專業叢書

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 4 Relevant U.S. Tax Forms for U.S. Trusts & Individuals

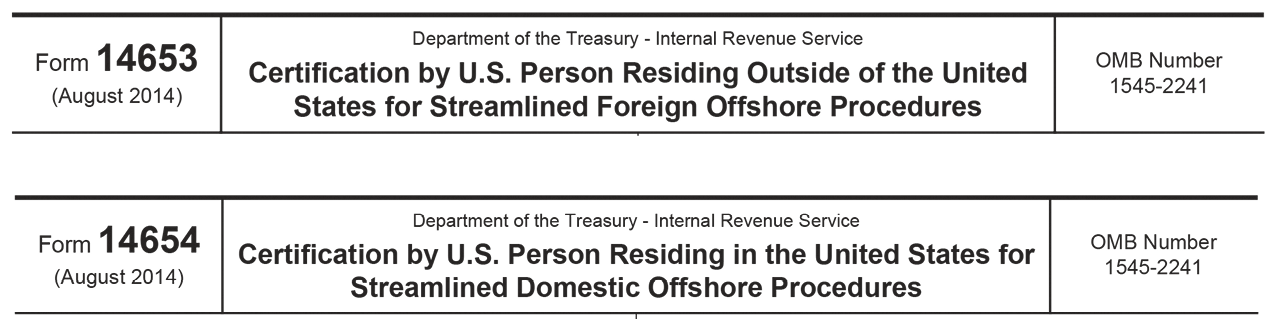

13. Streamlined Procedures (Form 14653 and 14654)

Effective July 1, 2014, the IRS began to offer two types of Streamlined Procedures, herein referred to as “Streamline”:

(1) Streamlined Foreign Offshore Procedures (“SFOP”)

-For U.S. taxpayers residing outside the United States

(2) Streamlined Domestic Offshore Procedures (“SDOP”)

-For U.S. taxpayers residing within the United States

Taxpayers who are U.S. citizens or lawful permanent residents (e.g., Green Card Holders) are considered to reside outside the United States if:

For at least one of the three Streamline years, the individual:

(1) did not have a U.S. “abode” (generally, one’s home, habitation, residence, domicile, or place of dwelling); and

(2) was physically outside the United States for at least 330 full days (meaning, the taxpayer did not spend more than 35 days in the United States).

Under Streamline, the taxpayer is generally required to submit:

- 3 years of tax returns and information returns

- 6 years of Report of Foreign Bank and Financial Accounts (“FBARs”) on Financial Crimes Enforcement Network (“FinCEN”) Form 114

- Non-willful certification (U.S. Resident: Form 14654, Non-US: Form 14653)

Domestic Streamline differs from Foreign Streamline in two main ways:

(1) A domestic resident taxpayer that has failed to file a U.S. income tax return in any of the three most recent tax years cannot participate in Domestic Streamline (while a foreign resident taxpayer that has been similarly delinquent can participate in the Foreign Streamline).

(2) Further, even if the taxpayer qualifies, Domestic Streamline bear a 5% miscellaneous penalty on the highest aggregate balance/value of one’s foreign financial assets (i.e., assets reportable on the FBAR or Form 8938) during the FBAR period. Foreign Streamline does not have this penalty.

Non-Willful Standard

The language of the certification forms seems to offer a broader range of conduct that will be considered non-willful for purposes of Streamline.

In the form, the taxpayer must certify the following:

“My failure to report all income, pay all tax, and submit all required information returns, including FBARs, was due to non-willful conduct. I understand that non-willful conduct is conduct that is due to negligence, inadvertence, or mistake or conduct that is the result of a good faith misunderstanding of the requirements of the law.”

The IRS does not send successful applicants an acceptance or closing letter. In this sense, “no news is good news.” If the IRS does not receive adequate information in the Streamline submission, it will often follow up with the taxpayer and ask for that information.

It may ask for:

- More detailed account information

- More detailed foreign entity information

- More information about the professional whose advice you relied upon

- A further explanation to support your claim of non-willful conduct

If the IRS receives or discovers evidence of willfulness or criminal conduct on the part of the taxpayer (e.g., information received from foreign governments or financial institutions), the IRS could open an examination or investigation that could lead to civil fraud penalties, FBAR penalties, information return penalties, or even a referral to Criminal Investigation. Entrance to the Streamlined program does not guarantee immunity from criminal prosecution.