專業叢書

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Chapter 3 ─ U.S. Dynasty Trusts

Section 5: Operation Process of Setting Up a Family Trust in the U.S

1. Why choose to set up a family trust in the U.S.?

In the U.S., family trusts have evolved over the centuries and have become a common solution for planning family wealth succession, successfully helping many families to manage, protect, pass on, or even expand their family wealth in a long-term and even sustainable manner; for example, the Vanderbilt family, the Kennedy family, and Rockefeller family, and the Carnegie family, etc., are all well-known for their successful trusts and have become models in inheriting their family businesses.

The family trust system in the U.S. allows flexibility for different purposes according to the circumstances and demands of different families, using different types of trusts, structures or organizations, and entrusting individuals, trustees or other entities to form a variety of different family trusts to facilitate the flexible inheritance of family wealth and ensure the proper use and supervision of family assets, and prevent future generations from running the family business into difficulties due to poor financial management, as well as reduce tax liabilities through the establishment of family trusts.

In addition, some types of family trusts in the U.S. have established a well-structured decision-making mechanism within the family, such as Investment Committees and Distribution Committees, as well as the roles such as Administrative Trustee and Trust Protector for management and assignment of different powers and responsibilities. Through the operational mechanism between the committee and the different roles, the modern corporate governance structure is incorporated into the family trust, so that the family trust system can effectively carry on the family business. For example, in the management of family trusts, by appointing trust companies and professionals as administrative trustees to manage properties of a family trust, it prevents some family members’ excessive intervention in the management of the family business. With those professionals with financial and investment backgrounds in the Investment Committees, we are able to achieve diversification, prudent evaluation and risk diversification of family assets; with the Distribution Committees’ decision, we are able to rationalize the distribution of family interests and encourage family members to comply with family statutes. 6

The public has the impression that the U.S. tax burdens are quite high and an accidental omission could result in bankruptcy. We can see from the following analysis that setting up a trust in the U.S. is not only for tax purposes, but there may be many other considerations.

6 https://www.trust.org.tw/upload/107404590001.pdf。

(4) Offshore trusts set up for offshore listings are required to set up US trusts in response to CRS notifications and China’s anti-tax avoidance rules.

Since 2018, for companies listed in Hong Kong alone, more than 17 Mainland companies have had their actual newly establish or transfer their shares to offshore family trusts, including Haidilao (海底撈,6862.HK), Sunac China (融創中國,1918.HK), Longhu Group (龍湖集團,0960.HK), Xiaomi Group (小米集團,1810.HK), Zhou Hei Duck (周黑鴨,1458.HK), etc.; among well-known entrepreneurs , Ma Yun (馬雲), Liu Qiangdong (劉強東), Sun Hongbin (孫宏斌), Lei Jun (雷軍), Wu Yajun (吳亞軍) and Zhang Yong (張勇) have all set up trusts or transferred their shares to offshore family trusts. Offshore family trusts are generally established by private companies after their company listedcompany listed overseas. They set up VIE shell companies and the offshore family trust to hold assets such as real estate and company equity and take advantage of tax-free treatment of some regions like BVI. Although China’s new tax law has not yet clarified whether offshore family trusts are taxable, these well-known entrepreneurs or major shareholders are obligated to pay tax in China since they are China citizens or still reside in China for more than 183 days per year. The US Trust may be the only solution under the double whammy of CRS reporting and China’s anti-tax avoidance rules.

Moreover, Article 1 of the Individualthe Individual Income Tax Law of the People’s Republic of China stipulates that Individuals who have a domicile in China, or no domicile but have lived in China for 183 days in a calendar tax year are both residents. In accordance with the law, resident shall pay individual income tax on income derived within and outside China. On the contrary, individuals who do not have a domicile and do not live in China, or have lived in China for less than 183 days in a tax calendar year, are non-resident. Non-resident shall only pay individual income tax occurred within China.

The wealthy people immigrate to prosper countries for a better living environment but they also immigrate to small countries for tax purpose. These small countries include Vanuatu, St. Kitts, Dominica, Grenada, Antigua, Cyprus, Malta, Turkey and some other EU and Commonwealth countries, all of which are world famous tax havens without global taxation, asset tax, individual income tax, capital gains tax, net worth tax, gift tax and estate tax. However, with the implementation of CRS and the globalization of the economy, it seems that if a person owns passports of two countries, which not only violates the Nationality Law of the People’s Republic of China, but the banks have the obligation to conduct due diligence when these people open accounts in Hong Kong or Singapore in order not to be fined or punished by the regulatory authorities. Therefore, people owning these small countries’ passports may be turned down their account-opening by the banks. Though their nationalities of these small countries seem separated from Chinese nationalities, in fact, the application documents submitted (birth certificate, criminal record, passport, etc.) during the process of accounts-opening could be all linked to the China nationalities and can be shown in the passports. Giving up China passports and making sure living in China for less than 183 days a calendar tax year may be the only way to hide their tax resident status.

Moreover, there are some offshore trustee companies that help people with offshore countries passports set up offshore trusts, claiming that it is able to hide their wealth abroad and avoid Chinese tax liabilities. But is it possible? Instead, you should rather consider setting up a U.S. trust. The Boston Consulting Group estimates that the foreign trust industry in the U.S. is larger than commonly acknowledged and that the U.S. is already the world’s largest international foreign financial center; the only requirement of setting up a U.S. foreign trust is to appoint a local trustee (a trustee company in any state in the U.S. such as Nevada, Delaware, Alaska, South Dakota, etc.) and to assign a foreign protector to give directions, so that the trustee company does not have the power to manage the client’s trust funds, but only assists the client to complies with the state law requirements; also, the trust’s assets are not supervised by the U.S. and international regulations. Therefore, it seems that a U.S. trust with the support of the stable and modernized legislature for trust asset protection in the U.S. would definitely be more superior to an offshore trust in a disadvantaged country like the small offshore countries mentioned earlier.

In the U.S., family trusts can be broadly classified into two types: dynasty trusts and non-dynasty trusts. The purpose of a non-dynasty trust is mainly to achieve a specific goal, once the goal is achieved, the trustee will then distribute the trust and the trust will be terminated; for example, Testamentary Trust, Grantor Retained Annuity Trust (GRAT), Intentionally Defective Grantor Trust (IDGT), Qualified Personal Residence Trust (QPRT), Qualified Domestic Trust (QDOT), Generation-skipping Trust (GST), Living Trust, and Irrevocable Life Insurance Trust (ILIT) are all classified as non-dynasty trusts. On the other hand, a dynasty trust is a long-term trust that may last up to 360 years (e.g. Nevada) or even no limit (e.g. Delaware); moreover, when the assets are transferred to the next generation, there would be no property transfer tax liability. A dynasty trust is usually irrevocable, and once established, the grantor cannot maintain any control over the assets or change the clauses of the trust; it can benefit the grantor’s offspring and avoids their unduly wasting of the property; future generations can have their own trusts per stirpes to facilitate trust management by the means of Division (splitting the original trust into different sub-trusts), Decanting (transferring the original trust to another trust), and Migration (changing to another trustee company). To be specific, Discretionary Trust, Delegated Trust, and Directed Trust are all classified as common dynasty trusts.

A grantor can also choose to set up a special purpose entity, a trust protector company, or a private family trust company, etc. to act as the trustee. Rest of this book will only focus on the practical use and operation of Directed Trusts. I will demonstrate process of setting up a trust so that you can understand the details of the case and then set up a family trust for yourselves or your clients.

2. Types of family trusts in the U.S.: target, purpose and structure

(2) Obtain a memorandum of engagement from the client

I. THE PURPOSE OF SETTING UP THIS IRREVOCABLE TRUST

I, [grantor’s name], the Grantor of trust, am a [grantor’s nationality] citizen residing in [grantor’s residency]. My wealth was accumulated from operating business and investing real estate in [grantor’s residency]. I intend to transfer my wealth which was earned from [grantor’s residency] into a U.S. domestic irrevocable trust for succession. However, I have no intention to renounce the [grantor’s nationality] citizenship. Therefore, I have no intention to become a U.S. citizen or permanent resident. I expect the establishment of this trust can help nurture my future generations.

The STRUCTURE OF TRUST

There shall be one share set aside for each of Bene 1, Bene 2 and Bene 3, if then living, and one share set aside for the then living descendants, collectively, of Bene 1, if he is then deceased, one share set aside for the then living descendants, collectively, of Bene 2, if he is then deceased, and one share set aside for the then living descendants, collectively, of Bene 3, if she is then deceased. Any share set aside for the then living descendants, collectively, of Bene 1, if he is then deceased, and of Bene 2, if he is then deceased, and of Bene 3, if she is then deceased shall be further divided into shares for such descendants, per stirpes.

Each person for whom a share is set aside shall be referred to as the “Primary Beneficiary” of such share. The Trustee shall hold each share so set aside in further trust hereunder. Any share set aside for a person for whom a trust is being held hereunder shall be added to and commingled with the trust held hereunder for such person and shall be held and distributed as if it had been an original part of the principal of that trust.

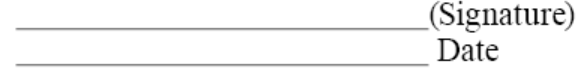

2. DECLARATION

I, [grantor’s name], acknowledge that I have read and understood the content of this form, and have been given full opportunity to discuss the implication of this consent of my own free will and my decision is not based upon representation or advice by representative of others.

I, [grantor’s name], being of sound mind and legal capacity, do hereby appoint KEDP CPAs Groups, to act for me and on my behalf to communicate related matters with U.S. attorneys and trust companies.

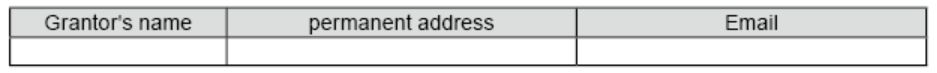

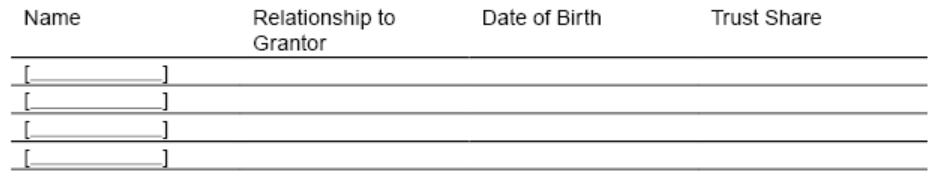

(1) Basic information for the setup of the trust.

