Publications

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 5 The Rise of the Global Family Office

What is bookkeeping? How can it help Wealth Creators?

Bookkeeping is a foundational aspect of financial management, crucial for both U.S. irrevocable trusts and U.S. companies. It involves maintaining accurate and detailed records of all financial transactions, supporting informed decision-making, regulatory compliance, and overall financial health. Here’s an in-depth look at its role in these two contexts:

Key Roles and Responsibilities

1. Accuracy and Reliability

Illustrative Accounting Treatment (Trusts and Single-Member LLCs)

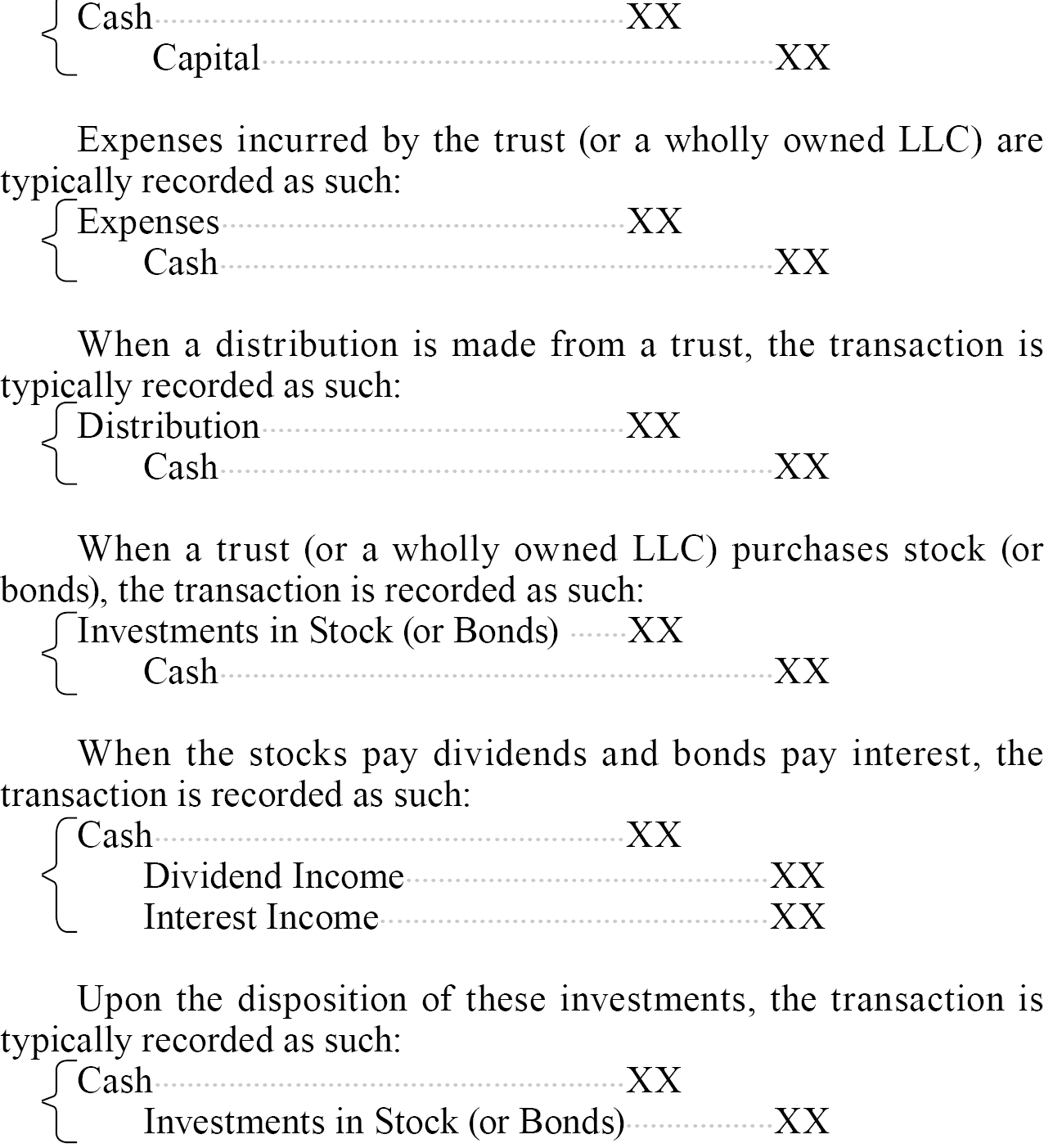

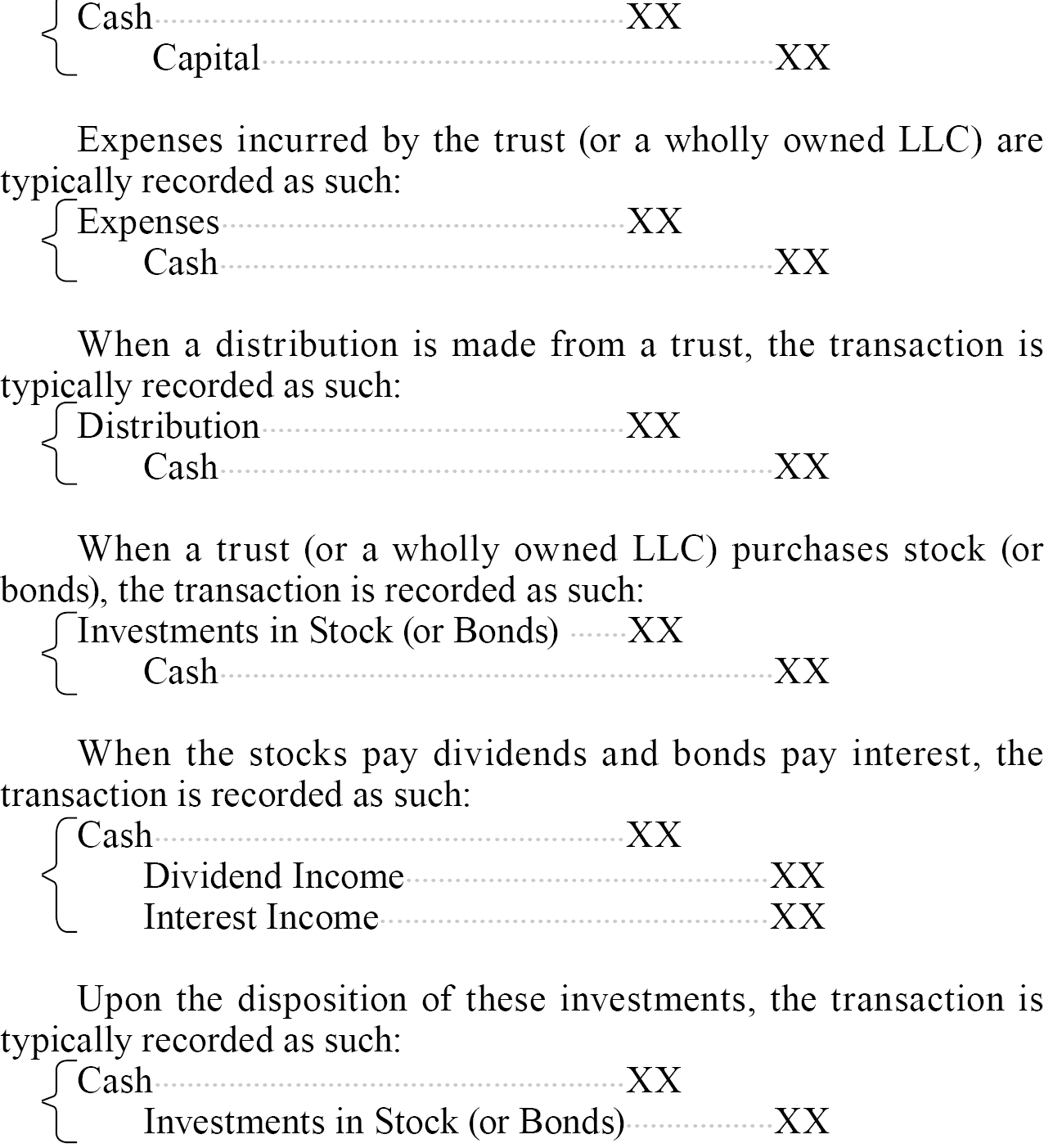

Since single-member LLCs are passthrough entities for income tax purposes, their transactions are typically combined with the trust’s transactions. The end result is typically consolidated financial statements for the trust.

When establishing a trust or making a cash gift to the trust, the transaction is typically recorded as such:

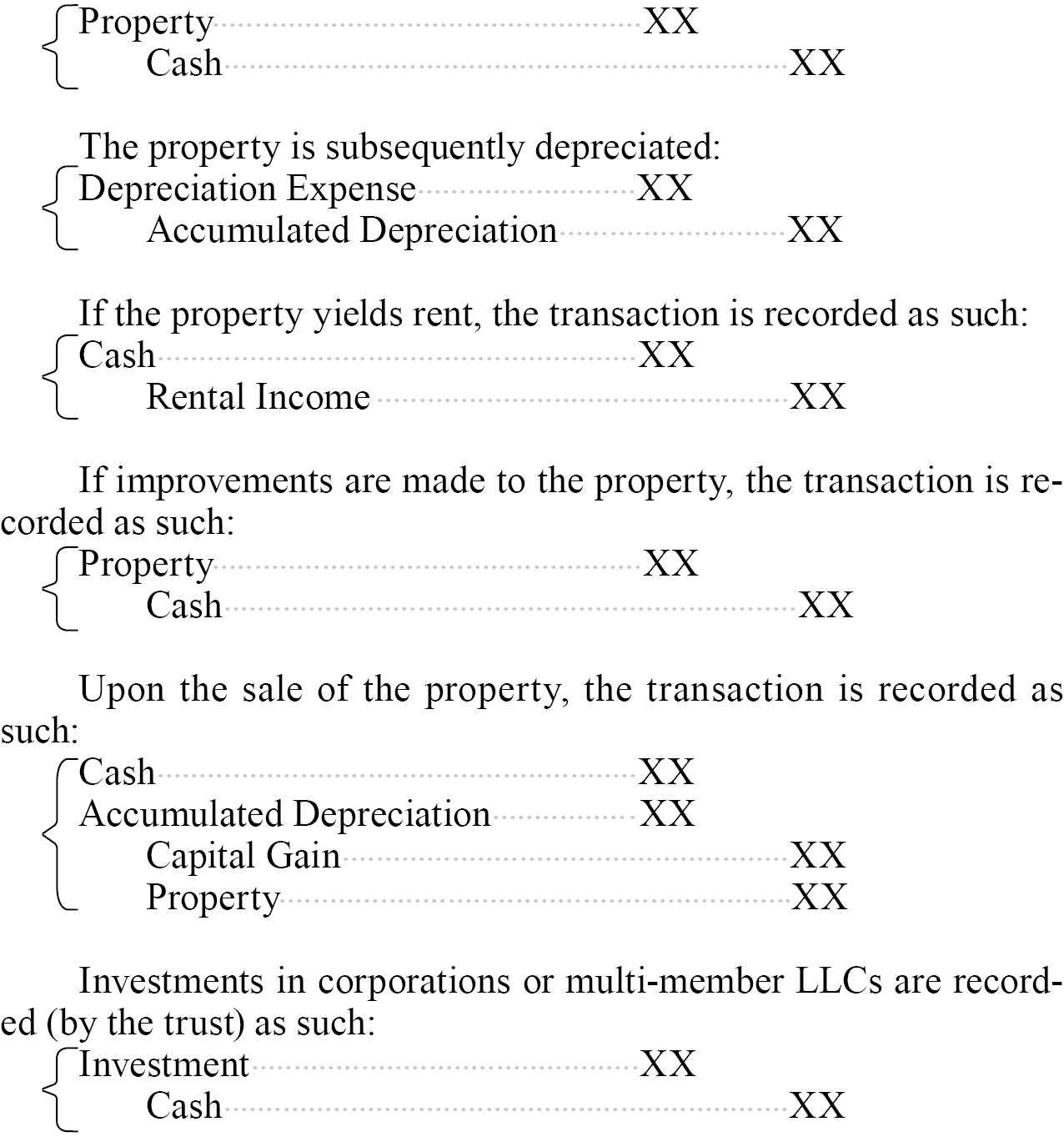

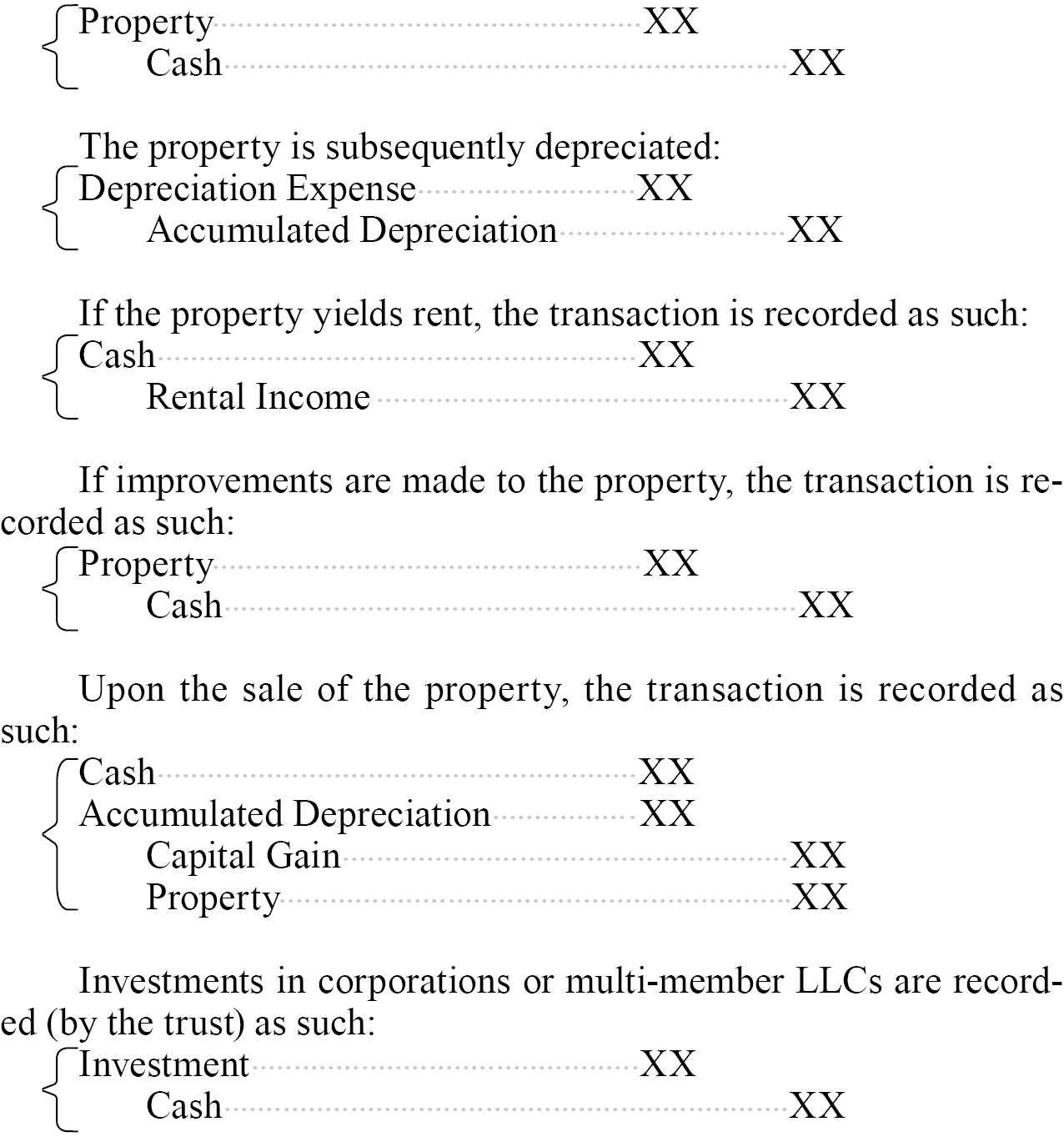

When a trust (or a wholly owned LLC) purchases real estate, the transaction is recorded as such:

Illustrative Accounting Treatment (Corporations and Multi-Member LLCs)

