專業叢書

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 4 Relevant U.S. Tax Forms for U.S. Trusts & Individuals

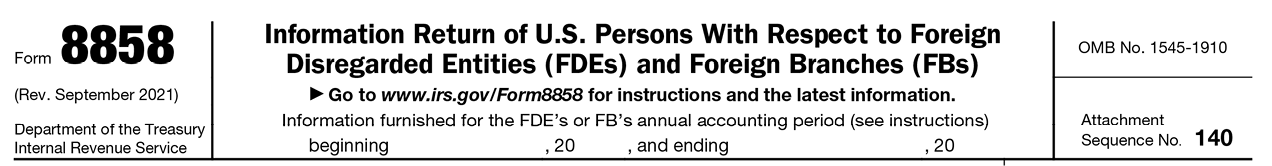

7. Form 8858

Form 8858 is used by certain U.S. persons that operate a Foreign Branch (“FB”) or own a Foreign Disregarded Entity (“FDE”) directly or, in certain circumstances, indirectly or constructively. The form and schedules are used to satisfy the reporting requirements of sections 6011, 6012, 6031, and 6038, and related regulations. Form 8858 reports certain information about the foreign disregarded entity, including information regarding the entity’s income, losses, earnings and profits, and income taxes paid.

An FB is defined in Regulations section 1.367(a)-6T(g). For purposes of filing a Form 8858, an FB also includes a qualified business unit (QBU) (as defined in Regulations section 1.989(a)-1(b)(2)(ii)) that is foreign.

An FDE is an entity that is not created or organized in the United States and that is disregarded as an entity separate from its owner for U.S. income tax purposes under Regulations sections 301.7701-2 and 301.7701-3. An eligible entity uses Form 8832 to elect how it will be classified for federal tax purposes. A copy of Form 8832 is generally attached to the entity’s federal tax return for the tax year of the election. The tax owner of the FDE is the person that is treated as owning the assets and liabilities of the FDE for purposes of U.S. income tax law.

The following U.S. persons that are tax owners of FDEs, operate an FB, or that own certain interests in tax owners of FDEs or FBs must file Form 8858 and Schedule M (Form 8858) :

Category 1: A U.S. person that is a tax owner of an FDE or operates an FB at any time during the U.S. person’s tax year or annual accounting period. Complete the entire Form 8858, including the separate Schedule M (Form 8858) and other schedules as required.

Category 2: A U.S. person that directly (or indirectly through a tier of FDEs) is a tax owner of an FDE or operates an FB. Complete the entire Form 8858, including the separate Schedule M (Form 8858).

Category 3: Certain U.S. persons that are required to file Form 5471 with respect to a CFC that is a tax owner of an FDE or operates an FB at any time during the CFC’s annual accounting period.

Category 4: Certain U.S. persons that are required to file Form 8865 with respect to a controlled foreign partnership (“CFP”) that is a tax owner of an FDE or operates an FB at any time during the CFP’s annual accounting period.

Category 5: Certain U.S. person that is a partner in a partnership that owns an FDE or operates an FB and applies section 987 to the activities of the FDE or FB. The U.S. person must complete the first page of the Form 8858 and Schedule C-1 for each FDE and FB of the partnership.

Category 6: Certain U.S. corporations (other than a RIC, a REIT, or an S corporation) that is a partner in a U.S. partnership, which checked box 11 on Schedules K-2 and K-3 (Form 1065). Even though the U.S. corporation is not the tax owner of the FDE and/or the FB, the U.S. corporation must complete lines 1 through 5 of the Form 8858, line 3 of Schedule G, and report its distributive share of the items on lines 10 through 13 of Schedule G for each FDE and FB of the U.S. partnership.

What are the penalties for the failure to file Form 8858 and Schedule M (Form 8858)?

A $10,000 penalty is imposed for each annual accounting period of each CFC or CFP for failure to furnish the required information within the time prescribed. If the information is not filed within 90 days after the IRS has mailed a notice of the failure to the U.S. person, an additional $10,000 penalty (per CFC or CFP) is charged for each 30-day period, or fraction thereof, during which the failure continues after the 90-day period has expired. The additional penalty is limited to a maximum of $50,000 for each failure.

Any person who fails to file or report all of the information required within the time prescribed will be subject to a reduction of 10% of the foreign taxes available for credit under sections 901 and 960. If the failure continues 90 days or more after the date the IRS mails notice of the failure to the U.S. person, an additional 5% reduction is made for each 3-month period during which the failure continues after the 90-day period has expired.

Criminal penalties. Criminal penalties under sections 7203, 7206, and 7207 may apply for failure to file the information required by section 6038.