Publications

(2020最新版本)美國報稅與海外財產揭露─美國信託、跨境資產傳承

附錄

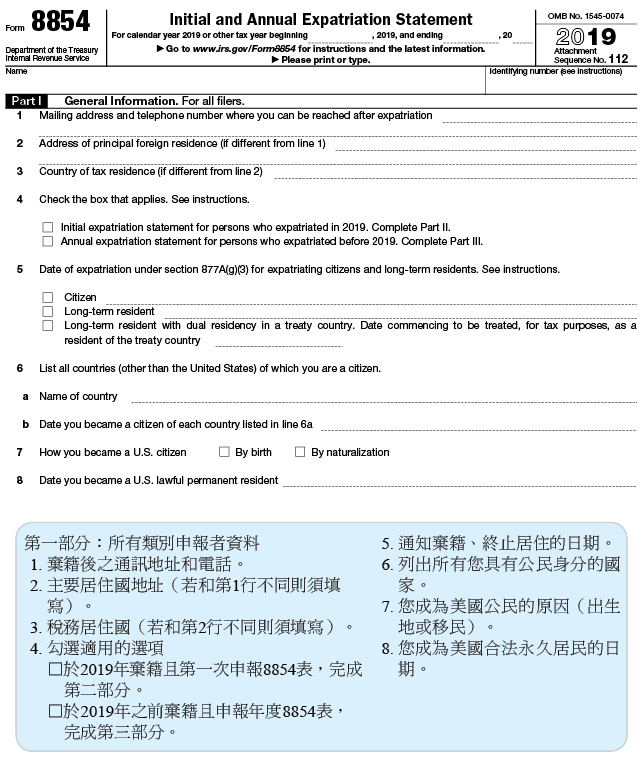

附錄八:8854表(棄籍申報表)及其申報說明

8854表申報說明(註)

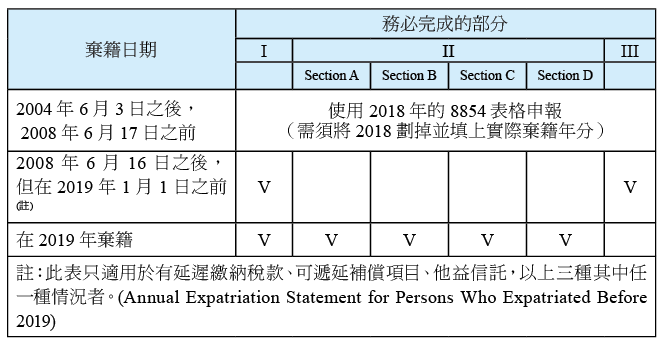

請見表 A,來決定需要填寫 8854 表中的哪些部分。

See Chart A to determine which Parts of Form 8854 you must complete.

識別號碼:一般而言,識別號碼就是美國社會安全號碼。如果提供不正確的號碼,或是漏寫此號碼,可能會導致 1 萬美元的罰款。如果從來沒有被核發社會安全號碼,請附上一份聲明說明理由。

Identifying number. Generally, this number is your U.S. social security number. An incorrect or missing identifying number may result in a penalty of $10,000. If you were never issued a social security number, please attach a statement explaining the reason.

註:編者為求版面精簡,在不影響此份申報說明下做了部分刪節。

第一部分 ── 一般資訊

Part I — General Information

第 4 行

勾選適用的選項:1. 於2019年棄籍且是第一次申報8854表;2. 於2019年之前(2008年6月16日之後)棄籍且是申報年度的8854表。

Check the appropriate box to indicate whether you expatriated in 2019 and are filing your initial expatriation statement, or if you expatriated before 2019 (but after June 16, 2008) and are filing an annual statement.

第 5 行

如果是前美國公民,棄籍日期就是終止公民身分的日期,如果是前美國居民,就是終止長期居留身分的日期。

Your expatriation date is the date you relinquish citizenship (in the case of a former citizen) or terminate your long-term residency (in the case of a former U.S. resident).

美國公民/合法永久居民棄籍日期

Date of relinquishment of U.S. citizenship / Date of termination of long-term residency

終止合法永久居民身分的日期。若為美國長期居民,下列列舉事件中最先發生的事件日期為其終止合法永久居民身分的日期:

Date of termination of long-term residency. If you were a U.S. long-term resident (LTR), you terminated your lawful permanent residency on the earliest of the following dates.

1. 主動向美國國土安全局官員或是移民官申報 I-407 表格以終止合法永久居民身分的日期

1. The date you voluntarily abandoned your lawful permanent resident status by filing Department of Homeland Security Form I-407 with a U.S. consular or immigration officer.

