Publications

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 1 Introduction to Cross-Border Estate Planning

Case Study 5: Planning prior to immigrating to the U.S.

Background:

Mr. Jiang and Mrs. Jiang, a married couple residing in China, finally received notices that they were granted their U.S. Permanent Resident Cards (Green Cards) after more than a decade. As they were not sure that they were going to ever receive their green cards, they never considered the tax consequences of their U.S. residency status. When they came to the U.S., they consulted with trusted U.S. CPAs, who informed them that their worldwide assets would now be subjected to U.S. income, gift, and estate taxes, much to their disbelief.

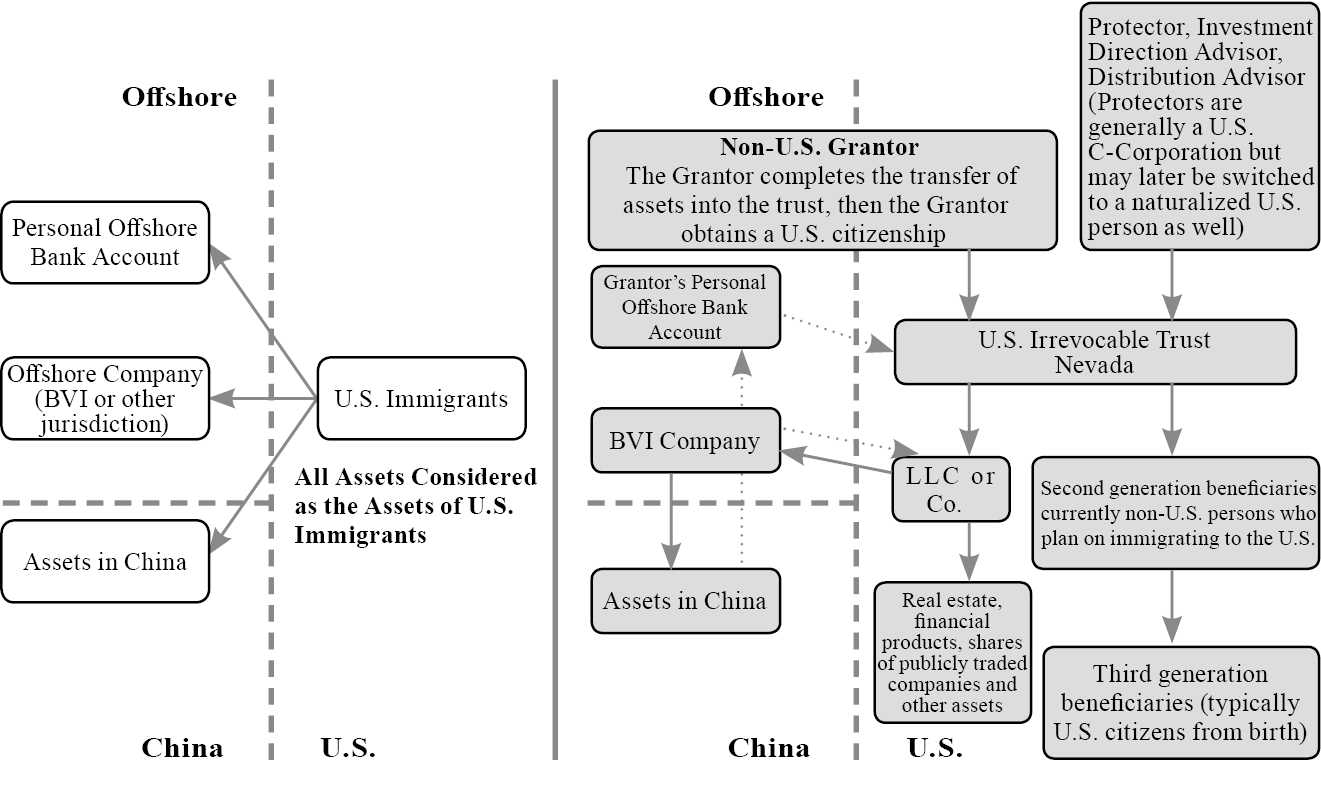

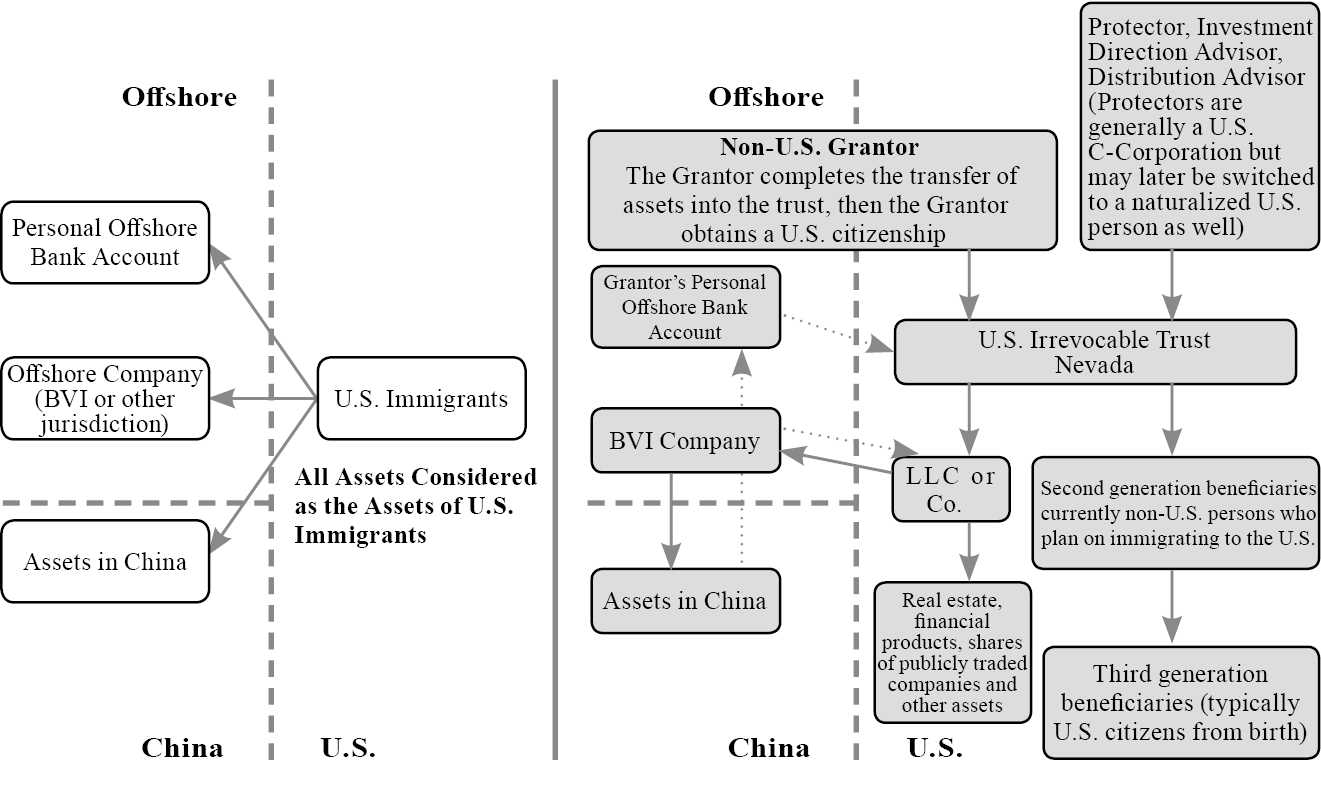

Reflections on Succession:

1. Over the past couple of years, Hong Kong, Australia, and Canada have increasingly tightened their immigration policies. The enactment of EB-5 in the U.S. came as a relief to many Chinese families seeking to permanently relocate their families. Tax advisors often advised Wealth Creators to retain their original citizenships and tax residency, while their spouses applied for Green Cards, since the U.S. generally taxes its residents more heavily. However, since many Chinese nationals believe that a married couple should stay together indefinitely and never separate, we frequently see both the Wealth Creator and their spouses attain Green Cards.

2. Once a foreign national obtains a Green Card and becomes a U.S. tax resident, he or she is liable for not only U.S. income taxes on his or her worldwide income, but also subject to disclosure requirements of his or her offshore assets in accordance with numerous U.S. laws and regulations. Many wonder whether there is a way to attain U.S. permanent residency, without the enormous tax and disclosure responsibilities that come with it. For those that created their wealth outside of the U.S., is there a path to U.S. citizenship without payment of considerable income, estate and gift taxes?

Succession Framework Proposal

Succession Framework Analysis:

2. Families immigrating to the U.S. often wish to transfer part or all of their wealth from foreign jurisdictions into the U.S. We generally recommend families bringing in excess of $2 million seek guidance from licensed professionals to increase their understanding of the U.S. tax and legal systems.

