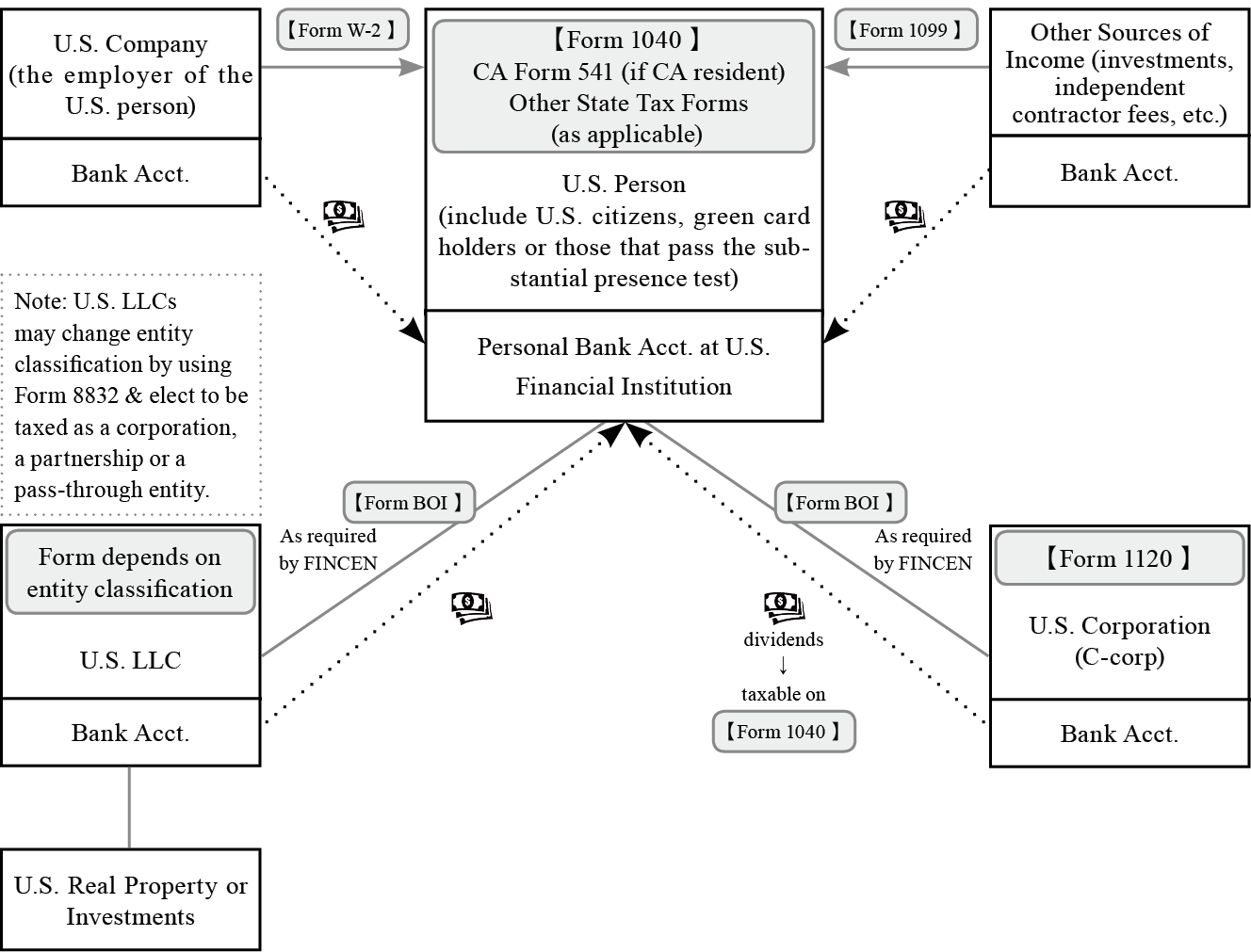

U.S. taxpayers generally report income from various sources on the Form 1040.