2. 基於行政命令而終止合法永久居民身分的日期。(若適用,以最終頒布的審查命令日期為主)

2. The date you became subject to a final administrative order that you abandoned your lawful permanent resident status (or, if such order has been appealed, the date of a final judicial order issued in connection with such administrative order).

3. 基於《移民與國籍法》而頒布的行政或審查命令而終止美國國籍的日期。

3. The date you became subject to a final administrative or judicial order for your removal from the United States under the Immigration and Nationality Act.

4. 具有美國以及與美國簽訂稅收協定國家的雙重國籍居民,其被視為成為該協定國稅務居民的日期、或是基於協定在連同稅表申報8833 表格後而自願被視為該協定國家居民的日期。若是符合這樣的情形,請參閱法規條款 301.7701(b)-7 相關申報規定。

4. If you were a dual resident of the United States and a country with which the United States has an income tax treaty, the date you commenced to be treated as a resident of that country and you determined that, for purposes of the treaty, you are a resident of the treaty country and gave notice to the Secretary of such treatment on a Form 8833 attached to a timely filed income tax return. See Regulations section 301.7701(b)-7 for information on other filing requirements if you are such an individual.

第 6 行

列出所有(美國除外)具有公民身份的國家以及成為該國公民的日期。

List all countries (other than the United States) of which you are a citizen and the date on which you became a citizen.

第 7 行

若是前美國公民,請勾選取得美國公民身分的方式

If you are a former U.S. citizen, indicate how you became a U.S. citizen.

第 8 行

若是前美國合法永久居民,請告知取得美國永久居民身分的日期。

If you are or were a U.S. lawful permanent resident, indicate the date on which you became a U.S. lawful permanent resident.

第二部分── 在2019年棄籍的人

Part II—Initial Expatriation Statement for Persons Who Expatriated During 2019

Section A 棄籍資訊

於2019年棄籍的人須完成這部分資訊

Section A ── Expatriation Information

This section must be completed by all individuals who expatriated in 2019.

第 2 行

利用第二部分Section B資產負債表計算個人資產淨值。

You can use the Part II, Section B, balance sheet to arrive at your net worth.

第 3 行

若出生即為雙重國籍的美國公民,自放棄美國籍之後,仍持有另一國的公民身分且為該國的納稅義務人時,勾選Yes。

Check the “Yes” box if you became at birth a U.S. citizen and a citizen of another country and, as of the expatriation date, you continue to be a citizen of, and are taxed as a resident of, that other country.

第 5 行

如果有下列的情況,請勾選「是」:

- 在十八歲半之前棄籍,而且

- 在棄籍前有不超過十個稅務年度是美國居民。為了判斷是否為美國居民,可以使用在 Pub. 519 第一章提到的「實質居留測試」。

- You expatriated before you were 181/2, and

- You have been a resident of the United States for not more than 10 tax years before you expatriated. For the purpose of determining U.S. residency, use the substantial presence test described in chapter 1 of Pub. 519.

第 6 行

如果在棄籍日前的五個稅務年度,您都有按時納稅,包括了但不限於,所得稅、雇主稅、贈與稅,以及個人資訊申報書,而也有按時繳納相關的稅負、利息和罰金,請勾選「是」;若沒有按時繳納上述稅負,不論年平均所得稅負或淨資產是否超過了門檻,都將根據 877A 條款來納稅。

Check the “Yes” box if you have complied with your tax obligations for the 5 tax years ending before the date on which you expatriated, including but not limited to, your obligations to file income tax, employment tax, gift tax, and information returns, if applicable, and your obligation to pay all relevant tax liabilities, interest, and penalties. You will be subject to tax under section 877A if you have not complied with these obligations, regardless of whether your average annual income tax liability or net worth exceeds the applicable threshold amounts.