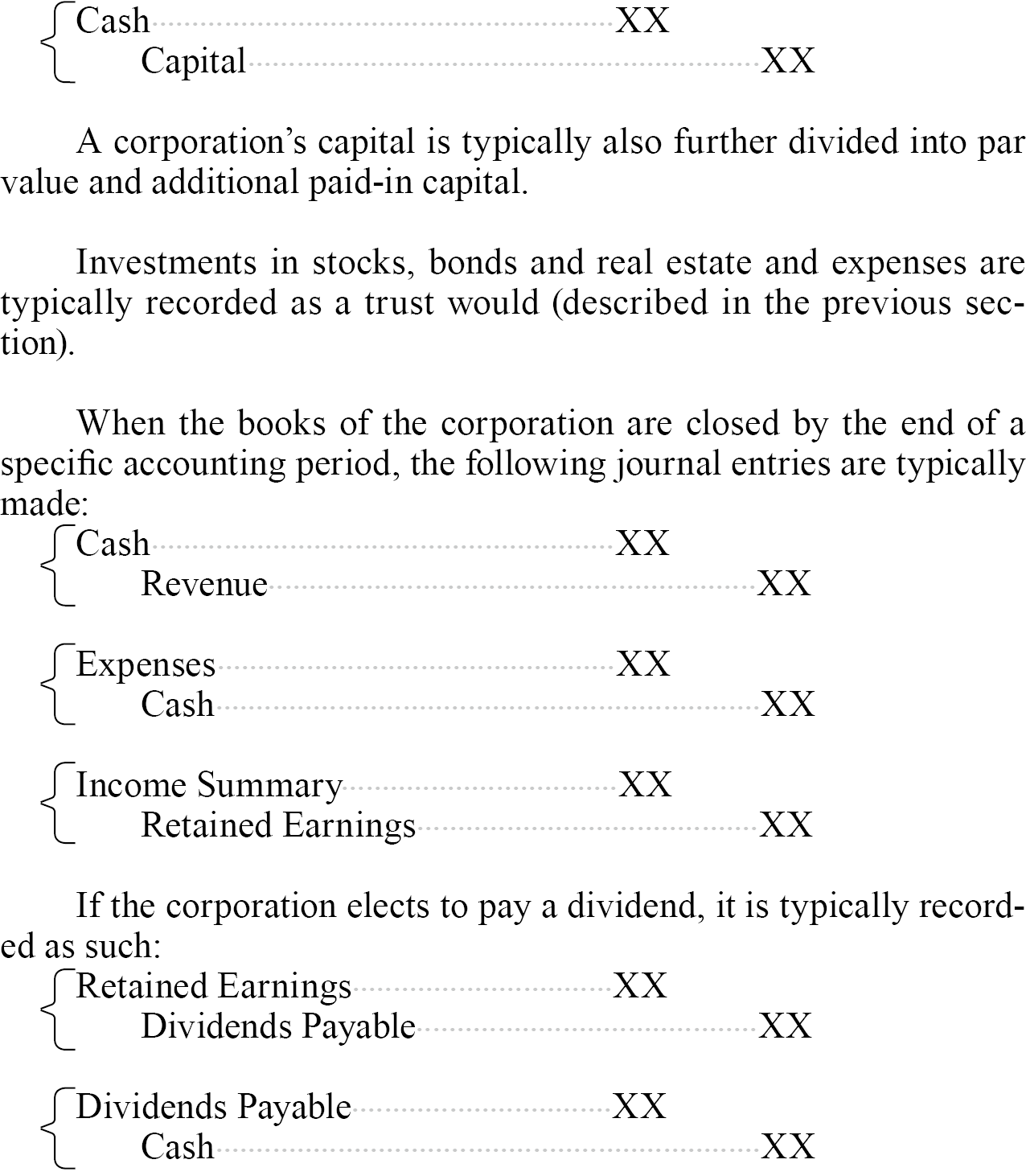

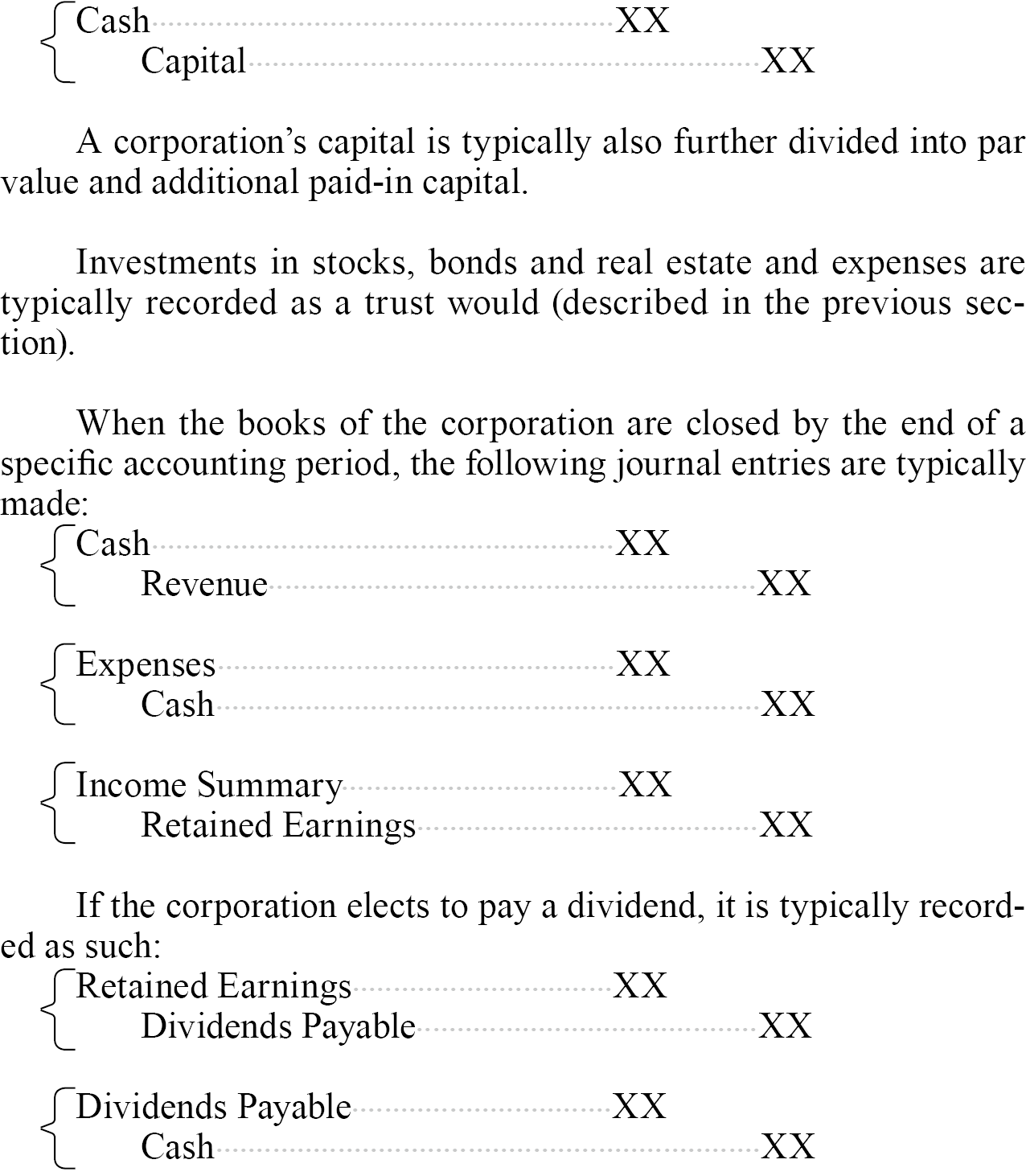

Corporations (including LLCs that have filed an entity classification election to be taxed as a corporation) in the U.S. are subject to corporate tax rates. LLCs may also be taxed as a partnership for U.S. income tax purposes. As such, unlike single-member LLCs, investments in corporations and multi-member LLCs are generally treated separately from the trust.