3. For U.S.-bound individuals with significant wealth, settling a U.S. non-grantor trust may help with both minimizing applicable taxes and asset protection. Individuals with assets in excess of the lifetime U.S. gift and estate tax exemption may be subject to a 40% estate tax for assets above that threshold. The tax is levied on both assets attained before and after an individual immigrates to the U.S. Additionally, individuals who wish to make gifts or leave assets in excess of their lifetime exemption to those 37.5 years younger may face an additional transfer tax, the U.S. Generation-Skipping Tax (GST).

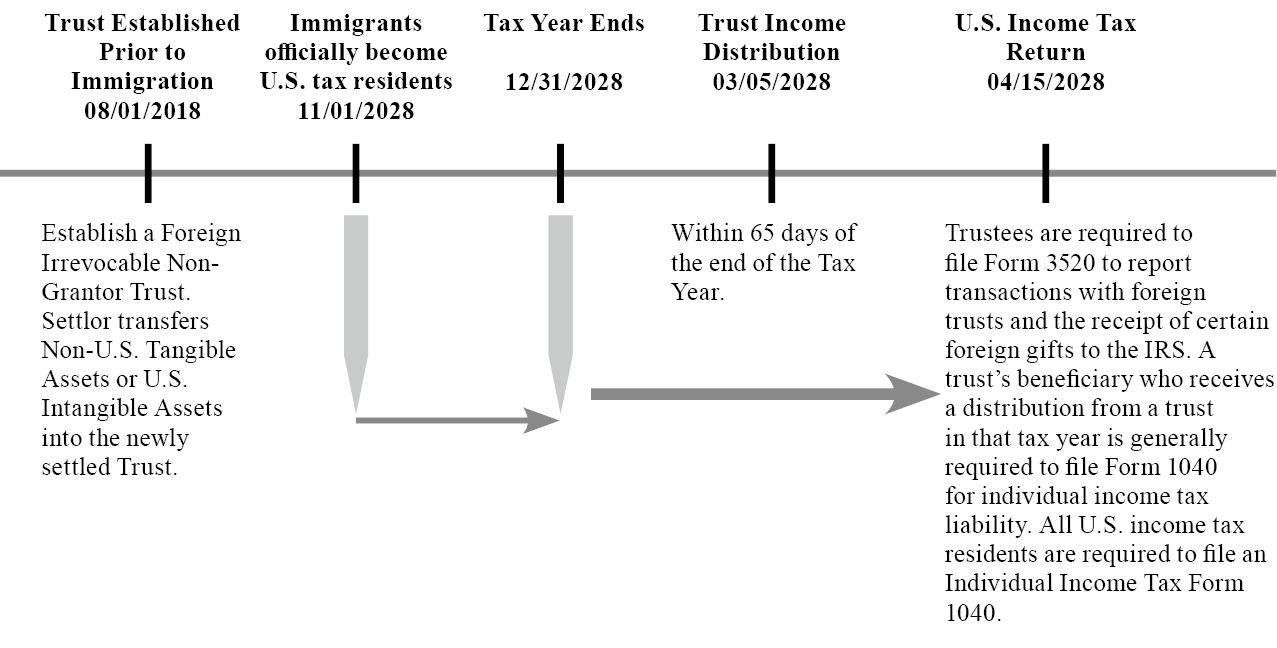

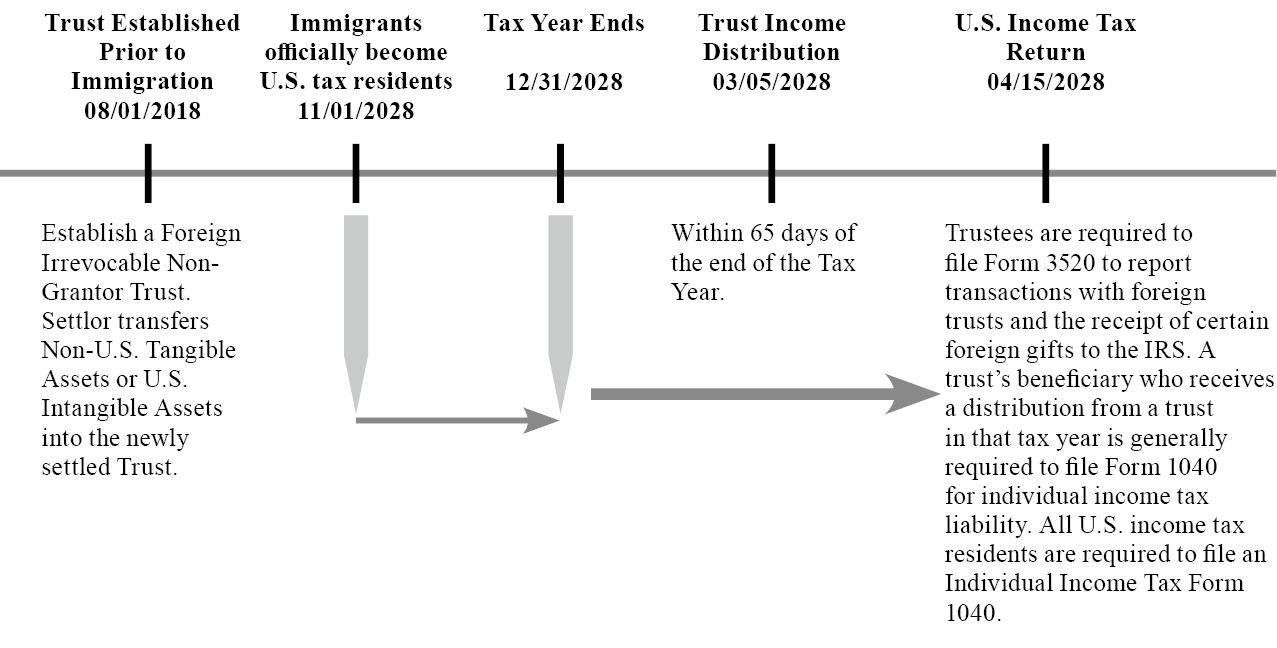

4. When settling certain U.S. trusts, both individuals and corporations may be named as fiduciaries. U.S. trusts are typically established and funded by its grantor with governance allocated among the trust’s fiduciaries (typically, the Trust Protector, the Distribution Advisor, and the Investment Direction Advisor, among others).

In Directed Trusts, the Trustee generally handles the administrative and secretarial functions of the trust. It is generally advisable for Wealth Creators to seek out the services of a licensed Trust Company to act as the Trustee. Doing so ensures that there is ongoing oversight of the trust and that the various secretarial functions are being monitored. Trust companies serving as Trustee of directed trusts typically charge a flat annual fee rather than a percentage of assets under administration.

