專業叢書

Estate Planning by U.S. Trust 美國報稅與海外財產揭露(英文部分)

Chapter 2 ─ U.S. Trust Planning and Example Structures for High Net Worth Families

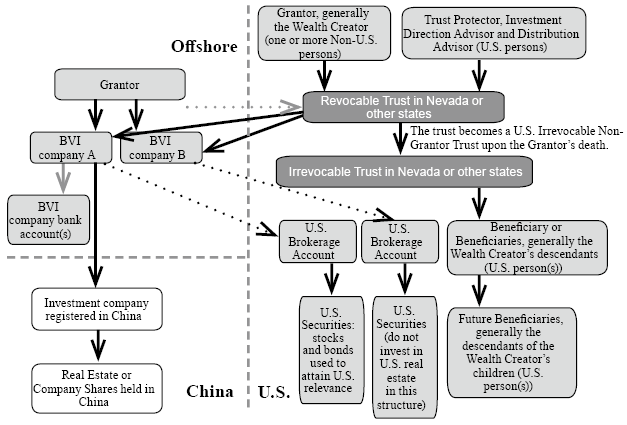

Type 3: A Non-U.S. Grantor Settles a U.S. Revocable Grantor Trust to Hold Non-U.S. Assets

- Rationale:

- By placing the assets in trust, the Grantor’s descendants will not have to go through U.S. probate to receive their inheritance. Probate in the U.S. is generally a long and costly endeavor.

- For those concerned with privacy, the United States is not a Common Reporting Standards (CRS) participant.

- The Wealth Creator can rest assured that his or her assets can be passed on to the next generation. Since the trust’s assets are held in trust, the Grantor of the trust is generally able to control how the assets will be managed and distributed after his death.

- The increase in value of assets held by the trust are not subject to U.S. income taxes during the Grantor’s life.

This structure applies when a non-U.S. person Grantor settles a U.S. Revocable Grantor Trust in the U.S. with U.S. beneficiaries. The trust becomes a U.S. Irrevocable Non-Grantor Trust upon the Grantor’s death. Upon the Grantor’s death, the cost basis of assets held by the trust can be stepped up to fair market value through a check the box election (please refer to Appendices, Section C for additional information).

Key Advantages: 1) The income from offshore assets is not subject to U.S. income tax during the Grantor’s life; 2) The basis of assets held by the trust can be stepped up to fair market value immediately prior to the Grantor’s death.

- Suitable Situations and Limitations:

- Grantor wishes to retain control over trust assets during his or her life. The Grantor’s gift to the trust is structured as an incomplete gift for U.S. gift and estate tax purposes.

- Non-U.S. person as Grantor (he or she is generally the person who currently possesses assets that will be gifted into the trust)

- The Trust Protector will typically be a U.S. person, U.S. C-Corporation or U.S. Limited Liability Company (LLC).

- The trust’s beneficiaries must be non-U.S. persons during the Grantor’s lifetime if the Grantor wishes that income generated by the trust’s non-U.S. assets not be subject to U.S. income tax during the Grantor’s life.

- Assets to be gifted to the trust should be outside of the U.S. prior to the transfer and remain outside of the U.S. after the transfer (and prior to the Grantor’s death) to avoid unwanted tax and legal complications. The gifted assets should not produce Effectively Connected Income for U.S. tax purposes (Generally, when a foreign person engages in a trade or business in the United States, all income from sources within the United States connected with the conduct of that trade or business is considered to be Effectively Connected Income (ECI).

- Assets gifted to the trust should not be U.S. situs for estate tax purposes (please refer to Appendices, Section A for additional information regarding U.S. situs for estate and gift tax purposes).

- The trust’s principal and income can be distributed to U.S. persons at any time. This requires a proper filing of Form 3520.

- Precautions:

- Since the Grantor is making an incomplete gift, the Grantor’s creditors (including an ex-spouse in the dissolution of a marriage dissolution) could potentially get access to trust assets.

- After the Grantor’s death, the trust will be subject to U.S. income tax.

- Check the box elections are complicated and require professional assistance. For more information, please refer to Appendices, Section C.