專業叢書

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 1 Introduction to Cross-Border Estate Planning

Case Study 3: What happens when Foreigners Purchasing U.S. Real Property?

Background:

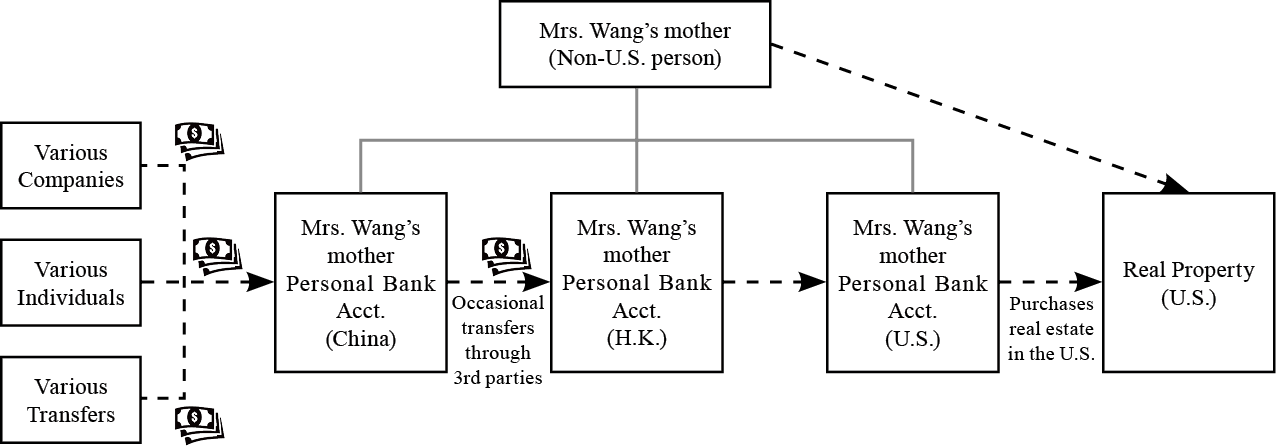

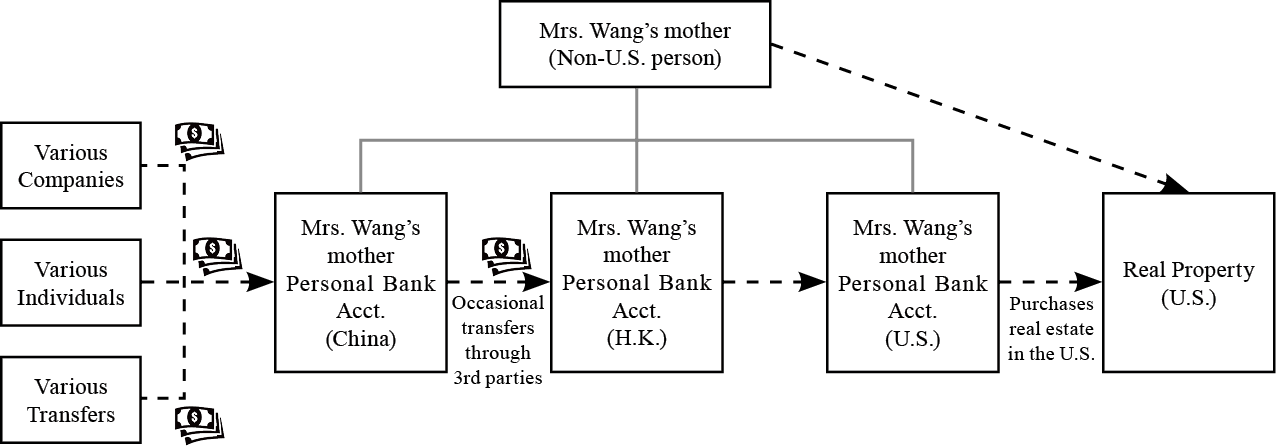

Mrs. Wang is a longstanding executive at a Shanghai-based construction company. Over the years, she has accumulated substantial wealth in China and overseas. Last year, she attained a Green Card through investment in the EB-5 program and moved to the United States with her children. Like many Wealth Creators, Mrs. Wang wished for her descendants to move to the U.S. and settle there permanently. Over the years, she has learned that the U.S. levies hefty taxes on the wealthy. Prior to her becoming a U.S. person (attaining a U.S. green card), she transferred funds to her mother, a Chinese citizen. She then purchased many U.S. properties in the U.S. under her mother’s name.