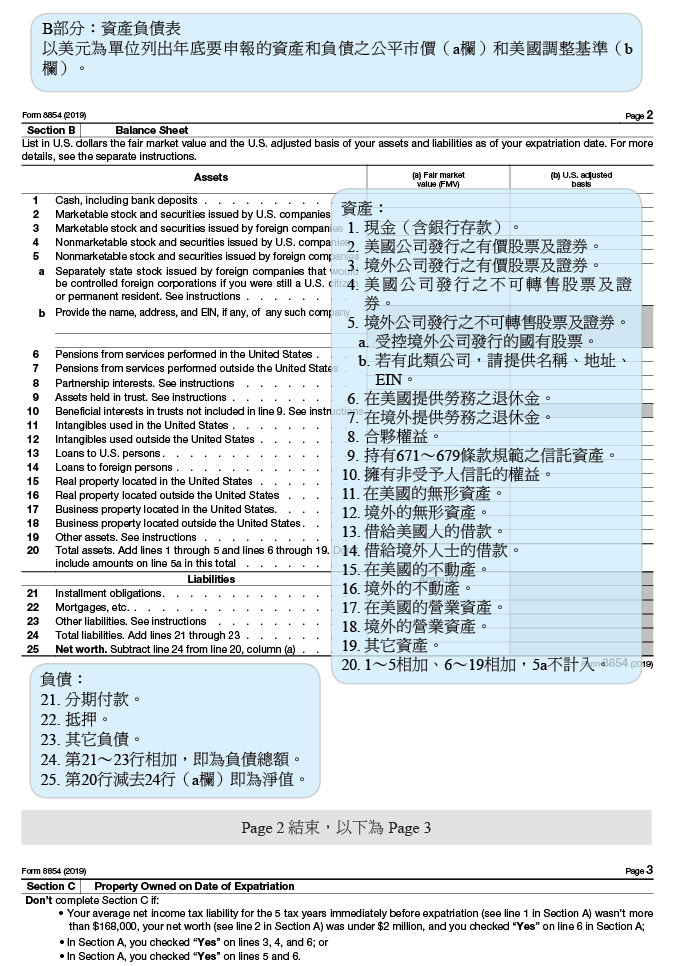

Section B──資產負債表

Section B—Balance Sheet

美國國稅局根據 6039G 條款,需要資產負債表相關資訊。由此可得知棄籍當年的資產淨值。

The financial information in this balance sheet is required under section 6039G.The balance sheet can be used to arrive at your net worth.

若是為了減少棄籍時所持有的總資產淨值而在棄籍前轉移財產權益,則將被視為持有財產權益,需依據法典12章次編B來課徵贈與稅。但適用法規第2503條(b)段至(g)段、2513條、2522條、2523條以及2524條的狀況則不列入考慮。利用法規2512條的評估原則以及其下的規定來計算所持有的財產權益價值。

For purposes of determining your net worth, you are considered to own any interest in property that would be taxable as a gift under Chapter 12 of Subtitle B of the Code had you transferred it immediately prior to expatriation, but without regard to the sections 2503(b) through (g), 2513, 2522, 2523, and 2524. To determine the value of your interests in property, use the valuation principles of section 2512 and the regulations thereunder.

注意:若是資產總值與負債總值在棄籍當年往前回溯5年到申報棄籍稅表8854表之間有大幅度的變化,則必須附上解釋說明。

Note. If there have been significant changes in your assets and liabilities for the period that began 5 years before your expatriation and ended on the date that you first filed Form 8854, you must attach a statement explaining the changes

欄位(a)和(b)

以美元為貨幣單位提供棄籍當日資產與負債的公允價值(欄位a)和美國調整後計稅基準(欄位b)。

您可以使用「誠意費用估計」來計算公允價值和調整後計稅基準,不需要正式的估價。

List in U.S. dollars the FMV (column (a)) and the U.S. adjusted basis (column (b)) of your assets and liabilities as of your expatriation date.

You can use good faith estimates of FMV and basis. Formal appraisals are not required.

第 5a 行

如果仍是美國公民或居民,把所有外國公司(由外國公司支配)發行的不可銷售的股票和債券的適當總額,列在每一欄內。要注意的是,這些總額已經包括在第 5 行內,所以不要把這一行的總額,包括在 20 行的總數中。

List the appropriate amount in each column for all nonmarketable stock and securities issued by foreign corporations that would be Controlled Foreign Corporations if you were still a U.S. citizen or resident. Note that these amounts are already included on line 5. Do not include amounts on this line in the total on line 20.

第 8 行

列出所有合夥組織的總股權的權益。如果在一個合夥組織或多個合夥組織中持有股份,則務必要在 8854 表上附加一份聲明,因為 8854 表會分別列出每個合夥組織,包括了每個合夥組織的雇主辨識號碼(簡稱 EIN)。請描述在每一個合夥組織中的資產和負債(使用 8854 表第五頁的資產負債表的分類)。

List the total value of all your partnership interests. If you hold an interest in one or more partnerships, you must attach a statement to Form 8854 that lists each partnership separately. Include the employer identification number (EIN), if any, for each partnership. Describe the assets and liabilities (using the categories on this balance sheet) from your interest in each partnership.

