Publications

(2020最新版本)美國報稅與海外財產揭露─美國信託、跨境資產傳承

附錄

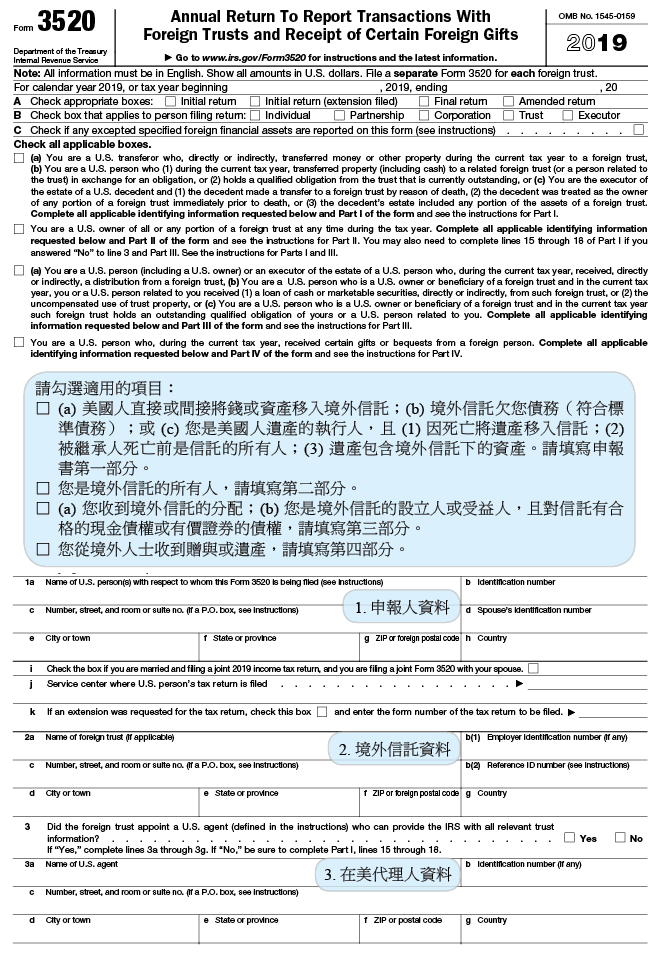

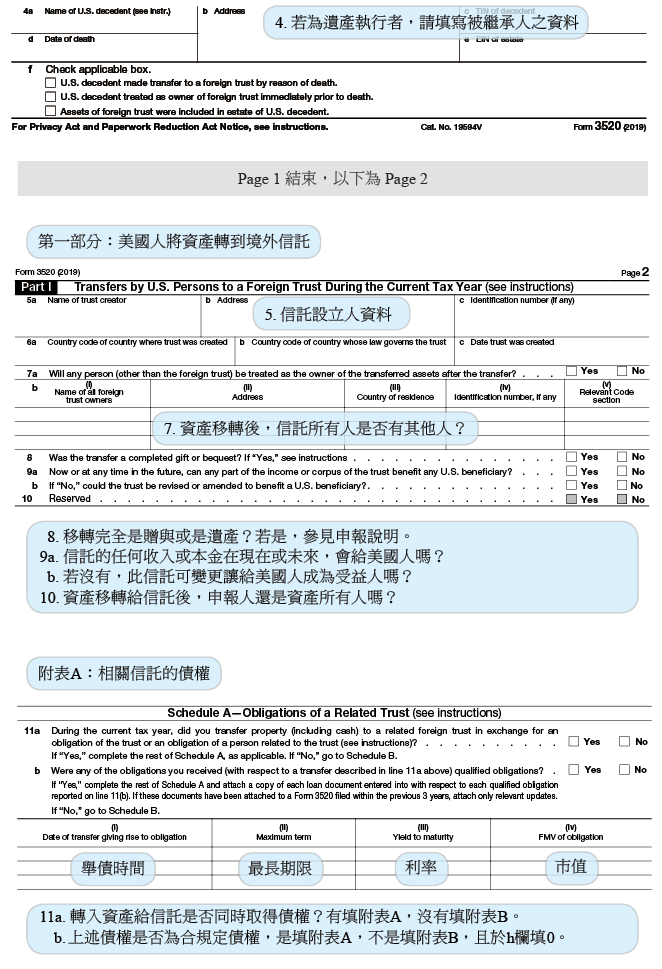

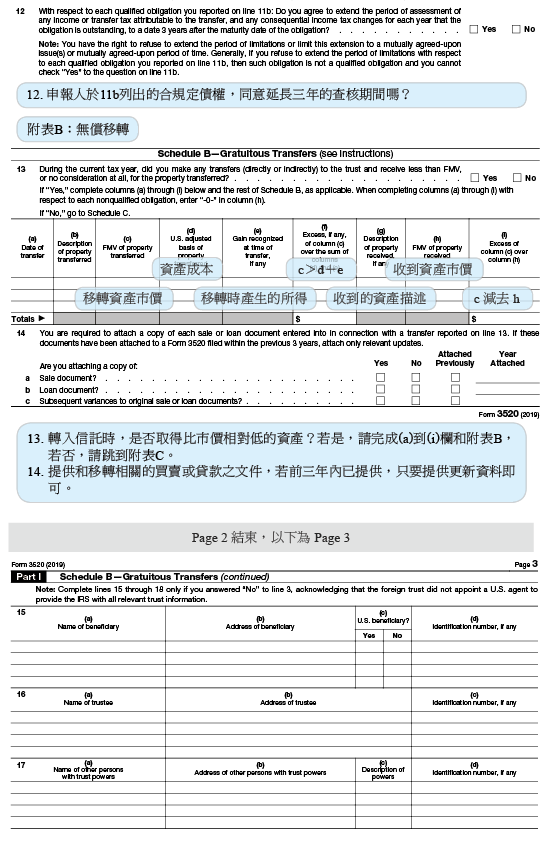

附錄六:3520表(境外信託及贈與申報表)及其申報說明

3520表申報說明

為兼顧版面精簡和實用性,編者刪去第一和第二部分,保留第三和第四部分供讀者參考。

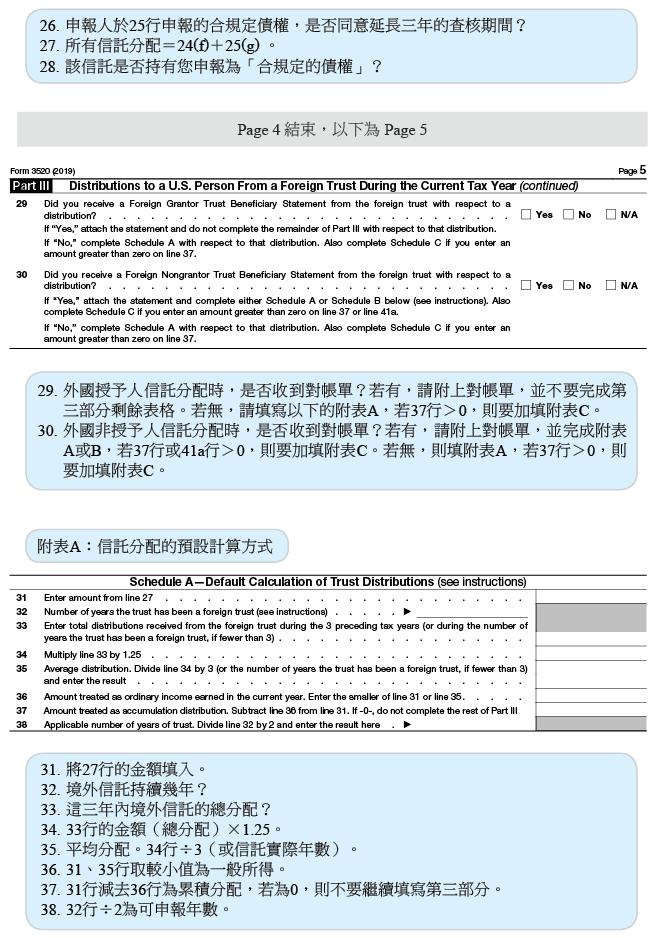

第三部分──在現行稅務年度中,從境外信託分配給美國人

Part III—Distributions to a U.S. Person From a Foreign Trust During the Current Tax Year

如果您從境外信託的一部分收到一筆款項,而又被視為這個境外信託的擁有人,並且您已經正確地申報第二部分要求的任何資訊,而且這個信託已申報了 3520-A 表給美國國稅局;在這樣的情況下,請不要在第三部分再一次個別揭露從這個信託而來的分配。如果您從境外信託收到一筆款項,而這筆款項需要在 3520 表的第三和第四部分進行申報,那麼請您只在第三部分申報這筆款項。

If you received an amount from a portion of a foreign trust of which you are treated as the owner and you have correctly reported any information required on Part II and the trust has filed a Form 3520-A with the IRS, do not separately disclose distributions again in Part III. If you received an amount from a foreign trust that would require a report under both Parts III and IV (gifts or bequests) of Form 3520, report the amount only in Part III.

第 24 行

請申報在現行稅務年度當中,您從境外信託中收到的任何現金或其它資產(實際或推定,直接或間接),不論課說與否,除非這筆款項是從信託給您的一筆貸款,否則務必要在第 25 行申報。例如,如果您是一個合夥組織的合夥人,而您從境外信託中收到一項分配,那麼您務必要申報該款項中屬於您的可分配的股份,作為來自這個信託的間接分配。

Report any cash or other property that you received (actually or constructively, directly or indirectly) from a foreign trust during the current tax year, whether or not taxable, unless the amount is a loan to you from the trust that must be reported on line 25. For example, if you are a partner in a partnership that receives a distribution from a foreign trust, you must report your allocable share of such payment as an indirect distribution from the trust.

第 24 行 (c) 欄

如果受益人手中資產的基準(如同 643(e)(1) 條款規定)低於資產的市價,則允許申報人填入該資產的基準;但只有在納稅義務人因缺乏憑證而不需要完成附表 A(第 31~38 行)的情況下可這樣做。

因為這樣的緣故,缺乏憑證會關係到申報者在第 29 或 30 行勾選「否」,因為:(a) 受益人並沒有從信託收到《外國授予人信託受益人申報書》或《外國非授予人信託受益人申報書》,或 (b) 這樣的申報表並沒有包括這份說明下面第 29 行或第 30 行的六個特定項目。

The filer is permitted to enter the basis of the property in the hands of the beneficiary (as determined under section 643(e)(1)), if lower than the FMV of the property, but only if the taxpayer is not required to complete Schedule A (lines 31 through 38) due to lack of documentation. For these purposes, lack of documentation refers to a situation in which the filer checked “No” on line 29 or 30 because (a) the beneficiary did not receive a Foreign Grantor Trust Beneficiary Statement or a Foreign Nongrantor Trust Beneficiary Statement from the trust or (b) such statement did not contain all six of the items specified under the instructions for line 29 or 30, later.

第 25 行

如果身為美國受益人的您,或是與您或美國受益人有關係的美國個人,直接或間接,從境外信託收到一項現金借款或是可銷售的證券上的借款,此借貸的總額將被視為給您或美國受益人的分配,除非這項債權為您、美國受益人或與您或美國受益人有關係的個人所有,用來交換前面所提到的貸款,是一項符合規定的債權。為了這個緣故,由境外信託所擔保、沒有關係的第三方給您的貸款,通常會被視為來自信託的貸款。

If you, a U.S. beneficiary, or a U.S. person related to you or the U.S. beneficiary, received a loan of cash or marketable securities, directly or indirectly, from a foreign trust, the amount of such loan will be treated as a distribution to you or the U.S. beneficiary, unless the obligation issued by you, the U.S. beneficiary, or the U.S. person related to you or the U.S. beneficiary, in exchange for the loan, is a qualified obligation. For this purpose, a loan to you by an unrelated third party that is guaranteed by a foreign trust is generally treated as a loan from the trust.

第 25 行 (e) 欄

如果您被給予的債權用來交換貸款,是一項符合規定的債權(見稍早定義),請回答「是」。

Answer “Yes” if your obligation given in exchange for the loan is a qualified obligation (defined earlier).

第 25 行 (f) 欄

除非是符合規定的債權,否則該債權的市價為 0。因此,在是合規定債權的情況下,請在 (f) 欄中填入「-0-」。

The FMV of an obligation is zero unless it is a qualified obligation. Therefore, in the case of obligations that aren't qualified obligations, enter “-0-” in column (f).

信託資產的無償使用/Uncompensated use of trust property

如果身為美國受益人的您,或是與您或美國受益人有關係的美國個人,直接或間接,收到境外信託的任何資產的使用權,該使用權的市價,將被視為一項給您或這位美國受益人的分配,除非身為美國受益人的您、或與您或這位美國受益人有關係的這位美國個人,在合理的期限內內使用該信託資產,而以市價來補償。此項規定適用於在 2010 年 3 月 18 日之後信託資產的使用權。更多相關資訊,請參見 643(i) 條款。請在 (a) 欄申報信託資產未補償使用的市價,並且在 (b) 欄申報第一次未補償使用的日期;請跳過 (c)~(f) 欄,並且將 (a) 欄的總額填入 (g) 欄。

If you, a U.S. beneficiary, or a U.S. person related to you or the U.S. beneficiary, directly or indirectly, received the use of any property of a foreign trust, the FMV of such use will be treated as a distribution to you or the U.S. beneficiary, unless you, the U.S. beneficiary, or the U.S. person related to you or the U.S. beneficiary compensate(s) the trust at FMV for the use of such property within a reasonable period of time. This rule is applicable for use of trust property after March 18, 2010. See section 643(i) for additional information. Report the FMV of the uncompensated use of trust property in column (a) and the date of first uncompensated use in column (b); skip columns (c) through (f), and enter the amount from column (a) in column (g).

註:HIRE 法案對 679(c) 條款做了改變(2010 年 3 月 18 日之後生效),因此根據 671~679 條款,如果一個有美國授予人的境外信託已經不被視為授予人信託了,那麼這個境外信託若直接或間接,進行現金貸款或有價證券給一位美國人,或是許可美國人直接或間接使用信託資產,而該美國人並沒有依照權益的市場價格來償付這筆貸款,或是在合理的期間之內,依照使用資產的市價支付給信託,則該境外信託將會被視為授予人信託。

Note. Due to changes to section 679(c) made by the HIRE Act, effective after March 18, 2010, if a foreign trust with a U.S. grantor is not already treated as a grantor trust under the rules of sections 671 through 679, the foreign trust will be treated as a grantor trust if it makes a loan of cash or marketable securities, directly or indirectly, to a U.S. person or allows a U.S. person, directly or indirectly, to use trust property, and the U.S. person does not repay the loan at a market rate of interest or pay the trust the FMV of the use of the property within a reasonable period of time.

第 28 行

請提供境外信託的未償付債權的狀態資訊,而這些未償付債權是您在現行年度中申報為符合規定的債權的。這些資訊是用來將這些債權保留在合規定債權的狀態。必要的話,請您附加一份報表來描述這項合規定債權中的任何條件改變。如果這項債權未能保留在合規定債權的狀態,您將被視為已經從境外信託收到分配,而您務必要在第 25 行申報這項分配。請見 97-34 聲明的 V(A) 條款。

Provide information on the status of any outstanding obligation to the foreign trust that you reported as a qualified obligation in the current tax year. This information is required in order to retain the obligation’s status as a qualified obligation. If relevant, attach a statement describing any changes to the terms of the qualified obligation. If the obligation fails to retain the status of a qualified obligation, you will be treated as having received a distribution from the foreign trust, which must be reported as such on line 25. See section V(A) of Notice 97-34.

第 29 和 30 行

如果缺了《外國授予人信託受益人申報書》(請見下面的 29 行)或《外國非授予人信託受益人申報書》所要求的六個項目中的任何一項,您務必要在第 29 或 30 行(視情況而定)勾選「否」。

此外,如果您在第 29 或 30 行回答「是」,並且被美國國稅局要求或是傳喚時,境外信託或美國代理人並沒有留下紀錄或證詞,美國國稅局可以重新判定您和該信託之間的交易的稅務結果,並且根據 6677 條款處以適當的罰款。

If any of the six items required for the Foreign Grantor Trust Beneficiary Statement (see Line 29 below) or for the Foreign Nongrantor Trust Beneficiary Statement (see Line 30 below) is missing, you must check “No” on line 29 or line 30, as applicable.