Two years later, a close friend introduced her to a U.S. accountant, who informed her that U.S. estate taxes are levied not only on U.S. persons, but also foreigners with certain assets in the U.S. Furthermore, the gift and estate tax exemption for foreigners was a mere $60,000 and that any taxable estate in excess of the exemption would generally be subject to a 40% estate tax. Hearing this, Mrs. Wang was in disbelief. She now began searching for a way to decrease her U.S. tax exposure.

Mrs. Wang’s Structure (Prior to Restructuring)

Reflections on Succession:

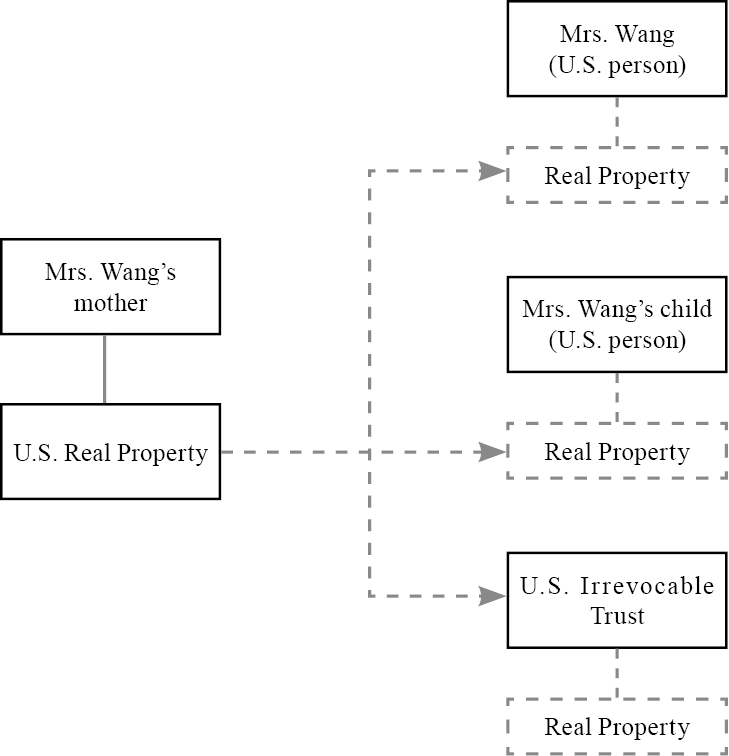

Succession Framework Analysis:

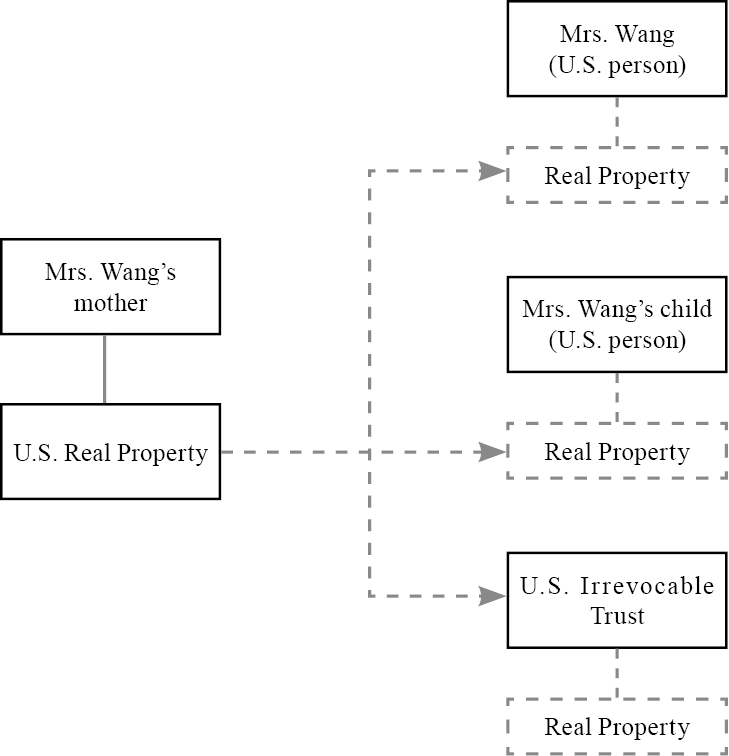

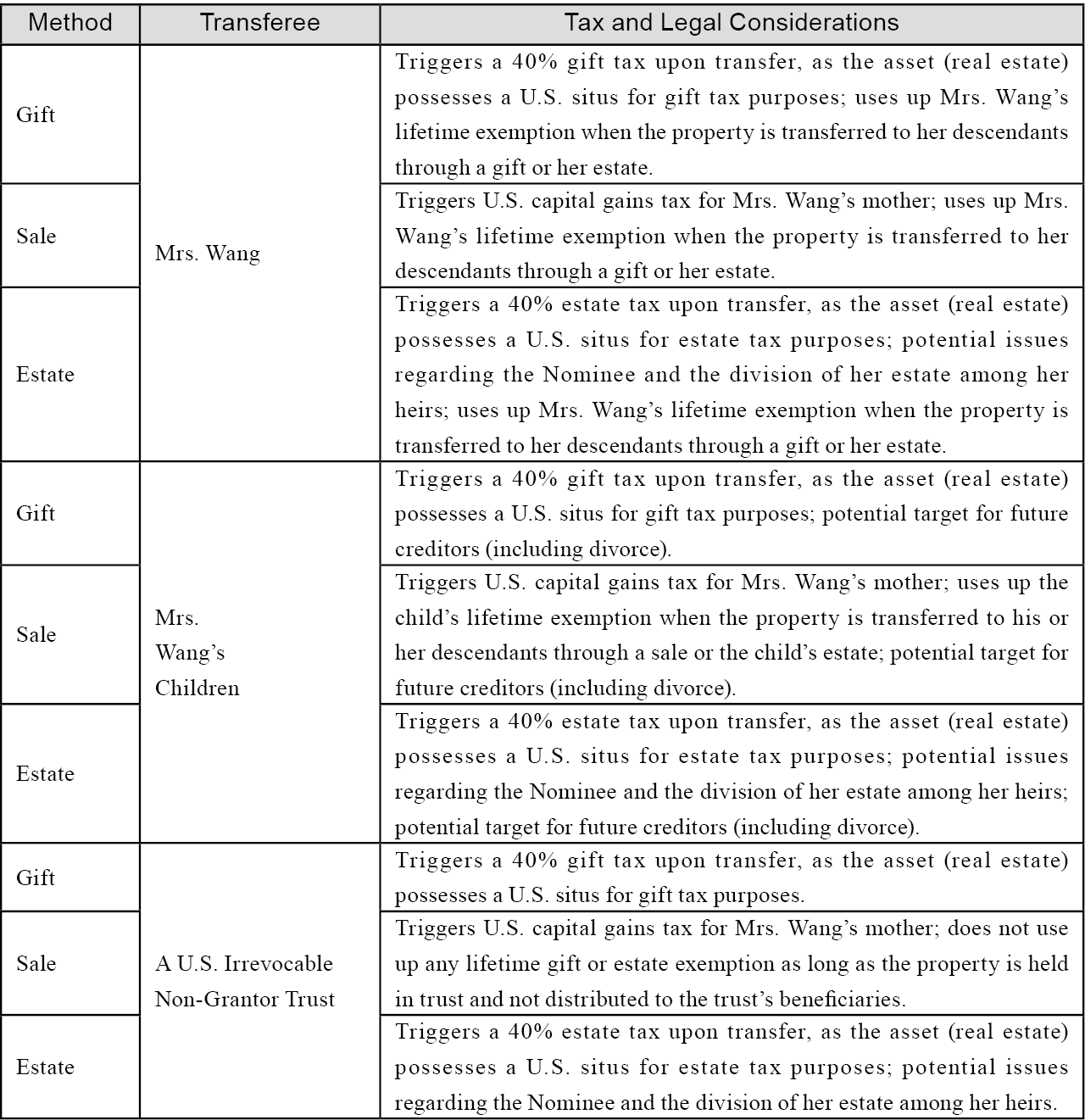

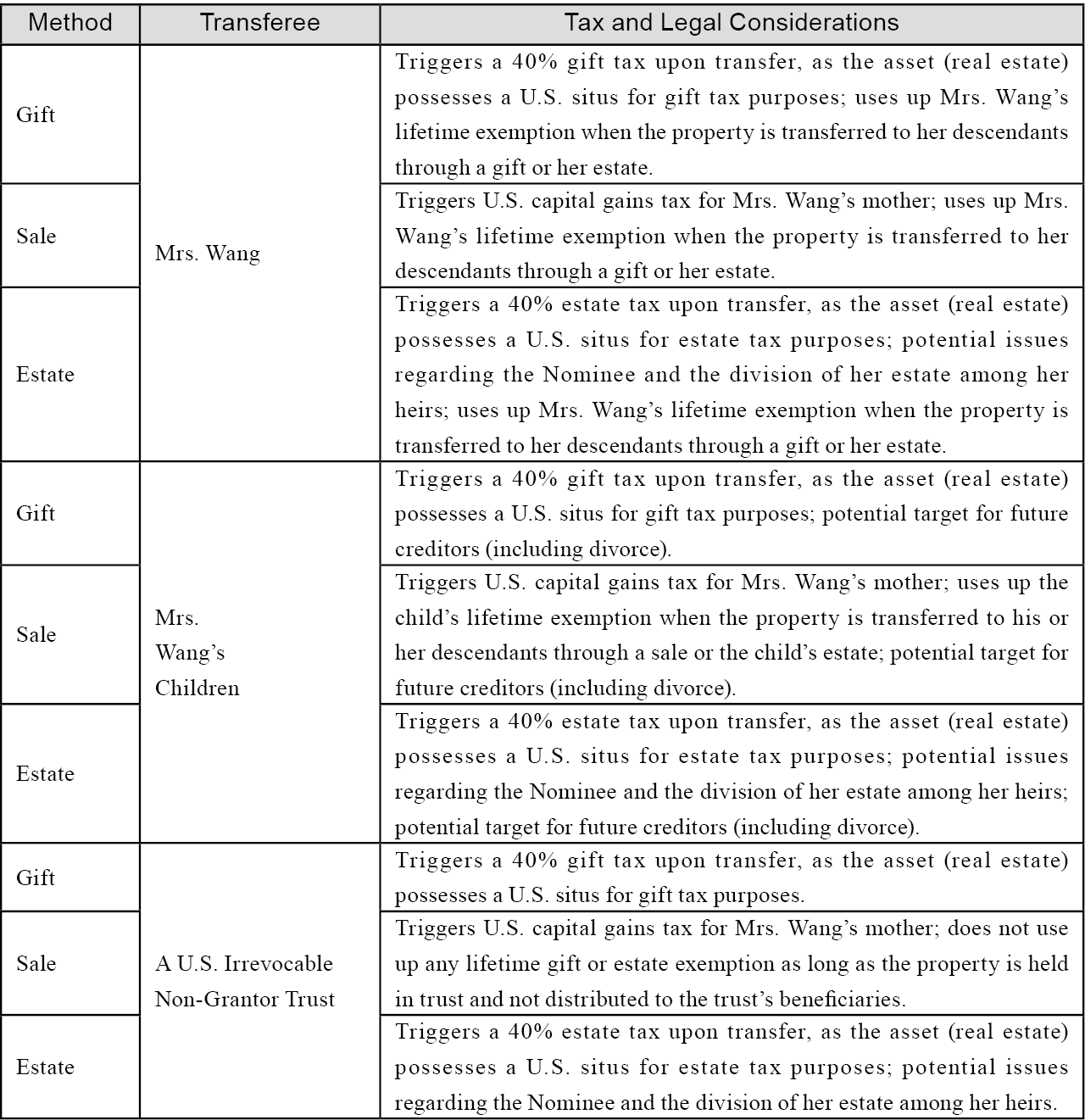

In order to transfer the property from Mrs. Wang’s mother to Mrs. Wang, her children or a U.S. trust, there may be a substantial tax consideration. Furthermore, assets held under individuals may be subject to further U.S. gift and estate taxation and can be a potential target for creditors if any legal disputes arise. Lastly, the Nominee may have other heirs, who may or may not know that the asset does not belong to the Nominee. Potential transfers and their tax and legal effects are summarized below:

Note 1: Taxes are generally taxed at market value and not cost basis, based on the timing of the gift or estate. Typically, valuations of real estate are conducted by licensed real estate appraisers based in the property’s jurisdiction.

Note 2: Lifetime exemption mentioned above refers to the unified lifetime gift and estate tax exemption available to U.S. persons.

Mrs. Wang’s Structure (After Restructuring)

