專業叢書

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Chapter 4 ─ Accounting Treatment and Tax Returns Filing of a Trust

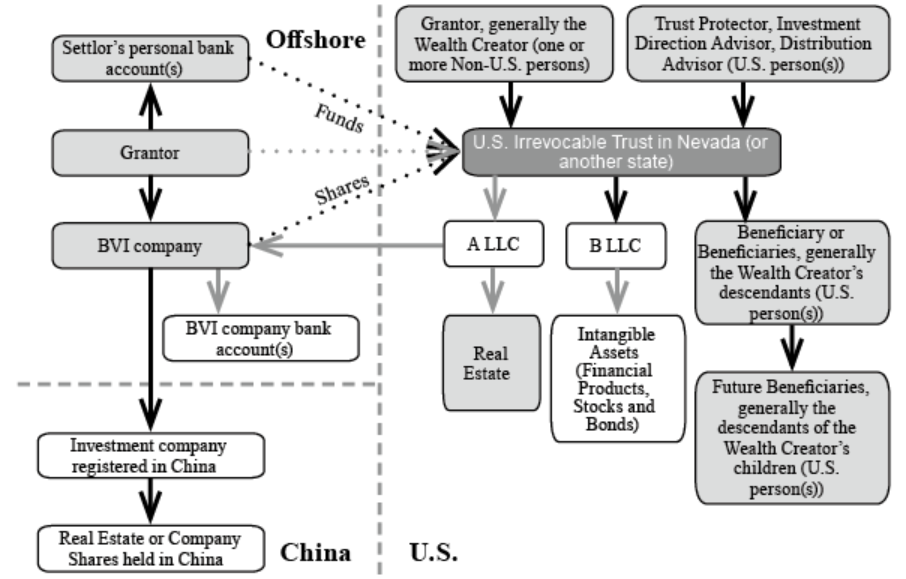

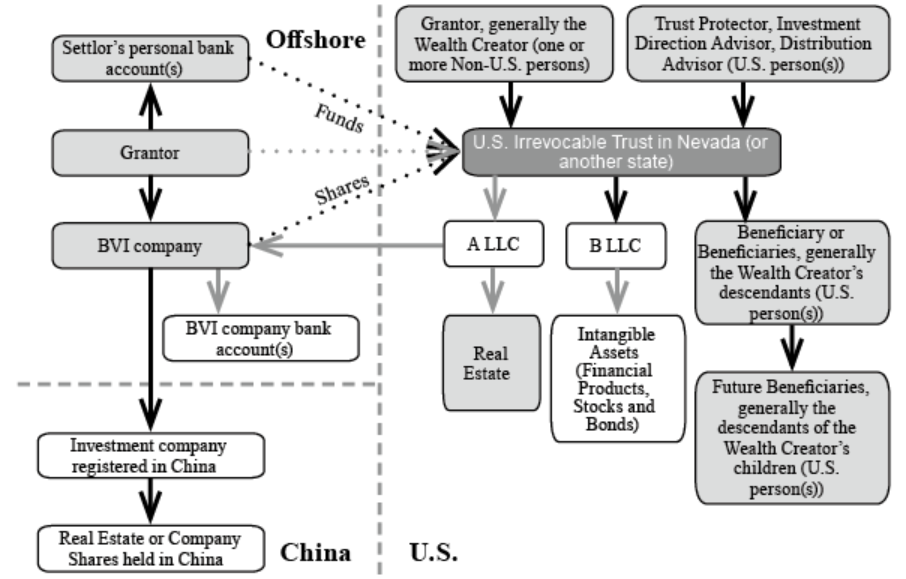

Part I. Accounting Treatment and Tax Returns Filing for U.S. Assets Held by a U.S. Irrevocable Trust Established by a Non-U.S. Person

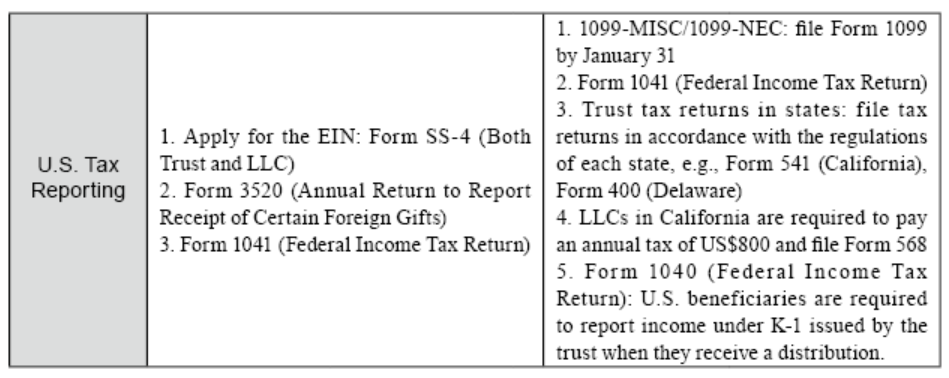

Accounting, tax and asset disclosure requirements are different based on the nature and relevant jurisdiction of each trust.

In this chapter, we will discuss accounting treatment and tax return filing when a non-U.S. citizen sets up an irrevocable trust in the U.S.

Part I. Accounting Treatment and Tax Returns Filing for U.S. Assets Held by a U.S. Irrevocable Trust Established by a Non-U.S. Person

