專業叢書

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Chapter 4 ─ Accounting Treatment and Tax Returns Filing of a Trust

信託成立後帳務處理及稅務申報

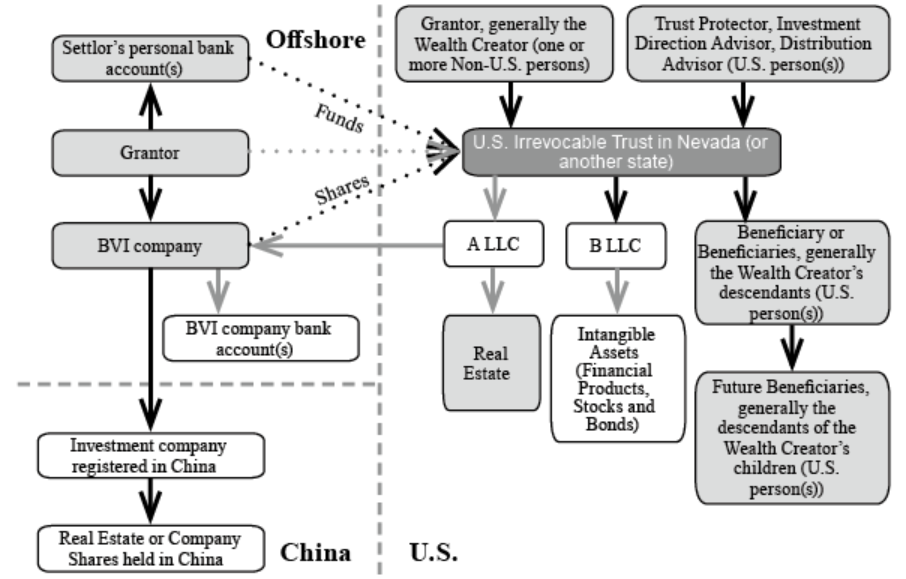

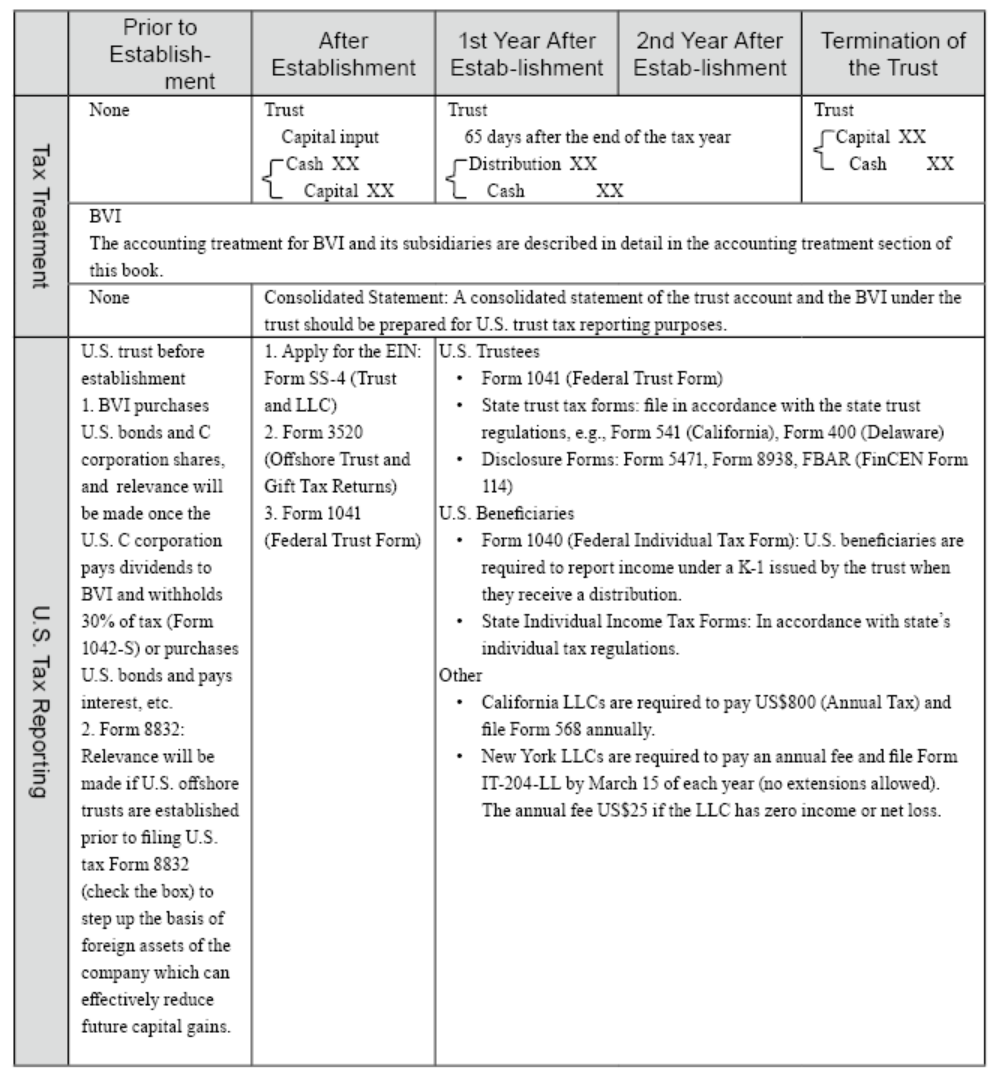

Accounting, tax and asset disclosure requirements are different based on the nature and relevant jurisdiction of each trust.

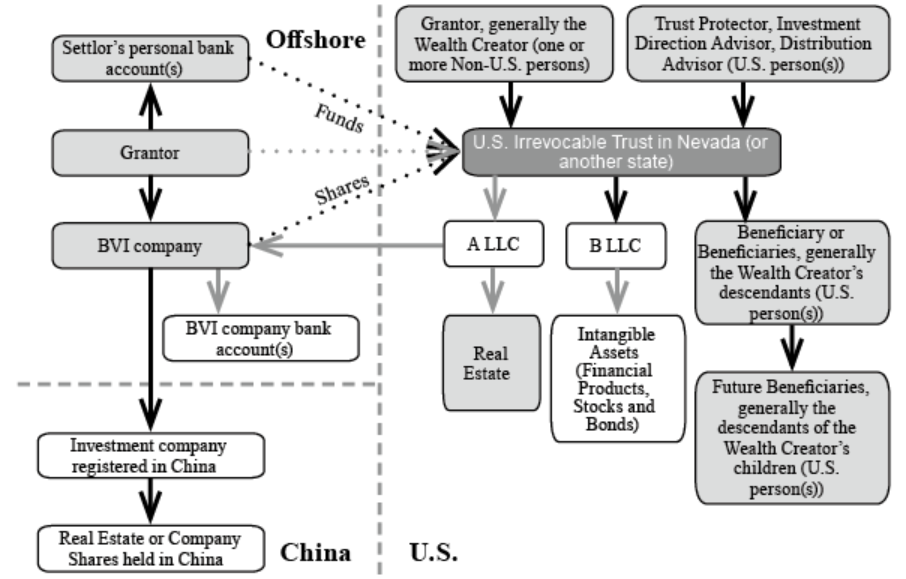

In this chapter, we will discuss accounting treatment and tax return filing when a non-U.S. citizen sets up an irrevocable trust in the U.S.

Part I. Accounting Treatment and Tax Returns Filing for U.S. Assets Held by a U.S. Irrevocable Trust Established by a Non-U.S. Person

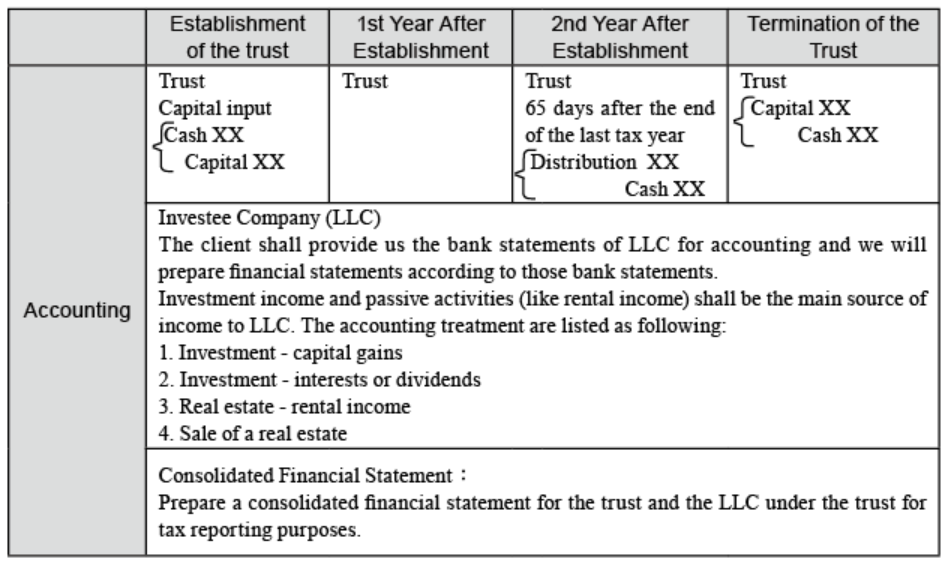

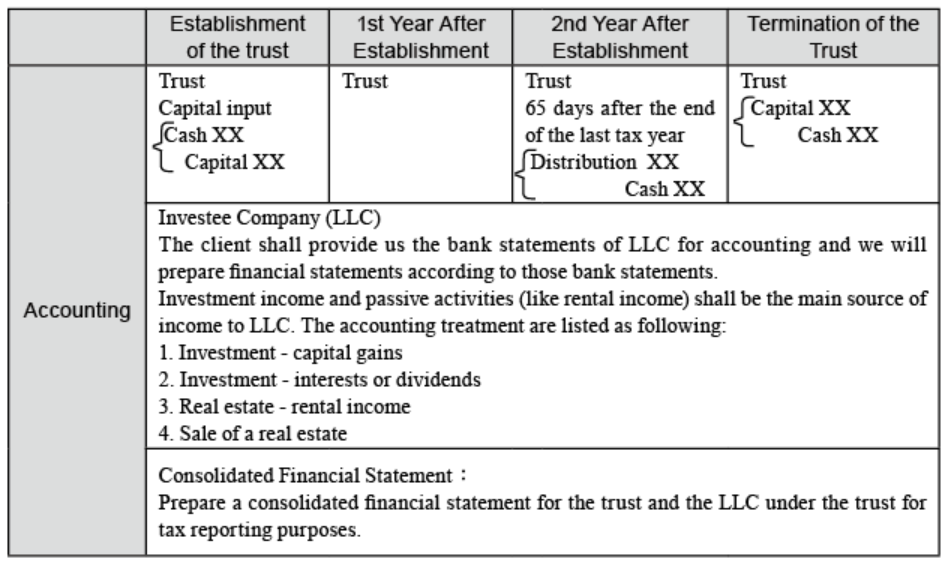

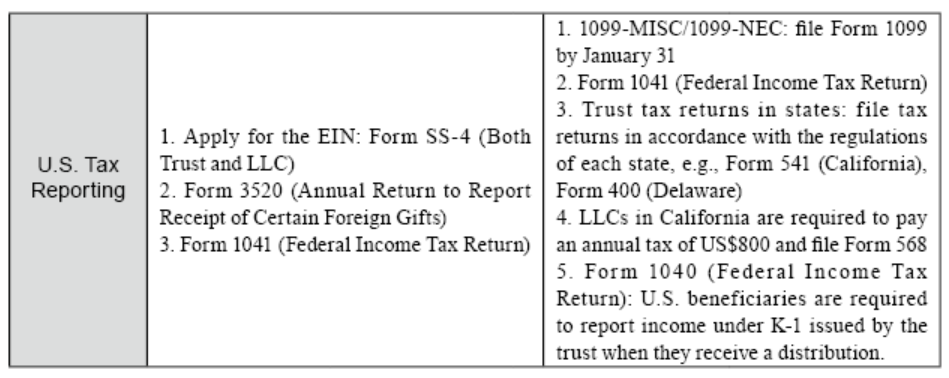

1. The Timeline of Accounting Treatment and Tax Returns Filing for a U.S. Irrevocable Trust

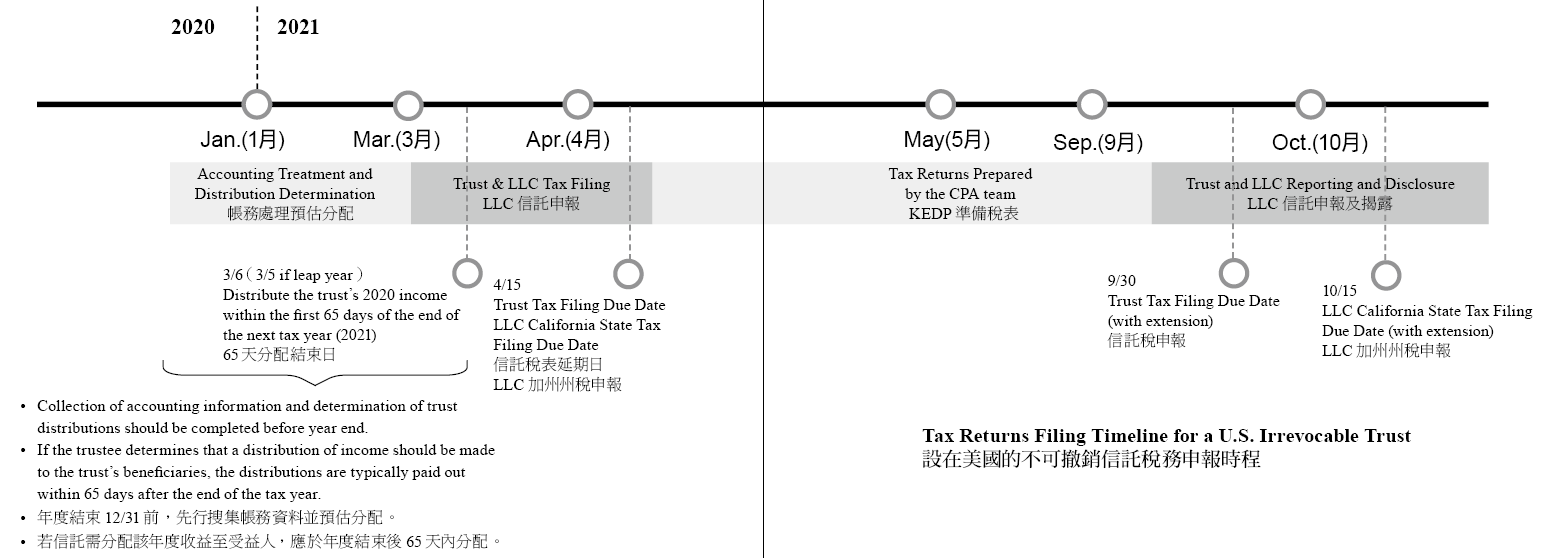

The following chart demonstrates time limit of tax reporting of the trust and LLC during a period (from December 2020 to October 2021) as an example.

2. Accounting Treatment:

(1) Initial phase

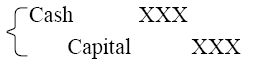

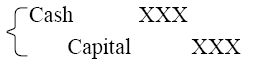

I. Capital inputs: Usually cash is deposited (one or more transactions) into a trust account or a trust-owned LLC bank account.

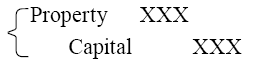

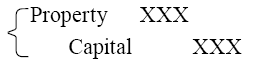

II. For real estate contributions, the fair market value or original cost basis is typically selected.

(2) Operational Phase

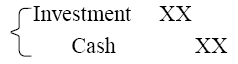

I. Investment - Capital Gains

(i) Investment Portfolio

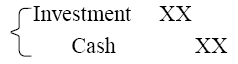

Generally, the transaction and cash flow from the bank statement are used to verify investment decisions provided by the clients.

(ii) Commodities Investments

The bank statement typically does not provide information regarding the cost basis and / or capital gains resulting from the sale of commodities. However, it will provide information regarding the proceeds from the sale. Once a sale has occurred, a journal entry should be completed. The journal entries can be modified or adjusted after receipt of the Form 1099-B.

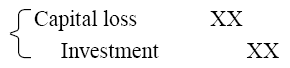

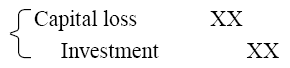

(iii) Capital gains (profits and losses)

Recognize capital gains or losses after obtaining Form 1099-B.

As a result, the cash on the account would still be equal to the bank statement and any capital gains (losses) should match numbers presented on the Form 1099-B.