1- Grantor’s name (in both English and Chinese).

2- Grantor’s nationality.

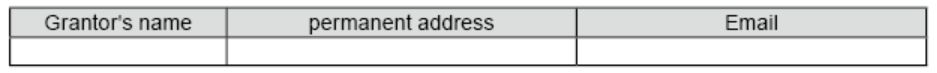

3- Grantor’s permanent address, contact telephone number, and e-mail address.

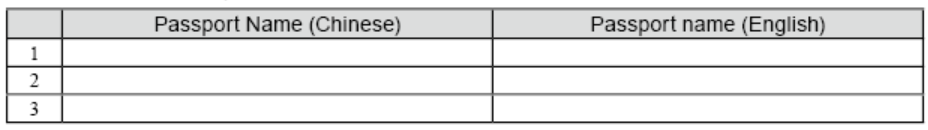

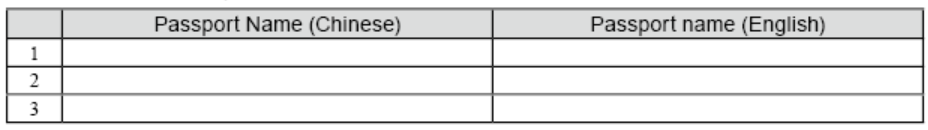

4- Names of all beneficiaries (shown on passport in both English and Chinese).

*Columns in the above table may be added

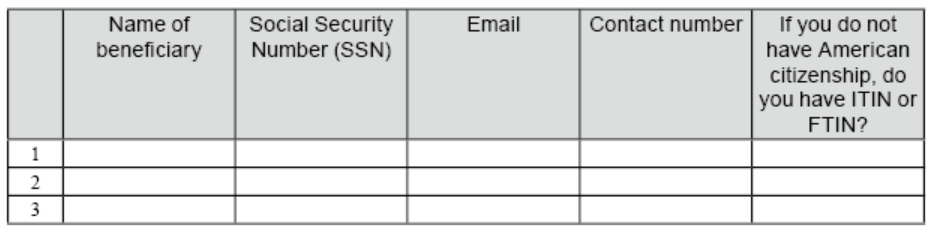

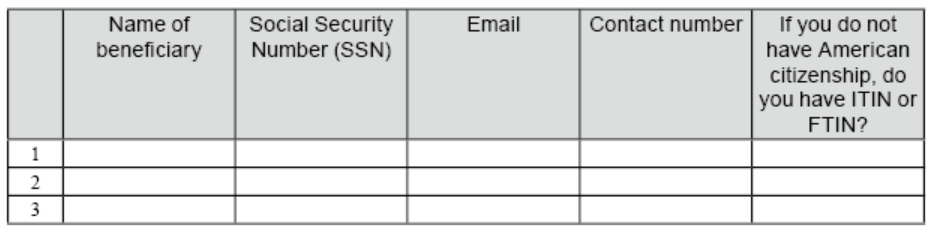

5- Social Security Number (SSN), address, contact number, email of all the beneficiaries.

*Columns in the above table can be added

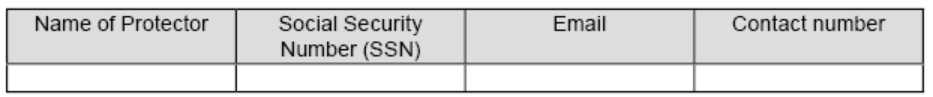

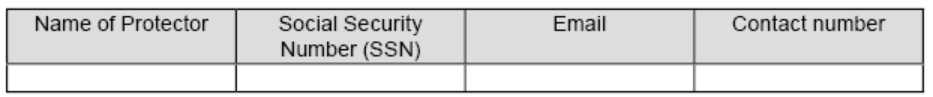

6- Protector’s name (Both English and Chinese).

I. Corporate Protector (suggested to be Company C)

7- Social Security Number (SSN), contact number, and email of the protector.

*If the protector is a corporate, the EIN will be applied on our behave.

8- The relationship between grantor and beneficiaries.

9- Amount of funds transferred by the grantor (approximate amount of fair market value amount).

10- Source of funds transferred by the grantor: the approximate salary, any related investments, trading of real estate, etc.

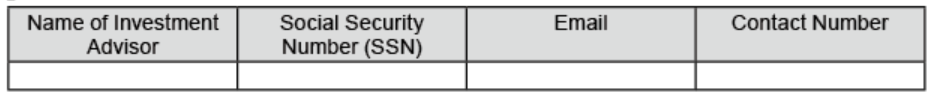

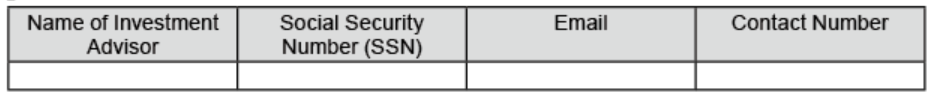

11- Name of the investment advisor.

12- Social Security Number (SSN), contact number and email of the investment advisor.

* If the investment advisor is a corporate, the EIN will be applied for on our behalf.

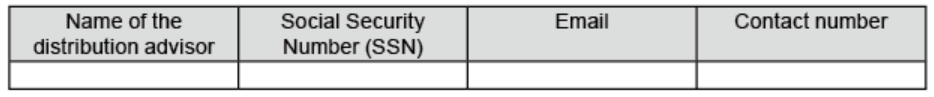

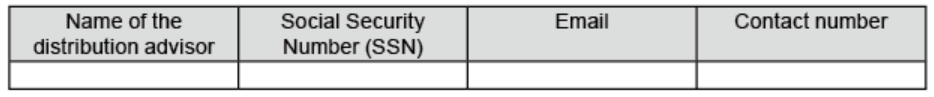

13- Name of the distribution advisor.

14- Social Security Number (SSN), contact number, and email of the distribution advisor.

*If the distribution advisor is a corporate protector, your EIN will be applied for on our behalf.

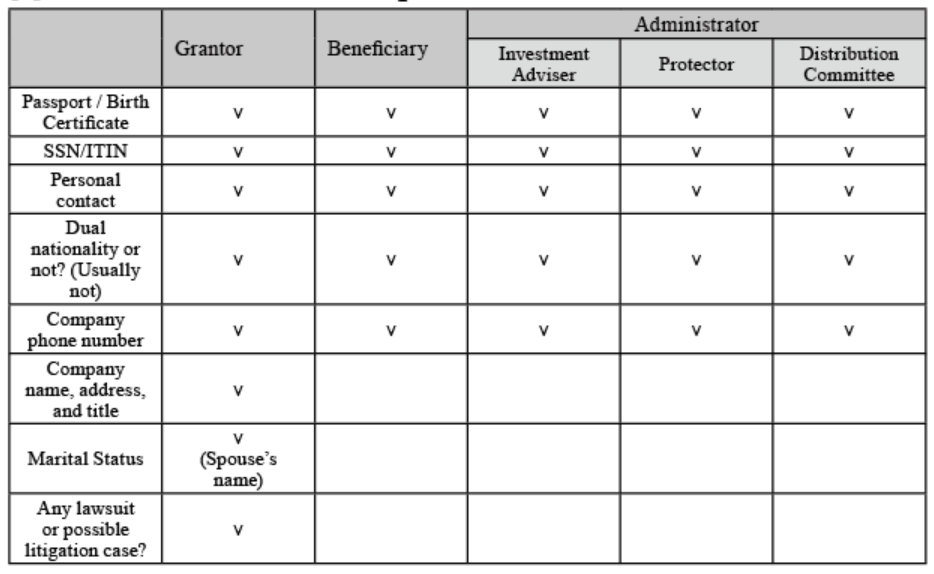

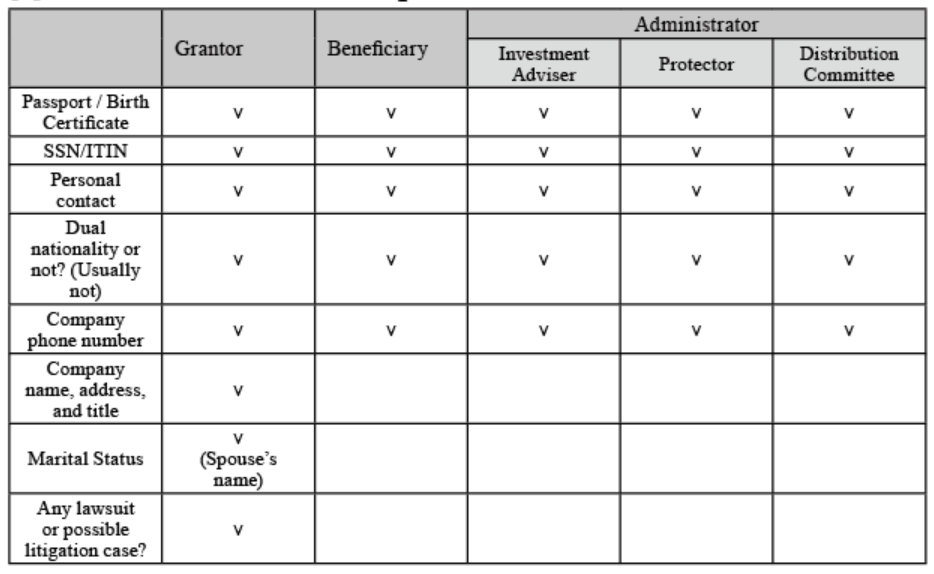

15- Identification documents - at least two copies of official IDs with photo for each person involved in the trust (grantor, protector, investment advisor, distribution advisor, and beneficiaries)

U.S. passport and California driver’s license are acceptable for U.S. citizens , but SSN card is not acceptable.

