專業叢書

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Chapter 3 ─ U.S. Dynasty Trusts

Section 4: Procedures for the Establishment of the U.S. Trust

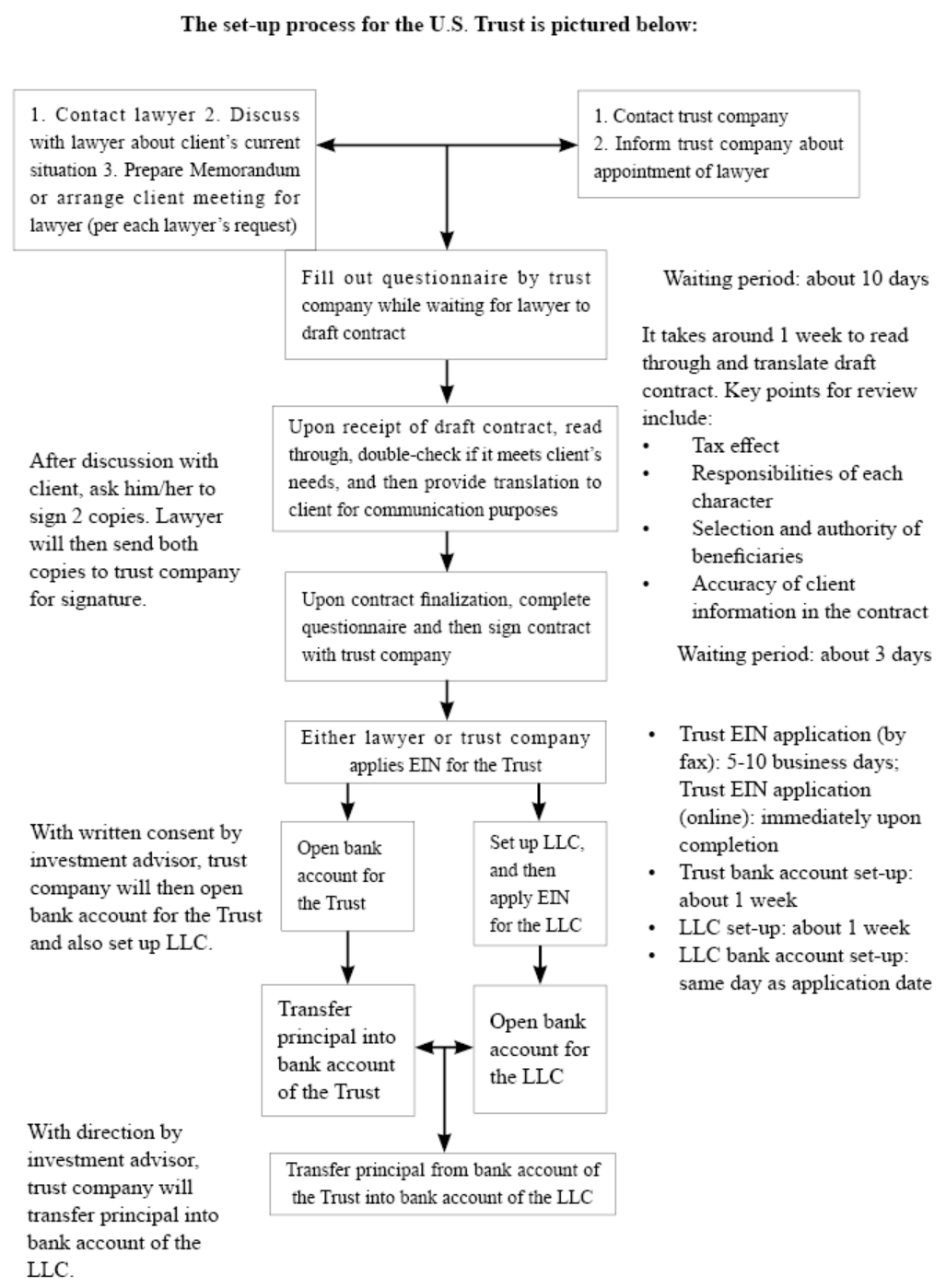

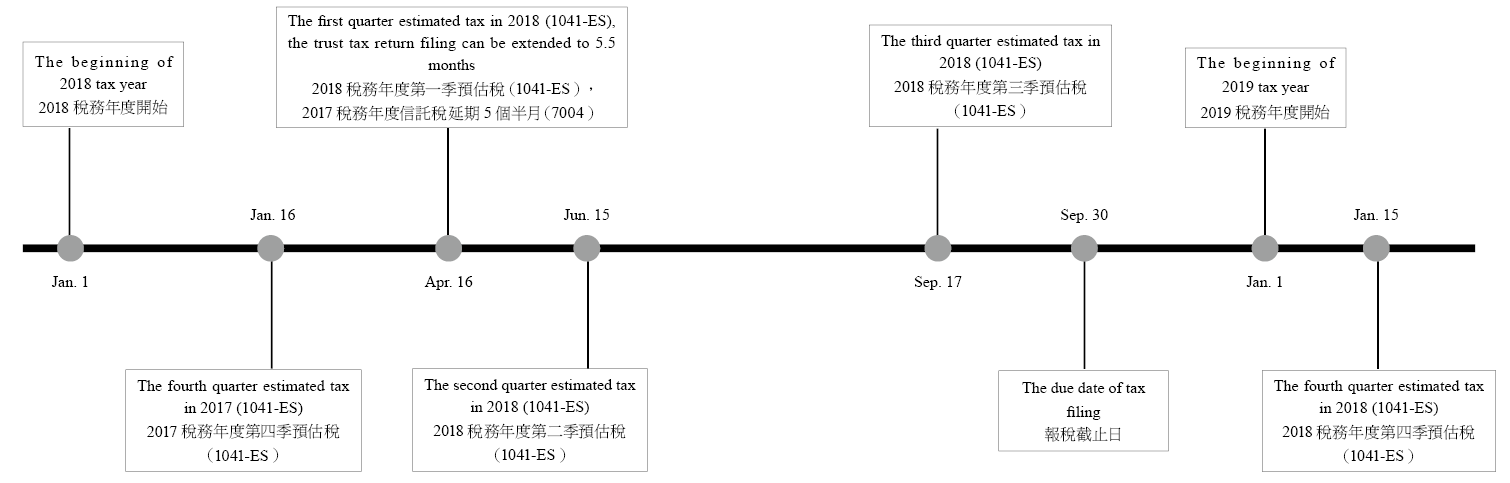

The following contents will introduce the set-up process, necessary documents and flowchart for establishing a new U.S. trust.

1. The Set-up Process for the U.S. irrevocable Trust

Typically, it takes three to six months to complete the set-up process, which includes the selection of a Trustee Company, one or more trust protectors, investment direction advisors and distribution advisors, one or more beneficiaries. The local U.S. attorney must also confirm that the trust agreement is agreeable with local laws and determine the proper trustee for this particular trust. After the attorney drafts the trust agreement, the attorney explains the trust agreement in its entirety to the grantor. Then, the trustee company reviews and approves the trust agreement. The trust agreement is then signed by the grantor and a representative of the trustee company and applications are filed for the trust’s EIN, bank accounts, LLCs and LLCs’ bank accounts. Foreign assets are then transferred to the U.S. trust by the grantor.

The following contents will introduce the set-up process, necessary documents and flowchart for establishing a new U.S. trust.