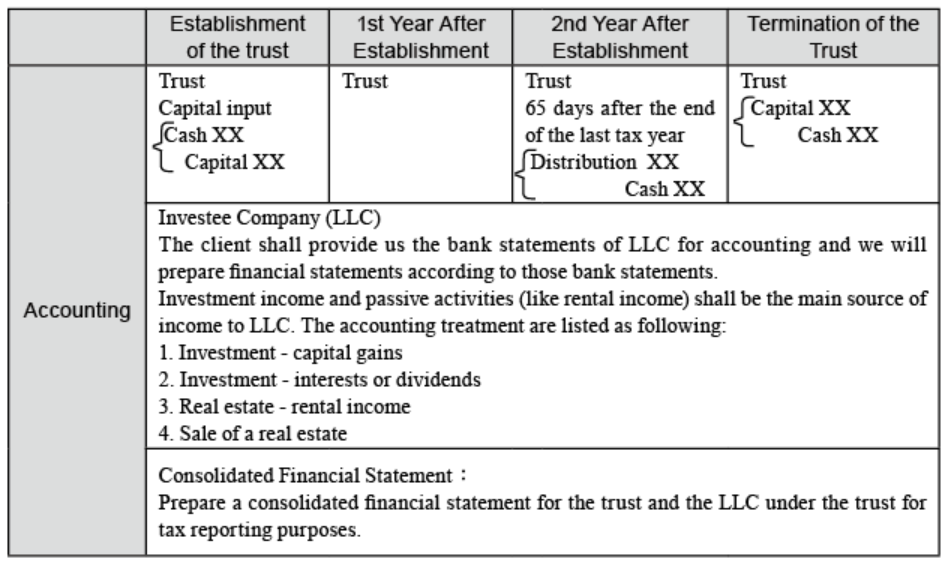

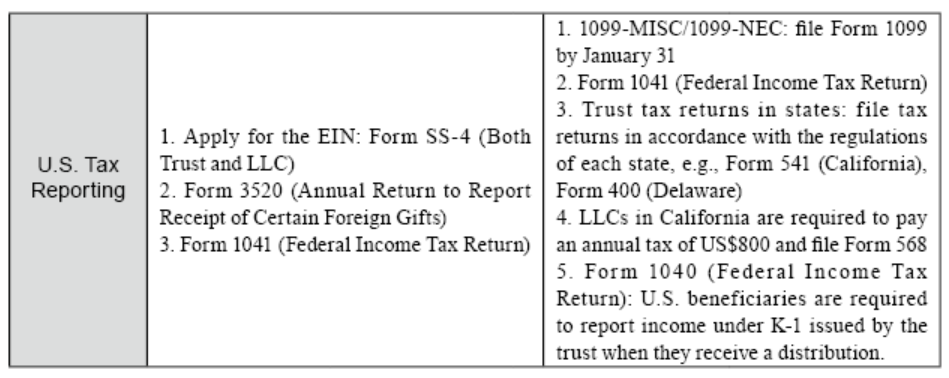

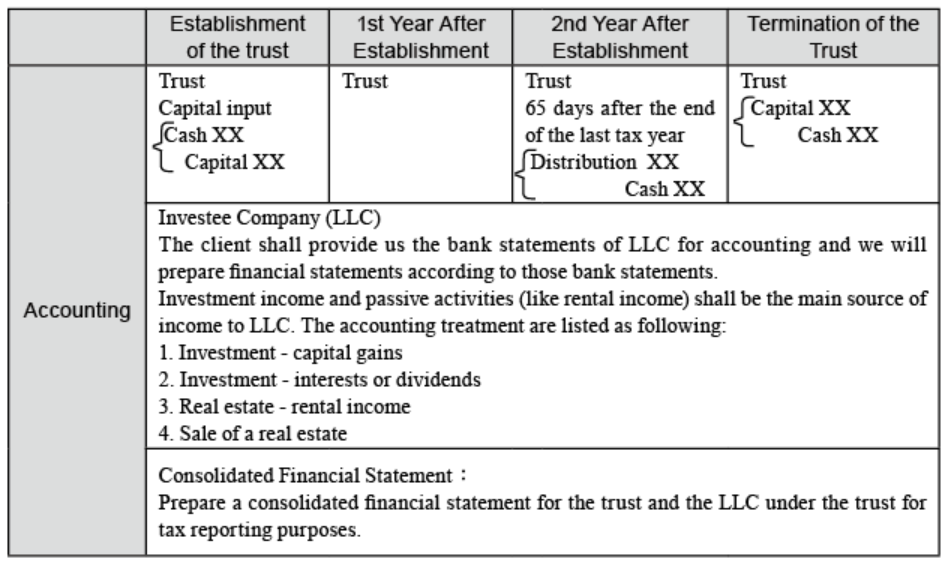

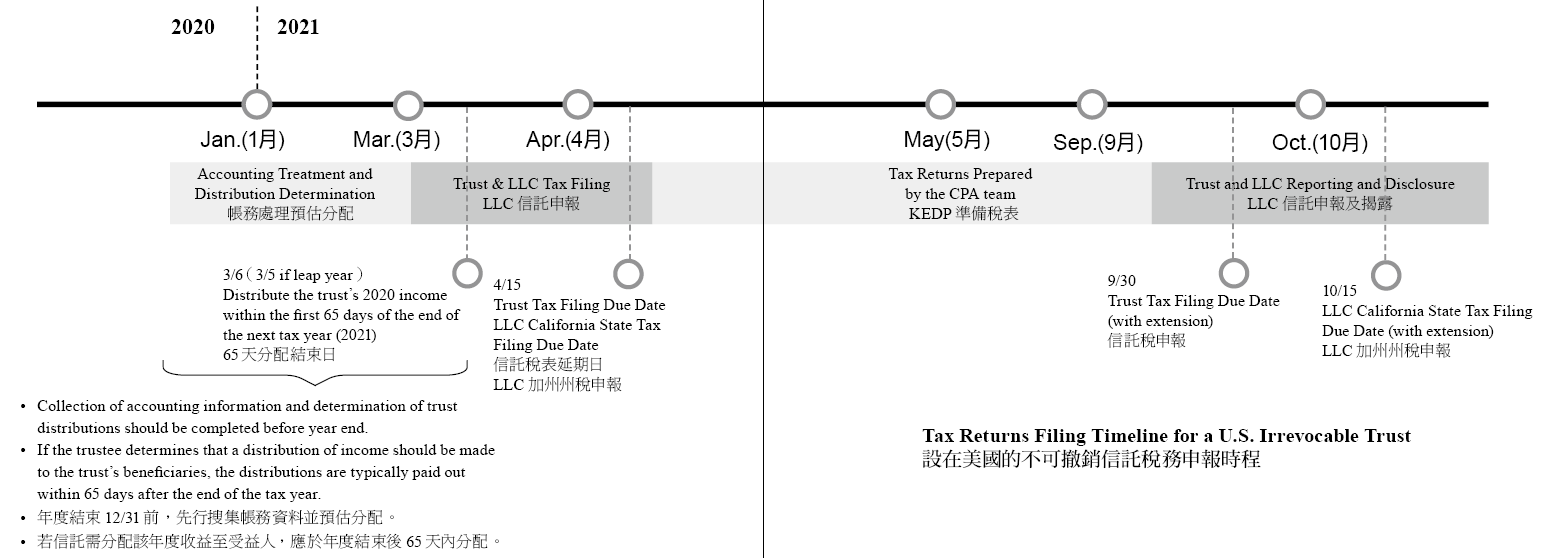

1. The Timeline of Accounting Treatment and Tax Returns Filing for a U.S. Irrevocable Trust

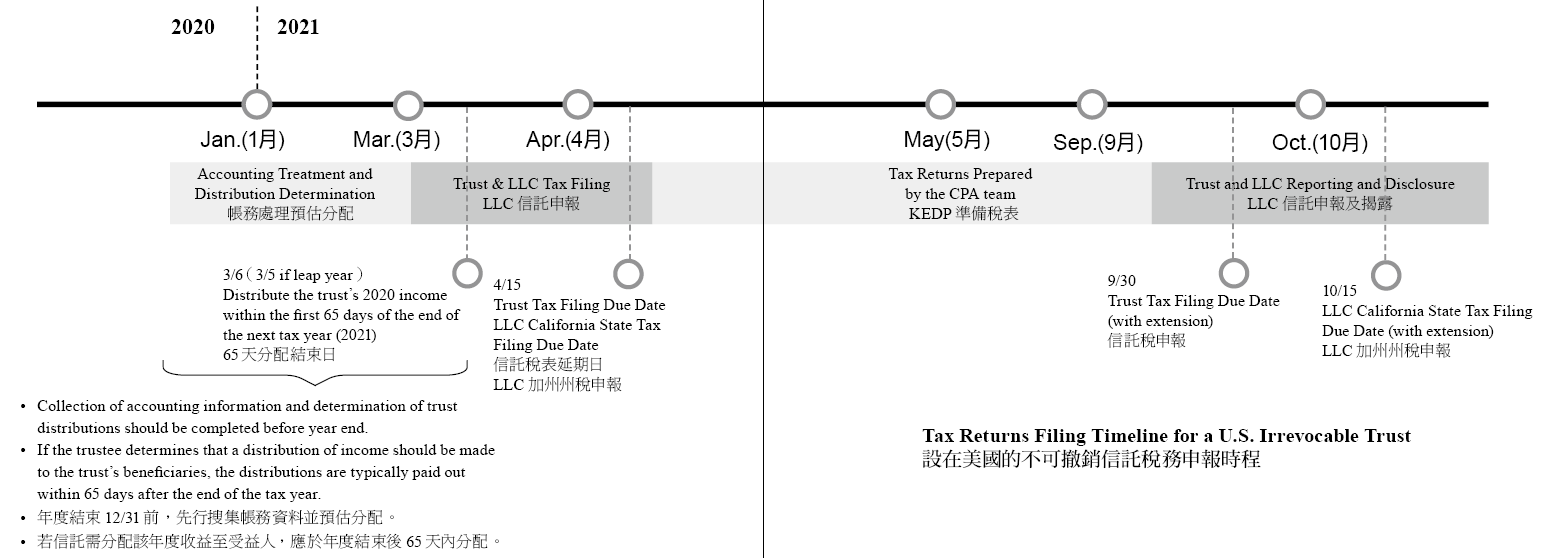

The following chart demonstrates time limit of tax reporting of the trust and LLC during a period (from December 2020 to October 2021) as an example.

2. Accounting Treatment:

(1) Initial phase

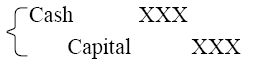

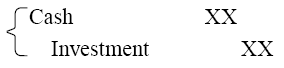

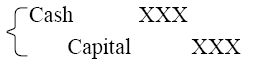

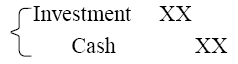

I. Capital inputs: Usually cash is deposited (one or more transactions) into a trust account or a trust-owned LLC bank account.

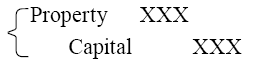

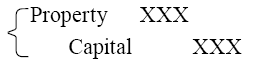

II. For real estate contributions, the fair market value or original cost basis is typically selected.

(2) Operational Phase

I. Investment - Capital Gains

(i) Investment Portfolio

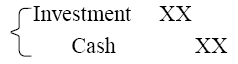

Generally, the transaction and cash flow from the bank statement are used to verify investment decisions provided by the clients.

(ii) Commodities Investments

The bank statement typically does not provide information regarding the cost basis and / or capital gains resulting from the sale of commodities. However, it will provide information regarding the proceeds from the sale. Once a sale has occurred, a journal entry should be completed. The journal entries can be modified or adjusted after receipt of the Form 1099-B.