U.S. citizens may also provide Chinese identification documents; non-U.S. citizens may provide Chinese ID cards, passports, or driver’s licenses, etc.

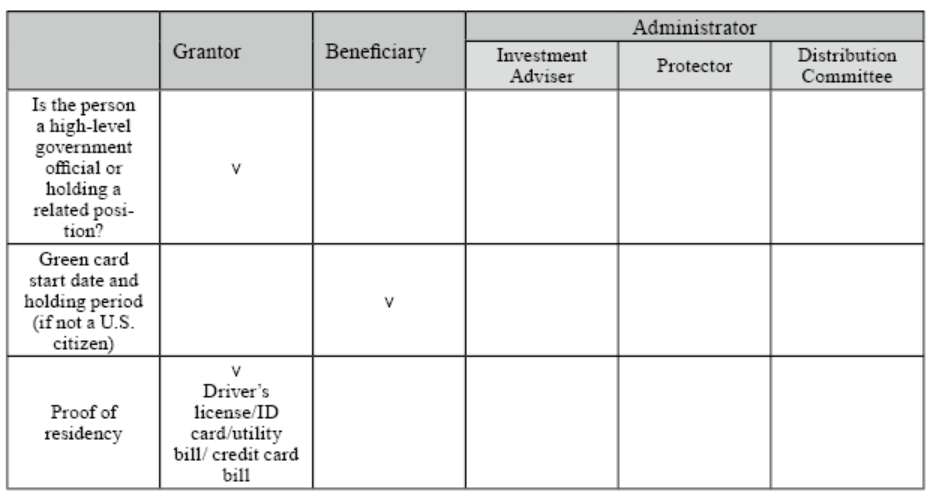

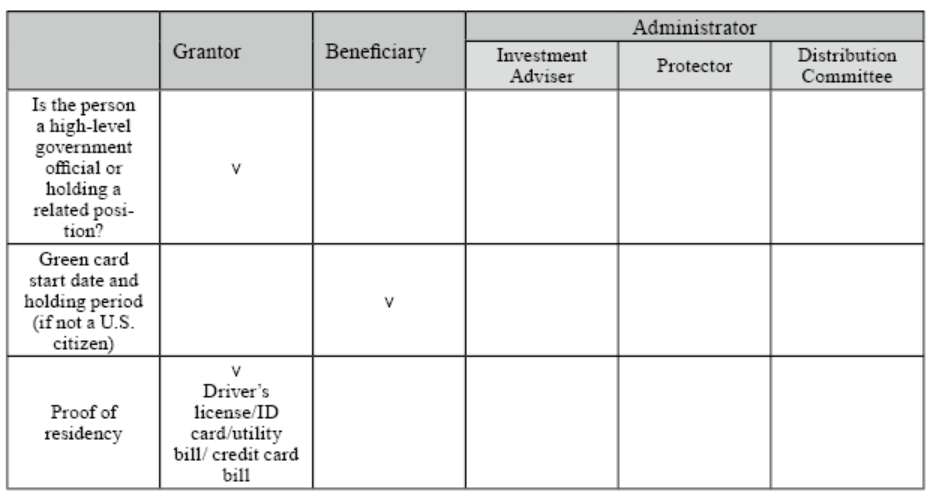

[1] Personal information required.

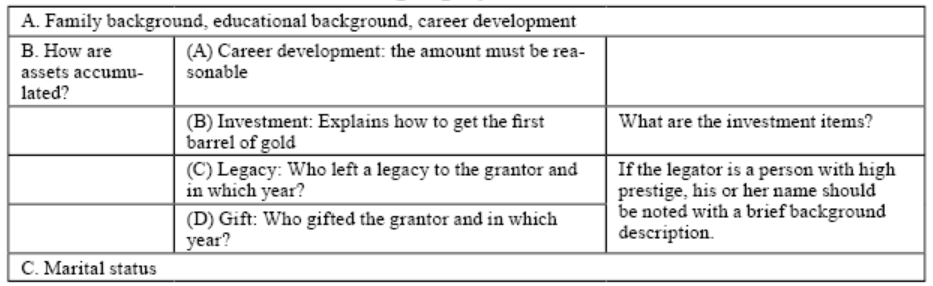

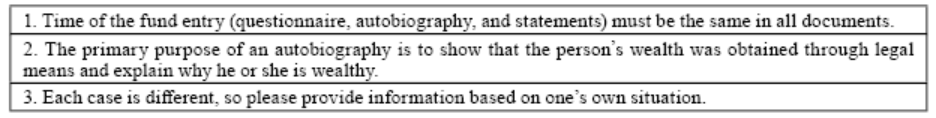

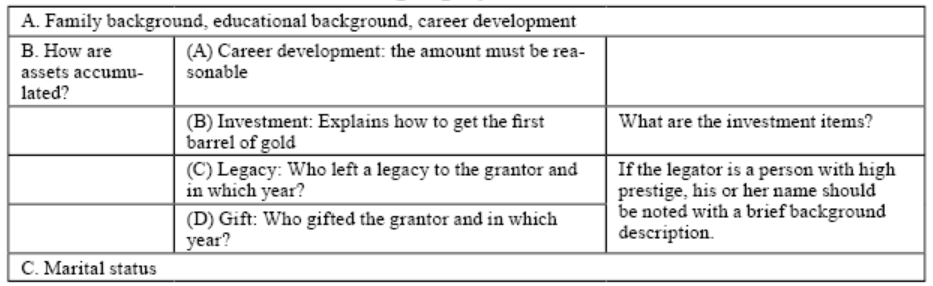

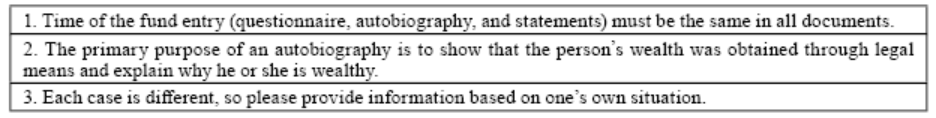

[2] How to write an autobiography.

Key points to note.