U.S. person owning domestic assets

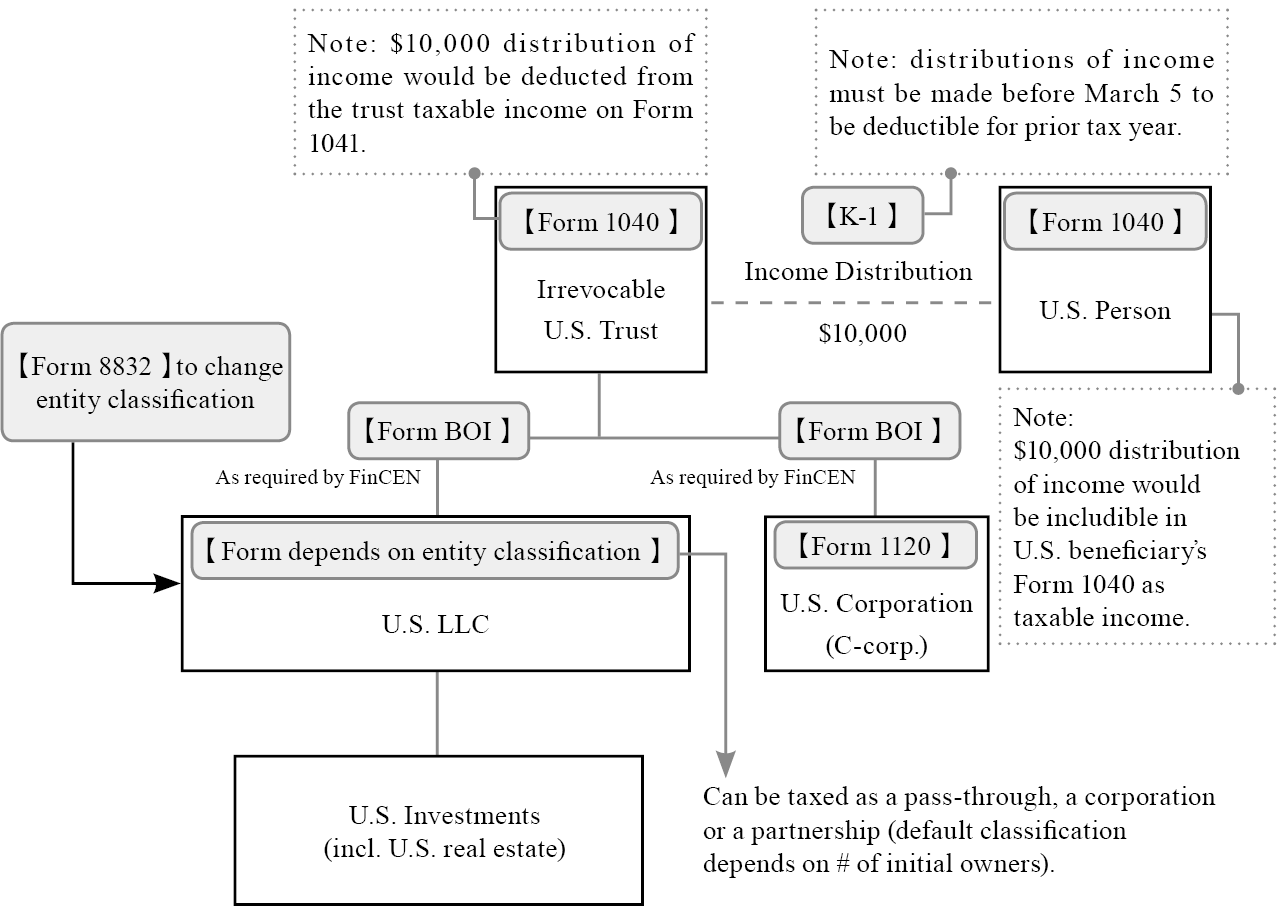

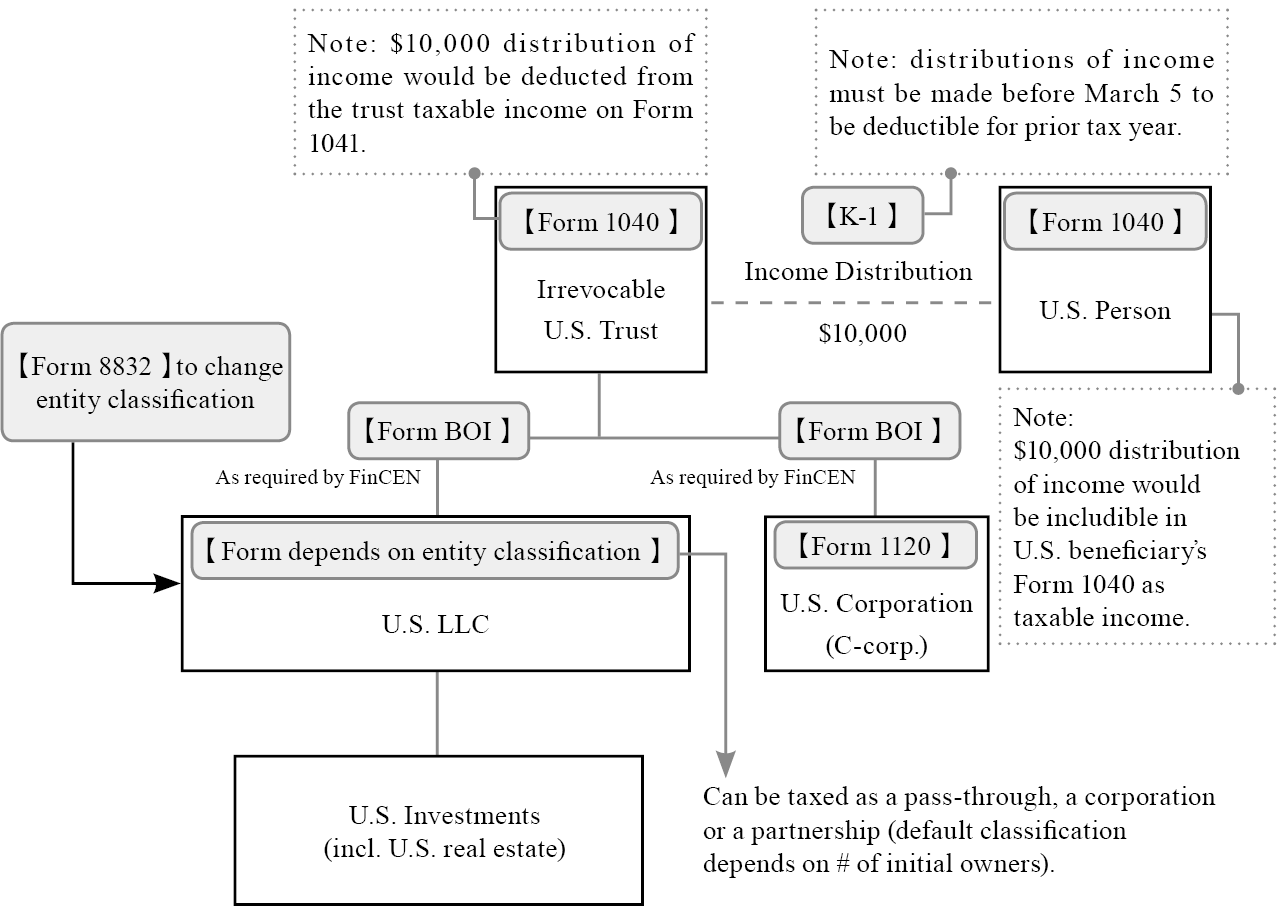

U.S. irrevocable trusts are generally subject to many of the same requirements as U.S. persons are subject to; however, trusts must complete a Form 1041 rather than a Form 1040.