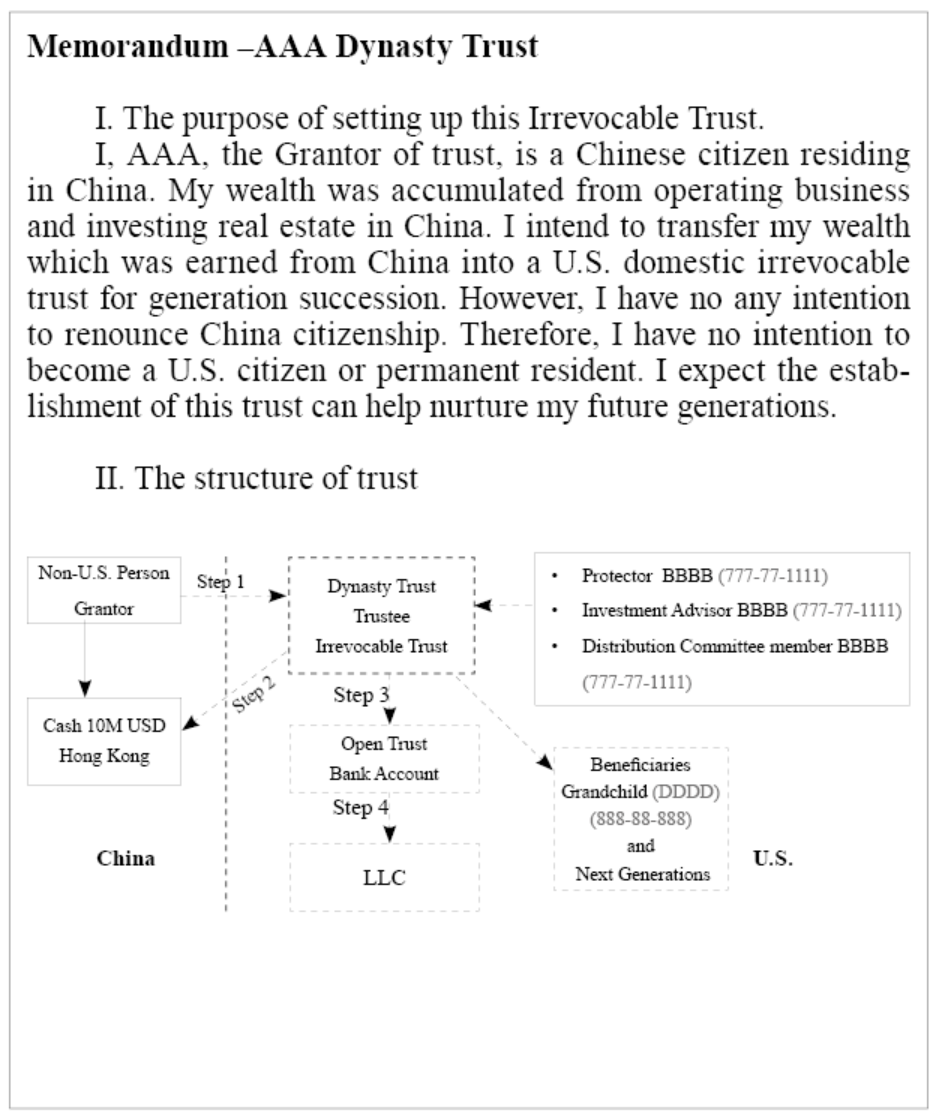

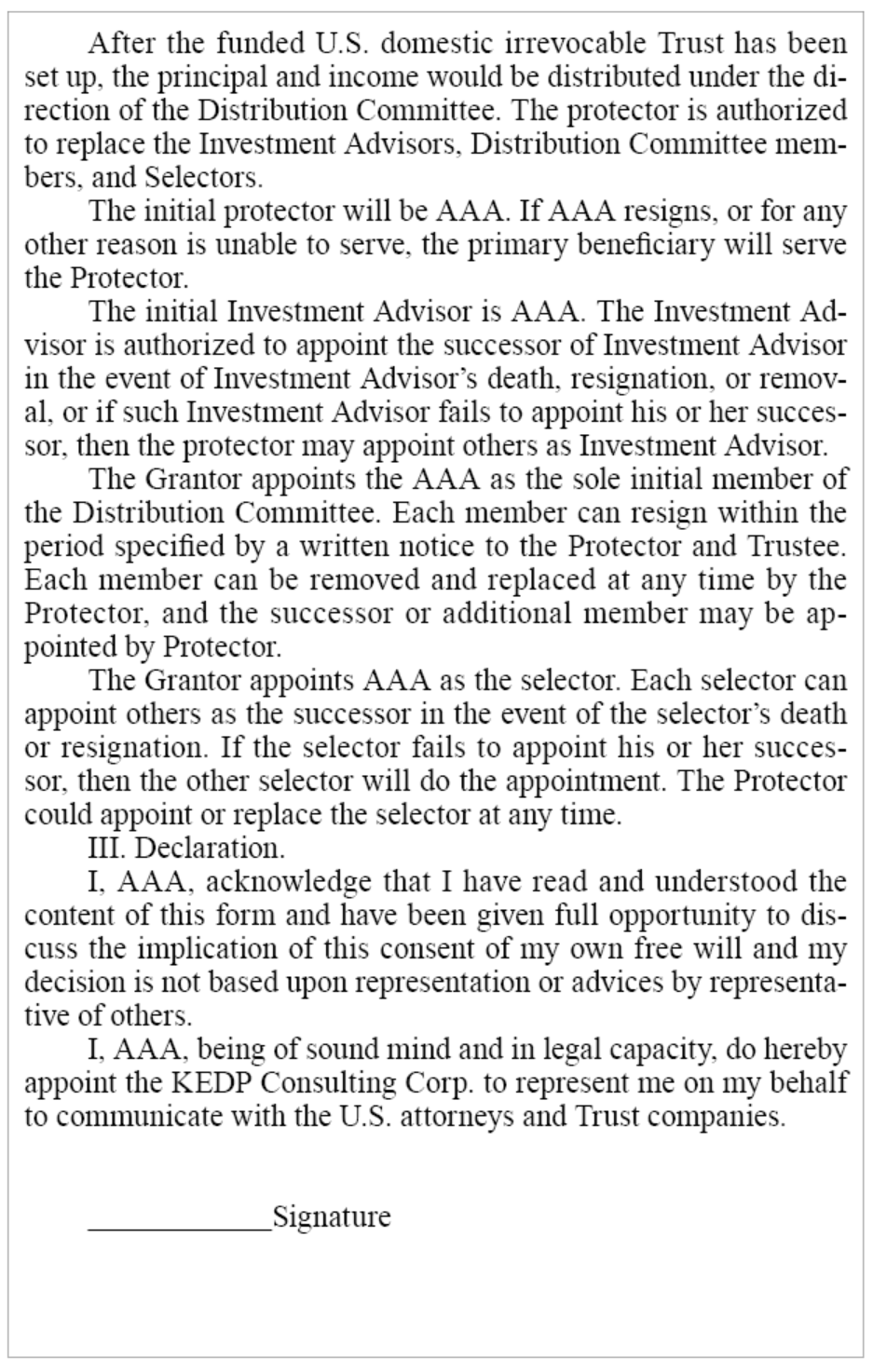

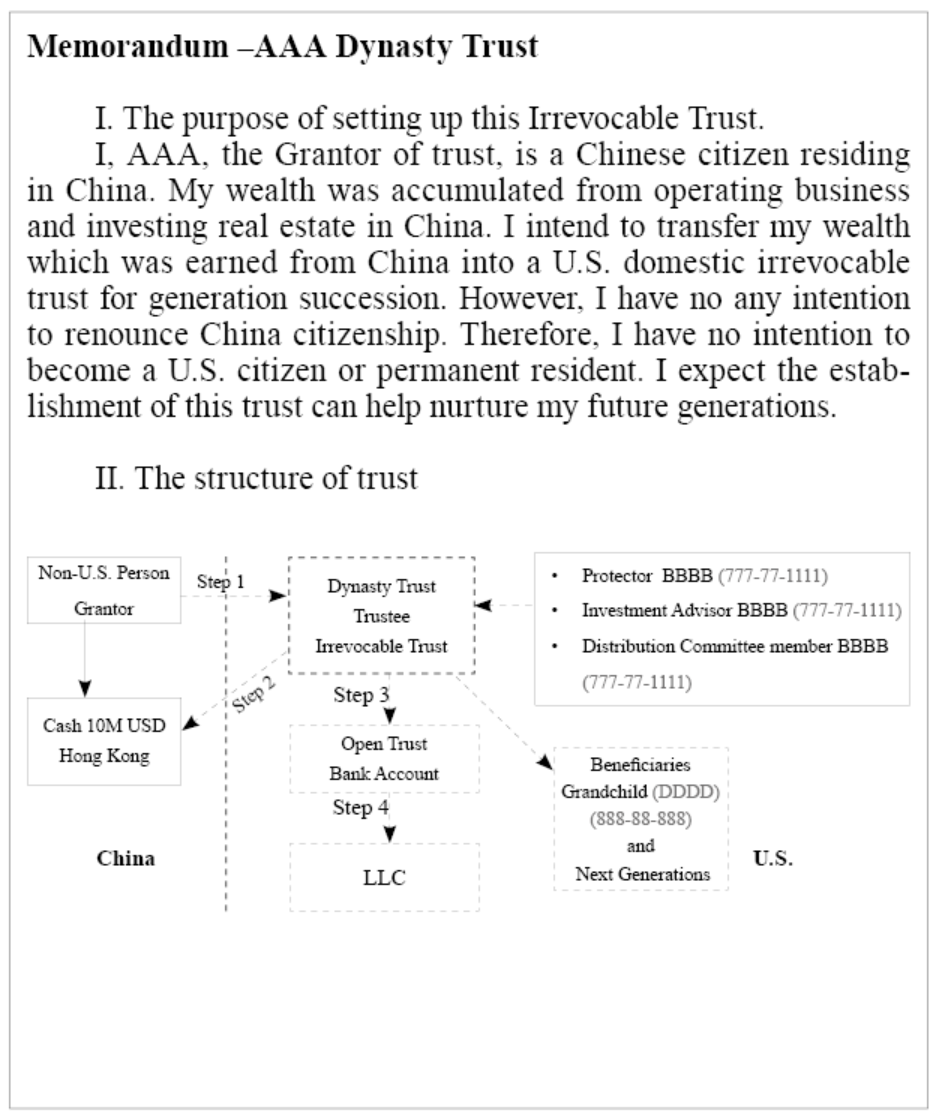

(1) Memorandum – AAA Dynasty Trust

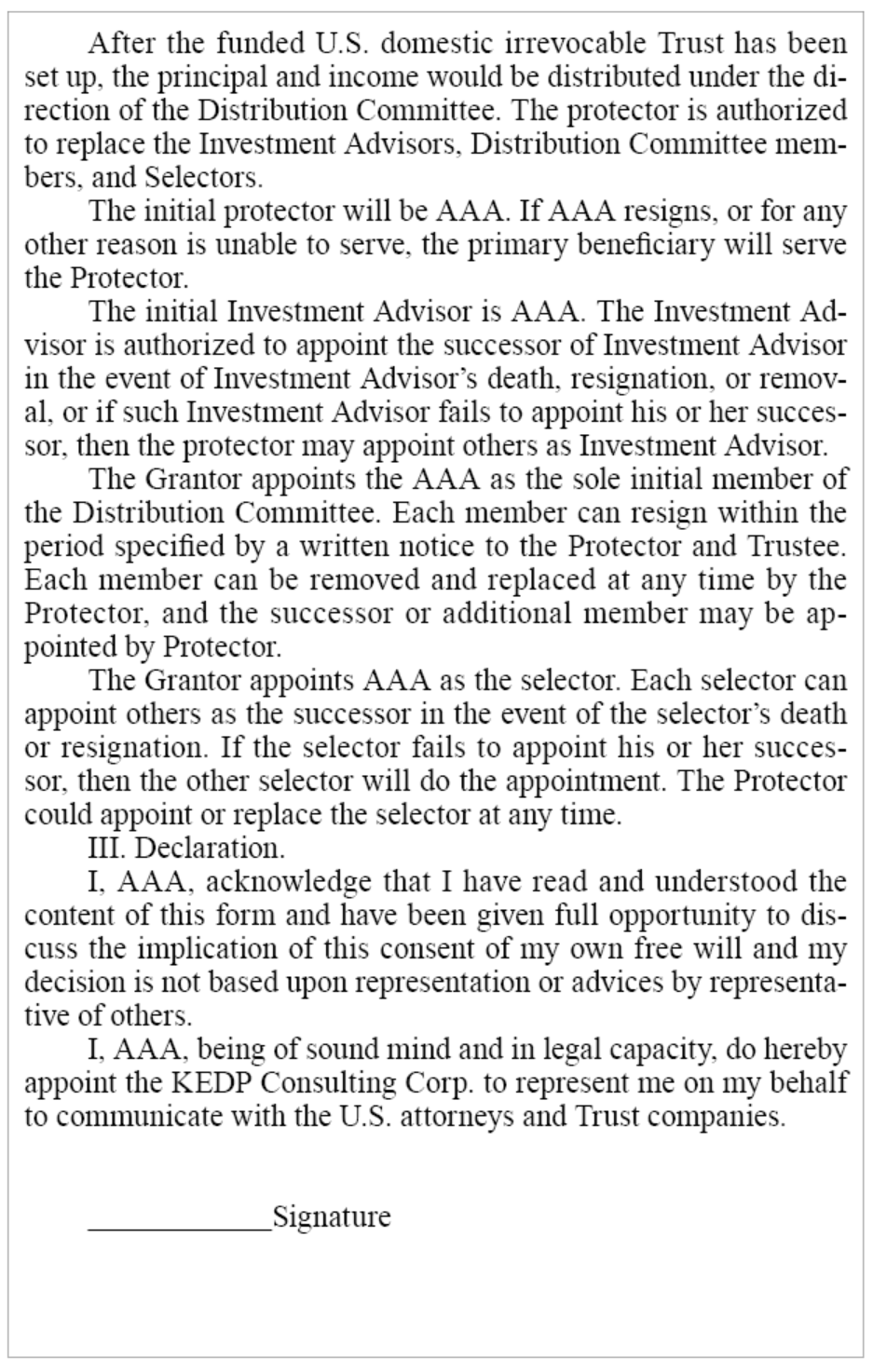

When a grantor decides to establish a trust, the grantor must sign a memorandum to give the drafting attorney an idea of the trust that he or she wishes to settle. Since many non-U.S. grantors are unable to communicate with local trust attorneys, they communicate through professionals from bilingual agencies, who are able to bridge the gap. These agencies typically create a memorandum in both the grantor’s language and in the trustee’s language (most often English).