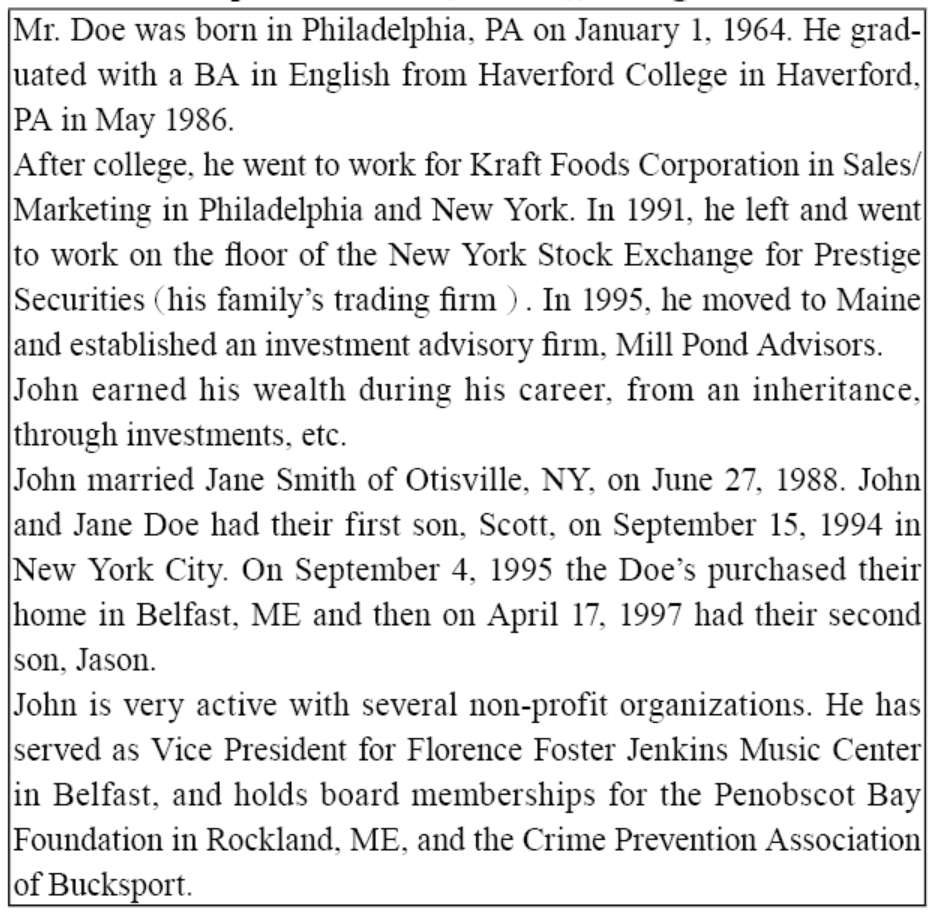

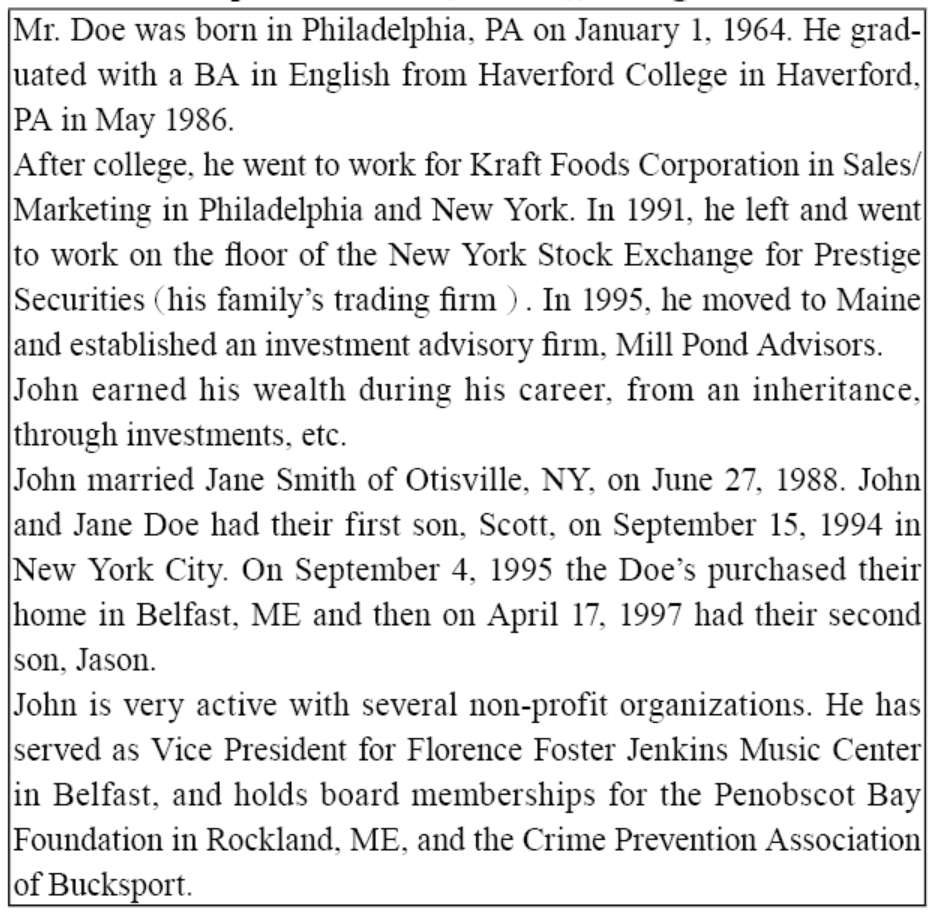

Reference example - John Doe (Mr. Doe), trust grantor

①Drafting the trust agreement

(Some parts of the trust agreement omitted)

[ Name of Trust] TRUST AGREEMENT

THIS [ NAME OF TRUST ] AGREEMENT (the “Agreement” or “Trust Agreement”) is made this day of , 2021, between OOO, of China, hereinafter 「Grantor,」 and OOO TRUST COMPANY, INC., an independent Nevada trust company, hereinafter “Trustee.”

WHEREAS, the Grantor desires to establish an irrevocable trust funded with such property as the Grantor may from time to time deposit into trust under this Agreement, together with the investments, reinvestments and proceeds thereof (all of which, with the investments, reinvestments and proceeds thereof, shall be termed the “Trust estate”).

WHEREAS, the Trustee accepts such trust and agrees to administer it in accordance with the terms and conditions of this Agreement.

NOW, THEREFORE, in consideration of the mutual promises and covenants contained in this Agreement, the Grantor hereby delivers to the Trustee the property described on Schedule “A” in trust which the Grantor has transferred to the Trustee for the following uses and purposes and subject to the terms and conditions contained in this Agreement.

(The following is an abbreviated version)

② EIN Application and bank account opening for the trust and the LLC

(i) Application for the EIN and Setting up a Trust Account (Please see page 237)

Once the grantor and the trustee company have signed the trust contract and the act has been notarized or observed by two witnesses, the Trust contract is deemed to be formally established. Next, one must apply for the tax number for the Trust. With the EIN (Employer Identification Number), it means that the Trust has its own identity, and it can open accounts, set up companies, and file annual trust tax returns in the future.

(ii) LLC establishment and account opening controlled by the Trust

It is recommended that the investment adviser instruct the trustee company to set up the LLC. The trustee company establishes the LLC and invests in the LLC on behalf of the Trust. The Trust is the shareholder of the LLC and the investment adviser can act as the manager of the LLC. All investment and capital control can be directly managed by the investment advisor in the future. It is unnecessary to wait for instructions to be sent to the trustee company for execution. With such arrangements, the process will become much more convenient. Once the LLC company has been established, the LLC must apply for a tax number. After the application, the LLC must open a dedicated bank account. The procedure is as follows:

(iii) Transfer Trust Account Funds to the Investment LLC.

Once the funds have been put into the Trust account, the Trust funds can be transferred to the LLC account after the LLC is set up and the account is opened. Meanwhile, the trustee company needs the investment consultant to send the transfer order from the provided e-mail address and contact the investment consultant to confirm the remittance.

(iv) Establishment and follow-up maintenance of the U.S. trust

After the establishment of a trust, there are different requirements for accounting and taxation, and property disclosure, depending on the classification and location of the trust, which are divided into the following six categories:

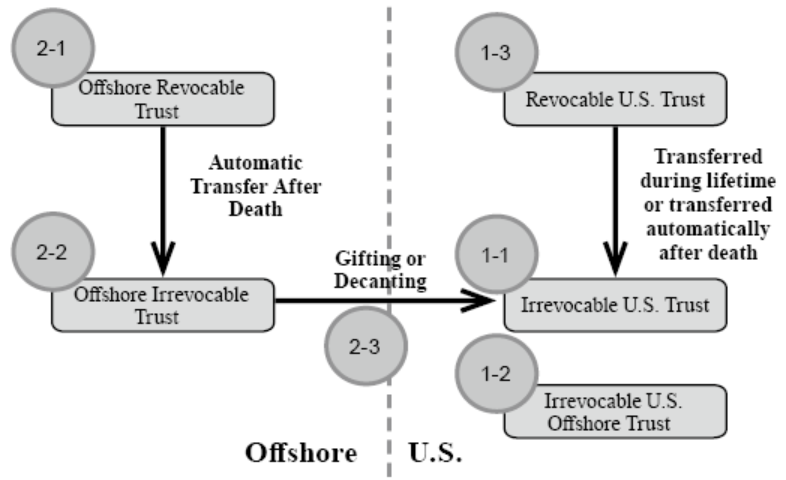

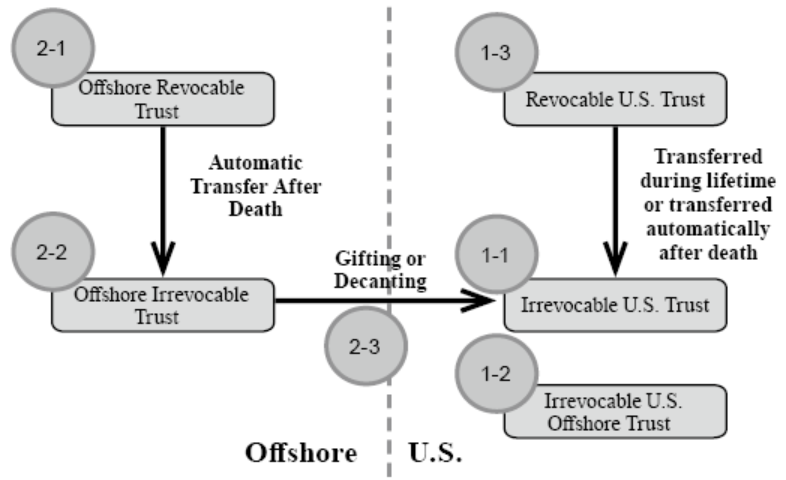

Scenario 1-1: An irrevocable trust is established in the U.S. and the funds are transferred from abroad or moved into a foreign company for the LLC’s investment. The income from the LLC investment is then returned to the trust and distributed to the beneficiary within 65 days of the year end for accounting, tax and property disclosure requirements.

Scenario 1-2: An irrevocable offshore trust is established in the U.S., and the equity of the offshore company is transferred into the trust. After the transfer, a consolidated statement of the CFC should be prepared every year, and the offshore bank accounts should be disclosed in accordance with the regulations.

Scenario 1-3: A revocable trust is established in the U.S., and the equity of the offshore company is transferred into the trust. After the transfer, a consolidated statement of the CFC should be prepared every year, and the offshore bank accounts should be disclosed in accordance with the regulations. If the grantor gives directions or unfortunately passes away, the revocable trust thus becomes an irrevocable trust. In this situation, the dividends transferred into the trust are distributed to the beneficiaries within 65 days of the end of the year for accounting, tax and property disclosure requirements.

Scenario 2-1: A revocable trust established outside of the U.S. and the equity of the foreign company is transferred into the trust. Since the trust is revocable, although there is a U.S. beneficiary, no tax reporting or property disclosure is required. But the relevant accounts and financial statements need to be prepared in advance each year for the subsequent conversion to an irrevocable trust.

Scenario 2-2: If the beneficiary of an offshore revocable trust is a U.S. person, he/she will be required to file tax returns and make property disclosure in accordance with the relevant U.S. tax laws and regulations upon receipt of distributions from the offshore trust after the grantor has given directions or has unfortunately passed away and thus the trust became irrevocable.

Scenario 2-3: When the grantor of an offshore revocable trust gives directions or unfortunately passes away and the trust becomes irrevocable, there are negative tax consequences for the beneficiary (U.S. person) of the offshore non-grantor trust because the governing law for the trust is outside the U.S. When a trust has accumulated undistributed net income (UNI), the beneficiaries will be subject to Throwback Tax when they receive the trust distributions in that year; and foreign non-grantor trusts usually hold foreign financial instruments, such as mutual funds and money market funds, etc., there will be tax for the passive foreign investment company (PFIC) when the income from the asset is distributed in the future, so it is usually the accounting treatment and tax declaration for each year after the transfer of the offshore trust to the U.S. trust. Therefore, it is suggested to convert a foreign trust into a U.S. trust to solve the problem of annual accounting and tax filing.

In the U.S., family trusts have evolved over the centuries and have become a common solution for planning family wealth succession, successfully helping many families to manage, protect, pass on, or even expand their family wealth in a long-term and even sustainable manner; for example, the Vanderbilt family, the Kennedy family, and Rockefeller family, and the Carnegie family, etc., are all well-known for their successful trusts and have become models in inheriting their family businesses.

The family trust system in the U.S. allows flexibility for different purposes according to the circumstances and demands of different families, using different types of trusts, structures or organizations, and entrusting individuals, trustees or other entities to form a variety of different family trusts to facilitate the flexible inheritance of family wealth and ensure the proper use and supervision of family assets, and prevent future generations from running the family business into difficulties due to poor financial management, as well as reduce tax liabilities through the establishment of family trusts.

