Publications

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 1 Introduction to Cross-Border Estate Planning

Case Study 2: How should Non-U.S. Wealth Creators transfer wealth to their descendants if their descendants are primarily U.S. Persons?

Background:

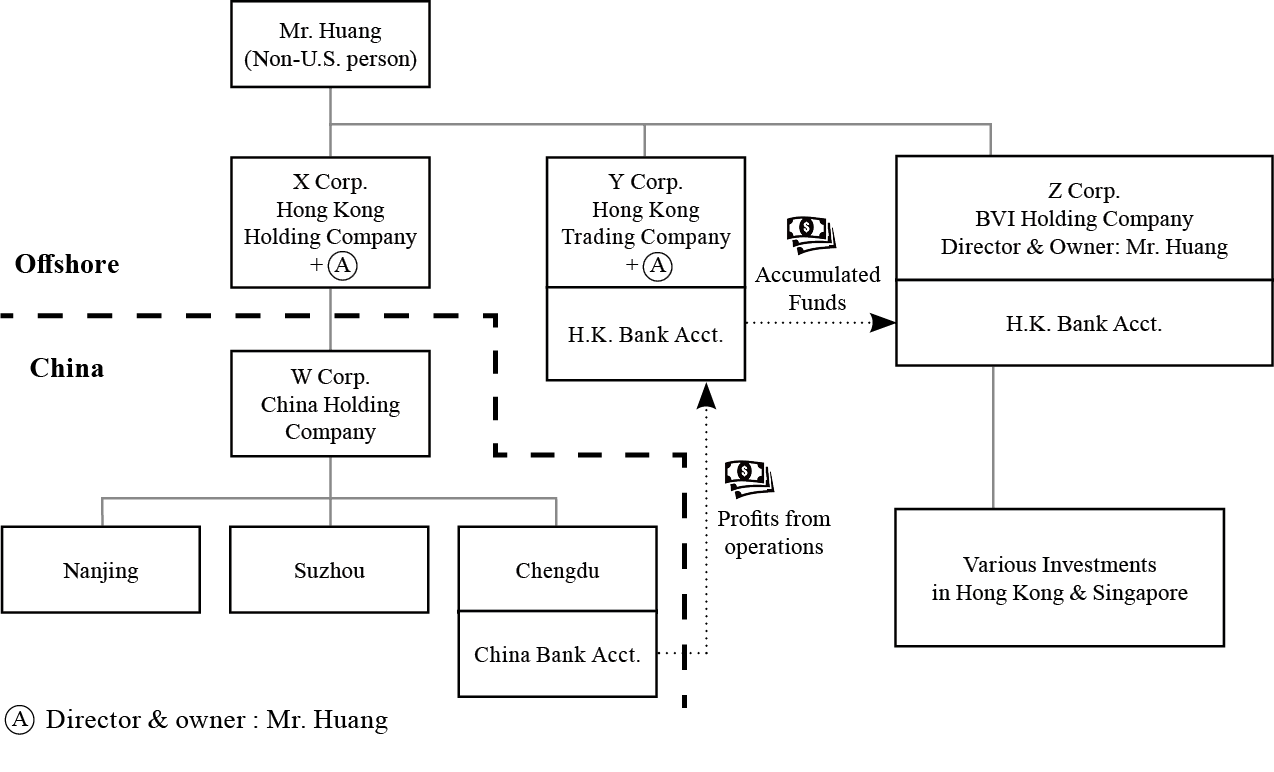

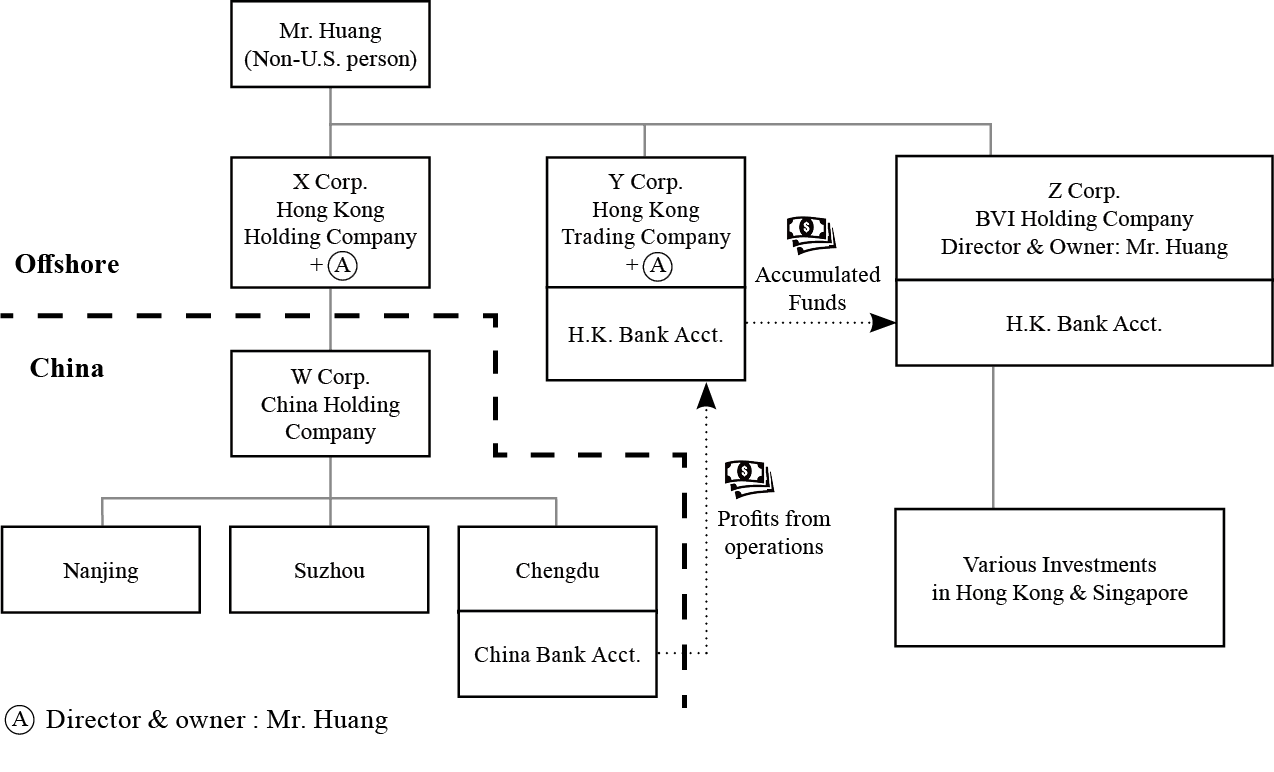

Mr. Huang, an entrepreneur based in China, owns several factories in Nanjing, Suzhou and Chengdu. His operations in China are held by W Corp., a Chinese holding company. W Corp. is owned by X Corp., a Hong Kong holding company that he holds. Over the years, he has transferred much of the profits from Chengdu to a Hong Kong bank account held by Y Corp., another wholly owned company. Periodically, he transfers funds from his Y Corp. bank account to another Hong Kong bank account held by Z Corp., a British Virgin Islands (BVI) company. Funds accumulated in Z Corp. are invested in various financial products and investments in both Hong Kong and Singapore.

While Mr. Huang is a Chinese citizen and does not have any plans of relocating to the U.S., his wife, daughter and sons are all based in the U.S. and have U.S. citizenship. Over the years, Mr. Huang has come to realize the need to formulate a plan that would allow him to effectively transition his assets to his descendants; however, he is unsure of how to proceed given the complexity of his structures.

Specifically, he had the following questions:

Below is a chart of Mr. Huang’s assets prior to estate planning:

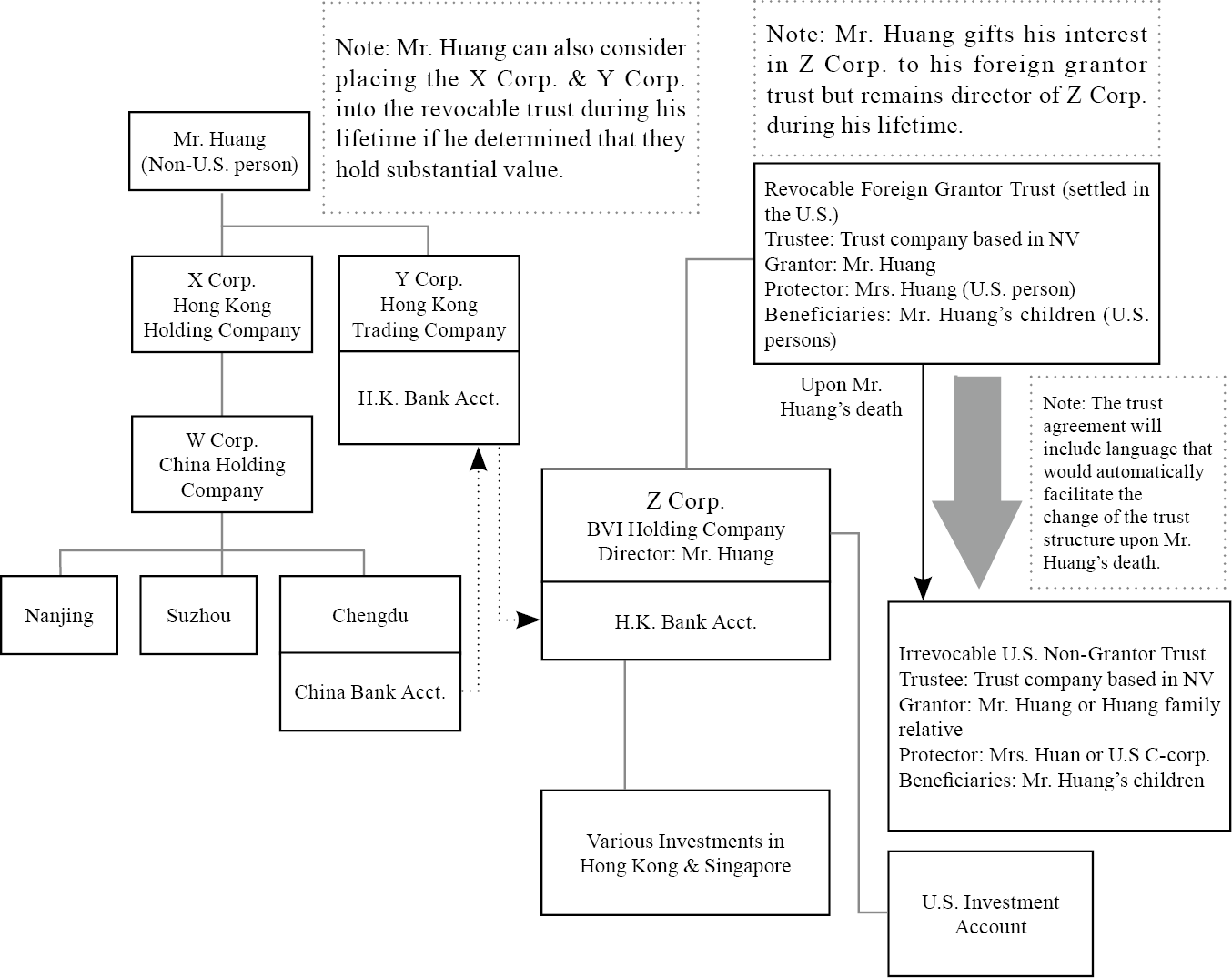

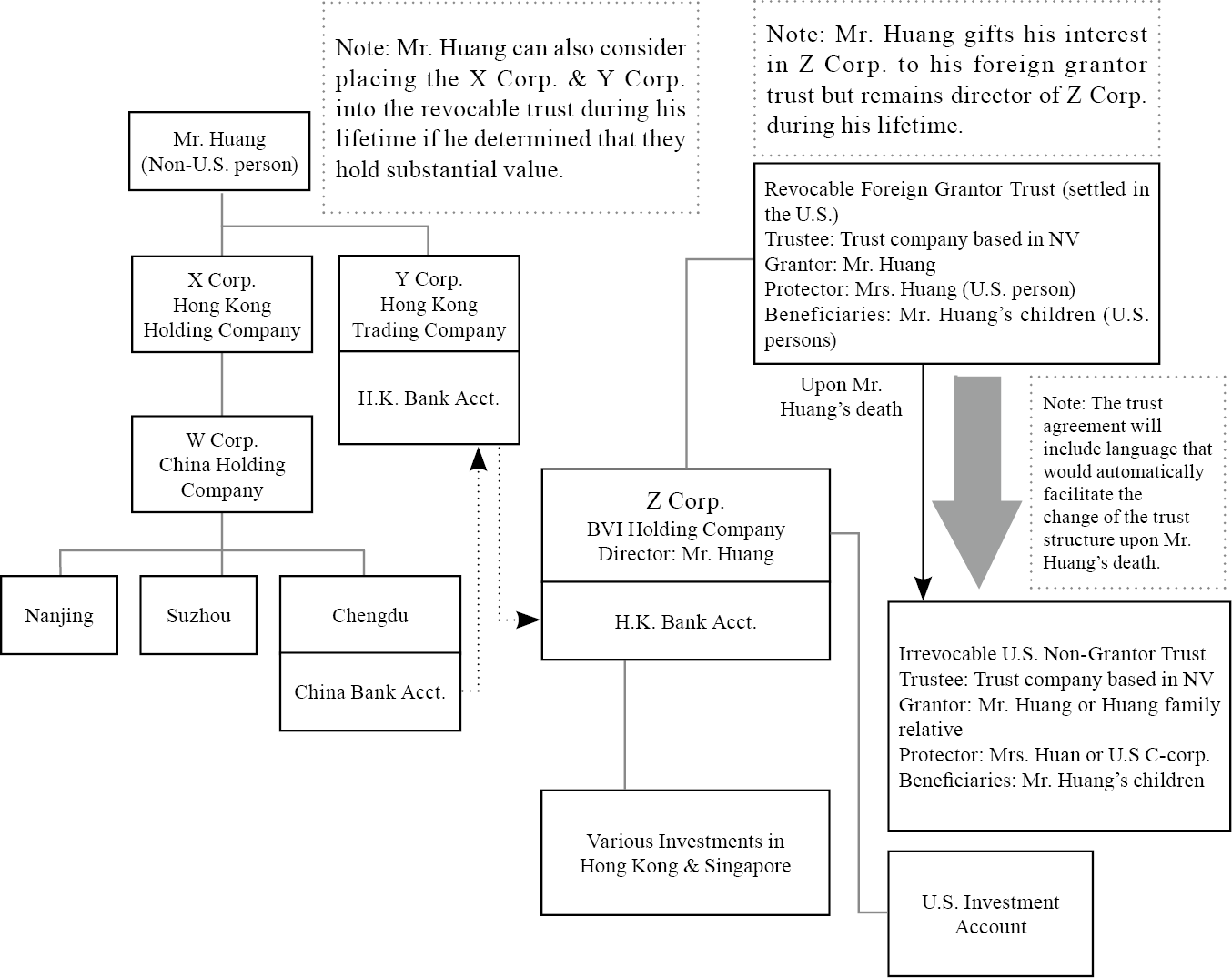

Below is a chart of Mr. Huang’s assets after estate planning:

Analysis:

Mr. Huang, an entrepreneur based in China, owns several factories in Nanjing, Suzhou and Chengdu. His operations in China are held by W Corp., a Chinese holding company. W Corp. is owned by X Corp., a Hong Kong holding company that he holds. Over the years, he has transferred much of the profits from Chengdu to a Hong Kong bank account held by Y Corp., another wholly owned company. Periodically, he transfers funds from his Y Corp. bank account to another Hong Kong bank account held by Z Corp., a British Virgin Islands (BVI) company. Funds accumulated in Z Corp. are invested in various financial products and investments in both Hong Kong and Singapore.

While Mr. Huang is a Chinese citizen and does not have any plans of relocating to the U.S., his wife, daughter and sons are all based in the U.S. and have U.S. citizenship. Over the years, Mr. Huang has come to realize the need to formulate a plan that would allow him to effectively transition his assets to his descendants; however, he is unsure of how to proceed given the complexity of his structures.