5. While gifts from non-U.S. persons are often tax-free, Wealth Creators who are considering gifts above $2 million (USD) should consider making the gift to a trust for the intended Beneficiary, rather than making a gift directly to the Beneficiary. Since the recipient of the gift is the trust itself rather than an individual, the trustee of the trust would file Form 3520 to report the gift. As a trust receiving large sums is more common, it is less likely to be scrutinized than if an individual were to receive the large gift.

6. U.S. persons receiving distributions from or controlling foreign trusts often face unfavorable or even punitive U.S. income tax consequences. As such, Wealth Creators seeking to immigrate the U.S. should consider unwinding their non-U.S. trusts in favor of U.S. trusts. Even Wealth Creators who are not personally seeking to immigrate to the U.S. but have U.S. descendants should consider shifting their assets into U.S. trusts, as they are generally more protective of U.S. descendants both from an asset protection perspective and from a U.S. tax perspective. When structured properly, moving assets into a U.S. trust can lead to (1) a clearer wealth transfer structure, (2) preferable tax treatment, (3) stronger asset protection and (4) lower ongoing maintenance costs (relating to both Trustee fees and accounting and disclosure requirements).

Mr. Jiang and Mrs. Jiang, a married couple residing in China, finally received notices that they were granted their U.S. Permanent Resident Cards (Green Cards) after more than a decade. As they were not sure that they were going to ever receive their green cards, they never considered the tax consequences of their U.S. residency status. When they came to the U.S., they consulted with trusted U.S. CPAs, who informed them that their worldwide assets would now be subjected to U.S. income, gift, and estate taxes, much to their disbelief.

