Publications

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 2 U.S. Irrevocable Dynasty Trusts

How does an Irrevocable Trust established in the U.S. compare with an Irrevocable Trust established outside of the U.S.?

In prior decades, numerous Wealth Creators, often persuaded by their private bankers and financial advisors, have settled irrevocable trusts outside of the U.S. These trusts are frequently settled in less established jurisdictions (the Cayman Islands, BVI, Bermuda or Cook Islands, among others) and may have ambiguous legal situs. While often marketed as tools to help safeguard and invest assets for the next generation, these trusts often failed to accomplish its preset goals.

Over the years, descendants of these Wealth Creators have immigrated to the U.S., either receiving a U.S. citizenship or green card; however, this information is rarely if ever considered when crafting the family’s estate plan. Unbeknownst to many of these Wealth Creators, trusts established outside of the U.S. often do not serve the needs of their U.S.-based descendants and could potentially have calamitous tax consequences for their U.S. beneficiaries.

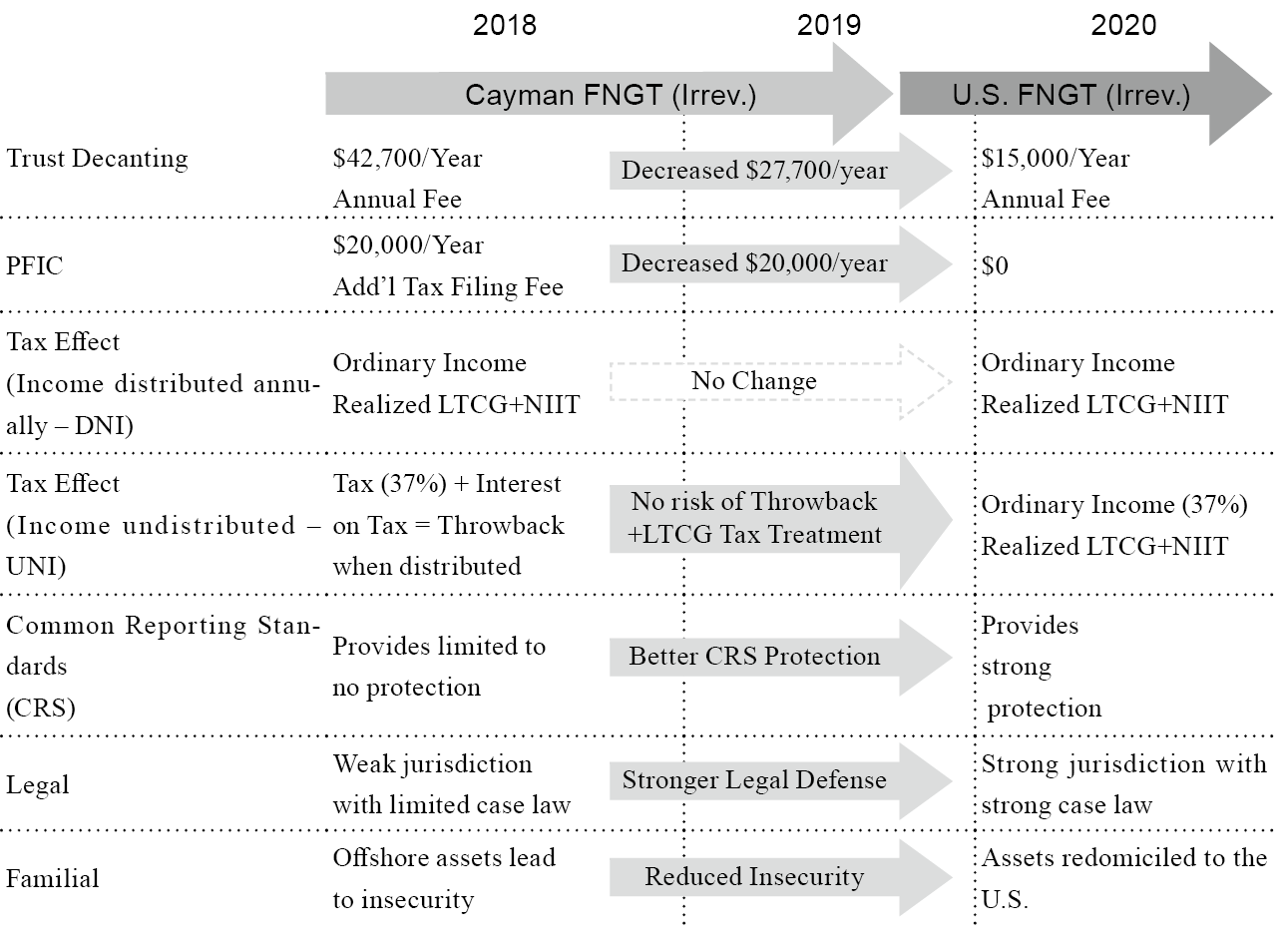

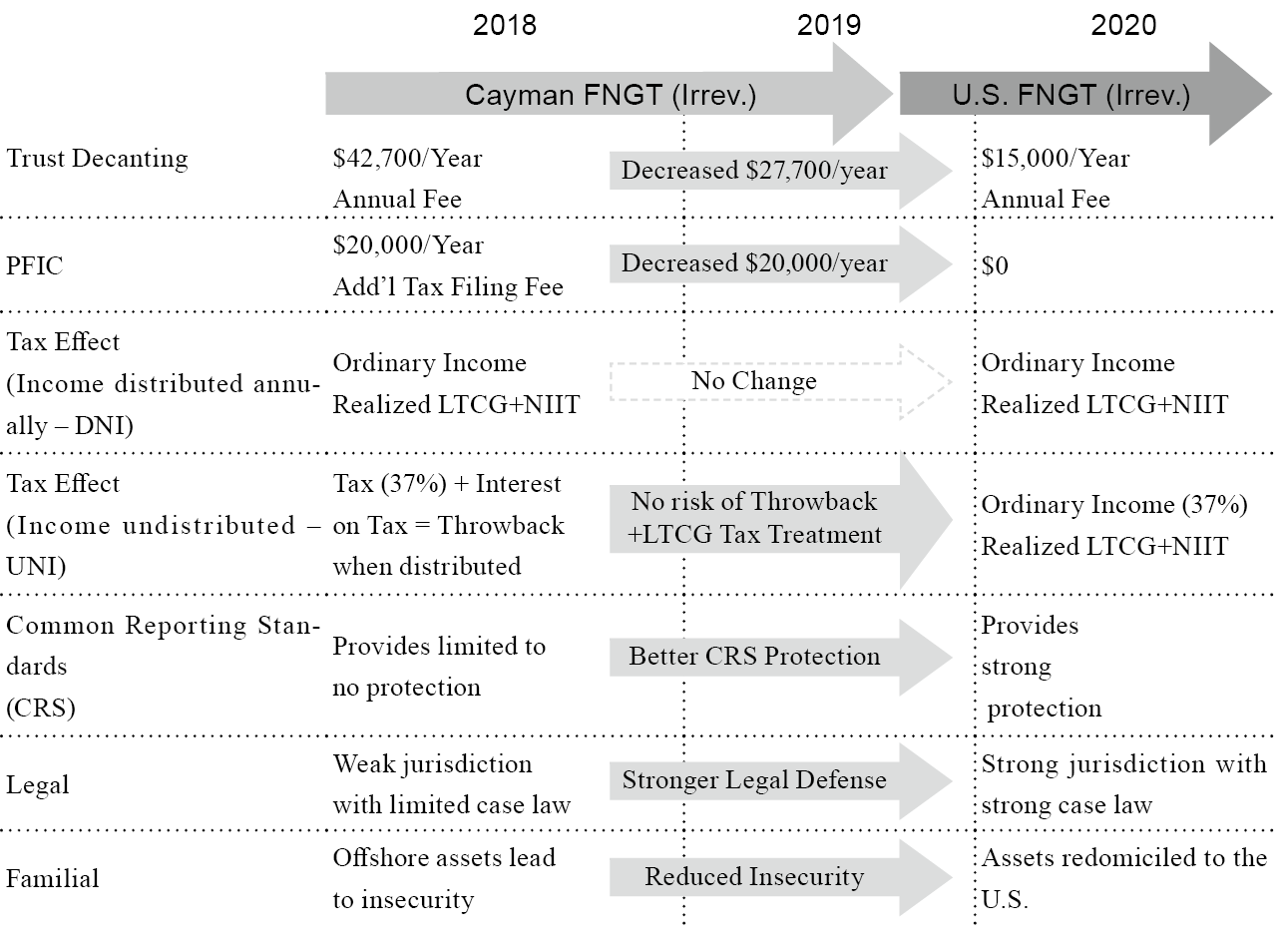

By decanting assets from an offshore irrevocable trust (one established outside of the U.S.) to a U.S.-based one, the Wealth Creator’s family can protect the trust’s assets more thoroughly and reduce its annual trust maintenance expenditures.