Also, if you answer “Yes” to line 29 or line 30, and the foreign trust or U.S. agent does not produce records or testimony when requested or summoned by the IRS, the IRS may redetermine the tax consequences of your transactions with the trust and impose appropriate penalties under section 6677.

第 29 行

如果回答「是」,請附上由境外信託提供的《外國授予人信託受益人申報書》(3520-A 表第四頁),並且不要完成第三部分剩下關於信託分配的部分。如果美國受益人在稅務年度中,收到一份關於信託分配的完整《外國授予人信託受益人申報書》,為了申報所得稅,這個受益人應視這項分配直接來自信託所有人。例如,如果這項分配屬贈與,那麼受益人不應在總所得中,納入這項分配。

If “Yes,” attach the Foreign Grantor Trust Beneficiary Statement (page 4 of Form 3520-A) from the foreign trust and do not complete the rest of Part III with respect to the distribution. If a U.S. beneficiary receives a complete Foreign Grantor Trust Beneficiary Statement with respect to a distribution during the tax year, the beneficiary should treat the distribution for income tax purposes as if it came directly from the owner. For example, if the distribution is a gift, the beneficiary should not include the distribution in gross income.

除了這個境外信託和其受託人的基本資料(例如名字、地址、TIN 等等)之外,這份申報書務必包括下列項目:

In addition to basic identifying information (i.e., name, address, TIN, etc.) about the foreign trust and its trustee, this statement must contain these items:

1. 這份申報書在稅務年度當中,適用於該境外信託的第一天和最後一天。

The first and last day of the tax year of the foreign trust to which this statement applies.

2. 必要的解釋,用來說明及證實為了申報美國所得稅,這個境外信託應被視為由另一個人所擁有。(此項解釋必須指出是依照哪一個條款所認定的)

An explanation of the facts necessary to establish that the foreign trust should be treated for U.S. tax purposes as owned by another person. (The explanation should identify the Code section that treats the trust as owned by another person.)

3. 一份聲明書,用來說明信託的所有人為個人、公司或合夥組織。

A statement identifying whether the owner of the trust is an individual,trust, corporation, or partnership.

4. 對於資產的描述(包括現金部分)。這些資產在稅務年度當中,依照資產的市價分配或被視為分配給美國個人。

A description of property (including cash) distributed or deemed distributed to the U.S. person during the tax year, and the FMV of the property distributed.

5. 一份聲明書,聲明該信託將許可美國國稅局或是美國受益人,審查或備份該信託的永久會計帳簿、紀錄,以及其它的文件,用來證實該信託為了申報美國所得稅,因此應被視為被另外一個人所擁有。但如果該信託已經任命了美國代理人,那麼就不需要出示這份聲明書。

A statement that the trust will permit either the IRS or the U.S. beneficiary to inspect and copy the trust’s permanent books of account, records, and such other documents that are necessary to establish that the trust should be treated for U.S. tax purposes as owned by another person. This statement is not necessary if the trust has appointed a U.S. agent.

6. 一份聲明書,聲明這個境外信託是否任命了美國代理人(見稍早定義)。如果這個信託有美國代理人,請在聲明書當中加入該代理人的名字、地址及納稅人識別號碼。

A statement as to whether the foreign trust has appointed a U.S. agent (defined earlier). If the trust has a U.S. agent, include the name, address, and taxpayer identification number of the agent.

第 30 行

如果回答「是」,請附上由境外信託提供的《外國非授予人信託受益人申報書》。《外國非授予人信託受益人申報書》務必包括下列項目:

If “Yes,” attach the Foreign Nongrantor Trust Beneficiary Statement from the foreign trust. A Foreign Nongrantor Trust Beneficiary Statement must include the following items:

1. 請解釋為了申報美國稅而做的任何分配或視為分配為適當處理,或是提供充分的資訊,可以證實美國受益人是為了申報美國稅,做出任何分配或視為分配的適當處理。

An explanation of the appropriate U.S. tax treatment of any distribution or deemed distribution for U.S. tax purposes, or sufficient information to enable the U.S. beneficiary to establish the appropriate treatment of any distribution or deemed distribution for U.S. tax purposes.

2. 一份聲明書,用來說明任何一位信託授予人是否為合夥組織或是外國公司。如果是的話,請附上相關事實的解釋。

A statement identifying whether any grantor of the trust is a partnership or a foreign corporation. If so, attach an explanation of the relevant facts.

3. 一份聲明書,聲明該信託將許可美國國稅局或美國受益人,審查並且備份該信託的永久會計帳簿、紀錄,以及其它文件,用來證實為了申報美國稅,任何分配或視為分配是適當處理。但如果該信託已經任命了美國代理人,那麼就不需要出示這份聲明書。

A statement that the trust will permit either the IRS or the U.S. beneficiary to inspect and copy the trust’s permanent books of account, records, and such other documents that are necessary to establish the appropriate treatment of any distribution or deemed distribution for U.S. tax purposes. This statement is not necessary if the trust has appointed a U.S. agent.