Reflections on Succession:

1. Over the past couple of years, Hong Kong, Australia, and Canada have increasingly tightened their immigration policies. The enactment of EB-5 in the U.S. came as a relief to many Chinese families seeking to permanently relocate their families. Tax advisors often advised Wealth Creators to retain their original citizenships and tax residency, while their spouses applied for Green Cards, since the U.S. generally taxes its residents more heavily. However, since many Chinese nationals believe that a married couple should stay together indefinitely and never separate, we frequently see both the Wealth Creator and their spouses attain Green Cards.

2. Once a foreign national obtains a Green Card and becomes a U.S. tax resident, he or she is liable for not only U.S. income taxes on his or her worldwide income, but also subject to disclosure requirements of his or her offshore assets in accordance with numerous U.S. laws and regulations. Many wonder whether there is a way to attain U.S. permanent residency, without the enormous tax and disclosure responsibilities that come with it. For those that created their wealth outside of the U.S., is there a path to U.S. citizenship without payment of considerable income, estate and gift taxes?

Succession Framework Proposal

Succession Framework Analysis:

1. Wealthy families planning on immigrating to the U.S. often consider investing in U.S. real estate. Prior to becoming U.S. persons, Wealth Creators should consult with tax and legal advisors and discuss the options available to achieve both the taxes minimization and asset protection.

2. Families immigrating to the U.S. often wish to transfer part or all of their wealth from foreign jurisdictions into the U.S. We generally recommend families bringing in excess of $2 million seek guidance from licensed professionals to increase their understanding of the U.S. tax and legal systems.

3. For U.S.-bound individuals with significant wealth, settling a U.S. non-grantor trust may help with both minimizing applicable taxes and asset protection. Individuals with assets in excess of the lifetime U.S. gift and estate tax exemption may be subject to a 40% estate tax for assets above that threshold. The tax is levied on both assets attained before and after an individual immigrates to the U.S. Additionally, individuals who wish to make gifts or leave assets in excess of their lifetime exemption to those 37.5 years younger may face an additional transfer tax, the U.S. Generation-Skipping Tax (GST).

4. When settling certain U.S. trusts, both individuals and corporations may be named as fiduciaries. U.S. trusts are typically established and funded by its grantor with governance allocated among the trust’s fiduciaries (typically, the Trust Protector, the Distribution Advisor, and the Investment Direction Advisor, among others).

The trust’s Beneficiary (or Beneficiaries) may receive distributions from the trust in accordance with the trust agreement, which is further categorized as income distributions or principal distributions. Many trust agreements are drafted so that the Beneficiaries are not legally entitled to any distributions for asset protection purposes. It can be drafted so that the trust’s Distribution Advisor has full discretion as to the amount of any distribution paid to the trust’s Beneficiaries (or even if the Beneficiaries receive any distribution at all). Doing this would generally protect the trusts’ assets from any creditors of the Beneficiaries of the trust.

Note: For a detailed explanation of the various roles and responsibilities in a U.S. Trust, please refer to the section of Chapter 2 that discusses Determining the Roles in a Nevada Irrevocable Trust.

In Directed Trusts, the Trustee generally handles the administrative and secretarial functions of the trust. It is generally advisable for Wealth Creators to seek out the services of a licensed Trust Company to act as the Trustee. Doing so ensures that there is ongoing oversight of the trust and that the various secretarial functions are being monitored. Trust companies serving as Trustee of directed trusts typically charge a flat annual fee rather than a percentage of assets under administration.

5. While gifts from non-U.S. persons are often tax-free, Wealth Creators who are considering gifts above $2 million (USD) should consider making the gift to a trust for the intended Beneficiary, rather than making a gift directly to the Beneficiary. Since the recipient of the gift is the trust itself rather than an individual, the trustee of the trust would file Form 3520 to report the gift. As a trust receiving large sums is more common, it is less likely to be scrutinized than if an individual were to receive the large gift.

6. U.S. persons receiving distributions from or controlling foreign trusts often face unfavorable or even punitive U.S. income tax consequences. As such, Wealth Creators seeking to immigrate the U.S. should consider unwinding their non-U.S. trusts in favor of U.S. trusts. Even Wealth Creators who are not personally seeking to immigrate to the U.S. but have U.S. descendants should consider shifting their assets into U.S. trusts, as they are generally more protective of U.S. descendants both from an asset protection perspective and from a U.S. tax perspective. When structured properly, moving assets into a U.S. trust can lead to (1) a clearer wealth transfer structure, (2) preferable tax treatment, (3) stronger asset protection and (4) lower ongoing maintenance costs (relating to both Trustee fees and accounting and disclosure requirements).