專業叢書

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 3 U.S. Revocable Dynasty Trusts

Which assets should I place in my Foreign Grantor Trust?

Assets held in a Foreign Grantor Trust (FGT) shift income tax liability from the trust to the Grantor (non-U.S. person) for U.S. income tax purposes. As such, for both U.S. and non-U.S. assets, the Grantor of the trust is viewed as the income taxpayer for U.S. income tax purposes.

When a foreigner (a non-U.S. person) holds non-U.S. assets, he is generally not liable for U.S. income tax (on income not “effectively connected” to the U.S.); however, when a foreigner holds U.S. assets, he is liable for U.S. income tax (often at a considerable higher tax rate than a U.S. person). As such, almost all assets placed in FGTs are non-U.S. assets.

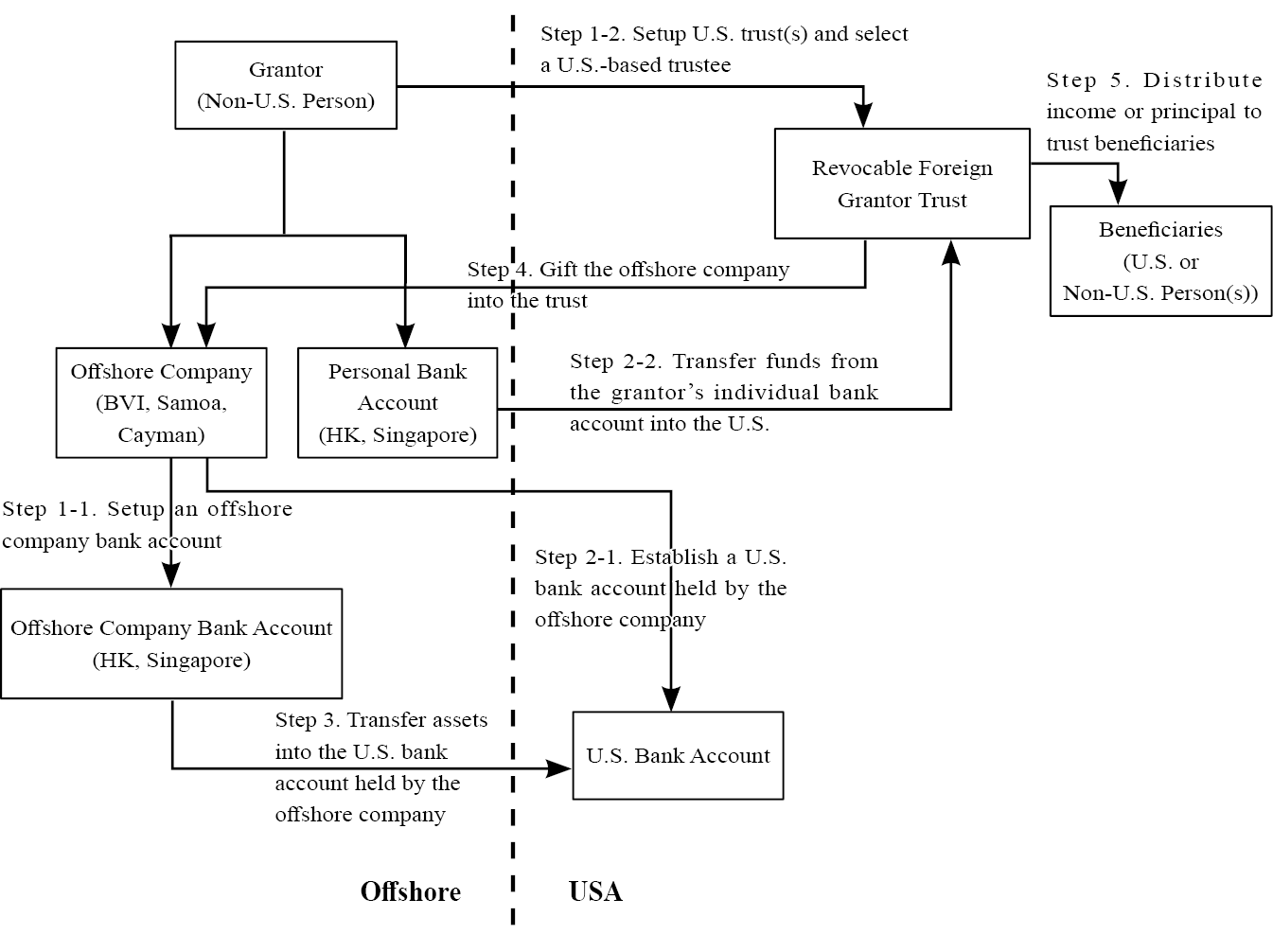

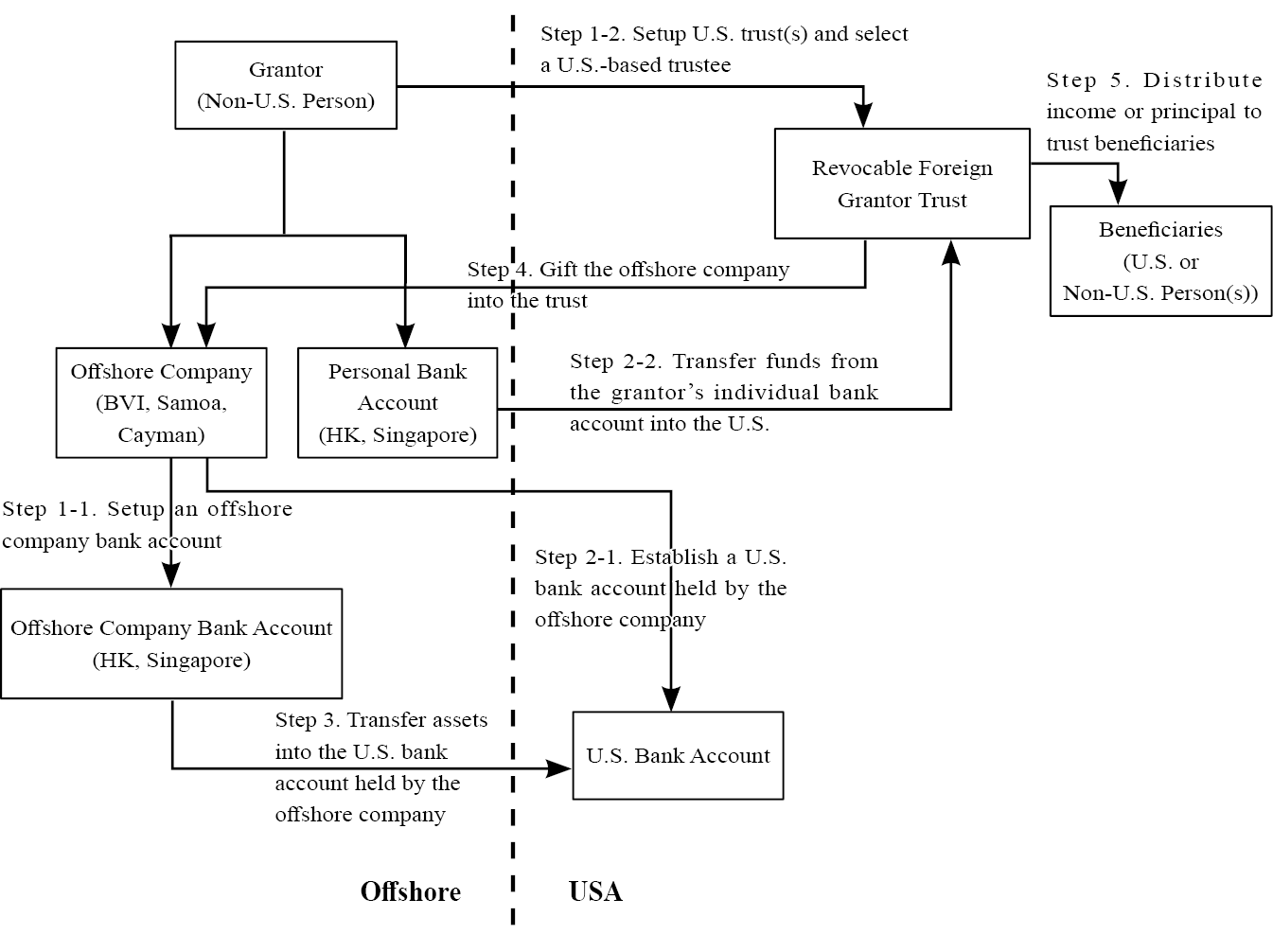

It is often recommended that clients place interest in non-U.S. holding and / or operating companies into FGTs. These assets primarily consist of offshore companies established in offshore jurisdictions, including the British Virgin Islands (BVI), Cayman Islands, Samoa, or other countries.

Could you provide an example of a Foreign Grantor Trust structure?

When a foreigner (a non-U.S. person) holds non-U.S. assets, he is generally not liable for U.S. income tax (on income not “effectively connected” to the U.S.); however, when a foreigner holds U.S. assets, he is liable for U.S. income tax (often at a considerable higher tax rate than a U.S. person). As such, almost all assets placed in FGTs are non-U.S. assets.

It is often recommended that clients place interest in non-U.S. holding and / or operating companies into FGTs. These assets primarily consist of offshore companies established in offshore jurisdictions, including the British Virgin Islands (BVI), Cayman Islands, Samoa, or other countries.

Could you provide an example of a Foreign Grantor Trust structure?