專業叢書

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 4 Relevant U.S. Tax Forms for U.S. Trusts & Individuals

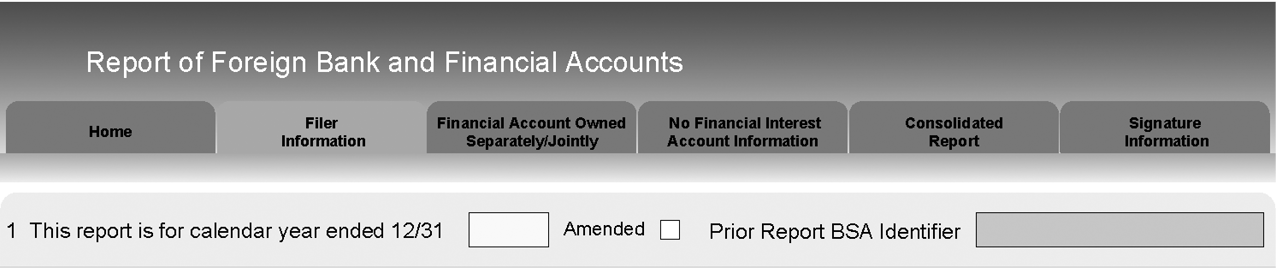

11. FinCEN Form 114

The Bank Secrecy Act (BSA) gives the Department of Treasury the authority to collect information from United States persons, including expats, who have financial interests in or signature authority over financial accounts maintained with financial institutions located outside of the United States.

The BSA requires that a Financial Crimes Enforcement Network (“FinCEN”) Report 114, Report of Foreign Bank and Financial Accounts (FBAR), be filed if the maximum values of the foreign financial accounts exceed $10,000 in the aggregate at any time during the calendar year.

Essentially, any U.S. person who owns a financial account outside of the U.S. generally must file FinCEN Form 114. These “accounts” include:

- Bank accounts (savings accounts, checking accounts and fixed deposit accounts)

- Securities accounts (stocks, bonds, and derivatives)

- Insurance (any policy that has a cash value)

- FBAR Civil Penalties:

-

- Negligent or “non-willful” delinquency can result in a penalty of $10,000 per account per year unless there is reasonable cause for failing to file.

- A “willful” failure to file could be subject to civil penalties equal to the greater of $100,000 or 50% of the balance in each unreported account.

- FBAR Criminal Penalties: A willful violation can result in fines of up to $250,000 and 5 years of jail time.

The FBAR is an annual report, due April 15 following the calendar year reported. You’re allowed an automatic extension to October 15 if you fail to meet the FBAR annual due date of April 15. You don’t need to request an extension to file the FBAR.