Please see below for an example of one such memorandum:

(2) Required documents prepared for the Attorney drafting the trust agreement

2. Settlement and maintenance of U.S. Trusts

(1) Application for the trust’s EIN and setting up a trust bank account

Once the grantor and the trustee company have signed the trust agreement and the signatures have been notarized or observed by two witnesses, the trust agreement is deemed settled. Next, the trust must apply for an employee identification number (EIN). Then, using the trust’s EIN, it can open bank accounts, set up subsidiary companies and declare and file annual tax filings.

(2) Trust establishes LLC and opens bank account(s)

After obtaining LLC’s business license, it can apply for an EIN on the IRS website. The responsible party puts trust as the sole member of the LLC and fill in the EIN of the Trust as well.

3. Subsequent Income Distribution of the U.S. Trust

Trust Tax Rate: Over $12,500 ..........$3,011.50 plus 37% of the excess over $12,500

Individual Tax Rate: Over $500,000 ..........$150,689.50 plus 37% of the excess over $500,000

1. The Set-up Process for the U.S. irrevocable Trust

Typically, it takes three to six months to complete the set-up process, which includes the selection of a Trustee Company, one or more trust protectors, investment direction advisors and distribution advisors, one or more beneficiaries. The local U.S. attorney must also confirm that the trust agreement is agreeable with local laws and determine the proper trustee for this particular trust. After the attorney drafts the trust agreement, the attorney explains the trust agreement in its entirety to the grantor. Then, the trustee company reviews and approves the trust agreement. The trust agreement is then signed by the grantor and a representative of the trustee company and applications are filed for the trust’s EIN, bank accounts, LLCs and LLCs’ bank accounts. Foreign assets are then transferred to the U.S. trust by the grantor.

The following contents will introduce the set-up process, necessary documents and flowchart for establishing a new U.S. trust.

(1) Memorandum – AAA Dynasty Trust

When a grantor decides to establish a trust, the grantor must sign a memorandum to give the drafting attorney an idea of the trust that he or she wishes to settle. Since many non-U.S. grantors are unable to communicate with local trust attorneys, they communicate through professionals from bilingual agencies, who are able to bridge the gap. These agencies typically create a memorandum in both the grantor’s language and in the trustee’s language (most often English).

Please see below for an example of one such memorandum:

(2) Required documents prepared for the Attorney drafting the trust agreement

- Grantor’s basic information.

- The trust’s name.

- A copy of the grantor’s passport and ID.

- The grantor’s address (It would be better to provide the same address on the grantor’s ID card).

- The grantor’s phone number.

- The grantor’s email.

- The grantor’s job title.

- The offshore company’s name, address, phone number and email (if applicable)

- The name of the grantor’s spouse (if applicable).

- Companies that the grantor currently owns.

- The value of the assets that will be transferred into the trust.

- Information of each beneficiary

- A copy of the beneficiary’s passport, ID card and social security card.

- The beneficiary’s place of birth.

- The beneficiary’s nationality.

- The beneficiary’s home address (a U.S. one, if available)

- The beneficiary’s phone number (a U.S. one if available)

- The beneficiary’s email.

- The beneficiary’s green card issuance date (if applicable).

- Information required of the Trust Protector, Investment Direction Advisor and Distribution Advisor.

- A copy of his or her passport, ID and social security card.

- His or her home address (a U.S. one, if available)

- His or her phone number (a U.S. one if available)

- His or her email.

- Grantor’s CV/Resume

- The grantor’s CV or resume is required by most trust companies, and the following should be provided:

- Place of birth and current address. Citizenship(s) in other countries should be provided.

- Family history, including information regarding family members and time and place of marriage, etc.

- Education background.

- Source of Funds:

╣If the source of funds is an inheritance or a gift, the name of the donor or ancestor and their sources of funds should be provided.

╣If the source of funds is an investment, indicating the type of investment.

╣If the source of funds is operating a business: the name of company and the type of business.

╣If the funds is cash, the source of cash must be explained:

┥Who else (individual/company) will fund the trust?

┥Would any shares of companies be transferred to the trust?

┥What is the purpose of the trust?

┥Are there any transactions that will take place in the trust? Examples may include frequent money transfers, frequent distributions or no distribution.

- Trust companies typically require the grantor’s background information

2. Settlement and maintenance of U.S. Trusts

(1) Application for the trust’s EIN and setting up a trust bank account

Once the grantor and the trustee company have signed the trust agreement and the signatures have been notarized or observed by two witnesses, the trust agreement is deemed settled. Next, the trust must apply for an employee identification number (EIN). Then, using the trust’s EIN, it can open bank accounts, set up subsidiary companies and declare and file annual tax filings.

I. Application for the EIN of the trust can be applied via FAX; it will take 5~10 working days. If the application is completed online, the trust can receive an EIN that same day.