In addition, some types of family trusts in the U.S. have established a well-structured decision-making mechanism within the family, such as Investment Committees and Distribution Committees, as well as the roles such as Administrative Trustee and Trust Protector for management and assignment of different powers and responsibilities. Through the operational mechanism between the committee and the different roles, the modern corporate governance structure is incorporated into the family trust, so that the family trust system can effectively carry on the family business. For example, in the management of family trusts, by appointing trust companies and professionals as administrative trustees to manage properties of a family trust, it prevents some family members’ excessive intervention in the management of the family business. With those professionals with financial and investment backgrounds in the Investment Committees, we are able to achieve diversification, prudent evaluation and risk diversification of family assets; with the Distribution Committees’ decision, we are able to rationalize the distribution of family interests and encourage family members to comply with family statutes. 6

The public has the impression that the U.S. tax burdens are quite high and an accidental omission could result in bankruptcy. We can see from the following analysis that setting up a trust in the U.S. is not only for tax purposes, but there may be many other considerations.

6 https://www.trust.org.tw/upload/107404590001.pdf。

(1) The U.S. Trust Law is stable and confidential and is superior to other small island offshore trusts.

In April 2016, the International Consortium of Investigative Journalists (ICIJ) uncovered information about 214,000 offshore financial companies with a total of 11.5 million records from the Panama law firm Mossack Fonseca since the 1970s, nearly 1/3 of the law firm’s cases came from Hong Kong and China. In November 2017, the so-called “Paradise Papers” made a huge leakage of financial documents of offshore investments, which originated from the Bermuda-registered law firm Appleby and the Singapore-based Asiaciti Trust, releasing the information of secret investments on 19 tax havens around the world, including Antigua and Barbuda, Aruba, the Bahamas, Barbados, Bermuda, the Cayman Islands, the Cook Islands, Dominica, Grenada, Labuan in Malaysia, Lebanon, Malta, Marshall Islands, St. Christopher and Nevis, St. Lucia, St. Vincent and the Grenadines, Samoa, Trinidad and Tobago, and Vanuatu. The Group of Seven (G7), comprising the U.S., the U.K., France, Germany, Canada, Italy, Japan and the European Union announced a “historic” tax deal. Under the agreement, each country will apply a uniform tax rate of at least 15% to multinational companies operating and conducting business in their own country, and the CRS (Common Reporting Standard) regulation will take effect from 2016. It is difficult to hide assets in this world, and the place that is sometimes considered to be the most dangerous and tax-intensive may be the safest place, and that is the U.S. The U.S. has implemented FATCA and does not participate in the CRS reporting system. There are no CRS asset reporting problems in the U.S., so it is clear that the U.S. intends to allow “offshore” funds from the traditional tax havens to be transferred to U.S. “onshore” tax havens.

(2) Use U.S. trusts to avoid future trust dispute litigation (pseudo trust issues)

In the current situation, especially in the case of offshore trusts settled by Chinese grantors, Chinese people tend to control the assets entrusted to the greatest extent possible; in the case of VISTA trusts in BVI, which are generally popular among Chinese people, the grantor, protector and first priority beneficiary may all be the same person. If the trust is set up at the beginning and the assets placed in the trust consist of many irregularities, such as fraud or transferring one’s assets urgently for divorce purpose, the trust may be considered a pseudo trust and its protection and security will be greatly reduced. When assets are claimed by a creditor and divorced spouse, the trust may be recognized as by the court as a pseudo trust and is not protected. In the U.S., a trust generally requires independence. Once a trust is validly established, the trust property becomes separate from the grantor’s, trustee’s and beneficiary’s own property. In the case of Foreign Non-Grantor Irrevocable Trust, the grantor will lose all the control power over the trust property; not to mention the fact that the trust statutes in the U.S. are robust, and some states have exclusive trust courts, so that people could resolve trust disputes with sufficient support.(3) The U.S. trust grantor or trust beneficiary has no choice but to establish a trust in the U.S.

If the offshore trust grantor has double or triple tax status (like Chinese passport, U.S. green card, Canadian maple card, Australian permanent residence, etc.), tax filing and disclosure are complicated and may violate the tax regulations of the countries of citizenship. In addition, most offshore trustee companies are often reluctant to accept U.S. grantors because the reporting and disclosure obligations are numerous, and the U.S. tax reporting and disclosure of U.S. beneficiaries after the death of the grantor of the offshore trust is very complicated, involving throw-back tax and CFC issues. Therefore, it is better to set up a family trust in the U.S.(4) Offshore trusts set up for offshore listings are required to set up US trusts in response to CRS notifications and China’s anti-tax avoidance rules.

Since 2018, for companies listed in Hong Kong alone, more than 17 Mainland companies have had their actual newly establish or transfer their shares to offshore family trusts, including Haidilao (海底撈,6862.HK), Sunac China (融創中國,1918.HK), Longhu Group (龍湖集團,0960.HK), Xiaomi Group (小米集團,1810.HK), Zhou Hei Duck (周黑鴨,1458.HK), etc.; among well-known entrepreneurs , Ma Yun (馬雲), Liu Qiangdong (劉強東), Sun Hongbin (孫宏斌), Lei Jun (雷軍), Wu Yajun (吳亞軍) and Zhang Yong (張勇) have all set up trusts or transferred their shares to offshore family trusts. Offshore family trusts are generally established by private companies after their company listedcompany listed overseas. They set up VIE shell companies and the offshore family trust to hold assets such as real estate and company equity and take advantage of tax-free treatment of some regions like BVI. Although China’s new tax law has not yet clarified whether offshore family trusts are taxable, these well-known entrepreneurs or major shareholders are obligated to pay tax in China since they are China citizens or still reside in China for more than 183 days per year. The US Trust may be the only solution under the double whammy of CRS reporting and China’s anti-tax avoidance rules.

(5) Offshore trustee companies help US persons to conceal their tax status in the original country with third country passports.

According to Article 3 of the Nationality Law of the People’s Republic of China, the People’s Republic of China does not recognize the dual nationalities of Chinese citizens. Some people believe that “not recognizing Chinese citizens with dual nationalities” is not equals to “not allowing Chinese citizens having dual nationalities.” That’s to say, people with multiple nationalities, countries will generally deal with nationality conflicts according to the laws of the country where the person within at that time. That is to say, people with dual or multiple nationalities will only be deemed and recognized as citizens in that country. This argument may be valid, but in the end the dual nationalities holder is still the one and only person.Moreover, Article 1 of the Individualthe Individual Income Tax Law of the People’s Republic of China stipulates that Individuals who have a domicile in China, or no domicile but have lived in China for 183 days in a calendar tax year are both residents. In accordance with the law, resident shall pay individual income tax on income derived within and outside China. On the contrary, individuals who do not have a domicile and do not live in China, or have lived in China for less than 183 days in a tax calendar year, are non-resident. Non-resident shall only pay individual income tax occurred within China.

The wealthy people immigrate to prosper countries for a better living environment but they also immigrate to small countries for tax purpose. These small countries include Vanuatu, St. Kitts, Dominica, Grenada, Antigua, Cyprus, Malta, Turkey and some other EU and Commonwealth countries, all of which are world famous tax havens without global taxation, asset tax, individual income tax, capital gains tax, net worth tax, gift tax and estate tax. However, with the implementation of CRS and the globalization of the economy, it seems that if a person owns passports of two countries, which not only violates the Nationality Law of the People’s Republic of China, but the banks have the obligation to conduct due diligence when these people open accounts in Hong Kong or Singapore in order not to be fined or punished by the regulatory authorities. Therefore, people owning these small countries’ passports may be turned down their account-opening by the banks. Though their nationalities of these small countries seem separated from Chinese nationalities, in fact, the application documents submitted (birth certificate, criminal record, passport, etc.) during the process of accounts-opening could be all linked to the China nationalities and can be shown in the passports. Giving up China passports and making sure living in China for less than 183 days a calendar tax year may be the only way to hide their tax resident status.

Moreover, there are some offshore trustee companies that help people with offshore countries passports set up offshore trusts, claiming that it is able to hide their wealth abroad and avoid Chinese tax liabilities. But is it possible? Instead, you should rather consider setting up a U.S. trust. The Boston Consulting Group estimates that the foreign trust industry in the U.S. is larger than commonly acknowledged and that the U.S. is already the world’s largest international foreign financial center; the only requirement of setting up a U.S. foreign trust is to appoint a local trustee (a trustee company in any state in the U.S. such as Nevada, Delaware, Alaska, South Dakota, etc.) and to assign a foreign protector to give directions, so that the trustee company does not have the power to manage the client’s trust funds, but only assists the client to complies with the state law requirements; also, the trust’s assets are not supervised by the U.S. and international regulations. Therefore, it seems that a U.S. trust with the support of the stable and modernized legislature for trust asset protection in the U.S. would definitely be more superior to an offshore trust in a disadvantaged country like the small offshore countries mentioned earlier.

In the U.S., family trusts can be broadly classified into two types: dynasty trusts and non-dynasty trusts. The purpose of a non-dynasty trust is mainly to achieve a specific goal, once the goal is achieved, the trustee will then distribute the trust and the trust will be terminated; for example, Testamentary Trust, Grantor Retained Annuity Trust (GRAT), Intentionally Defective Grantor Trust (IDGT), Qualified Personal Residence Trust (QPRT), Qualified Domestic Trust (QDOT), Generation-skipping Trust (GST), Living Trust, and Irrevocable Life Insurance Trust (ILIT) are all classified as non-dynasty trusts. On the other hand, a dynasty trust is a long-term trust that may last up to 360 years (e.g. Nevada) or even no limit (e.g. Delaware); moreover, when the assets are transferred to the next generation, there would be no property transfer tax liability. A dynasty trust is usually irrevocable, and once established, the grantor cannot maintain any control over the assets or change the clauses of the trust; it can benefit the grantor’s offspring and avoids their unduly wasting of the property; future generations can have their own trusts per stirpes to facilitate trust management by the means of Division (splitting the original trust into different sub-trusts), Decanting (transferring the original trust to another trust), and Migration (changing to another trustee company). To be specific, Discretionary Trust, Delegated Trust, and Directed Trust are all classified as common dynasty trusts.

