專業叢書

U.S. Trust and Estate Planning 美國信託規劃實務(英文部分)

Chapter 1 Introduction to Cross-Border Estate Planning

Case Study 1: How can Asia-based Wealth Creators utilize U.S. trusts to their advantage?

Background:

Mr. Fang is the Founder of a large restaurant group in Shanghai (a listed company) and just turned 65. Since Mr. Fang had a modest upbringing, he has always been extremely cautious financially. He primarily invests cash generated from his operating businesses in low-risk financial investments and real estate in China. Mr. Fang’s wife and children have lived in Los Angeles, CA for many years now, where he purchased a house under his wife’s name in 2015. Throughout the years, he has also gifted his wife various sums, which she has since invested in an LLC that holds equity investments in U.S. office buildings and shopping malls. While Mr. Fang’s wife and children have received U.S. green cards, Mr. Fang has not applied for immigration and is a non-U.S. person (a non-resident alien for U.S. tax purposes).

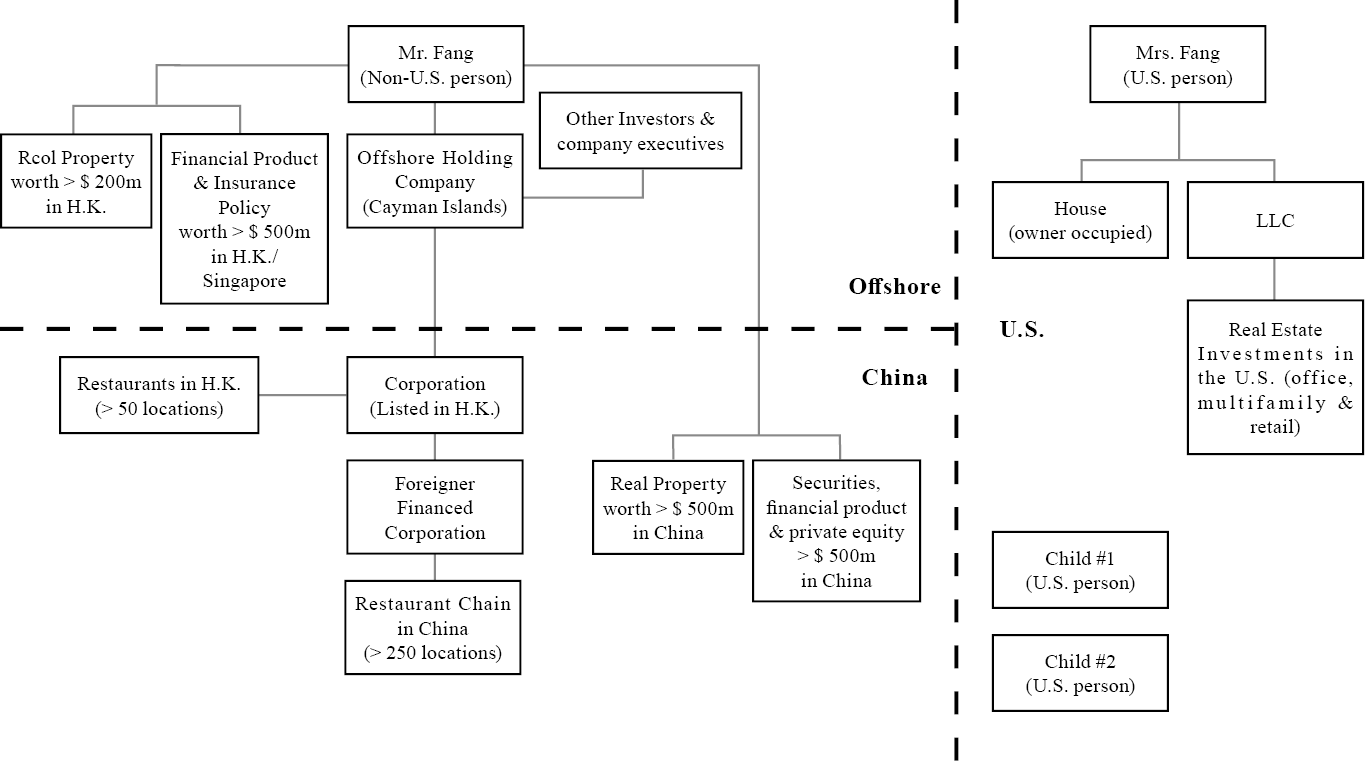

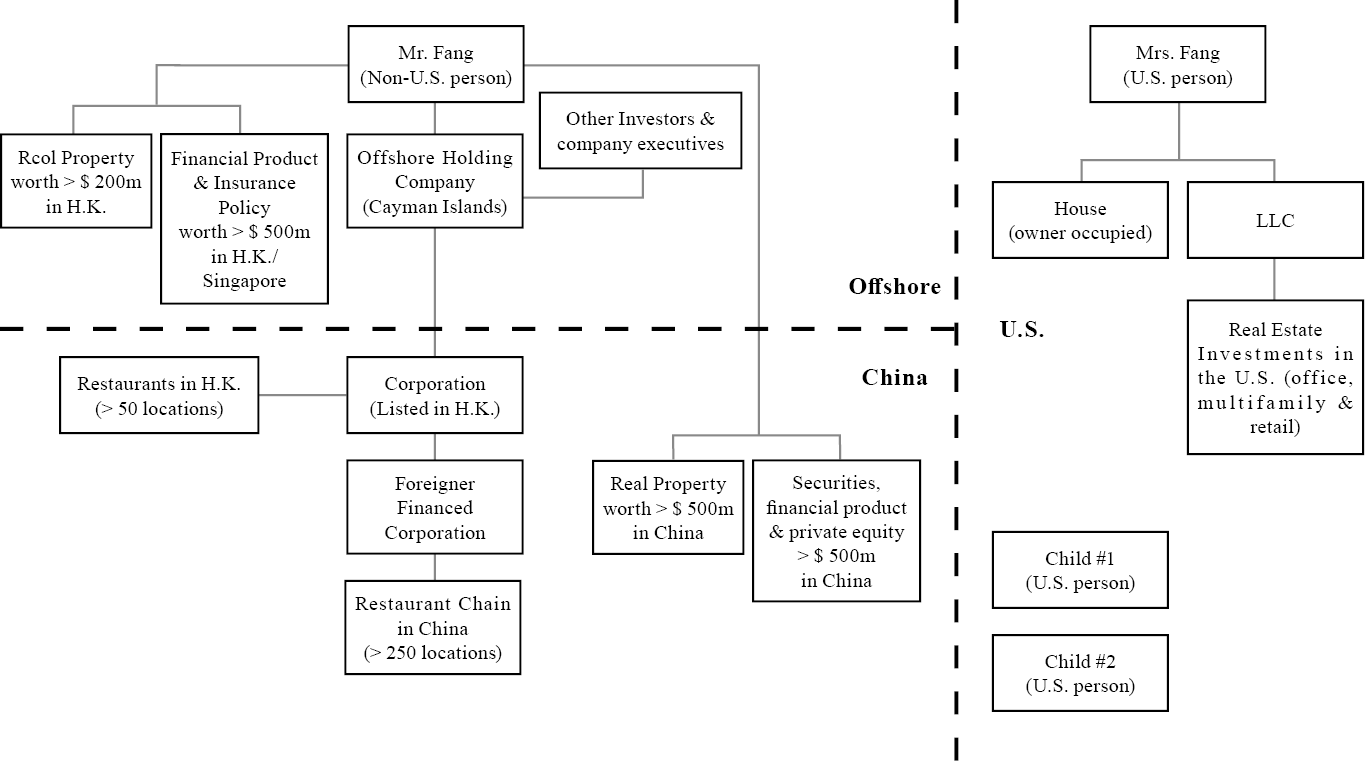

Below is a chart of Mr. Fang’s assets prior to estate planning:

Key Planning Points:

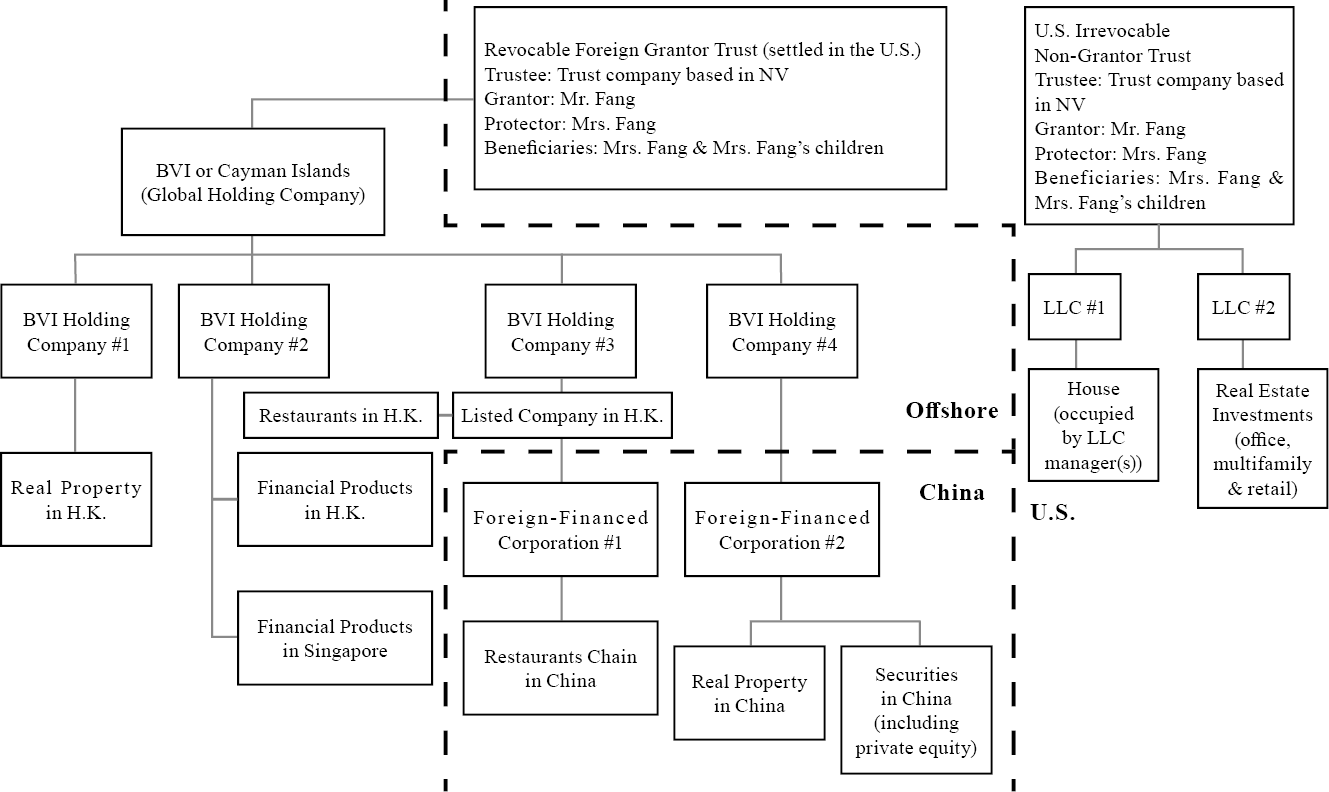

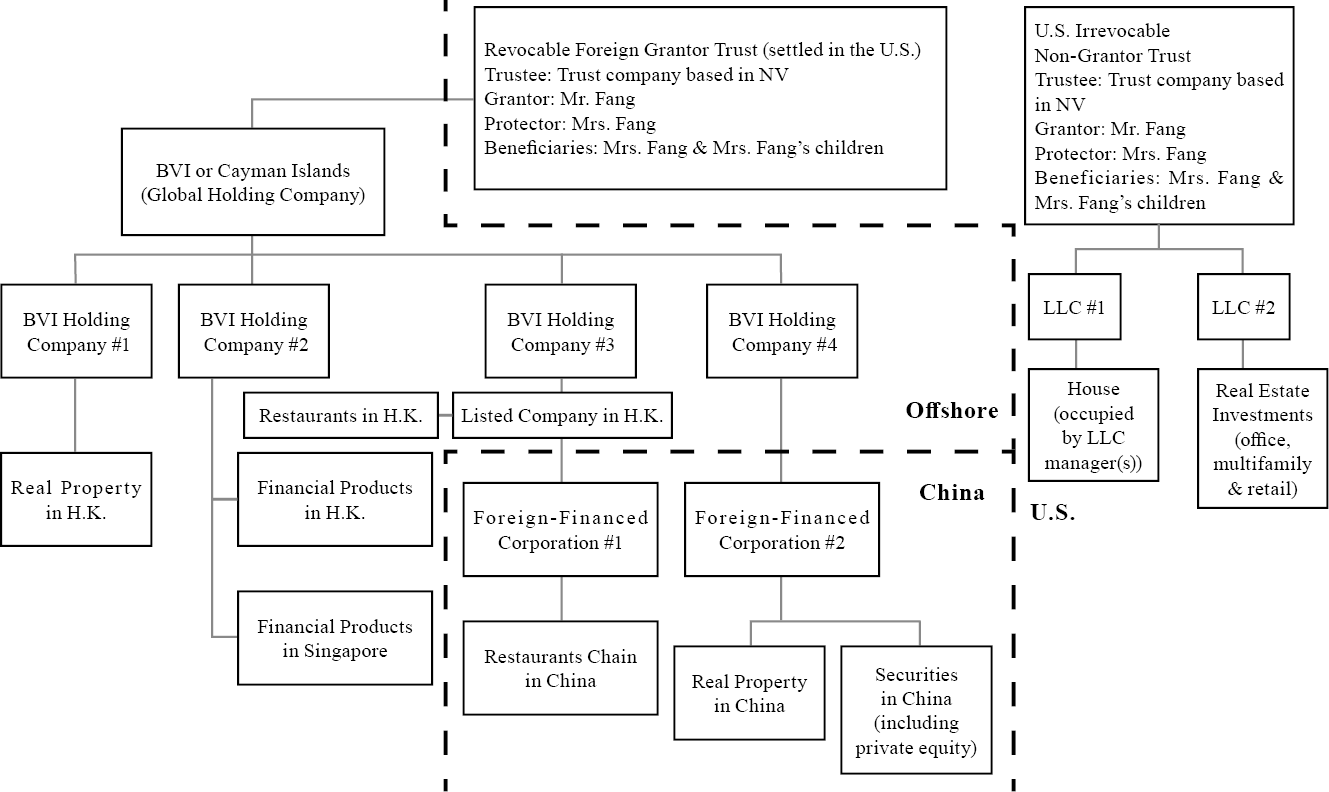

Below is a chart of Mr. Fang’s assets after estate planning:

Mr. Fang is the Founder of a large restaurant group in Shanghai (a listed company) and just turned 65. Since Mr. Fang had a modest upbringing, he has always been extremely cautious financially. He primarily invests cash generated from his operating businesses in low-risk financial investments and real estate in China. Mr. Fang’s wife and children have lived in Los Angeles, CA for many years now, where he purchased a house under his wife’s name in 2015. Throughout the years, he has also gifted his wife various sums, which she has since invested in an LLC that holds equity investments in U.S. office buildings and shopping malls. While Mr. Fang’s wife and children have received U.S. green cards, Mr. Fang has not applied for immigration and is a non-U.S. person (a non-resident alien for U.S. tax purposes).

Below is a chart of Mr. Fang’s assets prior to estate planning:

Key Planning Points:

1. Mr. Fang owns many assets in China. If China enacts an estate and transfer tax regime, a large proportion of Mr. Fang’s assets may be subject to taxation. To pay this tax, his descendants may have to sell off their families’ assets, potentially including shares of their listed company.

2. Since many of Mr. Fang’s family members have immigrated to the U.S. over the years, Mr. Fang wishes to transfer more of his assets into the U.S. If he wishes to apply for immigration to the U.S., he should consider transferring his assets prior to immigrating. An U.S. irrevocable trust can serve as an excellent vehicle to