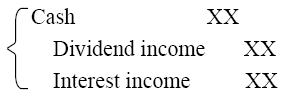

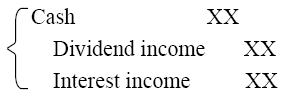

II. Interest and Dividends

One should be cautious of distinguishing the interest and dividends are taxable or tax-free and preparing trust tax returns.

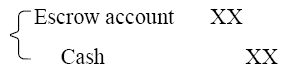

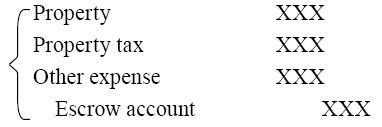

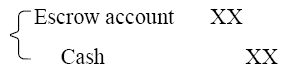

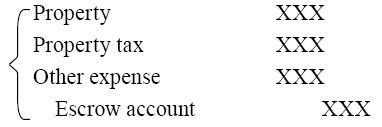

III. Purchase of real estate (rental income)

Whenever there is a purchase of real estate, the bank statement will show a lump-sum withdrawal. A “Settlement Statement” should be obtained in order to categorize additional costs and expenses relating to the purchase. When purchasing real estate in the U.S., expenses are usually paid out of an escrow account.

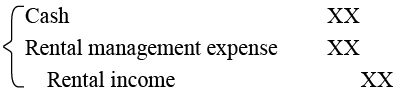

The following are some common accounting entries:

Transaction completed

If there is a balance refund:

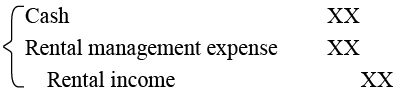

Rental Activities

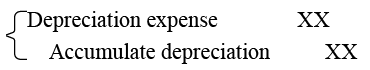

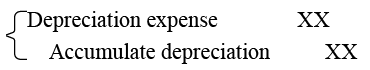

Depreciation is calculated annually depending on the type of real estate being depreciated:

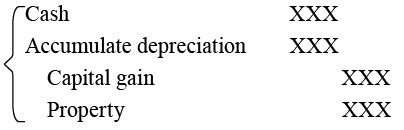

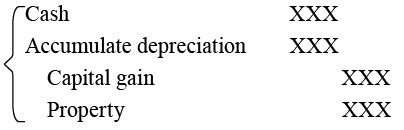

IV. Sale of a real estate

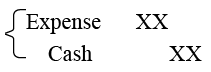

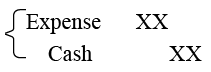

V. Various fees

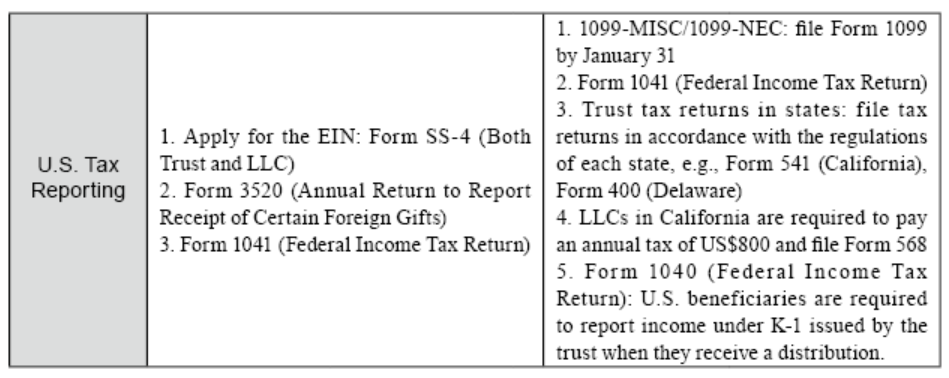

3. U.S. Tax Returns

(1) Initial phase

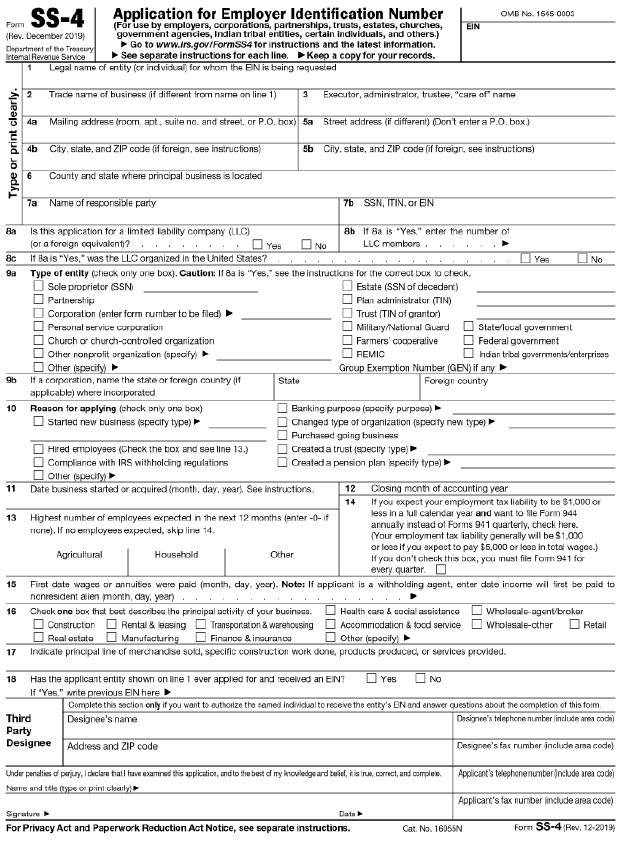

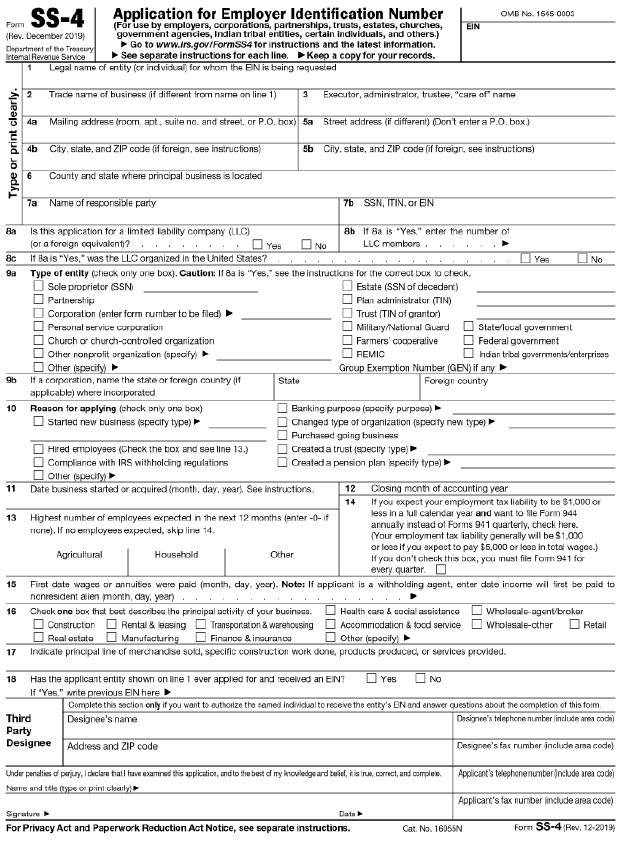

I. EIN (Employer Identification Number) Application

All EIN applications (mail, fax, internet) must disclose the name and Taxpayer Identification Number (e.g., SSN, ITIN or EIN number) of the principal officer, general partner, grantor, owner or trustor. These individuals or business entities, referred to by the IRS as “responsible parties,” are responsible for controlling, managing or directing the applicant entity and responsible for disposing of the funds and assets of that entity. Unless the applicant is a government entity, the responsible party must be an individual (i.e., a natural person) and not an entity.

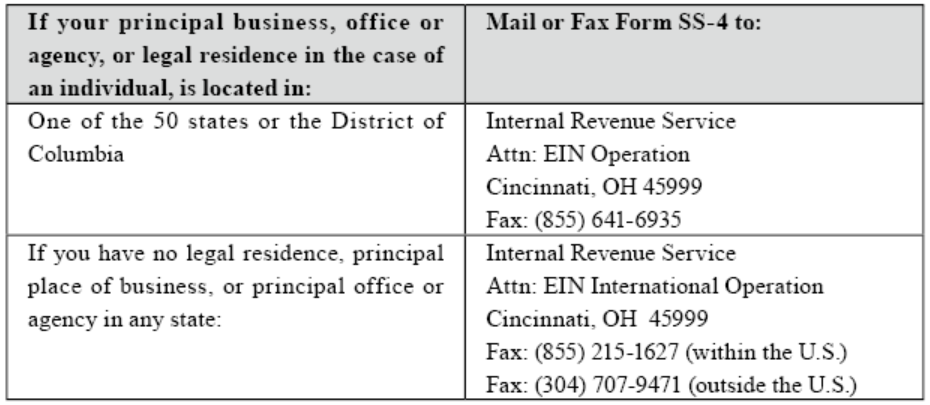

The following are common ways to apply for an EIN:

(i) Apply Online

The Internet EIN application is the most convenient method for customers to apply for and obtain an EIN. Once the application is completed, the information will be validated during the online session and an EIN will be immediately issued. The online application process is available for all entities whose principal business, office or agency or legal residence in the case of an individual, is located in the U.S. or U.S. Territories.

(ii) Apply by Fax

Taxpayers can fax the completed Form SS-4 application to the appropriate fax number. If it is determined that the entity needs a new EIN, one will be assigned using the appropriate procedures for the entity type. If the taxpayer’s fax number is provided, a fax will be sent back with the EIN within four business days.

(iii) Apply by Mail

The processing time for an EIN application received by mail is four weeks. If it is determined that the entity needs a new EIN, one will be assigned using the appropriate procedures for the entity type and mailed to the taxpayer.

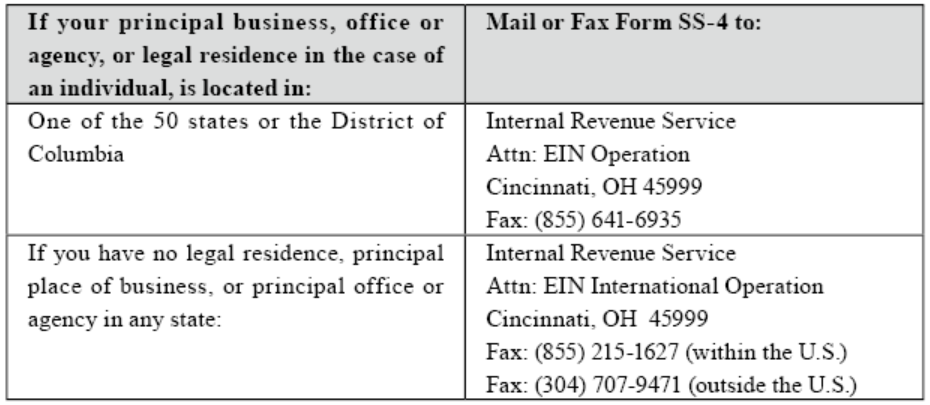

The IRS provides ways to mail or fax Form SS-4 as follows:

II. Form 3520 (Foreign Trusts and Gift Tax Returns)

(i) Filing date: April 15th of each year.

(ii) Filing requirements:

Form 3520 should be reported to the IRS, disclosing information of U.S. irrevocable trust receiving funds from offshore if the following conditions are met:

Form 3520, Part IV, column 54 and 55 should be reported respectively to the IRS if the following conditions are met:

What are the penalties for failing to report foreign gifts on time? This depends on the source of the gift, as explained below:

In the case of a failure to timely report foreign gifts described in section 6039F, a penalty equal to 5% of the amount of such foreign gifts applies for each month for which the failure to report continues (not to exceed a total of 25%).

If a U.S. individual fails to report the distribution received by the foreign trust, a penalty equal to 35% of the gross value of the distribution received from the foreign trust is levied. (Section 6677)

It is important to note that if the sum of money remitted to the trust in the year it is settled exceeds the Form 3520 filing threshold, the transfer must be reported in accordance with the regulations. Individuals or trusts receiving in excess of $100,000 generally should engage a U.S. accountant to assist with the filing process. It is important to note that the IRS may issue letters and / or audit taxpayers who file Form 3520, especially those who filled out the form incorrectly.

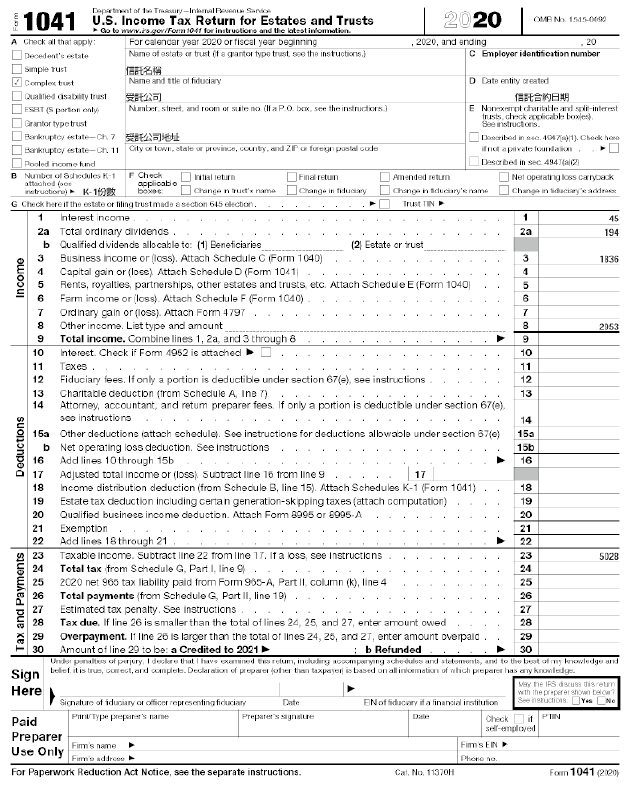

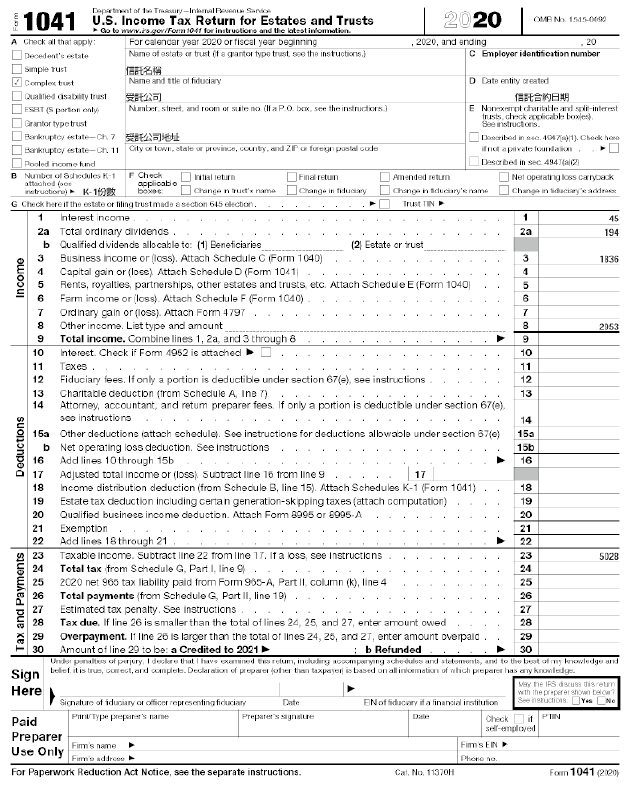

III. Form 1041 (Federal Trust Tax Form)

Usually, the capital invested in the beginning of the year after the trust is established will not generate much income. However, if the following conditions are met, taxpayers are required to file Form 1041:

(i) Gross Income (GI) greater than US$600

(ii) Taxable income for the year

(iii) A beneficiary who is a nonresident alien

(2) Operation Phase

After the first year of normal operation, the trust is required to file tax returns as follows:

I. Form 1099-NEC

LLCs under the trust may be required to file Form 1099-NEC (Nonemployee Compensation) to report payments made during your trade or business to independent contractors for the taxable year.

If the following four conditions are met, you must generally report a payment as NEC.

(i) You made the payment to someone who is not your employee.

(ii) You made the payment for services during your trade or business (including government agencies and nonprofit organizations).

(iii) You made the payment to an individual, partnership, estate, or, in some cases, a corporation.

(iv) You made payments to the payee of at least US$600 during the year.

According to the IRS, Form 1099-MISC is issued to any individual or organization that makes a payment to the taxpayer equal to or greater than US$600 (or rest) during the taxable year.