A grantor can also choose to set up a special purpose entity, a trust protector company, or a private family trust company, etc. to act as the trustee. Rest of this book will only focus on the practical use and operation of Directed Trusts. I will demonstrate process of setting up a trust so that you can understand the details of the case and then set up a family trust for yourselves or your clients.

2. Types of family trusts in the U.S.: target, purpose and structure

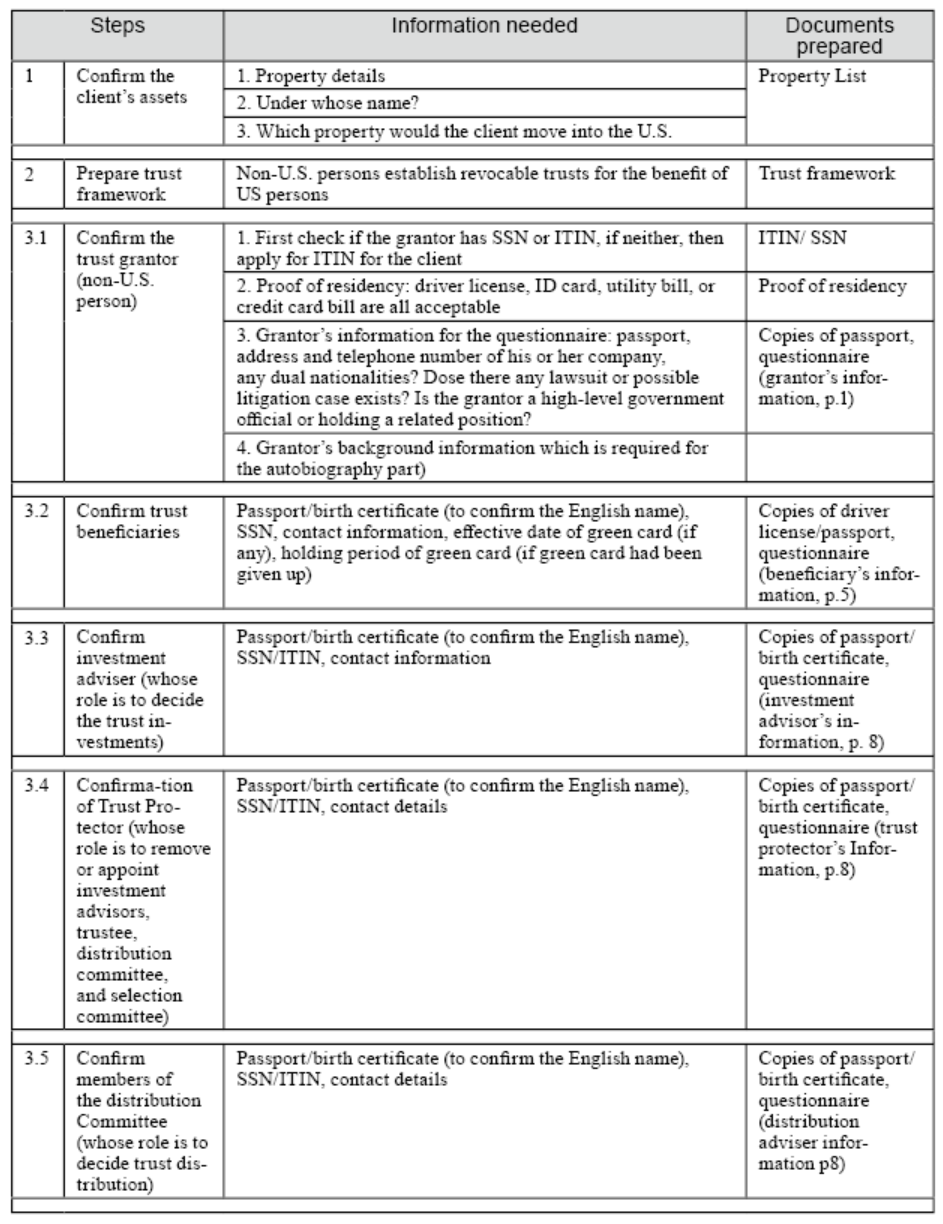

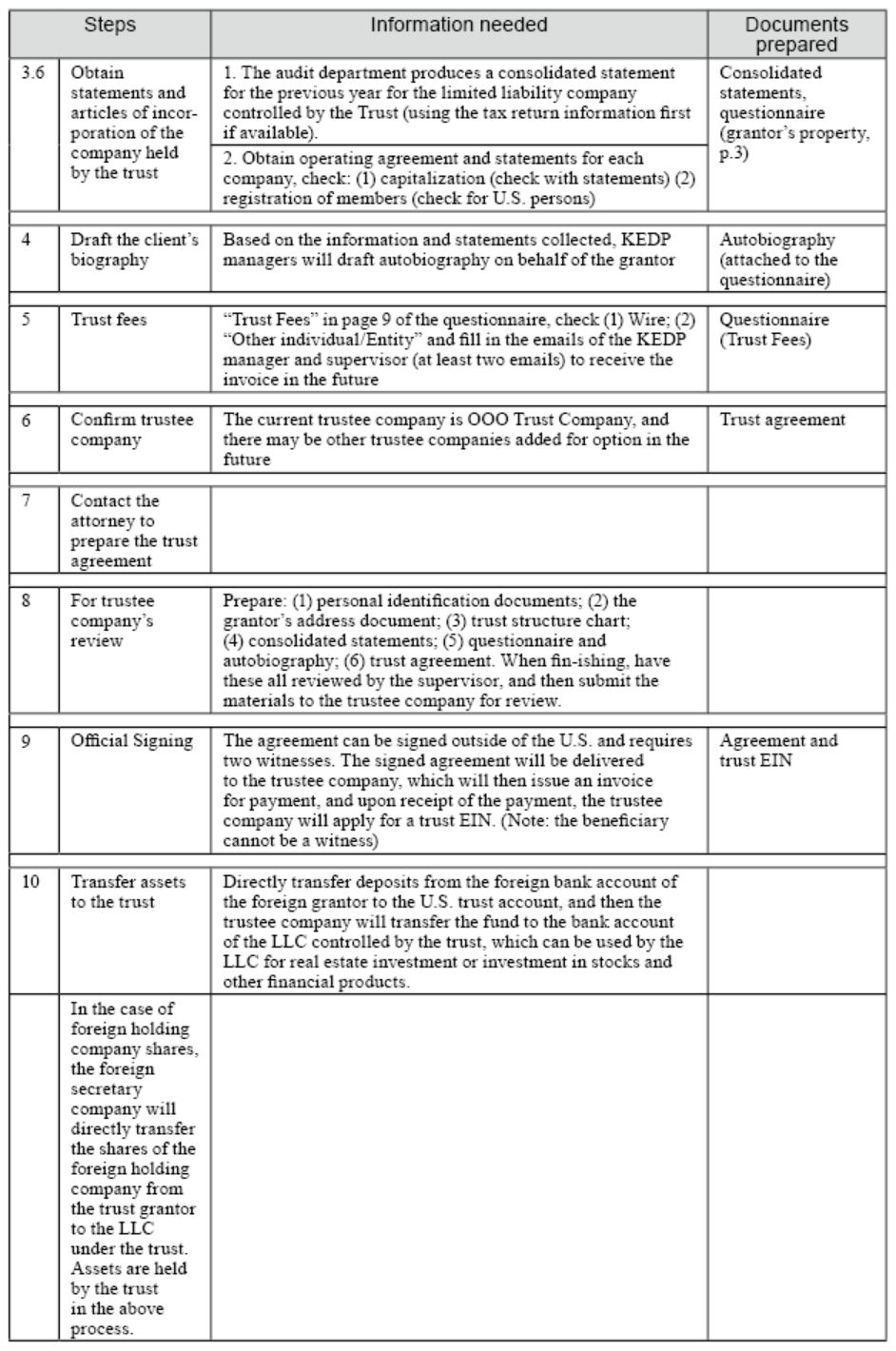

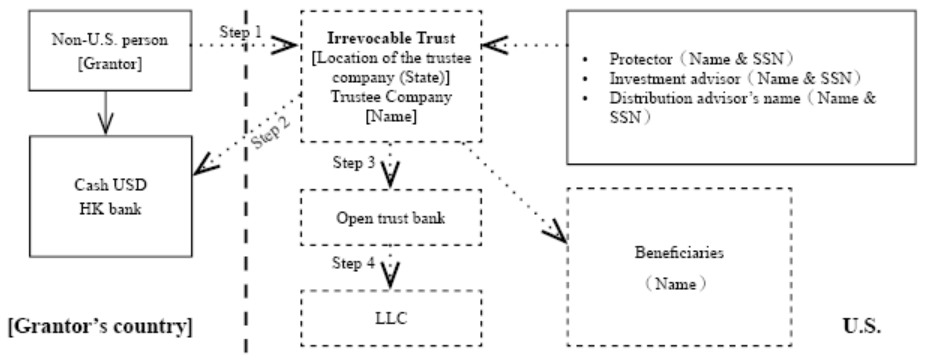

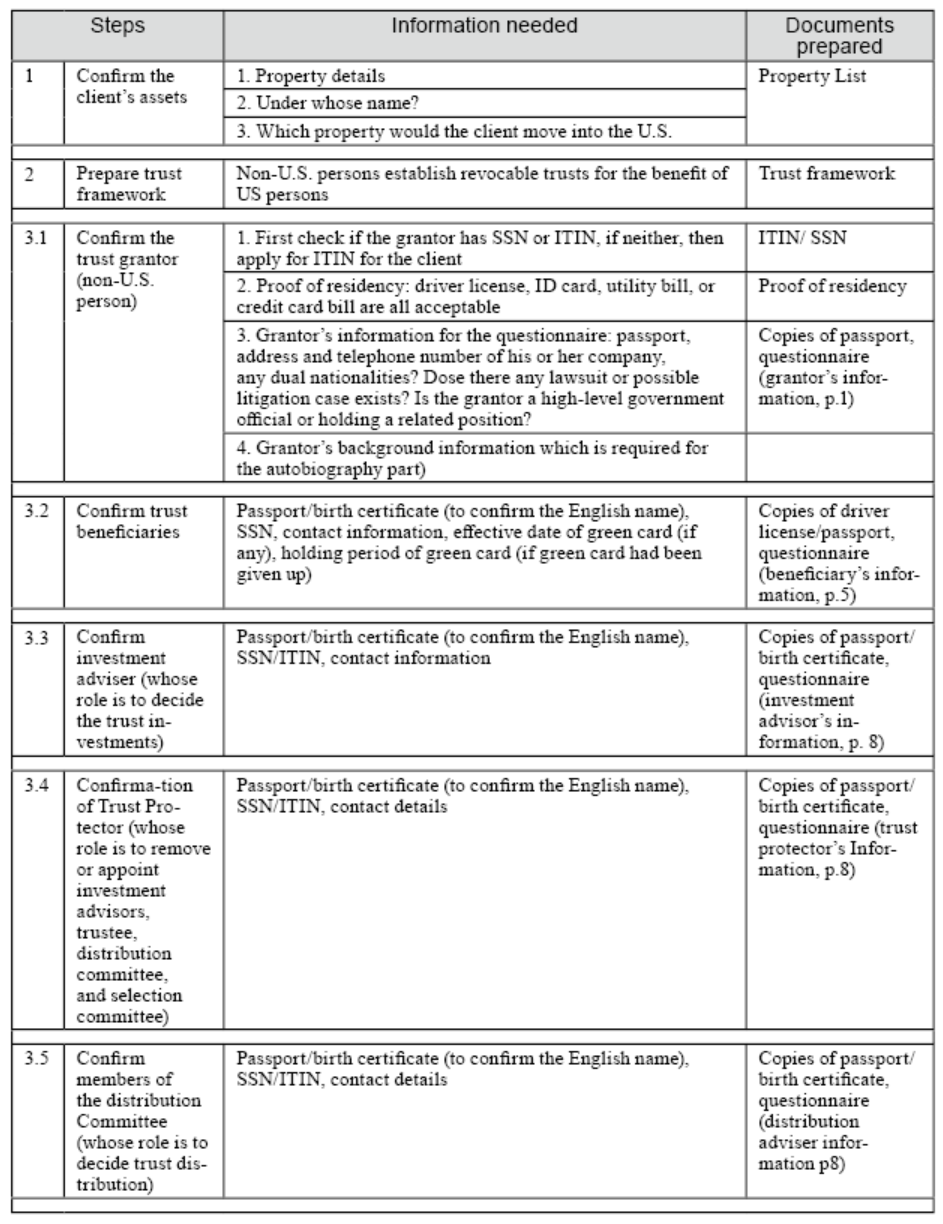

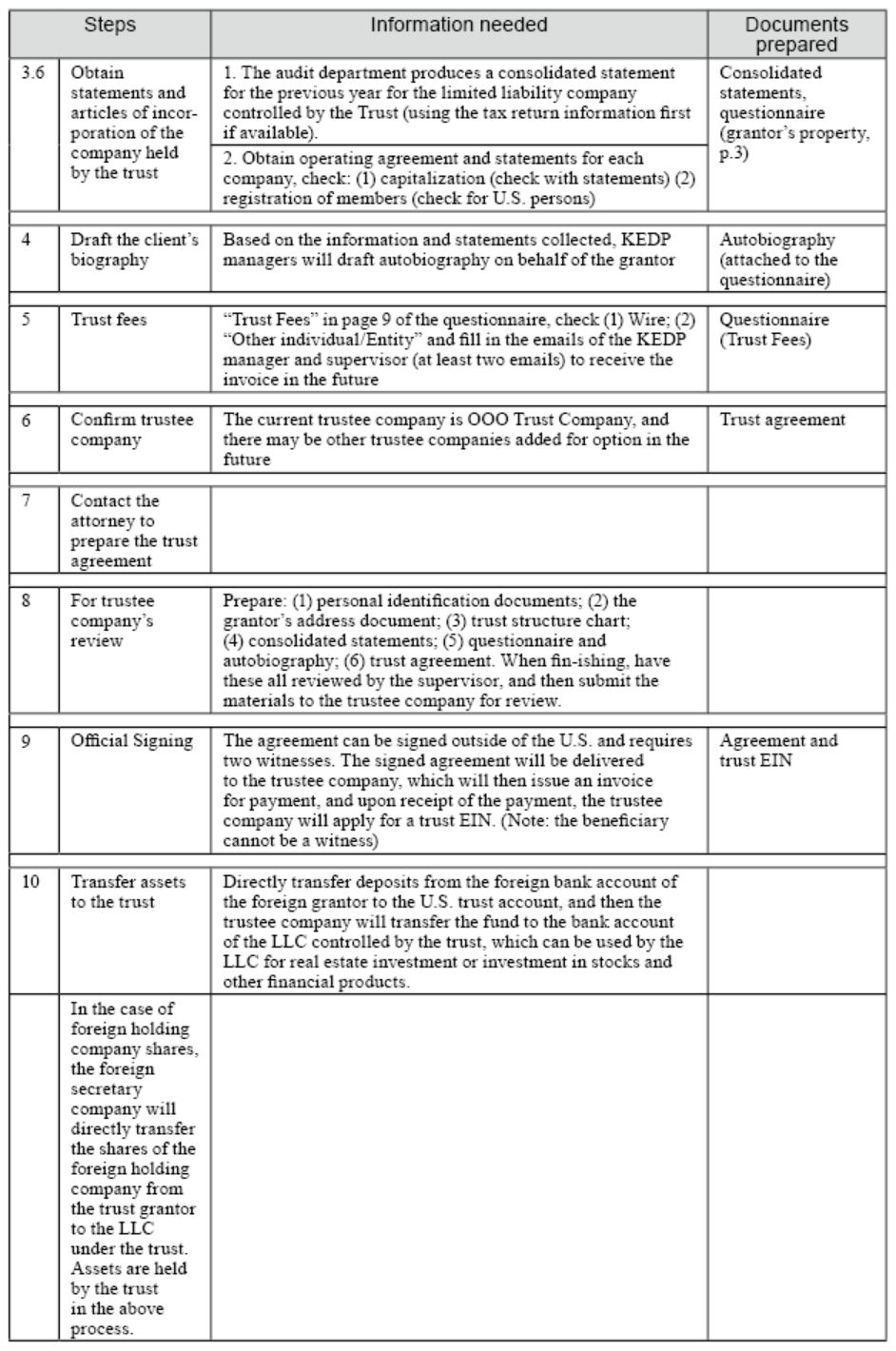

(1) The following ten steps are required for a family trust in the U.S.

(2) Obtain a memorandum of engagement from the client

I. THE PURPOSE OF SETTING UP THIS IRREVOCABLE TRUST

I, [grantor’s name], the Grantor of trust, am a [grantor’s nationality] citizen residing in [grantor’s residency]. My wealth was accumulated from operating business and investing real estate in [grantor’s residency]. I intend to transfer my wealth which was earned from [grantor’s residency] into a U.S. domestic irrevocable trust for succession. However, I have no intention to renounce the [grantor’s nationality] citizenship. Therefore, I have no intention to become a U.S. citizen or permanent resident. I expect the establishment of this trust can help nurture my future generations.

The STRUCTURE OF TRUST

- Role and Function of Related Party (Key Role and Position)

- Trust Protector

- Investment Direction Adviser

- Distribution Adviser

- The Order of Division (Division Order of Beneficiaries and Contingent Beneficiaries)

There shall be one share set aside for each of Bene 1, Bene 2 and Bene 3, if then living, and one share set aside for the then living descendants, collectively, of Bene 1, if he is then deceased, one share set aside for the then living descendants, collectively, of Bene 2, if he is then deceased, and one share set aside for the then living descendants, collectively, of Bene 3, if she is then deceased. Any share set aside for the then living descendants, collectively, of Bene 1, if he is then deceased, and of Bene 2, if he is then deceased, and of Bene 3, if she is then deceased shall be further divided into shares for such descendants, per stirpes.

Each person for whom a share is set aside shall be referred to as the “Primary Beneficiary” of such share. The Trustee shall hold each share so set aside in further trust hereunder. Any share set aside for a person for whom a trust is being held hereunder shall be added to and commingled with the trust held hereunder for such person and shall be held and distributed as if it had been an original part of the principal of that trust.

- Contingent Beneficiaries

- Relationship Information (grantor-centered)

2. DECLARATION

I, [grantor’s name], acknowledge that I have read and understood the content of this form, and have been given full opportunity to discuss the implication of this consent of my own free will and my decision is not based upon representation or advice by representative of others.

I, [grantor’s name], being of sound mind and legal capacity, do hereby appoint KEDP CPAs Groups, to act for me and on my behalf to communicate related matters with U.S. attorneys and trust companies.

(1) Basic information for the setup of the trust.

1- Grantor’s name (in both English and Chinese).

2- Grantor’s nationality.

3- Grantor’s permanent address, contact telephone number, and e-mail address.

4- Names of all beneficiaries (shown on passport in both English and Chinese).

*Columns in the above table may be added

5- Social Security Number (SSN), address, contact number, email of all the beneficiaries.

*Columns in the above table can be added

6- Protector’s name (Both English and Chinese).

I. Corporate Protector (suggested to be Company C)

i.Company mailing address (to receive relevant notices from the IRS).

ii.Register of Directors

II. Name of the natural person protector (Both in English and Chinese).7- Social Security Number (SSN), contact number, and email of the protector.

*If the protector is a corporate, the EIN will be applied on our behave.

8- The relationship between grantor and beneficiaries.

9- Amount of funds transferred by the grantor (approximate amount of fair market value amount).

10- Source of funds transferred by the grantor: the approximate salary, any related investments, trading of real estate, etc.

11- Name of the investment advisor.

12- Social Security Number (SSN), contact number and email of the investment advisor.

* If the investment advisor is a corporate, the EIN will be applied for on our behalf.

13- Name of the distribution advisor.

14- Social Security Number (SSN), contact number, and email of the distribution advisor.

*If the distribution advisor is a corporate protector, your EIN will be applied for on our behalf.