hold his funds currently held by offshore companies in Hong Kong or Singapore. Alternatively, a U.S. revocable trust prior to Mr. Fang’s death or immigration could serve as a vehicle for offshore companies that hold assets based in China or other operating companies.

3. When Mr. Fang makes gifts to his wife and children in the U.S., it is important to consider U.S. gift and estate tax implications of any such transfer. If Mrs. Fang holds enough assets in the U.S., it is likely that she will be liable for U.S. gift or estate tax if she receives additional assets from Mr. Fang over time. We recommend that Mr. Fang establish an irrevocable trust in the U.S. and transfer his assets into the trust. This would minimize the family’s exposure to a U.S. estate tax and facilitate a smoother transition of assets to future generations.

4. If members of the management team in China are awarded incentive compensation in the form of shares, they should receive shares of the Foreign-Financed Chinese Corporation. If members of the management team outside of China are awarded shares, they should receive shares of the BVI holding company.

5. Mr. Fang should consider restructuring his holdings in China. Due to tightening currency controls, moving assets out of China has become difficult. If the opportunity arises, Mr. Fang should consider transferring ownership of his China-based assets to various offshore companies to facilitate the transfer of assets to his descendants. With professional assistance, this can generally be done through direct transfers, pre-planned financing events and gifts.

Below is a chart of Mr. Fang’s assets after estate planning: