專業叢書

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 2 U.S. Irrevocable Dynasty Trusts

What is an ILIT (Irrevocable Life Insurance Trust)? How can an ILIT play a role in my estate planning?

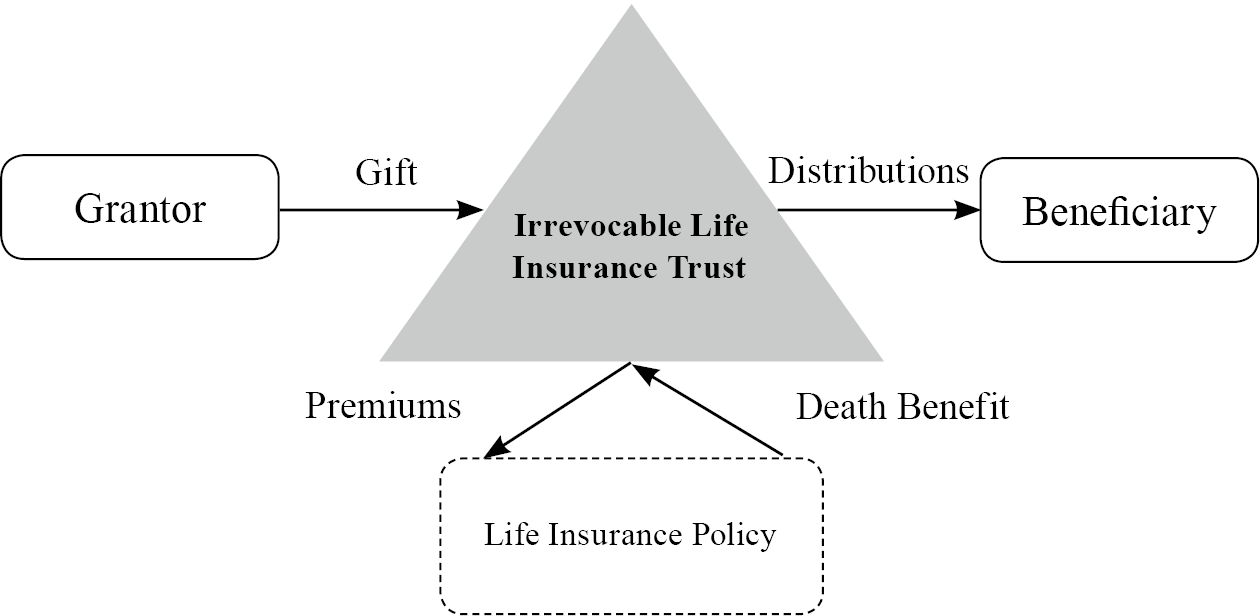

Irrevocable Life Insurance Trusts (ILITs) are a popular estate planning tool in the United States, especially for high-net-worth individuals seeking to minimize estate taxes and provide liquidity for their estates. An ILIT is an irrevocable trust that contains provisions specifically designed to facilitate the ownership of insurance policies.

The ILIT is the owner and the beneficiary of the life insurance policy. If the trust is structured and managed properly, the life insurance death benefit received by the ILIT will not be subject to income or estate tax upon the insured’s death.

Non-U.S. Wealth Creators with U.S. descendants should consider naming a U.S. irrevocable dynasty trust as their ILIT’s beneficiary. When structured properly, this can generally effectively shield proceeds from the life insurance policy both from U.S. gift and estate taxation and creditors of the beneficiaries.

During the grantor’s life, the trustee will often hold certain powers (including the power to distribute). Upon the grantor’s death, distributions will be made according to the trust agreement’s terms.

Benefits of ILITs

1. Estate Tax Mitigation: Non-U.S. persons with U.S.-based assets may still be subject to U.S. estate taxes. U.S. persons with assets above the lifetime gift and estate tax exemption would generally also be subject to U.S. estate taxes. An ILIT can help reduce the taxable estate by removing the life insurance policy from the individual's estate.

2. Asset Protection: ILITs can provide a level of protection for assets against creditors.

3. Liquidity: Life insurance proceeds can provide liquidity to pay estate taxes, debts, and other expenses without the need to sell other assets.

Key Non-Tax Considerations

1. U.S. Situs Assets: Non-U.S. persons owning U.S.-situs assets, such as real estate or tangible personal property located in the U.S., may benefit from using an ILIT to minimize U.S. estate tax exposure.

2. Trustee Selection: The choice of trustee is critical. The trustee can generally be anyone other than the insured person. Naming an “independent trustee,” such as a third-party independent trust company, may offer greater flexibility for estate planning.

3. Compliance and Reporting: ILITs established by non-U.S. persons may have additional compliance requirements, including reporting under the Foreign Account Tax Compliance Act (FATCA) and the Foreign Bank and Financial Accounts (FBAR) regulations.

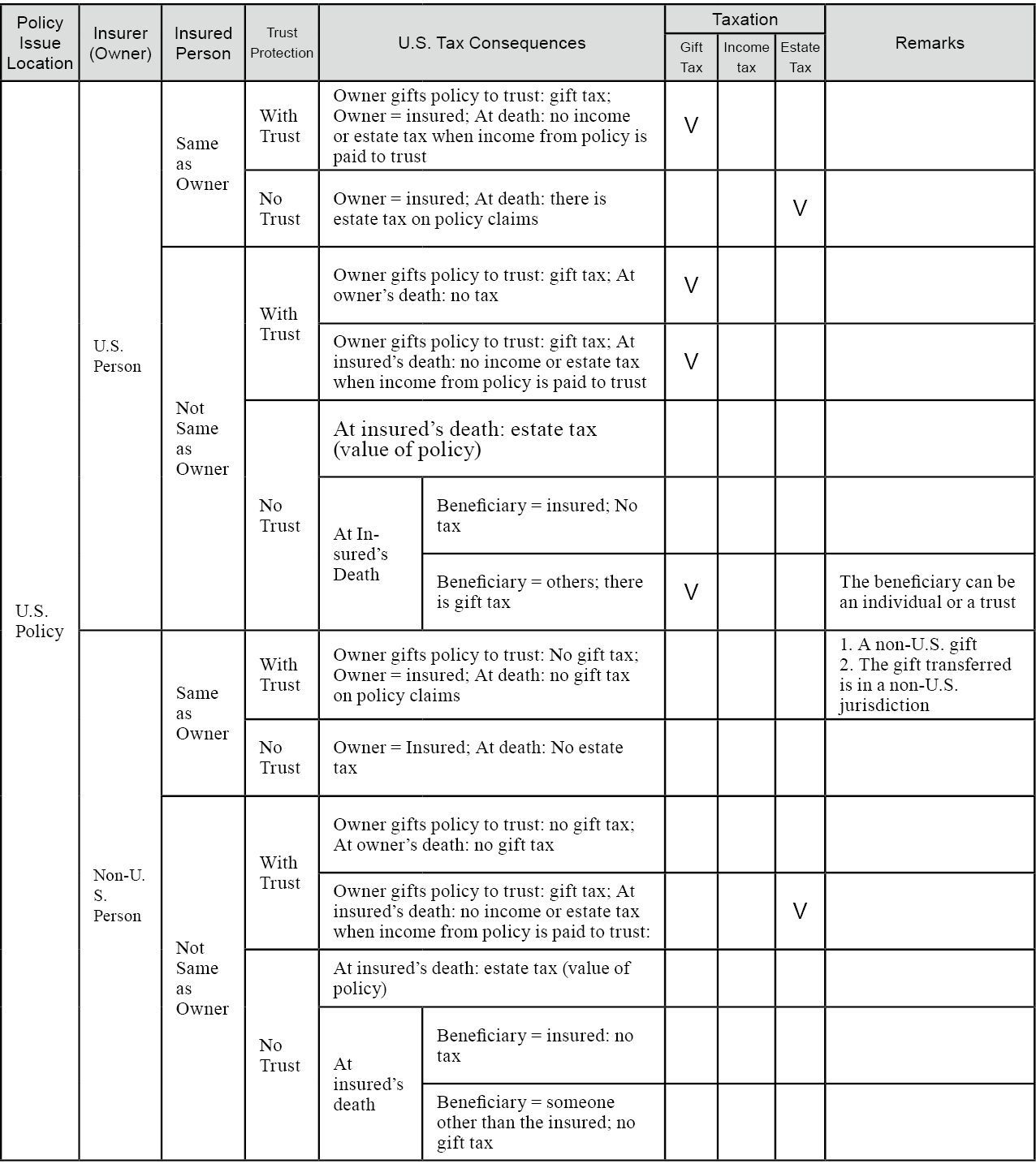

Key Tax Considerations for U.S. Policies

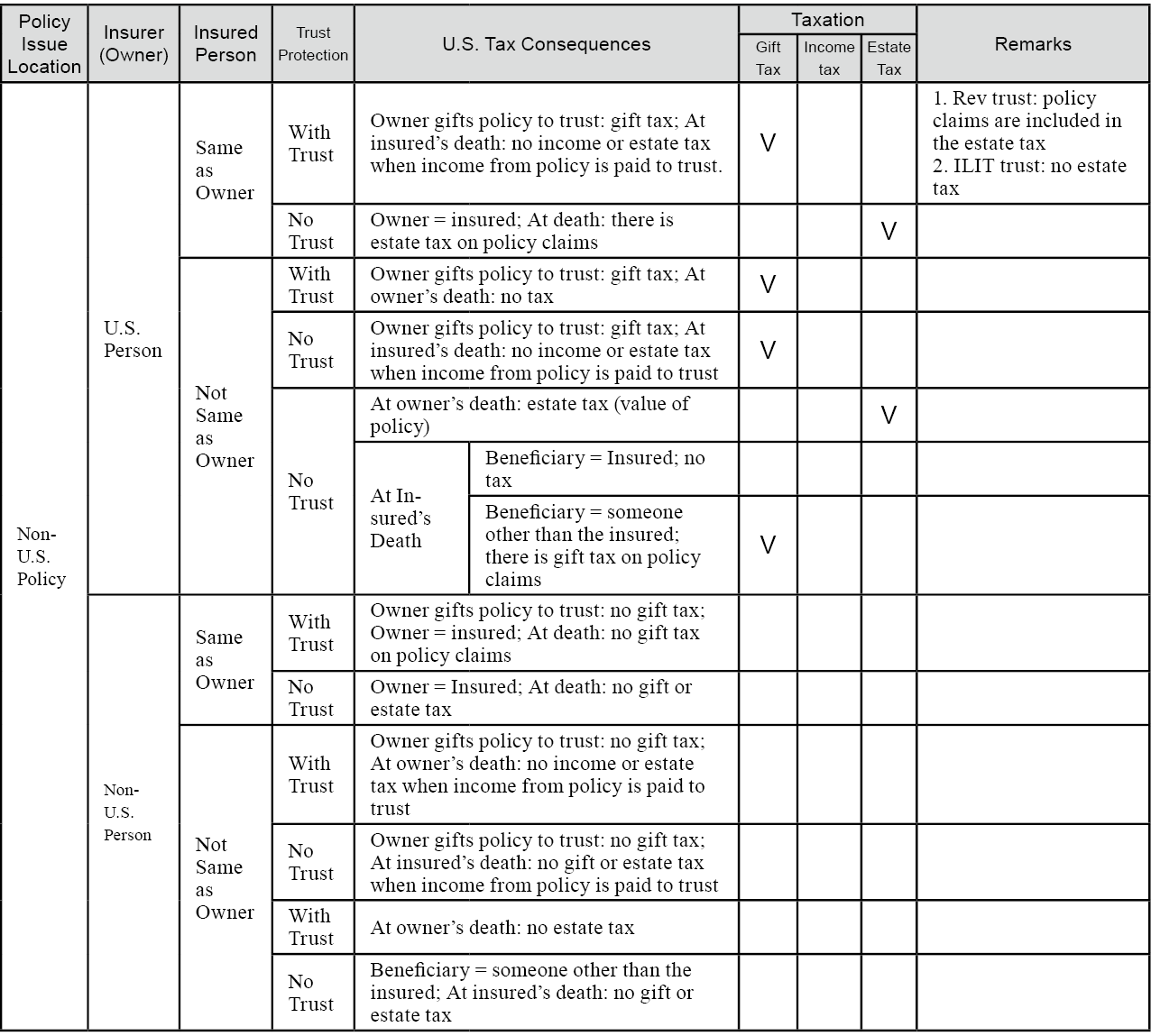

Key Tax Considerations for Non-U.S. Policies

Structuring the ILIT

1. Establishing the Trust: The ILIT must be properly drafted, typically under the laws of a jurisdiction that is favorable for trust creation, such as Nevada. As an ILIT is treated as a separate entity, it apply for its own separate taxpayer identification number (typically referred to as an “EIN” or “FEIN”). All policies purchased in the name of the ILIT or transferred to the ILIT should reference the ILIT’s taxpayer identification number (and not the insured’s social security number) on the ownership and beneficiary forms for the life insurance policy.

2. Funding the Trust: Gifting cash or other assets to an ILIT is a common and simple funding method. U.S. persons often need to consider their lifetime gift exemptions ($13.6 million per person in 2024). When funded properly, non-U.S. persons can make gifts to an ILIT free of U.S. gift tax.

3. Crummey Powers: To ensure that contributions to the trust qualify for the annual gift tax exclusion, the trust can include Crummey powers, allowing beneficiaries to withdraw contributions for a limited time. U.S. persons can generally make gifts of $18,000 to each beneficiary of the trust (in 2024) without using their lifetime gift exemptions.

Conclusion

ILITs can be a valuable tool for both U.S. and non-U.S. persons with significant assets. When purchasing a life insurance, always consult with your financial, legal and tax advisors to see if the policy is a good fit for your needs.