4. 《外國非授予人信託受益人申報書》也務必包括了第一、第四和第六個項目(如同第 29 行的申報說明中所列),以及關於該境外信託及其受託人的基本資料(例如名字、地址及 TIN 等等)。

The Foreign Nongrantor Trust Beneficiary Statement must also include items 1, 4, and 6, as listed in the line 29 instructions above, as well as basic identifying information (e.g., name, address, TIN, etc.) about the foreign trust and its trustee.

附表A── 信託分配的預設計算方式

Schedule A—Default Calculation of Trust Distributions

如果您在第 30 行回答「是」,您就會要填寫附表 A 或 B。然而,一般而言,如果您在當年度填寫附表 A(或是在先前的年度填寫附表 A),在未來的所有年度都要填寫該附表,即便您在未來的某個年度,在第 30 行能夠回答「是」。(這項一致性規定的唯一例外是,您可以在一個信託終止的年度使用附表 B,但只有在終止的那一個年度,您可以在第 30 行回答「是」。)

If you answered “Yes” to line 30, you may complete either Schedule A or Schedule B. Generally, however, if you complete Schedule A in the current year (or did so in the prior years), you must continue to complete Schedule A for all future years, even if you are able to answer “Yes” to line 30 in that future year. (The only exception to this consistency rule is that you may use Schedule B in the year that a trust terminates, but only if you are able to answer “Yes” to line 30 in the year of termination.)

第 32 行

請您在所知的範圍之內,指出信託存在為境外信託的年數,並且附上一份解釋基準。只要信託存在的任何一年,都要算為完整的一個年度。如果這是該信託成為境外信託的第一年,請不要填寫剩下的第三部分(您並沒有累積分配)。

To the best of your knowledge, state the number of years the trust has been in existence as a foreign trust and attach an explanation of your basis for this statement. Consider any portion of a year to be a complete year. If this is the first year that the trust has been a foreign trust, do not complete the rest of Part III (you do not have an accumulation distribution).

第 33 行

請填入在先前三個稅務年度(若成為境外信託少於三年,則按實際情況填寫),您所收到的分配總額。舉例來說,如果一個信託在第一年分配 50 美元,第二年分配 120 美元,以及第三年分配 150 美元,那麼在第 33 行申報的總額為 320 美元($50+$120+$150)。

Enter the total amount of distributions that you received during the 3 preceding tax years (or the number of years the trust has been a foreign trust, if less than 3). For example, if a trust distributed $50 in year 1, $120 in year 2, and $150 in year 3, the amount reported on line 33 would be $320 ($50 + $120 + $150).

第 35 行

請把第 34 行的數字除以 3(若少於 3,就是除以該信託成為境外信託的年數)。只要信託存在的任何一年,都要算為完整的一個年度。例如,一個在 2013 年 7 月 1 日設立的境外信託,會在 2015 曆年制的申報書上,被視為有二個先前年度(2013 和 2014 年)。在這個例子中,您把第 34 行的總額除以 2,就是第 35 行的總額。請不要忽略沒有進行分配的稅務年度。美國國稅局將會視您的這些先前分配的證明為適當的紀錄,用來說明加總為第 31 行的任何分配,不是在現行稅務年度中的累積分配。

Divide line 34 by 3 (or the number of years the trust has been a foreign trust if fewer than 3). Consider any portion of a year to be a complete year. For example, a foreign trust created on July 1, 2013, would be treated on a 2015 calendar year return as having 2 preceding years (2013 and 2014). In this case, you would calculate the amount on line 35 by dividing line 34 by 2. Do not disregard tax years in which no distributions were made. The IRS will consider your proof of these prior distributions as adequate records to demonstrate that any distribution up to the amount on line 31 is not an accumulation distribution in the current tax year.

第 36 行

請填入在您的稅務申報書上作為一般所得的總額。請在您申報書上適合的附表上,申報這個總額(例如 1040 表的附表 E 的第三部分)。

Enter this amount as ordinary income on your tax return. Report this amount on the appropriate schedule of your tax return (e.g., Schedule E (Form 1040), Part III).

註:如果在第 37 行有金額,請您務必也要完成第 38 行和附表 C「利息費用的計算」,來判定您可能積欠的任何利息費用的總額。

Note. If there is an amount on line 37, you must also complete line 38 and Schedule C — Calculation of Interest Charge, to determine the amount of any interest charge you may owe.

附表B── 信託分配的實際計算方式

Schedule B—Actual Calculation of Trust Distributions

只有在下列情況下,您才會使用到附表 B:

You may only use Schedule B if:

- 在第 30 行,您回答「是」。

- 您在這份申報書上,附加了一份《外國非授予人信託受益人申報書》的副本,並且

- 您之前不曾因為該境外信託而申報附表 A,或是該境外信託在稅務年度中終止了。

第 40a 行

請在 40a 行填入您收到來自境外信託的總額,而該總額在現行的稅務年度中被視為信託的一般實際所得。一般實際所得就是非資本利得的所有所得。請在您的稅務申報書的適當的附表中,申報這個總額(例如,1040 表的附表 E 第三部分)。

Enter on line 40a the amount received by you from the foreign trust that is treated as ordinary income of the trust in the current tax year. Ordinary income is all income that is not capital gains. Report this amount on the appropriate schedule of your tax return (e.g., Schedule E (Form 1040), Part III).

