专业丛书

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Chapter 2 ─ U.S. Trust Planning and Example Structures for High Net Worth Families

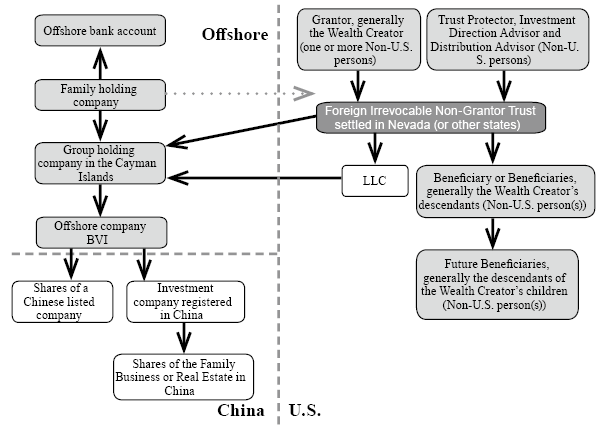

Type 5: A Non-U.S. Grantor Settles a Foreign Irrevocable Non-Grantor Trust

This trust structure includes foreign grantor, beneficiaries, and the trust assets are located outside the U.S. If the non-US protector changes to a U.S. person, the trust will then transfer to a U.S. trust accordingly.

If the dividends received each year are all distributed by the trust, the beneficiary and the trust would not be subject to U.S. income tax under IRC 662 (because the income is foreign-sourced in this case); however, the trust itself still has obligations to report Subpart F Income of its CFC each year, so this structure is not recommended.

- Applicable to:

- Prerequisites:

- Non-U.S. Grantors, non-U.S. Protectors, non-U.S. Beneficiaries.

- The assets which are ready to be transferred to the trust are located outside the U.S. ; upon transfer to the trust, assets are still offshore.

- The grantor shall make a complete gift to set up an irrevocable trust, which means the ownership of the assets will be immediately relinquished and prohibited to return to the grantor.

- The trustee company of the trust is U.S. Trustee Company (e.g in Delaware or Nevada).

- The grantor must be a non-resident alien to the U.S., and the trust is completely unrelated to the grantor once the trust agreement is signed.

- People other than the trust grantor can transfer property into this U.S. irrevocable trust.

- Assets held by the trust should be located outside of the U.S. (BVI company’s equity will be changed to be held directly by the U.S. trustee in the future)

- The protector is appointed by the grantor at trust establishment and must be a non-resident alien to the U.S., but can be changed at any time with the consent of the beneficiaries (the protector can be changed at any time).

- Offshore company’s equity is held by the trust, but the executive director (Director) of the company is appointed by the protector.

- The grantor shall open a bank account and must seek for banks outside the U.S. (ex. HK or Singapore) that could accept U.S. trust acting as a shareholder of the offshore company.

- In the future, all financial operations of the offshore company in offshore banks will be carried out by the executive director of the offshore company.

- Purposes:

- The grantor transfers asset ownership into the U.S while the actual assets remain outside the U.S. By giving up the ownership of the asset, there will be no estate and income tax issues in the located country in the future.

- The assets are sufficiently protected without the right of recourse from the creditor and the divorced spouse.

- Avoid the estate tax that may arise from the inheritance of grantor assets.

- Avoid the complicated procedures and high cost of the estate probate in the U.S.

- The estate is split by future generations per stirpes through “division” or “decanting ”.

- Avoidance of CRS notification issues (U.S. is non-CRS participant)

- Precautions:

- The assets gifted by the grantor cannot be revoked and the grantor has no right to manage or benefit from the principle and the income of the trust.

- U.S. income tax issues will arise under these circumstances in the future.

- Remember to take the grantor’s country of residence into consideration when transferring assets into a trust, since it might raise local gift tax issues. (For example, Taiwan gift tax residents will need to pay gift tax as they transfer foreign assets into U.S. irrevocable trust).