U.S. Irrevocable Trust holding domestic assets

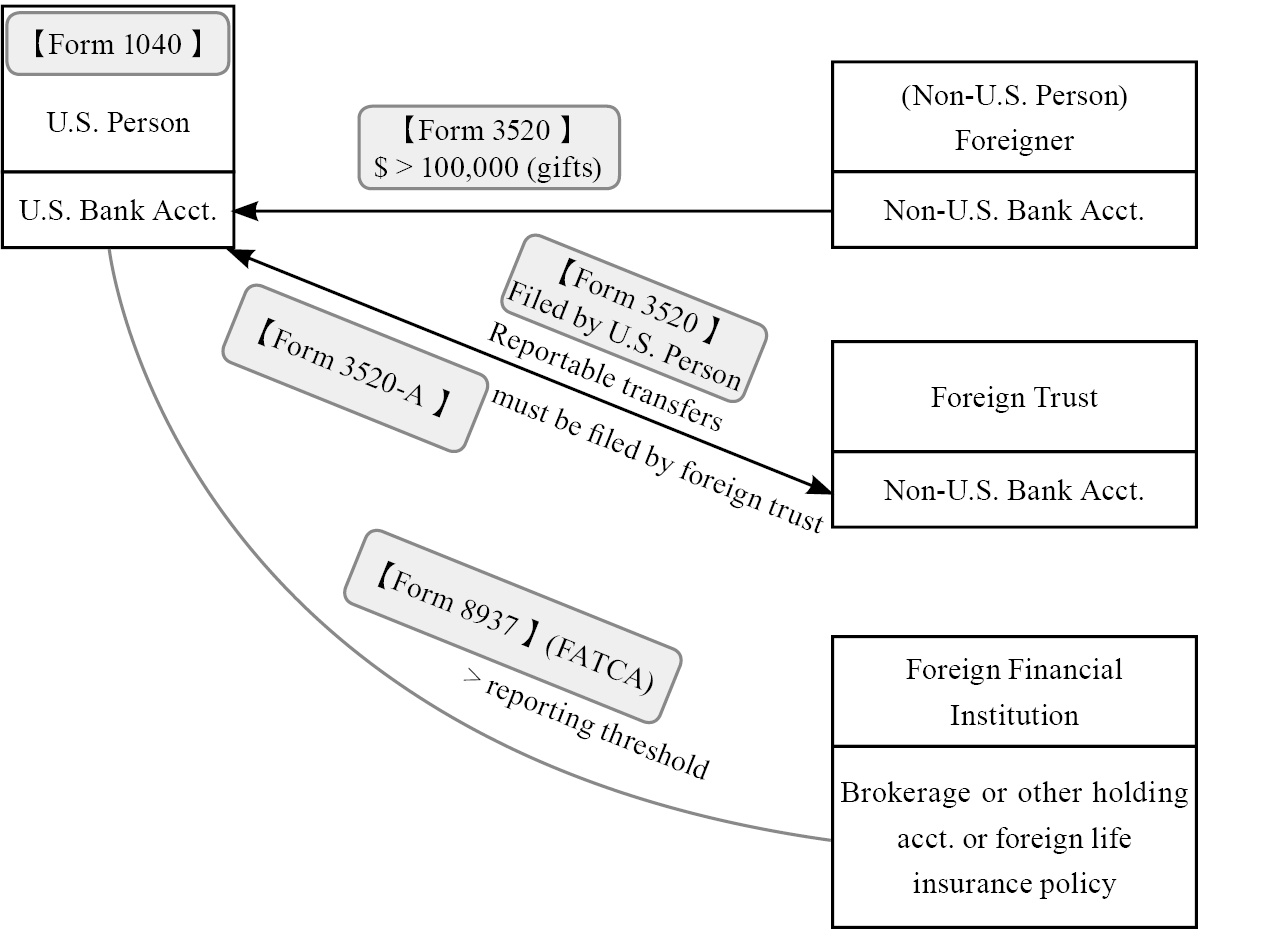

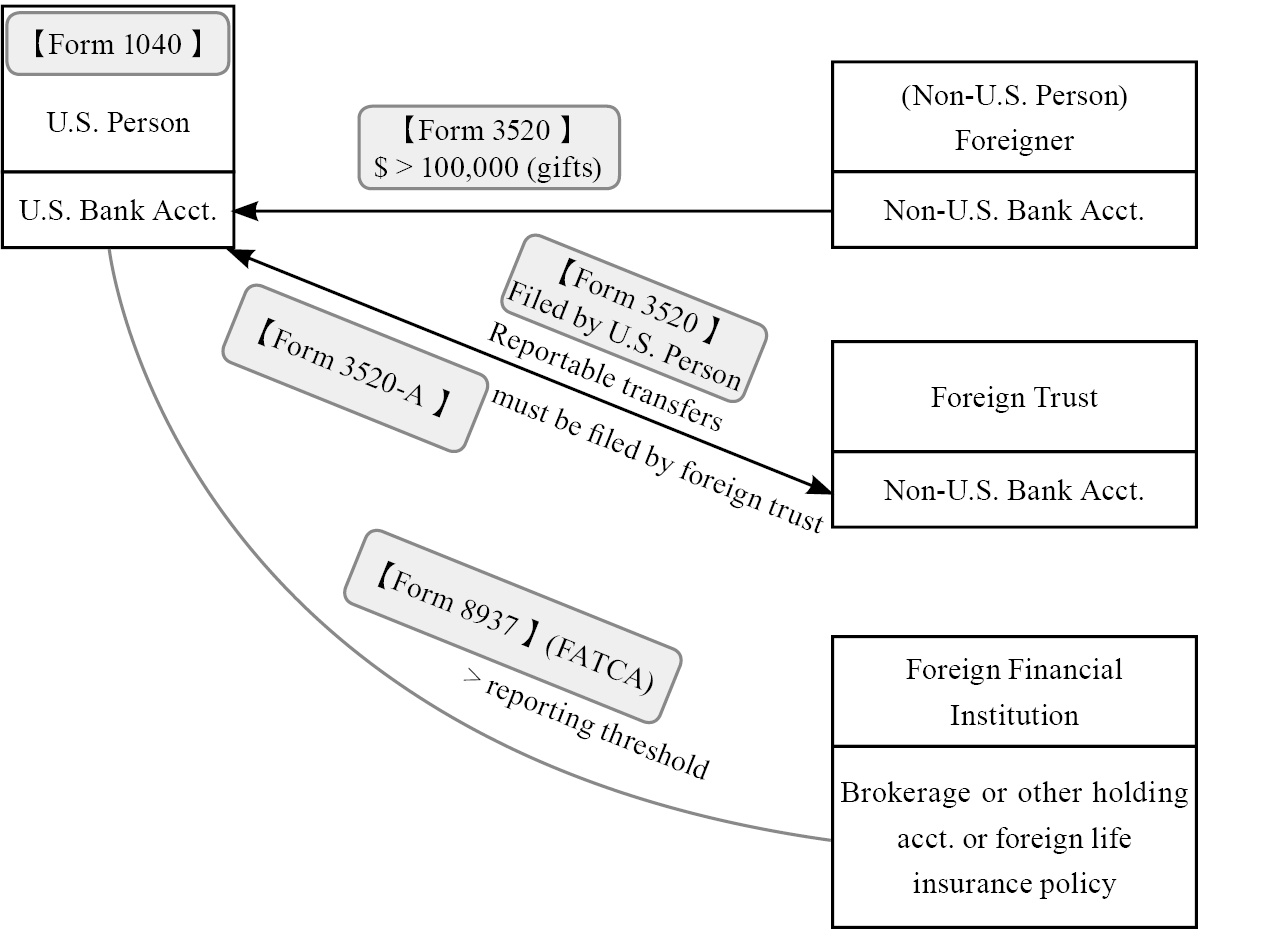

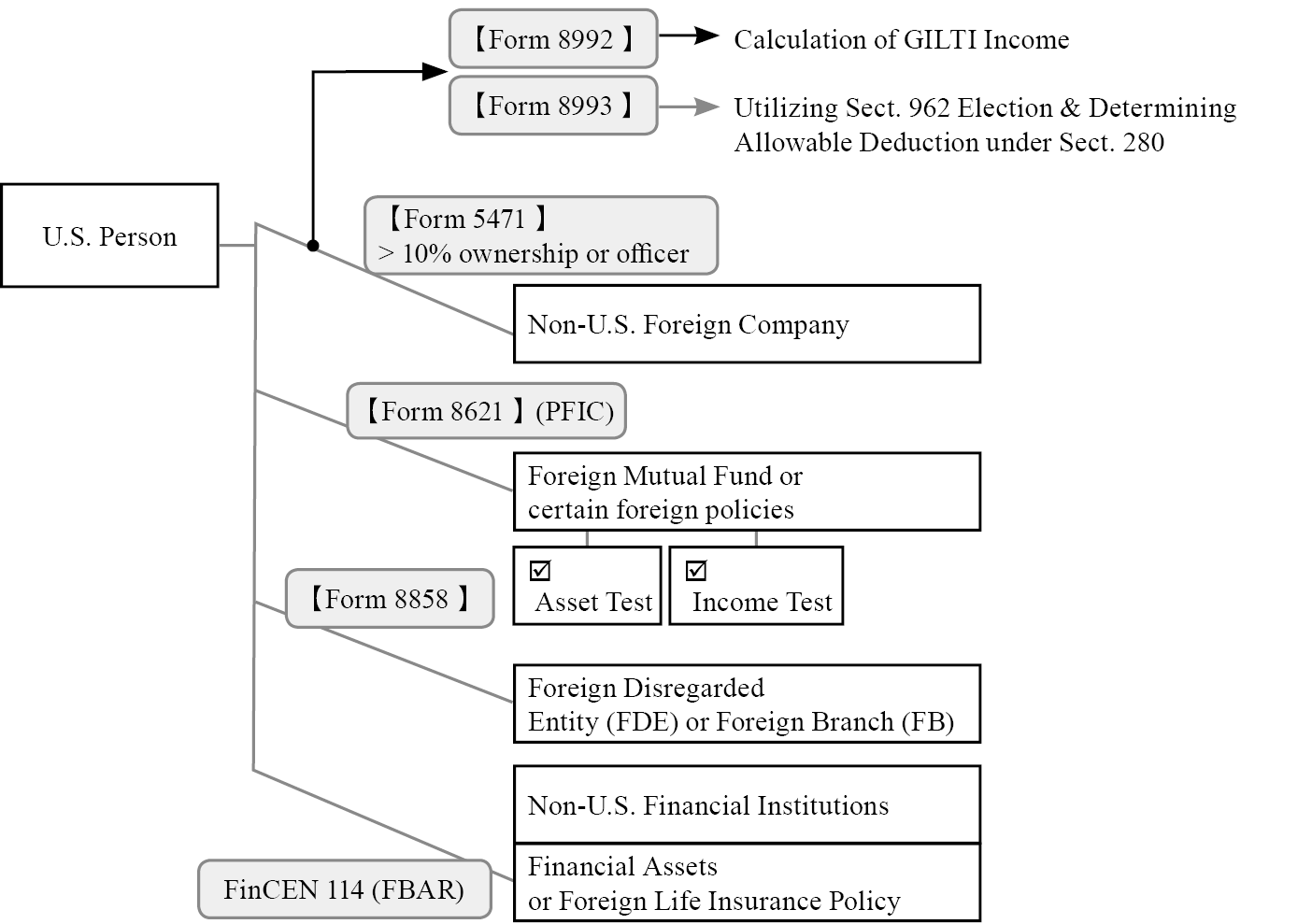

U.S. persons who own assets overseas are generally subject to U.S. taxation on their worldwide income. In addition, they may face certain disclosure requirements when receiving gifts from non-U.S. persons or trusts.

The following two charts include certain forms that may be required of U.S. persons when they directly or indirectly own or receive assets outside of the U.S:

U.S. person owning foreign assets (Part I)

U.S. person owning foreign assets (Part II)