第 42a~42d 行

請在這幾行中填入可適用的總額,這些總額是您從境外信託收到,並在現行的稅務年度被視為信託的資本利得所得。請在您的所得稅申報書的合適附表上,申報這些總額(例如,1040 表的附表 D)。

Enter on these lines the applicable amounts received by you from the foreign trust that are treated as capital gain income of the trust in the current tax year. Report these amounts on the appropriate schedule of your tax return (e.g., Schedule D (Form 1040)).

第 45 行

請填入境外信託的加總未分配的淨所得。舉例來說,假設信託設立於 2009 年,並且在 2015 年之前都沒有進行分配。假設該信託的一般所得在 2014 年是 0,2013 年是 60 美元,2012 年是 124 美元,2011 年是 87 美元,2010 年是 54 美元,2009 年是 25 美元。因此,針對 2015 年,該信託加總的未分配淨所得會是 350 美元。如果該信託在 2015 年賺了 100 美元,並且分配了200 美元(以致於當中有 100 美元是從累積收入中進行分配),那麼該信託 2016 年加總的淨所得會是 250 美元($350+$100-$200)。

Enter the foreign trust’s aggregate undistributed net income (UNI). For example, assume that a trust was created in 2009 and has made no distributions prior to 2015. Assume the trust’s ordinary income was $0 in 2014, $60 in 2013, $124 in 2012, $87 in 2011, $54 in 2010, and $25 in 2009. Thus, for 2015, the trust’s UNI would be $350. If the trust earned $100 and distributed $200 during 2015 (so that $100 was distributed from accumulated earnings), the trust’s 2016 aggregate UNI would be $250 ($350 + $100 - $200).

第 46 行

請填入境外信託的加權未分配淨所得。信託的加權未分配淨所得就是其累積且還未進行分配的所得,並藉由有累積所得的年度進行加權。為了要計算加權未分配的淨所得,請把來自每一個信託年度的未分配所得,乘上自那一年起的年數,再將每一年的結果合計。請使用第 45 行的例子,信託在 2015 年的加權未分配淨所得是 1,260 美元,計算如下:

Enter the foreign trust’s weighted undistributed net income (weighted UNI). The trust’s weighted UNI is its accumulated income that has not been distributed, weighted by the years that it has accumulated income. To calculate weighted UNI, multiply the undistributed income from each of the trust’s years by the number of years since that year, and then add each year’s result. Using the example from line 45, the trust’s weighted UNI in 2015 would be $1,260, calculated as follows:

為了要計算接下來年度(2016 年)的信託的加權未分配的淨所得,信託可以更新這裡的計算結果,或是顯示在 2015 年 3520 表第 46 行的加權未分配的淨所得,可以藉由下列的步驟更新:

To calculate the trust’s weighted UNI for the following year (2013), the trust could update this calculation, or the weighted UNI shown on line 46 of the 2015 Form 3520 could simply be updated using the following steps:

1. 從 2015 年加權的未分配的淨所得開始。

Begin with the 2015 weighted UNI.

2. 在 2015 年開始時,加上未分配的淨所得。

Add UNI at the beginning of 2015.

3. 加上在 2015 年的信託收入。

Add trust earnings in 2015.

4. 減去在 2015 年的信託分配。

Subtract trust distributions in 2015.

5. 減去 2015 年的加權信託累積分配。(加權信託累積分配就是把 2015 年的信託累積分配,乘上從 2015 年起的可適用年數。)

Subtract weighted trust accumulation distributions in 2015. (Weighted trust accumulation distributions are the trust accumulation distributions in 2015 multiplied by the applicable number of years from 2015.)

以上面的例子來算,這個信託的 2016 年的加權未分配淨所得會是 1,150 美元,計算如下。

Using the example above, the trust’s 2016 weighted UNI would be $1,150, calculated as follows.

第 47 行

把第 46 行的數字除以第 45 行的數字,來計算信託的可適用年數。請使用在申報說明中針對第 45 行和第 46 行的例子,信託的可適用年度在 2015 年是 3.6(1,260/350),而在 2016 年是 4.6(1,150/250)。

Calculate the trust’s applicable number of years by dividing line 46 by line 45. Using the examples in the instructions for lines 45 and 46, the trust’s applicable number of years would be 3.6 in 2015 (1,260/350) and 4.6 in 2016 (1,150/250).

註:如果在第 45 行的未分配淨所得的數字中有小數點的話,請不要刪除(例如,請使用在申報說明中第 45 行的例子,把小數點後面三位數字保留)。

Note. Include as many decimal places as there are digits in the UNI on line 45 (e.g., using the example in the instructions for line 45, include three decimal places).

附表C──利息費用的計算

Schedule C—Calculation of Interest Charge

如果您在第 37 行或第 41a 行有填入金額的話,請完成附表 C。

Complete Schedule C if you entered an amount on line 37 or line 41a.

第 49 行

請把本表第 48 行的金額,納入在 4970 表的第 1 行。然後使用 4970 表第 1~28 行,來計算總累積分配的稅負。請在第 49 行填入來自 4970 表第 28 行的稅負。

Include the amount from line 48 of this form on Form 4970, line 1. Then compute the tax on the total accumulation distribution using lines 1 through 28 of Form 4970. Enter on line 49 the tax from line 28 of Form 4970, Tax on Accumulation Distribution of Trusts.

註:請使用 4970 表作為工作附表,並將其附加在 3520 表上。

Note. Use Form 4970 as a worksheet and attach it to Form 3520.

第 51 行

一段期間會有稅負的累積利息(第 49 行),而這段期間是開始於適用日期之前的適用年數中的某一個日期,並結束於適用日期。為了計算利息,適用日期就是進行申報的稅務年度的年中(例如,採用 2015 曆年制,適用日期就是 2015 年 6 月 30日)。另外一種選擇是,如果您在稅務年度只收到一項累積分配,您可以使用分配的日期作為適用日期。

針對 1996 年之前、1976 年之後的利息累積期間,利息是以每年 6% 的單利來累積,而沒有複利。而 1995 年之後的利息累積期間,則是根據 6621(a)(2) 條款,每日以複利來計算,以課徵不足繳納的稅負。1995 年後這段期間的複利,不只是加徵在稅負上,也加在歸屬於 1996 年前的期間的總單利。

如果您是採用 2015 曆年制來申報,並且使用 2015 年 6 月 30 日作為計算利息的適用日期,請使用下面的表格來決定合併的利率,並請將合併的利率填入 51 行。如果您不是採用 2015 曆年制,或您選擇分配的真正日期作為適用日期,請依照上面的原則來計算合併利率,並且將其填入 51 行。

Interest accumulates on the tax (line 49) for the period beginning on the date that is the applicable number of years (as rounded on line 50) prior to the applicable date and ending on the applicable date. For purposes of making this interest calculation, the applicable date is the date that is mid-year through the tax year for which reporting is made (e.g., in the case of a 2015 calendar year taxpayer, the applicable date would be June 30, 2015). Alternatively, if you received only a single distribution during the tax year that is treated as an accumulation distribution, you may use the date of that distribution as the applicable date.

For portions of the interest accumulation period that are prior to 1996 (and after 1976), interest accumulates at a simple rate of 6% annually, without compounding. For portions of the interest accumulation period that are after 1995, interest is compounded daily at the rate imposed on underpayments of tax under section 6621(a)(2). This compounded interest for periods after 1995 is imposed not only on the tax, but also on the total simple interest attributable to pre-1996 periods.

If you are a 2015 calendar year taxpayer and you use June 30, 2015, as the applicable date for calculating interest, use the table below to determine the combined interest rate and enter it on line 51. If you aren't a 2015 calendar year taxpayer or you choose to use the actual date of the distribution as the applicable date, calculate the combined interest rate using the above principles and enter it on line 51.

累積分配總額的合併利率一覽表

Table of Combined Interest Rate Imposed on the Total Accumulation Distribution

第 53 行

請將作為「附加稅(ADT)」的總額,申報在所得稅申報書的適當欄位。(舉例來說,1040 表的申報者請包括這裡的總額,作為 2015 年 1040 表的部分數額,並且在第 62 行欄位的左邊填入附加稅。)

Report this amount as additional tax (ADT) on the appropriate line of your income tax return (for example, for Form 1040 filers, include this amount as part of the total for line 62 of your 2015 Form 1040 and enter “ADT” to the left of the line 62 entry space).

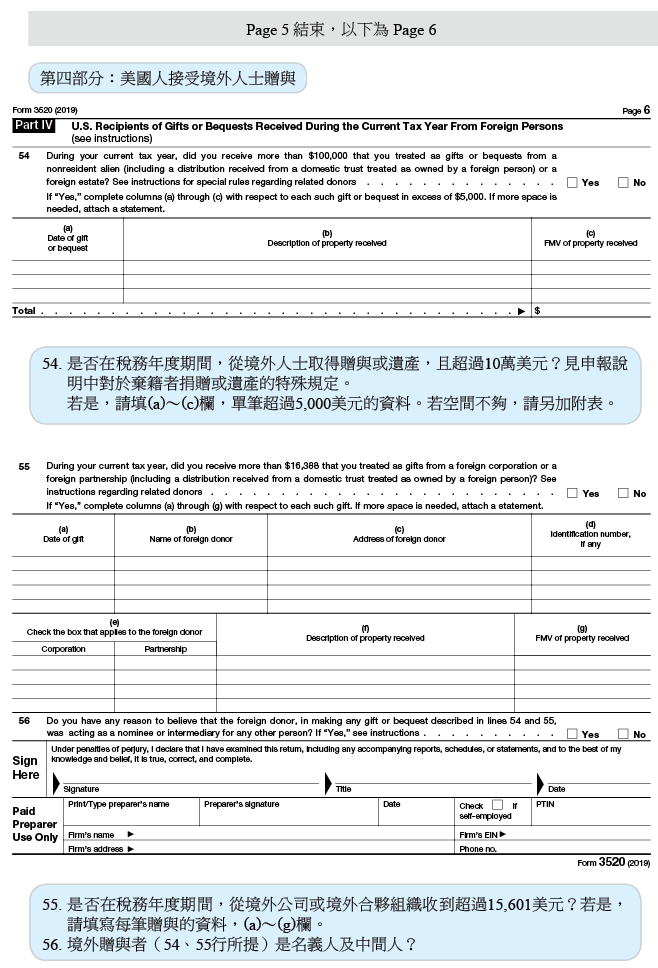

第四部分── 美國人在現行稅務年度,收到外國個人的贈予或遺產

Part IV—U.S. Recipients of Gifts or Bequests Received During the Current Tax Year From Foreign Persons

註:如果未能申報應申報的贈與,可能會被處以罰金。參見第二頁「處罰」。

給美國個人的贈與,並不包括任何學費款項支付,或是代表該美國個人支付的醫療款項。

如果境外信託分配給美國受益人,該美國受益人務必在第三部分申報這項數額作為分配,而非申報在第四部分的贈與。

由外國個人捐助給本國或境外信託的資產,且該信託有美國受益人,則這些美國受益人不需在第四部分申報這些資產捐助,除非這些受益人被視為在資產移轉的年度裡收到該捐贈(例如,根據 678 條款,美國受益人是這個信託某部分資產的擁有人,則必須在第四部分申報這項分配)。

一個不被視為另一人所擁有的國內信託,則需要在第四部分申報收到外國個人的捐贈;而被視為一外國個人所擁有的國內信託,則不需要申報此部分的捐贈。但是,美國受益人應該要在第四部分申報他收到來自外國人贈與的信託之分配,而非申報在第三部分的美國受益人分配。

Note. Penalties may be imposed for failure to report gifts that should be reported. See Penalties, earlier.

A gift to a U.S. person does not include any amount paid for qualified tuition or medical payments made on behalf of the U.S. person.

If a foreign trust makes a distribution to a U.S. beneficiary, the beneficiary must report the amount as a distribution in Part III, rather than as a gift in Part IV.

Contributions of property by foreign persons to domestic or foreign trusts that have U.S. beneficiaries aren't reportable by those beneficiaries in Part IV unless they are treated as receiving the contribution in the year of the transfer (e.g., if the U.S. beneficiary is treated as an owner of that portion of the trust under section 678, then the contribution must be reported by such U.S. beneficiary in Part IV).

A domestic trust that is not treated as owned by another person is required to report the receipt of a contribution to the trust from a foreign person as a gift in Part IV.

A domestic trust that is treated as owned by a foreign person is not required to report the receipt of a contribution to the trust from a foreign person. However, a U.S. beneficiary should report the receipt of a distribution from a domestic trust that is treated as owned by a foreign person as a gift from a foreign person in Part IV, rather than as a distribution to a U.S. beneficiary in Part III.

第 54 行

為計算門檻金額(10 萬美元),您務必加總不同的非居住外國人和外國遺產的贈與,如果您知道(或有理由知道)那些個人彼此之間有關係(定義見先前提及的「有關係個人」),或其中一位替另外一位作為被提名人或中間人。舉例來說,如果您從非居住外國人 A 收到一筆 75,000 美元的贈與,以及從非居住外國人 B 收到 4 萬美元的贈與,而您知道 A 和 B 是有關係的,那麼您務必回答「是」,並且在 (a)~(c) 欄內填入每項贈與。

如果您第 54 行回答「是」,也沒有收到超過 5,000 美元的贈與或遺產,請不要填寫第 54 行的 (a)~(c) 欄,而是在第 1 行的 (b) 欄中填入:「沒有超過 5,000 美元的贈與或遺產。」

To calculate the threshold amount ($100,000), you must aggregate gifts from different foreign nonresident aliens and foreign estates if you know (or have reason to know) that those persons are related to each other (see Related Person, earlier) or one is acting as a nominee or intermediary for the other. For example, if you receive a gift of $75,000 from nonresident alien individual A and a gift of $40,000 from nonresident alien individual B, and you know that A and B are related, you must answer “Yes” and complete columns (a) through (c) for each gift.

If you answered “Yes” to the question on line 54 and none of the gifts or bequests received exceeds $5,000, do not complete columns (a) through (c) of line 54. Instead, enter in column (b) of the first line: “No gifts or bequests exceed $5,000.”

第 55 行

如果您在現行稅務年度收到的加總金額,超過了 15,601 美元,並將此筆加總金額當作來自外國公司或外國合夥組織的贈與(或您知道(或有理由知道)任何外國個人,和這樣的外國公司或外國合夥組織有關係),請回答「是」。舉例來說,如果您採用 2015 曆年制來申報,從外國公司 X 收到了 8,000 美元,並將其當作是贈與;另外從非居住外國人 A 收到了 1 萬美元,也將其當作是贈與;而您也知道 A 一人擁有 X 公司,那麼您務必在 (a)~(g) 欄中填入每一項贈與。

Answer “Yes” if you received aggregate amounts in excess of $15,601during the current tax year that you treated as gifts from foreign corporations or foreign partnerships (or any foreign persons that you know (or have reason to know) are related to such foreign corporations or foreign partnerships).

For example, if you, a calendar-year taxpayer during 2015, received $8,000 from foreign corporation X that you treated as a gift, and $10,000 that you received from nonresident alien A that you treated as a gift, and you know that X is wholly owned by A, you must complete columns (a) through (g) for each gift.

註:來自外國公司或外國合夥組織的贈與,應受到美國國稅局根據 672(f)(4) 條款「重新定義(recharacterization)」的約束。

Note. Gifts from foreign corporations or foreign partnerships are subject to recharacterization by the IRS under section 672(f)(4).

第 56 行

如果您第 56 行回答「是」,且最終捐贈者是外國公司或外國合夥組織,請附上解釋。解釋要包括最終外國捐贈者的名字、地址、識別號碼,以及公司或合夥組織的狀態。

如果最終捐贈人是境外信託,請把收到的總額當作來自境外信託的分配,並且完成第三部分。

If you answered “Yes” to the question on line 56 and the ultimate donor on whose behalf the reporting donor is acting is a foreign corporation or foreign partnership, attach an explanation including the ultimate foreign donor’s name, address, identification number, if any, and status as a corporation or partnership.

If the ultimate donor is a foreign trust, treat the amount received as a distribution from a foreign trust and complete Part III.