Publications

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 4 Relevant U.S. Tax Forms for U.S. Trusts & Individuals

9. Form 8992 and Form 8993 (including Section 962 Election)

Generally, a person who is a U.S. shareholder of at least one foreign corporation (ownership of at least 10%) that is considered a CFC must file Form 8992.

All domestic corporations (and U.S. individual shareholders of controlled foreign corporations (CFCs) making a section 962 election (962 electing individual)) must use Form 8993 to determine the allowable deduction under section 250. A section 962 election, when properly elected, can:

- allow individual CFC shareholders the ability to offset their subpart F liability with foreign tax credits for taxes paid by the CFC.

- reduce the income tax consequence of a GILTI inclusion to only 10.5 percent.

- generate a second layer of tax as if the CFC shareholder received a dividend from a C corporation (which could potentially be beneficial for income tax purposes).

When an individual U.S. shareholder of a CFC has an income inclusion under either Subpart F or GILTI and makes an election pursuant to Sec. 962 to be taxed at corporate rates, the amount of income itself is not reported on Form 1040. Instead, taxpayers must track that information separately, attach a statement to the tax return, and report any tax directly on Form 1040, line 12a.

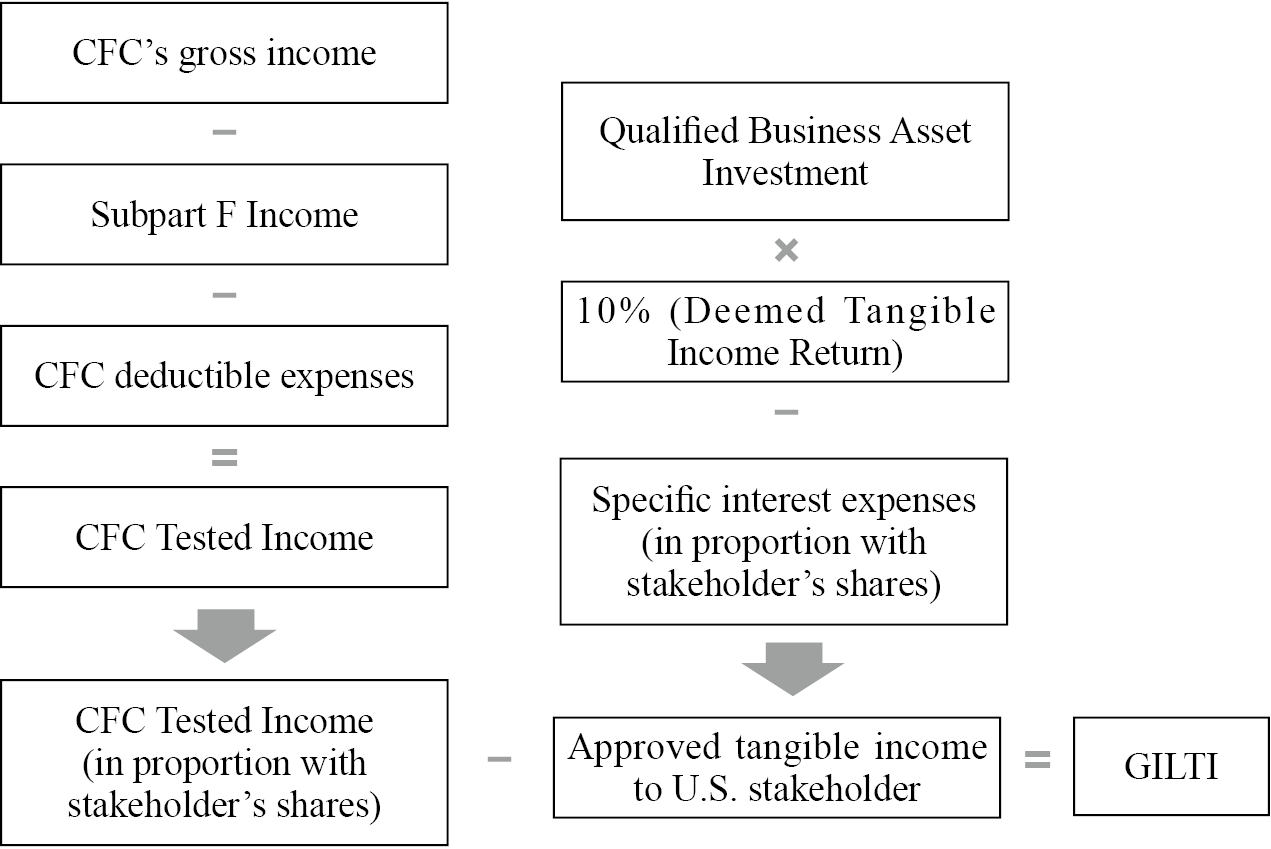

A 10% U.S. shareholder of a CFC is required to report inclusions of GILT and Subpart F income on the U.S. federal income tax return. A U.S. shareholder’s direct and indirect ownership percentages of a CFC under I.R.C. § 958(a) determine the allocable share of GILTI.

In the chart below, you can find a simplified version of the GILTI tax computations. It is generally advisable for you to seek professional advice regarding these calculations to ensure that the forms and eligible elections are properly filed.