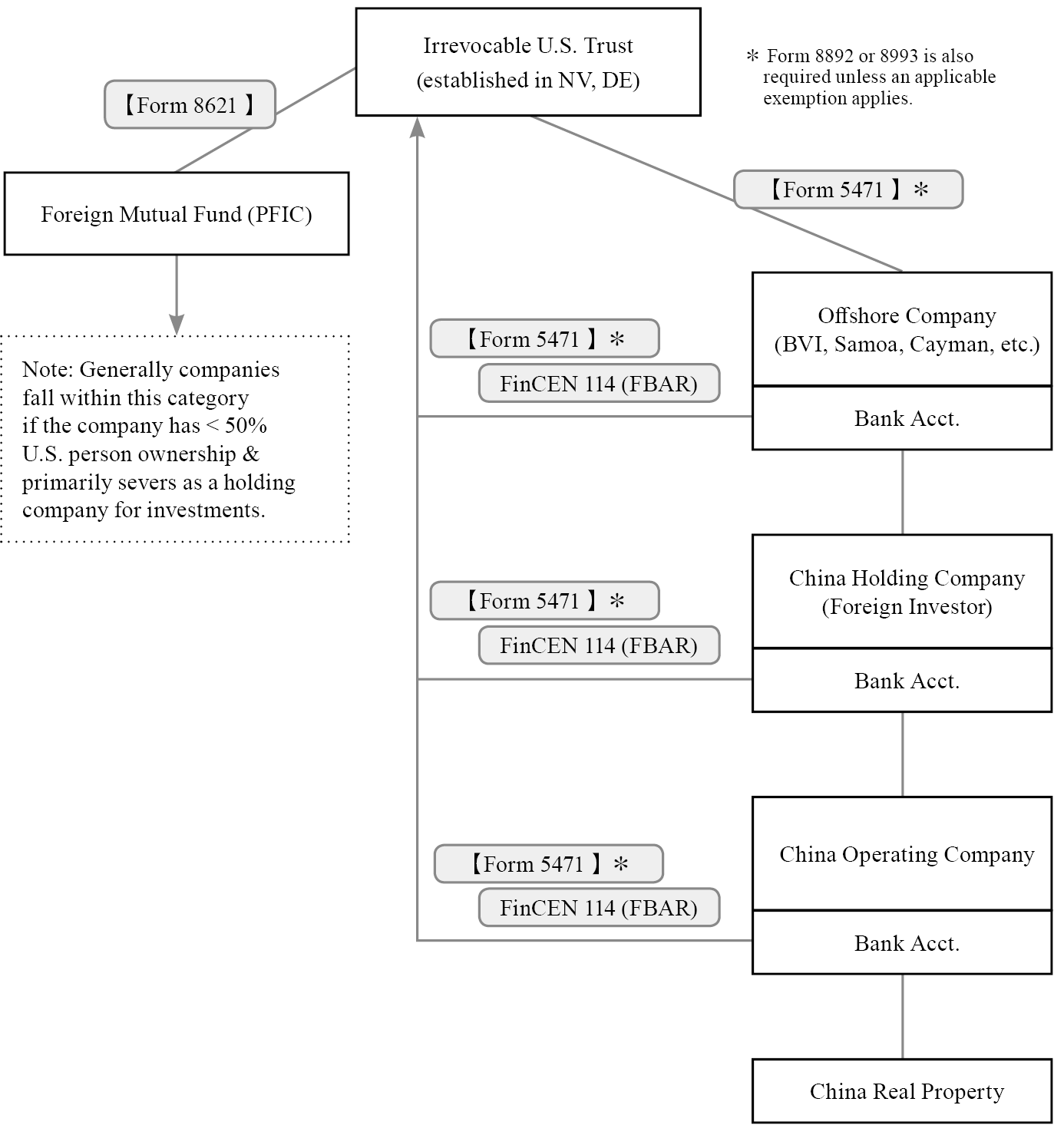

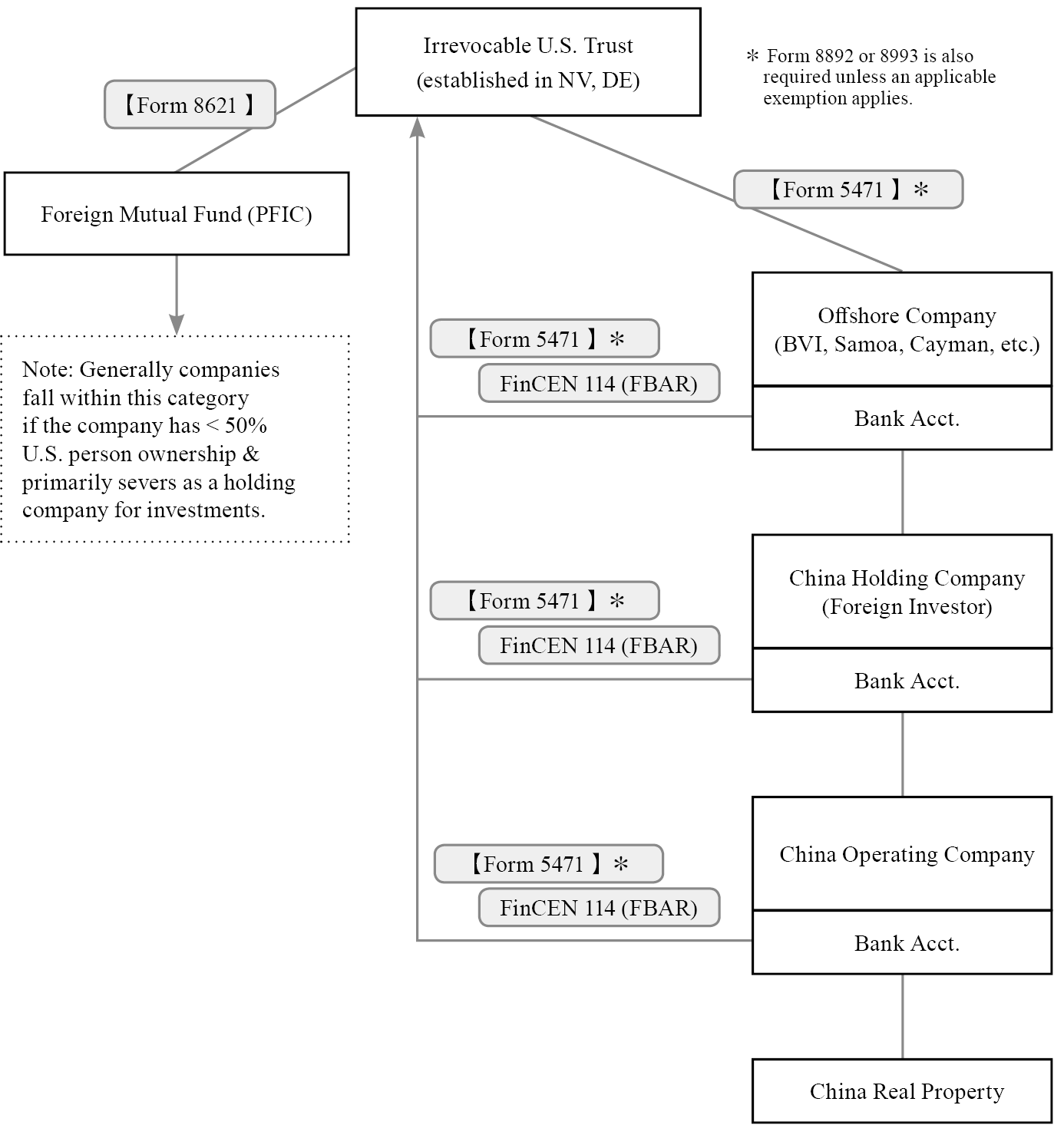

A U.S. irrevocable trust that owns assets overseas are also subject to a variety of requirements.