(iii) Capital gains (profits and losses)

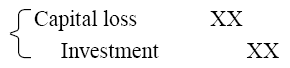

Recognize capital gains or losses after obtaining Form 1099-B.

As a result, the cash on the account would still be equal to the bank statement and any capital gains (losses) should match numbers presented on the Form 1099-B.

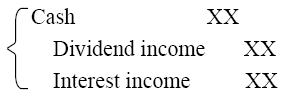

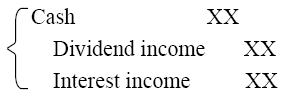

II. Interest and Dividends

One should be cautious of distinguishing the interest and dividends are taxable or tax-free and preparing trust tax returns.

III. Purchase of real estate (rental income)

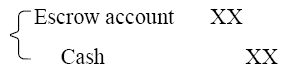

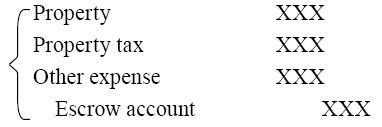

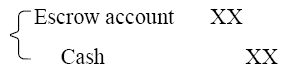

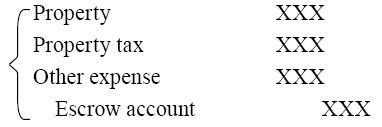

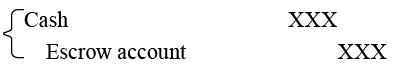

Whenever there is a purchase of real estate, the bank statement will show a lump-sum withdrawal. A “Settlement Statement” should be obtained in order to categorize additional costs and expenses relating to the purchase. When purchasing real estate in the U.S., expenses are usually paid out of an escrow account.

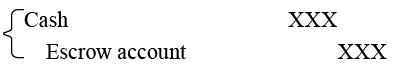

The following are some common accounting entries:

Transaction completed

If there is a balance refund:

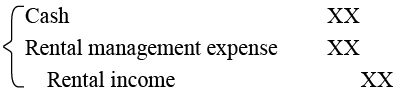

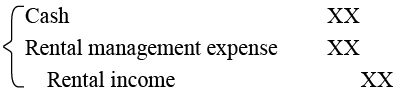

Rental Activities

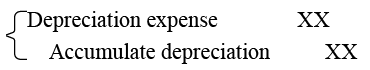

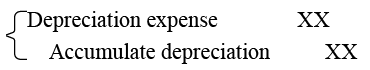

Depreciation is calculated annually depending on the type of real estate being depreciated:

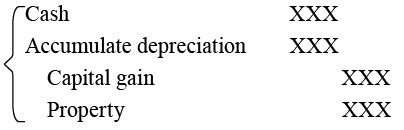

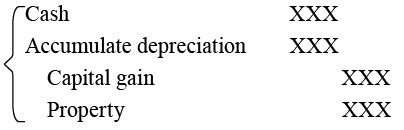

IV. Sale of a real estate

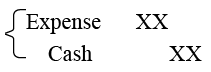

V. Various fees

3. U.S. Tax Returns

(1) Initial phase

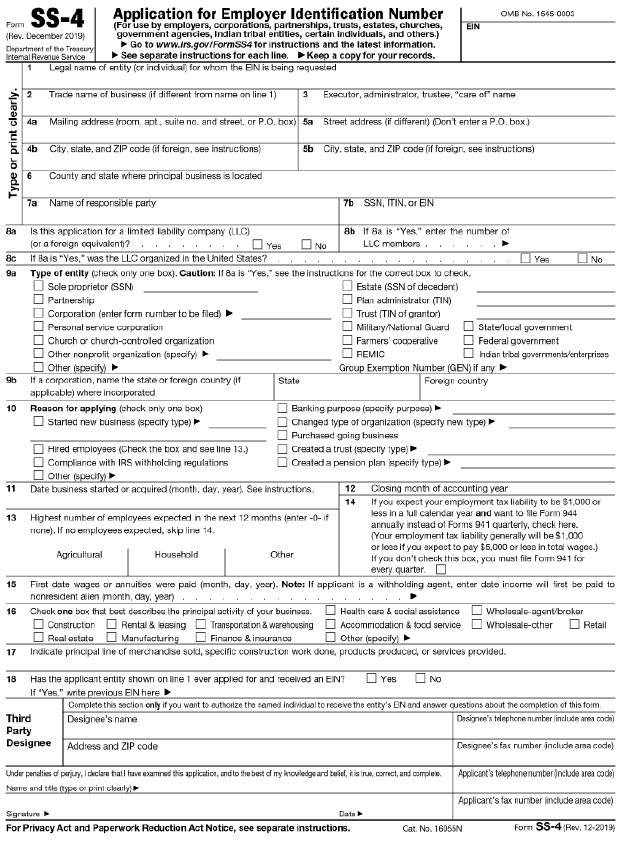

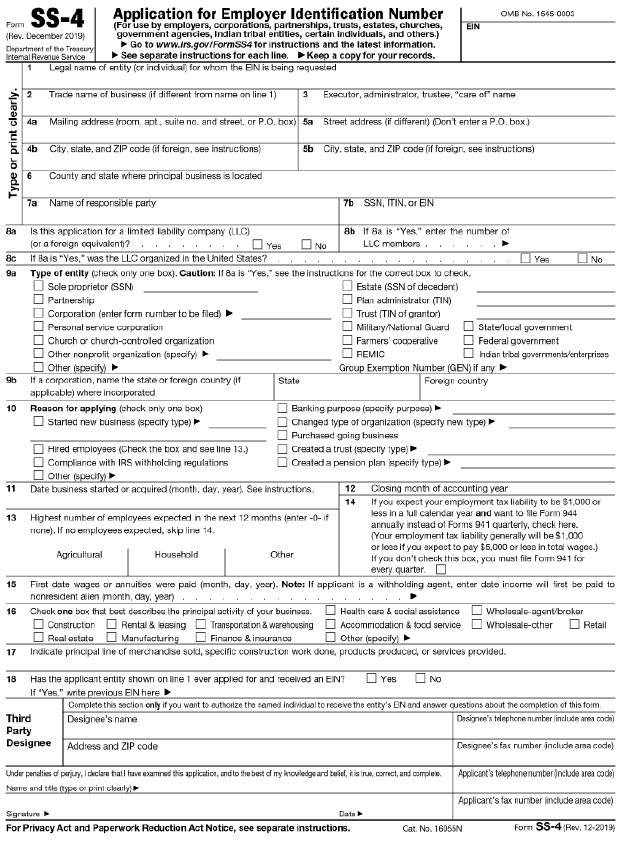

I. EIN (Employer Identification Number) Application

All EIN applications (mail, fax, internet) must disclose the name and Taxpayer Identification Number (e.g., SSN, ITIN or EIN number) of the principal officer, general partner, grantor, owner or trustor. These individuals or business entities, referred to by the IRS as “responsible parties,” are responsible for controlling, managing or directing the applicant entity and responsible for disposing of the funds and assets of that entity. Unless the applicant is a government entity, the responsible party must be an individual (i.e., a natural person) and not an entity.

The following are common ways to apply for an EIN:

(i) Apply Online

The Internet EIN application is the most convenient method for customers to apply for and obtain an EIN. Once the application is completed, the information will be validated during the online session and an EIN will be immediately issued. The online application process is available for all entities whose principal business, office or agency or legal residence in the case of an individual, is located in the U.S. or U.S. Territories.

(ii) Apply by Fax

Taxpayers can fax the completed Form SS-4 application to the appropriate fax number. If it is determined that the entity needs a new EIN, one will be assigned using the appropriate procedures for the entity type. If the taxpayer’s fax number is provided, a fax will be sent back with the EIN within four business days.

(iii) Apply by Mail

The processing time for an EIN application received by mail is four weeks. If it is determined that the entity needs a new EIN, one will be assigned using the appropriate procedures for the entity type and mailed to the taxpayer.

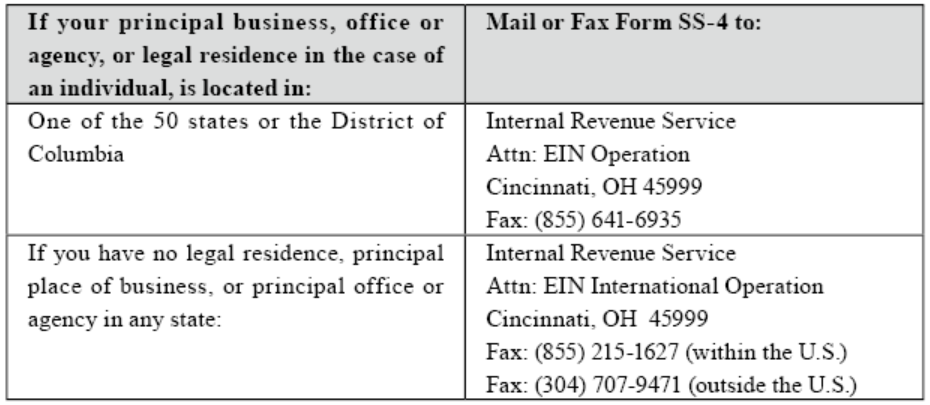

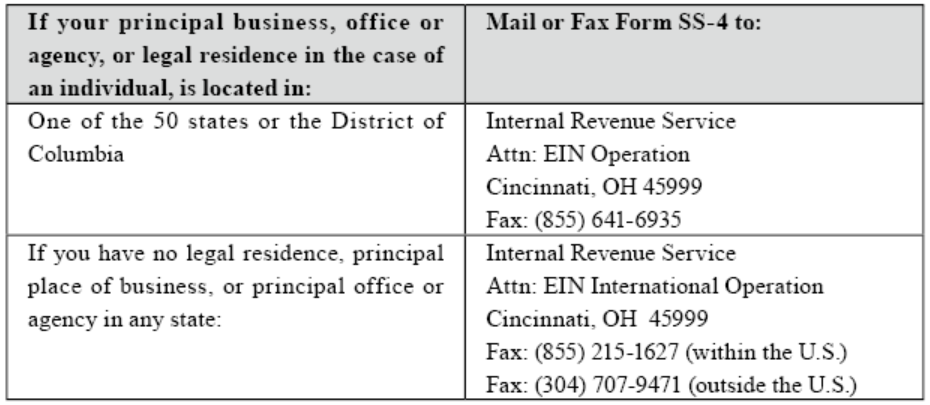

The IRS provides ways to mail or fax Form SS-4 as follows:

II. Form 3520 (Foreign Trusts and Gift Tax Returns)

(i) Filing date: April 15th of each year.

(ii) Filing requirements:

Form 3520 should be reported to the IRS, disclosing information of U.S. irrevocable trust receiving funds from offshore if the following conditions are met:

Form 3520, Part IV, column 54 and 55 should be reported respectively to the IRS if the following conditions are met:

What are the penalties for failing to report foreign gifts on time? This depends on the source of the gift, as explained below:

In the case of a failure to timely report foreign gifts described in section 6039F, a penalty equal to 5% of the amount of such foreign gifts applies for each month for which the failure to report continues (not to exceed a total of 25%).

If a U.S. individual fails to report the distribution received by the foreign trust, a penalty equal to 35% of the gross value of the distribution received from the foreign trust is levied. (Section 6677)

It is important to note that if the sum of money remitted to the trust in the year it is settled exceeds the Form 3520 filing threshold, the transfer must be reported in accordance with the regulations. Individuals or trusts receiving in excess of $100,000 generally should engage a U.S. accountant to assist with the filing process. It is important to note that the IRS may issue letters and / or audit taxpayers who file Form 3520, especially those who filled out the form incorrectly.

III. Form 1041 (Federal Trust Tax Form)

Usually, the capital invested in the beginning of the year after the trust is established will not generate much income. However, if the following conditions are met, taxpayers are required to file Form 1041:

(i) Gross Income (GI) greater than US$600

(ii) Taxable income for the year

(iii) A beneficiary who is a nonresident alien

(2) Operation Phase

After the first year of normal operation, the trust is required to file tax returns as follows:

I. Form 1099-NEC

LLCs under the trust may be required to file Form 1099-NEC (Nonemployee Compensation) to report payments made during your trade or business to independent contractors for the taxable year.