When establishing a corporation or making an investment in the corporation, the transaction is typically recorded as such:

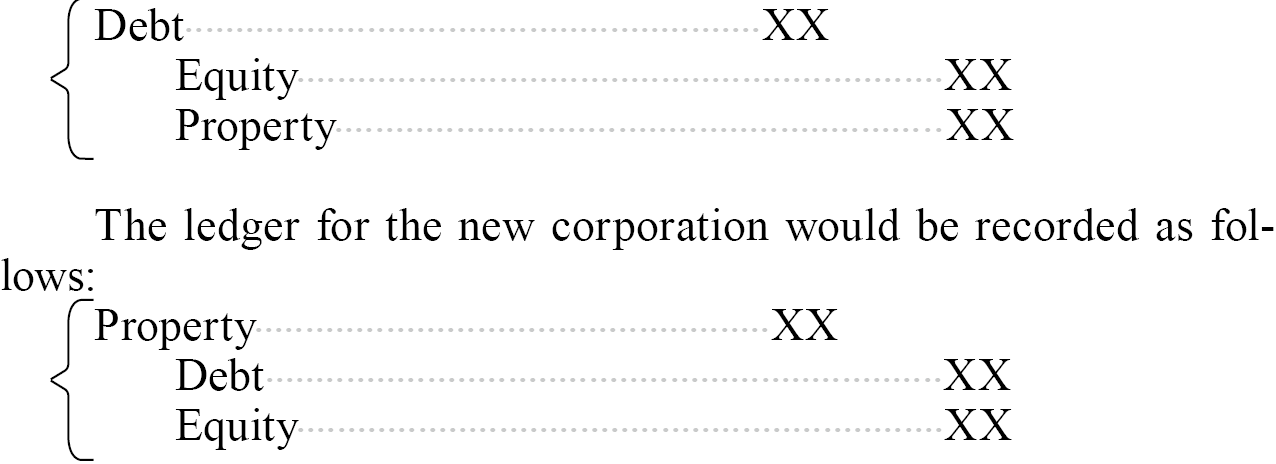

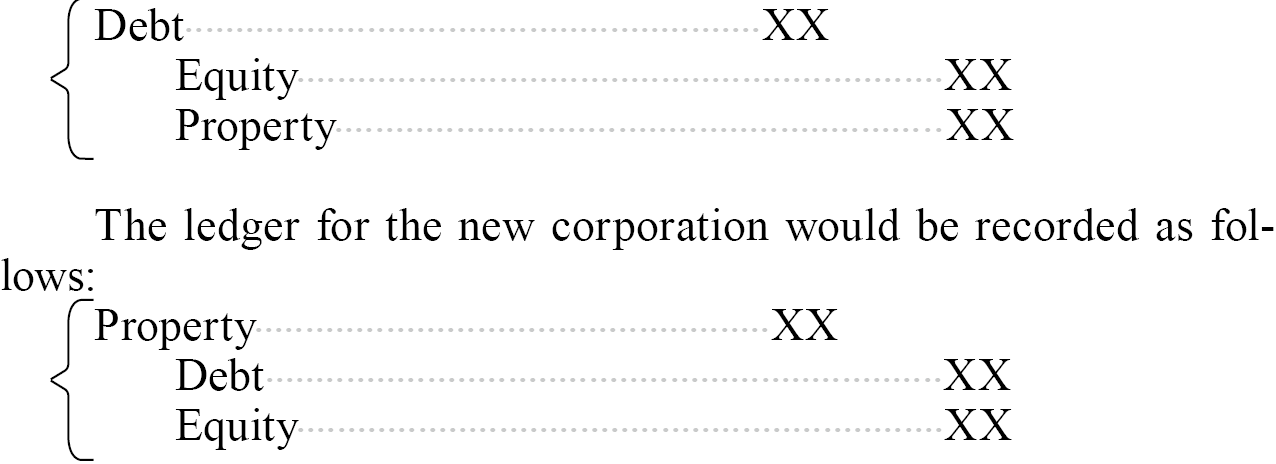

When closing a corporation, the journal entries can be recorded in two primary ways:

1. Transferring assets and liabilities to a newly established corporation or LLC, including any mark-to-market adjustments to the assets.