III. Form 1041 (Federal Trust Tax Form)

(i) Filing date: April 15th of each year. Form 7004 may be filed by April 15th and can be extended to September 30th.

(ii) Filing requirements: Form 1041 is required if any of the following conditions is met:

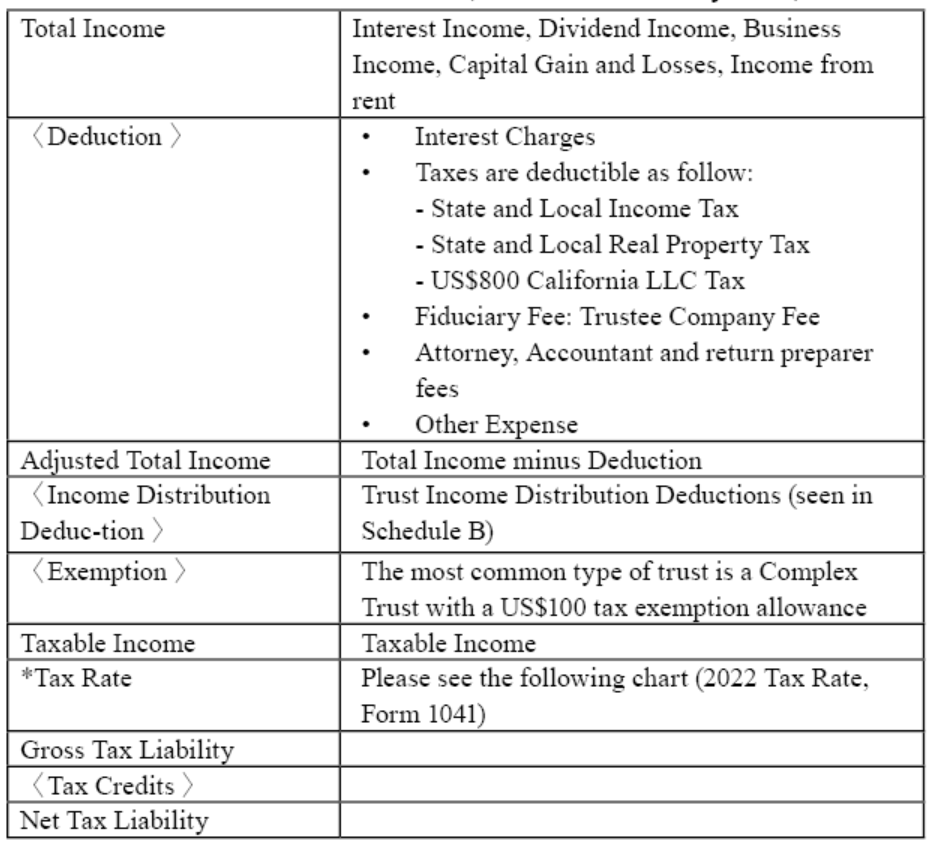

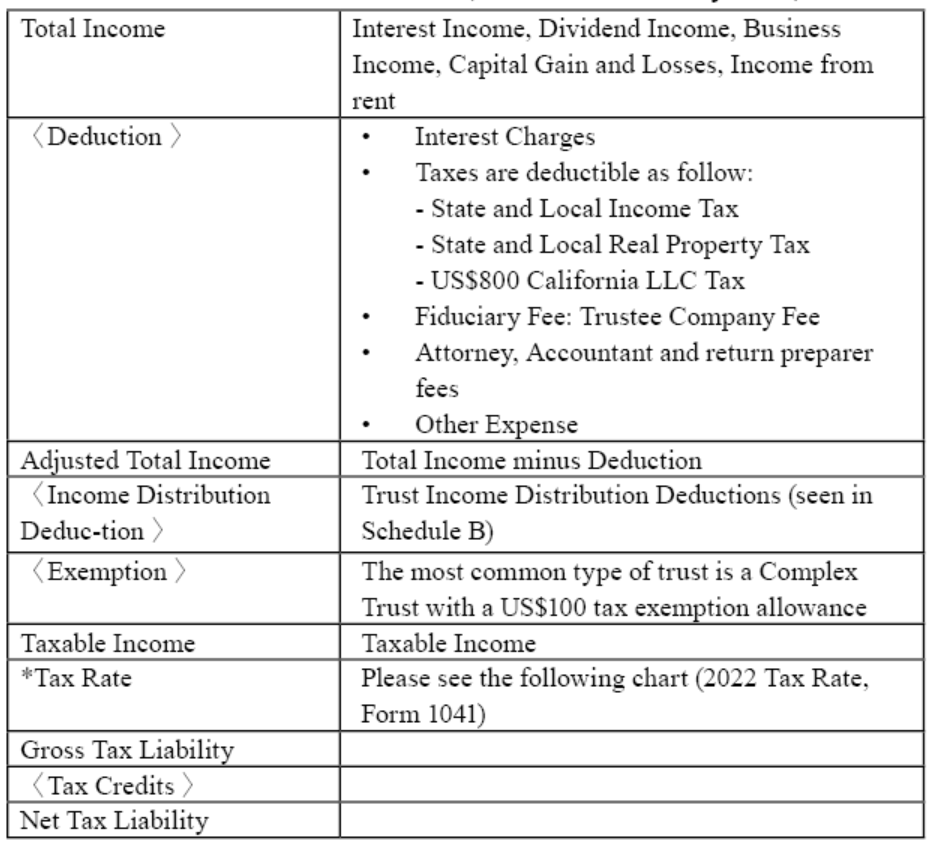

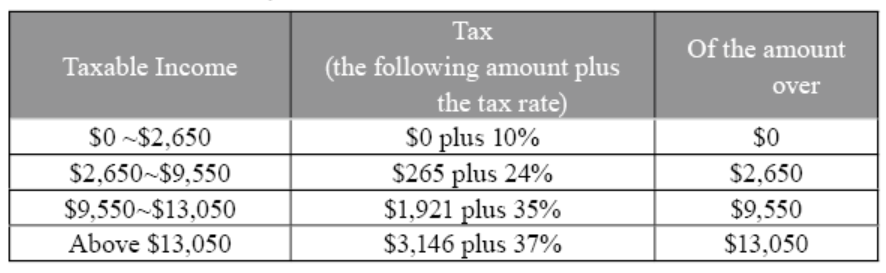

Trust tax is computed by subtracting the required deductions and exemptions from the trust’s gross income for the tax year. Fiduciary fees, attorney, accountant return preparer fees and other expenses are subject to Section 67(e) and the following limitations on the amount of the deduction based on the proportion of the exemption income.

The following is a calculation of the fees and solicitor’s fees of a trustee company:

* Tax exempt income US$30,000

* US$30,000 / US$50,000 = 60%

* US$15,000 × 0.6 = 9,000 (expenses corresponding to the tax-free income are not deductible)

* US$15,000 - 9,000 = 6,000 (deductible attorney’s fee)

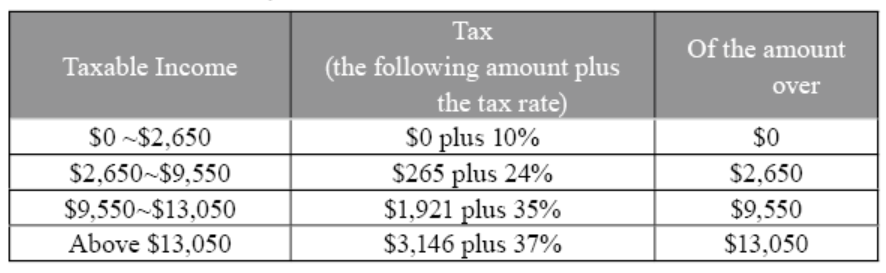

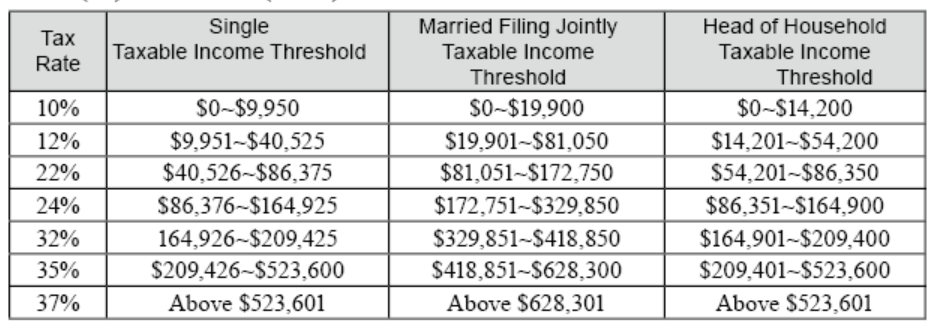

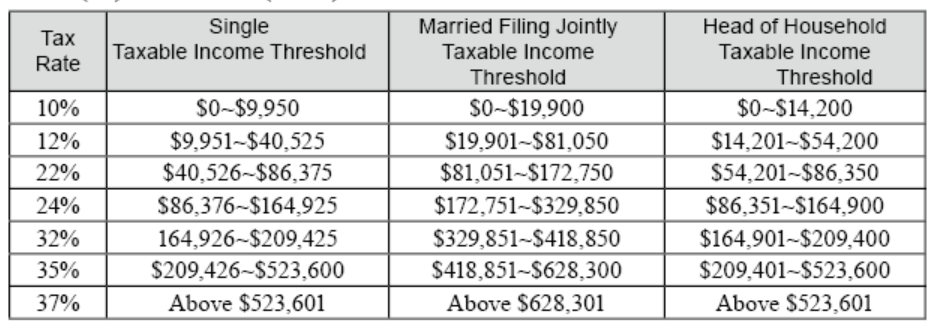

2021 Tax Rate, Form 1041

IV. Introduction on Schedules of Form 1041

The following are common schedules of Form 1041:

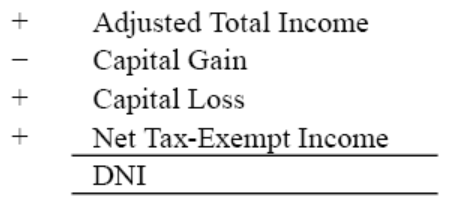

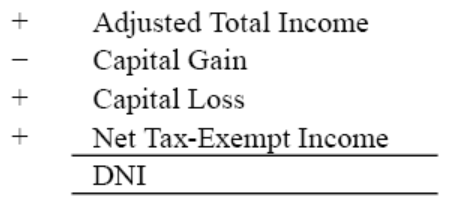

DNI is calculated as follows:

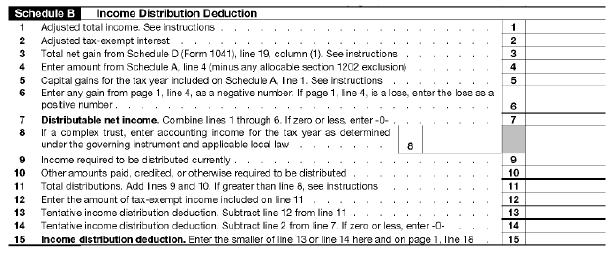

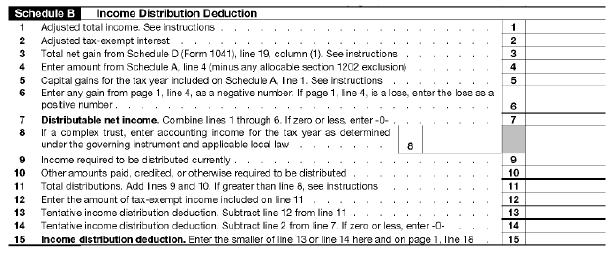

IDD (Income Distribution Deduction) as an amount of deduction on the trust’s tax return (Form 1041, line 18).

DNI (Distributable Net Income) - Tax-Exempt Income; or

Actual Distribution - Tax-Exempt Income whichever is smaller.

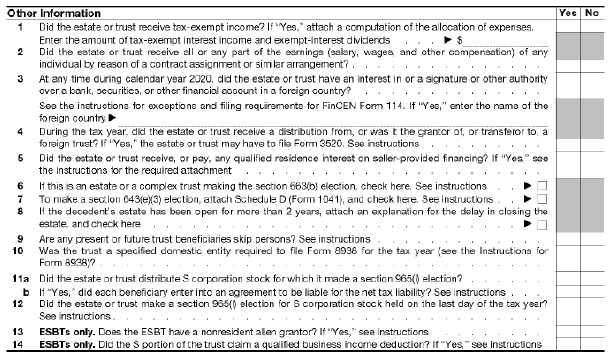

The following Schedule B and other columns of Form 1041 are provided for reference (“Other information” is shown on the right page):

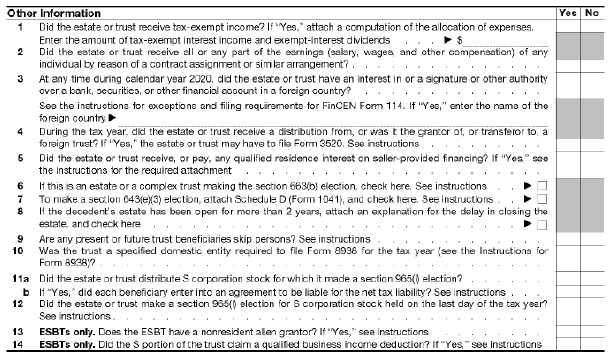

Here are some questions from the “Other Information” column of Form 1041:

Q1. Is there a tax-exempt income?

Q3. Do I need to file an FBAR (Form 114)?

Taxpayers must file an FBAR to report the following if the aggregate value of their foreign financial accounts exceed US$10,000:

Q6. Is there an option to make distributions by using the 65-day rule?

Distributions within the first 65 days following the close of the taxable year are treated as distributions for the current year. Therefore, trust accounts must be prepared, and distributions should be estimated as soon as possible after the end of the tax year. The trust will be responsible for paying taxes on any income generated by the trust that is not distributed to beneficiaries in that year.

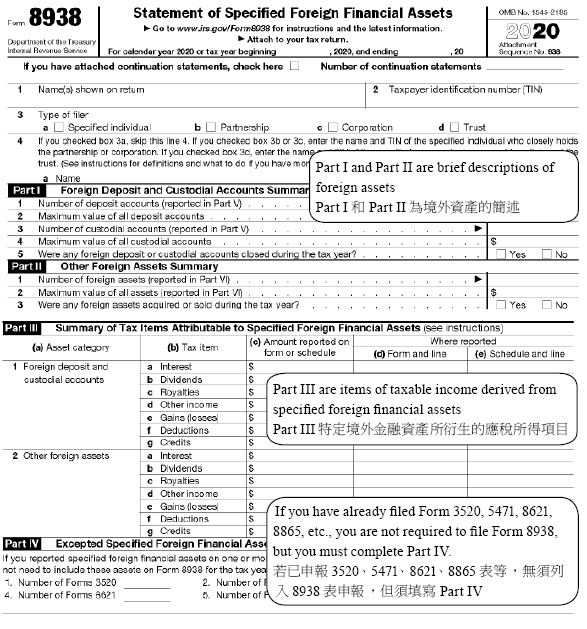

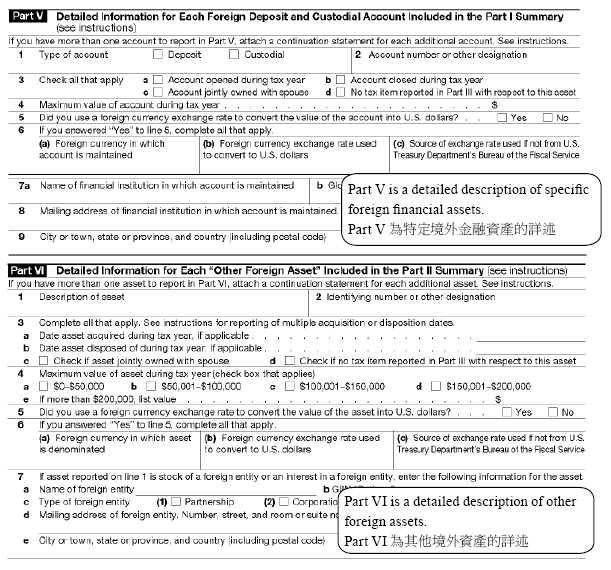

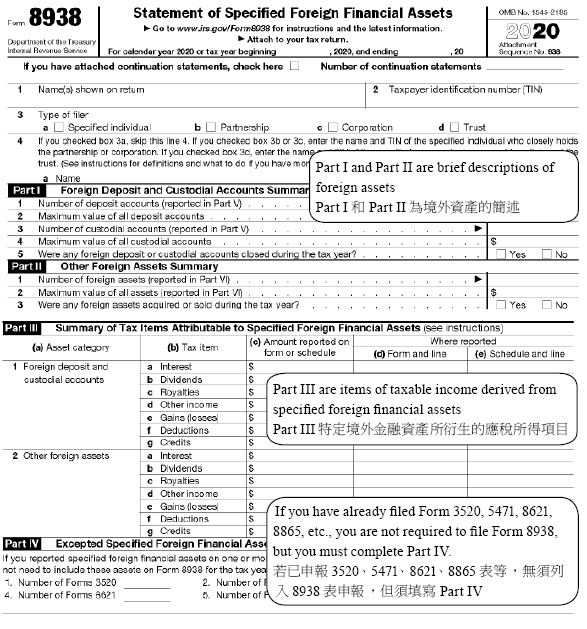

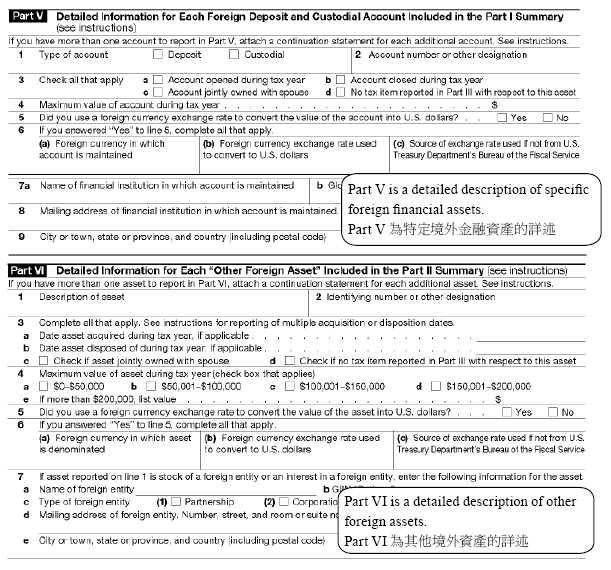

Q10. Do I need to file Form 8938?