If the following four conditions are met, you must generally report a payment as NEC.

(i) You made the payment to someone who is not your employee.

(ii) You made the payment for services during your trade or business (including government agencies and nonprofit organizations).

(iii) You made the payment to an individual, partnership, estate, or, in some cases, a corporation.

(iv) You made payments to the payee of at least US$600 during the year.

According to the IRS, Form 1099-MISC is issued to any individual or organization that makes a payment to the taxpayer equal to or greater than US$600 (or rest) during the taxable year.

III. Form 1041 (Federal Trust Tax Form)

(i) Filing date: April 15th of each year. Form 7004 may be filed by April 15th and can be extended to September 30th.

(ii) Filing requirements: Form 1041 is required if any of the following conditions is met:

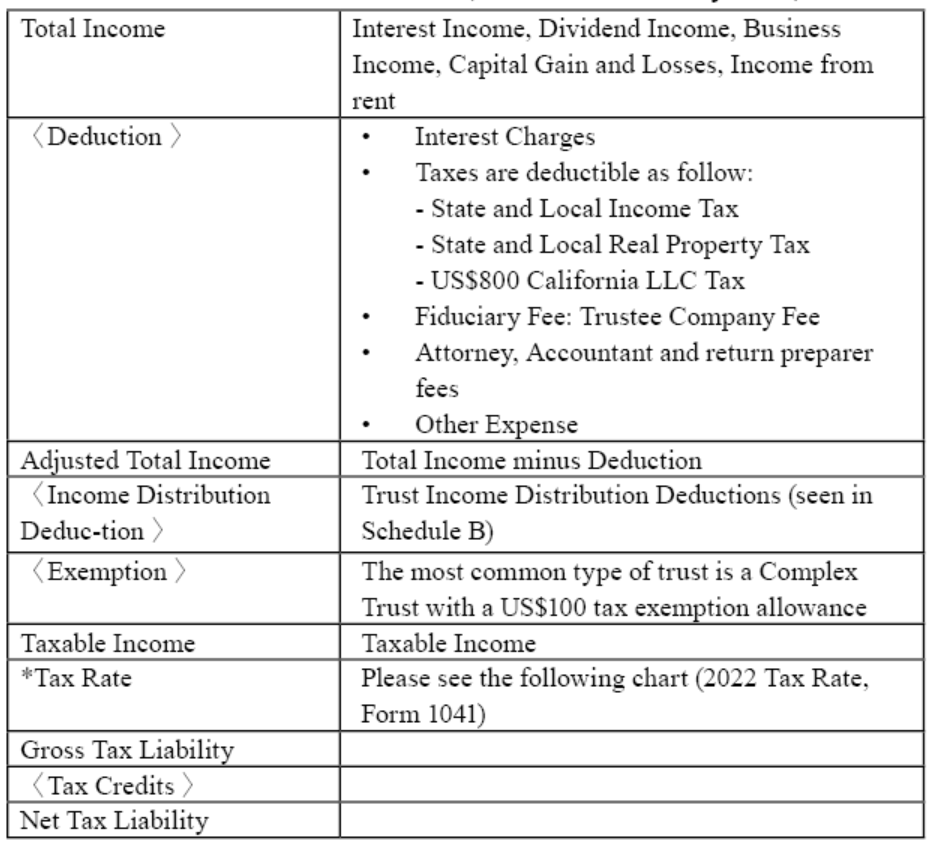

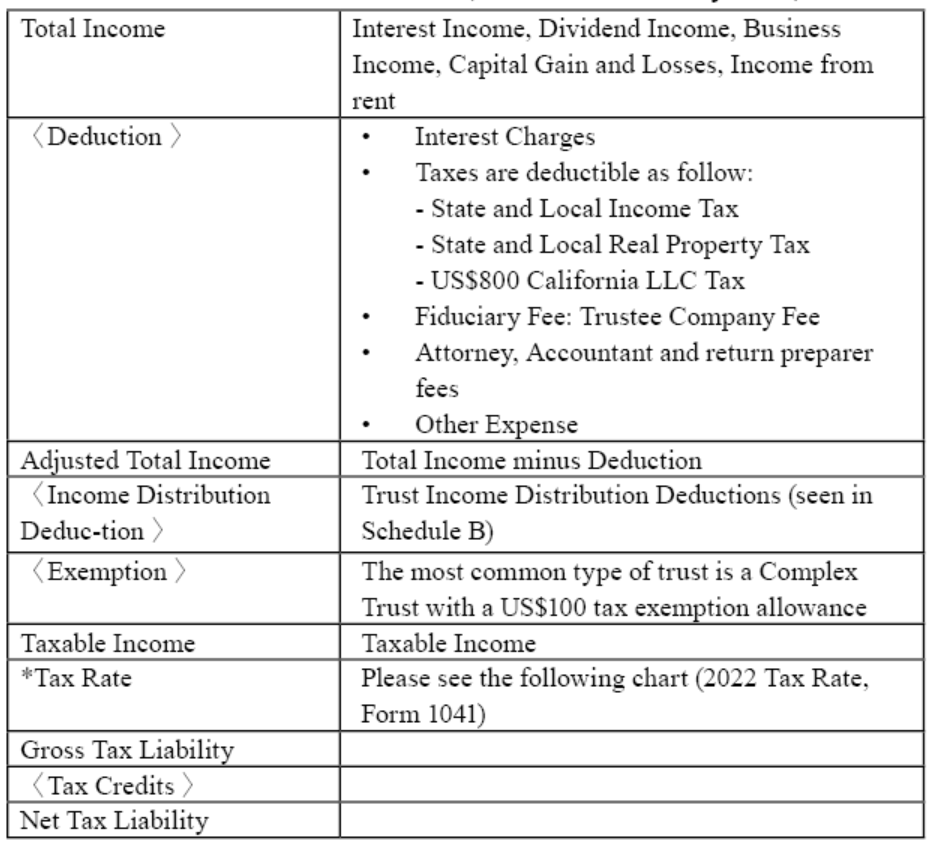

Trust tax is computed by subtracting the required deductions and exemptions from the trust’s gross income for the tax year. Fiduciary fees, attorney, accountant return preparer fees and other expenses are subject to Section 67(e) and the following limitations on the amount of the deduction based on the proportion of the exemption income.

The following is a calculation of the fees and solicitor’s fees of a trustee company:

* Tax exempt income US$30,000

* US$30,000 / US$50,000 = 60%

* US$15,000 × 0.6 = 9,000 (expenses corresponding to the tax-free income are not deductible)

* US$15,000 - 9,000 = 6,000 (deductible attorney’s fee)