第 9 行

若是為了減少棄籍時所持有的總資產淨值而在棄籍前轉移信託內的權益,則信託所持有的資產需依據稅法課徵贈與稅。但適用法規第2503 條 (b) 段至 (g) 段、2513 條、2522 條、2523 條以及 2524 條的狀況則不列入考慮。請列出第 9 行資產的公允價值與調整後計稅基準總額。在 8854 表附上詳細的資產清單列表與詳細資產內容描述。同時提供持有資產的信託的 EIN(若有 EIN 的話)。

For purposes of determining your net worth, you are considered to own assets held in trusts that would be subject to U.S. gift tax if you had transferred your interest by gift immediately before your expatriation date, but without regard to sections 2503(b) through (g), 2513, 2522, 2523, and 2524. List the total fair market value and basis of such property on line 9. Attach a statement to Form 8854 describing each asset. Include the EIN (if any) for the trust in which the asset is held.

第 10 行

請列出信託內持有所有資產的總價值。務必在 8854 表附上信託清單列表並標註每個信託的EIN(若有 EIN 的話)。請詳細說明每個自益信託下的權益其資產和負債價值(使用 8854 表第五頁資產負債表上的分類)。

List the total value of your beneficial interest in a trust. You must attach a statement to Form 8854 that lists each trust separately. Include the EIN (if any) for each trust. Describe the assets and liabilities (using the categories on this balance sheet) from your interest in each trust of which you have a beneficial interest.

注意:利用 Notice 97-19 的第三條內的二個步驟來計算自益信託權益價值。

Note. To determine the value of your beneficial interest, use the two-step process described in Section III of Notice 97-19.

第 11、12 行

無形資產包含下列具有重要價值且獨立於個人服務的項目:

- 專利權、發明、配方、製作流程、設計、商業模式、專業知識

- 著作權、文學著作、音樂著作、藝術著作

- 商標、商號、品牌

- 特許經銷權、授權執照、合約

- 決策方法、程式、系統、流程、活動、調查、研究、預測、預估、客戶名冊、專業數據

- 任何其他類似的項目

- Patent, invention, formula, process, design, pattern, or know-how.

- Copyright, literary, musical, or artistic composition.

- Trademark, trade name, or brand name.

- Franchise, license, or contract.

- Method, program, system, procedure, campaign, survey, study, forecast, estimate, customer list, or technical data.

- Any similar item.

第 19 行

附加一份聲明,描述並列出 1~18 行所沒有列到,所擁有的任何其它資產的總價值。

Attach a statement describing and listing the total value of any other assets you have that aren't included on lines 1 through 18.

第 20行

加總第 1~5 行以及第 6~19 行金額,但不包含第 5a 行的金額。第5a 行是用於計算第 5 行的金額。

Combine lines 1 through 5 and 6 through 19, not including any amounts on line 5a. The amounts on line 5a are included in determining the amounts on line 5.

第 23行

附加一份聲明,描述並列出 1~18 行所沒有列到,所擁有的任何其它資產的總價值。

Attach a statement describing and listing the total value of any other liabilities you have that aren't included on lines 21 and 22.

Section C. 棄籍日持有的資產價值

Section C ── Expatriation Information

只有當符合第二頁所列的棄籍者資格,才需要填完 C 部分。如果需要額外的空間或空白行來描述資產,可自行加上附表。

Complete Section C only if you are a covered expatriate (see Covered expatriate, earlier). If you need additional space for the description of property, or if you need additional entry lines, attach a continuation statement.

第 1 行

在第 1 行核對的數額都不需要申報市價稅,不要把這些數額納入第 2 行。

None of the amounts checked on line 1 are subject to the mark-to-market tax. Do not include them on line 2.

第 1a 行:一般而言,遞延薪資所得項目是指下面其中一項。

Line 1a. Generally, a deferred compensation item is one of the following.

一、219(g)(5) 條款所述的計劃或安排中的任何權益,包括了合格的退休金、利潤分享制的退休計劃(包括 401(k))、年金、SEP 和 SIMPLE 計劃。

1. Any interest in a plan or arrangement described in section 219(g)(5). This includes a qualified pension, profit-sharing (including 401(k)), annuity, SEP, and SIMPLE plan.

二、在外國退休金計劃,或是在類似的退休安排或計劃中的任何權益。

2. Any interest in a foreign pension plan or similar retirement arrangement or program.

三、不論是既得與否,任何一項遞延薪資所得。這是指由計劃、合約或其它安排所產生,並且符合以下情況的所得:

a. 就棄籍來說,對於這樣的所得,具有法律上的約束權利。

b. 在棄籍日當天或是之前,並沒有實際或推定性地收到此種所得。

c. 在棄籍日當天或是之後,這樣的所得會被支付。

3. Any item of deferred compensation, whether or not substantially vested. This is any amount of compensation if, under the terms of the plan, contract, or other arrangement providing for such compensation, the following conditions were met.

a. You had a legally binding right on your expatriation date to such compensation,

b. The compensation has not been actually or constructively received on or before the expatriation date, and

c. The compensation is payable on or after the expatriation date.