There are three ways to apply for the tax number. One is the online application. This way requires the shortest amount of time. However, the responsible person (Responsible Party, generally referred to as the trustee company) needs to have a valid social security number. The second way is to fill out Form SS-4 and fax it to the IRS, which roughly takes about 5~8 business days and loss of data is likely to happen. The third method is to call the IRS and apply over the phone, but because the IRS phone line is always busy and difficult to dial in, the process usually takes 2 to 3 hours.

II. The Trustee requires a direction letter from the investment direction adviser to direct the trustee to establish a trust account and LLC(s).

Once the trust has an EIN, the investment direction adviser can direct the trustee to set up an LLC held by the trust. The trust acts as shareholder of the LLC company and the investment direction adviser acts as manager of the LLC. All the future investments can be managed by the investment direction adviser. With such arrangements, the management process becomes more convenient, as there is no need to wait until the trustee company to receive the instructions to execute.

III. It takes approximately one week to set up the trust account.

Once the trust EIN is obtained, the trustee company will set up an account for the trust. Generally, setting up an account takes 1 to 4 weeks, depending on the situation. The bank will follow Know Your Client (KYC) compliance processes and require that the investment direction advisor answer additional questions.

IV. Transfer the principal into the trust account.

Once the trust account is established, the trust grantor can transfer funds to the trust account.(2) Trust establishes LLC and opens bank account(s)

It is recommended that the investment direction adviser direct the trustee company to set up the LLC through a direction letter. The trustee company establishes the LLC and invests in the LLC on behalf of the trust. The trust then becomes the shareholder of the LLC and the investment direction adviser can act as the manager of the LLC. All investments can be directly managed by the investment advisor. It is not necessary to wait for instructions to be sent to the trustee company for execution. With such arrangements, the process will become much more convenient. Once the LLC company has been established, the LLC must apply for EIN. After the application, the LLC may open an LLC bank account. The procedure is as follows:

I. Setting up an LLC takes about a week.

The LLC may be established through an attorney or an agency. The following information is required:

- Company mailing address (neither needs to be consistent with the registered address of the LLC, nor be in the state of the LLC).

- Name of LLC (three, just in case one or two are previously taken).

- Manager (typically the same person as the investment adviser).

Managers of trust-owned LLCs should observe the following when opening a bank account in the U.S.:

- The name of the first manager of the LLC will show up on the Certificate of Organization.

- The LLC must have a business address when it is established. If the LLC does not have a physical address, the agency or law firm can supply one for the registration.

- After the state approves the LLC application, the company’s agent will receive a business license.

- If the LLC is set up by the trust, the LLC’s Certificate of Organization must be signed by the trust company. The trust company will provide written investment instructions for the investment manager to sign.