U.S. Irrevocable Trust holding foreign assets

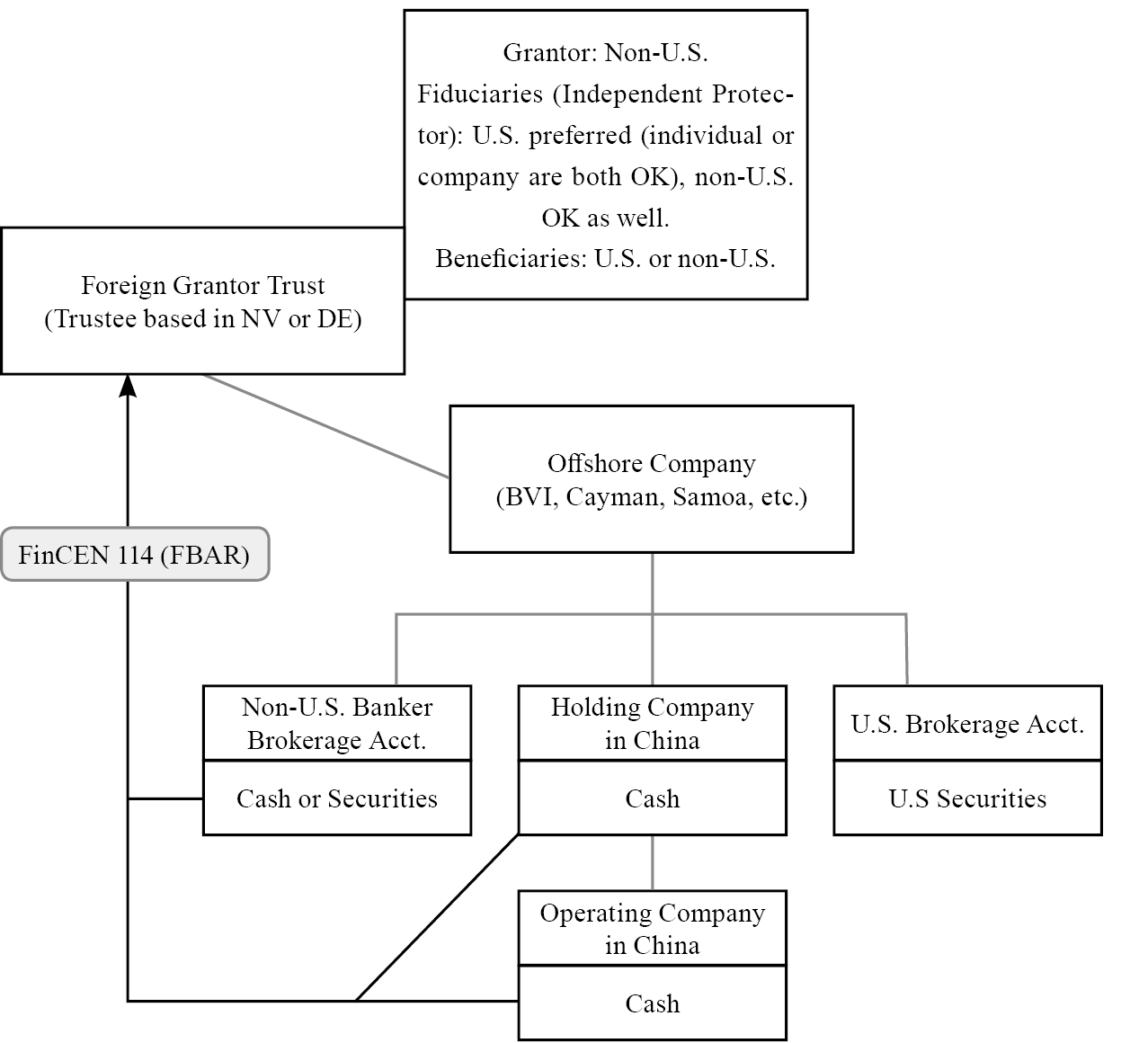

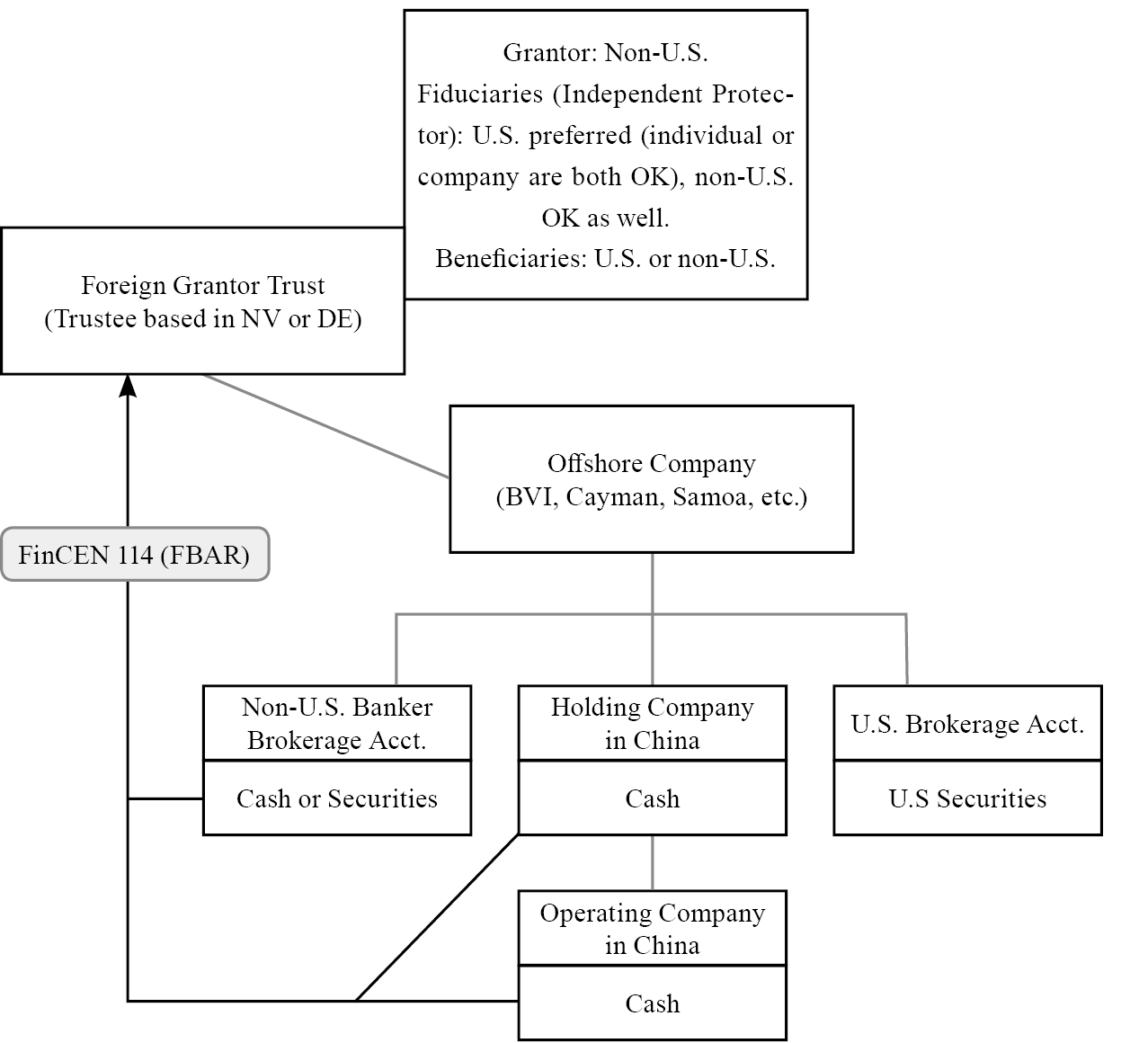

While foreign trusts (including foreign grantor trusts) that do not generate U.S.-sourced income generally does not file an income tax return, it is subject to FBAR requirements, which requires the completion of FINCEN Form 114.

FGT (Revocable Trust)

The U.S. imposes various obligations on many entities it has varying levels of jurisdiction over. These obligations are generally mandated by laws passed by the U.S. Congress and operationally carried out by U.S. Department of The Treasury (“USDT”). The Internal Revenue Service (“IRS”) is one of the many agencies that report to the USDT.

The descriptions that follow are for purely education purposes and is not meant to be and should not be used as a guide for tax filing purposes. Clients that must complete one or more of the following forms should engage professional CPAs and licensed attorneys for their unique tax filing and estate planning needs.

In our experience, cross-border families often must file one or more of the following forms. The following charts illustrate which forms could potentially be relevant for which taxpayers; please note that this is not an exhaustive list of the disclosures required of each individual within but rather an illustration of how and when each form could be used.

U.S. taxpayers generally report income from various sources on the Form 1040.

U.S. person owning domestic assets

U.S. irrevocable trusts are generally subject to many of the same requirements as U.S. persons are subject to; however, trusts must complete a Form 1041 rather than a Form 1040.

U.S. Irrevocable Trust holding domestic assets

U.S. persons who own assets overseas are generally subject to U.S. taxation on their worldwide income. In addition, they may face certain disclosure requirements when receiving gifts from non-U.S. persons or trusts.

The following two charts include certain forms that may be required of U.S. persons when they directly or indirectly own or receive assets outside of the U.S:

U.S. person owning foreign assets (Part I)

U.S. person owning foreign assets (Part II)

A U.S. irrevocable trust that owns assets overseas are also subject to a variety of requirements.

U.S. Irrevocable Trust holding foreign assets

While foreign trusts (including foreign grantor trusts) that do not generate U.S.-sourced income generally does not file an income tax return, it is subject to FBAR requirements, which requires the completion of FINCEN Form 114.

FGT (Revocable Trust)