遞延所得項目的例子包括了:現金差額結算的股票增值權、虛擬股票、現金差額結算的限制股股份,各種未來不確定會回收的投資項目(除了未來保證資產會移轉回來的項目),以及 402(b)(1) 或 (4) 規範下的信託利益(通常視作 Secular Trust 來估價)。

Examples of items of deferred compensation include: a cash-settled stock appreciation right, a phantom stock arrangement, a cash-settled restricted stock unit, an unfunded and unsecured promise to pay money or other compensation in the future (other than such a promise to transfer property in the future), and an interest in a trust described in section 402(b)(1) or (4) (commonly referred to value as a secular trust).

四、不論是既得與否,任何因執行勞務而收到的資產或是對於資產的權利,但是先前並沒有根據或依照 §83 列入計算。這些項目的例子包括了(但不限於):限制股、現金差額結算的股票增值權,以及現金差額結算的限制股股份。

4. Any property, or right to property, that you are entitled to receive in connection with the performance of services (whether or not such property or right to property is substantially vested) to the extent not previously taken into account under section 83 or in accordance with section 83. Examples of these items include, but aren't limited to, restricted stock, stock-settled stock appreciation rights, and stock-settled restricted stock units.

符合資格的遞延補償項目意指,任何和以下相關的遞延補償項目:

• 支付者是美國個人或非美國個人,而他因為 877A(d)(1) 條款選擇被視為美國個人,以及

• 適用的棄籍稅者,以 W-8CE 表告知支付者他的身分是適用的棄籍稅者,

• 在 8854 表內和美國政府的稅務協定下,不能就這個項目主張撤回任何預扣稅。

Eligible deferred compensation item means any deferred compensation item with respect to which:

• The payor is either a U.S. person or a non-U.S. person who elects to be treated as a U.S. person for purposes of section 877A(d)(1) and

• The covered expatriate notifies the payor of his or her status as a covered expatriate on Form W-8CE, and

• Irrevocably waives any right to claim any withholding reduction on such item under any treaty with the United States on Form 8854.

美國國稅局會針對 877A(d)(1) 條款下,非美國個人、但希望被視為美國個人的支付者,發行專門的指導手冊以說明申報過程。

The Secretary may provide separate guidance providing a procedure for a payor who is a non-U.S. person and wishes to be treated as a U.S. person for purposes of section 877A(d)(1).

注意:如果有一項或更多符合資格的遞延補償項目,務必要在 8854 表上附加上一份聲明,單獨標示每一項符合資格的遞延補償項目,並且還要在每一個項目下面加上:「根據和美國政府的稅務協定,我無法就此符合資格的遞延補償項目,主張任何要求預扣減免的權利。」

Note. If you have one or more eligible deferred compensation item, you must attach a statement to the form that separately identifies each eligible deferred compensation item and includes the following language for each item. “I irrevocably waive any right to claim any reduction in withholding for this eligible deferred compensation item under any treaty with the United States.”

第 1b 行。非符合資格的遞延補償項目意指,任何不符合資格的遞延補償項目。

Line 1b. Ineligible deferred compensation item means any deferred compensation item that is not an eligible deferred compensation item.

注意:如果有一項或更多非符合資格的遞延補償項目,務必要在 8854 表上面附加一份報表,單獨標示每一項非符合資格的遞延補償項目,並且提供自棄籍前一天開始,這樣不符合資格的遞延補償項目的現行價值。

Note. If you have one or more ineligible deferred compensation item(s), you must attach a statement to the form that separately identifies each ineligible deferred compensation item and provide the present value of such ineligible deferred compensation item as of the day before your expatriation date.

第 1c 行。一個特定的稅務遞延帳戶包括:

1. 個人退休計劃(除了列在 408(k) 或 408(p) 部分的帳戶)

2. 教育儲蓄帳戶,或

3. 健康儲蓄帳戶,或阿切爾醫療存款帳戶。

Line 1c. A specified tax deferred account includes:

1. An individual retirement plan (except those described in section 408(k) or 408(p)),

2. A Coverdell education savings account, or

3. A health savings account or an Archer medical savings account.

注意:如果有一項或更多特定的稅務遞延帳戶,務必要在 8854 表上附加一份聲明書,單獨標示每一個特定的稅務遞延帳戶,並且在您棄籍日的前一天,提供每個特定稅務遞延帳戶的總結餘。

Note. If you have one or more specified tax deferred account(s), you must attach a statement to the form that separately identifies each specified tax deferred account and provides the entire account balance of each specified tax deferred account on the day before your expatriation date.

