專業叢書

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 4 Relevant U.S. Tax Forms for U.S. Trusts & Individuals

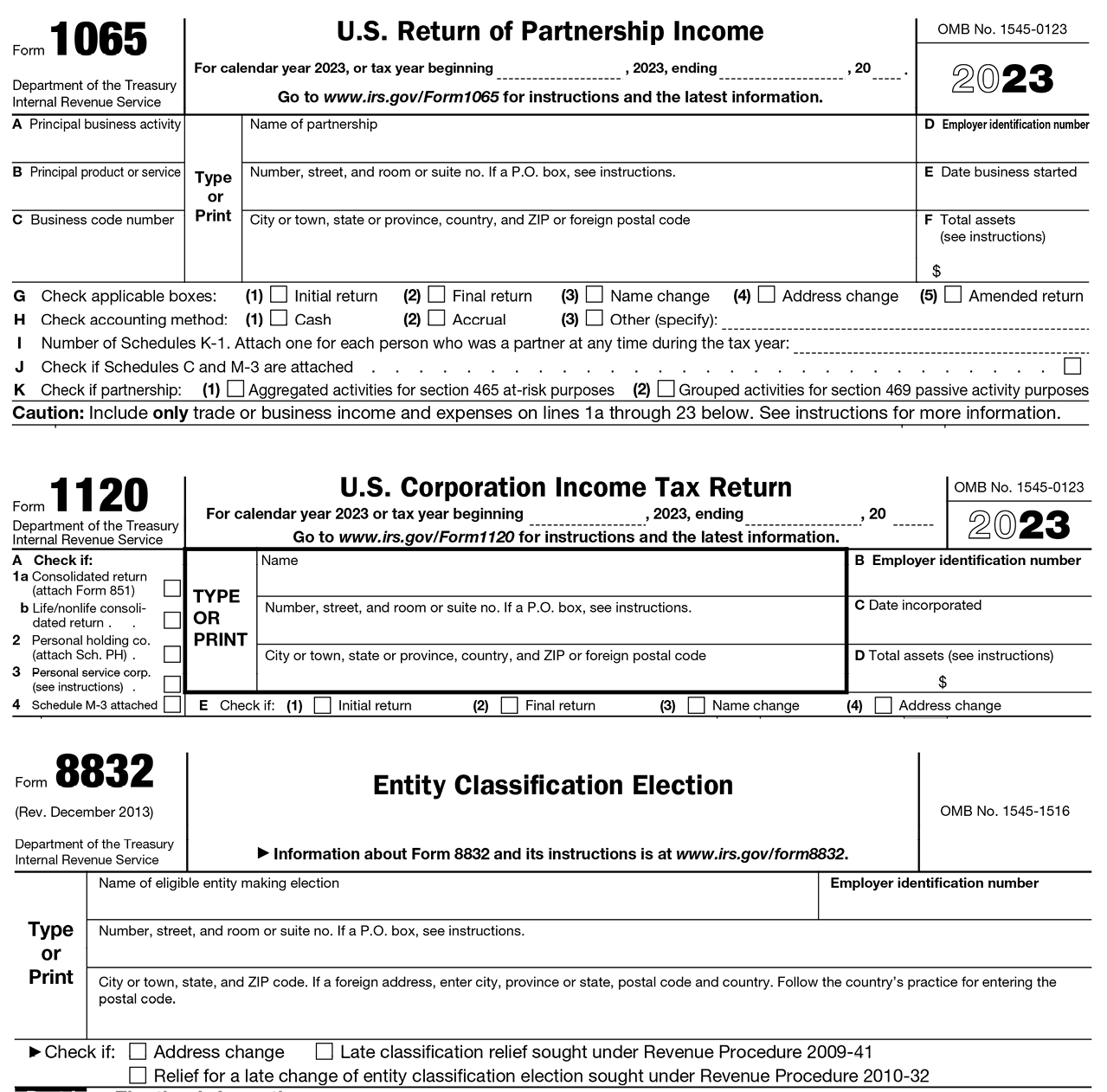

4. Form 1065, Form 1120, and Form 8832

Form 8832 categorizes an eligible entity (typically, a U.S. LLC) as either a corporation, a partnership, or a disregarded entity for federal tax purposes.

- When an LLC is categorized as a partnership, it generally must file Form 1065. This is the “default” state for U.S. LLCs with more than one owner when it was formed under state law.

- When an LLC is categorized as a disregarded entity, its income is includible in the income tax form filed by the company’s owner. This is the “default” state for U.S. LLCs with a single owner when it was formed under state law.

- When an LLC is categorized as a corporation, it generally must file Form 1120. This tax treatment is generally only eligible if a LLC has filed Form 8832 to elect to be treated as an association taxable as a corporation.

An eligible entity uses Form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. An eligible entity is classified for federal tax purposes under the default rules described below unless it files Form 8832 or Form 2553. The IRS will use the information entered on this form to establish the entity’s filing and reporting requirements for federal tax purposes.

An LLC is an entity formed under state law by filing articles of organization as an LLC. Unlike a partnership, none of the members of an LLC are personally liable for its debts. An LLC may be classified for federal income tax purposes as a partnership, a corporation, or an entity disregarded as an entity separate from its owner by applying the rules in Regulations section 301.7701-3.

Form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. Generally, a partnership doesn’t pay tax on its income but passes through any profits or losses to its partners. Partners must include partnership items on their tax or information returns.

Form 1120 is the U.S. Corporation Income Tax Return used to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an income tax return whether or not they have taxable income. Domestic corporations must file Form 1120.

Note: When owners of a foreign corporation agree to file an entity classification election (Form 8832) to treat the foreign company as a partnership for U.S. tax purposes, the election would trigger a deemed liquidation of the corporation for U.S. federal tax purposes on the day immediately preceding the effective date of the election. In a foreign grantor trust structure, a timely filed Form 8832 could increase the outside cost basis of an offshore company held by the trust prior to the grantor’s death without triggering U.S. income taxes. A subsequent sale of those assets (shares in the offshore company) could be fully taxable outside the U.S.; however, within the U.S., it would be taxable only for appreciation of the offshore company that materializes after the grantor’s death. Proper application and use of the “check the box” election (Form 8832) for eligible taxpayers could effectively reduce U.S. income tax.