If Mrs. Wang’s mother gifts the real estate to either Mrs. Wang or a U.S. Irrevocable Trust, the gift is taxed at 40% of the property’s market value. If Mrs. Wang chooses to leave the existing structure as is, her mother’s heir would be subject to a 40% estate tax upon her mother’s death. To eliminate U.S. transfer taxes, Mrs. Wang should seek to unwind the previous transaction.

Mrs. Wang is a longstanding executive at a Shanghai-based construction company. Over the years, she has accumulated substantial wealth in China and overseas. Last year, she attained a Green Card through investment in the EB-5 program and moved to the United States with her children. Like many Wealth Creators, Mrs. Wang wished for her descendants to move to the U.S. and settle there permanently. Over the years, she has learned that the U.S. levies hefty taxes on the wealthy. Prior to her becoming a U.S. person (attaining a U.S. green card), she transferred funds to her mother, a Chinese citizen. She then purchased many U.S. properties in the U.S. under her mother’s name.

Two years later, a close friend introduced her to a U.S. accountant, who informed her that U.S. estate taxes are levied not only on U.S. persons, but also foreigners with certain assets in the U.S. Furthermore, the gift and estate tax exemption for foreigners was a mere $60,000 and that any taxable estate in excess of the exemption would generally be subject to a 40% estate tax. Hearing this, Mrs. Wang was in disbelief. She now began searching for a way to decrease her U.S. tax exposure.

Mrs. Wang’s Structure (Prior to Restructuring)

Reflections on Succession:

1. The use of nominees for holding structures is common in China and may pose a number of significant obstacles to wealth preservation and transfer.

Wealth Creators in China are accustomed to holding assets under the names of others (“Nominees”), since they see minimal risks of doing so. Though nominee usage is prevalent in China, Wealth Creators who use nominees to hold assets outside of China may face considerable challenges.

Unlike in China, under U.S. laws, if the Wealth Creator were to challenge the legitimacy of the nominee’s ownership over an asset, they would need to assert a reasonable legal claim over the said asset. In the U.S., an agreement to hold an asset on someone else’s behalf could be viewed as insufficient to justify ownership. Thus, if the loyalty of the Nominee is at risk, the true owner of the assets can expect to face considerable odds when reasserting ownership.