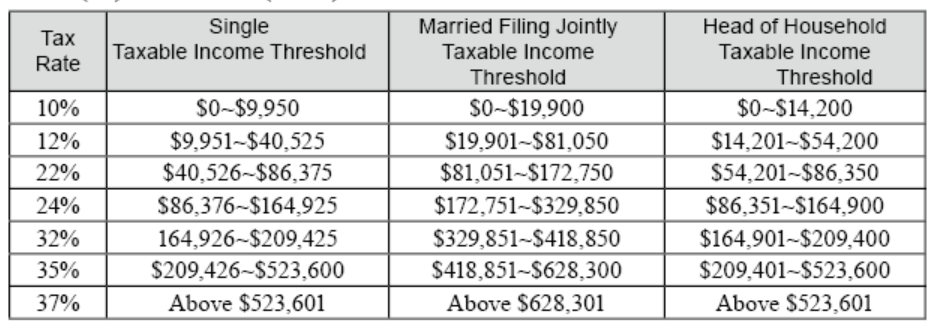

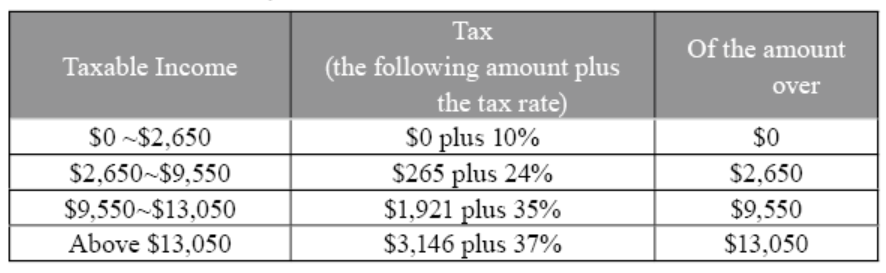

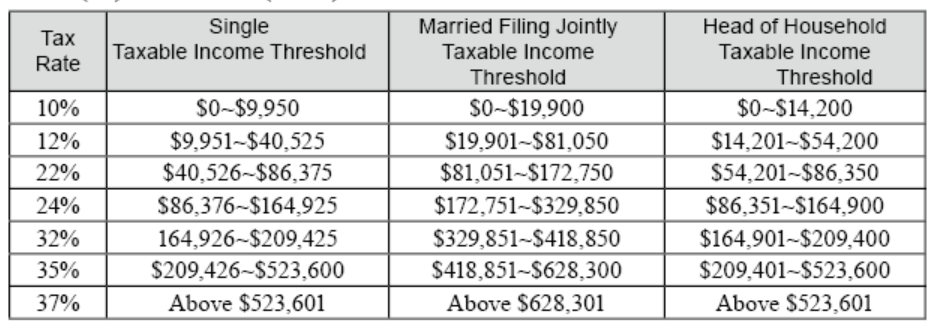

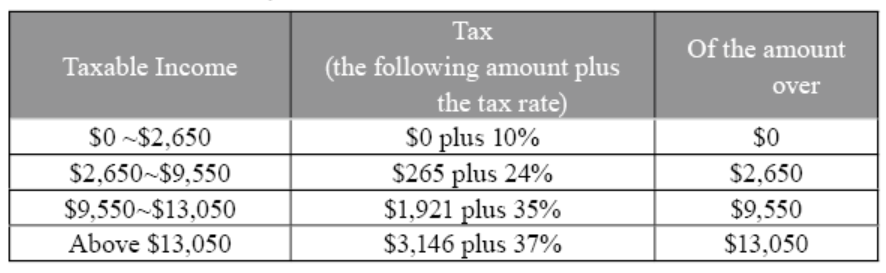

2021 Tax Rate, Form 1041

IV. Introduction on Schedules of Form 1041

The following are common schedules of Form 1041:

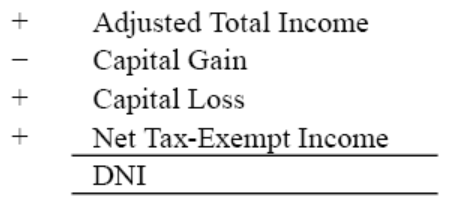

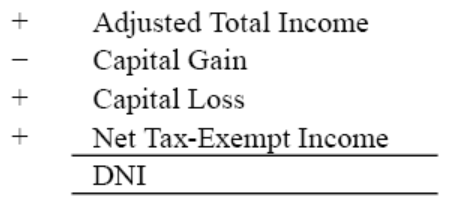

DNI is calculated as follows:

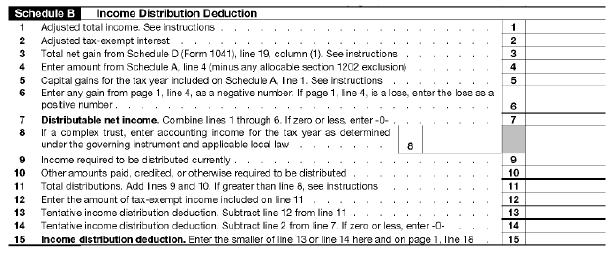

IDD (Income Distribution Deduction) as an amount of deduction on the trust’s tax return (Form 1041, line 18).

DNI (Distributable Net Income) - Tax-Exempt Income; or

Actual Distribution - Tax-Exempt Income whichever is smaller.

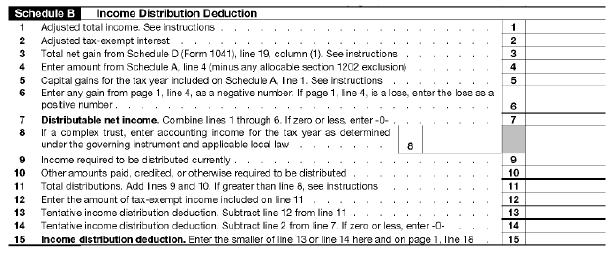

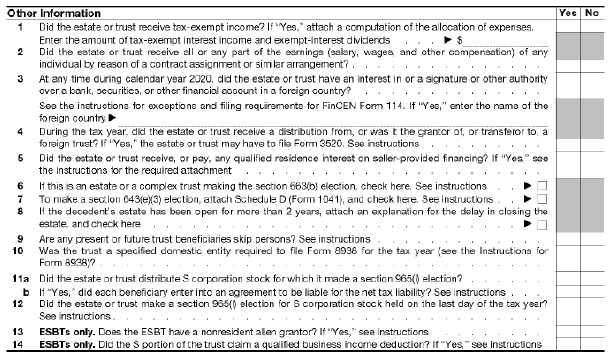

The following Schedule B and other columns of Form 1041 are provided for reference (“Other information” is shown on the right page):

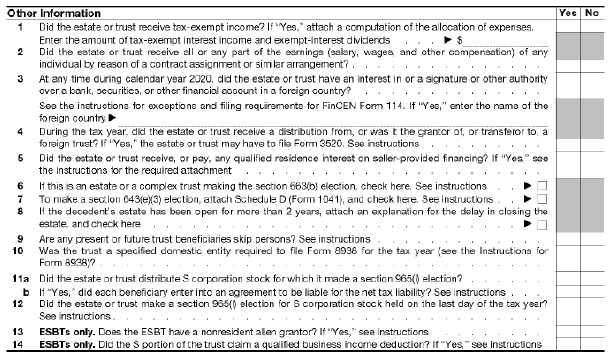

Here are some questions from the “Other Information” column of Form 1041:

Q1. Is there a tax-exempt income?

Q3. Do I need to file an FBAR (Form 114)?

Taxpayers must file an FBAR to report the following if the aggregate value of their foreign financial accounts exceed US$10,000:

Q6. Is there an option to make distributions by using the 65-day rule?

Distributions within the first 65 days following the close of the taxable year are treated as distributions for the current year. Therefore, trust accounts must be prepared, and distributions should be estimated as soon as possible after the end of the tax year. The trust will be responsible for paying taxes on any income generated by the trust that is not distributed to beneficiaries in that year.

Q10. Do I need to file Form 8938?

Foreign financial assets must file Form 8938 if the aggregate value of those assets exceeds US$50,000 on the last day of the tax year or US$75,000 at any time during the tax year.

