Publications

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 4 Relevant U.S. Tax Forms for U.S. Trusts & Individuals

8. Form 8938

Unless an exception applies, you must file Form 8938 if you are a specified person (specified individual or a specified domestic entity) that has an interest in specified foreign financial assets and the value of those assets is more than the applicable reporting threshold. If you are required to file Form 8938, you must report the specified foreign financial assets in which you have an interest even if none of the assets affects your tax liability for the year. Typically, filed with the Form 1040 (for individuals) or Form 1041 (for domestic trusts).

You are a specified individual if you are one of the following.

(1) A U.S. citizen.

(2) A resident alien of the United States for any part of the tax year (green card or substantial presence).

(3) A nonresident alien who makes an election to be treated as a resident alien for purposes of filing a joint income tax return.

(4) A nonresident alien who is a bona fide resident of American Samoa or Puerto Rico.

You are a specified domestic entity if you are one of the following.

(1) A closely held domestic corporation that has at least 50% of its gross income from passive income.

(2) A closely held domestic corporation if at least 50% of its assets produce or are held for the production of passive income.

(3) A closely held domestic partnership that has at least 50% of its gross income from passive income.

(4) A closely held domestic partnership if at least 50% of its assets produce or are held for the production of passive income (see Passive income and Percentage of passive assets held by a corporation or partnership, later).

(5) A domestic trust described in section 7701(a)(30)(E) that has one or more specified persons (a specified individual or a specified domestic entity) as a current beneficiary.

A domestic corporation is closely held if, on the last day of the corporation’s tax year, a specified individual directly, indirectly, or constructively owns at least 80% of the total combined voting power of all classes of stock of the corporation entitled to vote or at least 80% of the total value of the stock of the corporation.

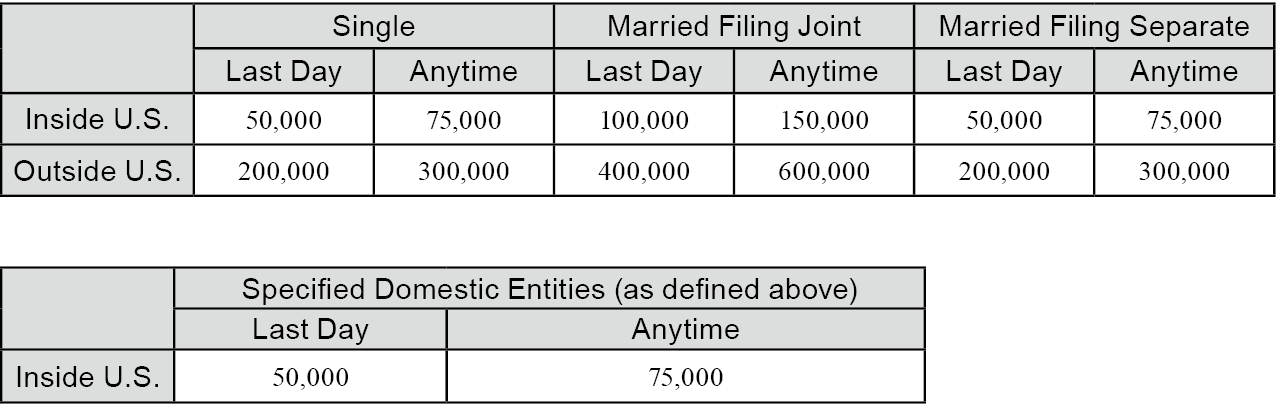

Applicable Reporting Threshold

If you are a specified individual, your applicable reporting threshold depends upon whether you are married, file a joint federal income tax return, and live inside (or outside) the United States.

You satisfy the reporting threshold only if:

(1) the total value of your specified foreign financial assets exceeds the amount specified under “Last Day” on the last day of the tax year; or

(2) the total value of your specified foreign financial assets exceeds the amount specified under “Anytime” at any time during the tax year.

What are the penalties for the failure to file Form 8938?

If you are required to file Form 8938 but do not file a complete and correct Form 8938 by the due date (including extensions), you may be subject to a penalty of $10,000. If you do not file a correct and complete Form 8938 within 90 days after the IRS mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for each 30-day period (or part of a period) during which you continue to fail to file Form 8938 after the 90-day period has expired. The maximum additional penalty for a continuing failure to file Form 8938 is $50,000.

Reasonable Cause Exception

No penalty will be imposed if you fail to file Form 8938 or to disclose one or more specified foreign financial assets on Form 8938 and the failure is due to reasonable cause and not to willful neglect. You must affirmatively show the facts that support a reasonable cause claim. The determination of whether a failure to disclose a specified foreign financial asset on Form 8938 was due to reasonable cause and not due to willful neglect will be determined on a case-by-case basis, taking into account all pertinent facts and circumstances.