專業叢書

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 3 U.S. Revocable Dynasty Trusts

Are there assets I shouldn’t put into my Foreign Grantor Trust?

An NRA is subject to gift and estate tax only on U.S. situs assets. However, domicile for U.S. gift and estate tax purposes is defined differently than that for U.S. income tax purposes. Unlike the substantial presence test for income tax purposes, which is generally based on the number of days one spends in the U.S., domicile for U.S. gift and estate tax purposes centers around being physically present in the U.S. and intending to permanently remain in the U.S. An individual can be deemed an income tax resident but not have a domicile in the U.S. and vice versa.

Whether an individual is deemed to remain permanently in the U.S. is a facts and circumstances test. The IRS characterizes the following as facts that may point to a U.S. domicile:

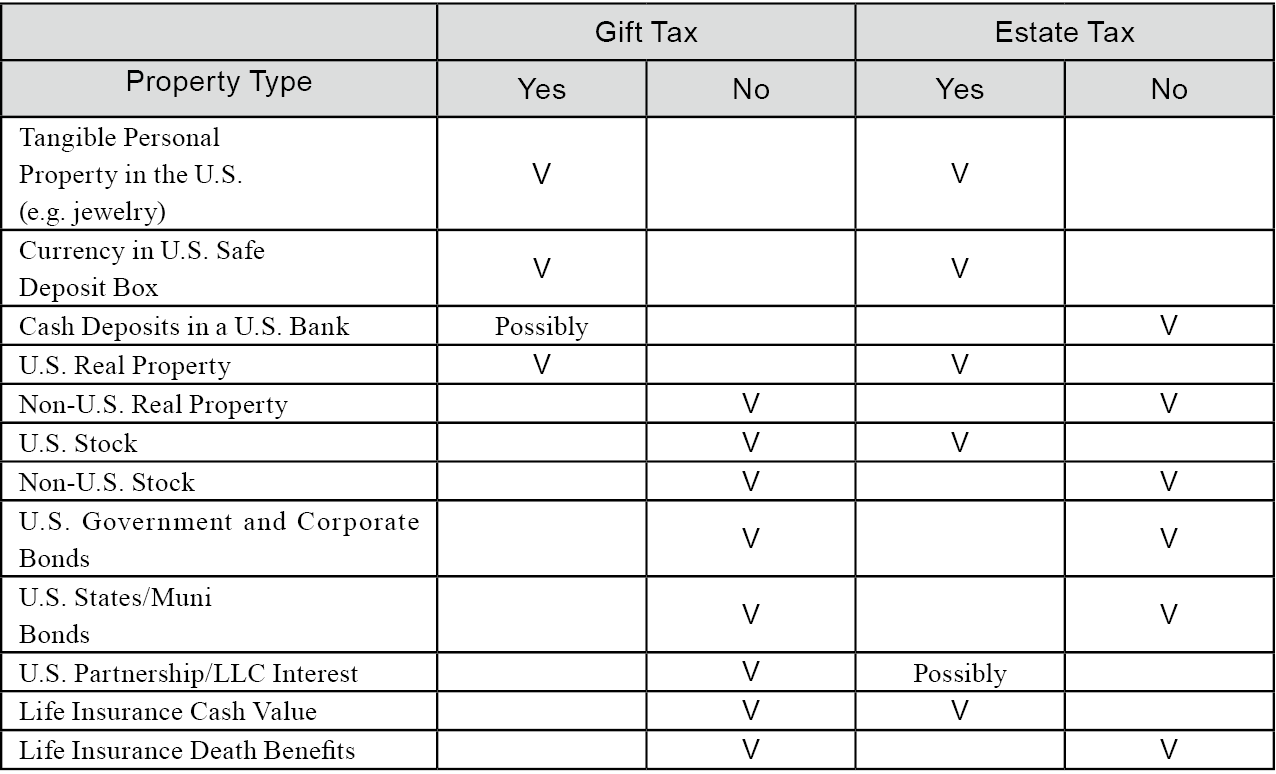

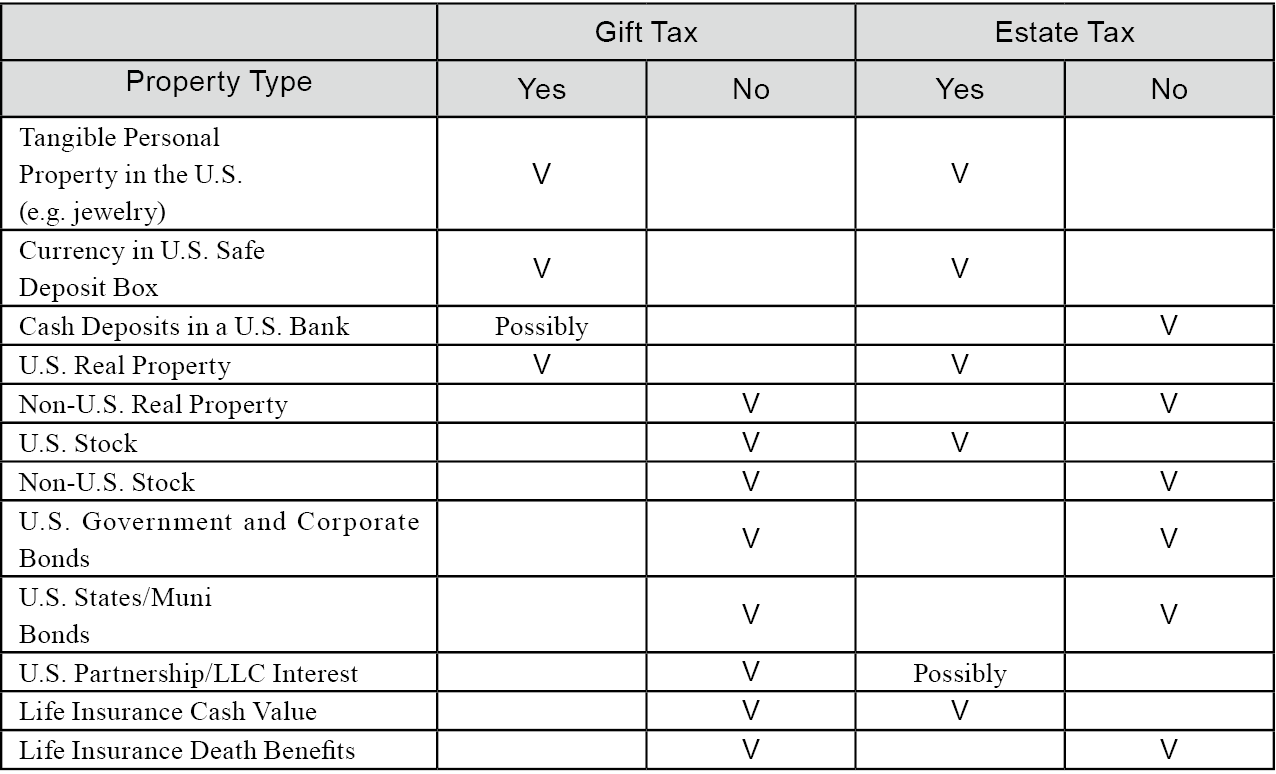

The IRS has defined assets that are and are not subject to U.S. gift and estate taxes when they are transferred by an individual who does not have a U.S. domicile. Assets that do trigger U.S. gift and estate taxes are generally termed assets with a U.S. situs.

The categorization of assets is different for U.S. estate and gift taxes. The following chart categorizes assets as those generally subject to U.S. gift tax, U.S. estate tax or both, when they are transferred from a person without a U.S. domicile.

Whether an individual is deemed to remain permanently in the U.S. is a facts and circumstances test. The IRS characterizes the following as facts that may point to a U.S. domicile:

- Where does the individual pay state income tax?

- Where does the individual vote?

- Where does the individual own property?

- Where is the individual’s citizenship?

- How long is the individual length of residence?

- Where is the individual’s business based?

- Where does the individual have social ties to his or her community?

The IRS has defined assets that are and are not subject to U.S. gift and estate taxes when they are transferred by an individual who does not have a U.S. domicile. Assets that do trigger U.S. gift and estate taxes are generally termed assets with a U.S. situs.

The categorization of assets is different for U.S. estate and gift taxes. The following chart categorizes assets as those generally subject to U.S. gift tax, U.S. estate tax or both, when they are transferred from a person without a U.S. domicile.