When the trust has capital gains, the total amount of capital gains (long and short term combined) is shown in column 4 of Form 1041 Capital Gain (or Loss), the long-term and short-term capital gains or losses are shown on Schedule D, and the transaction information in the current year is shown on Form 8949.

When there are both capital gains and losses, capital losses can fully offset against capital gains. When capital losses are greater than capital gains, there are two other methods to offset the gains:

① Offsetting other ordinary income. A negative amount is shown in column 4 of Form 1041 when offsetting an ordinary income, which directly deducts the ordinary income for the year, up to a maximum of US$3,000 a year.

② Capital losses can be carried forward into future years. If there is a capital gain in the following year, the capital loss will be used to offset the short-term and long-term capital gain respectively. Capital losses have no period of validity and can be carried forward into future years until exhausted.

V. Trust State Taxes

The need to file a trust state tax return is determined by state regulations. Due to the complexity of trust tax laws, it is recommended that you discuss your trust-related filing obligations with a U.S. accountant.

VI. California Form 541

(i) Filing date: April 15th of each year with an automatic filing extension to October 15th when Form 4868 is filed by April 15th.

(ii) Filing requirements: A person who is a resident of the U.S. for tax purposes and whose gross income for the year is greater than the following amounts (for tax year 2021):

In this chapter, we will discuss accounting treatment and tax return filing when a non-U.S. citizen sets up an irrevocable trust in the U.S.

Part I. Accounting Treatment and Tax Returns Filing for U.S. Assets Held by a U.S. Irrevocable Trust Established by a Non-U.S. Person

1. The Timeline of Accounting Treatment and Tax Returns Filing for a U.S. Irrevocable Trust

The following chart demonstrates time limit of tax reporting of the trust and LLC during a period (from December 2020 to October 2021) as an example.

2. Accounting Treatment:

(1) Initial phase

I. Capital inputs: Usually cash is deposited (one or more transactions) into a trust account or a trust-owned LLC bank account.

II. For real estate contributions, the fair market value or original cost basis is typically selected.

(2) Operational Phase

I. Investment - Capital Gains

(i) Investment Portfolio

Generally, the transaction and cash flow from the bank statement are used to verify investment decisions provided by the clients.

(ii) Commodities Investments

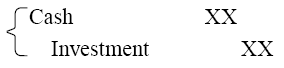

The bank statement typically does not provide information regarding the cost basis and / or capital gains resulting from the sale of commodities. However, it will provide information regarding the proceeds from the sale. Once a sale has occurred, a journal entry should be completed. The journal entries can be modified or adjusted after receipt of the Form 1099-B.

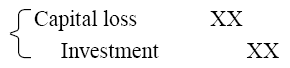

(iii) Capital gains (profits and losses)

Recognize capital gains or losses after obtaining Form 1099-B.

As a result, the cash on the account would still be equal to the bank statement and any capital gains (losses) should match numbers presented on the Form 1099-B.

II. Interest and Dividends

One should be cautious of distinguishing the interest and dividends are taxable or tax-free and preparing trust tax returns.

III. Purchase of real estate (rental income)

Whenever there is a purchase of real estate, the bank statement will show a lump-sum withdrawal. A “Settlement Statement” should be obtained in order to categorize additional costs and expenses relating to the purchase. When purchasing real estate in the U.S., expenses are usually paid out of an escrow account.

The following are some common accounting entries:

Transaction completed

If there is a balance refund:

Rental Activities

Depreciation is calculated annually depending on the type of real estate being depreciated:

- Residential Real Property is depreciated over 27.5 years using the straight-line basis method. Rental fees at the beginning and the end of the month are applied using the Mid-month Convention.

- Commercial property is depreciated over 39 years using the straight-line basis method. Rental fees at the beginning and the end of the month are applied using the Mid-month Convention.

IV. Sale of a real estate

V. Various fees

3. U.S. Tax Returns

(1) Initial phase

I. EIN (Employer Identification Number) Application

All EIN applications (mail, fax, internet) must disclose the name and Taxpayer Identification Number (e.g., SSN, ITIN or EIN number) of the principal officer, general partner, grantor, owner or trustor. These individuals or business entities, referred to by the IRS as “responsible parties,” are responsible for controlling, managing or directing the applicant entity and responsible for disposing of the funds and assets of that entity. Unless the applicant is a government entity, the responsible party must be an individual (i.e., a natural person) and not an entity.

The following are common ways to apply for an EIN:

(i) Apply Online

The Internet EIN application is the most convenient method for customers to apply for and obtain an EIN. Once the application is completed, the information will be validated during the online session and an EIN will be immediately issued. The online application process is available for all entities whose principal business, office or agency or legal residence in the case of an individual, is located in the U.S. or U.S. Territories.

(ii) Apply by Fax

Taxpayers can fax the completed Form SS-4 application to the appropriate fax number. If it is determined that the entity needs a new EIN, one will be assigned using the appropriate procedures for the entity type. If the taxpayer’s fax number is provided, a fax will be sent back with the EIN within four business days.

(iii) Apply by Mail

The processing time for an EIN application received by mail is four weeks. If it is determined that the entity needs a new EIN, one will be assigned using the appropriate procedures for the entity type and mailed to the taxpayer.

The IRS provides ways to mail or fax Form SS-4 as follows:

II. Form 3520 (Foreign Trusts and Gift Tax Returns)

(i) Filing date: April 15th of each year.

(ii) Filing requirements:

Form 3520 should be reported to the IRS, disclosing information of U.S. irrevocable trust receiving funds from offshore if the following conditions are met:

- When the trust is established, the grantor remits foreign funds into a U.S. irrevocable trust.

- Fees paid by the grantor but not paid by the trust are deemed gifts.

Form 3520, Part IV, column 54 and 55 should be reported respectively to the IRS if the following conditions are met:

- Taxpayers should complete Form 3520, Part IV, column 54, if the aggregate value of gifts or bequests he or she receives from nonresident alien or foreign estate exceeds US$100,000 during the taxable year.

- Taxpayers should complete Form 3520, Part IV, column 55, if the aggregate value of gifts or bequests he or she receives from foreign corporation or partnership exceeds US$16,815 (added May 17, 2021) during the taxable year.

What are the penalties for failing to report foreign gifts on time? This depends on the source of the gift, as explained below:

In the case of a failure to timely report foreign gifts described in section 6039F, a penalty equal to 5% of the amount of such foreign gifts applies for each month for which the failure to report continues (not to exceed a total of 25%).

If a U.S. individual fails to report the distribution received by the foreign trust, a penalty equal to 35% of the gross value of the distribution received from the foreign trust is levied. (Section 6677)

It is important to note that if the sum of money remitted to the trust in the year it is settled exceeds the Form 3520 filing threshold, the transfer must be reported in accordance with the regulations. Individuals or trusts receiving in excess of $100,000 generally should engage a U.S. accountant to assist with the filing process. It is important to note that the IRS may issue letters and / or audit taxpayers who file Form 3520, especially those who filled out the form incorrectly.

III. Form 1041 (Federal Trust Tax Form)

Usually, the capital invested in the beginning of the year after the trust is established will not generate much income. However, if the following conditions are met, taxpayers are required to file Form 1041:

(i) Gross Income (GI) greater than US$600

(ii) Taxable income for the year

(iii) A beneficiary who is a nonresident alien

(2) Operation Phase

After the first year of normal operation, the trust is required to file tax returns as follows:

I. Form 1099-NEC

LLCs under the trust may be required to file Form 1099-NEC (Nonemployee Compensation) to report payments made during your trade or business to independent contractors for the taxable year.