Assuming the Nominee remains loyal to the Wealth Creator, the nominee’s health could potentially be another concern. If the Nominee were to pass away while holding considerable assets, those assets may (1) be subject to substantial taxation in the U.S. or (2) subject to division per the Nominee’s estate or last will. In many cases the Nominee’s family may not be willing to cooperate or may even not be aware of arrangements between the Nominee and the “true” owner.

A last consideration would be the Nominee’s legal status. In the past, we’ve encountered situations in which even the Wealth Creator was unaware of the Nominee attaining a new citizenship or permanent residence (green card) in the U.S. or another jurisdiction. While these situations are rare, they may pose a considerable taxation risk to the Wealth Creator if improperly supervised or managed.

2. When moving assets into the U.S., Wealth Creators must explain their source(s) of wealth.

When creating U.S. accounts or moving cash into U.S. accounts, the Wealth Creator generally must declare his or her source(s) of wealth and his or her estimated total net worth at account opening. When transferring amounts in excess of $1 million (USD), we recommend Wealth Creators find qualified professionals to assist them with their transfers. Furthermore, our recommendation is to find professionals who are accustomed to assisting clients who receive large transfers from outside of the U.S. Once assets fall under U.S. jurisdiction, the financial institution itself, the U.S. Treasury Department or even the Internal Revenue Service (IRS) may question the source(s) of funds or request additional information including evidence of past transfers or income taxes paid. Competent professionals are able to both prepare the relevant documentation and assist the clients in preparing a proper written response to the questions posed.

3. Wealth Creators often wish to open bank accounts quickly in order to purchase U.S. real estate and financial products under the names of their foreign relatives, friends, or associates.

They may see this as an opportunity to invest in the U.S., while minimizing their U.S. tax exposure and disclosure obligations; however, many may falsely believe that the U.S. does not impose an estate tax on foreigners with U.S. holdings.

Furthermore, real estate brokers or investment management personnel often urge Wealth Creators to quickly transfer funds in order to further their own agendas (primarily their commissions and fees), without fully understanding or explaining the relevant tax and regulatory consequences of the proposed transactions. They may even make claims such as “don’t worry, the CPA will take care of your concerns.”

To minimize tax consequences and regulatory risk, we recommend that Wealth Creators find advisors who can address all aspects of wealth transfer at least 6-18 months prior to moving assets into the U.S. This team should consist of accountants who can analyze U.S. income, estate and gift taxes, attorneys who can analyze cross-border legal structures and secretaries who can manage U.S. and overseas fund transfers (often through financial institutions in Hong Kong and Singapore) and deliver sufficient evidence of the client’s source(s) of wealth.

Succession Framework Analysis:

In order to transfer the property from Mrs. Wang’s mother to Mrs. Wang, her children or a U.S. trust, there may be a substantial tax consideration. Furthermore, assets held under individuals may be subject to further U.S. gift and estate taxation and can be a potential target for creditors if any legal disputes arise. Lastly, the Nominee may have other heirs, who may or may not know that the asset does not belong to the Nominee. Potential transfers and their tax and legal effects are summarized below:

Note 1: Taxes are generally taxed at market value and not cost basis, based on the timing of the gift or estate. Typically, valuations of real estate are conducted by licensed real estate appraisers based in the property’s jurisdiction.

Note 2: Lifetime exemption mentioned above refers to the unified lifetime gift and estate tax exemption available to U.S. persons.