15- Identification documents - at least two copies of official IDs with photo for each person involved in the trust (grantor, protector, investment advisor, distribution advisor, and beneficiaries)

U.S. passport and California driver’s license are acceptable for U.S. citizens , but SSN card is not acceptable.

U.S. citizens may also provide Chinese identification documents; non-U.S. citizens may provide Chinese ID cards, passports, or driver’s licenses, etc.

[1] Personal information required.

[2] How to write an autobiography.

Key points to note.

Reference example - John Doe (Mr. Doe), trust grantor

①Drafting the trust agreement

(Some parts of the trust agreement omitted)

[ Name of Trust] TRUST AGREEMENT

THIS [ NAME OF TRUST ] AGREEMENT (the “Agreement” or “Trust Agreement”) is made this day of , 2021, between OOO, of China, hereinafter 「Grantor,」 and OOO TRUST COMPANY, INC., an independent Nevada trust company, hereinafter “Trustee.”

WHEREAS, the Grantor desires to establish an irrevocable trust funded with such property as the Grantor may from time to time deposit into trust under this Agreement, together with the investments, reinvestments and proceeds thereof (all of which, with the investments, reinvestments and proceeds thereof, shall be termed the “Trust estate”).

WHEREAS, the Trustee accepts such trust and agrees to administer it in accordance with the terms and conditions of this Agreement.

NOW, THEREFORE, in consideration of the mutual promises and covenants contained in this Agreement, the Grantor hereby delivers to the Trustee the property described on Schedule “A” in trust which the Grantor has transferred to the Trustee for the following uses and purposes and subject to the terms and conditions contained in this Agreement.

(The following is an abbreviated version)

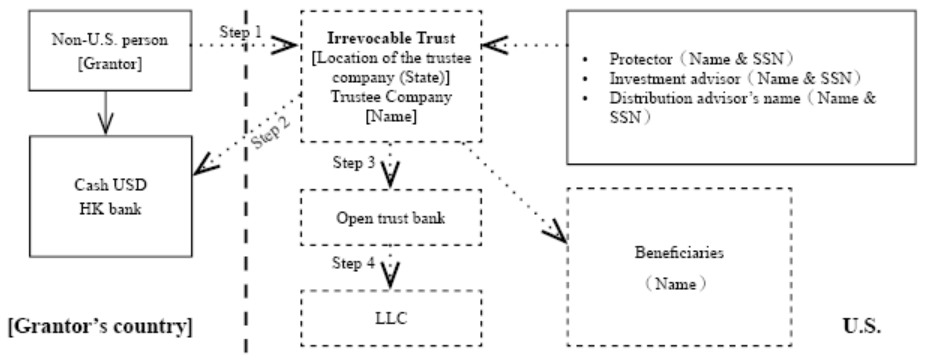

② EIN Application and bank account opening for the trust and the LLC

(i) Application for the EIN and Setting up a Trust Account (Please see page 237)

Once the grantor and the trustee company have signed the trust contract and the act has been notarized or observed by two witnesses, the Trust contract is deemed to be formally established. Next, one must apply for the tax number for the Trust. With the EIN (Employer Identification Number), it means that the Trust has its own identity, and it can open accounts, set up companies, and file annual trust tax returns in the future.

>>Application for the EIN of the Trust can be applied via FAX and it will take 5 to 10 business days. If the application is done online, the process can be completed on the same day.

>>The Trustee Company requires written instructions from the investment adviser to instruct the trustee to establish a trust account and LLC.

Once the Trust has an exclusive tax number, the investment adviser can instruct the trustee to set up and invest the LLC under the name of the trust. The trust could act as the shareholder of the LLC company and the investment adviser could act as the manager of the LLC. All the future investments and capital controls can be directly managed by the investment adviser. With such arrangements, the whole process becomes much more convenient as there is no need to wait until the trustee company to receive the instructions to execute.

>>It takes approximately one week to set up the trust account.

Once the trust tax number is obtained, the trustee company will set up an account for the trust. In general, setting up an account takes about 1 to 2 weeks (it depends on the situation, sometimes it may take 1 month). At this point, the bank will have KYC’s compliance process to go through and the investment adviser will be asked for some questions. Once the trust account is established, the trust grantor could put the principal into the trust account.(ii) LLC establishment and account opening controlled by the Trust

It is recommended that the investment adviser instruct the trustee company to set up the LLC. The trustee company establishes the LLC and invests in the LLC on behalf of the Trust. The Trust is the shareholder of the LLC and the investment adviser can act as the manager of the LLC. All investment and capital control can be directly managed by the investment advisor in the future. It is unnecessary to wait for instructions to be sent to the trustee company for execution. With such arrangements, the process will become much more convenient. Once the LLC company has been established, the LLC must apply for a tax number. After the application, the LLC must open a dedicated bank account. The procedure is as follows:

>>To set up an LLC takes about a week.

>>The establishment of the LLC can be appointed to the attorney or general agency to set up. The following information is required:

- Company mailing address (No need to be consistent with the registered address of the LLC, nor need to be in the state of LLC).

- Name of LLC (Three options, for alternatives).

- Manager (Usually the same person as the investment adviser).

>>The LLC controlled by the Trust should be aware of the following when establishing and opening a bank account in the United States:

- The name of the first manager of this company should be included in the Article of the LLC.

- The company must have a business address for the establishment of the company. If the company does not have an address, it could ask the agent to provide an temporary address for the establishment.

- After sending the company’s establishment documents to the state government, the company’s agent will send the registration license to the company.

- If the LLC is set up by the Trust, the Articles of LLC must be signed by the trustee company. The trustee company will provide the written investment instructions for the investment manager to sign.

>>Apply for an EIN for the LLC. To apply for an EIN for the LLC, Form SS-4 must be filled out.

>>After obtaining the company registration license for the LLC, it can apply for a tax number on the IRS website. The responsible party fills in the sole shareholder of the LLC, which is the Trust itself, and fill in the EIN of the trust as well.

>>To establish a bank account for the LLC (Generally, it can be completed on the same day).

>>The LLC account requires a company manager to prepare the following documents and go to the bank to open an account in person:

- Articles of Company (needs to be signed by both the trustee company and the manager).

- Signatory roster.

- Trust agreement.

- LLC establishment certificate

- LLC Tax Number.

- Manager’s ID card (driver’s license, passport).

Prepare the documents mentioned above to open a bank account and then take the following steps:

- The LLC manager will bring the above documents to open an account. It is necessary to bring the manager’s personal document to certify his or her identity. If opening a bank account in California, the bank will inquire to see the articles of company, the company registration license, EIN, and other supporting documents with the name of the manager.

- When opening an account in a U.S. local bank, the bank may ask the following questions that typically revolve around these topics:

-

-

- The class of LLC: Single member (usually recorded on the last page of the articles of association).

- LLC business: investment or real estate.

- Average account balance: depend on the situation, but in the next few months, it is expected to purchase XX in XX amount.

- Type of account to be opened: If the balance is above $3,000 USD, choosing the basic account for the maintenance fee is recommended.

- If it is an LLC established by the Trust, it is necessary to inform the trustee company that the account opening is completed. Usually the trustee company will deposit a few hundred dollars on behalf of the grantor when opening an account. So, the trustee company will provide a letter of instruction for the investment manager to sign.

-

(iii) Transfer Trust Account Funds to the Investment LLC.

Once the funds have been put into the Trust account, the Trust funds can be transferred to the LLC account after the LLC is set up and the account is opened. Meanwhile, the trustee company needs the investment consultant to send the transfer order from the provided e-mail address and contact the investment consultant to confirm the remittance.

(iv) Establishment and follow-up maintenance of the U.S. trust

After the establishment of a trust, there are different requirements for accounting and taxation, and property disclosure, depending on the classification and location of the trust, which are divided into the following six categories:

Scenario 1-1: An irrevocable trust is established in the U.S. and the funds are transferred from abroad or moved into a foreign company for the LLC’s investment. The income from the LLC investment is then returned to the trust and distributed to the beneficiary within 65 days of the year end for accounting, tax and property disclosure requirements.

Scenario 1-2: An irrevocable offshore trust is established in the U.S., and the equity of the offshore company is transferred into the trust. After the transfer, a consolidated statement of the CFC should be prepared every year, and the offshore bank accounts should be disclosed in accordance with the regulations.

Scenario 1-3: A revocable trust is established in the U.S., and the equity of the offshore company is transferred into the trust. After the transfer, a consolidated statement of the CFC should be prepared every year, and the offshore bank accounts should be disclosed in accordance with the regulations. If the grantor gives directions or unfortunately passes away, the revocable trust thus becomes an irrevocable trust. In this situation, the dividends transferred into the trust are distributed to the beneficiaries within 65 days of the end of the year for accounting, tax and property disclosure requirements.

Scenario 2-1: A revocable trust established outside of the U.S. and the equity of the foreign company is transferred into the trust. Since the trust is revocable, although there is a U.S. beneficiary, no tax reporting or property disclosure is required. But the relevant accounts and financial statements need to be prepared in advance each year for the subsequent conversion to an irrevocable trust.

Scenario 2-2: If the beneficiary of an offshore revocable trust is a U.S. person, he/she will be required to file tax returns and make property disclosure in accordance with the relevant U.S. tax laws and regulations upon receipt of distributions from the offshore trust after the grantor has given directions or has unfortunately passed away and thus the trust became irrevocable.

Scenario 2-3: When the grantor of an offshore revocable trust gives directions or unfortunately passes away and the trust becomes irrevocable, there are negative tax consequences for the beneficiary (U.S. person) of the offshore non-grantor trust because the governing law for the trust is outside the U.S. When a trust has accumulated undistributed net income (UNI), the beneficiaries will be subject to Throwback Tax when they receive the trust distributions in that year; and foreign non-grantor trusts usually hold foreign financial instruments, such as mutual funds and money market funds, etc., there will be tax for the passive foreign investment company (PFIC) when the income from the asset is distributed in the future, so it is usually the accounting treatment and tax declaration for each year after the transfer of the offshore trust to the U.S. trust. Therefore, it is suggested to convert a foreign trust into a U.S. trust to solve the problem of annual accounting and tax filing.