If the following four conditions are met, you must generally report a payment as NEC.

(i) You made the payment to someone who is not your employee.

(ii) You made the payment for services during your trade or business (including government agencies and nonprofit organizations).

(iii) You made the payment to an individual, partnership, estate, or, in some cases, a corporation.

(iv) You made payments to the payee of at least US$600 during the year.

- Note: In the beginning of tax year 2020, you must use Form 1099-NEC to report the NEC previously reported in Box 7 of Form 1099-MISC.

According to the IRS, Form 1099-MISC is issued to any individual or organization that makes a payment to the taxpayer equal to or greater than US$600 (or rest) during the taxable year.

III. Form 1041 (Federal Trust Tax Form)

(i) Filing date: April 15th of each year. Form 7004 may be filed by April 15th and can be extended to September 30th.

(ii) Filing requirements: Form 1041 is required if any of the following conditions is met:

- There is taxable income for the year

- Gross income greater than US$600

- There’s a beneficiary who is a nonresident alien

- Late filing penalty: a penalty of 5% of the tax due for each month, up to a maximum of 25%.

- Late payment penalty: a penalty of 0.5% of the tax due for each month, up to a maximum of 25%.

Trust tax is computed by subtracting the required deductions and exemptions from the trust’s gross income for the tax year. Fiduciary fees, attorney, accountant return preparer fees and other expenses are subject to Section 67(e) and the following limitations on the amount of the deduction based on the proportion of the exemption income.

- Fees paid or incurred in connection with the administration of the trust

- Management fee will only be incurred if the property is held in the trust

The following is a calculation of the fees and solicitor’s fees of a trustee company:

- Assuming the actual payment of the attorney’s fee is US$15,000

* Tax exempt income US$30,000

* US$30,000 / US$50,000 = 60%

* US$15,000 × 0.6 = 9,000 (expenses corresponding to the tax-free income are not deductible)

* US$15,000 - 9,000 = 6,000 (deductible attorney’s fee)

2021 Tax Rate, Form 1041

IV. Introduction on Schedules of Form 1041

The following are common schedules of Form 1041:

(i) Schedule B - Calculation of Income Distribution Deduction

To prevent double taxation, the amount of distribution to beneficiaries must be deducted from taxable income up to the maximum amount of Distributable Net Income (DNI) when calculating trust taxable income. Although tax-exempt interest is not included in taxable income, it is included in DNI because it can be distributed to beneficiaries (however, expenses related to tax-exempt income should be deducted when tax-exempt income is included in DNI). In addition, capital gains are not included in DNI because they are not distributed back to the principal of the trust.DNI is calculated as follows:

IDD (Income Distribution Deduction) as an amount of deduction on the trust’s tax return (Form 1041, line 18).

DNI (Distributable Net Income) - Tax-Exempt Income; or

Actual Distribution - Tax-Exempt Income whichever is smaller.

The following Schedule B and other columns of Form 1041 are provided for reference (“Other information” is shown on the right page):

Here are some questions from the “Other Information” column of Form 1041:

Q1. Is there a tax-exempt income?

Q3. Do I need to file an FBAR (Form 114)?

Taxpayers must file an FBAR to report the following if the aggregate value of their foreign financial accounts exceed US$10,000:

- A trust holding more than 50% of a corporation is required to declare the corporation’s foreign financial account.

- Foreign financial accounts and signature authority accounts held by the trust itself.

Q4. Have you received any distribution from a foreign trust or transferred any trust assets to a foreign trust? Do I need to file Form 3520?Q6. Is there an option to make distributions by using the 65-day rule?

Distributions within the first 65 days following the close of the taxable year are treated as distributions for the current year. Therefore, trust accounts must be prepared, and distributions should be estimated as soon as possible after the end of the tax year. The trust will be responsible for paying taxes on any income generated by the trust that is not distributed to beneficiaries in that year.

Q10. Do I need to file Form 8938?

Foreign financial assets must file Form 8938 if the aggregate value of those assets exceeds US$50,000 on the last day of the tax year or US$75,000 at any time during the tax year.

(ii) Schedule D - Capital Gains (Losses)

The amount of capital gain or loss from a Form 1099-B issued by a broker should be filled in Schedule D. Form 1040, Schedule D of the trust tax form is substantially the same as Form 1040, Schedule D of the individual tax form, see the following instructions:When the trust has capital gains, the total amount of capital gains (long and short term combined) is shown in column 4 of Form 1041 Capital Gain (or Loss), the long-term and short-term capital gains or losses are shown on Schedule D, and the transaction information in the current year is shown on Form 8949.

When there are both capital gains and losses, capital losses can fully offset against capital gains. When capital losses are greater than capital gains, there are two other methods to offset the gains:

① Offsetting other ordinary income. A negative amount is shown in column 4 of Form 1041 when offsetting an ordinary income, which directly deducts the ordinary income for the year, up to a maximum of US$3,000 a year.

② Capital losses can be carried forward into future years. If there is a capital gain in the following year, the capital loss will be used to offset the short-term and long-term capital gain respectively. Capital losses have no period of validity and can be carried forward into future years until exhausted.

(iii) Schedule K-1

When a U.S. beneficiary receives a distribution, the income from the K-1 needs to be filled on Form 1040 and attached Schedule E.V. Trust State Taxes

The need to file a trust state tax return is determined by state regulations. Due to the complexity of trust tax laws, it is recommended that you discuss your trust-related filing obligations with a U.S. accountant.

VI. California Form 541

More specifically, even if your U.S. irrevocable trust is established in another state, but the protector, beneficiary, or related parties under the trust is a California resident, a state tax Form 541 must be filed.

(i) Filing Requirements: if the protector, related beneficiary, or fiduciary related person is a California resident, the trustee is required to file Form 541 if any of the following conditions are met:

- Total income exceeds US$10,000 for the taxable year

- Net income exceeds US$100 for the taxable year

(ii) Filing date: April 15th. If you are unable to file on April 15th, you can get additional six months until October 15th without requiring to file for an extension, but the tax due should still be paid on April 15th to avoid late payment penalty.

(iii) Declaration:

- Situation: The trustee of the trust is a non-California tax resident and has two beneficiaries, one of whom is a California tax resident.

- Calculation:

- Fees can be split based on the proportion of the California source income (Column F / Column B above)

- The first split is calculated based on the proportion of the California tax resident trustee. Since the trust does not have a California tax resident trustee, there will be no income regarded as California source income in the first split (column C). Then the income that has not yet been distributed to California will be split again in the second split. The second split is calculated based on the proportion of the California tax resident beneficiary (column E). The proportion of the California tax resident beneficiary is 50%, so half of his or her income will be split as California source income in the second split.

VII. Form 1040 (Federal Individual Tax Return)(i) Filing date: April 15th of each year with an automatic filing extension to October 15th when Form 4868 is filed by April 15th.

(ii) Filing requirements: A person who is a resident of the U.S. for tax purposes and whose gross income for the year is greater than the following amounts (for tax year 2021):

- Single - US$12,550

- Married filing jointly or qualifying widow(er)- US$25,100

- Married filing separately - US$5

- Head of household - US$18,800