第 1d 行。非授予人信託屬任何國內或國外信託的一部分,在棄籍日之前,基於法條 671~679 條規定不被視為這個信託的所有人,如果有以下的情況,就會被視為此種信託的受益人:

一、根據信託工具的條款,或是適用的地方法律,被授予資格或是准許收到直接或間接的信託所得或本金分配(例如,包括了債務清償的分配);

二、有權因為個人利益,申請信託收入或本金;或

三、如果信託或是信託目前的利益被終止,可以從信託收入或信託本金中得到報酬。

Line 1d. A nongrantor trust is the part of any trust, whether domestic or foreign, of which you were not considered the owner under sections 671 through 679 on the day before your expatriation date. You are considered a beneficiary of such trust if:

1. You are entitled or permitted, under the terms of the trust instrument or applicable local law, to receive a direct or indirect distribution of trust income or corpus (including, for example, a distribution in discharge of an obligation);

2. You have the power to apply trust income or corpus for your own benefit; or

3. You could be paid from the trust income or corpus if the trust or the current interests in the trust were terminated.

在因為 877A 條款而必須要作出決定時,除非自棄籍日的前一天起,選擇被視為已經從信託中收到所屬權益的價值,在和美國政府有稅務協定的情況下,不能主張從信託分配中撤回預扣稅。在作出選擇之前,如果可以確定的話,務必依照 Rev. Proc. 2019-1, 2019-1 I.R.B. 1 所提出的程序,得到美國國稅局發出的信函,當中載明自棄籍日前一天開始起算在信託中權益的價值。執行勞務的信函可從 IRS.gov/irb/2019-01_IRB#RP-2019-01. 網頁上取得。務必勾選 1d 行下面的欄位,以作出這樣的選擇,並且把上述這封信的影本,附加在這份 2019 稅務年度表上和即時申報的稅務申報單(包含延期申報)。直到取得了估價信函的裁定,並且提供一份影本連同證明文件給非授予人信託的受託人,證明由於的選擇,納稅人已經支付應該支付的稅,否則根據偽證罪的處罰,任何從信託收到可以課稅的分配,都將被預扣 30%。

Unless you elect to be treated as having received the value of your interest in the trust, as determined for purposes of section 877A, as of the day before your expatriation date, you cannot claim a reduction in withholding on any distribution from the trust under any treaty with the United States. Before you can make the election, you must get a letter ruling from the IRS as to the value, if ascertainable, of your interest in the trust as of the day before the expatriation date by following the procedures set forth in Rev. Proc. 2019-1, 2019-1 I.R.B. 1, available at IRS.gov/irb/2019-01_IRB#RP-2019-01. You must make this election by checking the box under line 1d of this form and attaching a copy of the letter ruling both to this form and to your timely filed tax return (including extensions) for the 2019 tax year. Until you obtain the valuation letter ruling and provide a copy of such letter ruling to the trustee of the nongrantor trust together with certification, under penalties of perjury, that you have paid all tax due as a result of your election, any taxable distributions that you receive from the trust will be subject to 30% withholding.

第 2 行

(a) 欄:包括了錢或其它資產產生的權益,不論其是否產生任何收入或利得。此外,行使資產權利所獲得的權益,將被視為此類資產的權益。但不要列入下列項目:

1. 遞延補償項目。

2. 特定稅負遞延帳戶。

3. 在非授予人信託中的利益。

Column (a). An interest in property includes money or other property, regardless of whether it produces any income or gain. In addition, an interest in the right to use property will be treated as an interest in such property. However, do not list the following.

1. Deferred compensation items.

2. Specified tax deferred accounts.

3. Interests in nongrantor trusts.

根據美國國內稅法法規 B 編第十一章,如果在棄籍前一天死亡,但當時的身分是美國公民或居民,在聯邦遺產稅的規定下,被視為擁有計算在總遺產中資產的任何利益。不論資產是否會被計算在總遺產之中,都將不考慮 2010~2016 條款來決定。因為這個緣故,被視為在每一個信託當中擁受益(或是部分信託),除了受限於 877A(f) 條款的非授予人信託之外,這個情況下就不會被計算在前述的總遺產之中。在這樣的信託中您的受益,應根據在 97-19 公告第三部分所設立的特別規定來決定,此規定可以在美國國內地稅務公報 1997-10 的第四十頁找到,網址是:https://www.irs.gov/pub/irs-irbs/irb97-10.pdf。

You are considered to own any interest in property that would be included in your gross estate for federal estate tax purpose under Chapter 11 of Subtitle B of the Code if you died on the day before the expatriation date as a citizen or resident of the United States. Whether property would be included in your gross estate will be determined without regard to sections 2010 through 2016. For this purpose, you are considered to own your beneficial interest(s) in each trust (or part of a trust), other than a nongrantor trust subject to section 877A(f), that would not be included in your gross estate as described in the preceding sentences. Your beneficial interest(s) in such a trust shall be determined under the special rules set forth in section III of Notice 97-19, which is on page 40 of Internal Revenue Bulletin1997-10 at https://www.irs.gov/pub/irs-irbs/irb97-10.pdf.