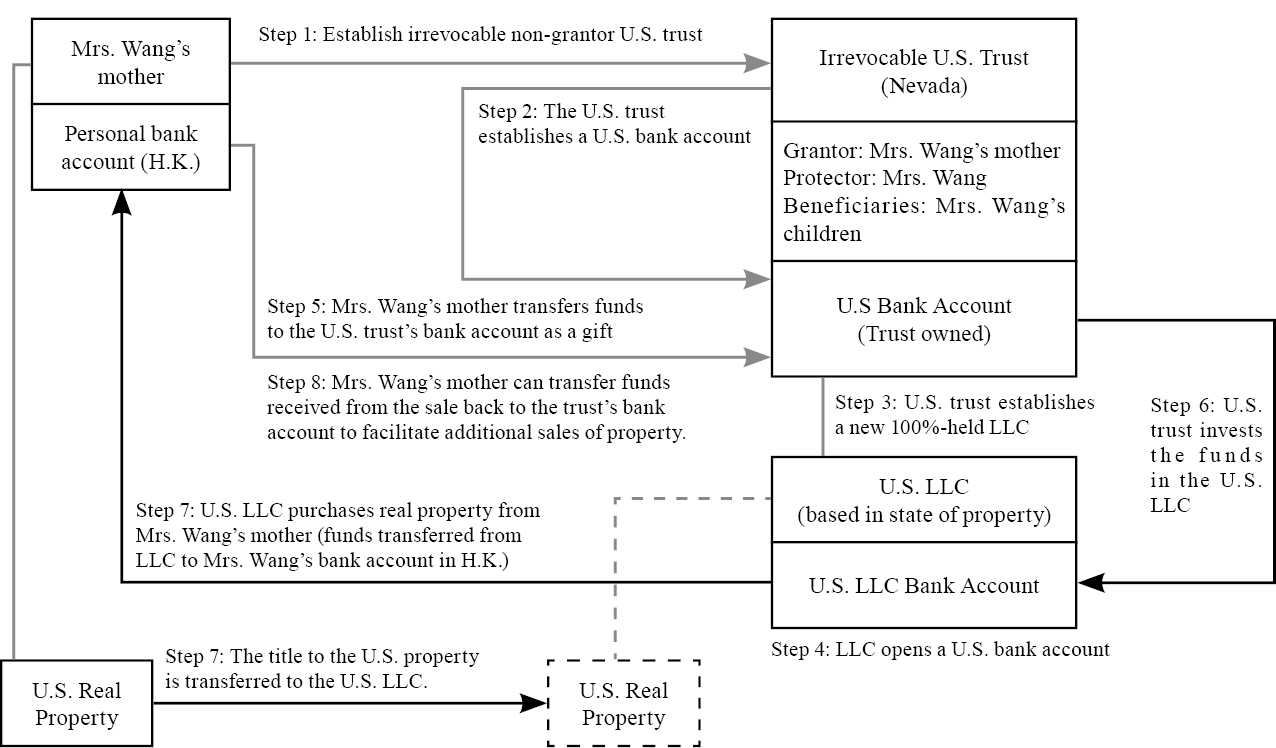

Mrs. Wang’s Structure (After Restructuring)

If Mrs. Wang’s mother gifts the real estate to either Mrs. Wang or a U.S. Irrevocable Trust, the gift is taxed at 40% of the property’s market value. If Mrs. Wang chooses to leave the existing structure as is, her mother’s heir would be subject to a 40% estate tax upon her mother’s death. To eliminate U.S. transfer taxes, Mrs. Wang should seek to unwind the previous transaction.