2. Liquidating the existing corporation.

Below are the relevant ledgers for each scenario:

Scenario 1: Transferring assets and liabilities to a newly established corporation or LLC, including any mark-to-market adjustments to the assets

If the shareholder decides to close the old corporation and transfer the assets and liabilities to the new corporation, the ledger for the old corporation would be recorded as follows:

Scenario 2: Liquidation

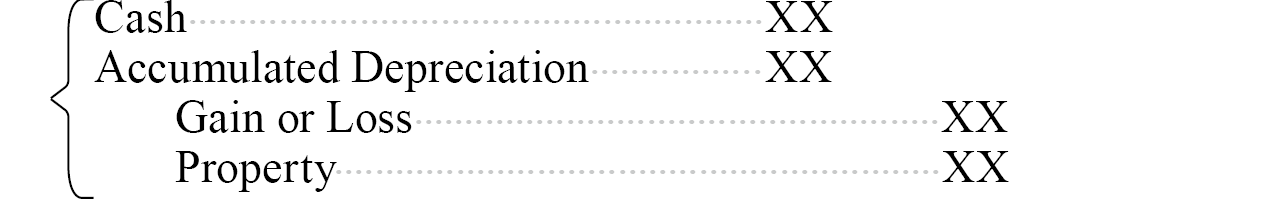

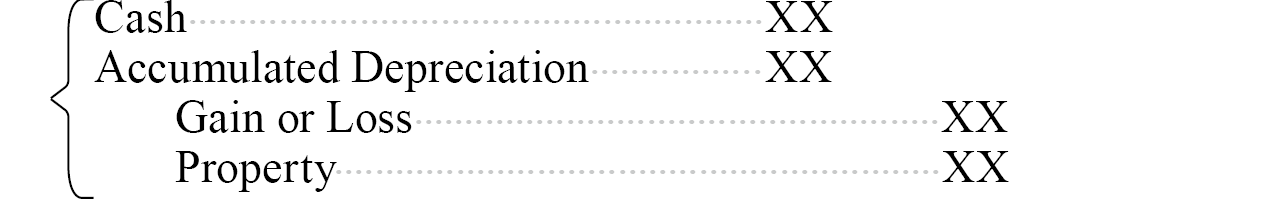

If the shareholders decide to end the operation of the corporation, the first step in the accounting treatment will usually involve selling the assets as follows:

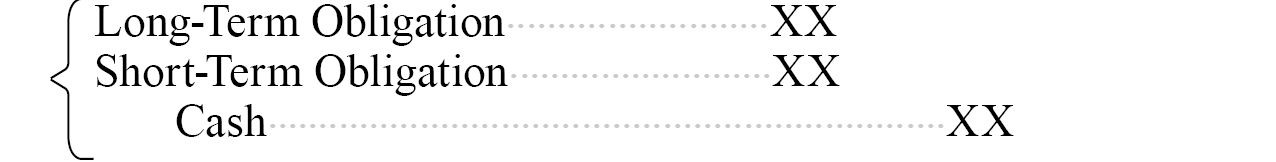

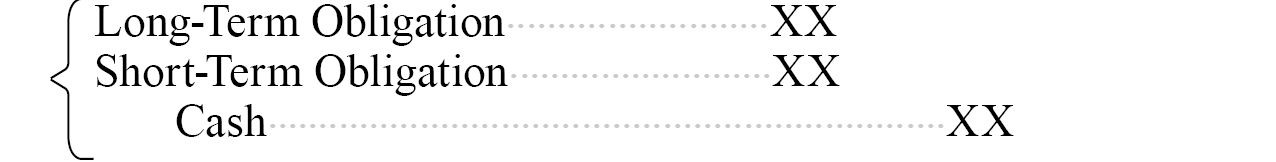

After selling the assets, the corporation is obligated to pay off the remaining debt.

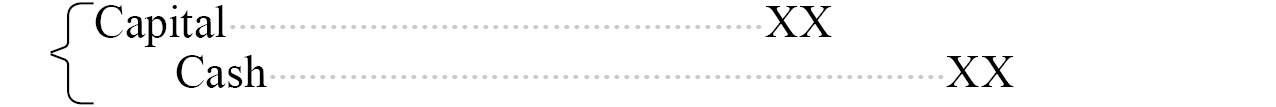

After paying off all the remaining debt, if the corporation still has remaining assets (e.g. cash), it shall return the capital to its shareholders.

Illustrative Accounting Treatment (BVI Corporation)

The bookkeeping for a corporation registered in the British Virgin Islands (BVI) is quite similar to that of a US corporation. The most significant discrepancy occurs when the BVI corporation is under the control of a trust. We begin our illustration with a common scenario where a corporation is the shareholder of the BVI corporation. Then we will illustrate the different bookkeeping for the BVI corporation under the trust.

Scenario1: Trust is not the shareholder of the BVI corporation

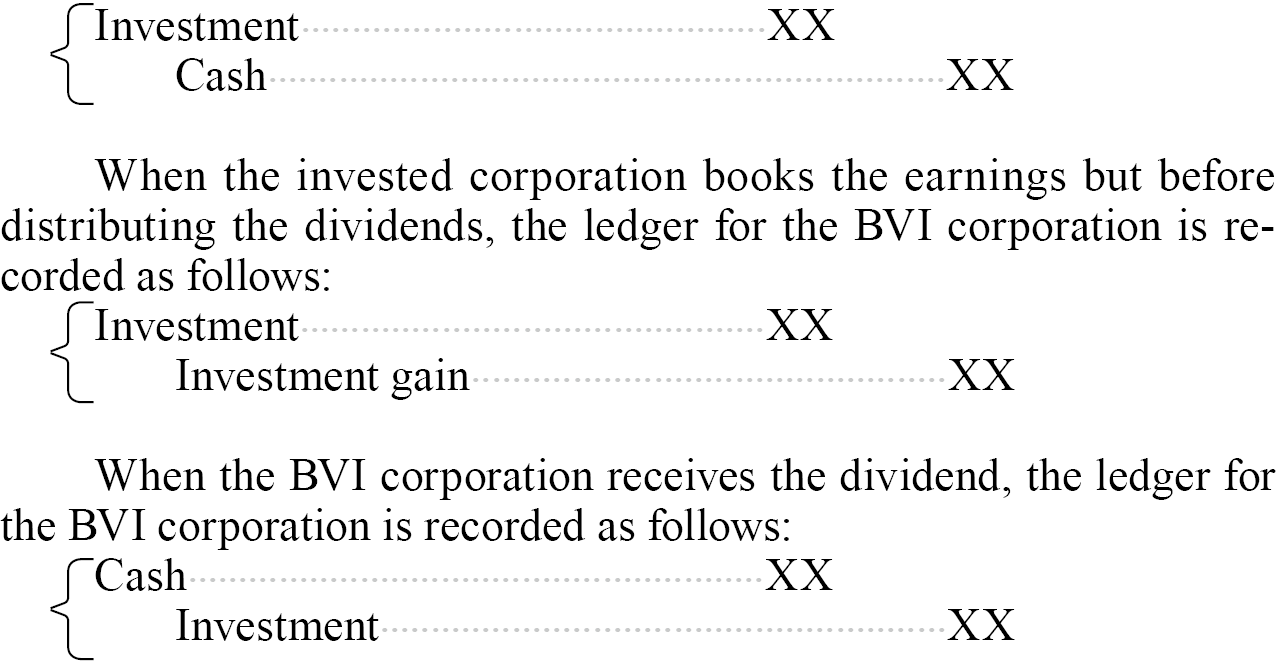

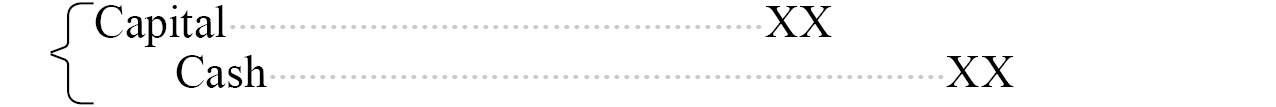

When a BVI corporation invests in another corporation, the ledger for the BVI corporation is recorded as follows:

Scenario2: Trust is the shareholder of the BVI corporation

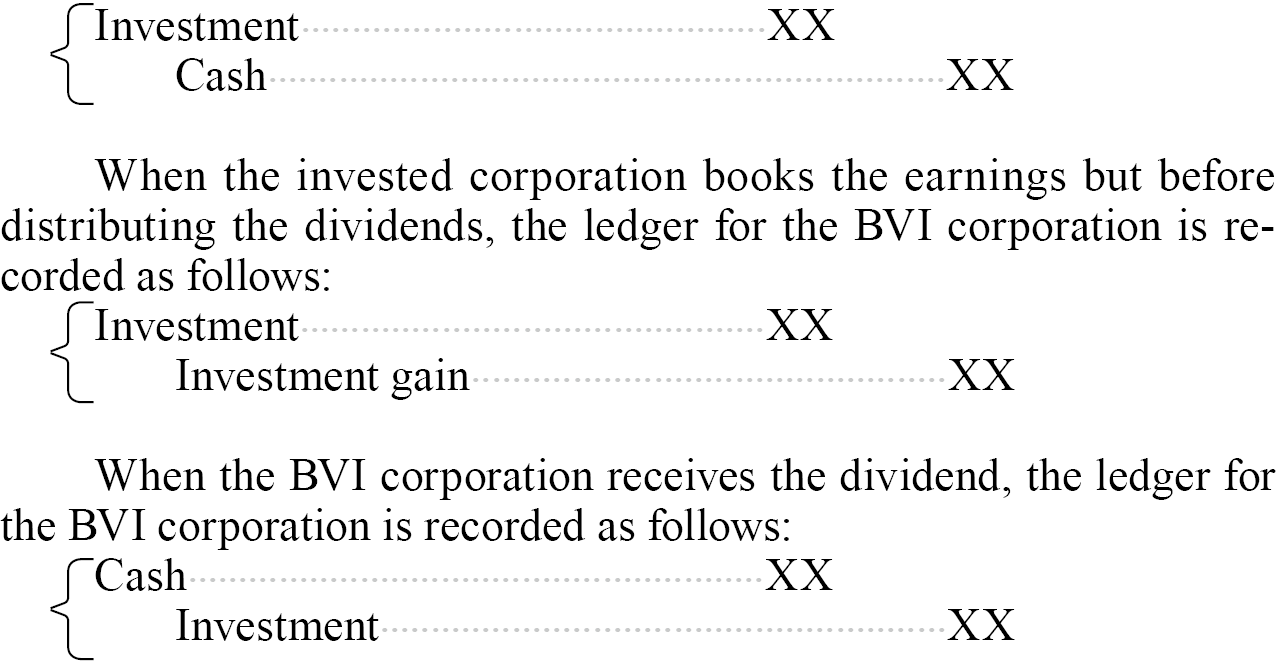

When a BVI corporation under a trust invests in another corporation, the ledger for the BVI corporation’s investment is recorded in the same way as in Scenario 1.

However, in Scenario 2, since the BVI corporation adopts the cost method rather than the equity method for booking investment income, it records the investment income only when it receives the cash dividend. Assuming a BVI company receives dividends from a Taiwanese company, Taiwan will withhold 21% tax on dividends paid to foreign shareholders.

Conclusion

Bookkeeping is a vital function in both U.S. irrevocable trusts and companies, underpinning financial health, regulatory compliance, and strategic decision-making. By maintaining accurate and detailed financial records, bookkeepers provide the data necessary for efficient management, regulatory adherence, and business growth. Professional bookkeeping services and advanced accounting software can enhance the accuracy, efficiency, and effectiveness of this critical function.

Key Roles and Responsibilities

1. Recording Financial Transactions

-

- Income: Documenting all sources of income, including interest, dividends, rental income for trusts, and sales, services, and other revenue streams for companies.

- Expenses: Tracking all expenses, such as administrative costs, management fees, payroll, rent, utilities, and other operational costs.

- Assets and Liabilities: Maintaining detailed records of assets and liabilities, including acquisitions, sales, valuations, and depreciation.

2. Maintaining the General Ledger

-

- Double-Entry System: Using a double-entry accounting system where each transaction affects at least two accounts, ensuring accuracy and balance in the books.

- Account Reconciliation: Regularly reconciling bank statements, credit card statements, and other financial accounts to ensure accuracy and consistency.

- Chart of Accounts: Customizing their chart of accounts to fit the specific needs of their business, making it easier to organize and track financial transactions.

3. Producing Financial Statements

-

- Balance Sheet: Summarizing the financial position at a specific point in time, showing assets, liabilities, and equity for companies, or net worth for trusts.

- Income Statement: Detailing financial performance over a period, including revenue, expenses, and profits or losses.

- Cash Flow Statement: Tracking cash inflows and outflows, providing insights into liquidity and cash management.

4. Supporting Tax Compliance

-

- Tax Documentation: Keeping accurate records to support tax filings, including income, deductions, credits, and other relevant data.

- Tax Filings: Assisting in the preparation and timely filing of federal, state, and local tax returns for both trusts and companies.

1. Accuracy and Reliability

-

- Error Reduction: Professional bookkeepers reduce the risk of errors that can lead to financial misstatements or regulatory issues.

- Timely Reporting: Ensuring financial data is recorded promptly, allowing for up-to-date financial reporting and decision-making.

2. Regulatory Compliance

-

- Legal Compliance: Staying current with changes in tax laws, labor laws, and other regulations affecting financial reporting.

3. Operational Efficiency

-

- Streamlined Processes: Implementing efficient bookkeeping processes and leveraging accounting software to automate routine tasks.

Illustrative Accounting Treatment (Trusts and Single-Member LLCs)

Since single-member LLCs are passthrough entities for income tax purposes, their transactions are typically combined with the trust’s transactions. The end result is typically consolidated financial statements for the trust.

When establishing a trust or making a cash gift to the trust, the transaction is typically recorded as such:

When a trust (or a wholly owned LLC) purchases real estate, the transaction is recorded as such:

Illustrative Accounting Treatment (Corporations and Multi-Member LLCs)

Corporations (including LLCs that have filed an entity classification election to be taxed as a corporation) in the U.S. are subject to corporate tax rates. LLCs may also be taxed as a partnership for U.S. income tax purposes. As such, unlike single-member LLCs, investments in corporations and multi-member LLCs are generally treated separately from the trust.

When establishing a corporation or making an investment in the corporation, the transaction is typically recorded as such:

When closing a corporation, the journal entries can be recorded in two primary ways:

1. Transferring assets and liabilities to a newly established corporation or LLC, including any mark-to-market adjustments to the assets.

2. Liquidating the existing corporation.

Below are the relevant ledgers for each scenario:

Scenario 1: Transferring assets and liabilities to a newly established corporation or LLC, including any mark-to-market adjustments to the assets

If the shareholder decides to close the old corporation and transfer the assets and liabilities to the new corporation, the ledger for the old corporation would be recorded as follows:

Scenario 2: Liquidation

If the shareholders decide to end the operation of the corporation, the first step in the accounting treatment will usually involve selling the assets as follows:

After selling the assets, the corporation is obligated to pay off the remaining debt.

After paying off all the remaining debt, if the corporation still has remaining assets (e.g. cash), it shall return the capital to its shareholders.

Illustrative Accounting Treatment (BVI Corporation)

The bookkeeping for a corporation registered in the British Virgin Islands (BVI) is quite similar to that of a US corporation. The most significant discrepancy occurs when the BVI corporation is under the control of a trust. We begin our illustration with a common scenario where a corporation is the shareholder of the BVI corporation. Then we will illustrate the different bookkeeping for the BVI corporation under the trust.

Scenario1: Trust is not the shareholder of the BVI corporation

When a BVI corporation invests in another corporation, the ledger for the BVI corporation is recorded as follows:

Scenario2: Trust is the shareholder of the BVI corporation

When a BVI corporation under a trust invests in another corporation, the ledger for the BVI corporation’s investment is recorded in the same way as in Scenario 1.

However, in Scenario 2, since the BVI corporation adopts the cost method rather than the equity method for booking investment income, it records the investment income only when it receives the cash dividend. Assuming a BVI company receives dividends from a Taiwanese company, Taiwan will withhold 21% tax on dividends paid to foreign shareholders.

Conclusion

Bookkeeping is a vital function in both U.S. irrevocable trusts and companies, underpinning financial health, regulatory compliance, and strategic decision-making. By maintaining accurate and detailed financial records, bookkeepers provide the data necessary for efficient management, regulatory adherence, and business growth. Professional bookkeeping services and advanced accounting software can enhance the accuracy, efficiency, and effectiveness of this critical function.