(b) 欄位:使用棄籍日前一天的公平市場價格(FMV)。公平市場價格(FMV)是指資產在買方和賣方之間轉手的價格,但買方和賣方不需要透過買賣,對於某項資產的價格即有合理的認知。如果持有相反利益的雙方,在公正交易中針對資產開出價格,這就是公平市場價格的有利證明。

Column (b). Use the fair market value (FMV) on the day before your expatriation date. FMV is the price at which the property would change hands between a buyer and a seller when both have reasonable knowledge of all the necessary facts and neither has to buy or sell. If parties with adverse interests place a value on property in an arm’s-length transaction, that is strong evidence of the FMV.

(c) 欄。一般而言,價格或在此欄位中的其它基準,不能少於第一次成為美國居民當日的資產的公平市場價格。然而可以作出不可撤銷的選擇,來決定這個欄位中的基準。若身為歸順美國人或長期居留者可參考 877A(h)(2) 條款說明。

Column(c). Generally, the cost or other basis in this column cannot be less than the fair market value (FMV) of the property on the date you first became a U.S. resident. However, if you are a naturalized citizen or LTR at the time you expatriated, you can make an irrevocable election under section 877A(h)(2) to determine basis without regard to this restriction. Print "(h)(2)" after any entry for which you make this election.

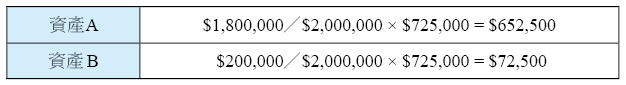

(e) 欄位:在填完 (e) 欄位之前,務必要在一張獨立的表單中分配好利得資產的扣除額,並把這份表單的影本附加在 8854 表上。為了要分配扣除額,要先決定好每一項列在 (a) 欄的利得資產的利得,並且把這樣的利得填入 (d) 欄中。如果所有利得資產的總利得超過了扣除額(2019 年度為 725,000 美元),則藉由扣除額乘上利得的比率(比率的取得,是以 (d) 欄中的每一項利得資產,除以列在 (d) 欄中的所有利得資產的總利得),把所有扣除額分配給利得資產。

Column (e). Before you complete column (e), you must allocate the exclusion amount to the gain properties on a separate schedule. Attach a copy of the separate schedule to this form. To allocate the exclusion amount, determine the gain of each gain property listed in column (a) and enter that gain in column (d). If the total gain of all the gain properties exceeds the exclusion amount ($725,000 for 2019), then allocate the entire exclusion amount to the gain properties by multiplying the exclusion amount by the ratio of the gain determined for each gain property in column (d) over the total gain of all gain properties listed in column (d).

在把扣除額分配給利得資產之後,把在 (d) 欄中申報的那項資產的利得,減去分配給每一項利得資產的扣除額,然後把得到的數額填入 (e) 欄。如果在 (d) 欄中的利得資產的總利得少於扣除額(但是大於 0),那就務必以總利得額度作為扣除額,並且根據先前所述的方法,把調整過後的扣除額,分配給利得資產。分配給每一項利得資產的扣除額,不能超過利得資產設算利得的額度。

After you have allocated the exclusion amount to the gain properties, subtract the exclusion amount allocated to each gain property from the gain reported for that property in column (d), and enter the resulting amount of gain in column (e). If the total gain of the gain properties in column (d) is less than the exclusion amount (but greater than -0-), then you must use the total gain amount as the exclusion amount, and you must allocate the exclusion amount, as adjusted, to the gain properties under the method described above. The exclusion amount allocated to each gain property cannot exceed the amount of that gain property’s built-in gain.

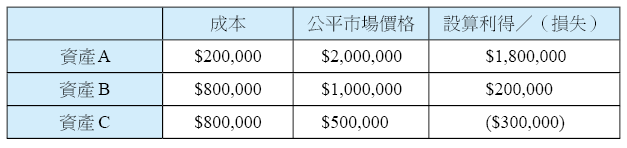

案例:適用的棄籍稅者 X 君在日期二放棄美國公民身分,在棄籍的前一天(日期一),X 君有三項擁有期長達一年以上的資產。這三項資產是:A 是營業性資產,B、C 是個人資產。而三項資產在日期一的公平市場價格及成本為,資產 A 的公平市場價格是 200 萬美元,成本為 20 萬美元;資產 B 的公平市場價格是 100 萬美元,成本為 80 萬美元;資產 C 的公平市場價格是 50 萬美元,成本為 80 萬美元。X 先生必須把免稅額依照比例分配給這三項資產,計算方式如下:

Example. X, a covered expatriate, renounced his citizenship on Date 2. On Date 1, the day before X's renunciation of his citizenship, X owned three assets, which he had owned for more than one year. Asset A is business property and assets B and C are personal property. As of Date 1, Asset A had an FMV of $2,000,000 and a basis of $200,000; Asset B had an FMV of $1,000,000 and a basis of $800,000; Asset C had an FMV of $500,000 and a basis of

$800,000. X must allocate the exclusion amount as follows:

第一步:決定在日期一的市價是多少,並算出設算利得和損失。

Step 1: Determine the built-in gain or loss of each asset by subtracting the basis from the FMV of the asset on Date 1.

第二步:把免稅額分配到有設算利得的資產 A 和 B。

Step 2: Allocate the exclusion amount to each of the gain properties by multiplying the exclusion amount ($725,000) by a ratio of the deemed gain attributable to each gain property over the total gain of all the gain properties deemed sold.

第三步:把被分配的免稅額從設算利得減除。

Step 3: Figure the final amount of deemed gain on each asset by subtracting the exclusion amount allocated to each asset.

然後把表三所得出的結果,填入 8854 表 Section B 的 (f) 欄位,如 1040 表的附表 D。

(f) 欄:這個欄位要列出您在 (a) 欄裡申報每一項資產利得或損失總額的附表或表格(例如 4797 表或 8949 表)。

Column (f). Complete this column in order to list the schedule or form on which you reported the deemed sale of each property listed in column (a) (for example, Form 4797 or Form 8949).

(g) 欄:如果您有選擇遞延稅的資產,才要填寫這一欄。首先,填寫 D 部分到 4 行。在一份獨立的附表上,在第 2 行列出的所有利得資產中分配符合資格的遞延稅負。可歸屬某項特別資產的稅負的計算方式是,把 D 部分第 4 行的總額,乘上在第 2 行 (e) 欄中填入的那項資產的利得比率,然後除以第 4 行 (e) 欄的所有利得資產的利得總金額。

在第 2 行 (g) 欄中,填入歸屬於每一項選擇遞延資產的稅負,然後,從第 4 行 (g) 欄中的那些資產的總遞延稅,填入 D 部分的 5 行內。

Column (g). Complete this column only for those properties for which you are electing to defer the payment of tax. First, complete Section D to line 4. On a separate attachment, allocate the amount of tax eligible for deferral among all gain properties listed on line 2. The tax attributable to a particular property is determined by multiplying the amount on Section D, line 4, by the ratio of the gain for that property entered on line 2, column (e), over the total amount of gain of all gain properties on line 4, column (e). On line 2, column (g), enter the tax attributable to each property for which you are electing to defer tax. Then enter the total deferred tax for those properties from line 4, column (g), on Section D, line 5.

如果想要了解遞延稅的更多資訊,請見 D 部分的說明,以及 2009-85 通知書的 3E 部分。

See Section D—Deferral of Tax and Notice 2009-85, section 3E, for more information on deferring the payment of tax.

申報利得或損失:務必要在 1040 表 或是 1040-SR 表的相關表格和附表上,申報並具結當年(包括了棄籍日的前一天)的每一項資產的利得或損失(即 Section C 第 2 行 (a) 欄中申報的)。申報書類別會依照您在那一年結束時的身分而定;請見 Pub.519 第一章,來決定您應該要使用哪種申報書。可歸於各項資產的利得((e) 欄),以及損失((d) 欄)應將資產視為實際售出來申報。例如,攤提過折舊的出租用資產,視為已處分所產生的利得,要在 4797 表上申報;個人資產的(如股票或是個人居所)要視作已處分來申報在附表 D 上。資本利得保持資本利得原有的特性,而一般利得保持一般收入原有的特性。

Reporting gain or loss. You must report and recognize the gain (or loss) of each property reported in Section C, line 2, column(a), on the relevant form or schedule of your Form 1040 or 1040-SR for the part of the year that includes the day before your expatriation date. The return to which you attach your form or schedule will depend on your status at the end of the year. See chapter 1 of Pub. 519 to determine which form you should file. The gain from column (e) or loss from column (d) attributable to each property is reported in the same manner as if the property had actually been sold. For example, gain recognized from the deemed sale of a rental property that has been depreciated is reported on Form 4797 as if it had been sold. Gain recognized from the deemed sale of personal property (such as stock or a personal residence) is reported on Form 8949 as if it had been sold. Capital gain retains its character as capital gain; ordinary gain retains its character as ordinary income.