Specifically, he had the following questions:

1. How do I effectively delegate responsibilities between my companies’ managers and my descendants?

2. How should I allocate company profits between my companies’ managers and my children?

3. What is a trust? Can a trust help me achieve my succession goals?

4. Which trust jurisdiction is most suitable?

5. Who should I engage to draft the trust agreement or maintain the trust?

6. How should I transfer assets to my trust?

7. Who can manage my trust’s assets once it is established?

8. Who will manage my trust assets after I pass away?

9. Which advisors can help me craft and execute my business succession plans?

Below is a chart of Mr. Huang’s assets prior to estate planning:

Below is a chart of Mr. Huang’s assets after estate planning:

Analysis:

1. Chinese Wealth Creators who wish to transfer their business interests to their descendants must first realize the importance of restructuring their holdings. Oftentimes, this is done by transferring their interest in closely held businesses to offshore companies, often based in Hong Kong, the British Virgin Islands (BVI) or the Cayman Islands. Since Mr. Huang’s wife and children have immigrated to the U.S., it is important for him to consider how he will eventually move some of his assets outside of China, if he wishes to eventually transfer his assets to his family.

2. Fortunately, since Mr. Huang does not have a U.S. Green Card or U.S. citizenship, he remains a non-U.S. person for U.S. income tax purposes. This has several important tax advantages. Since Mr. Huang is generally not considered a U.S. person for income tax purposes, he (and any Foreign Grantor Trust settled and funded exclusively by him) would generally not be liable for U.S. income tax. In addition, gifts that Mr. Huang makes (whether to an individual or to a trust) can be planned for in advance and structured so that it does not trigger any U.S. gift taxes. Lastly, upon Mr. Huang’s death, his assets would generally not be subject to U.S. estate taxation, unless he holds U.S. situs assets for estate tax purposes.

3. In this scenario, Mr. Huang should consider settling a Foreign Grantor Trust (FGT). Since the trust is a grantor trust for U.S. tax purposes, the income tax liability falls on the Mr. Huang (the trust’s grantor). Since Mr. Huang is a non-U.S. person for income tax purposes, non-U.S. situs assets gifted to the trust would continue to be tax free for U.S. tax purposes. Thus, until the FGT becomes a non-grantor trust (generally upon Mr. Huang’s death), non-U.S. sourced income is neither taxable to the trust itself nor to the trust’s beneficiaries. The trust agreement could be drafted to include provisions that would automatically convert the trust to a U.S. non-grantor trust upon Mr. Huang death. This prevents the trust from ever becoming a foreign non-grantor trust for U.S. income tax purposes, which in turn prevents the trust from being taxed unfavorably.

4. By settling a Foreign Grantor Trust (FGT), Mr. Huang does not need to cede control of assets transferred to the trust. Even after Mr. Huang gifts shares of his businesses into a FGT, Mr. Huang can continue to retain full control over the company’s management, voting and board of directors. Furthermore, upon Mr. Huang’s death, assets gifted to the trust can either be (1) distributed to his beneficiaries outright or (2) held in the trust for future generations in perpetuity.

5. Mr. Huang and other Chinese Wealth Creators are frequently approached by family offices or wealth managers who wish for them to settle non-U.S. based trusts. Since Mr. Huang’s spouse and descendants are U.S. persons, settling non-U.S. based trusts (such as one based in the Cayman Islands, Jersey, Guernsey, Nevis or Bahamas) may lead to unexpectedly adverse tax consequences. Distributions from Foreign Non-Grantor Trusts (FNGTs) typically face Throwback Taxes from Undistributed Net Income (UNI), leading to extremely high tax rates if distributions exceed income generated in that year. Furthermore, non-U.S. based trusts often do not have strong legal precedents protecting the trust. By settling a U.S.-based trust, whether the trust be revocable or irrevocable, wealth creators such as Mr. Huang can effectively prevent trust income from being taxed punitively by the U.S.

6. Even if Mr. Huang has already settled a non-U.S. based trust, he should consider (1) “migrating” the trust to the U.S. or (2) transferring or decanting the assets from the existing trust to a new trust based in the U.S. The majority of non-U.S. based trusts have provisions that allow for such a transfer. Though the legal and administrative hurdle of doing so may seem burdensome, a proficient team of cross-border professionals should be able to easily navigate the roadblocks and achieve the desired outcome.