Foreign financial assets must file Form 8938 if the aggregate value of those assets exceeds US$50,000 on the last day of the tax year or US$75,000 at any time during the tax year.

When the trust has capital gains, the total amount of capital gains (long and short term combined) is shown in column 4 of Form 1041 Capital Gain (or Loss), the long-term and short-term capital gains or losses are shown on Schedule D, and the transaction information in the current year is shown on Form 8949.

When there are both capital gains and losses, capital losses can fully offset against capital gains. When capital losses are greater than capital gains, there are two other methods to offset the gains:

① Offsetting other ordinary income. A negative amount is shown in column 4 of Form 1041 when offsetting an ordinary income, which directly deducts the ordinary income for the year, up to a maximum of US$3,000 a year.

② Capital losses can be carried forward into future years. If there is a capital gain in the following year, the capital loss will be used to offset the short-term and long-term capital gain respectively. Capital losses have no period of validity and can be carried forward into future years until exhausted.

V. Trust State Taxes

The need to file a trust state tax return is determined by state regulations. Due to the complexity of trust tax laws, it is recommended that you discuss your trust-related filing obligations with a U.S. accountant.

VI. California Form 541

(i) Filing date: April 15th of each year with an automatic filing extension to October 15th when Form 4868 is filed by April 15th.

(ii) Filing requirements: A person who is a resident of the U.S. for tax purposes and whose gross income for the year is greater than the following amounts (for tax year 2021):

In this chapter, we will discuss accounting treatment and tax return filing when a non-U.S. citizen sets up an irrevocable trust in the U.S.

Part I. Accounting Treatment and Tax Returns Filing for U.S. Assets Held by a U.S. Irrevocable Trust Established by a Non-U.S. Person

1. The Timeline of Accounting Treatment and Tax Returns Filing for a U.S. Irrevocable Trust

The following chart demonstrates time limit of tax reporting of the trust and LLC during a period (from December 2020 to October 2021) as an example.

2. Accounting Treatment:

(1) Initial phase

I. Capital inputs: Usually cash is deposited (one or more transactions) into a trust account or a trust-owned LLC bank account.

II. For real estate contributions, the fair market value or original cost basis is typically selected.

(2) Operational Phase

I. Investment - Capital Gains

(i) Investment Portfolio

Generally, the transaction and cash flow from the bank statement are used to verify investment decisions provided by the clients.

(ii) Commodities Investments

The bank statement typically does not provide information regarding the cost basis and / or capital gains resulting from the sale of commodities. However, it will provide information regarding the proceeds from the sale. Once a sale has occurred, a journal entry should be completed. The journal entries can be modified or adjusted after receipt of the Form 1099-B.

(iii) Capital gains (profits and losses)

Recognize capital gains or losses after obtaining Form 1099-B.

As a result, the cash on the account would still be equal to the bank statement and any capital gains (losses) should match numbers presented on the Form 1099-B.

II. Interest and Dividends

One should be cautious of distinguishing the interest and dividends are taxable or tax-free and preparing trust tax returns.

III. Purchase of real estate (rental income)

Whenever there is a purchase of real estate, the bank statement will show a lump-sum withdrawal. A “Settlement Statement” should be obtained in order to categorize additional costs and expenses relating to the purchase. When purchasing real estate in the U.S., expenses are usually paid out of an escrow account.

The following are some common accounting entries:

Transaction completed

If there is a balance refund:

Rental Activities

Depreciation is calculated annually depending on the type of real estate being depreciated:

- Residential Real Property is depreciated over 27.5 years using the straight-line basis method. Rental fees at the beginning and the end of the month are applied using the Mid-month Convention.

- Commercial property is depreciated over 39 years using the straight-line basis method. Rental fees at the beginning and the end of the month are applied using the Mid-month Convention.

IV. Sale of a real estate

V. Various fees

3. U.S. Tax Returns

(1) Initial phase

I. EIN (Employer Identification Number) Application

All EIN applications (mail, fax, internet) must disclose the name and Taxpayer Identification Number (e.g., SSN, ITIN or EIN number) of the principal officer, general partner, grantor, owner or trustor. These individuals or business entities, referred to by the IRS as “responsible parties,” are responsible for controlling, managing or directing the applicant entity and responsible for disposing of the funds and assets of that entity. Unless the applicant is a government entity, the responsible party must be an individual (i.e., a natural person) and not an entity.

The following are common ways to apply for an EIN:

(i) Apply Online

The Internet EIN application is the most convenient method for customers to apply for and obtain an EIN. Once the application is completed, the information will be validated during the online session and an EIN will be immediately issued. The online application process is available for all entities whose principal business, office or agency or legal residence in the case of an individual, is located in the U.S. or U.S. Territories.

(ii) Apply by Fax

Taxpayers can fax the completed Form SS-4 application to the appropriate fax number. If it is determined that the entity needs a new EIN, one will be assigned using the appropriate procedures for the entity type. If the taxpayer’s fax number is provided, a fax will be sent back with the EIN within four business days.

(iii) Apply by Mail

The processing time for an EIN application received by mail is four weeks. If it is determined that the entity needs a new EIN, one will be assigned using the appropriate procedures for the entity type and mailed to the taxpayer.

The IRS provides ways to mail or fax Form SS-4 as follows:

II. Form 3520 (Foreign Trusts and Gift Tax Returns)

(i) Filing date: April 15th of each year.

(ii) Filing requirements:

Form 3520 should be reported to the IRS, disclosing information of U.S. irrevocable trust receiving funds from offshore if the following conditions are met:

- When the trust is established, the grantor remits foreign funds into a U.S. irrevocable trust.

- Fees paid by the grantor but not paid by the trust are deemed gifts.

Form 3520, Part IV, column 54 and 55 should be reported respectively to the IRS if the following conditions are met:

- Taxpayers should complete Form 3520, Part IV, column 54, if the aggregate value of gifts or bequests he or she receives from nonresident alien or foreign estate exceeds US$100,000 during the taxable year.

- Taxpayers should complete Form 3520, Part IV, column 55, if the aggregate value of gifts or bequests he or she receives from foreign corporation or partnership exceeds US$16,815 (added May 17, 2021) during the taxable year.

What are the penalties for failing to report foreign gifts on time? This depends on the source of the gift, as explained below:

In the case of a failure to timely report foreign gifts described in section 6039F, a penalty equal to 5% of the amount of such foreign gifts applies for each month for which the failure to report continues (not to exceed a total of 25%).

If a U.S. individual fails to report the distribution received by the foreign trust, a penalty equal to 35% of the gross value of the distribution received from the foreign trust is levied. (Section 6677)

It is important to note that if the sum of money remitted to the trust in the year it is settled exceeds the Form 3520 filing threshold, the transfer must be reported in accordance with the regulations. Individuals or trusts receiving in excess of $100,000 generally should engage a U.S. accountant to assist with the filing process. It is important to note that the IRS may issue letters and / or audit taxpayers who file Form 3520, especially those who filled out the form incorrectly.

III. Form 1041 (Federal Trust Tax Form)

Usually, the capital invested in the beginning of the year after the trust is established will not generate much income. However, if the following conditions are met, taxpayers are required to file Form 1041:

(i) Gross Income (GI) greater than US$600

(ii) Taxable income for the year

(iii) A beneficiary who is a nonresident alien

(2) Operation Phase

After the first year of normal operation, the trust is required to file tax returns as follows:

I. Form 1099-NEC

LLCs under the trust may be required to file Form 1099-NEC (Nonemployee Compensation) to report payments made during your trade or business to independent contractors for the taxable year.

If the following four conditions are met, you must generally report a payment as NEC.

(i) You made the payment to someone who is not your employee.

(ii) You made the payment for services during your trade or business (including government agencies and nonprofit organizations).

(iii) You made the payment to an individual, partnership, estate, or, in some cases, a corporation.

(iv) You made payments to the payee of at least US$600 during the year.

- Note: In the beginning of tax year 2020, you must use Form 1099-NEC to report the NEC previously reported in Box 7 of Form 1099-MISC.

According to the IRS, Form 1099-MISC is issued to any individual or organization that makes a payment to the taxpayer equal to or greater than US$600 (or rest) during the taxable year.

III. Form 1041 (Federal Trust Tax Form)

(i) Filing date: April 15th of each year. Form 7004 may be filed by April 15th and can be extended to September 30th.

(ii) Filing requirements: Form 1041 is required if any of the following conditions is met:

- There is taxable income for the year

- Gross income greater than US$600

- There’s a beneficiary who is a nonresident alien

- Late filing penalty: a penalty of 5% of the tax due for each month, up to a maximum of 25%.

- Late payment penalty: a penalty of 0.5% of the tax due for each month, up to a maximum of 25%.

Trust tax is computed by subtracting the required deductions and exemptions from the trust’s gross income for the tax year. Fiduciary fees, attorney, accountant return preparer fees and other expenses are subject to Section 67(e) and the following limitations on the amount of the deduction based on the proportion of the exemption income.

- Fees paid or incurred in connection with the administration of the trust

- Management fee will only be incurred if the property is held in the trust

The following is a calculation of the fees and solicitor’s fees of a trustee company:

- Assuming the actual payment of the attorney’s fee is US$15,000

* Tax exempt income US$30,000

* US$30,000 / US$50,000 = 60%

* US$15,000 × 0.6 = 9,000 (expenses corresponding to the tax-free income are not deductible)

* US$15,000 - 9,000 = 6,000 (deductible attorney’s fee)

2021 Tax Rate, Form 1041

IV. Introduction on Schedules of Form 1041

The following are common schedules of Form 1041:

(i) Schedule B - Calculation of Income Distribution Deduction

To prevent double taxation, the amount of distribution to beneficiaries must be deducted from taxable income up to the maximum amount of Distributable Net Income (DNI) when calculating trust taxable income. Although tax-exempt interest is not included in taxable income, it is included in DNI because it can be distributed to beneficiaries (however, expenses related to tax-exempt income should be deducted when tax-exempt income is included in DNI). In addition, capital gains are not included in DNI because they are not distributed back to the principal of the trust.DNI is calculated as follows:

IDD (Income Distribution Deduction) as an amount of deduction on the trust’s tax return (Form 1041, line 18).

DNI (Distributable Net Income) - Tax-Exempt Income; or

Actual Distribution - Tax-Exempt Income whichever is smaller.

The following Schedule B and other columns of Form 1041 are provided for reference (“Other information” is shown on the right page):

Here are some questions from the “Other Information” column of Form 1041:

Q1. Is there a tax-exempt income?

Q3. Do I need to file an FBAR (Form 114)?

Taxpayers must file an FBAR to report the following if the aggregate value of their foreign financial accounts exceed US$10,000:

- A trust holding more than 50% of a corporation is required to declare the corporation’s foreign financial account.

- Foreign financial accounts and signature authority accounts held by the trust itself.

Q4. Have you received any distribution from a foreign trust or transferred any trust assets to a foreign trust? Do I need to file Form 3520?Q6. Is there an option to make distributions by using the 65-day rule?

Distributions within the first 65 days following the close of the taxable year are treated as distributions for the current year. Therefore, trust accounts must be prepared, and distributions should be estimated as soon as possible after the end of the tax year. The trust will be responsible for paying taxes on any income generated by the trust that is not distributed to beneficiaries in that year.

Q10. Do I need to file Form 8938?

Foreign financial assets must file Form 8938 if the aggregate value of those assets exceeds US$50,000 on the last day of the tax year or US$75,000 at any time during the tax year.

(ii) Schedule D - Capital Gains (Losses)

The amount of capital gain or loss from a Form 1099-B issued by a broker should be filled in Schedule D. Form 1040, Schedule D of the trust tax form is substantially the same as Form 1040, Schedule D of the individual tax form, see the following instructions:When the trust has capital gains, the total amount of capital gains (long and short term combined) is shown in column 4 of Form 1041 Capital Gain (or Loss), the long-term and short-term capital gains or losses are shown on Schedule D, and the transaction information in the current year is shown on Form 8949.

When there are both capital gains and losses, capital losses can fully offset against capital gains. When capital losses are greater than capital gains, there are two other methods to offset the gains:

① Offsetting other ordinary income. A negative amount is shown in column 4 of Form 1041 when offsetting an ordinary income, which directly deducts the ordinary income for the year, up to a maximum of US$3,000 a year.

② Capital losses can be carried forward into future years. If there is a capital gain in the following year, the capital loss will be used to offset the short-term and long-term capital gain respectively. Capital losses have no period of validity and can be carried forward into future years until exhausted.

(iii) Schedule K-1

When a U.S. beneficiary receives a distribution, the income from the K-1 needs to be filled on Form 1040 and attached Schedule E.V. Trust State Taxes

The need to file a trust state tax return is determined by state regulations. Due to the complexity of trust tax laws, it is recommended that you discuss your trust-related filing obligations with a U.S. accountant.

VI. California Form 541

More specifically, even if your U.S. irrevocable trust is established in another state, but the protector, beneficiary, or related parties under the trust is a California resident, a state tax Form 541 must be filed.

(i) Filing Requirements: if the protector, related beneficiary, or fiduciary related person is a California resident, the trustee is required to file Form 541 if any of the following conditions are met:

- Total income exceeds US$10,000 for the taxable year

- Net income exceeds US$100 for the taxable year

(ii) Filing date: April 15th. If you are unable to file on April 15th, you can get additional six months until October 15th without requiring to file for an extension, but the tax due should still be paid on April 15th to avoid late payment penalty.

(iii) Declaration:

- Situation: The trustee of the trust is a non-California tax resident and has two beneficiaries, one of whom is a California tax resident.

- Calculation:

- Fees can be split based on the proportion of the California source income (Column F / Column B above)

- The first split is calculated based on the proportion of the California tax resident trustee. Since the trust does not have a California tax resident trustee, there will be no income regarded as California source income in the first split (column C). Then the income that has not yet been distributed to California will be split again in the second split. The second split is calculated based on the proportion of the California tax resident beneficiary (column E). The proportion of the California tax resident beneficiary is 50%, so half of his or her income will be split as California source income in the second split.

VII. Form 1040 (Federal Individual Tax Return)(i) Filing date: April 15th of each year with an automatic filing extension to October 15th when Form 4868 is filed by April 15th.

(ii) Filing requirements: A person who is a resident of the U.S. for tax purposes and whose gross income for the year is greater than the following amounts (for tax year 2021):

- Single - US$12,550

- Married filing jointly or qualifying widow(er)- US$25,100

- Married filing separately - US$5

- Head of household - US$18,800

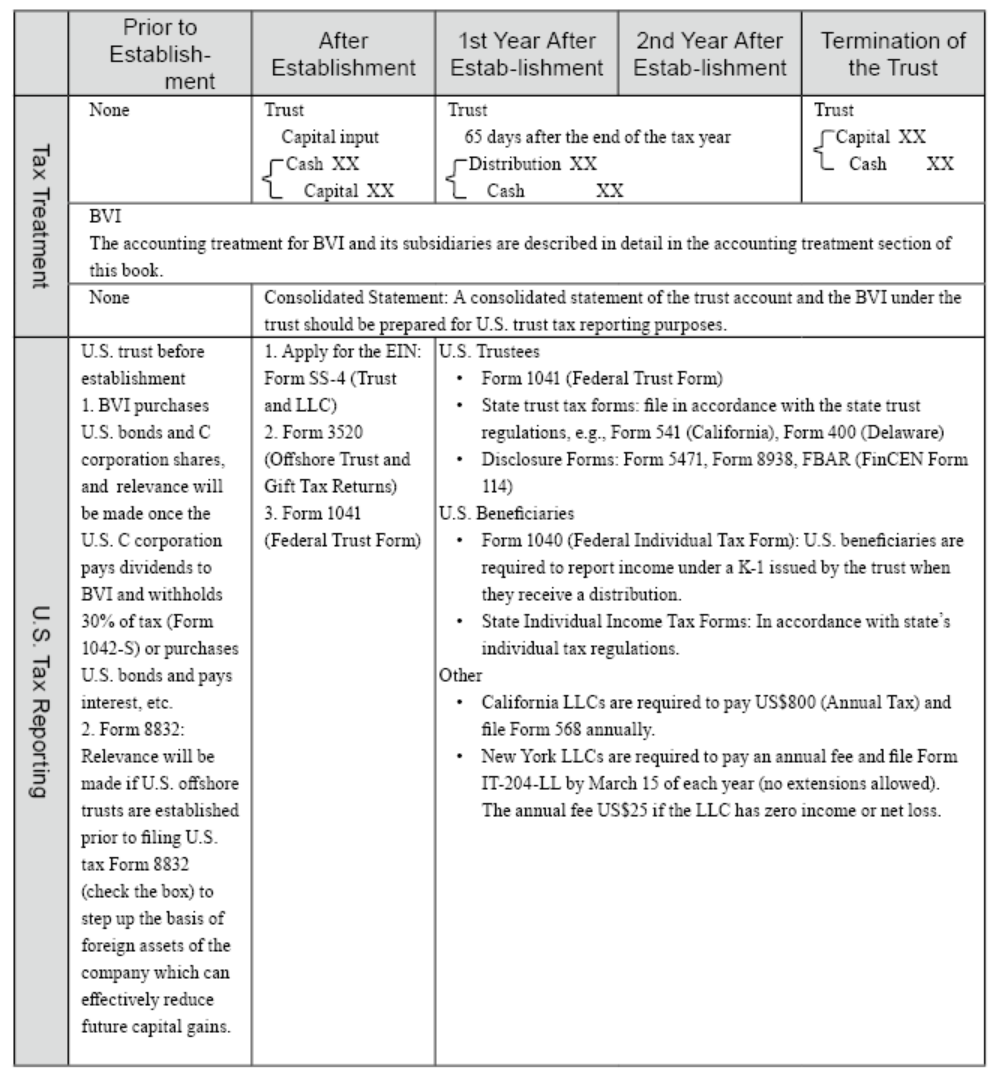

1. Annual Accounting Treatment and Tax Filings of the Trust

2. Accounting Treatment

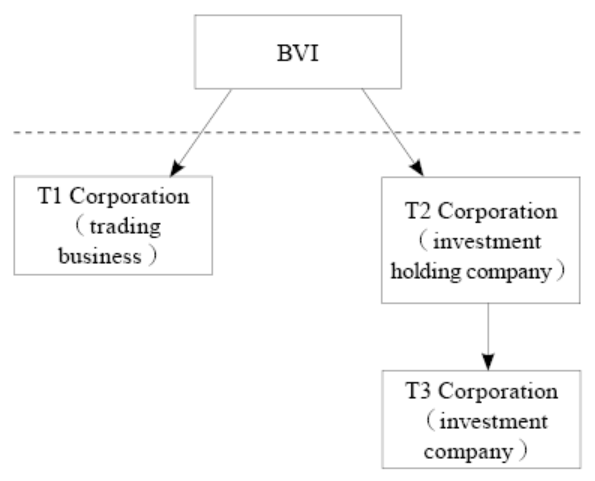

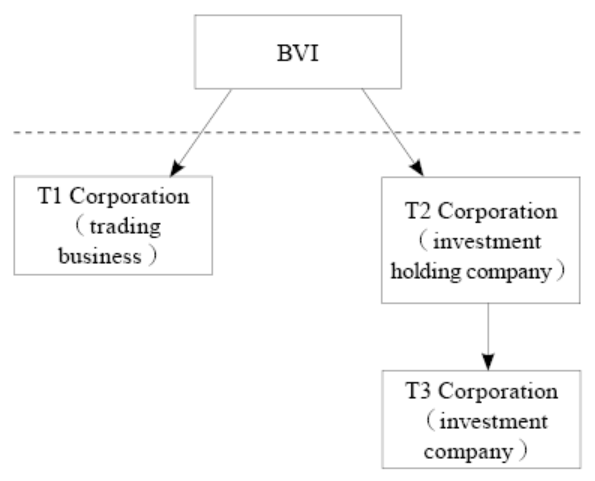

The accounting treatment of BVI assets, which are T1 subsidiary (manufacturing), T2 subsidiary (investment holding company) and T3 subsidiary (investment company), held by a U.S. irrevocable trust is described as follows:

3. U.S. Tax Filing

(1) Before the establishment of the trust

Under Section 7701 of the U.S. Tax Code (the “Check-the-box Regulations”), certain business entities are permitted to “check-the-box” by filing Form 8832 (Entity Classification Election) to select entity classification for U.S. federal income tax purposes. Under Form 8832, eligible entities include LLCs, partnerships, disregarded entities, foreign entities, and business entities that are not considered a per se corporation.

A foreign corporation may also choose other classifications of corporations through the election other than the ones under the Default Rules. For example, a wholly foreign-owned corporation (only one owner, 100% ownership) or an LLC may choose to become a “Disregarded Entity” in the U.S. through the election, which is a “Tax Transparent Entity”.

(i) Occasions for filing Form 8832:

(ii) Effective date specified on Form 8832:

(iii) 60-month limitation rule: If you have previously made an election, you may not make another election for another 60 months (5 years) after the election.

Exception: The 60-month limit may be waived unless① the company is newly formed and ② the effective date equal to the date of incorporation.

If you really want to re-elect within five years, you can apply for a Private Letter Ruling from the IRS for a fee if you meet some criteria.

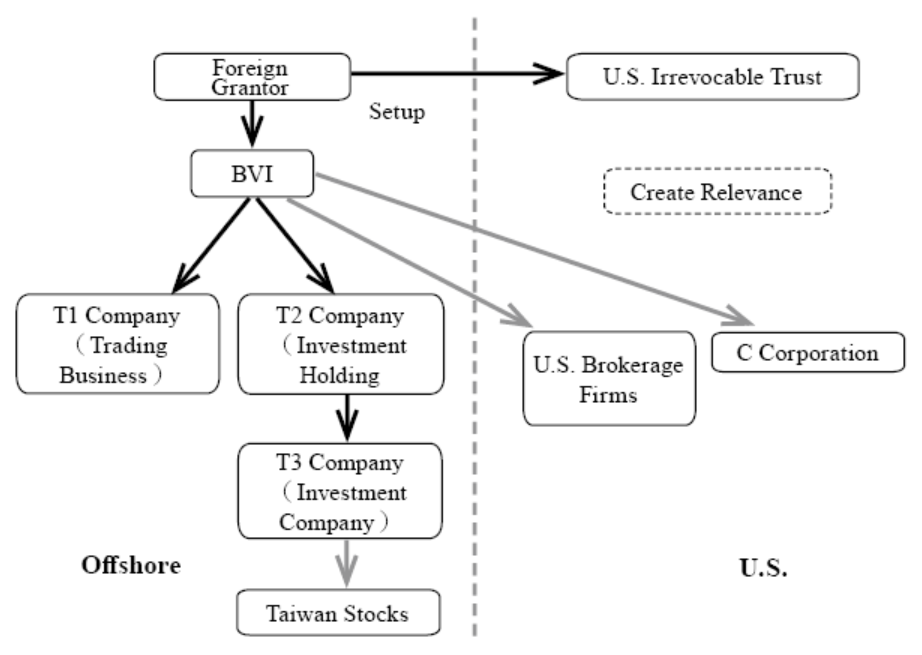

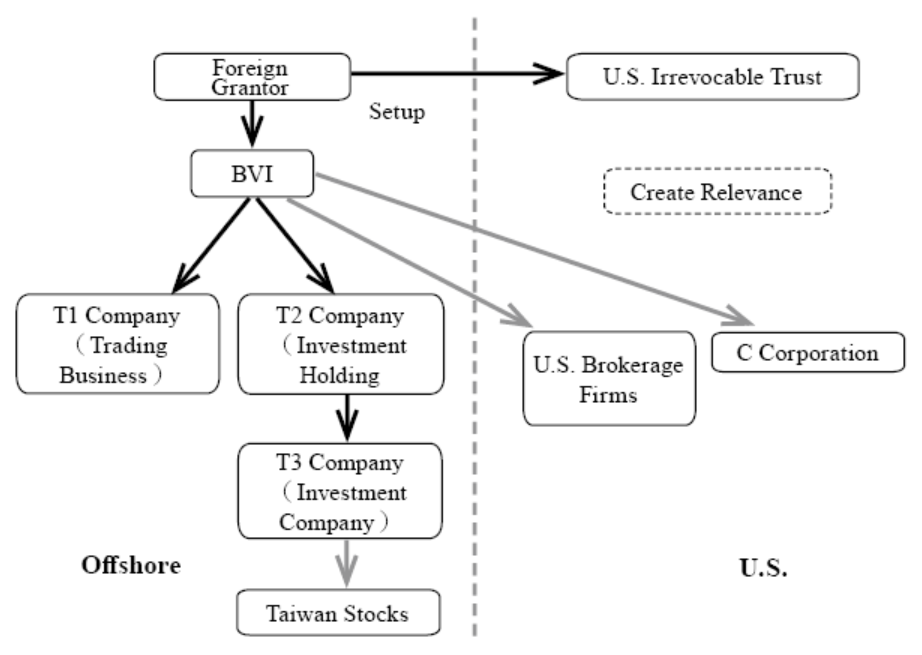

The following is the actual process for an inter vivos transfer of offshore holding assets into a U.S. irrevocable trust:

If a foreign holding company has a multi-tier ownership structure, it is advised that they should file Form 8832 (check-the-box election) from lower-tier to their upper-tier corporation, thus allowing the upper-tier holding company to create their relevance so that the assets held by the entire company are adjusted to the market value (Stepped-up Basis).

The term “relevance” can be exemplified as the following: A foreign entity can be deemed as relevant to a U.S. individual or business entity for federal tax purposes when it could impact tax returns of the U.S. individual or business entity. In practice, once a foreign entity earns interest income on treasury bills or receives dividend income, it will be deemed as relevant to the U.S. individual or business entity. Therefore, it will be subject to federal taxes and its classification will also be changed. Once a holding company files Form 8832 (check-the-box election), it is regarded as a new business after asset liquidation (asset value adjusted to market price). At this moment, if there is only one shareholder in this business entity, the holding company would be considered as the Disregarded Entity. Therefore, the assets held by the companies under the holding company tier would pass through to the trust. Then, the capital gains on the sale of assets would be lowered when the assets held by the trust are disposed in the future. Furthermore, surplus earnings distribution would not be seen as the dividend distribution before the distributions are transferred into the trust, leading the accrual income tax be lowered.

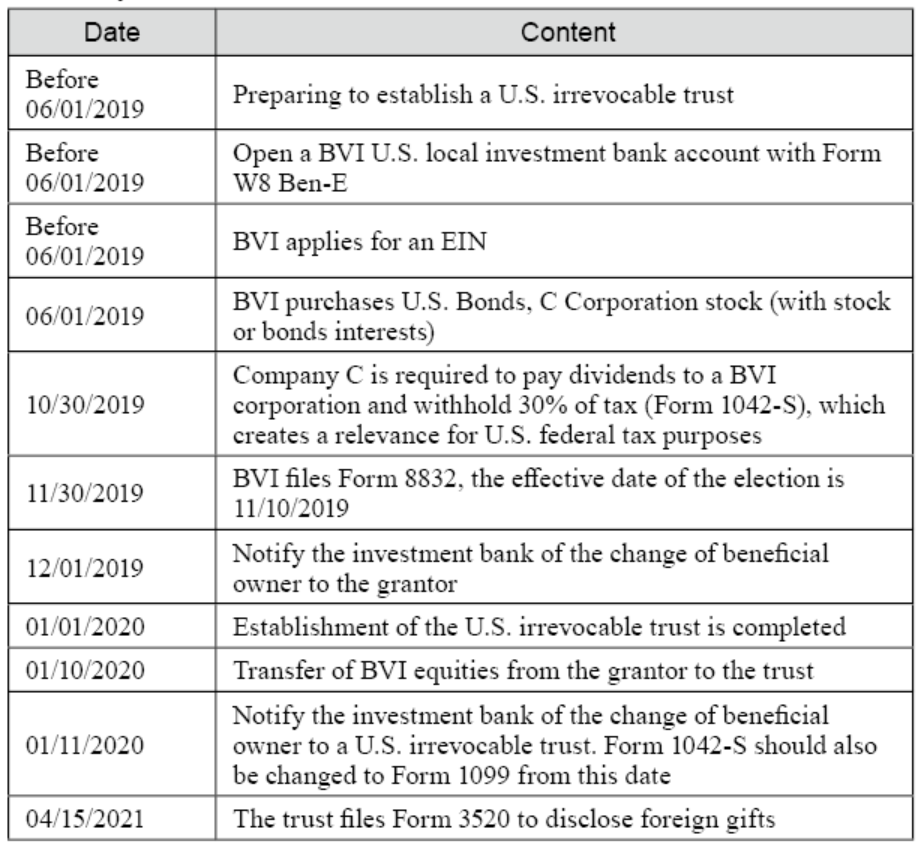

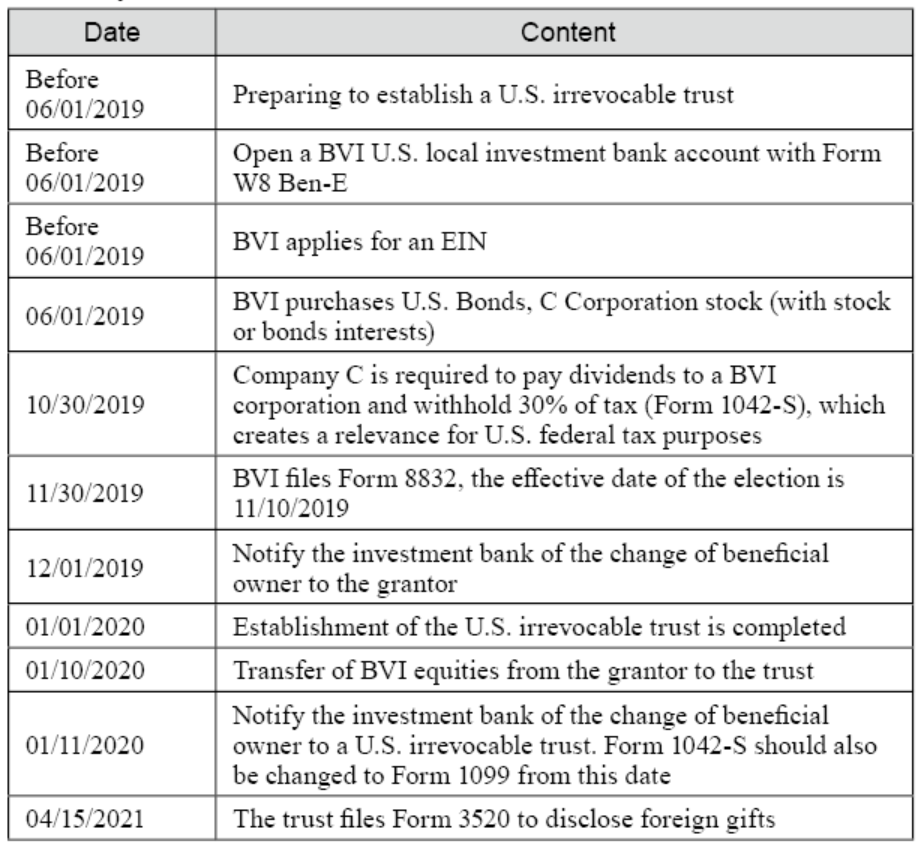

Please refer to the following table, which suggests when to generate relevance to check-the-box. This time schedule is only for reference. As the pandemic severely affects the operational procedure of the IRS in recent years, it is recommended to communicate with a professional U.S. accountant to ensure a more appropriate setup process for your trust.

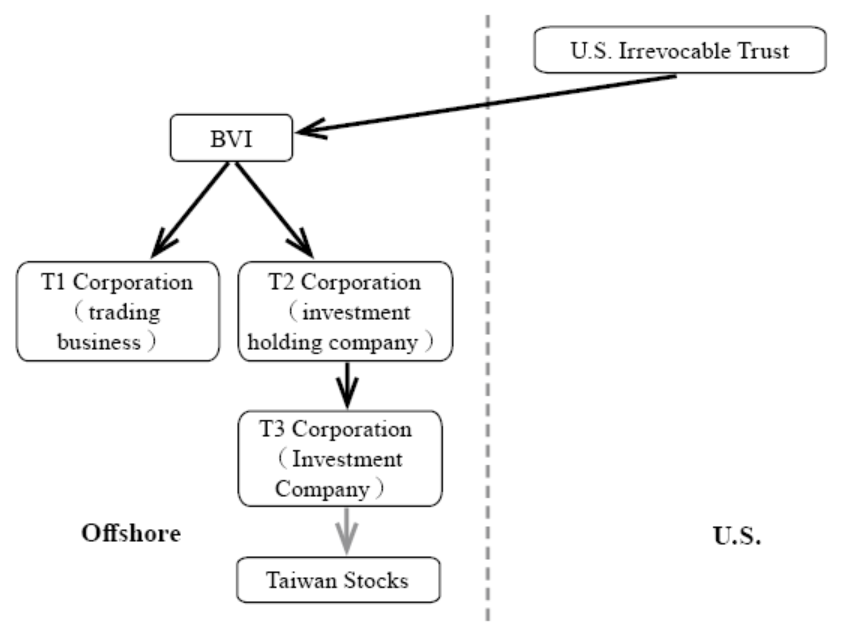

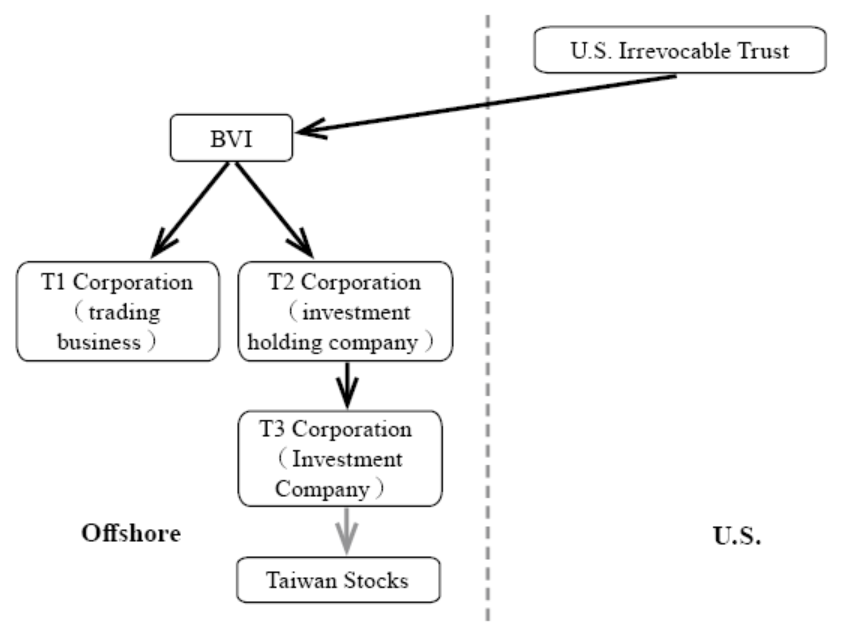

The establishment of a U.S. irrevocable trust and arrangement of the BVI into the trust will involve in U.S. trust tax filing obligations, which will be illustrated by this structure and the following consolidated statements below.

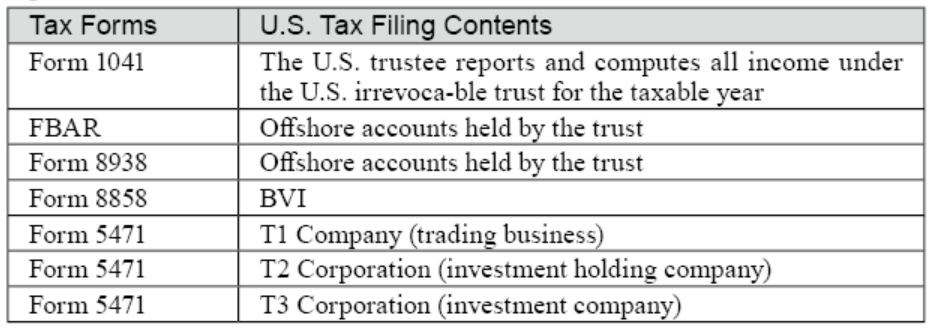

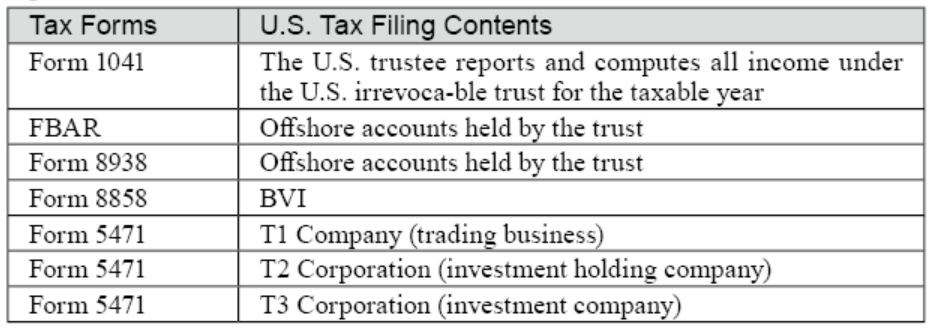

The reporting of U.S. irrevocable trust holding foreign assets is complex. It is recommended that the following tax forms are filed by a professional U.S. accountant.

After the BVI’s consolidated financial statements are combined with the trust accounts, various types of income can be accounted on Form 1041 for trust tax purposes and trust tax can also be calculated.

Example of Form1041.

Assuming there are no trust transactions and no related deductions, the trust tax return is filed as follows:

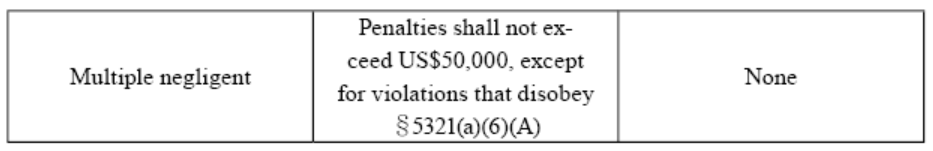

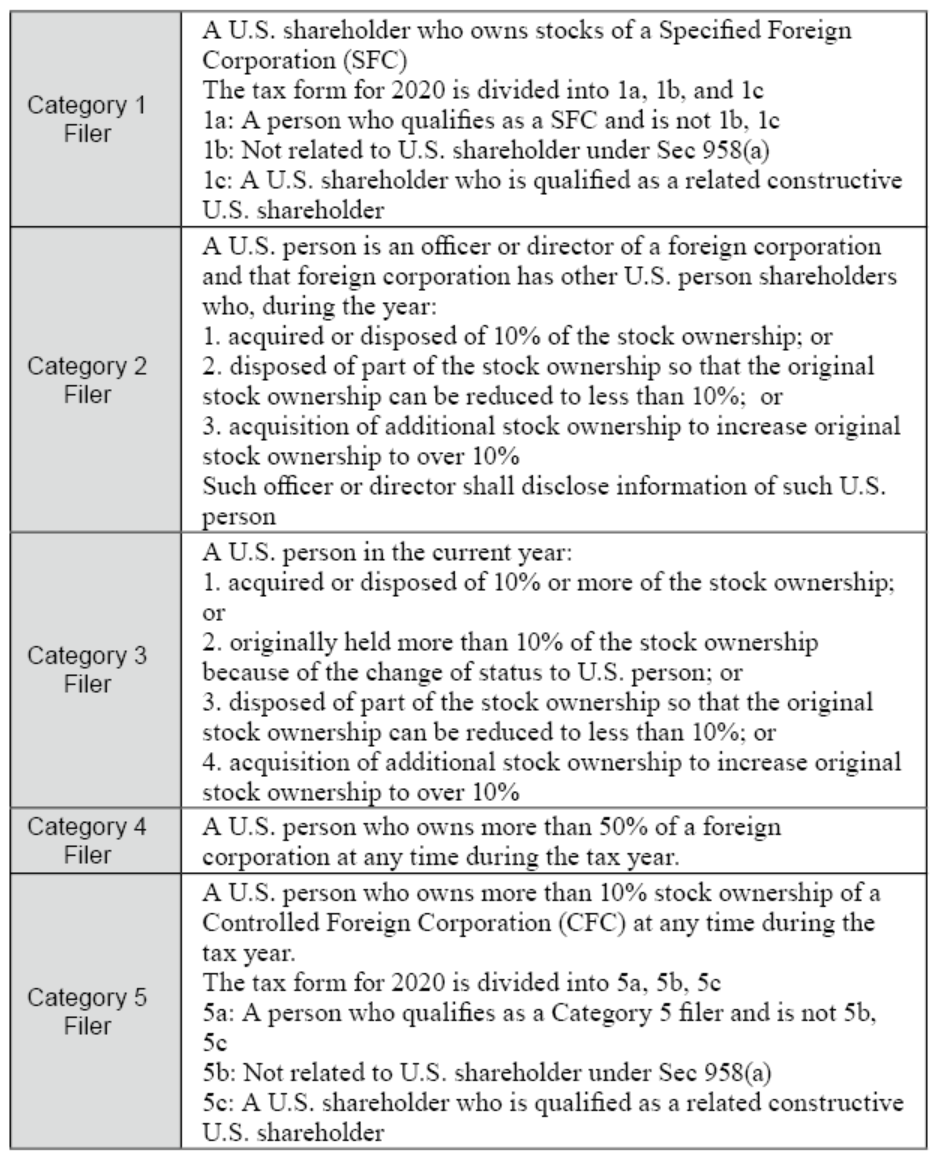

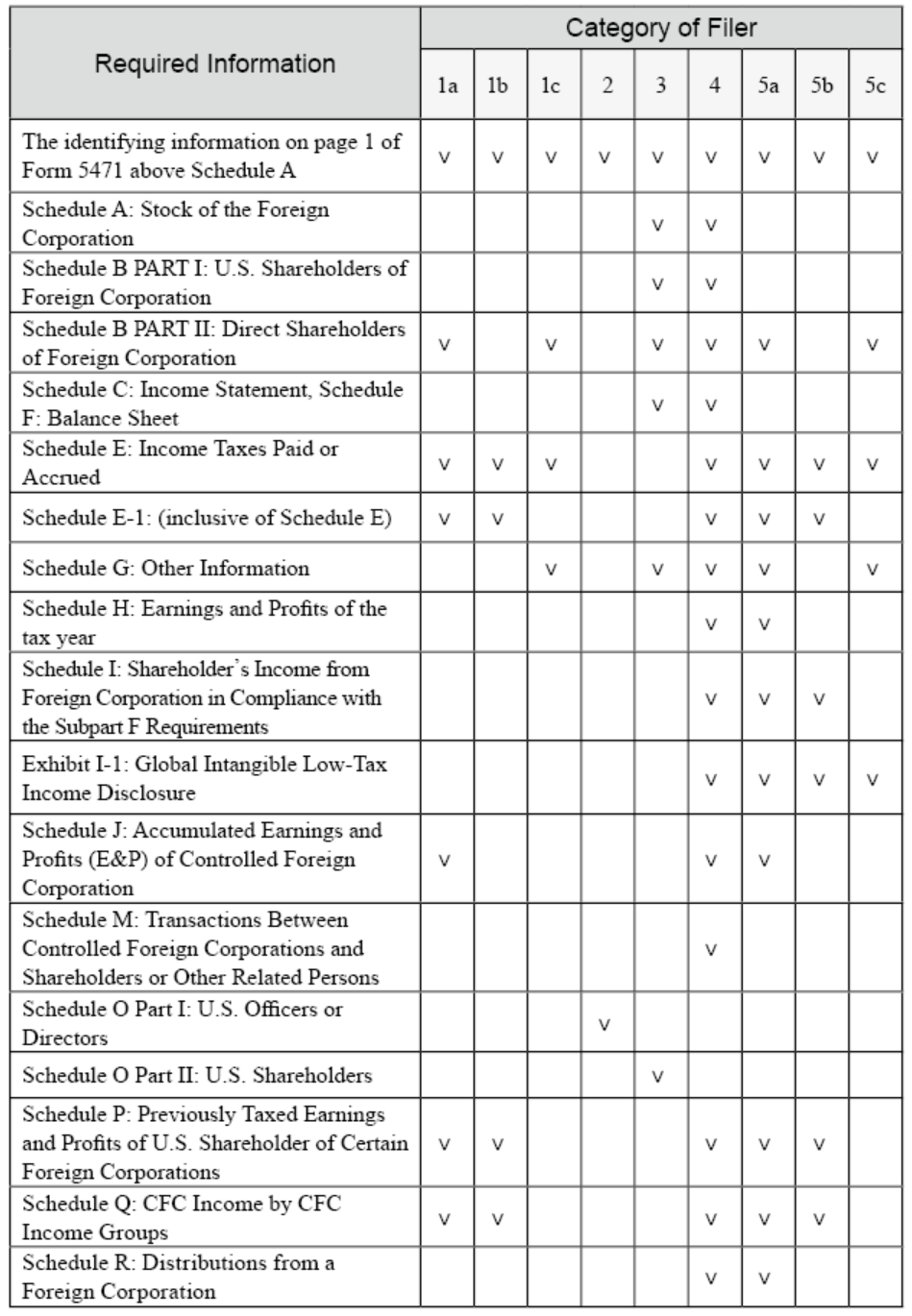

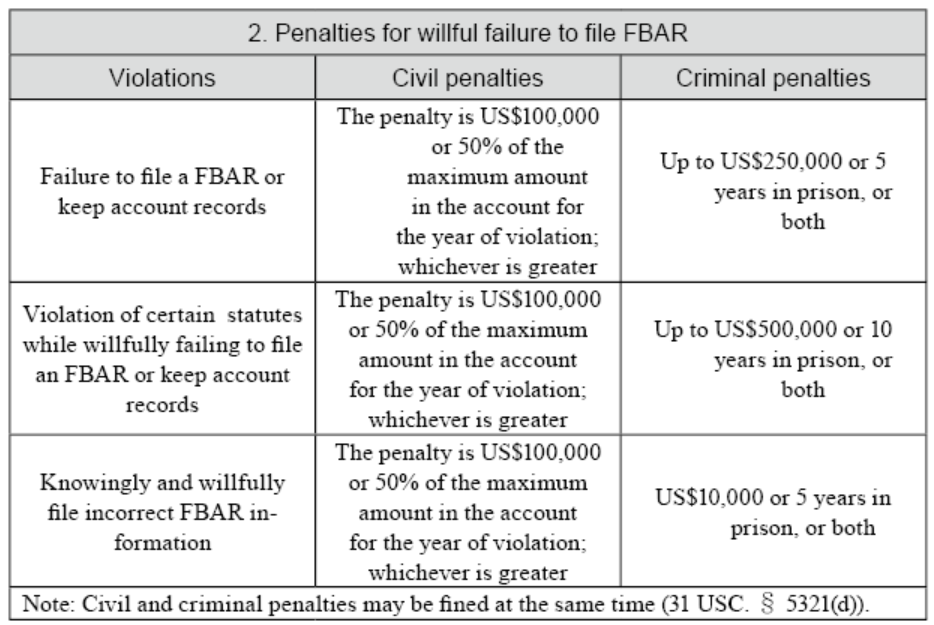

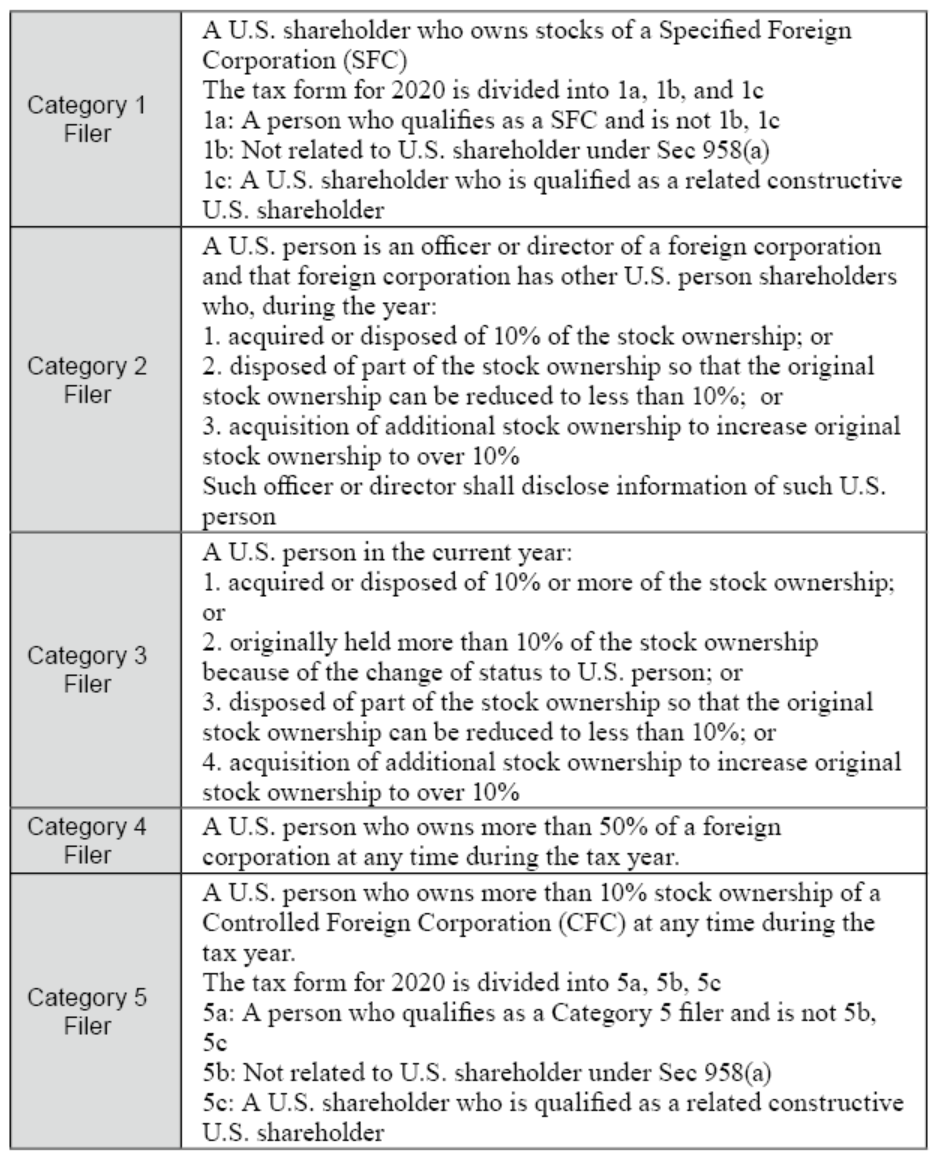

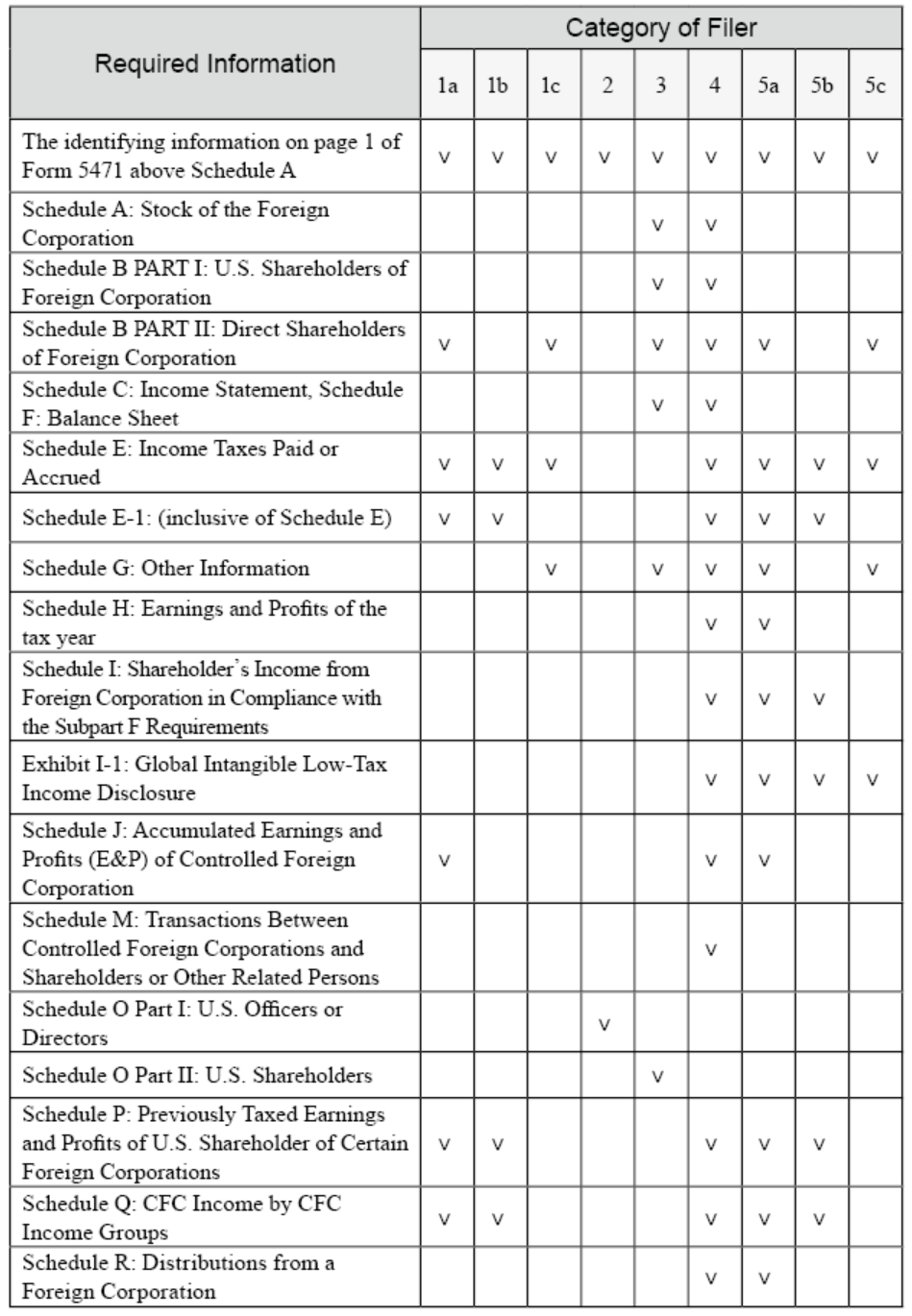

The following are the definitions of the five category filers on Form 5471, with the first category divided into 1a, 1b, and 1c and the fifth category divided into 5a, 5b, and 5c in the 2020 tax year.

Under the relevant reporting requirements, a U.S. person should include: a U.S. citizen or tax resident, a U.S. C corporation, a U.S. partnership, a U.S. estate or trust.

② Definition of a U.S. Shareholder

A U.S. Shareholder is any U.S. person who owns 10% of a foreign corporation, including individuals, corporations, trusts, and partnerships.

③ Definition of a Specified Foreign Corporation (SFC)

In practice, one of the most common situations in which U.S. persons are required to file Form 5471 is when they hold equity interests in a CFC (“Controlled Foreign Corporation”), which qualifies as Category 4 or 5 filers.

To determine if an offshore U.S. corporation is a CFC, it must meet both of the following tests:

1 Internal Revenue Code §952: SUBPART F INCOME DEFINED.參考美國《國內稅收法》§952:定義SUBPART F INCOME DEFINED。

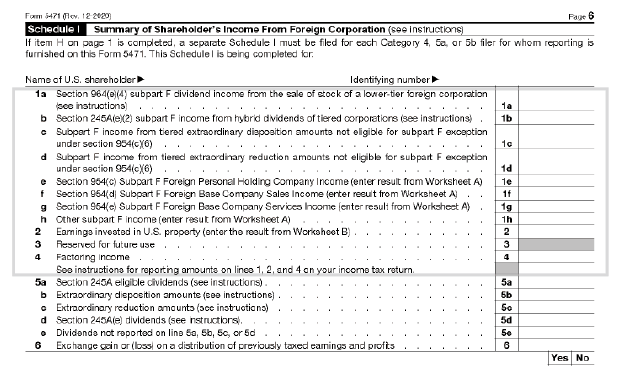

Subpart F Income has a complex classification, and it is mainly classified according to IRC section 952 regulations as follows:

Deduction of Subpart F Income

When calculating the Subpart F income, the cost of goods sold and the operating expenses of the CFC can be deducted from the Subpart F income. However, it is recommended that readers consult a professional accountant in advance.

Allowance of Subpart F Income

The application of the above allowances requires a complex and technical process. Hence, readers are advised to consult and discuss with a professional accountant.

(i) Insurance income losses

(ii) Foreign personal holding company income losses

(iii) Foreign company sales revenue losses

(iv) Foreign company service income losses

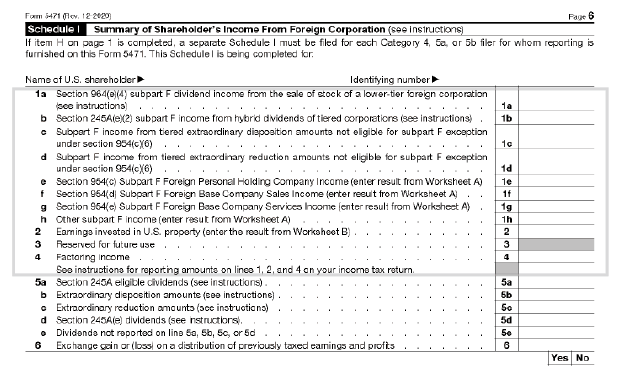

The following is Schedule I of Form 5471:

2. Accounting Treatment

The accounting treatment of BVI assets, which are T1 subsidiary (manufacturing), T2 subsidiary (investment holding company) and T3 subsidiary (investment company), held by a U.S. irrevocable trust is described as follows:

3. U.S. Tax Filing

(1) Before the establishment of the trust

I. Application for EIN (Employer Identification Number)

BVI and other jurisdictions are all required to apply for EIN. The application process is the same as on pages 237 to 238.

II. Form 8832 (Check-the-Box Election)

This election has been available to enterprise since January 1st, 1997 and is intended to reduce disputes between the IRS and enterprise.Under Section 7701 of the U.S. Tax Code (the “Check-the-box Regulations”), certain business entities are permitted to “check-the-box” by filing Form 8832 (Entity Classification Election) to select entity classification for U.S. federal income tax purposes. Under Form 8832, eligible entities include LLCs, partnerships, disregarded entities, foreign entities, and business entities that are not considered a per se corporation.

- What is a Per Se Corporation?

A foreign corporation may also choose other classifications of corporations through the election other than the ones under the Default Rules. For example, a wholly foreign-owned corporation (only one owner, 100% ownership) or an LLC may choose to become a “Disregarded Entity” in the U.S. through the election, which is a “Tax Transparent Entity”.

(i) Occasions for filing Form 8832:

- When you want to change the entity’s classification: ①original classification → new classification; ② old classification → new classification (previously elected).

- If a corporation wants to file a tax return using its original classification, it does not need to file Form 8832.

(ii) Effective date specified on Form 8832:

- No earlier than 75 days and no later than 12 months on the effective date of which the election is filed.

- If the effective date is 75 days earlier than the date on which the election is filed, it will be effective 75 days prior to the date it was filed. If the effective date is 12 months later than the date on which the election is filed, it will be effective 12 months after the date it was filed.

- If no effective date is specified in the form, effective date equal to election date.

(iii) 60-month limitation rule: If you have previously made an election, you may not make another election for another 60 months (5 years) after the election.

Exception: The 60-month limit may be waived unless① the company is newly formed and ② the effective date equal to the date of incorporation.

If you really want to re-elect within five years, you can apply for a Private Letter Ruling from the IRS for a fee if you meet some criteria.

The following is the actual process for an inter vivos transfer of offshore holding assets into a U.S. irrevocable trust:

If a foreign holding company has a multi-tier ownership structure, it is advised that they should file Form 8832 (check-the-box election) from lower-tier to their upper-tier corporation, thus allowing the upper-tier holding company to create their relevance so that the assets held by the entire company are adjusted to the market value (Stepped-up Basis).

The term “relevance” can be exemplified as the following: A foreign entity can be deemed as relevant to a U.S. individual or business entity for federal tax purposes when it could impact tax returns of the U.S. individual or business entity. In practice, once a foreign entity earns interest income on treasury bills or receives dividend income, it will be deemed as relevant to the U.S. individual or business entity. Therefore, it will be subject to federal taxes and its classification will also be changed. Once a holding company files Form 8832 (check-the-box election), it is regarded as a new business after asset liquidation (asset value adjusted to market price). At this moment, if there is only one shareholder in this business entity, the holding company would be considered as the Disregarded Entity. Therefore, the assets held by the companies under the holding company tier would pass through to the trust. Then, the capital gains on the sale of assets would be lowered when the assets held by the trust are disposed in the future. Furthermore, surplus earnings distribution would not be seen as the dividend distribution before the distributions are transferred into the trust, leading the accrual income tax be lowered.

Please refer to the following table, which suggests when to generate relevance to check-the-box. This time schedule is only for reference. As the pandemic severely affects the operational procedure of the IRS in recent years, it is recommended to communicate with a professional U.S. accountant to ensure a more appropriate setup process for your trust.

(2) Initial phase

I. Application for EIN

All trusts must apply for an EIN, and the application process is the same as on pages 237 to 238.

II. Form 3520 (Foreign Trusts and Gift Tax Returns)

(i) Filing date: April 15 of each year.

(ii) Filing requirements: Form 3520 should be reported to the IRS, disclosing information of U.S. irrevocable trust receiving funds from offshore if the following conditions are met:

- When the trust is established, the grantor remits Foreign funds into a U.S. irrevocable trust.

- Fees paid by the grantor but not paid by the trust are deemed as gifts.

- Form 3520, Part IV, column 54 and 55 should be reported respectively to the IRS if the following conditions are met:

- Taxpayers should complete Form 3520, Part IV, column 54, if the aggregate value of gifts or bequests he or she receives from nonresident alien or foreign estate exceeds US$100,000 during the taxable year.

- Taxpayers should complete Form 3520, Part IV, column 55, if the aggregate value of gifts or bequests he or she receives from foreign corporation or partnership exceeds US$16,649 during the taxable year.

(iii) Penalties for failure to report foreign gifts

What are the penalties for failing to report foreign gifts on time? This depends on the source of the gift, as explained below.- If Form 3520 is not reported, a penalty of 5% per month of the total value of the foreign gift or bequest is levied (but not more than 25% of the gift).

- If a U.S. individual fails to report the distribution received by the foreign trust, a penalty of 35% of the total value of the distribution received from the foreign trust is levied. (Section 6677)

III. Form 1041 (Federal Trust Tax Form)

Usually, the capital invested in the beginning of the year after the trust is established will not generate much income. However, if the following conditions are met, taxpayers are required to file Form 1041:

(i) Gross Income (GI) greater than US$600

(ii) Taxable income for the year

(iii) A beneficiary who is a nonresident alien

(3) Operation PhaseThe establishment of a U.S. irrevocable trust and arrangement of the BVI into the trust will involve in U.S. trust tax filing obligations, which will be illustrated by this structure and the following consolidated statements below.

The reporting of U.S. irrevocable trust holding foreign assets is complex. It is recommended that the following tax forms are filed by a professional U.S. accountant.

I. Form 1041 (Federal Trust Tax Form)

The relevant reporting requirements are the same as those for U.S. assets held in a U.S. irrevocable trust.After the BVI’s consolidated financial statements are combined with the trust accounts, various types of income can be accounted on Form 1041 for trust tax purposes and trust tax can also be calculated.

Example of Form1041.

Assuming there are no trust transactions and no related deductions, the trust tax return is filed as follows:

II. Disclosure Form: Form 8938

(i) Filing requirements: U.S. irrevocable trusts that meet the specified domestic entity requirements and hold specified foreign assets that exceeds the reporting threshold are required to report all specified foreign assets on Form 8938.

According to Section 7701(a)(30)(E), if a U.S. trust has one or more specified individuals as beneficiaries for the tax year, then the trust will be treated as a specified domestic entity.

(ii) Reporting threshold: the total value of all foreign assets exceeds US$50,000 on the last day of the tax year or US$75,000 at any time of the tax year.

(iii) Filing Date: File with Form 1041

Failure to file the correct Form 8938 in a timely manner or miscalculation of tax liability due to undisclosed specified foreign asset may result in penalties.

- Failing to file Form 8938

- Continuing fail to file

III. FBAR

(i) Filing requirements: A U.S. person who owns any financial account, which includes bank accounts (savings, checking or fixed deposits, etc.), securities accounts and insurances with cash value, etc., with a foreign financial institution that has a financial interest and a signature authority or other right to such account, and whose total account value exceeds US$10,000 on any day between January 1st and December 31th of each year must file FinCEN Form 114.

In the case of a U.S. irrevocable trust, if the trust itself, the trustee of the trust, or the agent of the trust meets the following condition, then the beneficiary of the trust is directly or indirectly entitled to more than 50% of the economic benefits of the trust’s assets or income and would not be required to report FBAR:- a U.S. person

- files a FBAR to disclose foreign financial accounts info of a trust

(ii) Filing date: April 15th of each year, with an automatic filing extension to October 15th.

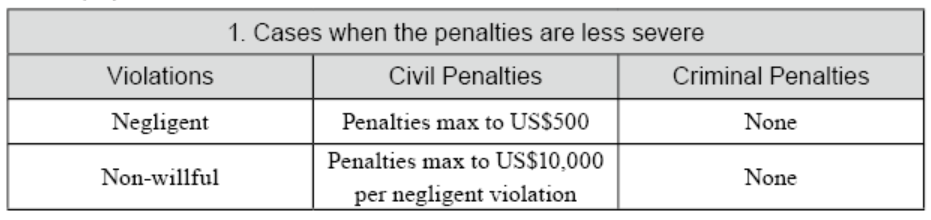

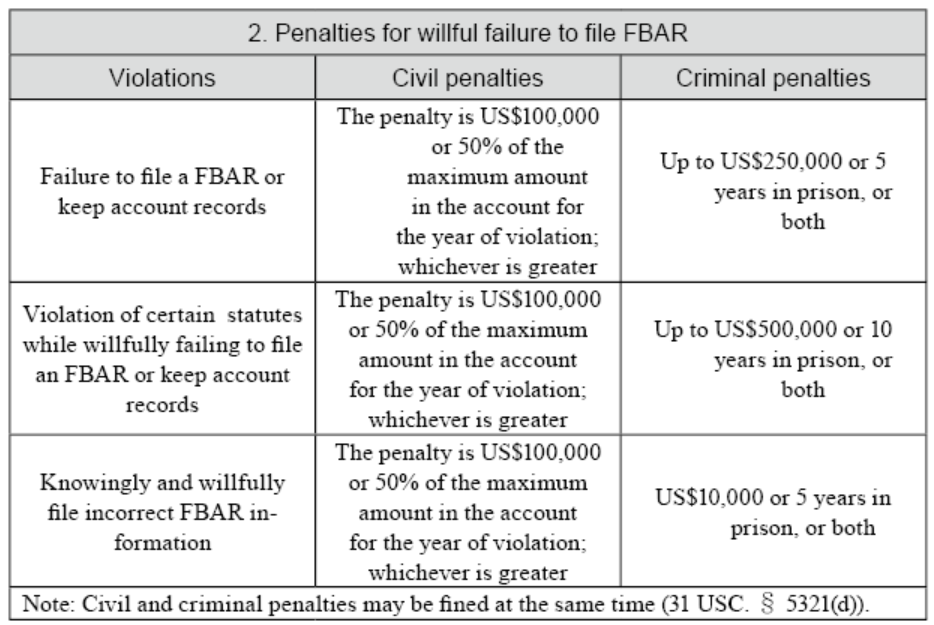

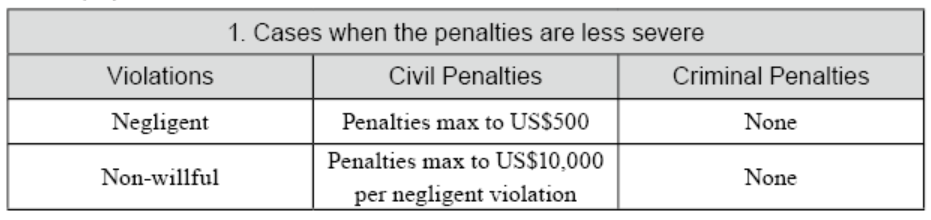

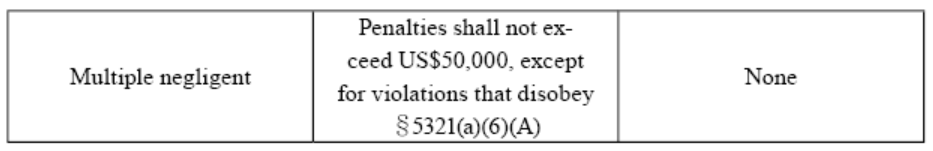

(iii) Penalties for failure to file FinCEN Form 114

IV. Form 8858

U.S. persons holding foreign disregarded entities are required to report Form 8858 (e.g., profit and loss summary, simplified balance sheet, etc.)

(i) Filing requirements: Specified U.S. person operates FBs (Foreign Branches) or own FDEs (Foreign Disregarded Entities) directly, indirectly, or constructively. This form and schedule are filed to conform the regulations in Section 6011, 6012, 6031, 6038 and other related regulations.

(ii) Filing date: Same as the due date of the income tax return or other related disclosure tax return (including the extension date)

(iii) Relevant definitions of Form 8858:

Definition of a U.S. person: A U.S. person includes a U.S. citizen or tax resident, a U.S. C corporation, a U.S. partnership, U.S. domestic estate or trust under the relevant reporting requirements. A U.S. domestic trust referred here must meet the following conditions:- U.S. court test

- One or more U.S. persons have substantial control over the trust

(iv) Penalty: US$10,000 for failure to file. If failure to file continues within 90 days after the IRS notice, a penalty of US$10,000 will be imposed per month and up to a maximum of US$50,000. In addition, the filer may be criminally liable for willful non-reporting or misreporting.

V. Form 5471

The primary purpose of this form is to monitor the tax liability of U.S. corporations or U.S. shareholders who invest in or operate through subsidiaries in low-tax or tax-exempt countries, trying to retain their foreign revenue from the subsidiaries without distributing them back to the U.S., which may raise concerns regarding incorrect tax disclosure from U.S. taxpayers. Hence, the regulations governing the CFCs (Controlled Foreign Corporations) were enacted and Form 5471 is required to be filed annually by the U.S. shareholders to disclose specific information regarding the CFCs.(i) Filing date: April 15th of each year, along with the U.S. Income Tax Return for Estates and Trusts (Form 1041). The filing deadline would be September 30th if Form 7004(extension form) was filing in advance.

(ii) Penalty: A US$10,000 penalty is imposed for failure to file Form 5471 on time. If failure to file continues after the IRS notice within 90 days then additional penalties of US$10,000 will be imposed per company per month, up to a maximum of US$50,000. Hence the total amount of penalty will be US$60,000.

The following are the definitions of the five category filers on Form 5471, with the first category divided into 1a, 1b, and 1c and the fifth category divided into 5a, 5b, and 5c in the 2020 tax year.

(iii) Information required to be disclosed on Form 5471 by category

(iv) Definitions relating to Form 5471

① Definition of a U.S. Person Under the relevant reporting requirements, a U.S. person should include: a U.S. citizen or tax resident, a U.S. C corporation, a U.S. partnership, a U.S. estate or trust.

② Definition of a U.S. Shareholder

A U.S. Shareholder is any U.S. person who owns 10% of a foreign corporation, including individuals, corporations, trusts, and partnerships.

③ Definition of a Specified Foreign Corporation (SFC)

- If a foreign corporation is a Controlled Foreign Corporation (CFC), it will be considered as a Specified Foreign Corporation (SFC); or

- A foreign corporation is a Specified Foreign Corporation (SFC) if it is owned by a U.S. domestic corporation.

In practice, one of the most common situations in which U.S. persons are required to file Form 5471 is when they hold equity interests in a CFC (“Controlled Foreign Corporation”), which qualifies as Category 4 or 5 filers.

To determine if an offshore U.S. corporation is a CFC, it must meet both of the following tests:

- U.S. Shareholder Test: Under IRC §957, if a U.S. person who owns or is deemed to own 10% or more of the total combined voting power of all classes of voting stock of a CFC, then it is considered as a U.S. shareholder.

- 50% Shareholding Test: If the U.S. shareholders own more than 50% of the total combined voting power of all classes of voting stock or owned more than 50% of the total value of the stock of the corporation.

In addition to filing the complicated Form 5471, CFC also needs to consider the calculation of Subpart F Income and GILTI then add those income in their relative tax filings.

VI. Introduction to Subpart F Income

Under U.S. tax law, to prevent U.S. taxpayers from retaining their business profits abroad and thereby deferring or avoiding U.S. tax liability, U.S. shareholders are required to include the portion of the undistributed foreign income of the CFC that is deemed as Subpart F Income when filing them in their U.S. tax return based on the shareholding ratio in the current year.11 Internal Revenue Code §952: SUBPART F INCOME DEFINED.參考美國《國內稅收法》§952:定義SUBPART F INCOME DEFINED。

Subpart F Income has a complex classification, and it is mainly classified according to IRC section 952 regulations as follows:

(i) Insurance income: Insurance income from the CFC countries. (IRS section 953)

(ii) Foreign Base Company Income (IRC Section 954) includes:

- FPHCI (Foreign Personal Holding Company Income)

- Foreign base company sales income

- Foreign base company service income

- International Boycott Income as defined in IRC Section 952(a)(3)

- Illegal bribes, kickbacks or other payment as defined in IRC Section 952(a)(4)

- Income described in IRC Section 952(a)(5) derived from any foreign country that complies with IRC Section 901(j)

Deduction of Subpart F Income

When calculating the Subpart F income, the cost of goods sold and the operating expenses of the CFC can be deducted from the Subpart F income. However, it is recommended that readers consult a professional accountant in advance.

Allowance of Subpart F Income

(i) De Minimis Rule

If the total annual insurance income (IRC Section 953) and the foreign company income (IRC Section 954) is less than 5% of the CFC’s total annual income or if the total annual foreign company income does not exceed US$1 million, the CFC may exclude the foreign company income from the Subpart F Income in the current year. Let’s assume Company A is a CFC and qualifies as a foreign personal holding company and the company has an annual revenue of US$5 million with a rental income of US$150,000. Since its rental income only represents 3% of its total annual revenue, its rental income qualifies under the “de minimis” rule and can be excluded from the Subpart F income.

(ii) Exception for certain income subject to high foreign taxes

CFC’s annual insurance income (IRC Section 953) and foreign company income (IRC Section 954) would qualify for the high tax rate exclusion if the tax paid abroad exceeds 90% of the 21% of the maximum U.S. corporate tax rate. Assuming that CFC’s effective foreign tax rate is 19%, which has already reached 90% of the U.S. corporate tax rate, then the high tax exclusion would apply, but only if the CFC shareholder is a U.S. corporation.(iii) Distribution excluded

When a CFC distributes dividend, the dividend distribution is excluded from the Subpart F Income calculation because the distribution of the proceeds from the CFC back to the U.S. shareholder would not result in deferral of income, and the dividend distribution is reported by the U.S. shareholder on his or her individual tax return on a pro rata basis.The application of the above allowances requires a complex and technical process. Hence, readers are advised to consult and discuss with a professional accountant.

- Calculation of the Subpart F Income Threshold

(i) Insurance income losses

(ii) Foreign personal holding company income losses

(iii) Foreign company sales revenue losses

(iv) Foreign company service income losses

The following is Schedule I of Form 5471:

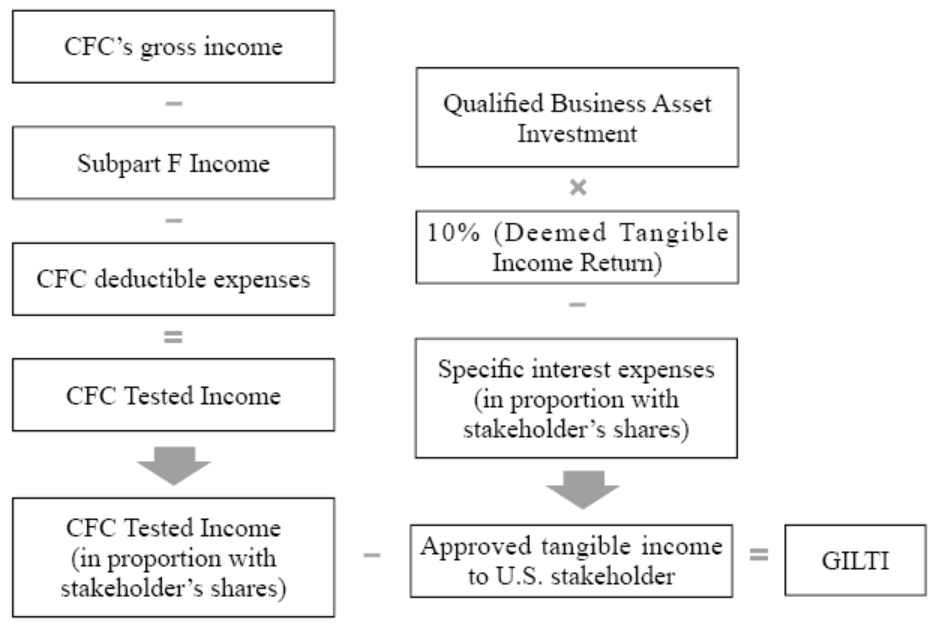

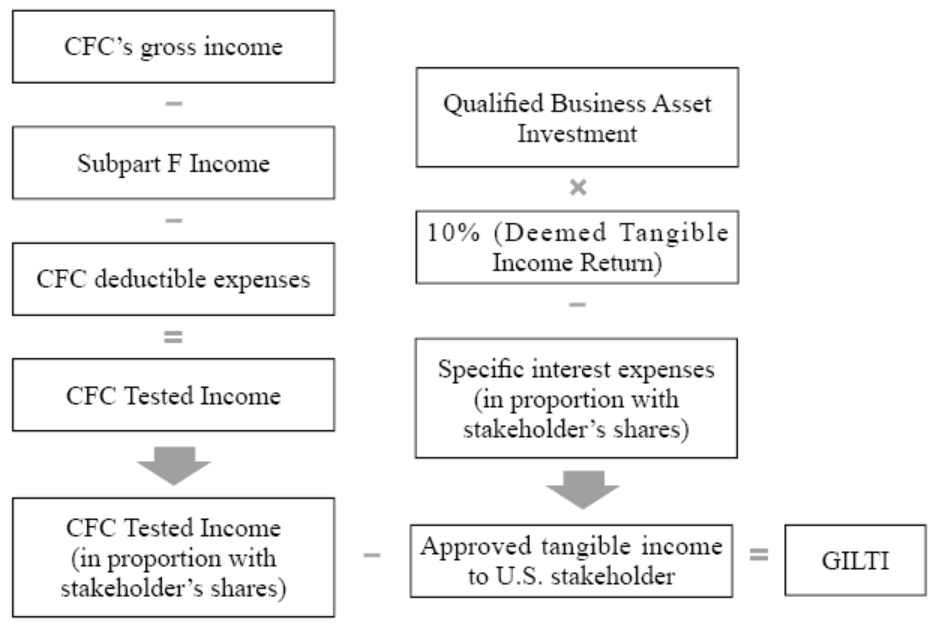

VII. GILTI

GILTI was added after the TCJA to prevent U.S. persons from deferring or avoiding U.S. tax liability by retaining non-foreign generated business profits abroad. 26 U.S. Code § 951A regulates the taxation of global intangible low-taxed income (GILTI) for U.S. foreign corporations with intangible assets above certain thresholds. The U.S. person shareholders of the CFC are required to include GILTI in their income where the gross income of the CFC (Net CFC Tested Income) exceeds the proposed Net Deemed Tangible Income Return (NDTIR).