Publications

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 4 Relevant U.S. Tax Forms for U.S. Trusts & Individuals

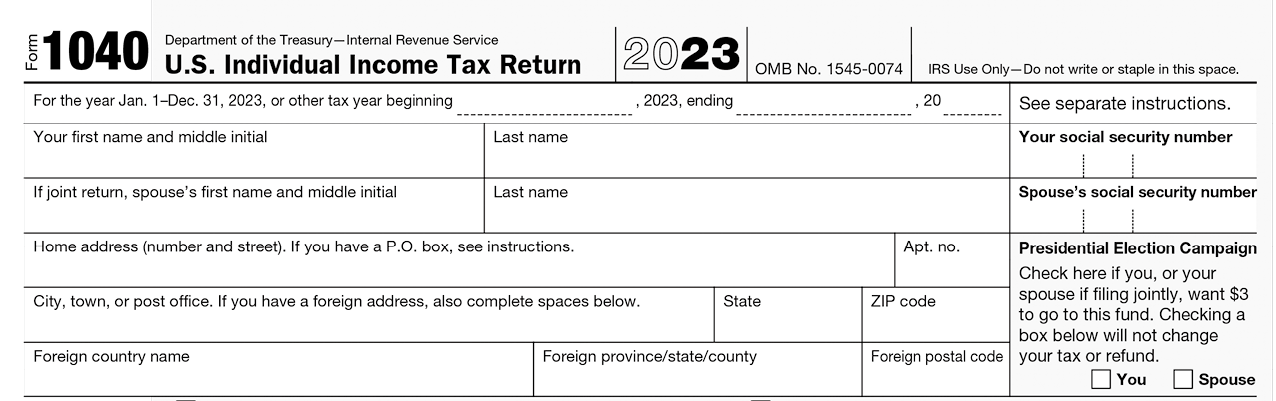

1. Form 1040

Individuals who are U.S. citizens or resident aliens (non-Citizens who are residents for income tax purposes) generally must file an income tax return in their individual capacity (Form 1040). Individuals may be exempt from filing a Form 1040 if their gross income is less than certain thresholds as set forth by the IRS ($13,850 for single filers under 65 and $27,700 for married filers under 65 filing joint returns in 2023).

Form 1040 is due on April 15 of each year. An automatic filing extension to October 15 is generally applicable if Form 4868 is filed by April 15. The U.S. imposes higher income taxes on those with higher incomes up to a maximum Federal income tax rate of 37%. Specific tax rates depend on the status of the filer and any tax deductions or credits the filer is applicable for.

When preparing your Form 1040 filing, your tax preparer will often request that you provide certain information regarding your income including but not limited to any Form 1099s or W-2s that you have received. When a U.S. beneficiary receives a distribution, the income from the K-1 needs to be filled on Form 1040 and attached Schedule E. These forms inform the tax preparer of income you’ve received over the course of the previous calendar year.