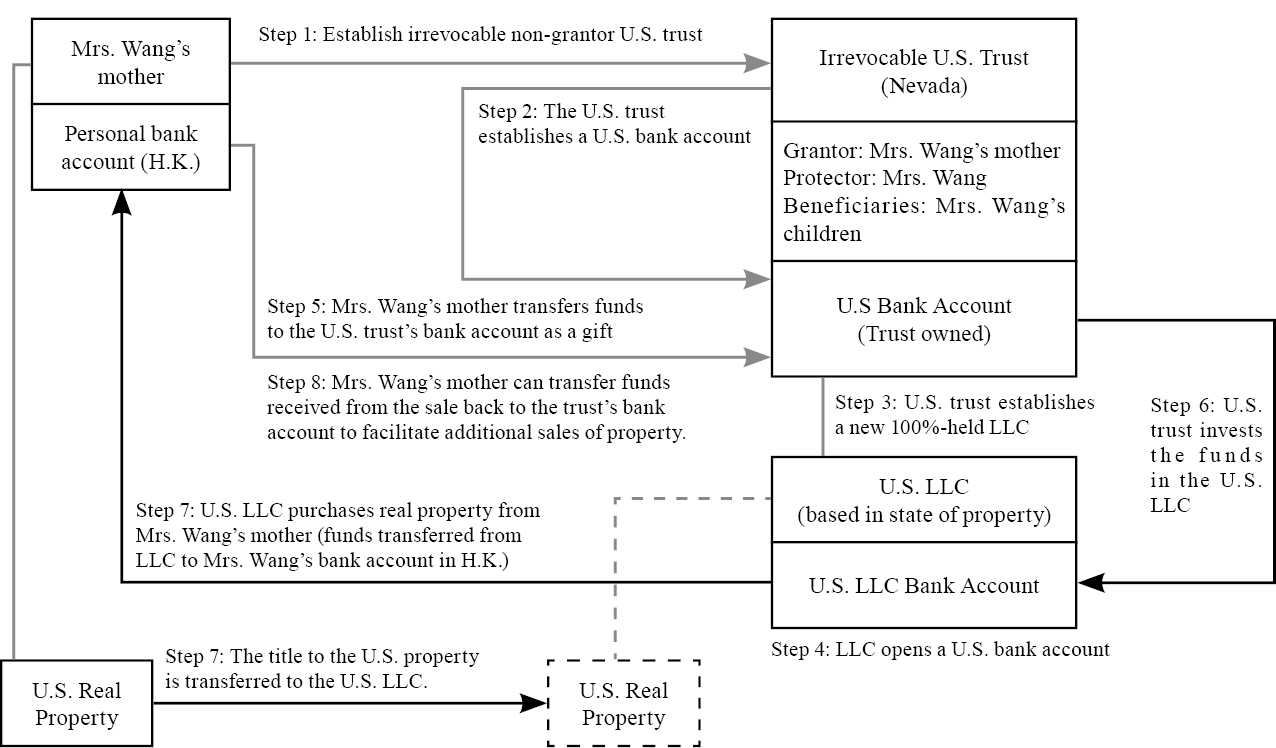

1. In these situations, we recommend that Mrs. Wang’s mother first establish a U.S. Irrevocable Non-Grantor Trust. Mrs. Wang, a U.S. person, can serve as the Trust Protector of this trust. Her children and / or other persons determined by Mrs. Wang can be selected as beneficiaries of the trust.

2. The Trust can then establish a U.S. bank account.

3. The Trust can then establish a 100% owned U.S. Limited Liability Company (LLC)

4. The LLC can then open U.S. LLC bank checking account(s), after applying for an Employer Identification Number (EIN) with the IRS through Form SS-4.

5. Mrs. Wang’s mother gifts funds from her personal bank account outside of the U.S. (typically in Hong Kong or Singapore) into a bank account set up by the U.S. Trust.

6. A direction letter is drafted by Mrs. Wang to instruct the Nevada trustee to transfer the funds from the trust’s bank account to the LLC’s U.S. bank account.

7. The U.S. LLC hires a real estate appraiser and appraises the property that will be sold. The U.S. LLC then purchases the property from Mrs. Wang’s mother at the value determined through a property’s appraisal, transferring proceeds from the sale to a bank account held by Mrs. Wang’s mother.

8. If proceeds are transferred to Mrs. Wang’s mother’s bank account outside the U.S., the funds can be transferred back to the U.S. after the transaction is complete. The funds, now in the LLC’s U.S. bank account, can then be used to purchase additional real estate (or stakes of real estate) held by Mrs. Wang’s mother. If proceeds are transferred to Mrs. Wang’s mother’s bank account in the U.S., we recommend that funds be transferred from her U.S. bank account back to her offshore bank account prior to transferring the funds back into the U.S. LLC.

9. Since the U.S. real estate is now held by the U.S. irrevocable non-grantor trust, Mrs. Wang’s mother’s death would no longer trigger U.S. estate tax for the real estate sold to the trust-owned LLC.