專業叢書

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Chapter 4 ─ Accounting Treatment and Tax Returns Filing of a Trust

Part II. Accounting Treatment and Tax Return Filings for Foreign Assets Held by a U.S. Irrevocable Trust Established by a Non-U.S. Person

1. Annual Accounting Treatment and Tax Filings of the Trust

2. Accounting Treatment

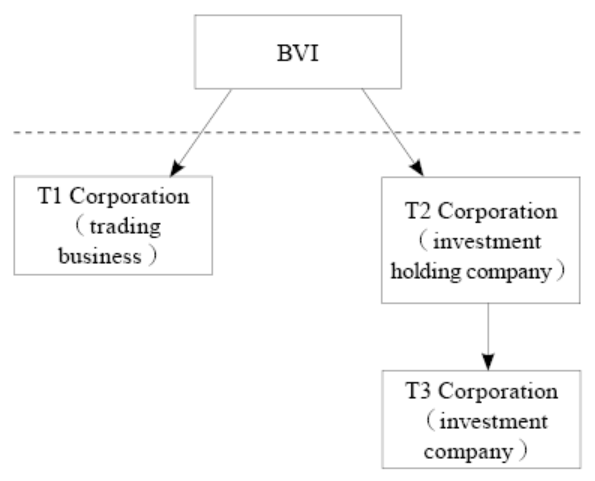

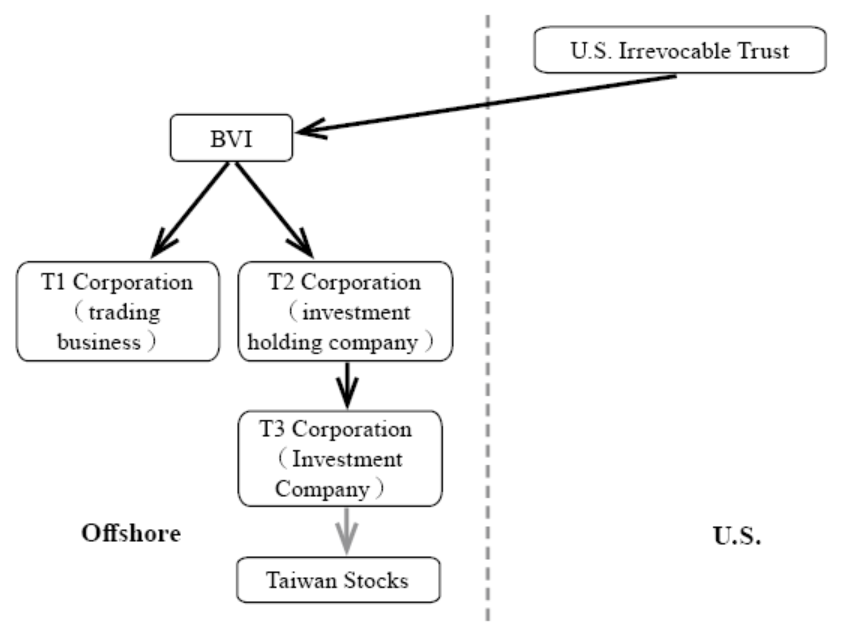

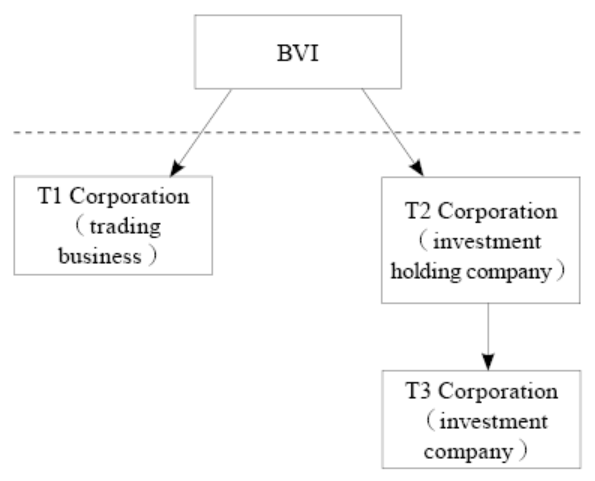

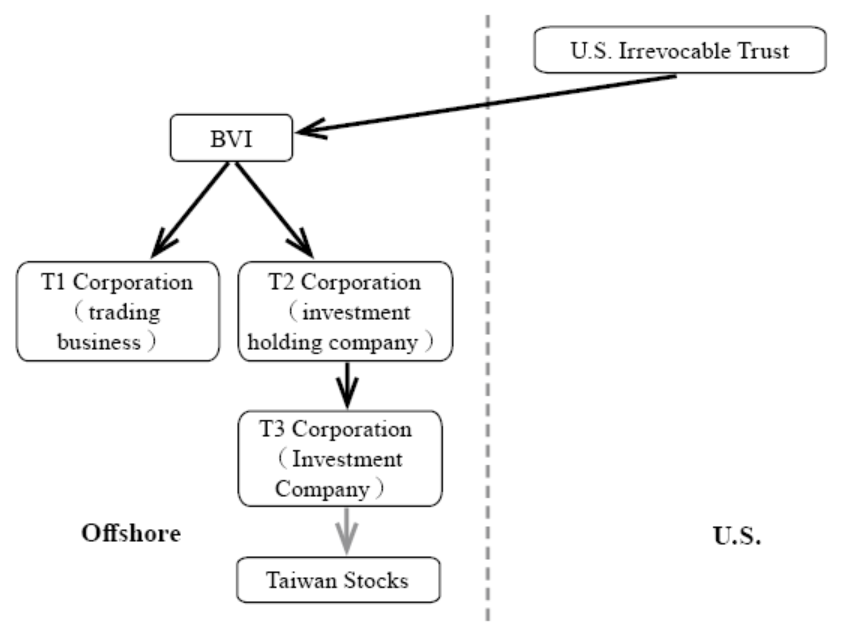

The accounting treatment of BVI assets, which are T1 subsidiary (manufacturing), T2 subsidiary (investment holding company) and T3 subsidiary (investment company), held by a U.S. irrevocable trust is described as follows:

3. U.S. Tax Filing

(1) Before the establishment of the trust

Under Section 7701 of the U.S. Tax Code (the “Check-the-box Regulations”), certain business entities are permitted to “check-the-box” by filing Form 8832 (Entity Classification Election) to select entity classification for U.S. federal income tax purposes. Under Form 8832, eligible entities include LLCs, partnerships, disregarded entities, foreign entities, and business entities that are not considered a per se corporation.

A foreign corporation may also choose other classifications of corporations through the election other than the ones under the Default Rules. For example, a wholly foreign-owned corporation (only one owner, 100% ownership) or an LLC may choose to become a “Disregarded Entity” in the U.S. through the election, which is a “Tax Transparent Entity”.

(i) Occasions for filing Form 8832:

(ii) Effective date specified on Form 8832:

(iii) 60-month limitation rule: If you have previously made an election, you may not make another election for another 60 months (5 years) after the election.

Exception: The 60-month limit may be waived unless① the company is newly formed and ② the effective date equal to the date of incorporation.

If you really want to re-elect within five years, you can apply for a Private Letter Ruling from the IRS for a fee if you meet some criteria.

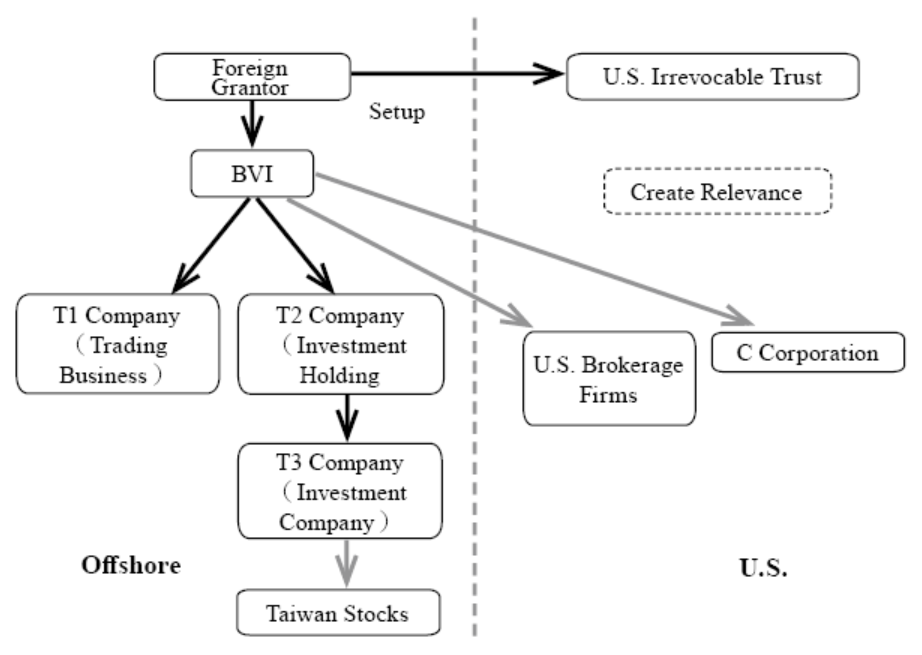

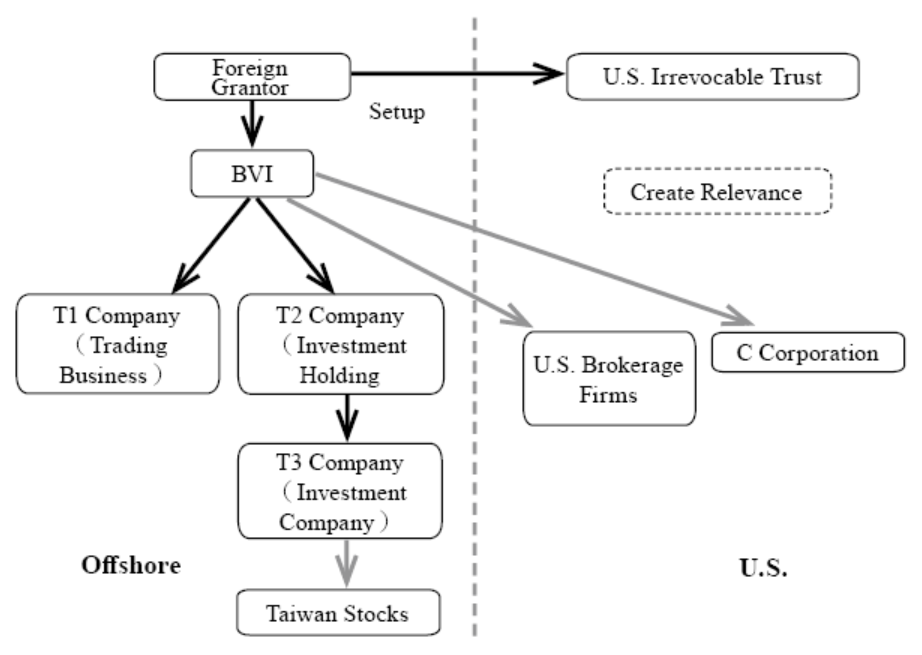

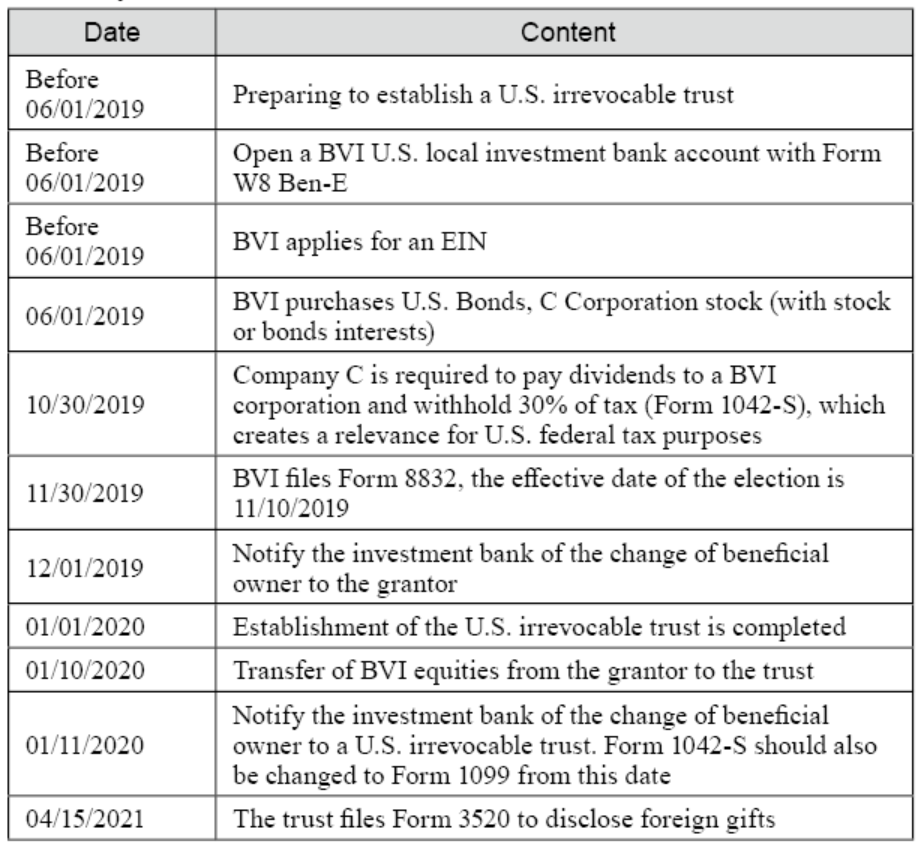

The following is the actual process for an inter vivos transfer of offshore holding assets into a U.S. irrevocable trust:

If a foreign holding company has a multi-tier ownership structure, it is advised that they should file Form 8832 (check-the-box election) from lower-tier to their upper-tier corporation, thus allowing the upper-tier holding company to create their relevance so that the assets held by the entire company are adjusted to the market value (Stepped-up Basis).

The term “relevance” can be exemplified as the following: A foreign entity can be deemed as relevant to a U.S. individual or business entity for federal tax purposes when it could impact tax returns of the U.S. individual or business entity. In practice, once a foreign entity earns interest income on treasury bills or receives dividend income, it will be deemed as relevant to the U.S. individual or business entity. Therefore, it will be subject to federal taxes and its classification will also be changed. Once a holding company files Form 8832 (check-the-box election), it is regarded as a new business after asset liquidation (asset value adjusted to market price). At this moment, if there is only one shareholder in this business entity, the holding company would be considered as the Disregarded Entity. Therefore, the assets held by the companies under the holding company tier would pass through to the trust. Then, the capital gains on the sale of assets would be lowered when the assets held by the trust are disposed in the future. Furthermore, surplus earnings distribution would not be seen as the dividend distribution before the distributions are transferred into the trust, leading the accrual income tax be lowered.

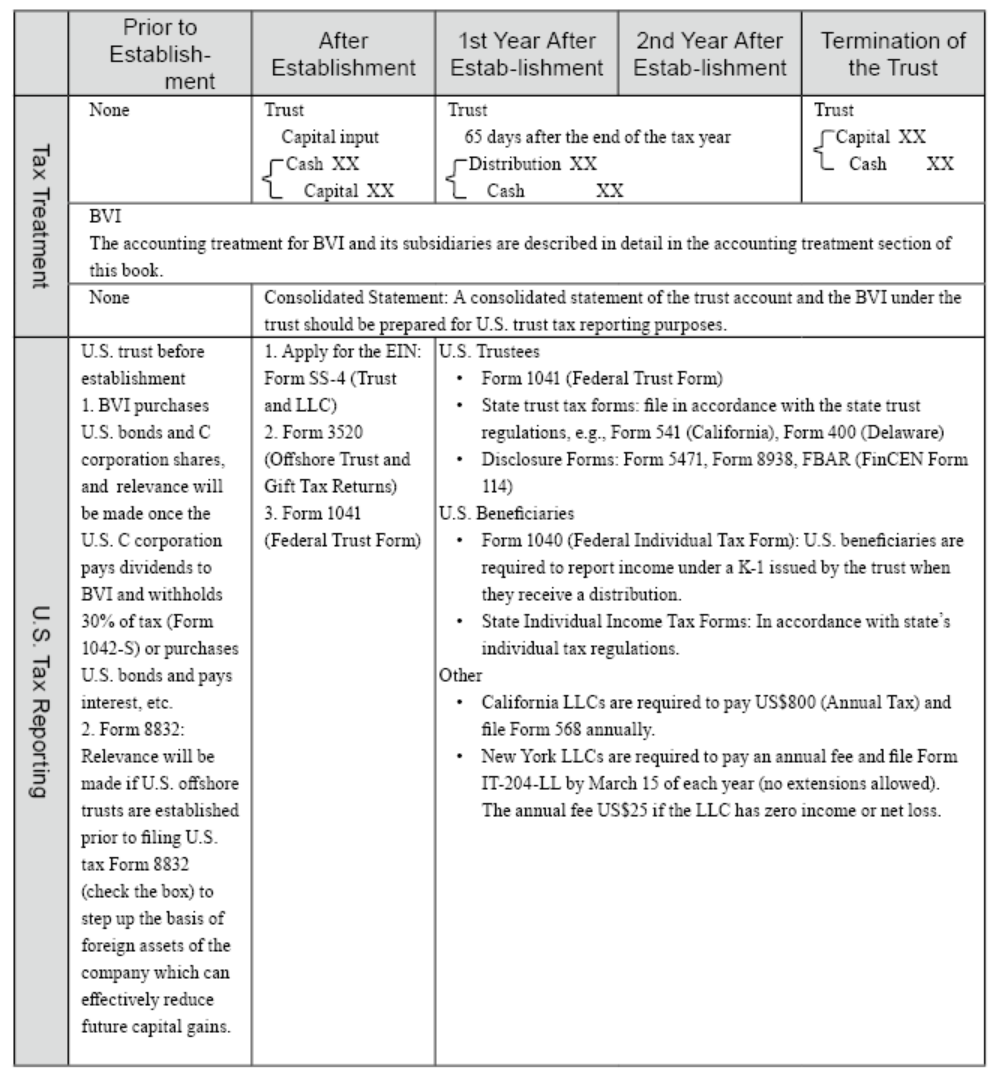

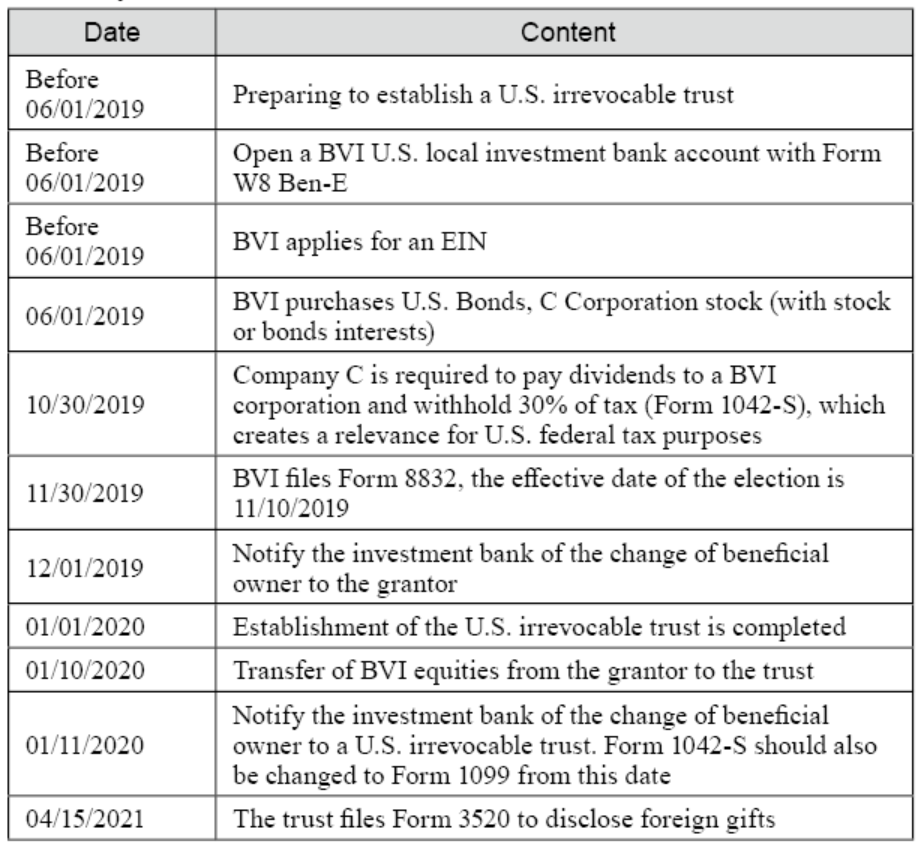

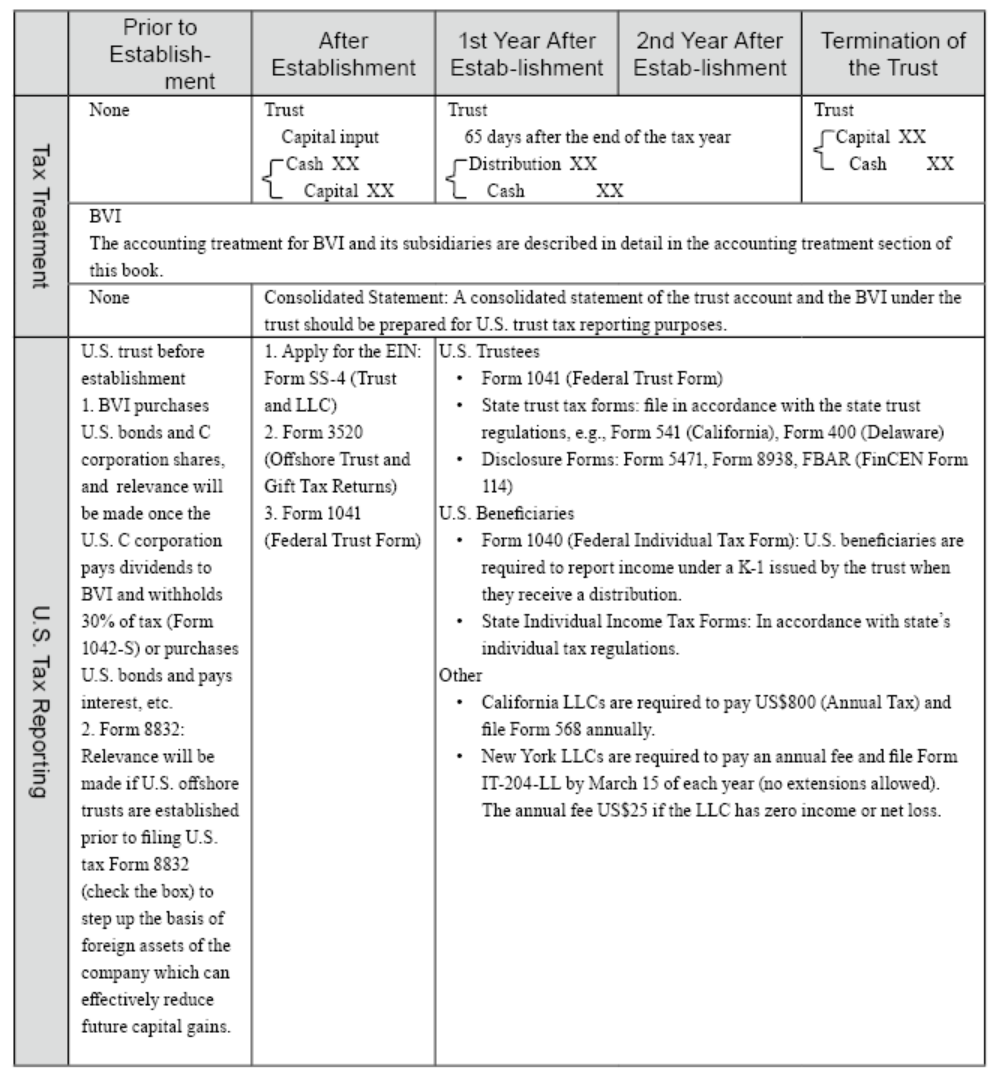

Please refer to the following table, which suggests when to generate relevance to check-the-box. This time schedule is only for reference. As the pandemic severely affects the operational procedure of the IRS in recent years, it is recommended to communicate with a professional U.S. accountant to ensure a more appropriate setup process for your trust.

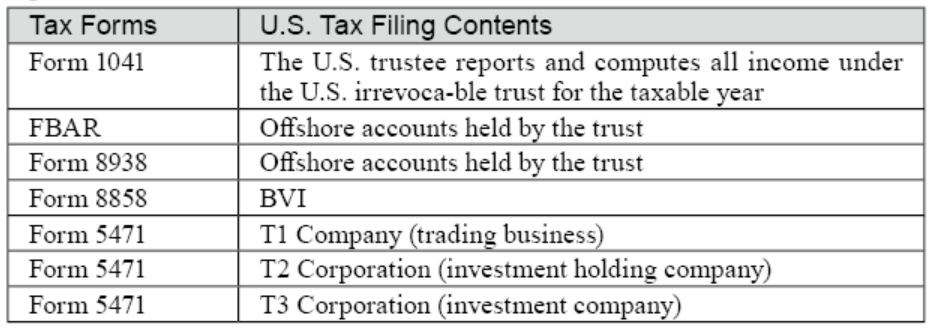

The establishment of a U.S. irrevocable trust and arrangement of the BVI into the trust will involve in U.S. trust tax filing obligations, which will be illustrated by this structure and the following consolidated statements below.

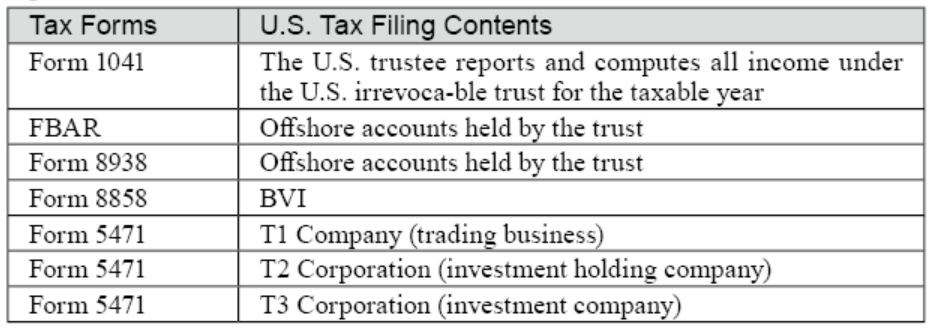

The reporting of U.S. irrevocable trust holding foreign assets is complex. It is recommended that the following tax forms are filed by a professional U.S. accountant.

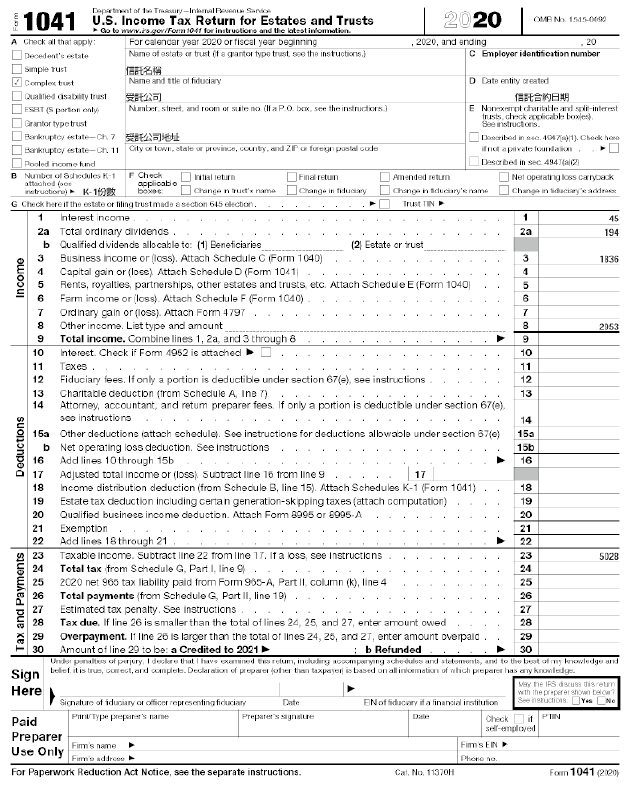

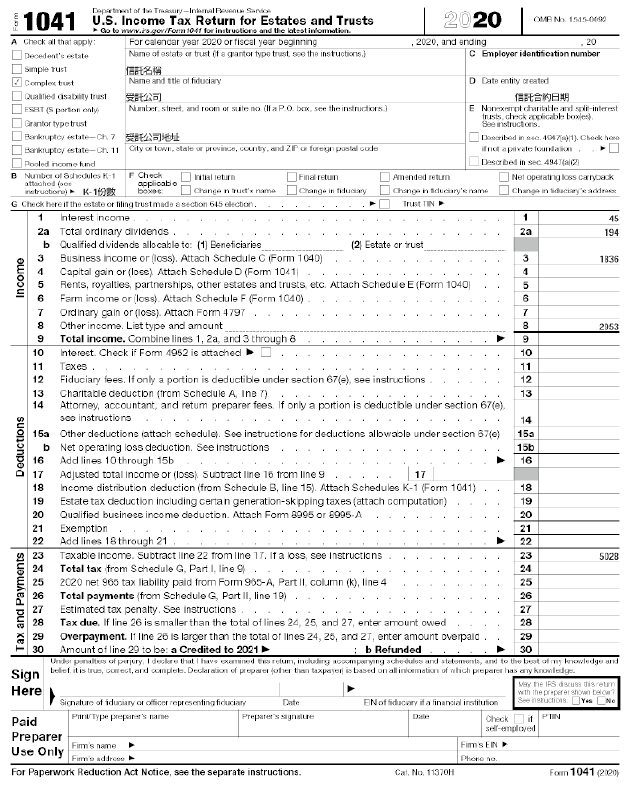

After the BVI’s consolidated financial statements are combined with the trust accounts, various types of income can be accounted on Form 1041 for trust tax purposes and trust tax can also be calculated.

Example of Form1041.

Assuming there are no trust transactions and no related deductions, the trust tax return is filed as follows:

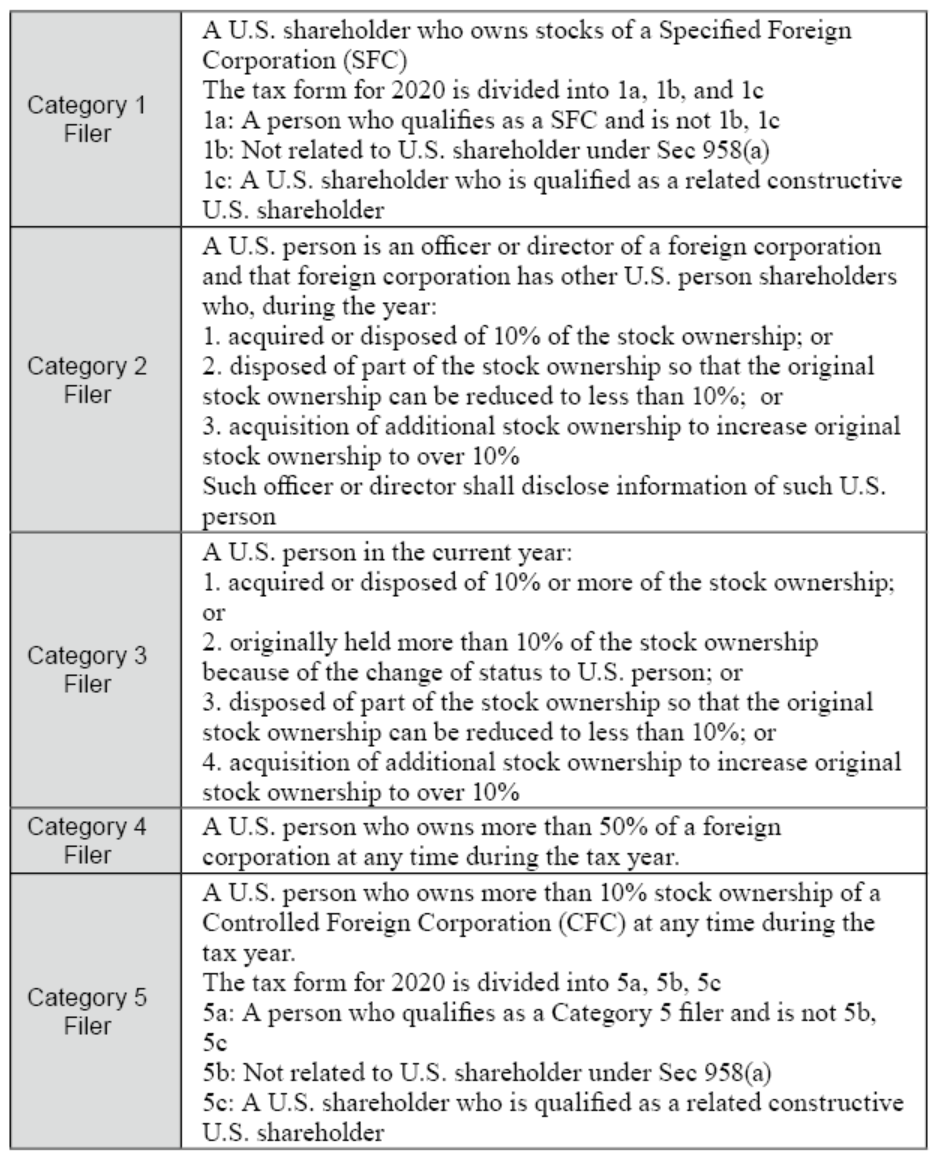

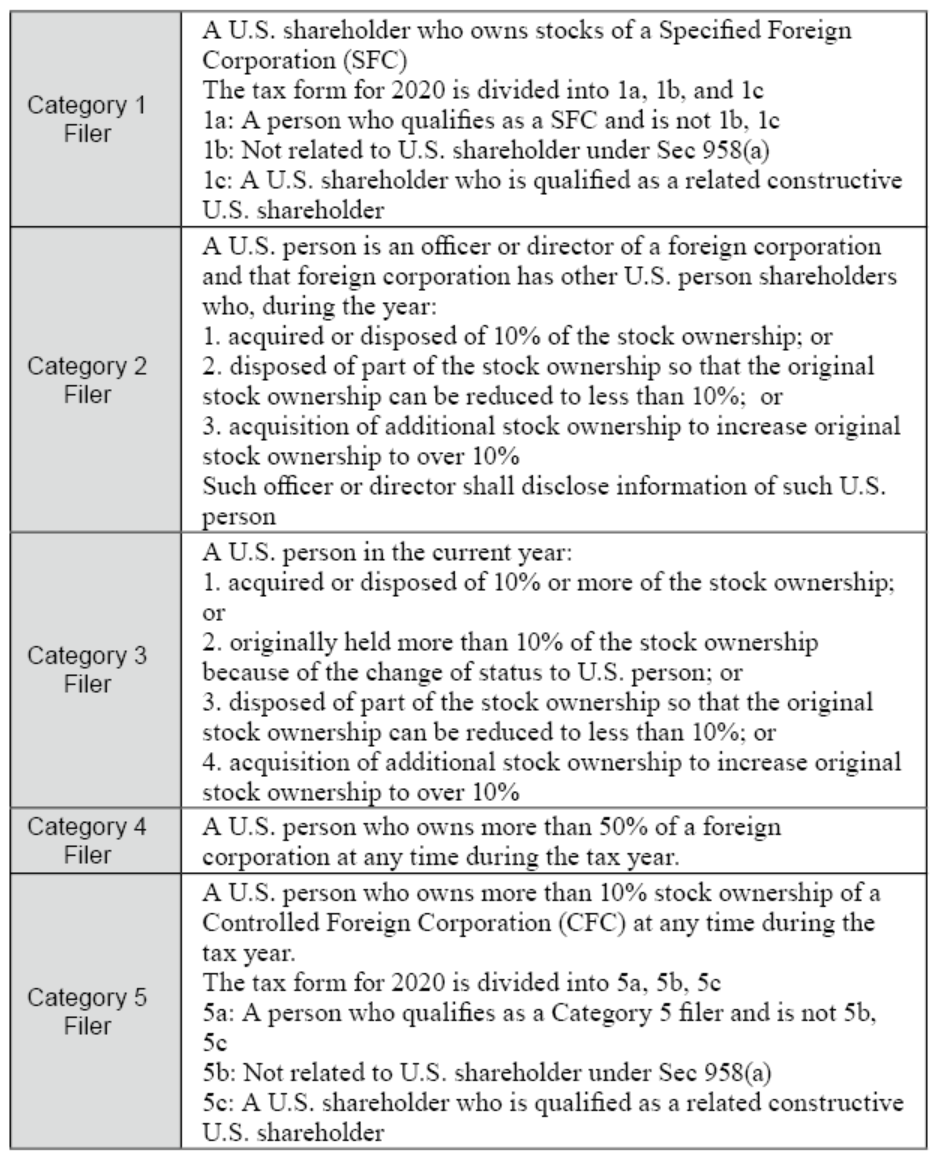

The following are the definitions of the five category filers on Form 5471, with the first category divided into 1a, 1b, and 1c and the fifth category divided into 5a, 5b, and 5c in the 2020 tax year.

Under the relevant reporting requirements, a U.S. person should include: a U.S. citizen or tax resident, a U.S. C corporation, a U.S. partnership, a U.S. estate or trust.

② Definition of a U.S. Shareholder

A U.S. Shareholder is any U.S. person who owns 10% of a foreign corporation, including individuals, corporations, trusts, and partnerships.

③ Definition of a Specified Foreign Corporation (SFC)

In practice, one of the most common situations in which U.S. persons are required to file Form 5471 is when they hold equity interests in a CFC (“Controlled Foreign Corporation”), which qualifies as Category 4 or 5 filers.

To determine if an offshore U.S. corporation is a CFC, it must meet both of the following tests:

1 Internal Revenue Code §952: SUBPART F INCOME DEFINED.參考美國《國內稅收法》§952:定義SUBPART F INCOME DEFINED。

Subpart F Income has a complex classification, and it is mainly classified according to IRC section 952 regulations as follows:

Deduction of Subpart F Income

When calculating the Subpart F income, the cost of goods sold and the operating expenses of the CFC can be deducted from the Subpart F income. However, it is recommended that readers consult a professional accountant in advance.

Allowance of Subpart F Income

The application of the above allowances requires a complex and technical process. Hence, readers are advised to consult and discuss with a professional accountant.

(i) Insurance income losses

(ii) Foreign personal holding company income losses

(iii) Foreign company sales revenue losses

(iv) Foreign company service income losses

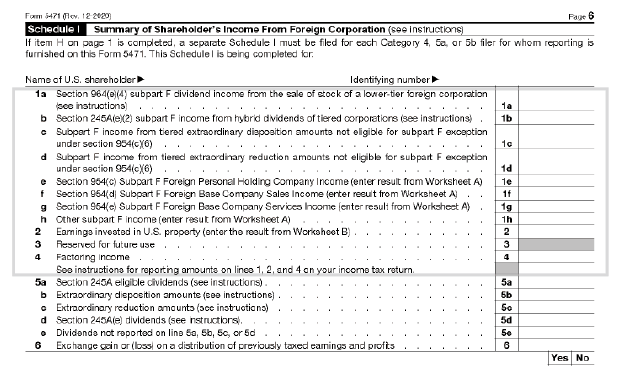

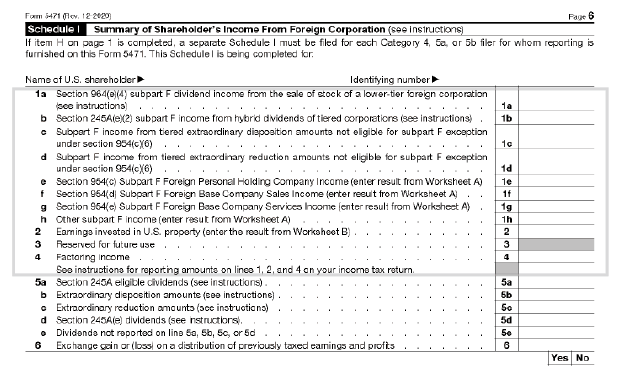

The following is Schedule I of Form 5471:

2. Accounting Treatment

The accounting treatment of BVI assets, which are T1 subsidiary (manufacturing), T2 subsidiary (investment holding company) and T3 subsidiary (investment company), held by a U.S. irrevocable trust is described as follows:

3. U.S. Tax Filing

(1) Before the establishment of the trust

I. Application for EIN (Employer Identification Number)

BVI and other jurisdictions are all required to apply for EIN. The application process is the same as on pages 237 to 238.

II. Form 8832 (Check-the-Box Election)

This election has been available to enterprise since January 1st, 1997 and is intended to reduce disputes between the IRS and enterprise.Under Section 7701 of the U.S. Tax Code (the “Check-the-box Regulations”), certain business entities are permitted to “check-the-box” by filing Form 8832 (Entity Classification Election) to select entity classification for U.S. federal income tax purposes. Under Form 8832, eligible entities include LLCs, partnerships, disregarded entities, foreign entities, and business entities that are not considered a per se corporation.

- What is a Per Se Corporation?

A foreign corporation may also choose other classifications of corporations through the election other than the ones under the Default Rules. For example, a wholly foreign-owned corporation (only one owner, 100% ownership) or an LLC may choose to become a “Disregarded Entity” in the U.S. through the election, which is a “Tax Transparent Entity”.

(i) Occasions for filing Form 8832:

- When you want to change the entity’s classification: ①original classification → new classification; ② old classification → new classification (previously elected).

- If a corporation wants to file a tax return using its original classification, it does not need to file Form 8832.

(ii) Effective date specified on Form 8832:

- No earlier than 75 days and no later than 12 months on the effective date of which the election is filed.

- If the effective date is 75 days earlier than the date on which the election is filed, it will be effective 75 days prior to the date it was filed. If the effective date is 12 months later than the date on which the election is filed, it will be effective 12 months after the date it was filed.

- If no effective date is specified in the form, effective date equal to election date.

(iii) 60-month limitation rule: If you have previously made an election, you may not make another election for another 60 months (5 years) after the election.

Exception: The 60-month limit may be waived unless① the company is newly formed and ② the effective date equal to the date of incorporation.

If you really want to re-elect within five years, you can apply for a Private Letter Ruling from the IRS for a fee if you meet some criteria.

The following is the actual process for an inter vivos transfer of offshore holding assets into a U.S. irrevocable trust:

If a foreign holding company has a multi-tier ownership structure, it is advised that they should file Form 8832 (check-the-box election) from lower-tier to their upper-tier corporation, thus allowing the upper-tier holding company to create their relevance so that the assets held by the entire company are adjusted to the market value (Stepped-up Basis).

The term “relevance” can be exemplified as the following: A foreign entity can be deemed as relevant to a U.S. individual or business entity for federal tax purposes when it could impact tax returns of the U.S. individual or business entity. In practice, once a foreign entity earns interest income on treasury bills or receives dividend income, it will be deemed as relevant to the U.S. individual or business entity. Therefore, it will be subject to federal taxes and its classification will also be changed. Once a holding company files Form 8832 (check-the-box election), it is regarded as a new business after asset liquidation (asset value adjusted to market price). At this moment, if there is only one shareholder in this business entity, the holding company would be considered as the Disregarded Entity. Therefore, the assets held by the companies under the holding company tier would pass through to the trust. Then, the capital gains on the sale of assets would be lowered when the assets held by the trust are disposed in the future. Furthermore, surplus earnings distribution would not be seen as the dividend distribution before the distributions are transferred into the trust, leading the accrual income tax be lowered.

Please refer to the following table, which suggests when to generate relevance to check-the-box. This time schedule is only for reference. As the pandemic severely affects the operational procedure of the IRS in recent years, it is recommended to communicate with a professional U.S. accountant to ensure a more appropriate setup process for your trust.

(2) Initial phase

I. Application for EIN

All trusts must apply for an EIN, and the application process is the same as on pages 237 to 238.

II. Form 3520 (Foreign Trusts and Gift Tax Returns)

(i) Filing date: April 15 of each year.

(ii) Filing requirements: Form 3520 should be reported to the IRS, disclosing information of U.S. irrevocable trust receiving funds from offshore if the following conditions are met:

- When the trust is established, the grantor remits Foreign funds into a U.S. irrevocable trust.

- Fees paid by the grantor but not paid by the trust are deemed as gifts.

- Form 3520, Part IV, column 54 and 55 should be reported respectively to the IRS if the following conditions are met:

- Taxpayers should complete Form 3520, Part IV, column 54, if the aggregate value of gifts or bequests he or she receives from nonresident alien or foreign estate exceeds US$100,000 during the taxable year.

- Taxpayers should complete Form 3520, Part IV, column 55, if the aggregate value of gifts or bequests he or she receives from foreign corporation or partnership exceeds US$16,649 during the taxable year.

(iii) Penalties for failure to report foreign gifts

What are the penalties for failing to report foreign gifts on time? This depends on the source of the gift, as explained below.- If Form 3520 is not reported, a penalty of 5% per month of the total value of the foreign gift or bequest is levied (but not more than 25% of the gift).

- If a U.S. individual fails to report the distribution received by the foreign trust, a penalty of 35% of the total value of the distribution received from the foreign trust is levied. (Section 6677)

III. Form 1041 (Federal Trust Tax Form)

Usually, the capital invested in the beginning of the year after the trust is established will not generate much income. However, if the following conditions are met, taxpayers are required to file Form 1041:

(i) Gross Income (GI) greater than US$600

(ii) Taxable income for the year

(iii) A beneficiary who is a nonresident alien

(3) Operation PhaseThe establishment of a U.S. irrevocable trust and arrangement of the BVI into the trust will involve in U.S. trust tax filing obligations, which will be illustrated by this structure and the following consolidated statements below.

The reporting of U.S. irrevocable trust holding foreign assets is complex. It is recommended that the following tax forms are filed by a professional U.S. accountant.

I. Form 1041 (Federal Trust Tax Form)

The relevant reporting requirements are the same as those for U.S. assets held in a U.S. irrevocable trust.After the BVI’s consolidated financial statements are combined with the trust accounts, various types of income can be accounted on Form 1041 for trust tax purposes and trust tax can also be calculated.

Example of Form1041.

Assuming there are no trust transactions and no related deductions, the trust tax return is filed as follows:

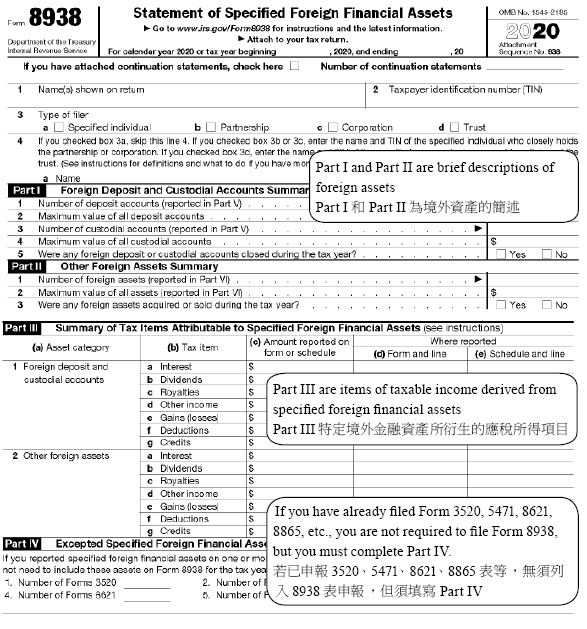

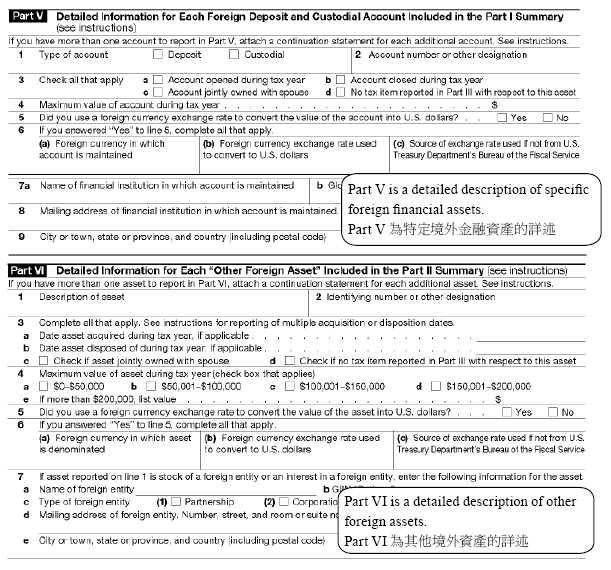

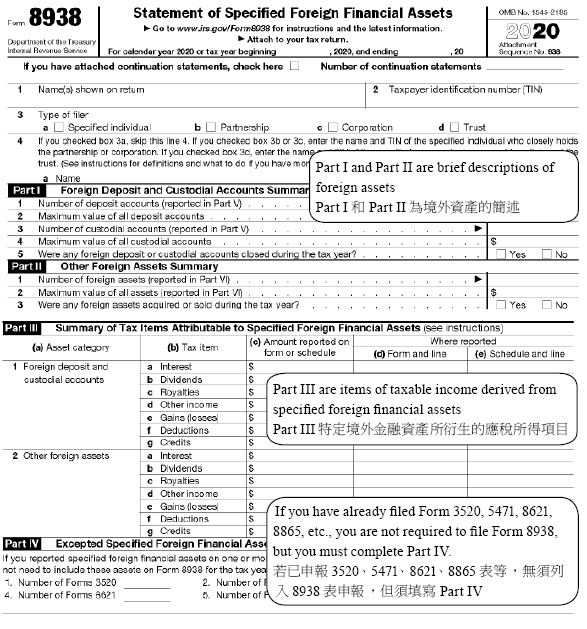

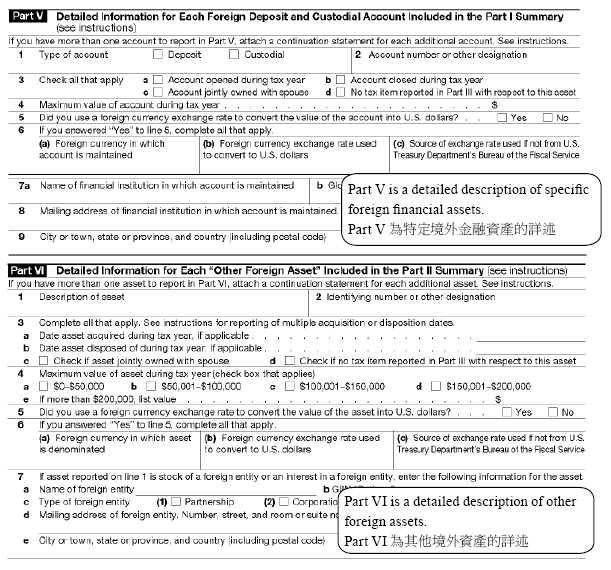

II. Disclosure Form: Form 8938

(i) Filing requirements: U.S. irrevocable trusts that meet the specified domestic entity requirements and hold specified foreign assets that exceeds the reporting threshold are required to report all specified foreign assets on Form 8938.

According to Section 7701(a)(30)(E), if a U.S. trust has one or more specified individuals as beneficiaries for the tax year, then the trust will be treated as a specified domestic entity.

(ii) Reporting threshold: the total value of all foreign assets exceeds US$50,000 on the last day of the tax year or US$75,000 at any time of the tax year.

(iii) Filing Date: File with Form 1041

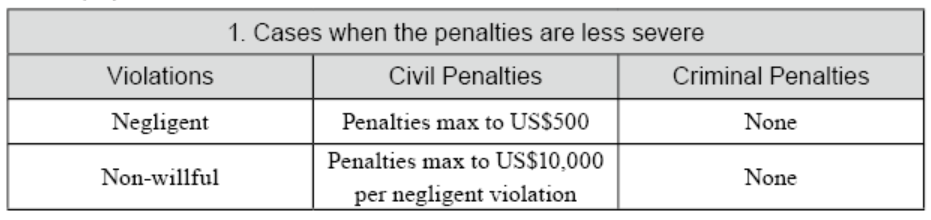

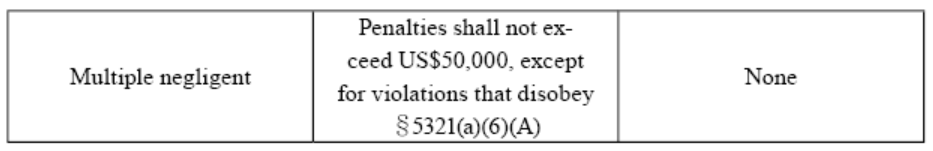

Failure to file the correct Form 8938 in a timely manner or miscalculation of tax liability due to undisclosed specified foreign asset may result in penalties.

- Failing to file Form 8938

- Continuing fail to file

III. FBAR

(i) Filing requirements: A U.S. person who owns any financial account, which includes bank accounts (savings, checking or fixed deposits, etc.), securities accounts and insurances with cash value, etc., with a foreign financial institution that has a financial interest and a signature authority or other right to such account, and whose total account value exceeds US$10,000 on any day between January 1st and December 31th of each year must file FinCEN Form 114.

In the case of a U.S. irrevocable trust, if the trust itself, the trustee of the trust, or the agent of the trust meets the following condition, then the beneficiary of the trust is directly or indirectly entitled to more than 50% of the economic benefits of the trust’s assets or income and would not be required to report FBAR:- a U.S. person

- files a FBAR to disclose foreign financial accounts info of a trust

(ii) Filing date: April 15th of each year, with an automatic filing extension to October 15th.

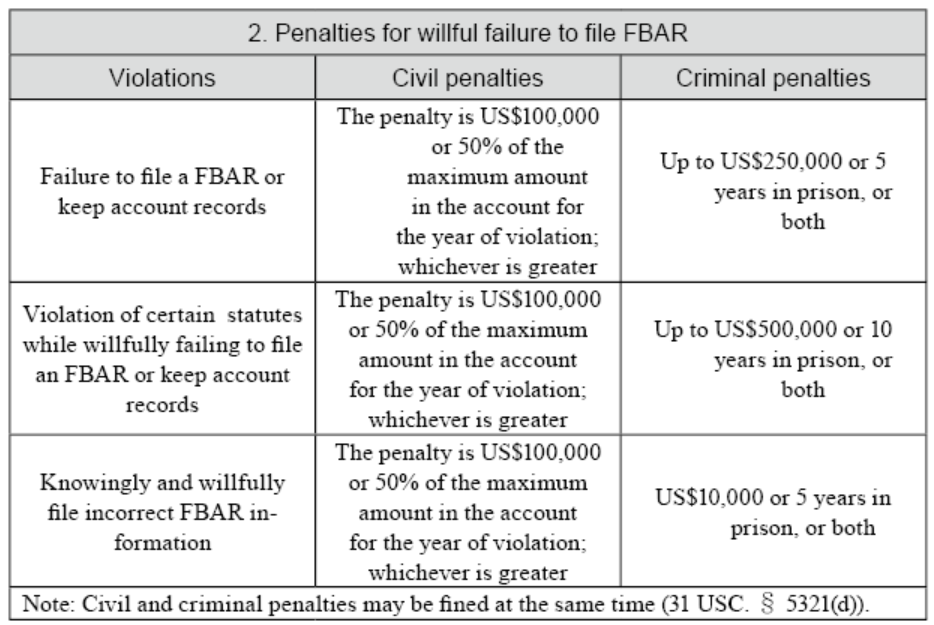

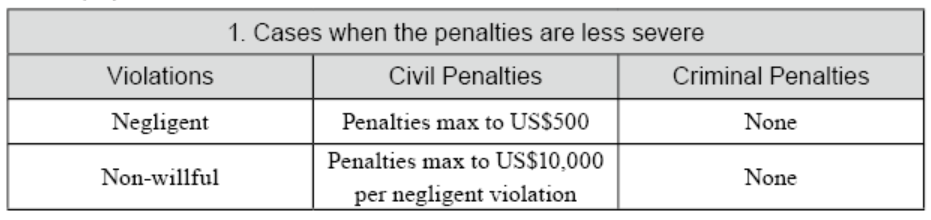

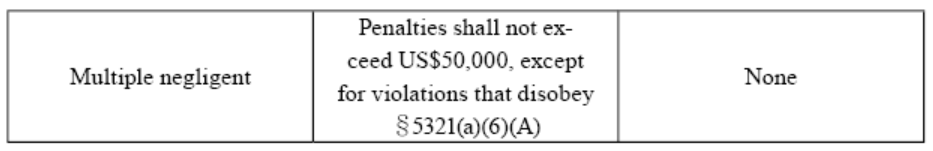

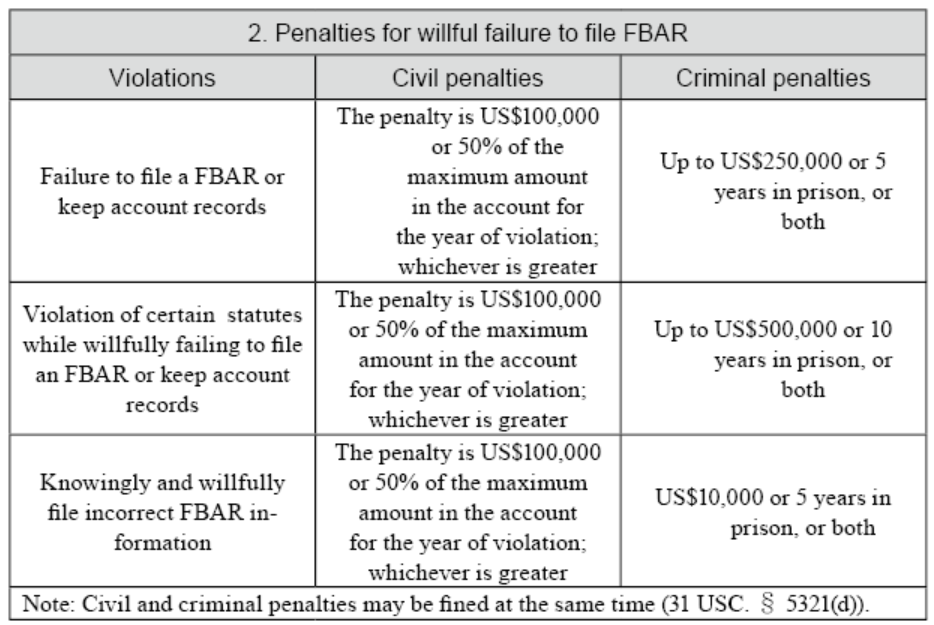

(iii) Penalties for failure to file FinCEN Form 114

IV. Form 8858

U.S. persons holding foreign disregarded entities are required to report Form 8858 (e.g., profit and loss summary, simplified balance sheet, etc.)

(i) Filing requirements: Specified U.S. person operates FBs (Foreign Branches) or own FDEs (Foreign Disregarded Entities) directly, indirectly, or constructively. This form and schedule are filed to conform the regulations in Section 6011, 6012, 6031, 6038 and other related regulations.

(ii) Filing date: Same as the due date of the income tax return or other related disclosure tax return (including the extension date)

(iii) Relevant definitions of Form 8858:

Definition of a U.S. person: A U.S. person includes a U.S. citizen or tax resident, a U.S. C corporation, a U.S. partnership, U.S. domestic estate or trust under the relevant reporting requirements. A U.S. domestic trust referred here must meet the following conditions:- U.S. court test

- One or more U.S. persons have substantial control over the trust

(iv) Penalty: US$10,000 for failure to file. If failure to file continues within 90 days after the IRS notice, a penalty of US$10,000 will be imposed per month and up to a maximum of US$50,000. In addition, the filer may be criminally liable for willful non-reporting or misreporting.

V. Form 5471

The primary purpose of this form is to monitor the tax liability of U.S. corporations or U.S. shareholders who invest in or operate through subsidiaries in low-tax or tax-exempt countries, trying to retain their foreign revenue from the subsidiaries without distributing them back to the U.S., which may raise concerns regarding incorrect tax disclosure from U.S. taxpayers. Hence, the regulations governing the CFCs (Controlled Foreign Corporations) were enacted and Form 5471 is required to be filed annually by the U.S. shareholders to disclose specific information regarding the CFCs.(i) Filing date: April 15th of each year, along with the U.S. Income Tax Return for Estates and Trusts (Form 1041). The filing deadline would be September 30th if Form 7004(extension form) was filing in advance.

(ii) Penalty: A US$10,000 penalty is imposed for failure to file Form 5471 on time. If failure to file continues after the IRS notice within 90 days then additional penalties of US$10,000 will be imposed per company per month, up to a maximum of US$50,000. Hence the total amount of penalty will be US$60,000.

The following are the definitions of the five category filers on Form 5471, with the first category divided into 1a, 1b, and 1c and the fifth category divided into 5a, 5b, and 5c in the 2020 tax year.

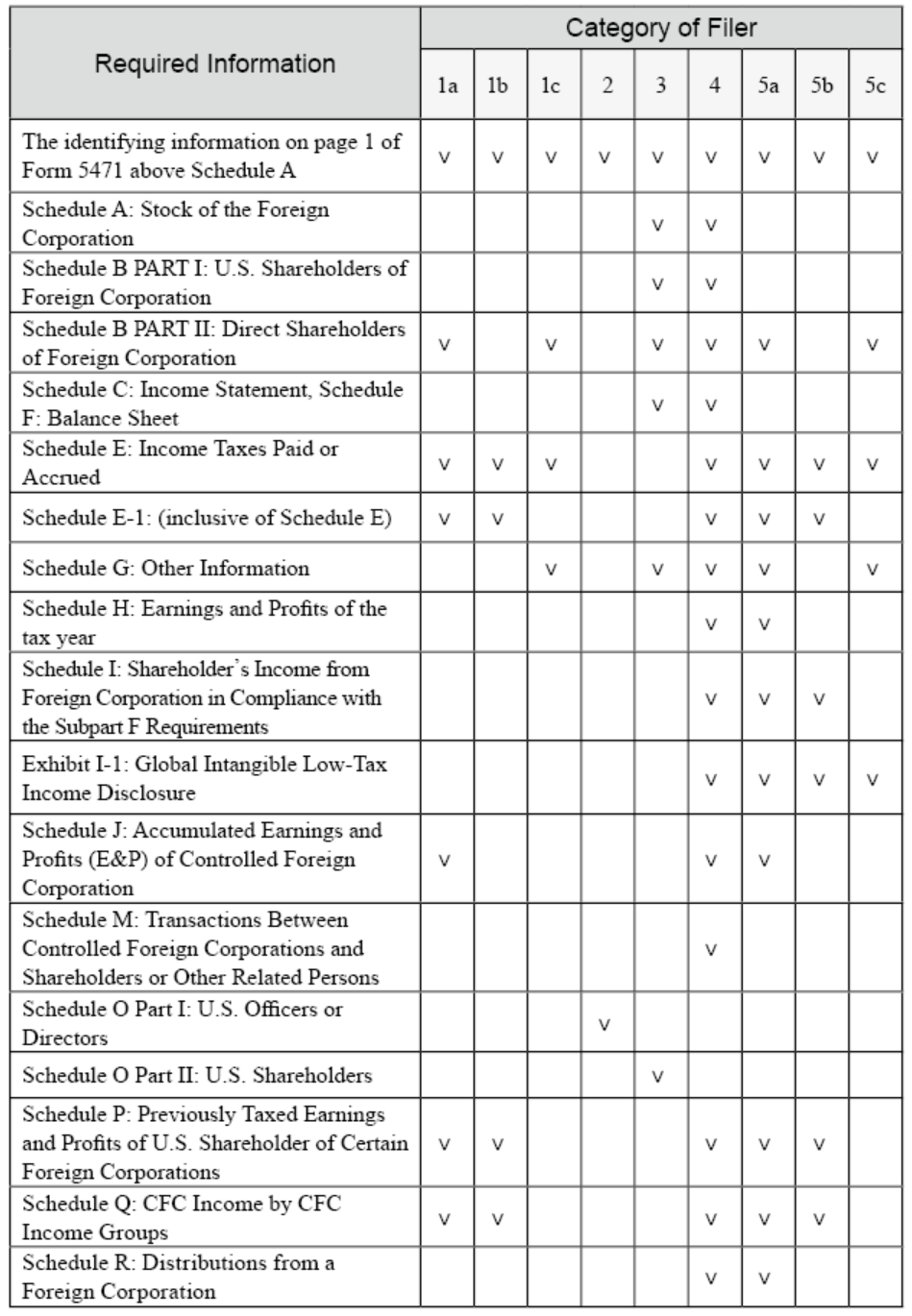

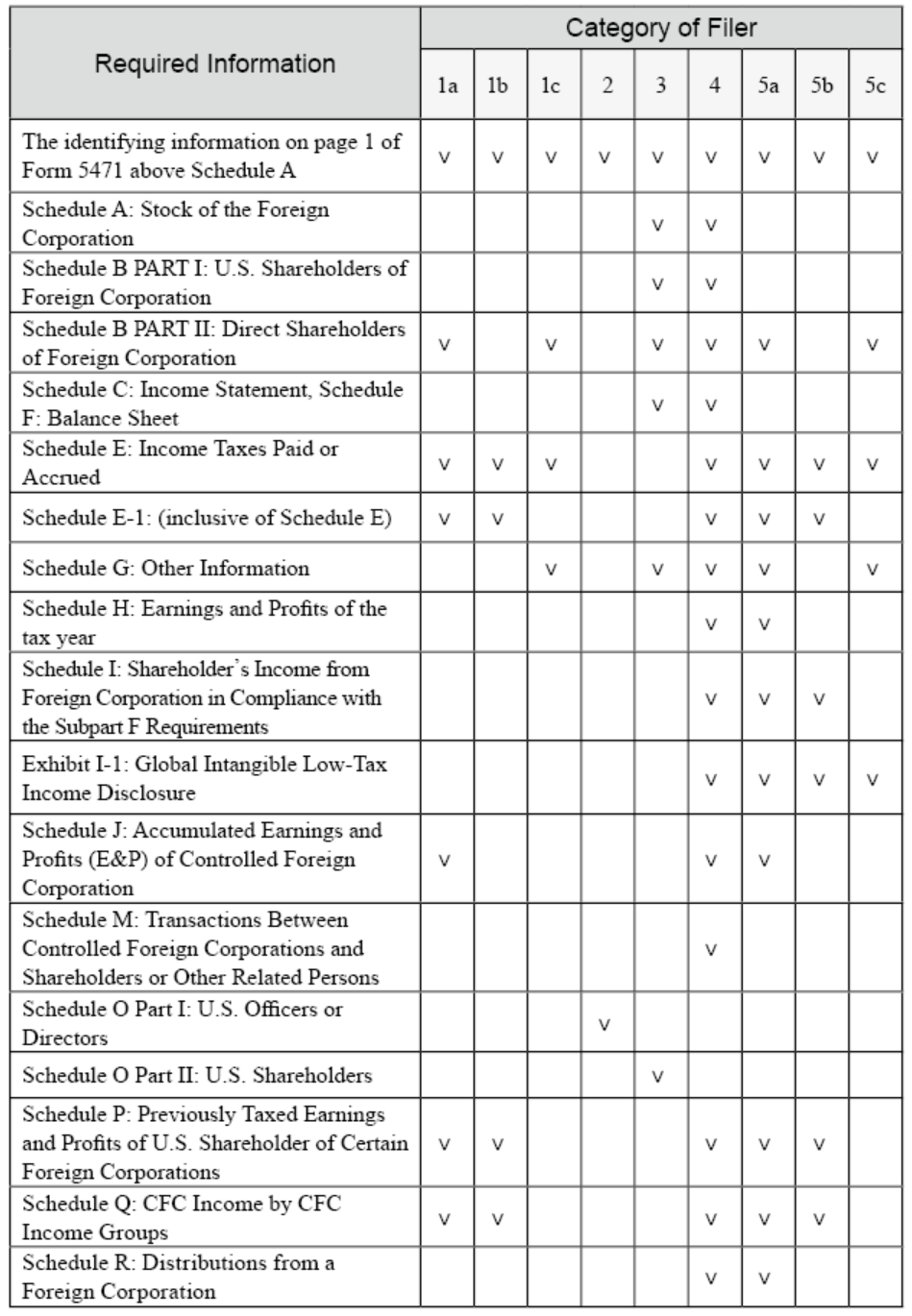

(iii) Information required to be disclosed on Form 5471 by category

(iv) Definitions relating to Form 5471

① Definition of a U.S. Person Under the relevant reporting requirements, a U.S. person should include: a U.S. citizen or tax resident, a U.S. C corporation, a U.S. partnership, a U.S. estate or trust.

② Definition of a U.S. Shareholder

A U.S. Shareholder is any U.S. person who owns 10% of a foreign corporation, including individuals, corporations, trusts, and partnerships.

③ Definition of a Specified Foreign Corporation (SFC)

- If a foreign corporation is a Controlled Foreign Corporation (CFC), it will be considered as a Specified Foreign Corporation (SFC); or

- A foreign corporation is a Specified Foreign Corporation (SFC) if it is owned by a U.S. domestic corporation.

In practice, one of the most common situations in which U.S. persons are required to file Form 5471 is when they hold equity interests in a CFC (“Controlled Foreign Corporation”), which qualifies as Category 4 or 5 filers.

To determine if an offshore U.S. corporation is a CFC, it must meet both of the following tests:

- U.S. Shareholder Test: Under IRC §957, if a U.S. person who owns or is deemed to own 10% or more of the total combined voting power of all classes of voting stock of a CFC, then it is considered as a U.S. shareholder.

- 50% Shareholding Test: If the U.S. shareholders own more than 50% of the total combined voting power of all classes of voting stock or owned more than 50% of the total value of the stock of the corporation.

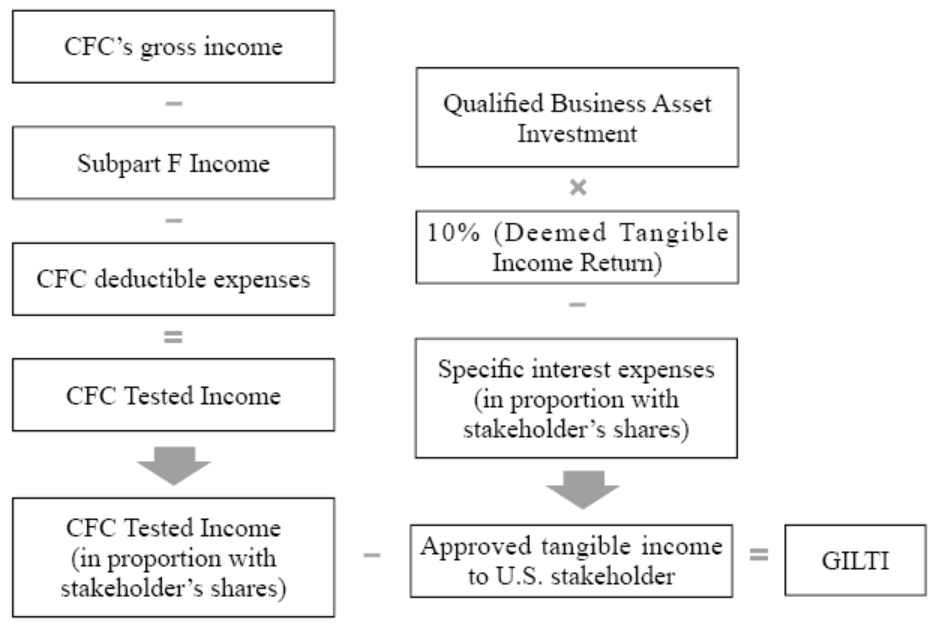

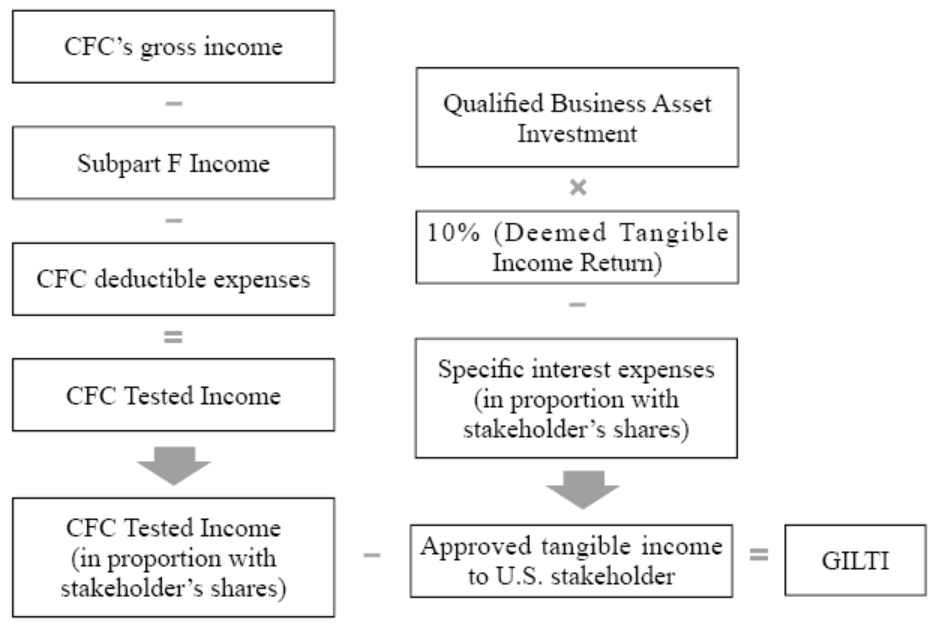

In addition to filing the complicated Form 5471, CFC also needs to consider the calculation of Subpart F Income and GILTI then add those income in their relative tax filings.

VI. Introduction to Subpart F Income

Under U.S. tax law, to prevent U.S. taxpayers from retaining their business profits abroad and thereby deferring or avoiding U.S. tax liability, U.S. shareholders are required to include the portion of the undistributed foreign income of the CFC that is deemed as Subpart F Income when filing them in their U.S. tax return based on the shareholding ratio in the current year.11 Internal Revenue Code §952: SUBPART F INCOME DEFINED.參考美國《國內稅收法》§952:定義SUBPART F INCOME DEFINED。

Subpart F Income has a complex classification, and it is mainly classified according to IRC section 952 regulations as follows:

(i) Insurance income: Insurance income from the CFC countries. (IRS section 953)

(ii) Foreign Base Company Income (IRC Section 954) includes:

- FPHCI (Foreign Personal Holding Company Income)

- Foreign base company sales income

- Foreign base company service income

- International Boycott Income as defined in IRC Section 952(a)(3)

- Illegal bribes, kickbacks or other payment as defined in IRC Section 952(a)(4)

- Income described in IRC Section 952(a)(5) derived from any foreign country that complies with IRC Section 901(j)

Deduction of Subpart F Income

When calculating the Subpart F income, the cost of goods sold and the operating expenses of the CFC can be deducted from the Subpart F income. However, it is recommended that readers consult a professional accountant in advance.

Allowance of Subpart F Income

(i) De Minimis Rule

If the total annual insurance income (IRC Section 953) and the foreign company income (IRC Section 954) is less than 5% of the CFC’s total annual income or if the total annual foreign company income does not exceed US$1 million, the CFC may exclude the foreign company income from the Subpart F Income in the current year. Let’s assume Company A is a CFC and qualifies as a foreign personal holding company and the company has an annual revenue of US$5 million with a rental income of US$150,000. Since its rental income only represents 3% of its total annual revenue, its rental income qualifies under the “de minimis” rule and can be excluded from the Subpart F income.

(ii) Exception for certain income subject to high foreign taxes

CFC’s annual insurance income (IRC Section 953) and foreign company income (IRC Section 954) would qualify for the high tax rate exclusion if the tax paid abroad exceeds 90% of the 21% of the maximum U.S. corporate tax rate. Assuming that CFC’s effective foreign tax rate is 19%, which has already reached 90% of the U.S. corporate tax rate, then the high tax exclusion would apply, but only if the CFC shareholder is a U.S. corporation.(iii) Distribution excluded

When a CFC distributes dividend, the dividend distribution is excluded from the Subpart F Income calculation because the distribution of the proceeds from the CFC back to the U.S. shareholder would not result in deferral of income, and the dividend distribution is reported by the U.S. shareholder on his or her individual tax return on a pro rata basis.The application of the above allowances requires a complex and technical process. Hence, readers are advised to consult and discuss with a professional accountant.

- Calculation of the Subpart F Income Threshold

(i) Insurance income losses

(ii) Foreign personal holding company income losses

(iii) Foreign company sales revenue losses

(iv) Foreign company service income losses

The following is Schedule I of Form 5471:

VII. GILTI

GILTI was added after the TCJA to prevent U.S. persons from deferring or avoiding U.S. tax liability by retaining non-foreign generated business profits abroad. 26 U.S. Code § 951A regulates the taxation of global intangible low-taxed income (GILTI) for U.S. foreign corporations with intangible assets above certain thresholds. The U.S. person shareholders of the CFC are required to include GILTI in their income where the gross income of the CFC (Net CFC Tested Income) exceeds the proposed Net Deemed Tangible Income Return (NDTIR).