*LTCG refers to long-term capital gains, generally taxed at 20% for trusts

*NIIT refers to net investment income tax, generally taxed at 3.8% for trusts

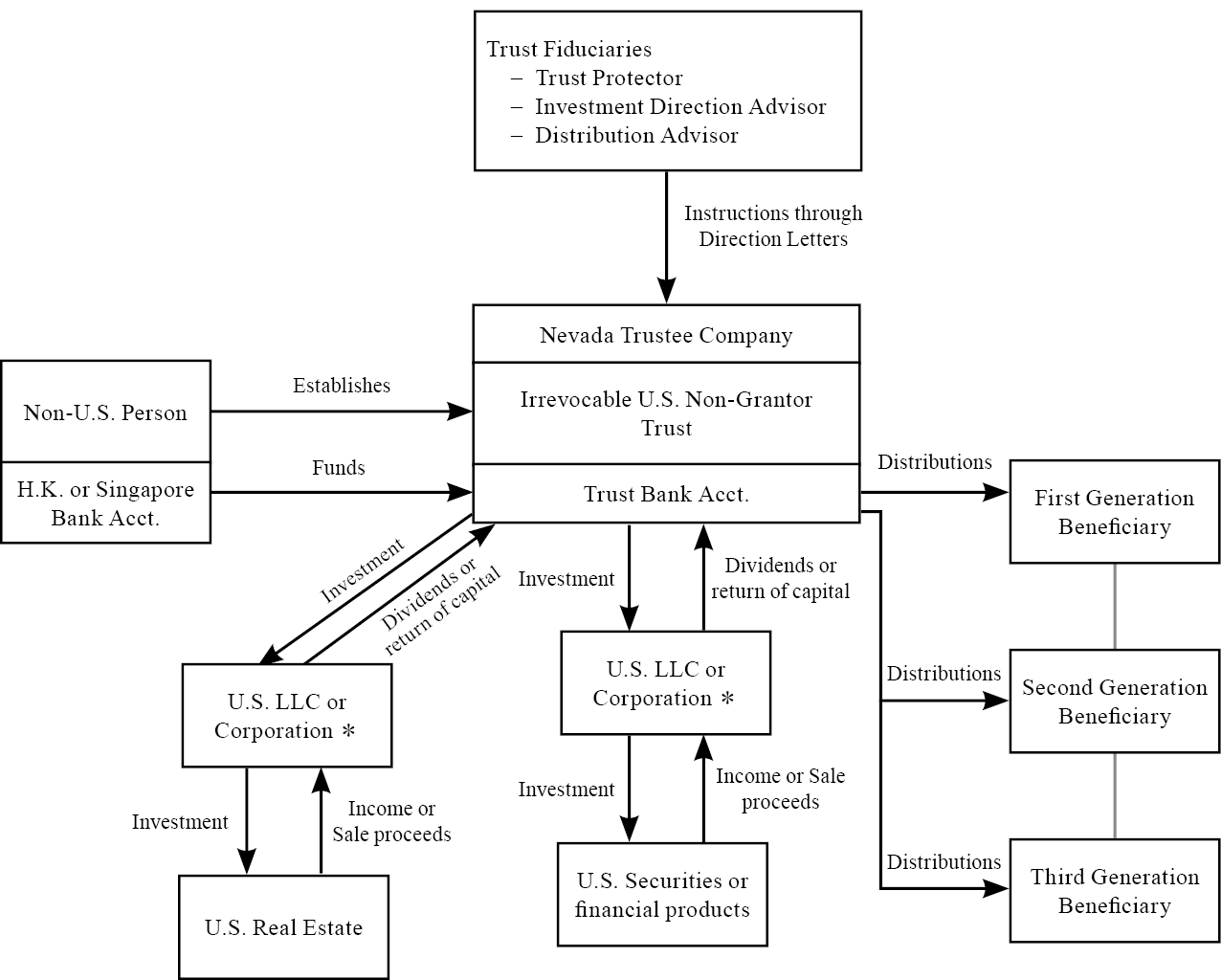

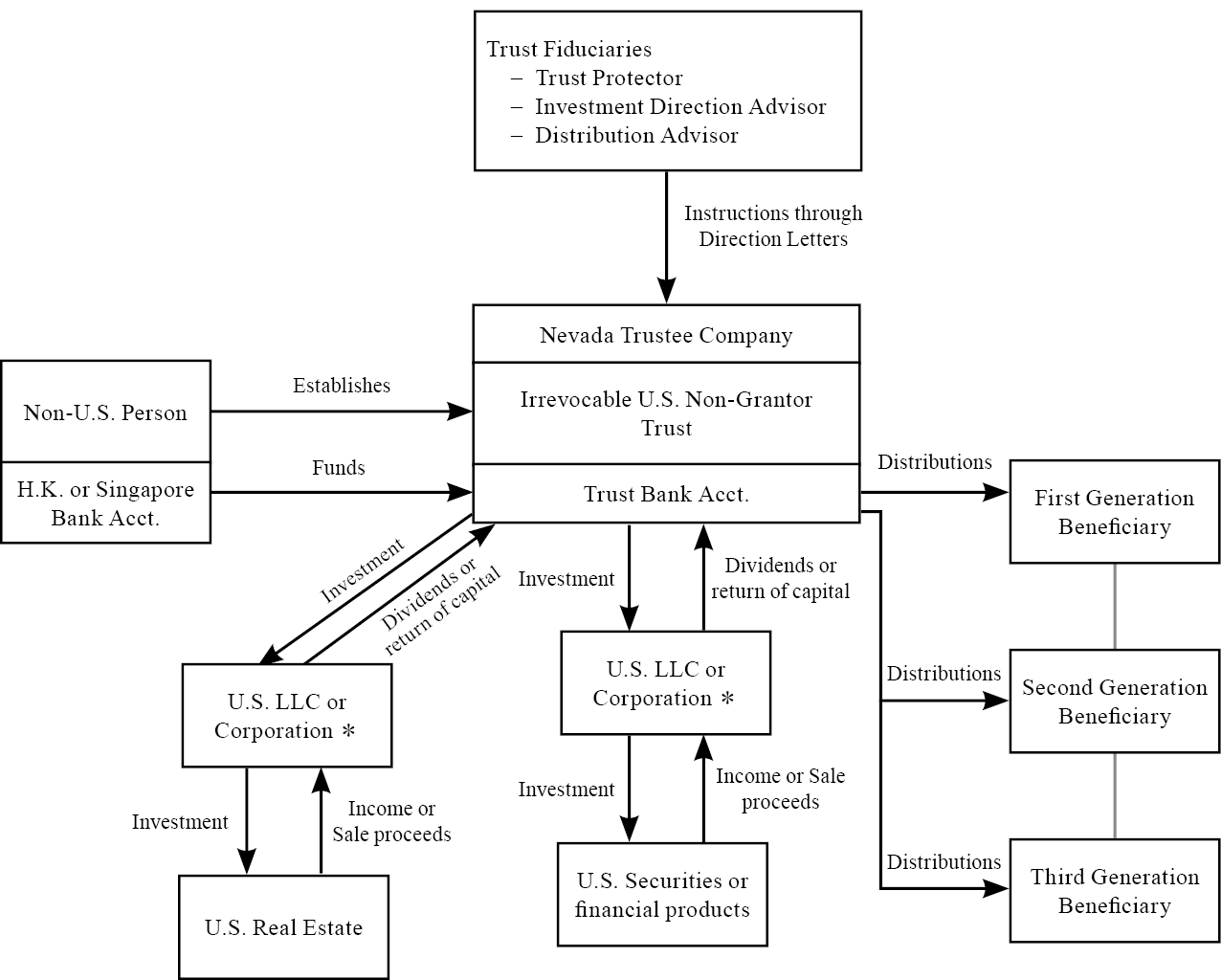

Illustrative Nevada Irrevocable Trust

*Managers or Directors of LLCs and Corporations may be the fiduciaries or beneficiaries of the irrevocable trust.

The above trust is settled by a non-U.S. person in Nevada. A Nevada Trust Company is selected as Trustee. The trust’s beneficiaries, designated by the grantor, are all U.S. persons. The trust invests in multiple wholly-owned LLCs and / or C-Corporations. These companies are invested in U.S. securities, time deposits and real estate.

Over the years, descendants of these Wealth Creators have immigrated to the U.S., either receiving a U.S. citizenship or green card; however, this information is rarely if ever considered when crafting the family’s estate plan. Unbeknownst to many of these Wealth Creators, trusts established outside of the U.S. often do not serve the needs of their U.S.-based descendants and could potentially have calamitous tax consequences for their U.S. beneficiaries.

By decanting assets from an offshore irrevocable trust (one established outside of the U.S.) to a U.S.-based one, the Wealth Creator’s family can protect the trust’s assets more thoroughly and reduce its annual trust maintenance expenditures.

*LTCG refers to long-term capital gains, generally taxed at 20% for trusts

*NIIT refers to net investment income tax, generally taxed at 3.8% for trusts

Illustrative Nevada Irrevocable Trust

*Managers or Directors of LLCs and Corporations may be the fiduciaries or beneficiaries of the irrevocable trust.

The above trust is settled by a non-U.S. person in Nevada. A Nevada Trust Company is selected as Trustee. The trust’s beneficiaries, designated by the grantor, are all U.S. persons. The trust invests in multiple wholly-owned LLCs and / or C-Corporations. These companies are invested in U.S. securities, time deposits and real estate.