II. Apply for an EIN for the LLC.

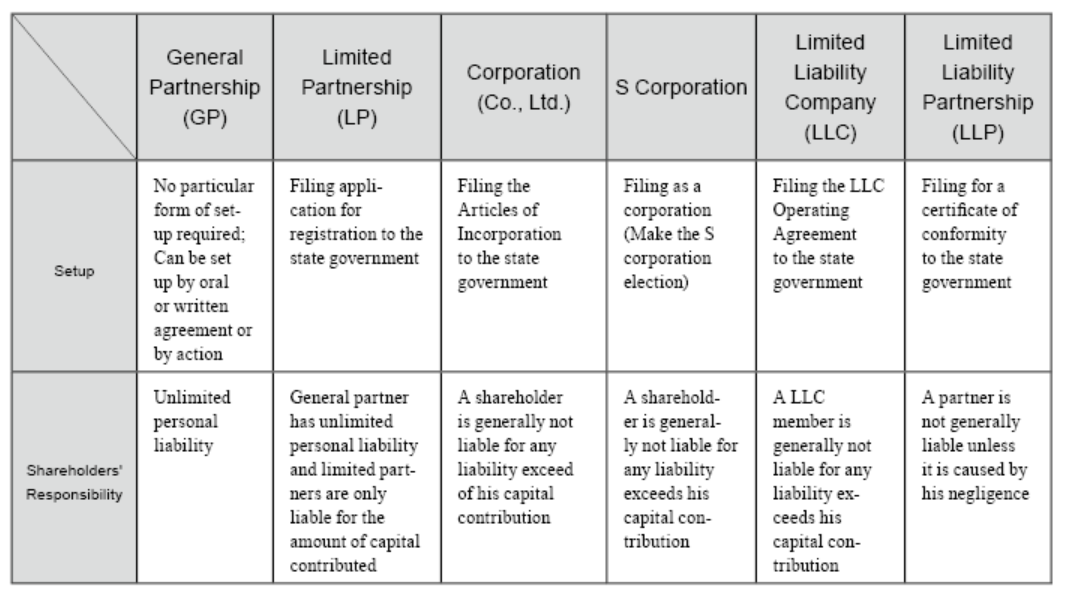

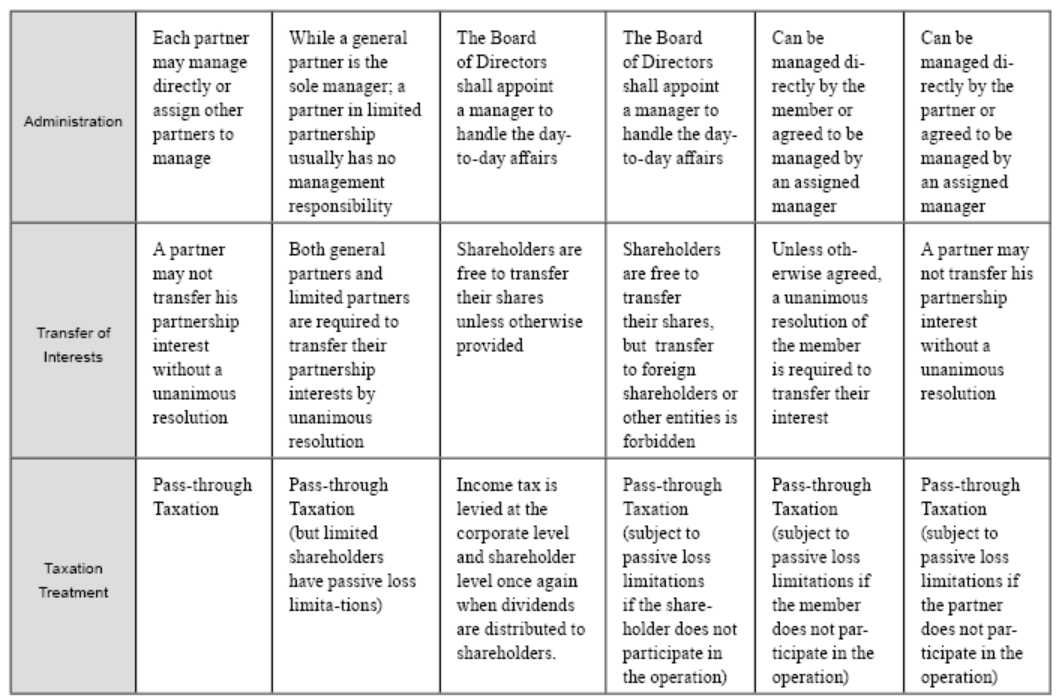

Form SS-4 is required to apply for an LLC EIN, and the following form is stated for the types and attributes of the U.S. company.

After obtaining LLC’s business license, it can apply for an EIN on the IRS website. The responsible party puts trust as the sole member of the LLC and fill in the EIN of the Trust as well.

III. To open a bank account for the LLC (Generally, it can be completed on the same day).

The LLC account requires a company manager to prepare the following documents and go to the bank to open an account in person:

- Operating agreement must be signed by both the trustee company and the manager.

- Signatory roster.

- Trust contract.

- LLC establishment certificate

- LLC EIN.

- Manager’s personal identification (driver’s license, passport).

Prepare the above-mentioned documents to open a bank account, then the following steps should be taken:

- The LLC manager will bring the above documents to open an account. It is necessary to bring the manager’s personal identification. If opening a bank account in California, the bank will require the Operating Agreement, the company registration license, EIN, and other supporting documents with the name of the manager.

- When opening an account in a U.S. local bank, the bank may ask the following questions. They typically revolve around these topics:

╣The class of LLC: Single member (usually recorded on the last page of the Operating Agreement).

╣LLC business: investment or real estate.

╣Average account balance: depend on the situation, but in the next few months, it is expected to purchase XX in XX amount

╣Type of account to be opened: If the balance is above $3,000 USD, choosing the basic account for the maintenance fee is recommended.

╣If it is an LLC established by the Trust, it is necessary to inform the trustee company that the account opening has been completed. Usually, the trustee company will deposit a few hundred dollars on behalf of the grantor when opening an account, follows with a direction letter for the investment manager to sign.

IV. Transfer Trust Account Funds to the LLC.

After the funds have been put into the Trust account, the Trust funds can be transferred to the LLC account after the LLC is set up and the account is opened. At this time, the trustee company needs the investment manager to send the transfer order from the provided e-mail address and contact the investment consultant to confirm the remittance3. Subsequent Income Distribution of the U.S. Trust

(1) Trust profits distribution

The distributions of Trust profits will be decided by the distribution to beneficiaries there will be responsible for income tax levied on profits from the trust.

(2) Irrevocable Trust profits―which are not distributed is subject to a 37% federal income tax.

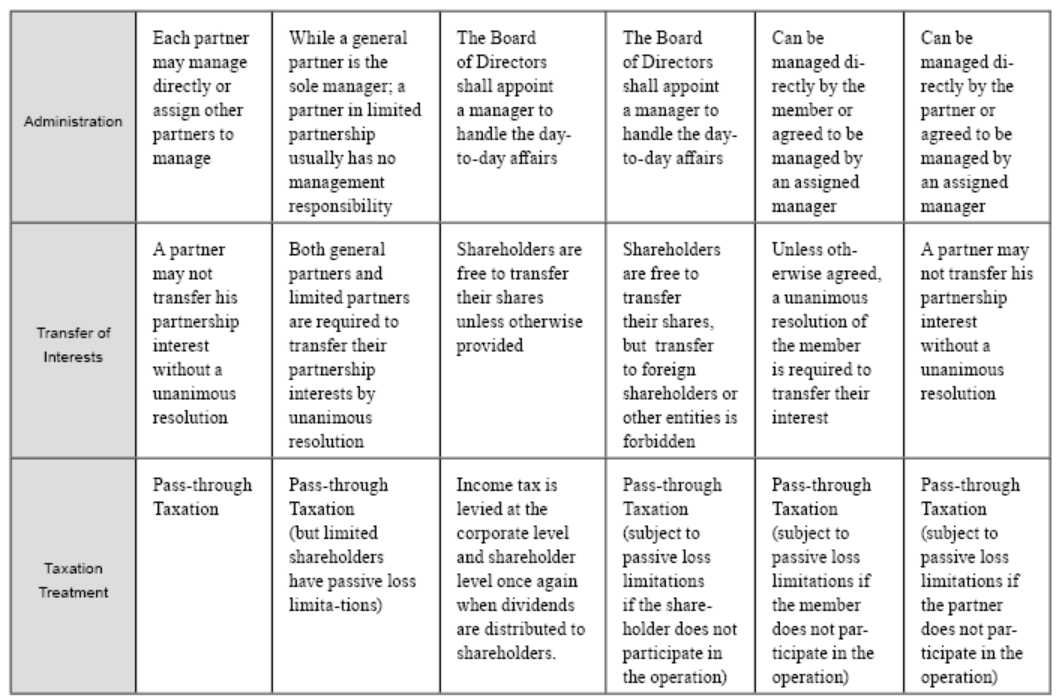

Generally, Trust income needs to be declared and income tax needs to be paid on it. If there are profits generated by the Trust which are not distributed to the beneficiary during the year, the Trust will be responsible for paying the tax. The after-tax income will be incorporated into the Trust principal and no additional tax will be levied for future distribution. However, the above situation is less favorable from a tax perspective. Although the Trust has the same highest tax rate as that of individuals, the former’s income bracket is much narrower. The Trust is subject to income tax rate of 37% if its income is more than $12,500, compared to income of $500,000 for individuals. As such, given the lower income tax threshold, distribute trust’s taxable income to beneficiary is relatively tax efficient. Trust Tax Rate: Over $12,500 ..........$3,011.50 plus 37% of the excess over $12,500

Individual Tax Rate: Over $500,000 ..........$150,689.50 plus 37% of the excess over $500,000

(3) Trust Profit Distribution―Trustee will issue K-1 with stated income, the beneficiary incorporates and reports the income on Form 1040.If the Trust distributed the annual profits to the beneficiary, the beneficiary is required to pay tax for the Trust income. At this moment, the Trust will issue a K-1 form to the beneficiary, which will specify amount and type of income the Trust has distributed. Then, the beneficiary will incorporate the profit into their personal income and pay the personal income tax.

(4) Distribution of Trust principal.

There will be no tax issues for the beneficiaries when receiving the distribution of the Trust principal. However, it should be noted that if the Trust distributes both the principal and the profits to different beneficiaries, the profits and principal must be split according to the number of beneficiaries. They cannot separately nominate the earnings and principal to the different beneficiaries.

(5) Disclosure of the irrevocable Trust for holding offshore assets. Disclosure of irrevocable Trusts for holding offshore assets, mainly includes the disclosure of company equity, financial assets, bank accounts, insurance policies, and creditor’s rights. The Trust needs to file Form 8938, Form 5471, and FinCEN114. (For the contents of the form, please refer to the book “U.S. Taxation and Foreign Asset Reporting”)

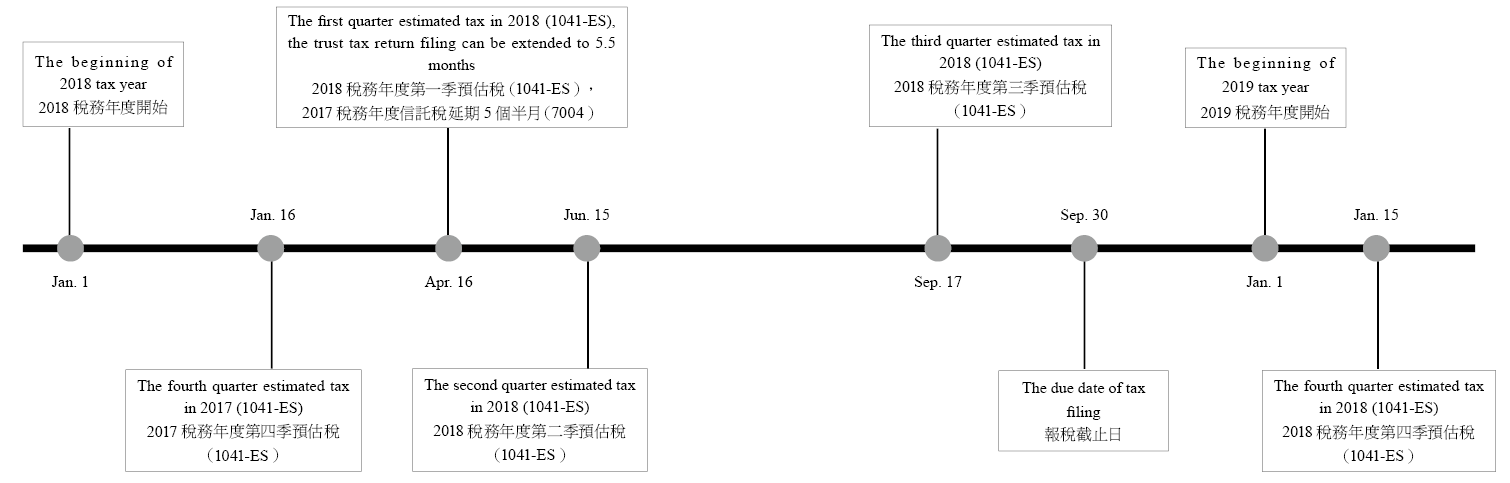

(6) Annual Tax Return for Irrevocable Trusts. The irrevocable Trust is required to declare Form 1041 before April 15th of each year. If the Trust had a tax liability in the previous year, estimated income tax is also required to be paid quarterly. The trust may file Form 7004 to make the filing date extend to September 15. However, the tax has to be paid by April 15, even if an extension is granted.